Fidelity

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- FAQ

Fidelity is a well known name in the investing industry, with a history dating back to 1946. However, the company has moved with the times and is not stuck in the traditional brokerage model.

The Fidelity app and investing platform offer innovative features designed to appeal to a wide variety of investors, from total newbies to frequent traders.

While Fidelity may have established its name as a traditional brokerage with bricks and mortar locations around the country, it is now possible to access its experience and expertise from the comfort of your own home.

In this Fidelity review, I’ll walk you through my experiences using the platform with the features I found most useful and where I’ve identified areas where Fidelity could make some improvements to help you decide if it is the right choice for you.

Are there any account minimums at Fidelity?

Fidelity has no account minimums for most of its accounts, including individual brokerage accounts and IRAs, making it accessible for investors at all levels. However, Robo advisor and weakth management options do require fee, depend on the chosen plan.

Can I access international markets through Fidelity?

Fidelity offers access to some international markets, but its range of international investment options is more limited compared to global-focused brokerages.

What is Fidelity’s cash management account?

Fidelity’s cash management account is a hybrid checking and savings account offering features like ATM fee reimbursements, check writing, and FDIC insurance through partner banks.

Does Fidelity offer fractional shares?

Yes, Fidelity allows investors to purchase fractional shares of stocks and ETFs, enabling them to invest in high-priced securities with as little as $1.

What retirement account options does Fidelity provide?

Fidelity offers traditional IRAs, Roth IRAs, SEP IRAs, and rollover IRAs, as well as 401(k) plans for businesses and self-employed individuals.

What is Fidelity’s stance on socially responsible investing (SRI)?

Fidelity offers a range of socially responsible investment (SRI) options, including mutual funds and ETFs that focus on environmental, social, and governance (ESG) criteria.

Pros | Cons |

|---|---|

Wide Range of Investment Options | Low Interest Rates On Uninvested Cash |

Access to annuities, CDs and IPOs | Robo-Advisor/Wealth Management Fees |

Comprehensive Retirement Planning | No Paper Trading |

Strong Research and Educational Resources | No Futures Trading |

Fidelity Features I Mostly Liked

Here are the key features that I found most appealing in Fidelity:

-

Fidelity Go

Fidelity Go is the brokerage’s robo advisor. To use this service, all I needed to do was answer a couple of questions and Fidelity built a strategy around my specific needs. I could then enjoy my money being professionally managed in a completely hands off approach.

Fidelity monitors the markets and automatically rebalances my portfolio to keep it on track. However, the best thing is that Fidelity Go is a tiered program. If my balance is under $25,000, I don’t incur any advisory fees.

For those with a balance over $25,000, there is a 0.35% advisory fee, but this also includes access to the Fidelity advisor team and unlimited 20-minute one-on-one phone calls to discuss all aspects of investing and finance, including retirement planning, budgeting, and even managing debt.

There are no minimums to open an account and there is just a $10 minimum investment. But, I can also set auto fund deposits, so I can set and forget my portfolio.

-

A Variety of Retirement Products

Fidelity offers a solid variety of IRAs, including Traditional and Roth IRAs, as well as retirement products for the self-employed. This is an attractive feature of Fidelity, as many low-cost brokerage platforms are limited to a very basic selection of IRAs.

There are no fees or minimums to open a Fidelity retirement account and the platform has a number of tools to help me plan my retirement fund.

As you can see in these screenshots, I can use the retirement planning tool to create an estimate of how much I’ll need and I can keep an eye on my contributions to see if I’m on track.

I can also track my IRA activity to check my contributions and the movements of the assets in my IRA portfolio.

What is really nice about Fidelity retirement products is that while I can manage my IRA, if I have any queries or issues, I can reach out to the Fidelity team for help.

-

Fidelity Wealth Management

Fidelity also offers wealth management services to help address the full financial picture.

I have the option to work one on one with a professional to create a personalized plan that includes retirement, health care, estate planning and more. The Fidelity team can manage my portfolio to grow and protect my funds.

There are two wealth management options that depend on financial status. The general Wealth Management is available to those with a fund of $500,000 or more, but there is also Private Wealth Management.

