Whether a checking or savings account, joint bank accounts work the same way as their sole ownership counterparts.

The primary difference is that both parties own the money in the joint account, have full control of the account. Each account owner can add funds, write checks, make purchases, withdraw cash and use their debit card.

Any funds in the account are considered as belonging to both owners. Either person can spend or withdraw the money at will, regardless of whether they were the one who deposited the funds.

Ally Interest Checking

Fees

Minimum Deposit

Current Promotion

APY Checking

- Why We Picked It?

- Banking Options

Ally Bank’s Interest Checking Account is hard to beat, and it is a great option for couples who want to avoid almost all fees.

Opening a joint account is simple and almost entirely online. Since this bank is online only, there are no branches to visit, but you can live chat or call to speak to the customer service team.

The Ally checking account has no requirements to avoid monthly fees and you can have checks printed with both account holder names at no charge, with no charge for free refills.

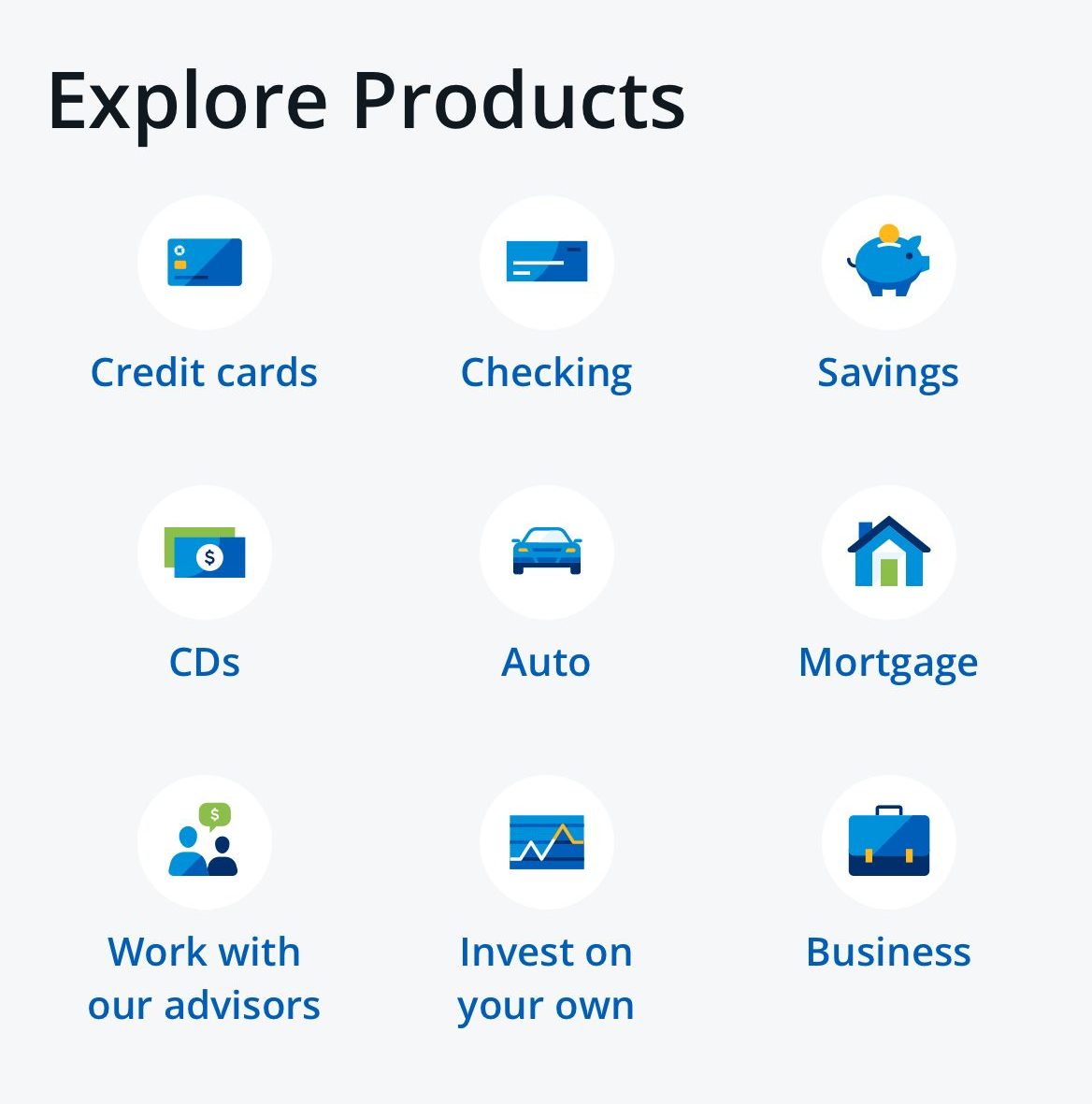

Ally has a highly user-friendly interface on the web and mobile platforms and the bank offers savings, CDs, mortgages, loans and investment products, in addition to the checking account.

- Savings Accounts

- Checking Accounts

- CDs

- Money Market Accounts

- Debit Cards

- Mortgage

- Investing

Axos Rewards Checking

Fees

Minimum Deposit

Current Promotion

APY Checking

- Why We Picked It?

- Banking Options

