Acre Gold

Storage Fees

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

Acre Gold is a relatively new player in the precious metals market, offering a unique way for people to invest in gold through a subscription-based model.

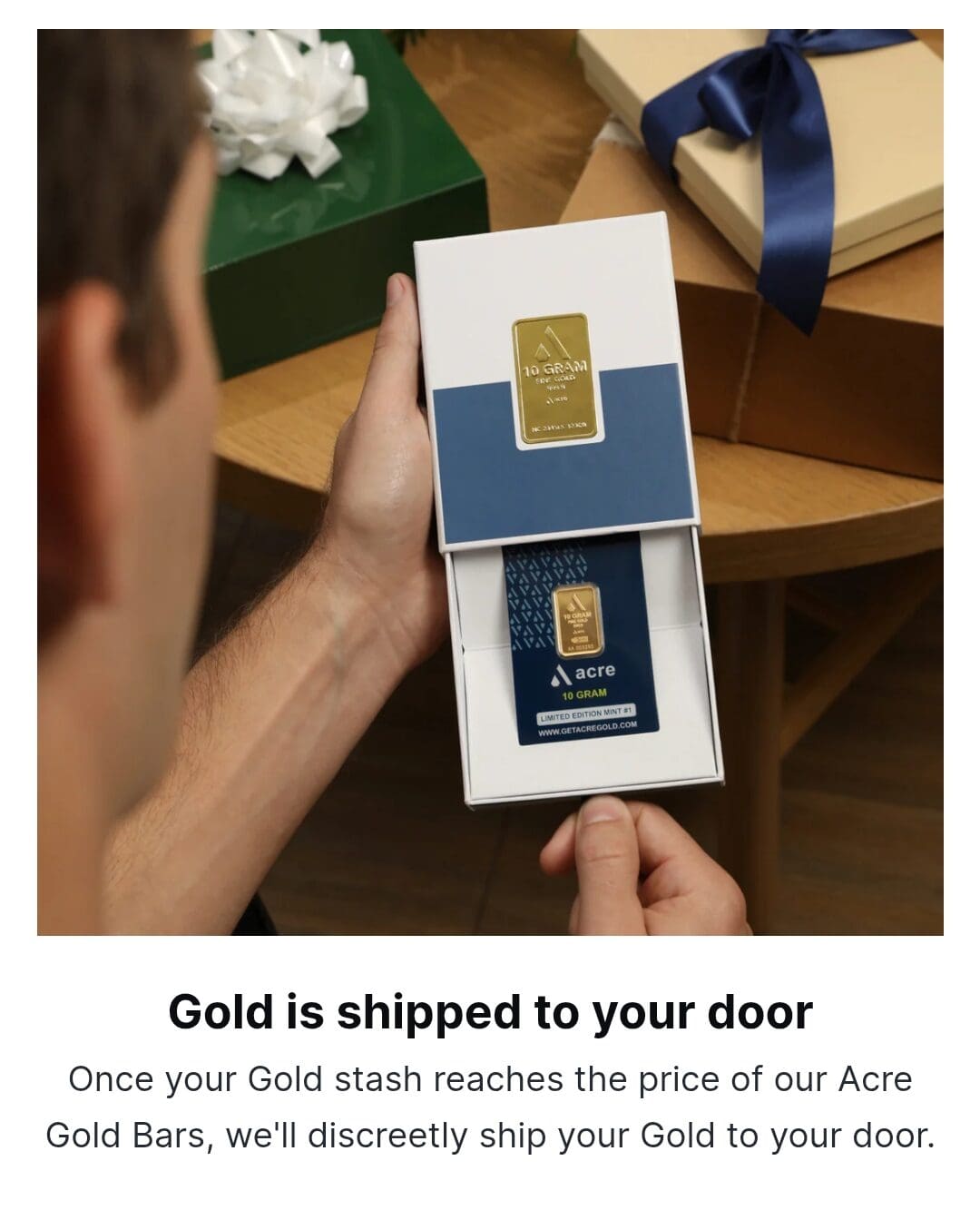

The business model is simple: you choose a subscription tier, make monthly payments, and receive gold bars once your contributions hit the required threshold.

Once a customer’s balance reaches the price of a gold bar, the company ships it directly to their doorstep.

Acre Gold is headquartered in Santa Monica, California and the company is backed by Science Inc., a venture firm.

