BullionVault

Storage Fees

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

BullionVault is one of the largest online platforms for buying, selling, and storing physical gold, silver, platinum, and palladium.

Founded in 2005, it allows everyday investors to own real bullion stored in professional vaults worldwide. The platform works in two ways:

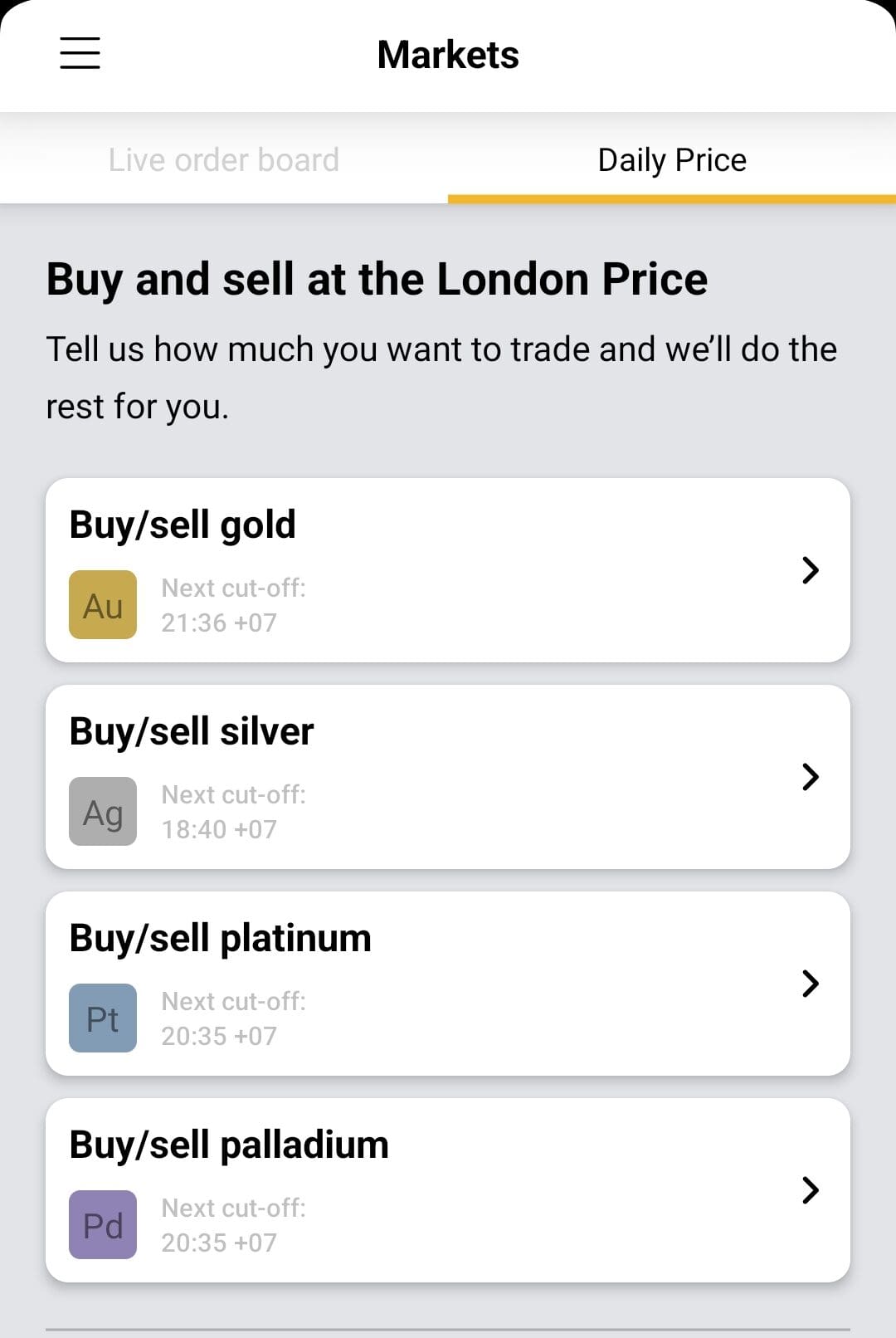

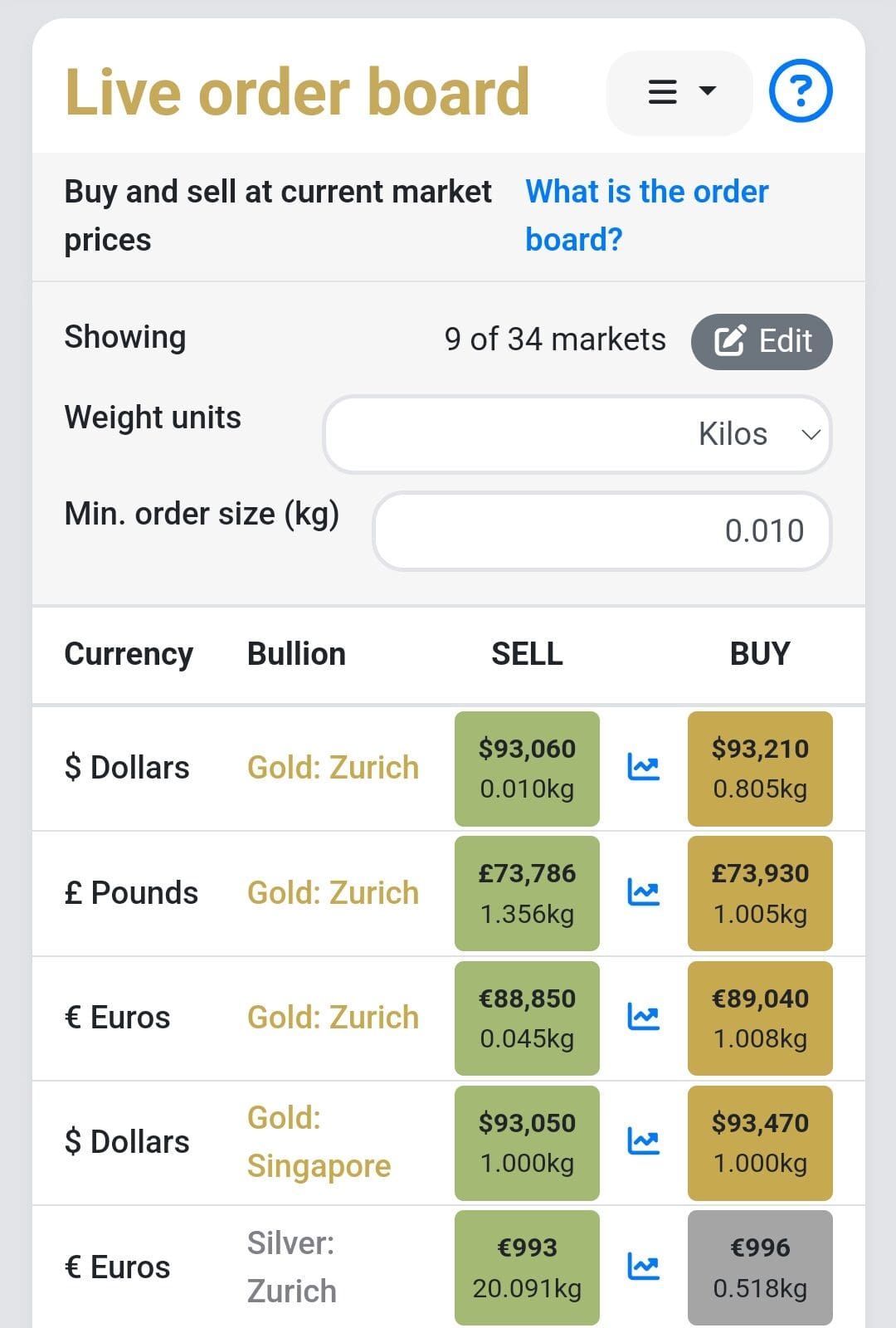

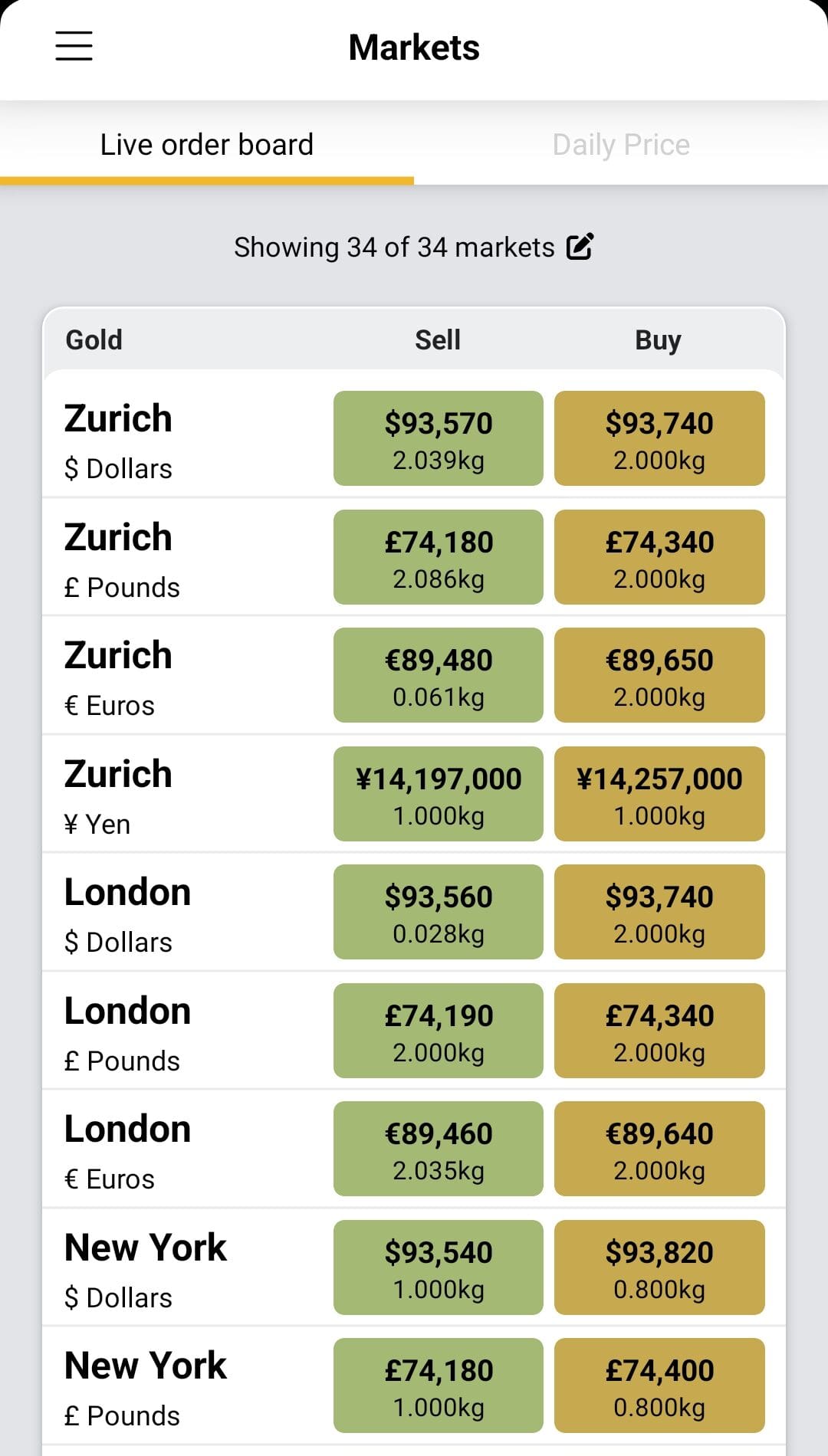

- Live Order Board – Buy and sell metals in real-time, directly from other users at competitive prices.

- Daily Price Service – Fixed price for metals, similar to how banks operate. This method is convenient but comes with a small additional fee.

For new investors, BullionVault offers a user-friendly experience with mobile access, real-time pricing, and expert customer support.

- Competitive Pricing & Low Fees

- High Liquidity with 24/7 Trading

- Secure & Fully Insured Storage

- Daily Independent Audits

- No Minimum Deposit

- No Buyback Guarantee

- Limited Physical Delivery (Gold & UK Only)

- Fees Can Add Up for Small Investors

Can I invest in BullionVault if I’m outside the UK?

