The cryptocurrency market is evolving rapidly, and choosing the right exchange or app is crucial for traders looking to buy, sell, and manage digital assets effectively.

With countless platforms available, each offering unique features, security measures, and fee structures, finding the best fit can be overwhelming.

Here at The Smart Investor, we’ve extensively researched, rated, and reviewed the top crypto exchanges and apps to help you make an informed decision. Here's a summary of our top picks:

Platform | Coins | Spot Trading Fee | U.S. Status | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | Available

Not available in New York. Some services, like web based trading platform, margin trading and staking, are also restricted for U.S. users. Despite these limitations, U.S. users can still use the Crypto.com Visa Card, earn rewards, and trade through the mobile app.

| Crypto Payments & Rewards |

|---|---|---|---|---|

Kraken | +300 | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | Available

New York and Washington residents cannot open accounts or trade on Kraken due to strict state regulations. Additionally, U.S. users have limited access to certain features. | Advanced Traders & Futures |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Available

In 46 states, not including New York, Texas, Hawaii, and North Carolina. Some advanced features like staking options are unavailable | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Available

Fully available in all 50 U.S. states. Derivatives trading and Staking Pro are currently unavailable in the U.S., and the Gemini Earn lending program was shut down due to legal issues with the SEC. | Security & Regulation |

Robinhood | +20 | $0 | Available | Fee-Free Crypto Trading |

We’ve evaluated these platforms based on key factors such as trading fees, supported cryptocurrencies, security measures, liquidity, user experience, and additional features like staking, lending, and futures trading.

Let’s dive into our top-rated crypto exchanges and apps to find the best one for your trading needs.

Coinbase Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%.

-

Overview

- FAQ

- Platform at a Glance

Coinbase is an excellent choice for both investors and traders looking for a reliable and secure cryptocurrency exchange.

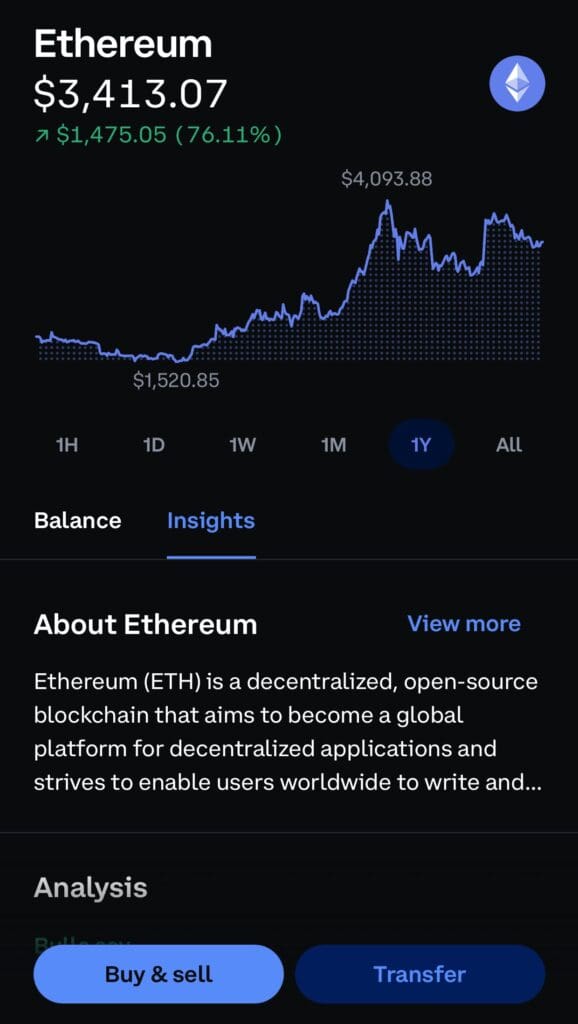

With its wide selection of assets, +250 cryptocurrencies, including popular choices like Bitcoin, Ethereum, and Solana—Coinbase provides a diverse portfolio for investors to choose from.