- Easy Gold Accumulation Over Time

- Physical Gold Ownership

- Multiple Subscription Tiers

- No Buyback Program

- Unclear Fees & Pricing

- No Gold IRA Options

How long does it take to receive my gold bar after my payments reach the threshold?

Shipping times vary, but some customers report delays of weeks. Acre Gold does not provide a guaranteed delivery timeline.

Can I pause my subscription instead of canceling it?

No, Acre Gold does not offer a “pause” option. You must either continue payments or cancel your subscription and restart later.

Can I track my shipments once my gold is sent?

Yes, once your gold is shipped, Acre Gold provides a tracking number, but customers have reported delays in receiving these updates.

Does Acre Gold offer silver or other precious metals?

No, Acre Gold only deals in gold bars. If you’re looking for silver, platinum, or palladium, you’ll need to check other brokers.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

Is Acre Gold Trustworthy? What Customers Say

As of 2025, here isn't enough customer feedback to form a clear opinion about Acre Gold.

While its ratings on Google Play and the App Store are high, the lack of Trustpilot reviews, Google reviews, and other sources makes it difficult to assess its overall trustworthiness.

Platform | Rating |

|---|---|

Trustpilot

| N/A |

Better Business Bureau (BBB) | A+ | Accredited Since 2023 |

Google Play | 4.3 (95 reviews) |

App Store | 4.5 (109 reviews) |

Acre Gold: Step-by-Step Sign-Up Guide

Investing with Acre Gold is fairly straightforward, but it follows a subscription-based model rather than traditional gold purchasing.

Instead of buying gold outright, you make monthly payments until you accumulate enough to receive a gold bar.

Here’s how the process works:

-

Step 1: Sign Up & Choose a Subscription Plan

Visit Acre Gold’s website and create an account.

You'll need to pay a one-time $12 membership fee and choose a subscription plan based on the weight of gold you want.