Yes, BullionVault accepts customers from over 175 countries. However, all transactions are processed in USD, GBP, EUR, or JPY, so you may need to convert your currency.

Can I own specific gold bars with BullionVault?

No, BullionVault does not assign specific bars to individual investors. Instead, you own allocated portions of wholesale bars stored in professional vaults.

What happens if BullionVault goes out of business?

Your metals remain your legal property and are stored separately from company assets. A liquidator would return all bullion to the rightful owners.

Is VAT charged on my precious metal purchases?

No VAT is applied to gold purchases, but silver, platinum, and palladium may be subject to VAT depending on your country’s tax laws.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

BullionVault’s Reputation: Trusted or Overrated?

While the company is not BBB accredited, its ratings on TrustPilot are impressive, and reflect a high satisfaction of customers:

Platform | Rating |

|---|---|

Trustpilot

| 4.7 (2,705 reviews) |

Better Business Bureau (BBB) | NOT BBB Accredited |

Google Reviews | N/A |

Positive reviews highlight BullionVault's user-friendly platform and efficient ordering system, while negative feedback points to issues with customer support.

Gold Bars, Silver, & Platinum: What You Can Buy

BullionVault offers a range of physical precious metals for investors who want to own real gold, silver, platinum, or palladium.

Whether you're looking to buy gold in small amounts or larger bars, the platform provides options for secure storage or, in some cases, delivery.

Here’s a quick look at what’s available:

- Gold Products – BullionVault sells investment-grade gold bars starting from 1 gram up to full-sized 400-ounce bars. These bars are securely stored in professional vaults worldwide, and UK customers can even request delivery of certain gold products.

- Silver Products – Silver bars are available for purchase and storage, starting from 1,000-ounce bars. Unlike gold, silver isn’t available for direct delivery, making it ideal for those who want to invest in bulk without handling storage themselves.

- Platinum & Palladium Products – These metals are available for purchase and storage but only in London vaults. They are traded in standard industry bar sizes and are a great option for diversifying a metals portfolio.