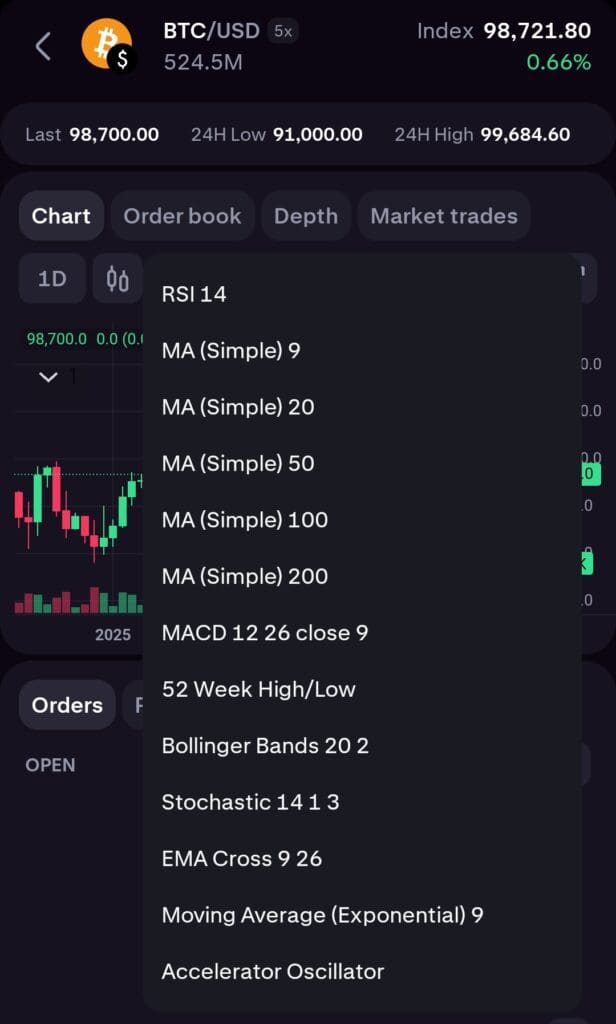

For traders, Coinbase offers a solid trading experience with advanced tools like real-time charts, TradingView integration, and a variety of order types such as limit, market, and stop orders. There are lower fees for high volume traders.

Security is a top priority, with two-factor authentication (2FA), cold storage for the majority of funds, and insurance for digital assets held on the platform.

Coinbase One, a subscription service, provides added benefits like zero fees on up to $10,000 in monthly trades, priority customer support, and enhanced staking rewards

Can I withdraw my crypto from Coinbase?

Yes, you can withdraw crypto to an external wallet, but network fees may apply, especially during high network congestion.

What are Coinbase’s staking rewards?

Coinbase offers staking rewards for select cryptocurrencies, allowing users to earn passive income by holding and staking assets like Ethereum and Cardano.

Can I trade on Coinbase if I’m not in the U.S.?

Yes, Coinbase is available in over 100 countries, though some features and cryptocurrencies may not be available in all regions.

How long does it take to withdraw funds from Coinbase?

Withdrawal times on Coinbase vary depending on your chosen method. Bank transfers can take 1-3 business days, while PayPal and debit card withdrawals are typically faster, sometimes processing instantly. Crypto withdrawals depend on network conditions.