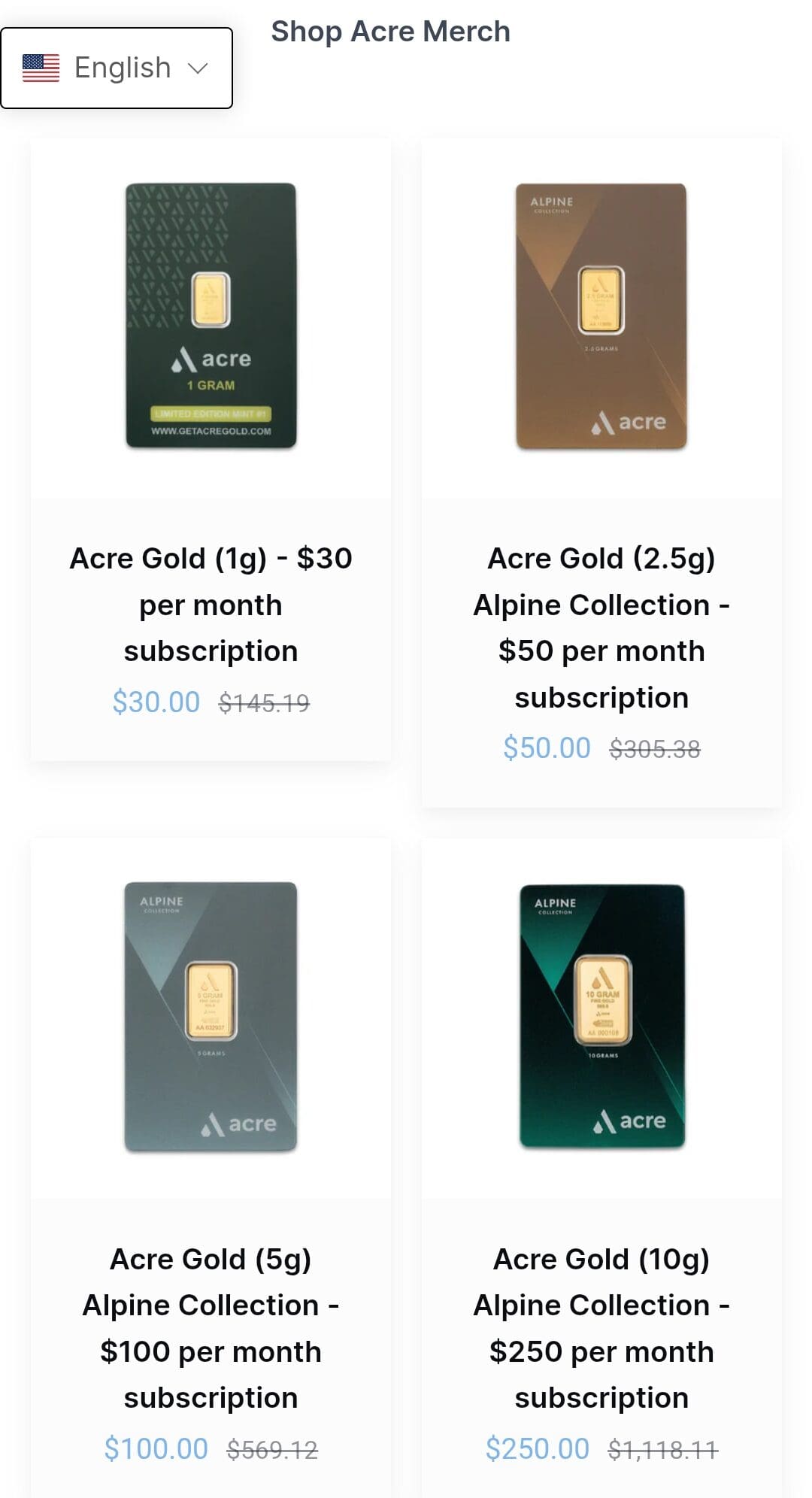

Options include 1g ($30/month), 2.5g ($50/month), 5g ($100/month), and 10g ($250/month).

-

Step 2: Make Monthly Payments

Each month, Acre Gold deducts your chosen subscription amount from your payment method.

Your contributions build up in your “Gold Stash”, which acts as a savings fund for your gold bar.

-

Step 3: Receive Your Gold Bar

Once your payments reach the price of a gold bar, Acre Gold ships it to your address in tamper-proof packaging.

Shipping and fulfillment fees apply, but they are not clearly disclosed upfront.

-

Step 4: Repeat or Cancel

After receiving a gold bar, the cycle automatically restarts unless you cancel or modify your subscription.

You can also stack multiple subscriptions for faster accumulation.

Acre Gold’s Product Line: What You Can Buy

Acre Gold offers a range of physical gold products through its subscription service, catering to both novice and seasoned investors. Here's an overview of their offerings:

1-Gram Gold Bar: Ideal for first-time buyers, this 1-gram bar is made of 0.9999 fine gold. Subscribers pay $30 per month until the total cost is covered, after which the bar is shipped directly to them.

2.5-Gram Gold Bar: For those looking to invest a bit more, the 2.5-gram bar offers a balance between affordability and value. Subscribers contribute $50 monthly until the bar's price is met.

5-Gram Gold Bar: Aimed at more committed investors, this 5-gram bar allows for a more substantial gold holding. The subscription is set at $100 per month until the full amount is accumulated.

10-Gram Gold Bar: Designed for serious investors, the 10-gram bar provides a significant addition to one's portfolio. Subscribers pay $250 monthly until the bar's cost is fully paid.

Each bar is minted with the Acre Gold logo and comes with a certificate of authenticity, ensuring the purity and quality of the gold.

Does Acre Gold Offer Secure Storage?

Acre Gold offers a digital gold storage program, where instead of receiving physical gold, the company holds it for the customer in their vault.

Investors can track their holdings online and may be able to redeem or liquidate their gold later.

Key Benefits:

- Secure storage – No need to worry about theft, loss, or damage from home storage.

- Convenience – Customers can accumulate gold without the hassle of shipping or delivery.

Key Drawbacks:

- $1 monthly storage fee – While small, this fee adds up over time.

- Lack of clarity – There is no clear process for retrieving or selling digital gold.

- Lower resale value – Customers who cash out their digital gold have reported low market value payouts.

Acre Gold’s Pricing: More Expensive Than Spot

Apart from the gold bar cost, Acre Gold charges various fees that can add up over time:

Fee | Cost |

|---|---|

One-time Membership Fee | $12 |

Monthly Subscription Fee | $30 – $350, Depends on gold bar weight

|

Storage Fee (Digital Gold) | $1/month, only for digital gold storage |

Shipping Fee | Varies, up to $50 |

Cancellation Fee | $20, applies to canceled shipments |

Acre Gold’s fees make it convenient for small-scale gold buyers, but higher prices and hidden costs may not be ideal for serious investors.