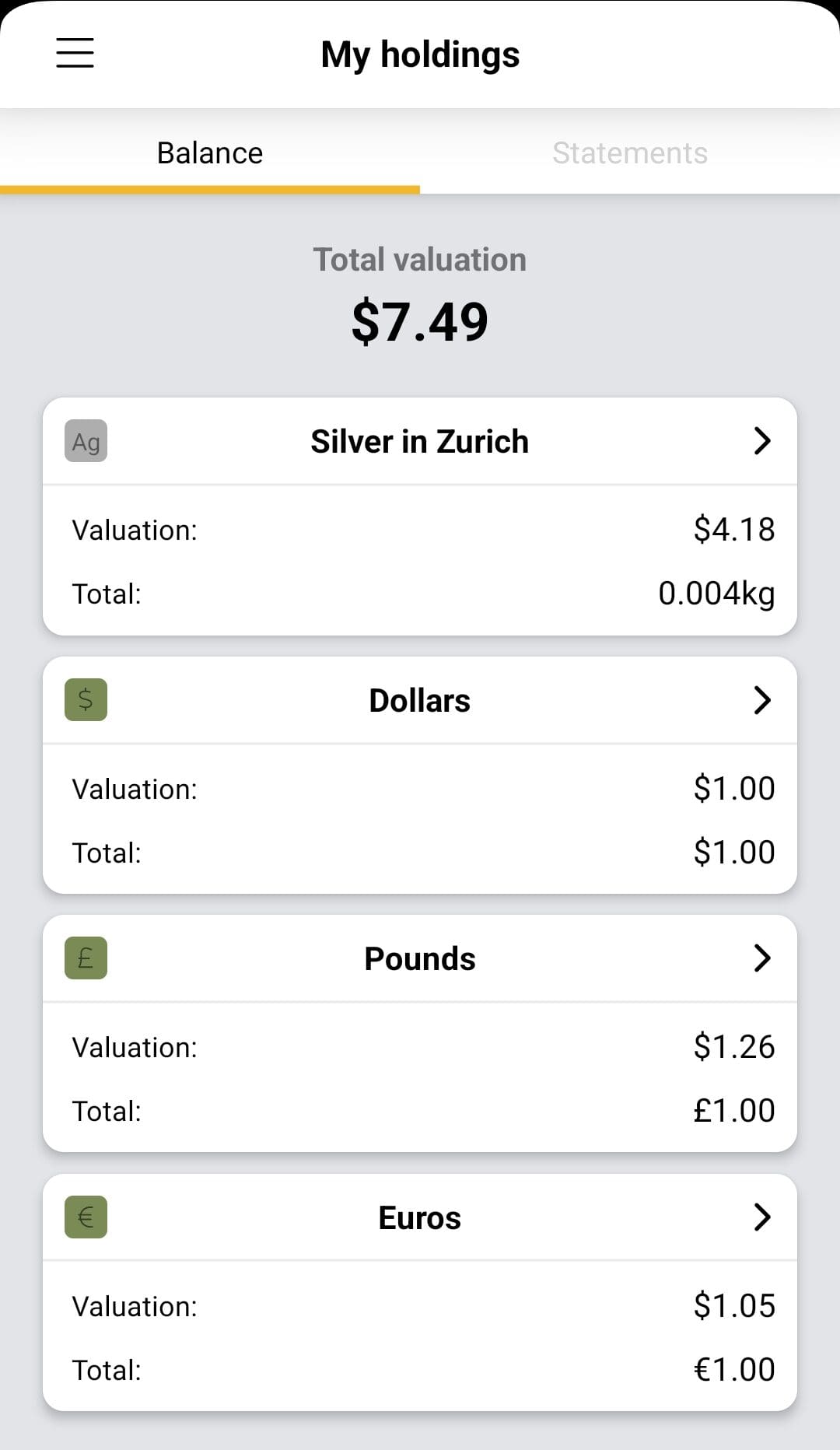

Where Does BullionVault Store Your Gold?

BullionVault provides secure, insured storage for gold, silver, platinum, and palladium in professional vaults across major global financial hubs, including London, Zurich, New York, Toronto, and Singapore.

BullionVault does not rely on third-party brokers—you directly own the stored metal.

Key Storage & Security Features:

- Segregated Storage – Your metals are fully allocated, meaning they are not mixed with company assets. Even if BullionVault were to close, your holdings remain protected.

- Comprehensive Insurance – All metals stored in BullionVault’s vaults are fully insured, covering theft, damage, or other risks.

- Flexible Vault Locations – Choose where to store your metals for added control.

Can I Get Physical Delivery from BullionVault?

Yes, but only for gold and only for UK customers. US customers can withdraw and get the money to their bank account, but not the physical metal.

Also there are additional fees – delivery comes with handling, transport, and insurance costs, which vary depending on the weight and destination.

For example, releasing a 400-ounce bar from a vault in Zurich costs around $250 plus transport fees.

Typically, gold deliveries require a minimum quantity, such as 50 grams or a full bar, depending on the request.

Fees & Pricing

BullionVault keeps its pricing transparent and competitive, especially for larger transactions.