Pros | Cons |

|---|---|

Wide Selection of Cryptocurrencies | Higher Fees |

User-Friendly Interface | Limited Advanced Features for Experienced Traders |

Strong Security Features | Customer Support Challenges |

Regulatory Compliance | Limited Privacy |

Mobile and Desktop Accessibility | Crypto Withdrawal Network Fees |

Educational Resource |

Crypto.com Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

- Platform at a Glance

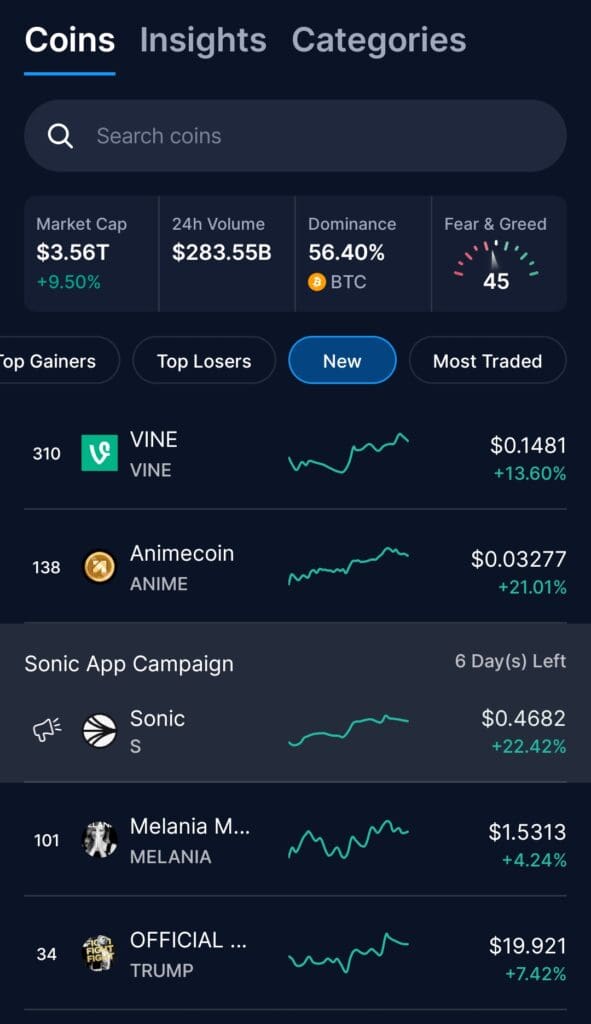

Crypto.com is a top-tier cryptocurrency exchange and app, offering a powerful suite of tools for traders and investors.

With support for 350+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and a variety of altcoins and stablecoins, it provides one of the largest selections in the industry.

For active traders, Crypto.com offers spot, futures, and margin trading with up to 10x leverage, as well as an OTC trading desk for high-volume transactions.

The platform’s Trading Arena adds a competitive edge, allowing traders to participate in trading battles and win crypto prizes.

Automated strategies are also available through the DCA Trading Bot, helping investors dollar-cost average into positions with minimal effort.

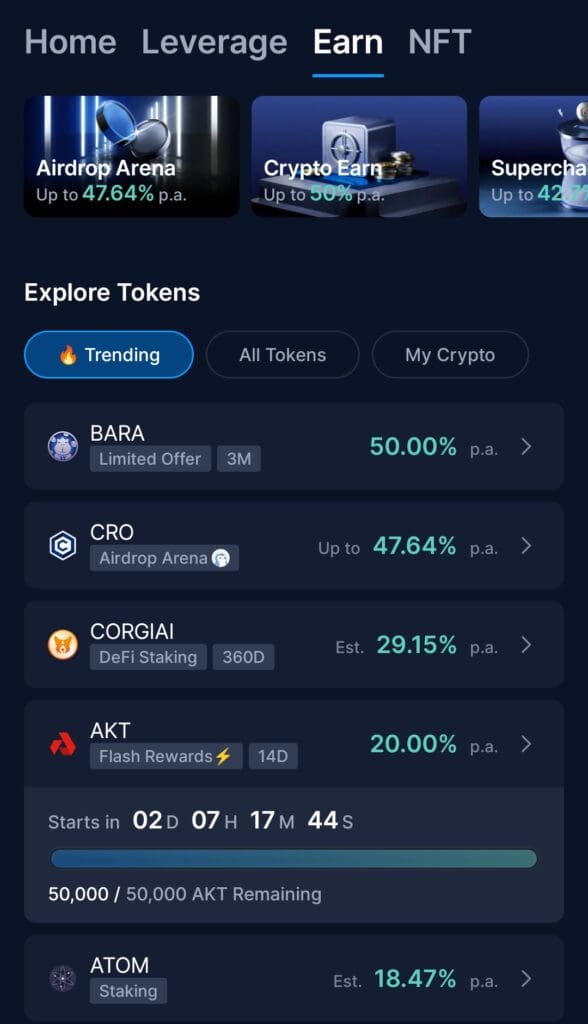

For long-term investors, Crypto.com offers a secure ecosystem with a non-custodial DeFi Wallet, an NFT marketplace, and Supercharger staking rewards.

Is Crypto.com available in the U.S.?

Yes, but with limitations. U.S. users can access the Crypto.com app, but the Crypto.com Exchange is only available for institutional investors, and some features, like staking, are not offered in the U.S.