Axos Bank has been around since 2000, but it was rebranded to this name in 2018. There are several joint checking account options from Axos including Essential Checking, which has no monthly maintenance fees, no minimum balance requirements, no overdraft fees and unlimited ATM fee reimbursements.

If you prefer, you can choose Rewards Checking or CashBack Checking, to earn rewards of up to 1.25% interest or 1% cash back on debit card purchases respectively. The higher tier interest rates are available if you have 10 or more debit card transactions per month and at least $1,500 in direct deposits each month.

All three checking account options have some great features and the Axos interface is easy to use. This means that you can tailor your joint checking account to suit your preferences.

- Savings Accounts

- Checking Accounts

- CDs

- Money Market Account

- Mortgage

- Debit Card

- Investing

U.S. Bank Smartly™ Checking

Fees

Minimum Deposit

Current Promotion

Earn $250 for $2,000–$4,999.99 in direct deposits.

Earn $350 for $5,000–$7,999.99 in direct deposits.

Earn $450 for $8,000+ in direct deposits.. Expired on 12/30/2024

APY Checking

- Why We Picked It?

- Banking Options

U.S. Bank, one of the largest banks in the country, offers several checking account options, including the popular Smartly Checking account.

The Smartly Checking account provides many of the standard features found in traditional bank checking accounts, as well as a few innovative tools that can make managing your daily expenses easier.

There are multiple ways to waive the account's monthly maintenance fee, and you can access budgeting and financial goal-setting tools.

