Birch Gold Group

Storage Fees

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

Established in 2003 and based in Burbank, California, Birch Gold Group specializes in assisting customers with purchasing physical precious metals or rolling over their retirement accounts into a self-directed Precious Metals IRA.

Whether you’re looking to buy gold and silver outright or secure your retirement savings through an IRA, the company provides personalized guidance every step of the way.

The company partners with trusted storage facilities like Delaware Depository and Brink’s Global Services to ensure secure asset protection.

One of the key advantages of Birch Gold is its straightforward fee structure, with a minimum investment of $10,000 and no percentage-based custodial fees.

- Transparent Pricing Structure

- Wide Range of Precious Metals

- Buyback Program

- Good Ratings & Reputation

- Extensive Educational Resources

- No Online Purchases

- No Live Chat Support & Mobile App

- Limited International Services

Can I store my gold at home if I open a Gold IRA?

No, IRS regulations require that precious metals in a Gold IRA be stored in an approved depository. However, if you buy metals for personal ownership, home storage is an option.

Does Birch Gold Group charge any penalties for IRA rollovers?

No, IRA rollovers with Birch Gold Group are tax-free and penalty-free, as long as they comply with IRS guidelines.

Can I purchase precious metals using a credit card?

No, Birch Gold Group does not accept credit card payments. Purchases must be made via bank wire or check.

What happens if Birch Gold Group goes out of business?

Your metals remain safe because they are stored in IRS-approved depositories, not with Birch Gold itself. Even if the company ceases operations, your investments remain secure and accessible.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

Customer Reputation & Ratings: What Investors Are Saying

Birch Gold Group has established a strong reputation over the years, consistently receiving high ratings on platforms like BBB and Trustpilot.

Platform | Rating |

|---|---|

Trustpilot

| 4.3 (197 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2013 |

Consumer Affairs | 5.0 (170 reviews) |

Google Reviews | 4.7 (371 reviews) |

From what we've seen, Birch Gold Group has actively responded to and resolved most customer complaints, demonstrating a commitment to customer satisfaction.

Gold IRA Services: What Birch Gold Offers?

Birch Gold Group provides a range of services for individuals looking to secure their retirement savings with a Gold IRA.

A Gold IRA lets you diversify your retirement plan with physical gold, providing a hedge against economic uncertainty.

Here’s what they offer:

- Self-Directed Gold/Silver IRA – Allows investors to hold physical gold in a tax-advantaged retirement account.

- IRA Rollover Assistance – Birch Gold helps customers roll over funds from traditional IRAs, Roth IRAs, 401(k)s, 403(b)s, and other retirement accounts into a Gold IRA without tax penalties.

- Personalized Guidance – Each investor is assigned a Precious Metals Specialist who assists with account setup, metal selection, and ongoing portfolio management.

- Secure Storage Options – Birch Gold partners with IRS-approved depositories, including Delaware Depository, Brink’s Global Services, Texas Precious Metals Depository, and International Depository Services.

- Transparent Pricing – No hidden fees, with a flat-rate $200 annual charge covering storage and management.

- Buyback Program – Investors can sell metals back to Birch Gold at market rates.

Keep in mind: A minimum of $10,000 is required to open a Gold IRA.

Gold, Silver & More: Birch Gold’s Selection

Birch Gold Group offers a variety of precious metal products, including gold, silver, platinum, or palladium:

-

Gold Products

- Gold Bars & Rounds – Available in various sizes, gold bars offer a simple way to invest in pure gold.

- Gold Coins (American Gold Eagle, Canadian Gold Maple Leaf, etc.) – Popular choices for investors who want IRS-approved coins for a Gold IRA.

-

Silver Products

- Silver Bars & Rounds – A more affordable way to enter the precious metals market, often used for bulk investments.

- Silver Coins (American Silver Eagle, Canadian Silver Maple Leaf, etc.) – Recognized worldwide and suitable for both collectors and investors.

-

Platinum & Palladium Products

- Platinum Coins & Bars – Less common but valuable, these metals offer another layer of diversification.

- Palladium Coins & Bars – Known for industrial use and increasing investment demand, palladium adds a unique option to your portfolio.

There are several ways to invest in gold, but buying physical gold continues to be a top option for many investors.