There are three main fees to consider: trading commissions, storage & insurance, and withdrawal fees:

Fee | Cost |

|---|---|

Trading Commission | 0.5% (under $75K), down to 0.05% (over $750K)

|

Gold Storage & Insurance | 0.12% per year ($4/month min)

|

Silver, Platinum, Palladium Storage | 0.48% per year ($8/month min) |

Withdrawal Fees | UK: Free (under £20K), £20 (over £20K) US: $10-$30 |

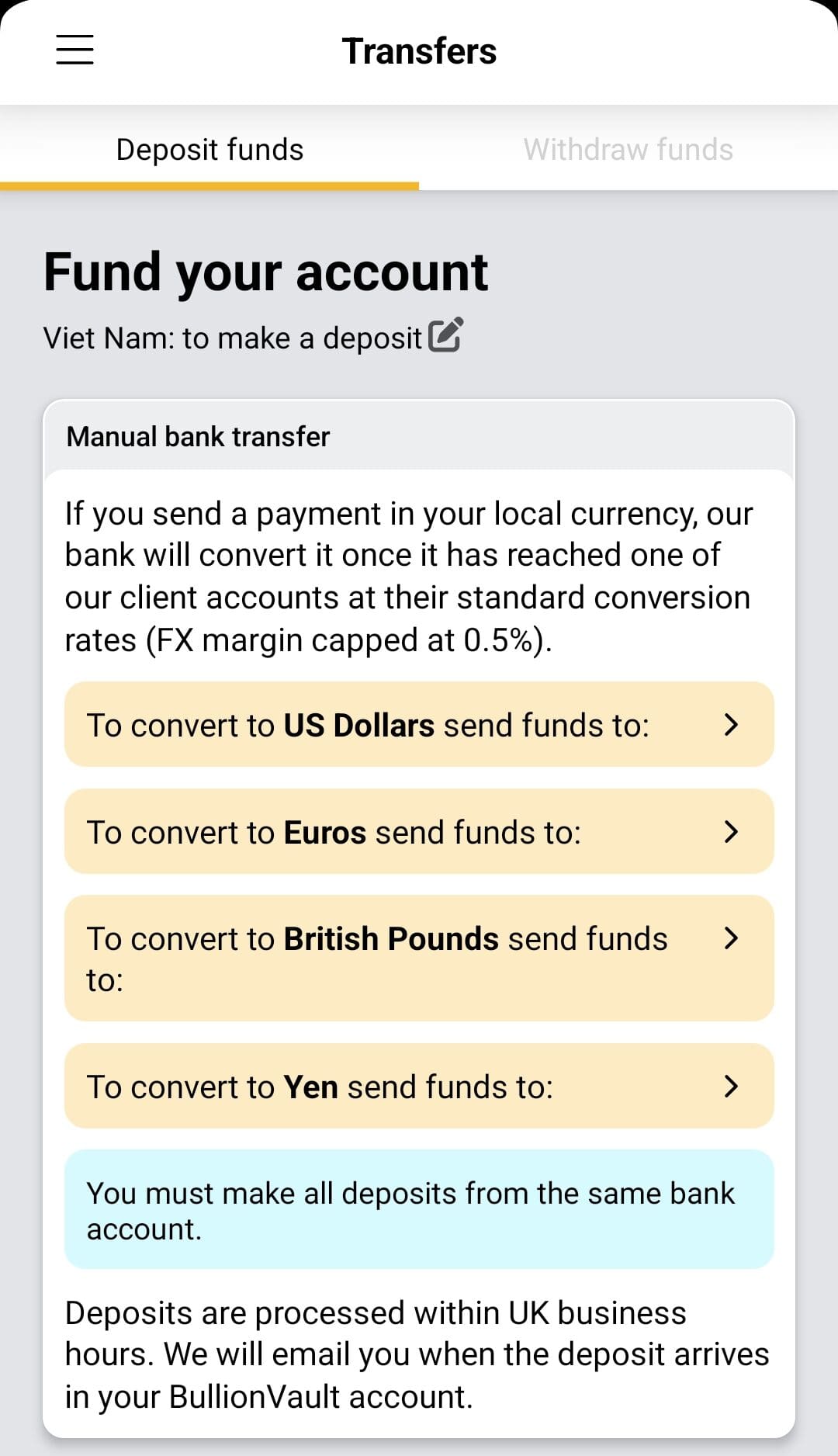

How Can You Fund Your BullionVault Account?

BullionVault keeps things simple when it comes to funding your account.

While it doesn’t support credit cards or e-wallets like PayPal, it does offer secure and widely accepted payment methods:

- Bank Wire Transfers – The primary way to deposit and withdraw funds. Processing time depends on the bank and currency, usually taking 1-3 business days.

- Online Banking Transfers – Available for UK customers through Truelayer, allowing for instant deposits.

- Check Payments – Accepted in some cases, but they take much longer to clear (up to 15 days).

BullionVault doesn’t charge fees for deposits, but withdrawals have a minimum requirement ($100) and may come with bank processing fees, especially for international transfers.