Is There A Buyback Policy?

One major downside of Acre Gold is that it does not offer a buyback program, meaning customers cannot sell their gold back to the company.

This limits liquidity, as investors must find an external buyer if they decide to liquidate their gold holdings.

Unlike many traditional gold brokers that offer direct buyback options, Acre Gold leaves customers on their own when it comes to reselling.

Additionally, Acre Gold’s subscription model means that gold is not immediately liquid—customers have to wait until their payments reach the required threshold before they receive a physical gold bar.

This can take months, making it a slower way to accumulate gold compared to direct purchases.

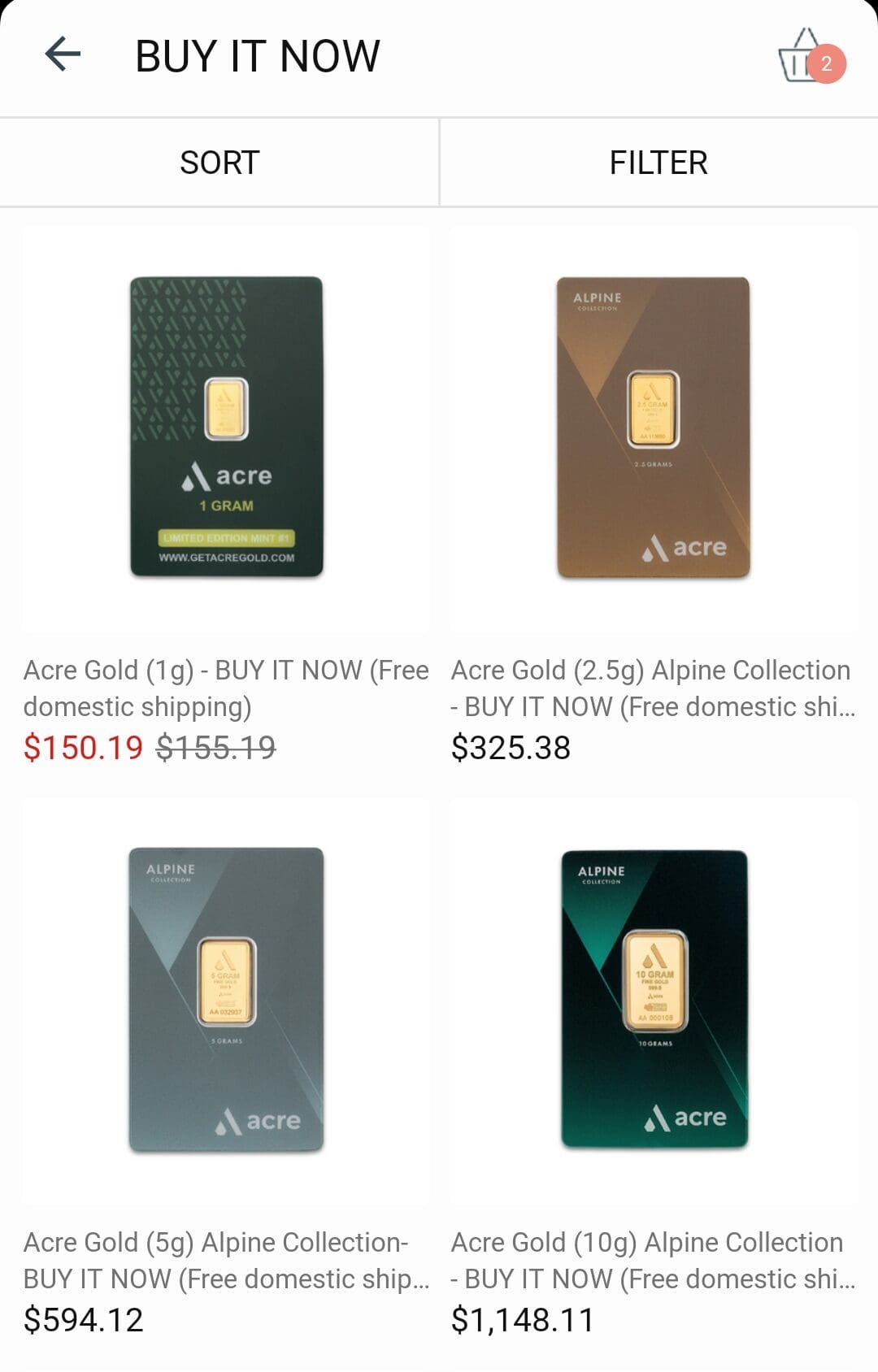

One-Time Purchases Without a Subscription

For those who don’t want to wait months to accumulate gold, Acre Gold offers the option to buy gold bars outright at a fixed price.