How can I lower my Crypto.com trading fees?

Users can lower fees by increasing their 30-day trading volume or staking CRO tokens, which provides additional discounts.

What is Crypto.com Supercharger?

Supercharger is a staking rewards program where users stake CRO to earn free crypto rewards over time.

What is the Crypto.com Trading Arena?

The Trading Arena is a feature where users can compete in trading competitions to win crypto rewards and prizes.

Pros | Cons |

|---|---|

Wide Selection of Cryptocurrencies | Limited Access for U.S. Users |

Competitive Trading Fees | High Fees for Credit/Debit Card Purchases |

Strong Security & Compliance | Crypto Withdrawals Can Be Expensive |

Feature-Rich Ecosystem | No Staking for U.S. Users |

Seamless Mobile Experience | |

Institutional-Grade Storage & Trading |

Gemini Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%.

-

Overview

- FAQ

- Platform at a Glance

Gemini is one of the best cryptocurrency exchanges and apps for both investors and active traders, offering a secure, regulated, and feature-rich platform.

Long-term investors will appreciate Gemini Custody, a regulated and insured cold storage solution that ensures assets are protected with multi-signature security and institutional-grade controls.

For traders, Gemini’s ActiveTrader platform provides a high-speed trading experience with lower maker/taker fees, advanced charting tools, and multiple order types, making it ideal for technical analysis and professional trading strategies.

Gemini also offers staking rewards on Ethereum (ETH) and Polygon (MATIC), allowing investors to earn passive income on their holdings.

Is Gemini available in the U.S.?

Yes, Gemini is fully licensed and regulated in all 50 U.S. states, making it one of the most compliant crypto exchanges in the country.

Does Gemini offer staking?

Yes, Gemini supports staking for Ethereum (ETH) and Polygon (MATIC) for U.S. users, while Solana (SOL) is available for non-U.S. users. Staking rewards come with a 15% service fee.

What cryptocurrencies can I trade on Gemini?

Gemini offers over 150 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and stablecoins like Gemini Dollar (GUSD) and USD Coin (USDC).

Can I buy NFTs on Gemini?

Yes, Gemini owns Nifty Gateway, an NFT marketplace where users can buy, sell, and store NFTs securely using fiat or crypto.

Does Gemini charge inactivity fees?

No, Gemini does not charge inactivity fees. However, storing assets on the exchange does not generate interest, so some users prefer to transfer funds to external wallets.

Can I stake my crypto on Gemini?

Yes, Gemini supports staking for Ethereum (ETH) and Polygon (MATIC). Solana (SOL) is also available for non-U.S. users. However, Gemini’s staking rewards are lower than other exchanges and charges a 15% staking fee.

Can I use Gemini for crypto lending?

No, Gemini’s Earn program was shut down due to regulatory issues, and users are no longer able to lend crypto for interest. Other lending platforms, like Nexo or BlockFi, offer similar services, but always research risks before lending crypto.

How long do Gemini withdrawals take?

Crypto withdrawals are usually processed within minutes, depending on network congestion. Fiat withdrawals via ACH take 4-6 business days, while wire transfers are typically completed within 24 hours.

What happens if I send crypto to the wrong address on Gemini?

Unfortunately, crypto transactions are irreversible. If you send funds to the wrong address, Gemini cannot recover them, so always double-check wallet addresses before sending crypto.

Pros | Cons |

|---|---|

Strong Security & Compliance | High Trading Fees |

Available in All 50 U.S. States | Limited Crypto Selection Compared to Competitors |

Beginner & Advanced Trading Options | Limited Staking Options |

NFT & Web3 Integration | Mixed Customer Support Reputation |

Crypto Rewards Credit Card | Complicated Fee Structure |

Institutional-Grade Storage & Trading |

Kraken Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

- Platform at a Glance

Kraken is a top-tier cryptocurrency exchange offering over 300 cryptocurrencies, advanced trading tools, and strong security features, making it a great choice for both investors and active traders.

For long-term investors, Kraken offers high liquidity, fiat on-ramps with bank transfers and ACH, and a secure environment with cold storage, two-factor authentication (2FA), and withdrawal whitelisting.