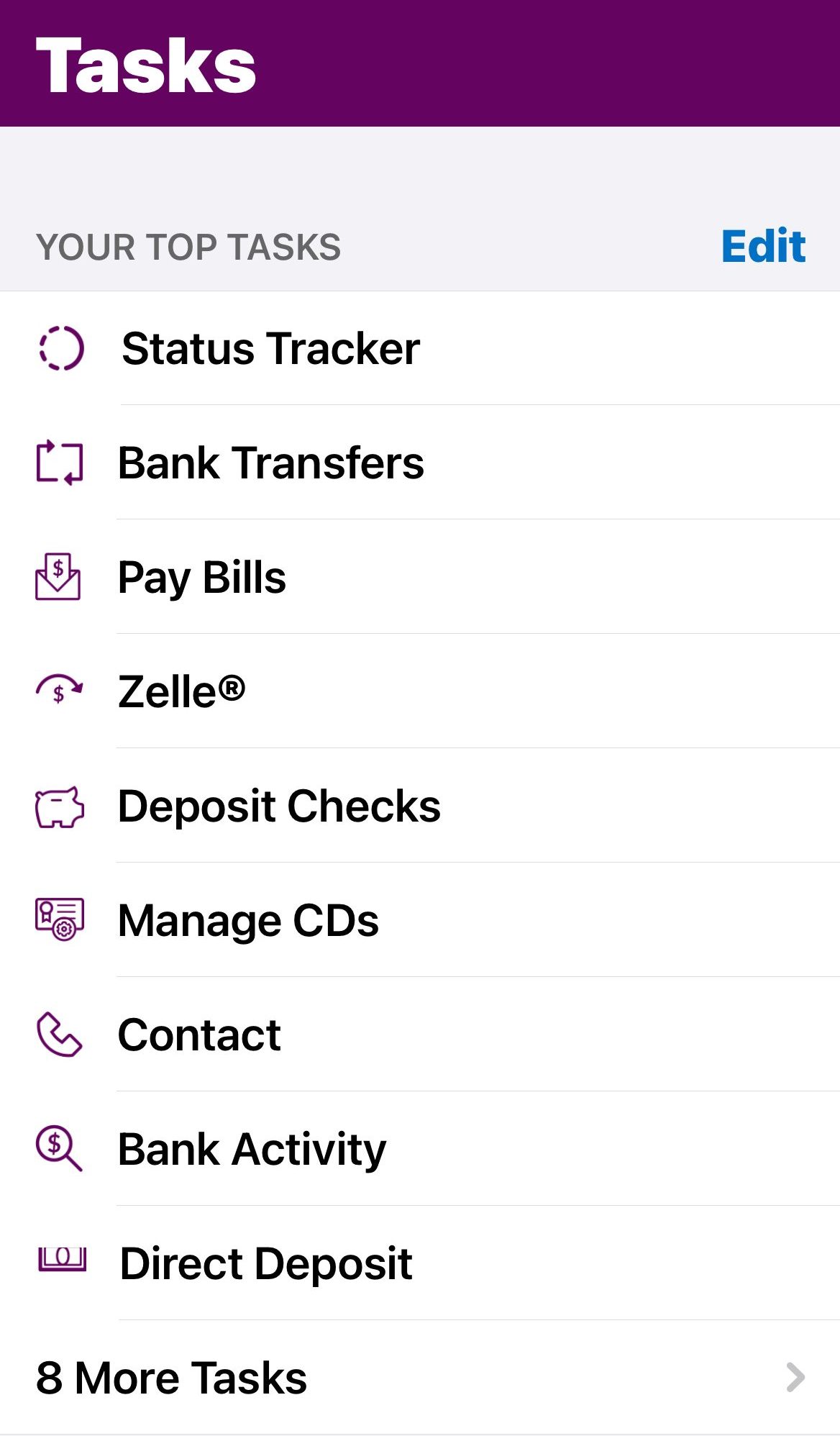

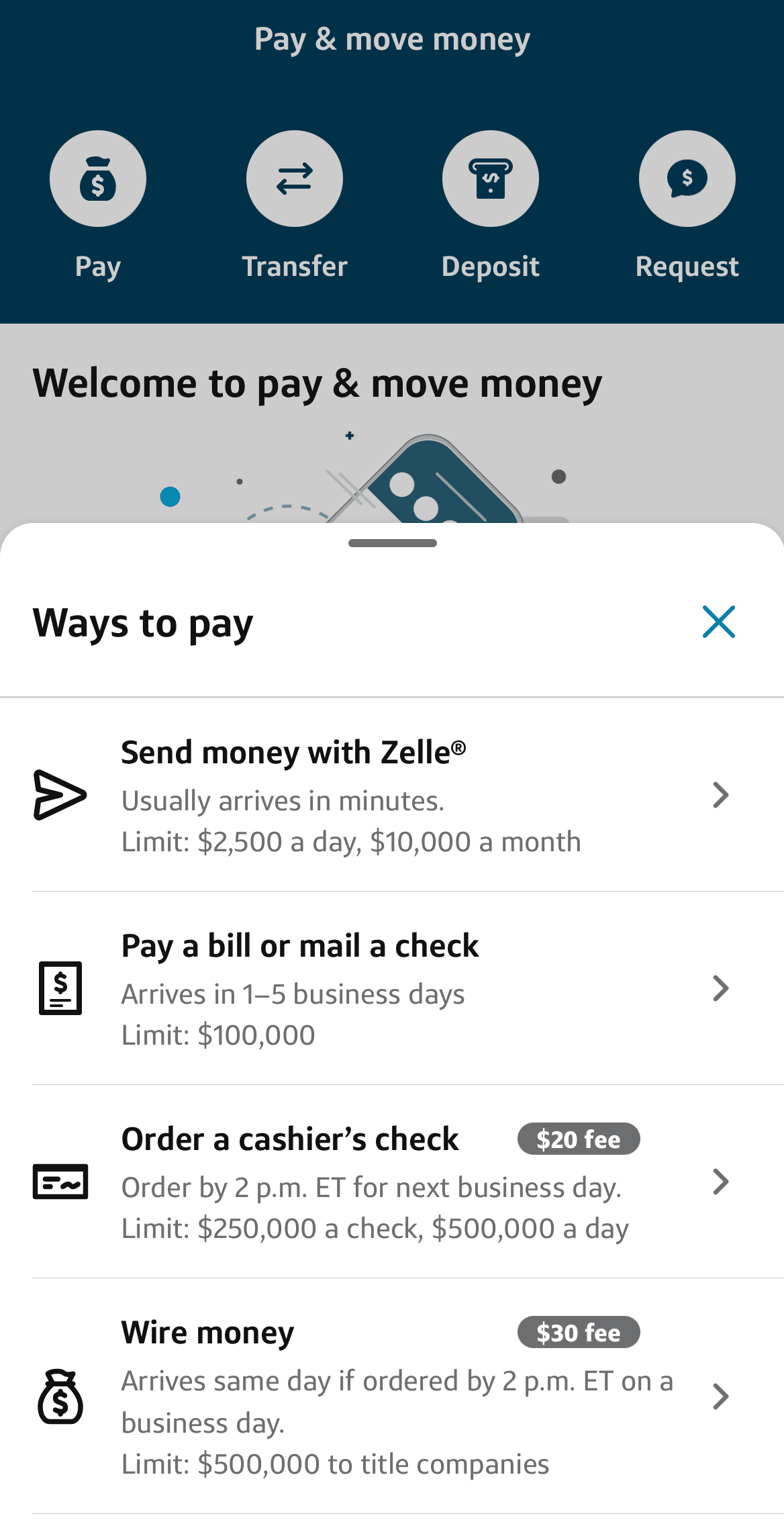

Opening an account is straightforward and can be done online, and you can manage your account through your local branch or the bank's online platform or mobile app.

The app used for Smartly Checking is user-friendly and highly regarded for its features, such as mobile check deposit and customer service tools.

- Savings Accounts

- Checking Accounts

- CDs

- Money Market Account

- Mortgage

- Government Mortgage

- Debit Cards

- Credit Cards

- Personal Loans

- Investing

Capital One 360 Checking

Fees

Minimum Deposit

Current Promotion

APY Checking

- Why We Picked It?

- Banking Options

If you want to open a joint checking account with your teen, Capital One has a Money Checking account that is available for children aged eight or older together with a parent or guardian.

The account has no fees, and there are no minimum balance requirements. Additionally, you don’t have to have a Capital One account of your own, as you can link an account from another bank in a few simple steps.

This account is interest-bearing, but there are some limitations. For example, there is no facility to write checks, as it is a debit card-only account.

Also, while the ATM network includes over 70,000 machines, if you use a non network ATM, there is no fee reimbursement.

- Savings Accounts

- Checking Accounts

- CDs

- Credit Cards

- Debit Cards

Citi Access Account

Fees

Minimum Deposit

Current Promotion

APY Checking

- Why We Picked It?

- Banking Options

The Citi Access Account is the bank’s lowest-tier checking account, but it offers access to an extensive ATM network with more than 72,000 machines throughout the US, with withdrawal limits of $1,500 per day from ATMs and up to $5,000 for debit card purchases daily.

There are no opening deposit requirements, no overdraft fees, and the monthly service fees are straightforward to waive.

The main advantage of Citi accounts is that there are checking and savings account packages, so you can pair your Access account with a savings account to get your finances under control.

However, there are no paper checks with this account. So, if this is an important feature for you, this is not the right account for you.

- Savings Accounts

- Checking Accounts

- CDs

- Mortgage

- Personal Loans

- Debit Cards

- Credit Cards

- Investing

LendingClub Rewards Checking

Fees

Minimum Deposit

Current Promotion

APY Checking

- Why We Picked It?

- Banking Options

LendingClub Bank is a great option for couples looking for a rewards checking account.

The Rewards Checking earns up to 1% cash back on debit card transactions from either person’s debit card.

You do need to maintain a minimum balance or receive a minimum amount of direct deposits each month to qualify for the premium cash back rate.

However, the cash back is available on an unlimited number of debit card transactions each month.