This does require a managed fund of $2 million or more with Fidelity Wealth Services or $10 million plus with Fidelity Strategic Disciplines.

-

Research Tools

Fidelity has an impressive array of research tools that means that I don’t need to rely on a third party site to decide on my next purchase.

As with many platforms, I can look at specific stocks with an overview chart.

However, Fidelity goes beyond this. As you can see in these screenshots, I can get more in depth information about companies including a financial overview with key statistics and financial report information.

Each company is also allocated an analyst rating based on independent firm opinions.

I can also consult lists of market movers, the top rated companies by sector and even the companies that other Fidelity customers are buying and selling, so I can spot upcoming trends.

-

Watchlists

There are times when I am researching assets but I’m not quite ready to pull the trigger and place a buy order. So, I really like that Fidelity has included watchlists on its platform.

I can create multiple watchlists and get an instant view of movements in stocks of interest to me. I can also click for a more detailed view if I need further information when I’m ready to buy.

The platform also makes it easy to edit my watchlists, so I can refine my search and not need to trawl through lists of companies that I am no longer interested in.

-

Active Trader Pro

In addition to the research tools, the Active Trader Pro dashboard provides analytics for before, during and after trades. It uses real time data and insights with dozens of filters to make it easier to see opportunities.

I like how I can customize the layout to suit my personal preferences and create my own shortcuts to make the workflow easier for me. There is even a feature to create and save trade orders so I can place them in one go with just one click when I’m ready.

You do need a Windows 10 or Mac OS 12 or higher to download Active Trader Pro and it is worth checking the system requirements to ensure that your computer has sufficient memory and graphics card to support the dashboard.

-

Cash Management Account

Like many brokerages, Fidelity offers a cash management account for its clients. However, with this platform, there is a choice of two accounts.

The Fidelity Government Money Market Fund allows me to maximize any cash I’ve not currently invested, but this account does not offer FDIC protection, so Fidelity also offers the FDIC Insured Deposit Sweep Program.

The Deposit Sweep Program offers a lower rate, but it is still competitive compared to many high yield savings accounts in the marketplace.

Both accounts have no account minimums or fees, and I can access my funds via ATM with unlimited reimbursement for ATM withdrawal fees. The platform includes a comprehensive panel to manage my account with real time spending views.

I can also access Bill Pay, mobile check deposit and a digital wallet compatible debit card. There are also payment apps integrated into the system, making it easy to move my money around.

-

Fidelity Smart Money

Smart Money is Fidelity’s learning resource center. There are lots of articles that not only cover investing and retirement planning, but also money management, budgeting and small businesses.

There is also a cool little “Fact or Fiction” section, which details common theories with whether they are based in reality or have become a myth. For example, there is currently a card covering whether you can pay into a Traditional IRA along with a Roth IRA.

I subscribed to the Smart Money newsletter to receive the latest industry news along with tips for spending, saving and investing.

-

Fidelity Collections

I prefer to browse the assets to find my next investment purchase, as you can see from this screenshot.

However, I did find the Fidelity collections a helpful feature. Essentially, these are groups of investment assets to help me to quickly find my next purchase. The collections include new issue CDs and income stocks, but there are also sustainable investments.

This is a nice touch as I can invest in these companies without worrying about their environment, social or governance policies.

While this may not be a priority for every investor, sustainable investments tend to have a better long term track record. So, it is nice that Fidelity has done the research for me.

-

High Rates On CDs

Fidelity offers Certificates of Deposit (CDs) with competitive interest rates, often higher than traditional bank CD

These CDs are FDIC-insured up to applicable limits, ensuring your investment's safety. Fidelity provides a broad range of CD options, including new issue CDs and secondary market CDs, allowing investors to choose terms and rates that best fit their financial goals.

Additionally, Fidelity provides a CD laddering tool, which helps you build a strategy to maximize returns while maintaining liquidity.

Fidelity Additional Features That Helped Me

Besides the main features I use regularly, there are additional features for investors:

-

The Selection of Mutual Funds

Since Fidelity is such a well established name in investment products, it should be no surprise that you can access a decent selection of mutual funds. However, that is impressive is that Fidelity offers two ways to invest in mutual funds.