For active traders, Kraken Pro provides a professional-grade trading experience with low maker-taker fees, detailed order books, advanced charting tools, and features like margin trading (up to 5x) and futures trading (up to 50x leverage).

Non-U.S. users can also stake cryptocurrencies like Ethereum (ETH), Polkadot (DOT), and Cardano (ADA) to earn passive rewards.

Can I use Kraken without verifying my identity?

No, Kraken requires KYC (Know Your Customer) verification for fiat deposits, withdrawals, and most crypto transactions. The basic verification level (Tier allows limited crypto trading, but higher tiers unlock more features and higher limits.

Does Kraken charge fees for crypto withdrawals?

Yes, Kraken charges network fees for crypto withdrawals. The fee depends on the blockchain network and asset

Is Kraken available in all U.S. states?

No, Kraken is not available in New York or Washington due to state regulations. Additionally, U.S. users have limited access to some features, such as staking and futures trading.

Does Kraken offer a crypto debit card?

No, Kraken does not currently offer a crypto debit card. Some competitors, like Crypto.com and Binance, provide crypto cards for spending crypto like cash.

Can I transfer crypto from another exchange to Kraken?

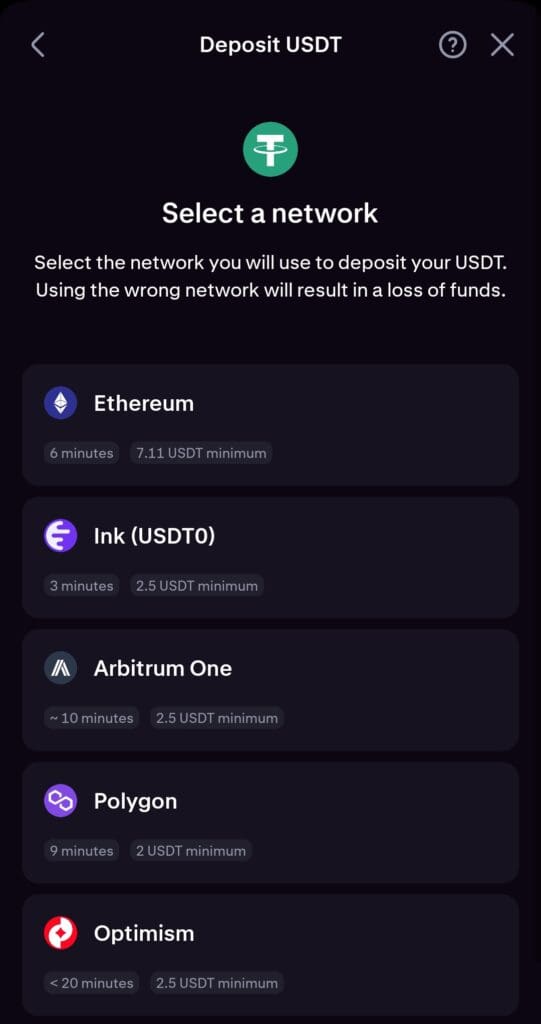

Yes, you can send crypto from another exchange or wallet to Kraken by copying your Kraken deposit address for the specific cryptocurrency. Be sure to select the correct blockchain network to avoid losing funds.

Pros | Cons |

|---|---|

Strong Security Measures | High Fees for Instant Buy & Credit/Debit Transactions |