There are also no minimum balance requirements or monthly maintenance fees. LendingClub will also reimburse your US and international ATM fees with no limit.

However, the account is only interest bearing if you maintain a minimum balance of $2,500.

- Savings Accounts

- Checking Accounts

- CDs

- Personal Loans

- Debit Cards

- Credit Cards

What is a Joint Bank Account?

As the name suggests, a joint bank account is jointly owned by two parties.

This means that you open the account with someone else, usually a spouse or partner. However, you can have a joint account with a parent or child.

A joint bank account is typically a checking account that offers all the features you would expect from a sole checking account, such as ability to pay bills or receive salary payments.

Both parties will receive an associated debit card that they can use to make purchases in stores or online. However, it is also possible to open a joint savings account.

How to Find the Best Joint Account for You?

While we’ve discussed some great joint checking account options, there are plenty of other products if these do not seem like the right choice for you.

If you want to narrow down the choices, there are some factors to consider:

- What Are the Account Requirements?

The first thing you need to check is if there are any requirements to open and maintain your account. Banks tend to have different requirements, which can vary from product to product.

You need to check if there are any requirements or if you need to meet specific requirements to avoid monthly maintenance fees.

- What Fees Could Apply

This follows on from the previous point, but you need to be aware if there are any charges to maintain your account each month.

However, you should also check what fees may apply to your account, including overdraft fees, ATM fees or other charges.

- Online or Branch Access

This is a matter of personal preference, but if you like the reassurance of speaking to customer service in person, you’ll need an account that provides branch access.

However, if you are tech-savvy and like using an online portal or an app, you may be able to save fees and charges with an online-only account.

- The ATM Network

Even if your account offers reimbursement for out of network ATM fees, you may not have access to full ATM services.

So, if you need to deposit cash or access other ATM features, check that your potential bank has ATM coverage in your area and how much you can withdraw.

- The App Functionality

These days, practically every financial institution has an app that you can use to manage your account. However, not all these apps have the same level of user experience or functionality.

It is well worth checking the customer ratings of the various apps to see if previous and current users find them easy to use. You may find the app frustrating if you see a number of complaints about particular glitches.

Types of Joint Account

While we’ve been discussing joint checking accounts, there are different types of joint accounts. These include:

- Basic Checking Account: These types of accounts offer all the basics, including access to online banking, a debit card and possibly the ability to write paper checks. While they may lack the bells and whistles of more sophisticated checking accounts, they tend to have fewer or no monthly maintenance fees or easy-to-achieve waiver criteria.

- Standard Checking Accounts: These accounts are the “standard” form of checking account with all the features you would expect. You may need to pay a monthly maintenance fee or meet more challenging waiver criteria, but there could be perks such as ATM fee reimbursement.

- Interest Bearing Checking Accounts: These accounts pay interest on credit balances. Although this is typically far lower than a savings account, if you need to keep a reserve fund in your account to cover various bills or payments, it is nice to earn a little on the money while it is sitting in your account.

- Rewards Checking Accounts: These accounts offer cash back or other rewards for using your debit card. This is similar to a rewards checking account, but you do need to watch out for any caps on the rewards.

- Savings Accounts: Finally, if you want to take control of your finances, you not only need a joint checking account, but also a joint savings account. This will make it easier to work towards your savings goals.

Joint Checking Account: Pros and Cons

As with any financial product, there are both positives and potential negatives associated with joint checking accounts. It is important to be aware of these before making the decision to open a joint checking account.

Pros | Cons |

|---|---|

Convenience |

Lack of Privacy |

Greater FDIC Coverage | Overdraft Issues |

Potential Larger Account Balance | Creditor Problems |

Immediate Access to Funds | Difficulties If a Relationship Ends |

- Convenience

One of the biggest advantages of a joint account is that you have the convenience of having the money you need for shared responsibilities in one place.

For example, if you’re running a household together, you can both contribute to the account and withdraw funds at your discretion. This makes it easier to manage shared bills without needing to work out another way to split the bills.

- Greater FDIC Coverage

When you have a joint account, it increases the FDIC insurance coverage. While a sole account has coverage for up to $250,000, each co owner on a joint account is entitled to this coverage, so it offers a combined coverage of up to $500,000.