There are approximately 3,400 mutual funds that don’t carry a transaction fee. So, although there are still expense ratio charges, you can buy and sell these funds without fees.

Fidelity also has several fee free funds with no transaction fees or annual expense ratios. As you can see in the following screenshot, customers can also exchange mutual funds:

You don’t even need to be a Fidelity brokerage customer to access these fee free funds, making them a solid choice even if you’re not completely sold on the brokerage services.

-

Fidelity Crypto

Fidelity Crypto allows me to buy and sell ethereum, litecoin and bitcoin within the same app as my stock trades. I can also access crypto ETFs.

What is nice about Fidelity Crypto is that I can get started in this niche with just $1. This is helpful if you’re new to crypto and don’t want to commit a large portion of your investment fund.

While Fidelity may lack the long list of cryptocurrencies that some other platforms offer, there are plenty of helpful resources including crypto news, market updates and even a helpdesk.

The trades are free of commission and there is just a 1% spread included in the trade execution prices to cover Fidelity’s costs.

-

IPO And Annuities

Fidelity provides opportunities for both IPO investments and annuities to help diversify and secure your financial future. IPOs (Initial Public Offerings) offer a chance to invest in companies as they go public, potentially benefiting from early growth.

Fidelity supports this with an IPO calendar, detailed company information, and alerts, though participation requires a portfolio of at least $100,000 and no guarantee of share allocation.

For retirement planning, Annuities are available through The Fidelity Insurance Network, offering income, fixed, and variable annuities. Investors can work with Fidelity advisors to tailor plans that meet their specific needs.

How's Fidelity Customer Support?

Fidelity also has a solid reputation for its customer support. If I run into any issues, there is a comprehensive help section on the platform with dozens of topics. I can even share my screen with the support team if the issue is a little complex and I need help.

If the help section doesn’t provide an answer, I can ask the Fidelity virtual assistant or call the helpline 24/7. Fidelity also offers live chat with specialized support for any technical or account issues.

This service is available 8 am to 10 pm Monday to Friday and 9 am to 4 pm on weekends.

Investing With Fidelity: What Can Be Improved

No platform or company is perfect and there are a couple of areas where Fidelity could make some improvements. These include:

- No Paper Trading: While Fidelity is fairly beginner friendly with resources for investors of all experience levels, it does lack paper trading. Paper trading is not only great for building initial investing confidence, but it is also remarkably helpful for testing out new investing strategies, so this is an obvious gap in the Fidelity feature set.

- No Futures Trading: Although Fidelity offers options, forex and fractional share trading, it does not offer any futures trading. Considering the product list is quite comprehensive including retirement and student accounts, charitable giving and more, it would be nice if I could also access futures.

- Limited Crypto: It is nice that Fidelity does make it easy to access crypto trading with low minimums and minimal fees. However, the selection of coins is quite basic. It is possible to expand this with crypto ETFs, but it would be good if I could trade in more coins directly.

What Type of Investor is Best Suited to Fidelity?

While Fidelity is a good all round investing option, there are a few types of investors who are likely to get the most from the platform. These include:

-

Technical Traders

Although Fidelity is beginner friendly, it does offer comprehensive research capabilities for ETFs, stocks and fixed income assets.

I can find pretty much everything I need for fundamental or technical trading without needing to seek out third party resources.

-

Retirement Planners

Fidelity is a leader in retirement planning services, offering a variety of retirement accounts (like IRAs and 401(k) plans) with comprehensive planning tools.

Investors focused on retirement can benefit from Fidelity's target-date funds, retirement calculators, and personalized advice, helping them stay on track with their long-term goals.

-

High Net Worth Individuals Looking For A Dedicated Advisor

Fidelity is an excellent choice for investors who need a dedicated advisor, particularly through its Wealth Management and Private Wealth Management services. These services are tailored for high-net-worth individuals who require personalized and comprehensive financial planning and investment management.

-

Investors Seeking An Automated Investing Or Hybrid Approach

Fidelity offers excellent options for investors who prefer the convenience and efficiency of robo-advisors, particularly through Fidelity Go® and Fidelity Managed FidFolios℠.

These services are designed to provide professional investment management with minimal effort required from the investor and can be combined with self directed investing.