Low Trading Fees on Kraken Pro | Limited Availability in the U.S |

Wide Range of Cryptocurrencies | Complex Interface for Beginners |

Advanced Trading Features | Fiat Withdrawal Fees Can Be High |

Staking Rewards (Non-U.S. Users) | SEC Legal Challenges |

24/7 Customer Support & Phone Service | Customer Support Complaints |

Robinhood

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

- Platform at a Glance

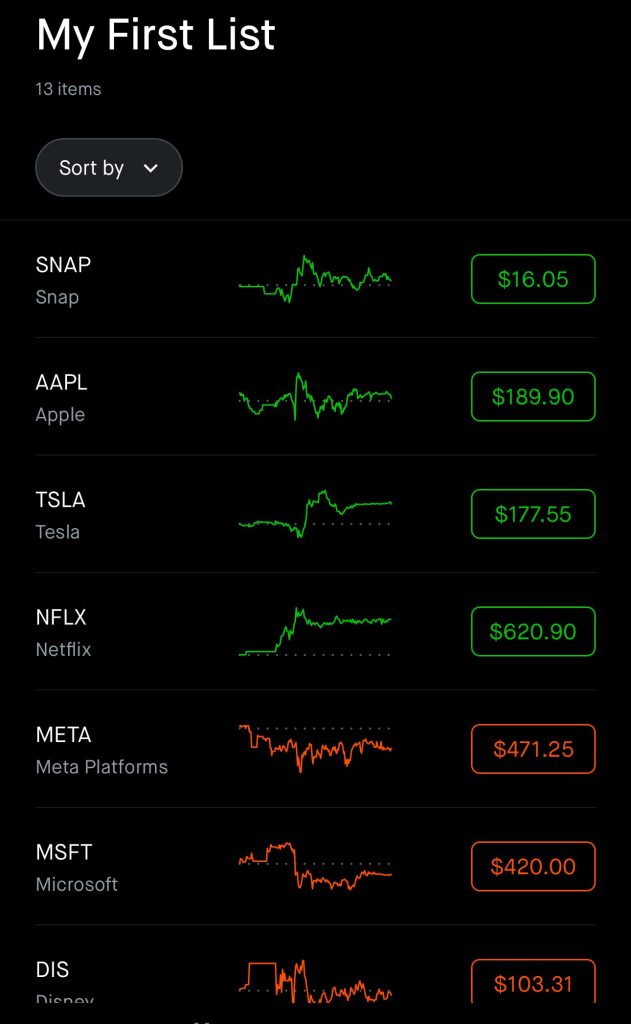

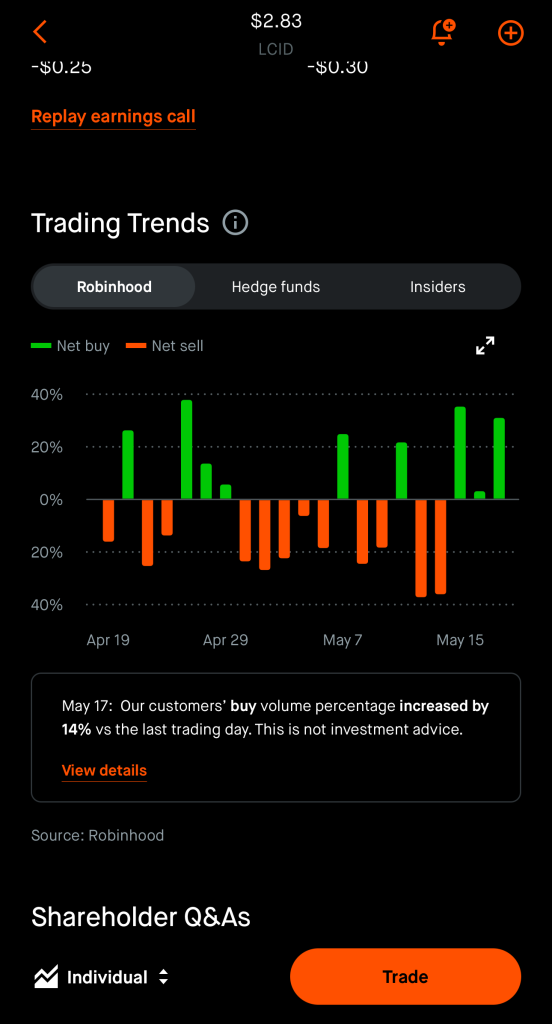

Robinhood has emerged as a top choice among crypto exchanges and apps, particularly for investors and traders looking for a seamless, low-cost trading experience.