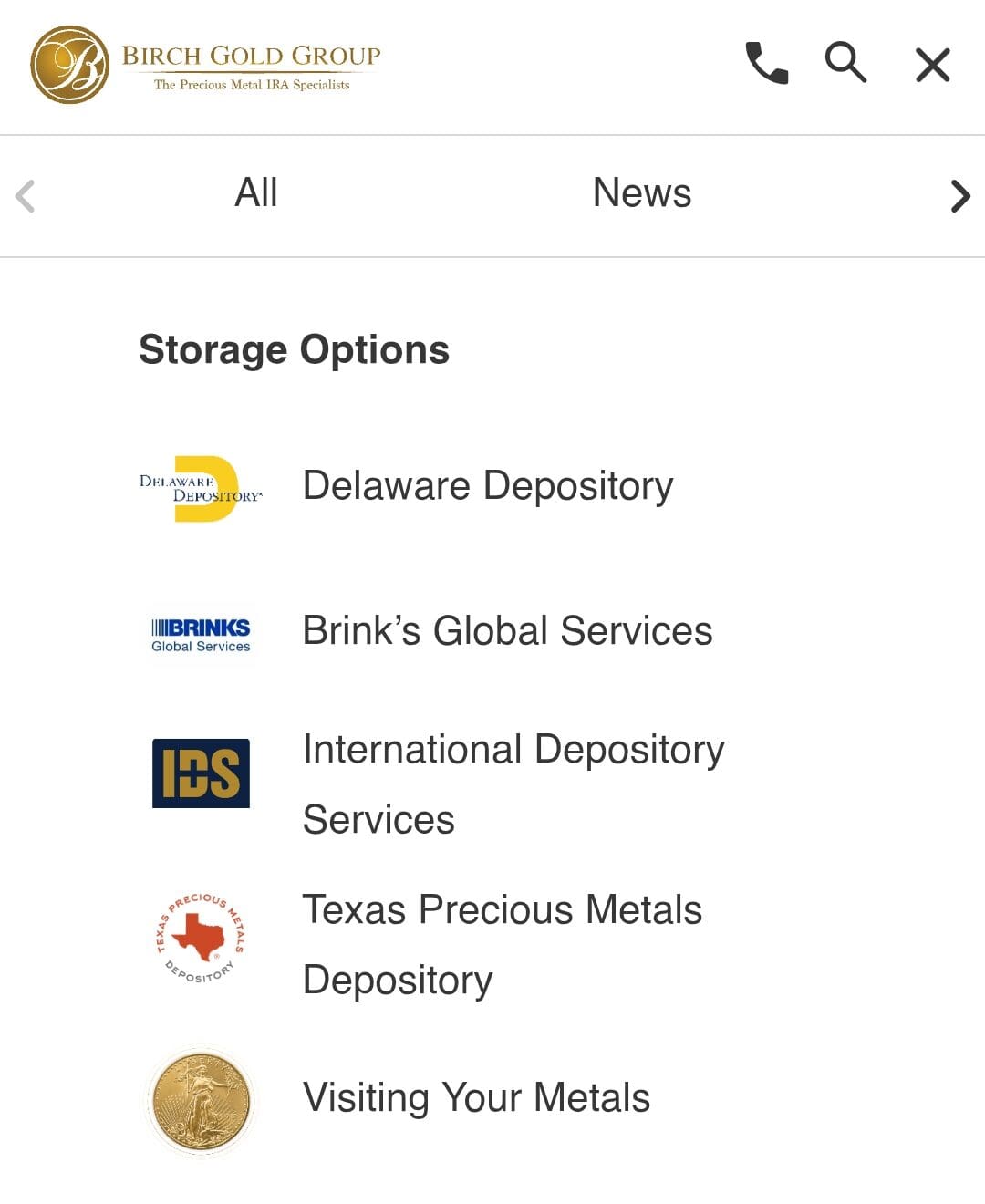

Storage Choices: Safety & IRS-Approved Vaults

Since the IRS requires Gold IRAs to store physical metals in an approved depository, Birch Gold Group offers secure, insured storage solutions through trusted partners.

- IRS-Approved Depositories – Customers can choose from Delaware Depository, Brink’s Global Services, Texas Precious Metals Depository, and International Depository Services for safekeeping.

- Full Insurance Coverage – All assets stored in these depositories are fully insured against theft or damage.

