Lear Capital

Storage Fees

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

Lear Capital is a well-established precious metals dealer that has been in business since 1997, helping investors buy gold, silver, and other metals.

It specializes in gold and silver IRAs, allowing customers to diversify their portfolios with physical metals while enjoying tax advantages.

Customers can roll over or transfer funds from an existing IRA, 401(k), or other retirement accounts into a gold IRA

If you're looking to buy gold, silver, platinum, or palladium outside of an IRA, Lear Capital also sells investment-grade bullion and rare coins, which you can have shipped directly to your home.

- Wide Range of Precious Metals

- Price Match Guarantee

- Free Shipping

- Flexible Payment Options

- Excellent Ratings

- Minimum Investment Requirement

- No Formal Buyback Program

Do I have to pay taxes on my precious metals investments?

If you hold precious metals in an IRA, they benefit from tax-deferred growth, and taxes are only due upon withdrawal or sale, subject to IRA tax rules.

How do I track my investments with Lear Capital?

You can track your investments through 24/7 online access, where you can view portfolio updates and receive quarterly statements.

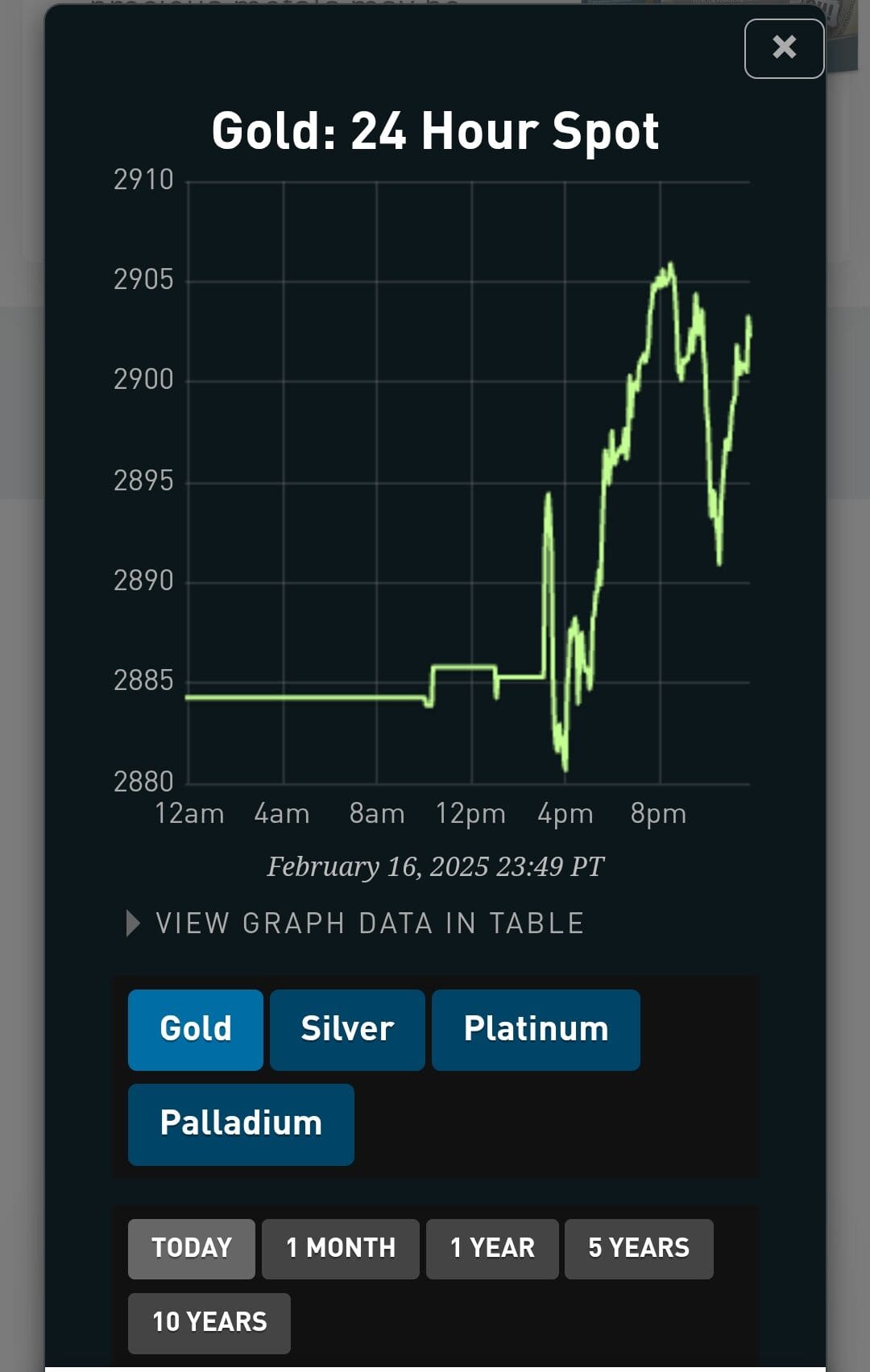

Is there a way to track real-time prices of precious metals?

Yes, Lear Capital provides real-time price charts for gold, silver, platinum, and palladium directly on their website for easy tracking.

Can I transfer my current IRA into a Gold IRA with Lear Capital?

Yes, Lear Capital specializes in helping customers roll over existing IRAs into a Gold IRA, ensuring the process is tax and penalty-free.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