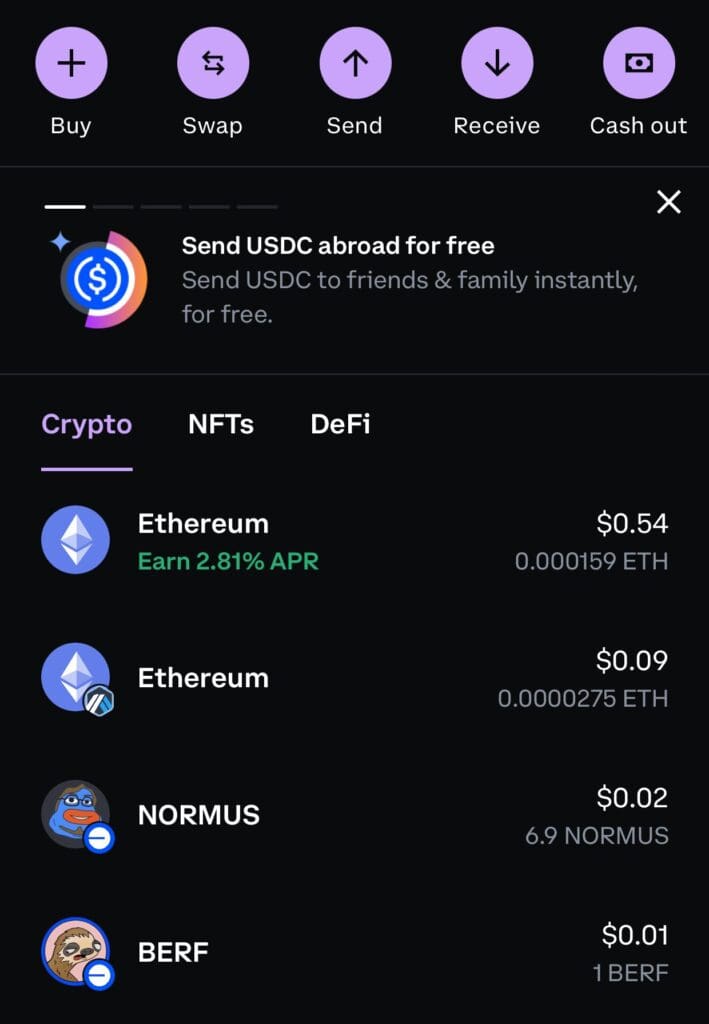

Known for its commission-free model, Robinhood allows users to trade popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and several others without incurring additional trading fees.

Unlike traditional crypto exchanges, Robinhood integrates cryptocurrency trading within the same app that offers stocks, ETFs, and options trading, allowing users to manage a diversified portfolio in one place.

For those looking for added flexibility, Robinhood offers a dedicated crypto wallet, allowing users to store and transfer digital assets securely.

The Robinhood Connect feature further enhances accessibility by enabling users to fund wallets with USDC and interact with decentralized applications (dApps).

Does Robinhood offer advanced crypto trading tools?

Robinhood provides basic charting tools, but it does not offer advanced order types, deep liquidity, or futures trading like dedicated crypto exchanges.

Can I use leverage or margin to trade crypto on Robinhood?

No, Robinhood does not currently offer margin or leveraged trading for cryptocurrencies.

Can I use Robinhood Crypto for day trading?

Yes, you can trade crypto 24/7 on Robinhood without restrictions like the pattern day trading (PDT) rule that applies to stocks.

Are my crypto assets insured on Robinhood?

No, cryptocurrency holdings on Robinhood are not covered by SIPC insurance, but Robinhood follows security best practices to protect assets.

Pros | Cons |

|---|---|

Fractional Shares, Crypto Access | Lacking Mutual Funds and Bonds |

Advanced Charting And Research Tools

| No Automated Investing |

Robinhood Gold Features | No Advisory Services |

IPO Access | Reliability Issues |

Manage Retirement Accounts |

How to Choose the Best Crypto Exchange or App

Choosing the right crypto exchange or app depends on your trading needs, security concerns, and investment goals.

Here are the key factors to consider:

- Security & Regulation

Security is crucial when dealing with digital assets.

Look for platforms with two-factor authentication (2FA), cold storage for funds, and regulatory compliance (e.g., Coinbase and Gemini follow U.S. regulations). A regulated exchange ensures better consumer protection.

- Fees & Costs

Exchanges charge different fees, including trading fees, withdrawal fees, and deposit costs.

Platforms like Binance and Kraken offer competitive rates, while Robinhood provides commission-free crypto trading. Check for hidden costs that could affect profitability.

- Supported Cryptocurrencies

If you want to trade beyond Bitcoin and Ethereum, choose an exchange that supports a wide range of altcoins and tokens.