- Visitation Options – Some storage facilities allow investors to personally visit their stored metals for added peace of mind.

How Much Does Investing with Birch Gold Cost?

Birch Gold Group has a transparent pricing structure, making it easy for investors to understand the costs involved:

Fee | Cost |

|---|---|

Account Setup Fee

| $50

|

Wire Transfer Fee

| $30

|

Annual Storage Fee

| $100

|

Annual Management Fee

| $125 |

For investors rolling over $50,000 or more, Birch Gold waives the first year’s fees, making it a great deal for larger investors.

Selling Your Gold Back to Birch: How It Works

Birch Gold Group offers a buyback program, allowing investors to sell their precious metals back to the company at market value.

This feature provides added liquidity for investors who may need to convert their holdings into cash.

Key Details:

- No Guaranteed Buyback Prices – While Birch Gold does buy back metals, the price depends on current market rates, meaning values fluctuate based on supply and demand.

- Straightforward Selling Process – Investors can contact Birch Gold to receive a buyback quote, making liquidation easier than finding a private buyer.

- No Online Selling – Unlike some competitors, Birch Gold does not support online transactions for selling metals, requiring customers to work directly with a specialist.

- No Fees for Selling – Birch Gold Group does not charge any additional fees for the buyback process, ensuring that investors receive a fair market offer.

- Limited Information on Timeline – While the company facilitates buybacks, details on processing time for liquidation and payouts are not explicitly stated.

Overall, Birch Gold’s buyback program adds a layer of flexibility but is subject to market conditions.

Payment & Funding Options

Birch Gold Group provides multiple payment methods to accommodate different types of investors. Whether you’re funding a Precious Metals IRA or purchasing metals for direct ownership, the company ensures a smooth transaction process.

- IRA Rollovers & Transfers – Investors can fund their Gold IRA by rolling over funds from an existing retirement account (401(k), IRA, TSP, etc.) with no tax penalties.

- Bank Wire Transfers – For quick transactions, Birch Gold accepts wire transfers, ensuring funds are processed efficiently.

- Personal Checks – Investors can also pay via personal or cashier’s checks, though processing may take longer.

- No Cryptocurrency Payments – Unlike some competitors, Birch Gold does not accept crypto as a payment method.

Birch Gold focuses on traditional and secure payment methods, ensuring compliance with IRS regulations and making it easy for investors to move funds into their accounts.