Fidelity Trading Platforms

Fidelity Investment's trading platform, Active Trader Pro, has a bundle of features enabling the investor to closely monitor the account and easily find the desired products to trade.

It comes in all versions (desktop, web-based, and as an app for trading on-the-go).

It makes it easier to discover trading opportunities using various filters (e.g., social sentiment) and has an options trade builder feature that helps traders in the learning process of trading options.

The platform also enables simple and complex multi-leg option orders, which typically is a complex feature for options trading.

Fidelity Customer Service

Fidelity Investments puts customer service at the top of its agenda.

It may charge higher margin rates than competitors, but the customer service makes you feel it earns a higher commission with interest.

A 24/7 customer service rule applies, and there's a representative standing by to help, regardless of the time during the day or night. One can also use the live chat options within certain working hours, send a secure email or use the virtual assistant for the most common questions and answers.

Trading Education

Fidelity Investments built a state of the art learning center that focuses on five different areas: Active Trader Pro, options, technical analysis, trading basics, and volatility.

Literally, the broker offers virtual courses to learn about each individual area. All those with an active account at Fidelity Investments can register in advance and take part in the course.

What's interesting is that the courses address all types of investors and cover a wide range of topics, from beginner trading strategies to complex features of the trading platform, for example.

How to Open a Brockerage Account With Fidelity?

Step 1:

Visit the Fidelity Investments homepage and click “Open an account.”

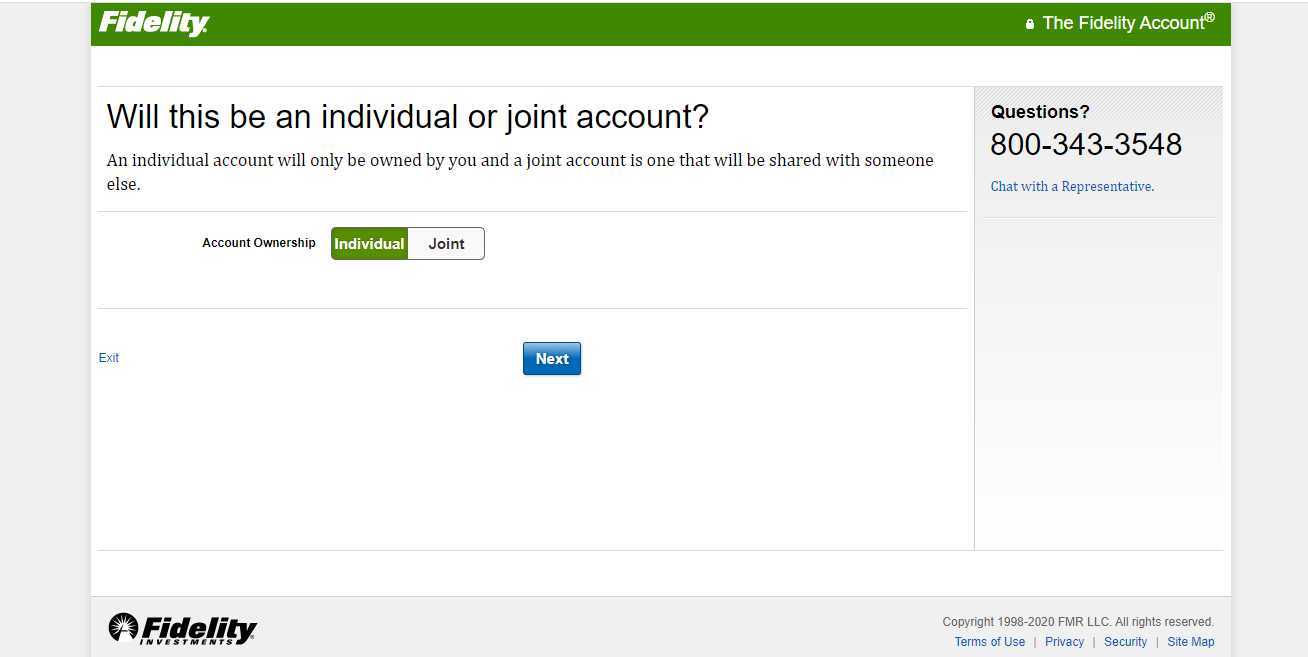

Step 2:

Next, indicate whether it is a joint or an individual account.