Reputation & Ratings Breakdown: What Customers Think

Lear Capital has built a solid reputation over the years, consistently earning high ratings on platforms like BBB and Trustpilot, makes it one of the best platforms when it comes to customer ratings.

Platform | Rating |

|---|---|

Trustpilot

| 4.9 (2,561 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 1997 |

Consumer Affairs | 5 (1,436 reviews) |

Google Reviews | 4.7 (404 reviews) |

Choosing the right gold dealer isn’t easy, but Lear Capital has earned the trust of customers looking for a safe and reputable investment option.

Gold IRA with Lear Capital: How It Works

Lear Capital makes it easy to invest in a Gold IRA, helping you roll over or transfer funds from an existing IRA, 401(k), or other retirement account into physical gold and silver—all tax and penalty-free. Here’s what they offer:

- Full-Service Gold IRA Setup – Lear Capital handles the entire process, from paperwork to funding, ensuring a smooth transition.

- Personal Account Executive – Every customer gets a dedicated expert to guide them through investment choices and avoid tax penalties.

- Wide Selection of Metals – Choose from IRS-approved gold, silver, platinum, and palladium coins and bars for your IRA.

- Secure Storage – Your metals are stored in an IRS-approved vault (Delaware Depository) with full insurance coverage.

- Price Match Guarantee – If you find a better price, Lear Capital will match it.

- Fee Waivers for Large Investments – Invest $75,000+, and Lear covers your storage fees for three years.

- Fast Processing – Accounts can be set up within one business day, and fund transfers take up to five business days.