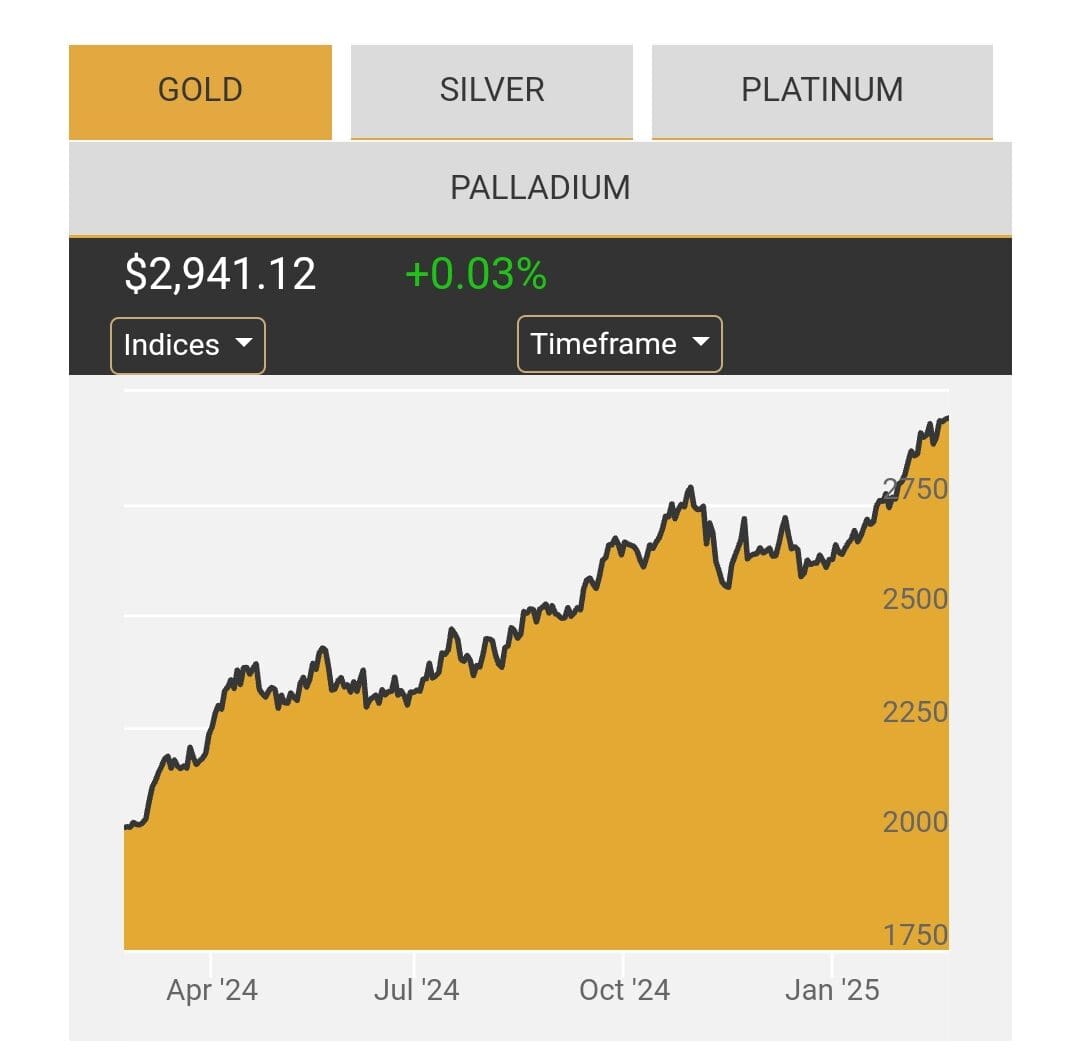

Birch Gold’s Online Tools & Resources: Review

Birch Gold Group’s website is easy to navigate, making it simple for investors to find relevant information about precious metals, IRAs, and market updates.

The site features a clean layout, guiding users through the investment process while offering extensive educational resources.

One of the standout features is real-time price charts, which allow users to track gold, silver, platinum, and palladium trends over time.

Additionally, Birch Gold provides a free investment info kit, helping new customers understand the benefits of investing in precious metals.

However, the website lacks online account management, meaning investors must contact a representative to complete purchases or manage their portfolios.

There is no live chat support or mobile app, which could make communication less convenient.

Can You Get Quick Help? Support Breakdown

Birch Gold Group offers personalized customer service, ensuring investors receive guidance at every step.

Each customer is assigned a dedicated Precious Metals Specialist, who assists with account setup, investment decisions, and ongoing support.

The company also provides phone and email support, though it lacks a live chat option.

Contact Option | Details |

|---|---|

Phone Support | (877) 373-1207 |

Email Support | info@birchgold.com |

Availability | Monday – Friday 8am – 7:30pm (CST) |

Customers can access educational resources, market updates, and newsletters, making it easier to stay informed.

Pros & Cons

Birch Gold Group stands out in several areas, but like any gold investing company, it has both strengths and limitations.

Here’s a closer look at what it does well and where it could improve.

- Transparent Pricing Structure

The company has a clear fee structure, with a flat $200 annual fee instead of percentage-based charges, which can save investors money over time.

- Wide Range of Precious Metals

Birch Gold offers gold, silver, platinum, and palladium, giving investors more options to diversify their portfolios compared to competitors that focus only on gold and silver.

- Buyback Program

Investors can sell their metals back to Birch Gold at market value, providing an added layer of liquidity and flexibility.

- Good Ratings & Reputation

Birch Gold has very high ratings and reputation across all sources we've checked.

- Extensive Educational Resources

Birch Gold provides a wealth of educational materials, including market insights, expert interviews, and investment guides, making it easier for investors to understand the precious metals market.

- No Online Purchases

Investors cannot buy or sell metals directly on the website, requiring them to speak with a representative to complete transactions.

- No Live Chat Support & Mobile App

Birch Gold does not offer live chat or mobile app for account management.

- Limited International Services

Birch Gold does not offer international shipping, making it less suitable for investors outside the U.S. who want direct delivery.

How to Open a Gold IRA or Buy Gold With Birch

Whether you’re opening a Gold IRA or purchasing physical precious metals, Birch Gold provides a smooth investment experience.