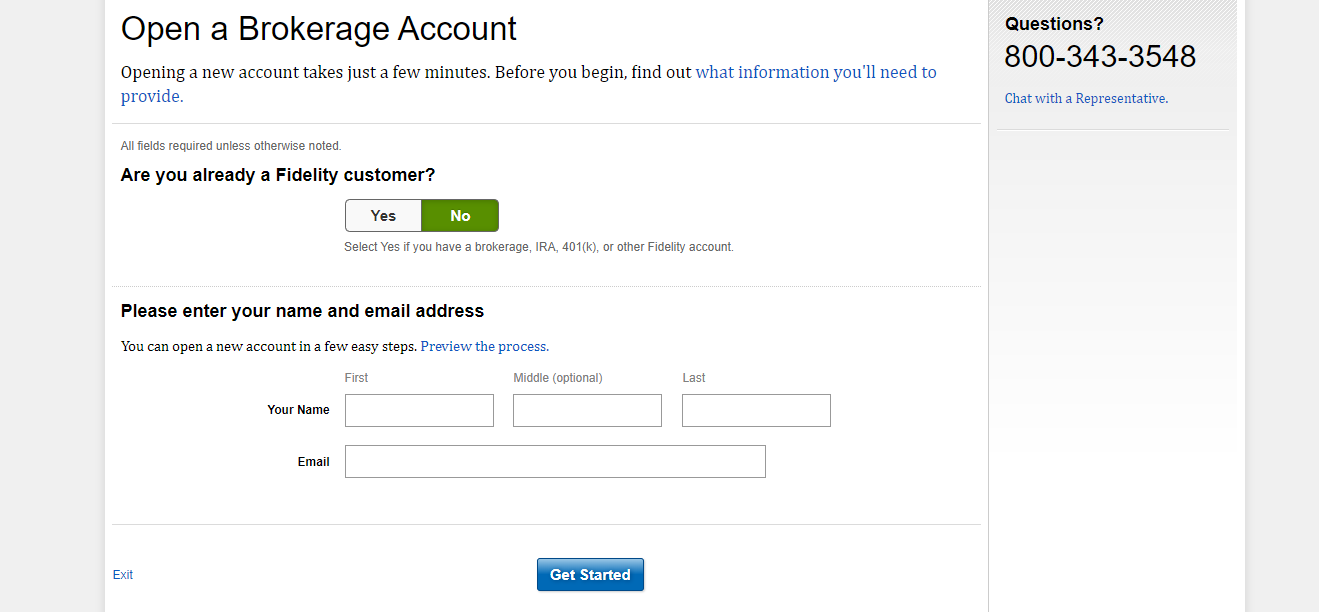

Step 3:

Create a new account, inserting your name and email address.