Automatic Gold Investment Plan

For those who prefer a hands-off approach to investing, BullionVault offers an Automatic Gold Investment Plan.

This feature lets you buy gold at regular intervals, similar to a dollar-cost averaging strategy.

- You deposit funds into your BullionVault account.

- The system automatically purchases gold at the daily London price, ensuring you get a fair market rate.

- No need to manually place orders—just set it up and let the system handle the rest.

This is a great option if you want to build up your gold holdings over time without worrying about market timing. However, it only applies to gold.

Live Order Board & Tools: A Website Tour

BullionVault’s website and mobile app make it easy to buy, sell, and store precious metals. The platform is straightforward, though it focuses more on functionality than fancy design.

New investors might need a bit of time to get used to the layout, but once familiar, it’s simple to navigate.

The Live Order Board is one of the best features, allowing real-time trades with other users.

While the desktop version is fully functional, the mobile app (iOS & Android) is useful for checking prices and making trades on the go.

Also, some users find the app’s design a bit outdated.

Security & Transparency Measures

BullionVault takes security seriously, making it one of the most trusted online gold investment platforms. Here’s how they keep your investments safe:

- Daily Audits – Every day, the company publishes an independent audit of all stored metals, allowing customers to verify their holdings.

- Two-Factor Authentication (2FA) – Adds an extra layer of protection for your account. You can use apps like Google Authenticator or a YubiKey.

- LBMA Membership – Being a member of the London Bullion Market Association ensures the company follows strict ethical and security standards.

Support Options: How to Get Help

BullionVault offers multiple customer support options, making it easy to get help when needed.

Their support team is available Monday to Friday from 9 AM to 8:30 PM (GMT). You can reach them via live chat, email, phone, or by visiting their London office.

Contact Option | Details |

|---|---|

Phone Support | +44 208 6000 130 (UK) / 1-888-908-2858 (US) |

Email Support | support@bullionvault.com |

Live Chat | Available on the website |

Availability | Monday to Friday from 9 AM to 8:30 PM (GMT) |

They also provide a Help Center with FAQs and tutorial videos covering topics like how to place an order, deposit funds, and withdraw money.

What’s Great & What’s Lacking in BullionVault

Below is a breakdown of the key pros and cons when choosing BullionVault:

- Competitive Pricing & Low Fees

BullionVault offers low trading commissions and affordable storage fees, making it cost-effective compared to traditional gold dealers.

- High Liquidity with 24/7 Trading

The Live Order Board allows users to buy and sell metals at real-time market prices, ensuring fast transactions and easy liquidity whenever needed.

- Secure & Fully Insured Storage

All metals are stored in high-security vaults across five global locations, fully insured and protected from theft or insolvency.

- Daily Independent Audits

The platform publishes daily audit reports, allowing users to independently verify their holdings and ensuring complete transparency.

- No Minimum Deposit

Unlike many competitors, BullionVault has no minimum deposit requirement, making it accessible for both small and large investors.

- No Buyback Guarantee

BullionVault does not offer a guaranteed buyback program, meaning investors must manually sell their holdings through the order board.

- Limited Physical Delivery (Gold & UK Only)

While storage is global, only UK customers can request physical delivery, and only for gold, making it less flexible for international buyers.

- Fees Can Add Up for Small Investors

The monthly storage minimums ($4 for gold, $8 for silver/platinum) may not be cost-effective for very small investments.

How to Buy & Store Precious Metals with BullionVault

Investing in gold, silver, platinum, or palladium through BullionVault is straightforward and secure. The platform is designed for investors who want fully allocated precious metals stored in professional vaults worldwide. Here’s how it works:

- Create an Account – Register on BullionVault’s website and complete the identity verification process. This includes linking your bank account and providing identification documents for security purposes.

- Deposit Funds – Fund your account via bank wire transfer or online banking. BullionVault does not charge deposit fees, but banks may have their own processing fees.

- Choose Your Metal & Vault Location – Select whether you want to buy gold, silver, platinum, or palladium, and choose a vault location from London, Zurich, New York, Toronto, or Singapore.