Here’s a detailed step-by-step guide to help you through the process.

-

Gold IRA Investment

Investing in a Gold IRA with Birch Gold Group is a straightforward process designed to help you secure your retirement savings with precious metals while ensuring IRS compliance.

- Select Your Funding Source – Investors decide whether to fund their Gold IRA with an IRA rollover (Traditional IRA, Roth IRA, SEP IRA, 401(k), etc.) or through a new cash deposit. Birch Gold ensures that rollovers are tax-free and penalty-free when handled correctly.

- Work with a Precious Metals Specialist – Birch Gold assigns an expert specialist who guides investors through the paperwork, account setup, and funding process, ensuring a smooth transition.

- Choose Your Precious Metals – Investors select IRS-approved gold, silver, platinum, or palladium coins or bars for their IRA, with assistance from the specialist in evaluating investment options.

- Secure Storage Selection – The purchased metals are shipped to an IRS-approved depository (such as Delaware Depository or Brink’s Global Services) for safekeeping, as self-storage is not allowed for Gold IRAs.

- Ongoing Account Management – Investors receive regular market updates and portfolio reviews, with the option to liquidate or adjust their holdings over time.

-

Physical Precious Metals Purchase

For investors who prefer to own physical gold, silver, platinum, or palladium, Birch Gold Group offers a simple purchasing process with secure delivery options.

- Contact Birch Gold Group –Birch Gold does not offer online purchases, so investors must contact a representative to discuss their options.

- Select Metals for Purchase – Investors can choose from gold, silver, platinum, and palladium bars or coins, based on personal preference or investment strategy.

- Complete Payment & Order Processing – Payments are accepted via bank wire or check, but cryptocurrency payments are not supported. Birch Gold ensures transparent pricing throughout the process.

- Choose Delivery or Storage – Investors can opt for direct physical delivery of their metals or secure storage in one of Birch’s partner depositories.

FAQ

Birch Gold Group is a legitimate precious metals investment company, established in 2003 and accredited by the Better Business Bureau (BBB) with an A+ rating. It has served thousands of investors and follows IRS regulations for Gold IRAs.

The process typically takes a few days to a couple of weeks, depending on how quickly your current retirement account provider processes the transfer. Birch Gold assists with all paperwork to speed up the process.

Yes, metals stored in Birch Gold’s partnered depositories are fully insured against theft, damage, or loss, giving investors added protection.

Yes, some storage facilities, like Delaware Depository and Texas Precious Metals Depository, allow investors to visit and inspect their holdings.

Yes, Birch Gold Group allows precious metals IRA transfers from other custodians, making it easy to move your existing holdings to their platform.

Review Gold Dealers For Direct Purchase & Gold IRA

How We Rated Gold & Silver Dealers: Review Methodology

At The Smart Investor, we evaluated gold brokers & dealers based on their overall value, pricing transparency, and investment options compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to precious metals investors, including fees, security, product selection, and IRA investment options. Each broker was rated based on the following criteria:

- Pricing & Fees (15%): We prioritized brokers with transparent pricing, low markups on gold and silver, and fair premiums. Some platforms had hidden costs, including storage and liquidation fees.

- User Experience & Buying Process (20%): A smooth, intuitive, and secure buying process scored highest. Some brokers had complex procedures, slow transactions, or unclear order processing.

- Reputation & Ratings (10%): We factored in customer reviews, industry ratings, and regulatory compliance. Highly rated brokers had strong reputations for reliability, trustworthiness, and investor protection. Some had mixed reviews or unresolved complaints.

- Customer Support & Service (15%): We tested response times, availability, and helpfulness of support via phone, chat, and email. The best brokers provided knowledgeable assistance with fast, professional service, while others were slow or unresponsive

- Security & Storage Options (10%): We favored brokers offering secure vault storage, insured holdings, and direct delivery options. Some lacked proper security measures, increasing investment risks.

- IRA & Retirement Investment Options (20%): The best brokers offered Gold & Silver IRA accounts with IRS-approved metals, simple setup, and rollover assistance. Some lacked IRA services or charged high fees.

- Precious Metals Selection (10%): We rated brokers higher if they offered a wide range of gold and silver products, including bullion, coins, and bars. Some had limited selections, restricting investment choices.