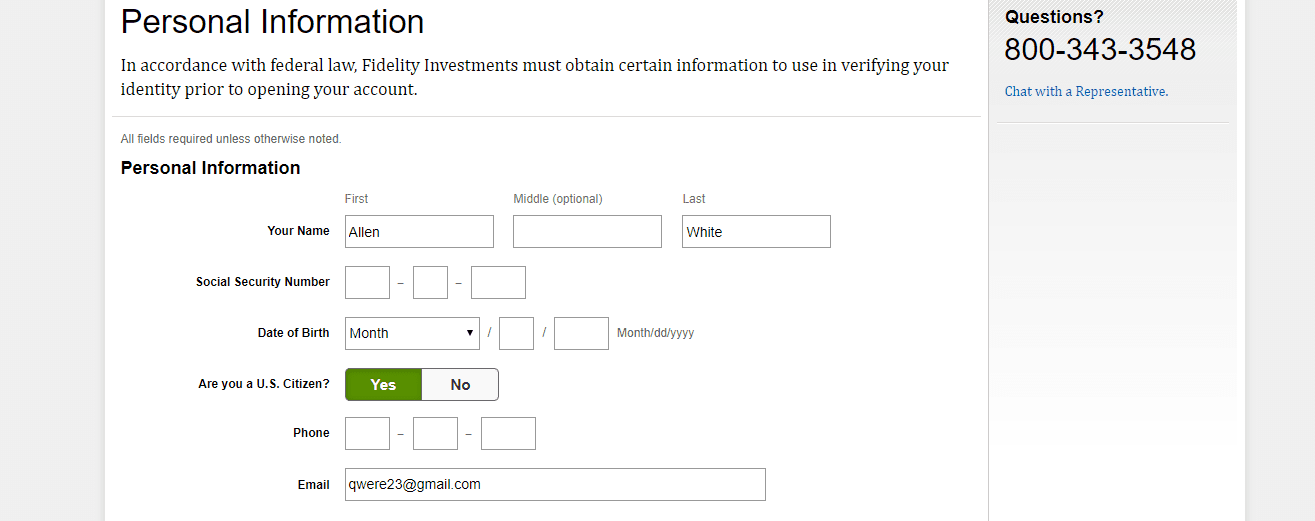

Step 4:

The next page comes up, insert your security number, date of birth, and phone details.

Step 5:

Type in your residential address, and the city, state, and zip code of your location, then click “Next.”

Once your identity is verified, you are good to go.

FAQs

How does Fidelity's trading education compare to competitors?

Fidelity's trading education division is strong and often surpasses competitors, offering valuable resources for improving trading skills and understanding financial markets.

Can beginners benefit from Fidelity's services?

Yes, beginners can benefit from Fidelity's educational resources and user-friendly platform, which help them understand and navigate the world of investing. However, fees may be a bit high for beginners.

Is Fidelity's customer service responsive and helpful?

Yes, Fidelity is known for its excellent customer service, offering prompt assistance and guidance to investors, which can be especially valuable during market fluctuations.

What sets Fidelity apart from other brokerages?

Fidelity stands out for its exceptional customer service, comprehensive trading education, and a diverse array of investment products.

Fidelity vs. Competitors: How Does It Stack Up?

Both Schwab and Fidelity offer great options for traders, plans for wealth management, and sophisticated auto-investing platforms.

Fidelity excels in investment options, wealth management, and retirement planning. Webull trading platform is one of the most fascinating we've seen.

Both platforms have great options for investors, but Fidelity excels in comprehensive retirement planning and cash management options

Interactive Brokers vs. Fidelity: Which Brokerage Suits Your Investing Style?

Fidelity is our winner due to its investment options, research tools, advanced trading features, and excellent retirement planning services.

J.P. Morgan Self-Directed Investing vs. Fidelity : A Side-by-Side Comparison

Fidelity has more investing options, cheaper robo-advisor, and more banking options. Merrill is better for Bank of America customers.

Fidelity in retirement planning and personalized wealth management, while E-Trade stands out with its research tools and competitive savings rates

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners

Fidelity is our choice due to its better retirement options and more extensive trading app. But, the differences are insignificant.

Review Brokerage Accounts

How We Rated Brokerage Accounts: Review Methodology

At The Smart Investor, we evaluated brokerage account platforms based on their overall value, features, and user experience compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to investors, including fees, trading tools, investment options, and security. Each platform was rated based on the following criteria:

- Fees & Commissions (20%): We prioritized commission-free trading and low-margin rates. The best platforms had zero hidden fees, while others charged for inactivity or withdrawals.

- User Experience & Interface (20%): A clean, easy-to-navigate platform with smooth execution scored highest. Some apps felt outdated or laggy, impacting the experience.

- Trading Tools & Features (30%): We favored platforms with real-time data, smart order types, and special features that support smart investing. Some lacked depth, making it harder for active traders.

- Automated Investing (10%) : The best platforms offered AI-driven portfolios, robo-advisors, and automatic rebalancing. Some lacked automation or charged high fees for managed accounts.

- Investment Options (10%): Platforms with stocks, ETFs, options, crypto, and fractional shares scored highest. A few lacked key asset classes or international access.

- Account Types (5%): The best platforms supported taxable accounts, IRAs, and custodial options. Some lacked flexibility, limiting investment strategies.

- Cash Management & Banking Features (5%): We favored platforms with high-interest cash accounts, debit cards, and seamless banking. Many lacked competitive rates or useful features.