Binance and Crypto.com offer hundreds of cryptocurrencies, while some platforms have limited options.

- Ease of Use & Mobile Experience

Beginners should opt for user-friendly platforms like Coinbase or Gemini, while experienced traders may prefer advanced tools available on Kraken or Bybit. A smooth mobile app is essential for on-the-go trading.

- Trading Features & Liquidity

For active traders, platforms with high liquidity, low slippage, and advanced order types (e.g., stop-loss, margin trading, futures) are ideal.

DEXs like Uniswap suit those prioritizing decentralization, while CEXs offer better liquidity.

How To Open A Crypto Account On These Platforms?

Opening a crypto account on centralized exchanges (CEXs) like Coinbase, Binance, Kraken, Crypto.com, and Gemini is a straightforward process. Here’s a step-by-step guide:

1. Choose a Crypto Exchange

Select an exchange based on factors like security, fees, supported cryptocurrencies, and ease of use. Coinbase and Gemini are beginner-friendly, while Kraken and Binance offer advanced trading tools.

2. Sign Up for an Account

Visit the exchange's website or download the app. Click “Sign Up” and enter your email, phone number, and password.

3. Verify Your Identity (KYC Process)

Most CEXs require KYC (Know Your Customer) verification for compliance with regulations. You’ll need to:

- Upload a government-issued ID (passport, driver’s license).

- Provide proof of address (utility bill or bank statement).

- Take a selfie for identity verification (on some platforms).

4. Deposit Funds

Once verified, fund your account using bank transfers, credit/debit cards, or crypto deposits. Some exchanges support PayPal and Apple Pay.

5. Start Trading

After depositing, explore the platform’s buy/sell options, trading pairs, and investment features. Beginners can use instant buy, while advanced traders can access spot, margin, or futures trading.

For decentralized exchanges (DEXs) like Uniswap or PancakeSwap, you only need a crypto wallet (e.g., MetaMask) to connect and start trading—no KYC required.

Security Features to Look for in Crypto Exchanges

When choosing a crypto exchange, security should be a top priority to protect your assets. Here are key features to look for:

- Two-Factor Authentication (2FA) – Adds an extra layer of security by requiring a second verification step.

- Cold Storage – Reputable exchanges store most funds in offline cold wallets to prevent hacking.

- Regulatory Compliance – Licensed platforms like Coinbase and Gemini offer better consumer protection.

- Insurance Coverage – Some exchanges insure user funds against cyberattacks.

- Withdrawal Whitelisting – Limits withdrawals to pre-approved addresses.

- Anti-Phishing Protection – Email and URL verification to prevent scams.

Prioritizing these features ensures safer trading.

Types of Crypto Exchanges: CEX vs. DEX

Crypto exchanges are broadly categorized into Centralized Exchanges (CEX) and Decentralized Exchanges (DEX), each with distinct advantages.

- CEX Platforms

CEX (Centralized Exchange) platforms like Binance, Coinbase, and Kraken operate under a central authority, offering user-friendly interfaces, high liquidity, and fiat on-ramp options.

They provide enhanced security but require KYC (Know Your Customer) verification and hold users' funds in custodial wallets.

- DEX Platforms

DEX (Decentralized Exchange) platforms like Uniswap, PancakeSwap, and dYdX run on blockchain networks, allowing peer-to-peer trading without intermediaries.

They prioritize privacy, self-custody, and decentralization, reducing risks of hacks or regulatory control. However, DEXs often have lower liquidity, higher fees, and a steeper learning curve.

FAQ

On centralized exchanges, KYC is required. However, decentralized exchanges (DEXs) like Uniswap and PancakeSwap allow anonymous trading using crypto wallets.

Yes, most exchanges like Coinbase and Crypto.com allow purchases via credit cards, bank transfers, and PayPal.

Some are highly secure, but always choose platforms with 2FA, cold storage, and regulatory compliance to reduce risks.

If an exchange has insurance, it may cover user losses. However, always use cold wallets to store large amounts of crypto.

Yes, platforms like Gemini Earn, Crypto.com, and Nexo offer interest accounts for users to earn passive income on their crypto assets.