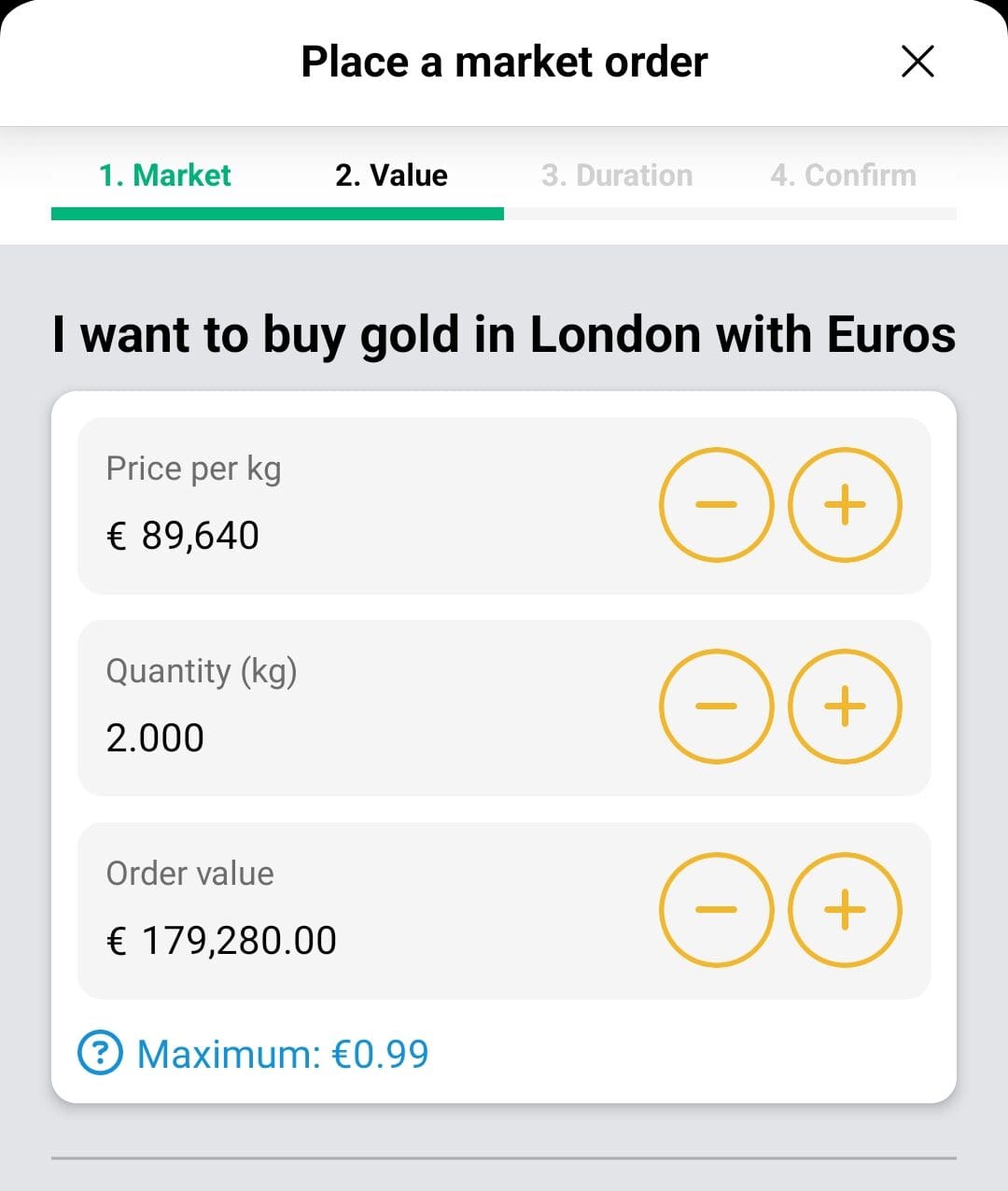

- Place an Order – You have two options:

- Live Order Board – Trade directly with other investors at real-time market prices.

- Daily Price Service – Buy at a fixed daily price (set once per day) for a simpler experience but with a 0.5% extra fee.

- Store & Monitor Your Holdings – Once purchased, your metals are stored securely in the selected vault. BullionVault provides daily independent audits, and you can track your holdings anytime through the platform.

-

Buying Gold for Physical Delivery (UK Only)

Unlike stored bullion, delivery must be manually requested. Contact BullionVault’s customer service team to begin the process.

Since the default option on BullionVault is storage, withdrawing physical gold incurs extra fees, including handling, transport, and insurance.

Once processed, your gold is shipped via secure, insured transport to your UK address. Delivery times depend on logistics but are typically within a few business days.

FAQ

Yes, BullionVault offers a price alert service that notifies you when the spot price of gold, silver, platinum, or palladium reaches your target level.

Yes, through the Automatic Gold Investment Plan, you can schedule regular gold purchases at the daily London price, ideal for long-term investors.