- Potential Larger Account Balance

Many banks offer perks when you have a larger balance, so having a joint account can help couples take advantage of these benefits.

When you pool your funds into one joint account, it will be easier to meet the minimum balance requirements to waive maintenance fees or access lower loan rates.

- Immediate Access to Funds

Should the worst happen and your partner passes away, a joint account means that you can still access communal funds. While you may be entitled to the money as a beneficiary or next of kin, the probate process can be quite time consuming.

However, as a co-owner on the account, you can access any funds in a joint account.

- Lack of Privacy

If you are not comfortable with your partner knowing how you spend money or you want to buy a surprise gift, a joint account can be a problem, particularly if you have debit card SMS alerts.

- Overdraft Issues

If you and your account co-owner are not both on the same page about bills and purchases, it can lead to overdraft issues.

For example, if one of you makes a purchase, it could cause a bill to be returned. It can also lead to embarrassing situations, where your debit card may be declined when you’re making a purchase because your partner has inadvertently spent your intended funds.

- Creditor Problems

If you share a bank account and your partner has unpaid debts, creditors may go after the money in your joint bank account to satisfy the debt.

- Difficulties If a Relationship Ends

Finally, if your relationship goes through difficulties or you split up, there can be arguments about how the funds in the account are divided.

You may feel particularly aggrieved if you feel more of the funds solely belong to you. In some cases, one person may withdraw all the funds before ending a relationship and you would have no recourse.

How to Open a Joint Checking Account Online?

Opening a joint checking account online is similar to an individual account. Many banks and financial institutions allow their accounts to be opened online, so you won’t need to visit a branch or make phone calls.

1. Gather Your Paperwork

Before you begin the actual account opening procedure, gathering the required documentation and paperwork is a good idea. Depending on the bank or financial institution, you may need to upload your documents as part of the application form, but others require submission later. Either way, if you delay sending your documents, it will slow down the account opening procedure.

Banks will require that you provide the ID and address for both applicants. So, you’ll need a government-issued ID, such as a driver’s license or passport, and a utility bill. You will also need personal information for both of you, including Social Security Numbers, dates of birth, and full names.

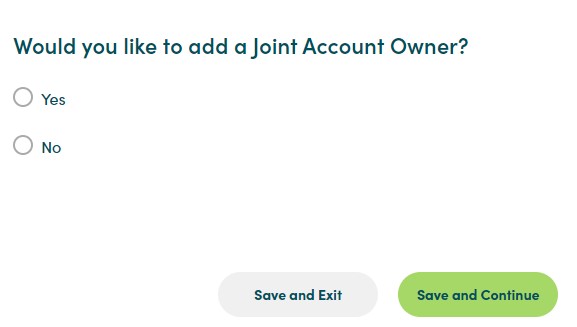

2. Complete the Application Form

You’ll be directed to the application form for the appropriate product when you click “apply” on the product page. When you click the button, you will be redirected to further product details and confirm you want to apply.

Complete the application form, filling in all the required fields, such as name, address, phone number, email, and Social Security Number. Then there is usually a prompt for adding another account owner. When you click yes, you’ll need to fill in the details for your partner.

3. Await Approval

After you submit your application form and the required documentation, you’ll need to wait for account approval. Depending on the financial institution and specific account, this may take a day or two.

Once your application has been approved, the bank will provide you with your new bank account information, so you can start setting up your bill payments and having your salary paid into the account.

4. Activate Cards

Your new debit cards should arrive in the mail in approximately one week. Once you have them, you’ll need to activate them via the online portal, phone number, or app. Then you’re ready to use your new account fully.

Best Tips To Get Started With Your Joint Bank Account

Once you’ve decided to open your joint bank account, some tips can help you to get started.

- Set your goals and expectations: First, you should have a conversation about your account expectations and goals. You both need to understand what the account will be used for and if there is a budget for incidental debit card purchases. Ideally, you will have worked out a budget, so you will know how much you have to spend, but if funds are tight, you may want to keep this account for essentials, such as bills.

- Set up your bill payments: If your joint account is for household expenses, get your bill payments set up on the account as soon as possible. This will help you keep organized and ensure that the bills are covered per your agreement.

- Set up your direct deposits: Be sure to give your employer your new account details or if you’re using the account as a secondary checking account, set up an automatic transfer for the desired amount each week or month.