The process is straightforward—customers select a gold bar, complete the checkout, and receive their shipment once the order is processed.

The biggest advantage of this option is instant ownership, as buyers don’t have to wait for a subscription to build up.

However, the main downside is the high markup on gold prices, which are often significantly above market rates.

Acre Gold’s Support: Too Many Complaints

Acre Gold’s customer service is one of its weakest points, with multiple complaints about slow response times, lack of direct contact options, and difficulty resolving issues.

Unlike many gold brokers that offer phone support or live chat, Acre Gold only provides email support, which has been criticized for delayed or no responses.

The company does not have a dedicated customer service phone number, and its website lacks a help center or FAQ section with detailed answers.

Contact Option | Details |

|---|---|

Email Support | info@getacregold.com |

What’s Great & What’s Missing at Acre Gold

Below is a breakdown of the key benefits and considerations when choosing Acre Gold:

- Easy Gold Accumulation Over Time

Acre Gold’s subscription model makes it easier for people to buy gold without needing a large upfront investment. This is great for beginners or those on a budget.

- Physical Gold Ownership

You receive real gold bars delivered to your doorstep once you reach the required payment threshold.

- Multiple Subscription Tiers

Customers can choose from different subscription plans (1g, 2.5g, 5g, and 10g) to match their budget and investment goals.

- No Buyback Program

Acre Gold doesn’t let you sell gold back to them, so you’ll have to find your own buyers if you ever need to liquidate.

- Unclear Fees & Pricing

Shipping and fulfillment fees aren’t disclosed upfront, and some customers have reported unexpected charges when receiving their gold.

- No Gold IRA Options

Acre Gold doesn’t offer gold IRA services, making it less attractive for long-term retirement investing.

FAQ

Yes, Acre Gold allows you to upgrade, downgrade, or cancel your subscription at any time. However, changes may not take effect immediately, and you should check your account for updates.

Acre Gold does not automatically cancel your subscription for missed payments. However, your balance won’t accumulate toward a gold bar until payments resume.

Yes, you can stack multiple subscriptions (e.g., paying for two 5g subscriptions simultaneously) to accumulate gold faster.

If you cancel, Acre Gold may refund your payments but does not refund gold already delivered. Refund policies can vary, so check their terms.

Acre Gold does not mention whether shipments are insured, so customers should verify with their shipping provider or insure it themselves after delivery.

Review Gold Dealers For Direct Purchase & Gold IRA

How We Rated Gold & Silver Dealers: Review Methodology

At The Smart Investor, we evaluated gold brokers & dealers based on their overall value, pricing transparency, and investment options compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to precious metals investors, including fees, security, product selection, and IRA investment options. Each broker was rated based on the following criteria:

- Pricing & Fees (15%): We prioritized brokers with transparent pricing, low markups on gold and silver, and fair premiums. Some platforms had hidden costs, including storage and liquidation fees.

- User Experience & Buying Process (20%): A smooth, intuitive, and secure buying process scored highest. Some brokers had complex procedures, slow transactions, or unclear order processing.

- Reputation & Ratings (10%): We factored in customer reviews, industry ratings, and regulatory compliance. Highly rated brokers had strong reputations for reliability, trustworthiness, and investor protection. Some had mixed reviews or unresolved complaints.

- Customer Support & Service (15%): We tested response times, availability, and helpfulness of support via phone, chat, and email. The best brokers provided knowledgeable assistance with fast, professional service, while others were slow or unresponsive

- Security & Storage Options (10%): We favored brokers offering secure vault storage, insured holdings, and direct delivery options. Some lacked proper security measures, increasing investment risks.

- IRA & Retirement Investment Options (20%): The best brokers offered Gold & Silver IRA accounts with IRS-approved metals, simple setup, and rollover assistance. Some lacked IRA services or charged high fees.

- Precious Metals Selection (10%): We rated brokers higher if they offered a wide range of gold and silver products, including bullion, coins, and bars. Some had limited selections, restricting investment choices.