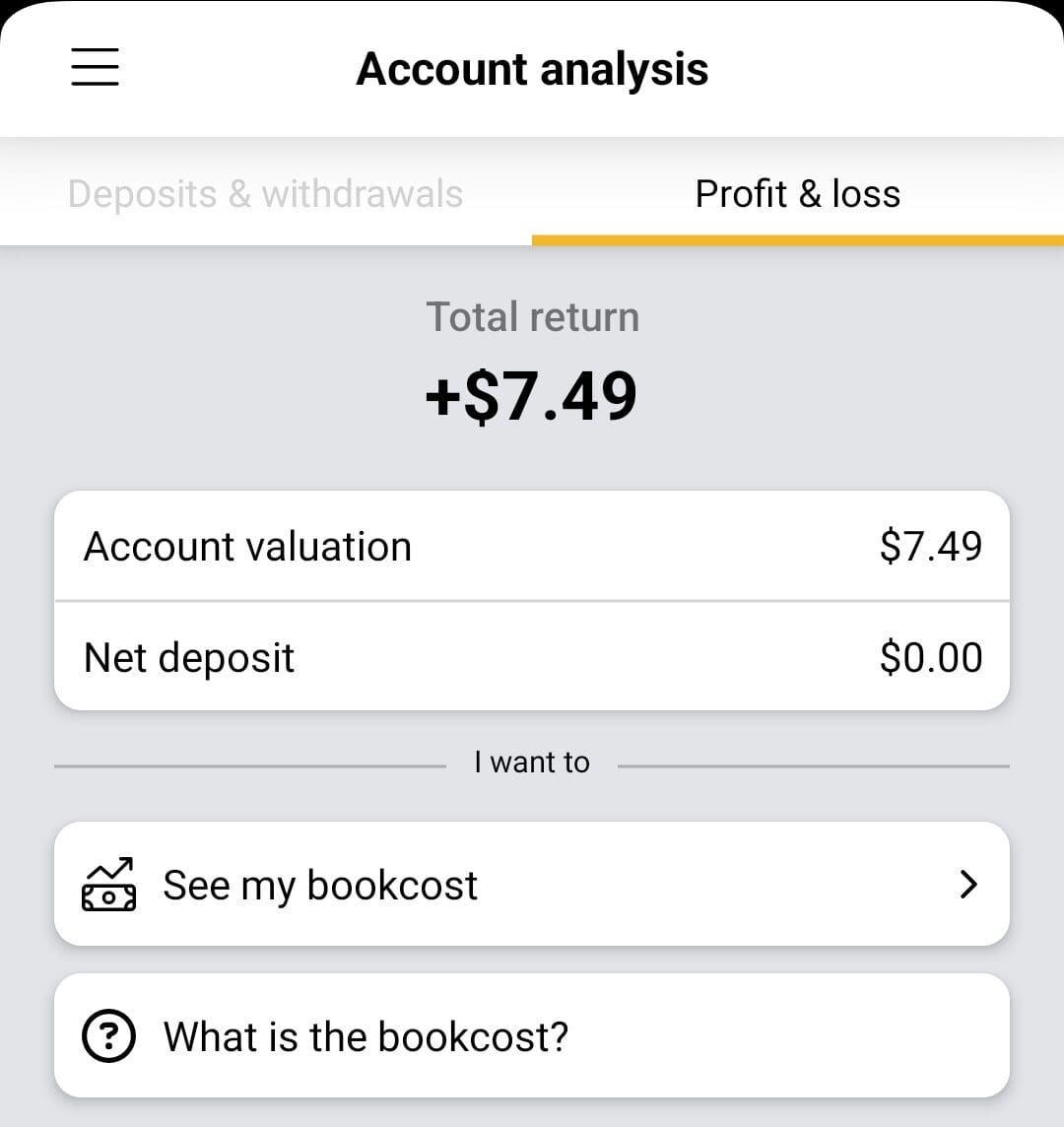

You can log in to your account anytime to view real-time balances, trade history, and price charts, but no advanced portfolio analysis tools are available.

Yes, you can transfer metals between vaults for a fee, which varies based on metal type and vault location.

Yes, as long as your order has not been matched. Once a trade is executed, it is final and cannot be reversed.

Yes, BullionVault supports individual, joint, and corporate accounts, though additional verification documents are required for non-personal accounts.

Review Gold Dealers For Direct Purchase & Gold IRA

How We Rated Gold & Silver Dealers: Review Methodology

At The Smart Investor, we evaluated gold brokers & dealers based on their overall value, pricing transparency, and investment options compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to precious metals investors, including fees, security, product selection, and IRA investment options. Each broker was rated based on the following criteria:

- Pricing & Fees (15%): We prioritized brokers with transparent pricing, low markups on gold and silver, and fair premiums. Some platforms had hidden costs, including storage and liquidation fees.

- User Experience & Buying Process (20%): A smooth, intuitive, and secure buying process scored highest. Some brokers had complex procedures, slow transactions, or unclear order processing.

- Reputation & Ratings (10%): We factored in customer reviews, industry ratings, and regulatory compliance. Highly rated brokers had strong reputations for reliability, trustworthiness, and investor protection. Some had mixed reviews or unresolved complaints.

- Customer Support & Service (15%): We tested response times, availability, and helpfulness of support via phone, chat, and email. The best brokers provided knowledgeable assistance with fast, professional service, while others were slow or unresponsive

- Security & Storage Options (10%): We favored brokers offering secure vault storage, insured holdings, and direct delivery options. Some lacked proper security measures, increasing investment risks.

- IRA & Retirement Investment Options (20%): The best brokers offered Gold & Silver IRA accounts with IRS-approved metals, simple setup, and rollover assistance. Some lacked IRA services or charged high fees.

- Precious Metals Selection (10%): We rated brokers higher if they offered a wide range of gold and silver products, including bullion, coins, and bars. Some had limited selections, restricting investment choices.