- Check you meet the requirements: Finally, be sure that your new account activities will meet the requirements for fee waivers.

How To Close A Joint Bank Account

Closing your joint bank account is similar to the process to close any other bank account. Depending on the bank policies, both account holders may need to visit a local bank branch. It may also be possible to request account closure via email, mail or fax.

If your account is online only, you will need to both log into the dashboard and approve an account closure. If you need to visit a branch, you will need to bring proof of your ID.

You will need to withdraw any funds remaining in the account or settle any negative balance. The bank team will calculate if there are any fees or partial fees that need to be applied to the account before closure.

Many banks require that you send in or destroy any associated debit cards and ensure that you don’t use your card while you’re awaiting account closure. You should also double check that all of your bills and your salary payments have been redirected to another account.

FAQs

Is a Joint Bank Account Right for You?

This will depend on your preferences and requirements. There are financial risks and you need to feel completely confident that you can trust your partner.

What are the requirements to open a joint checking account?

You will need to provide proof of ID and address for both parties. You will also need to provide personal details including your full names, dates of birth and Social Security Numbers.

Do joint checking accounts offer promotions?

This depends on the bank. Some banks do have promotions for new accounts.

Can I open a joint checking account with no initial deposit?

There are many joint checking accounts that do not have a minimum initial deposit.

Does a joint checking account earn interest?

There are a number of interest bearing joint checking accounts, just be sure to check the terms and conditions to see if you need to maintain a minimum balance to qualify for interest.

Can i deposit an estate check into a joint account

In most cases, you cannot deposit an estate check into any private account including a joint account. Estate checks can only be deposited into an estate account.

Can I open a joint bank account online?

There are many banks that allow you to open a joint bank account online. You’ll need to complete an application form and submit the required documentation, but you won’t need to call into a branch.

Can you deposit a joint check into a single account?

This depends on the wording on the check. If it is made payable to X and Y, both parties would need to endorse the check. However, if it is made payable to X or Y, either could deposit it into their single account.

Can one person close a joint bank account?

Generally, banks require that both parties sign the account closure form or are present in the branch for an account closure request.

Can you close a joint bank account over the phone?

This depends on the bank. You may be able to submit a closure request over the phone, but you are likely to have to confirm it with a written request.

Is it safe to open a checking account online?

Most financial institutions have secure websites that ensure it is safe to open a checking account online.

Can you add a spouse to a joint bank account?

This depends on the bank, but many do allow you to add another party to your account to transform it into a joint bank account.

FDIC or NCUA insurance: what's the difference?

These insurances work in a similar way, the primary difference is that FDIC insurance is for bank deposits, while NCUA insures credit union deposits.

Can I remove my name from a joint checking account?

It may be possible to remove your name from a joint checking account, but you would need to check the specific policies for your bank.

Picking The Best Joint Checking Accounts: Methodology

The Smart Investor team conducted an extensive evaluation of hundreds of banks and credit unions to identify the best joint checking accounts available. We considered crucial factors specific to joint checking accounts, focusing on four primary categories:

Account Features (40%): We evaluated the features and benefits offered by each joint checking account, such as ATM access, mobile banking capabilities, check deposit options (mobile or in-person), bill pay services, and access to surcharge-free ATM networks. Joint checking accounts providing a comprehensive set of convenient features earned higher scores.

- Fees and Terms (30%): In this category, we assessed the fees associated with joint checking accounts, including monthly maintenance fees, overdraft fees, and minimum balance requirements. Joint checking accounts with lower fees and more favorable terms received higher ratings.

Customer Experience (20%): This category focused on the overall customer experience, including the ease of account opening, communication with customer service representatives, the usability of mobile banking apps (tested by our team), and the responsiveness of customer support. Joint checking accounts with user-friendly interfaces, efficient customer service, and intuitive mobile apps received higher ratings.

Bank Reputation (10%): Our team examined each bank's reputation based on factors such as customer satisfaction ratings, JD Power scores, TrustPilot reviews, and the bank's Better Business Bureau (BBB) profile. Banks with positive reputations and a history of satisfied joint account holders received higher ratings.

We carefully weighted various features and qualities within each category to ensure a comprehensive evaluation of each joint checking account.