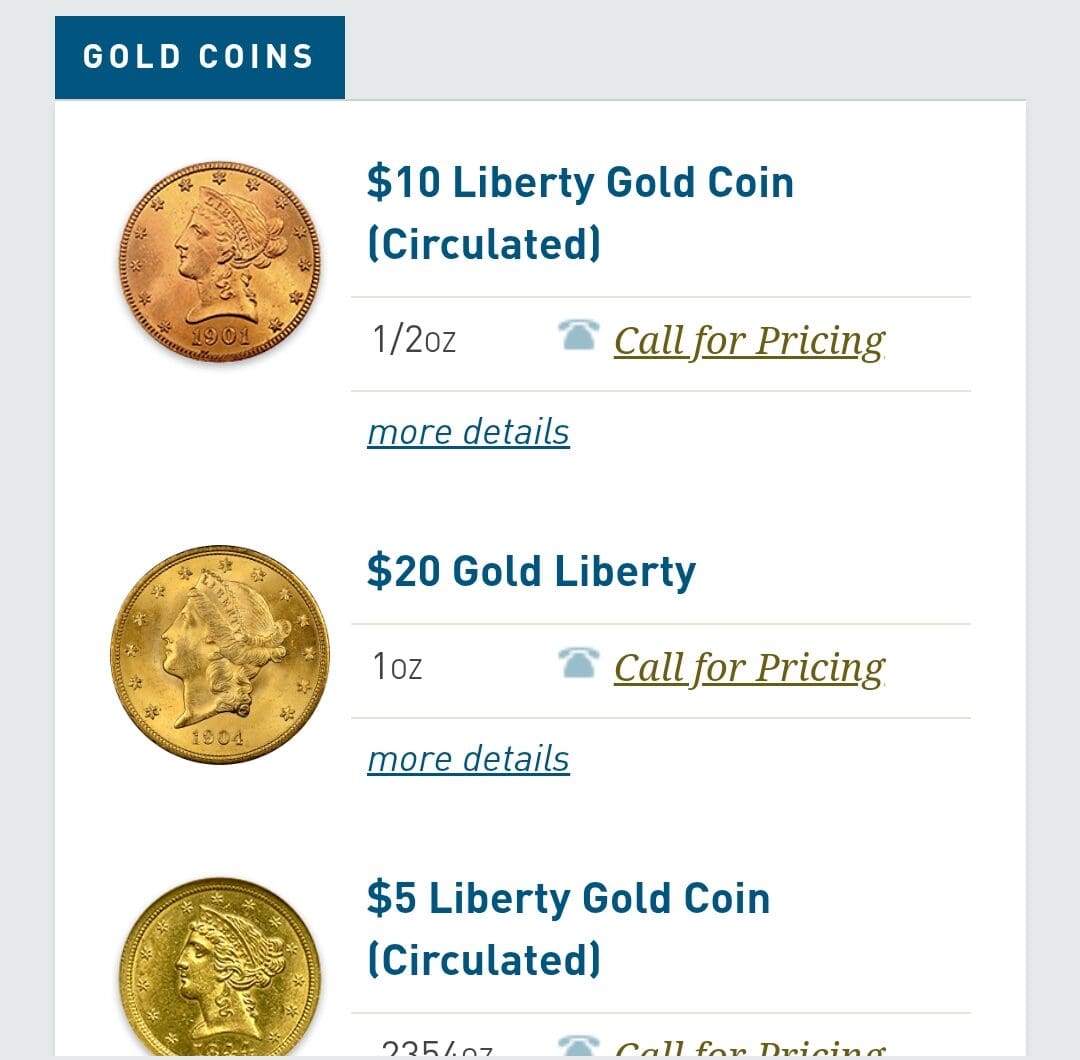

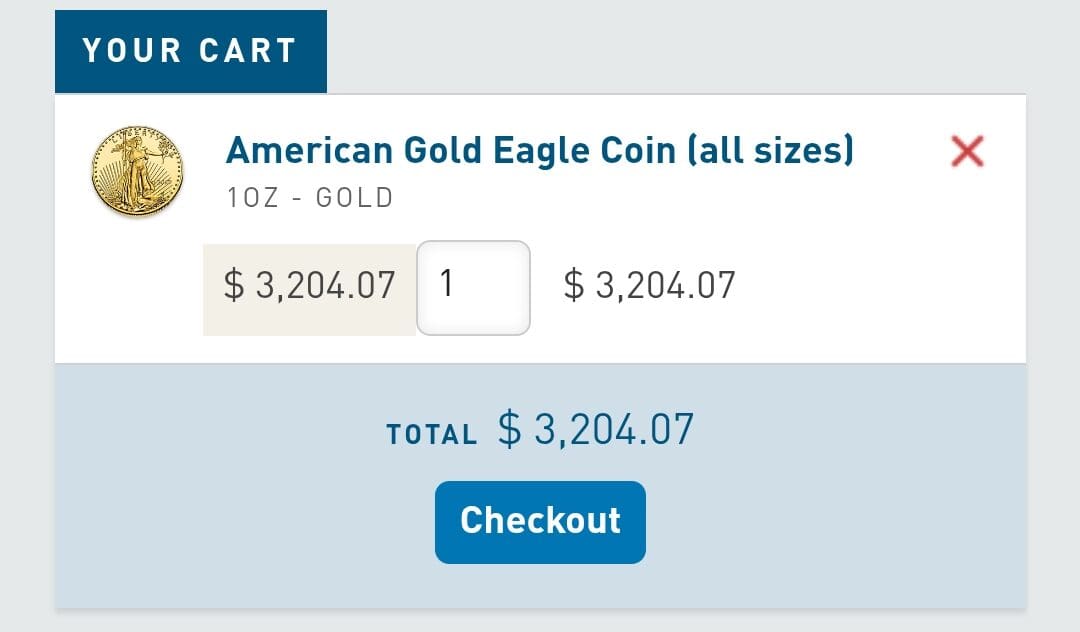

Lear Capital’s Precious Metals Selection

Lear Capital offers a variety of gold, silver, platinum, and palladium products for both IRA investors and collectors.

Whether you're looking for investment-grade bullion or rare coins, their selection includes IRS-approved options and high-quality numismatics:

-

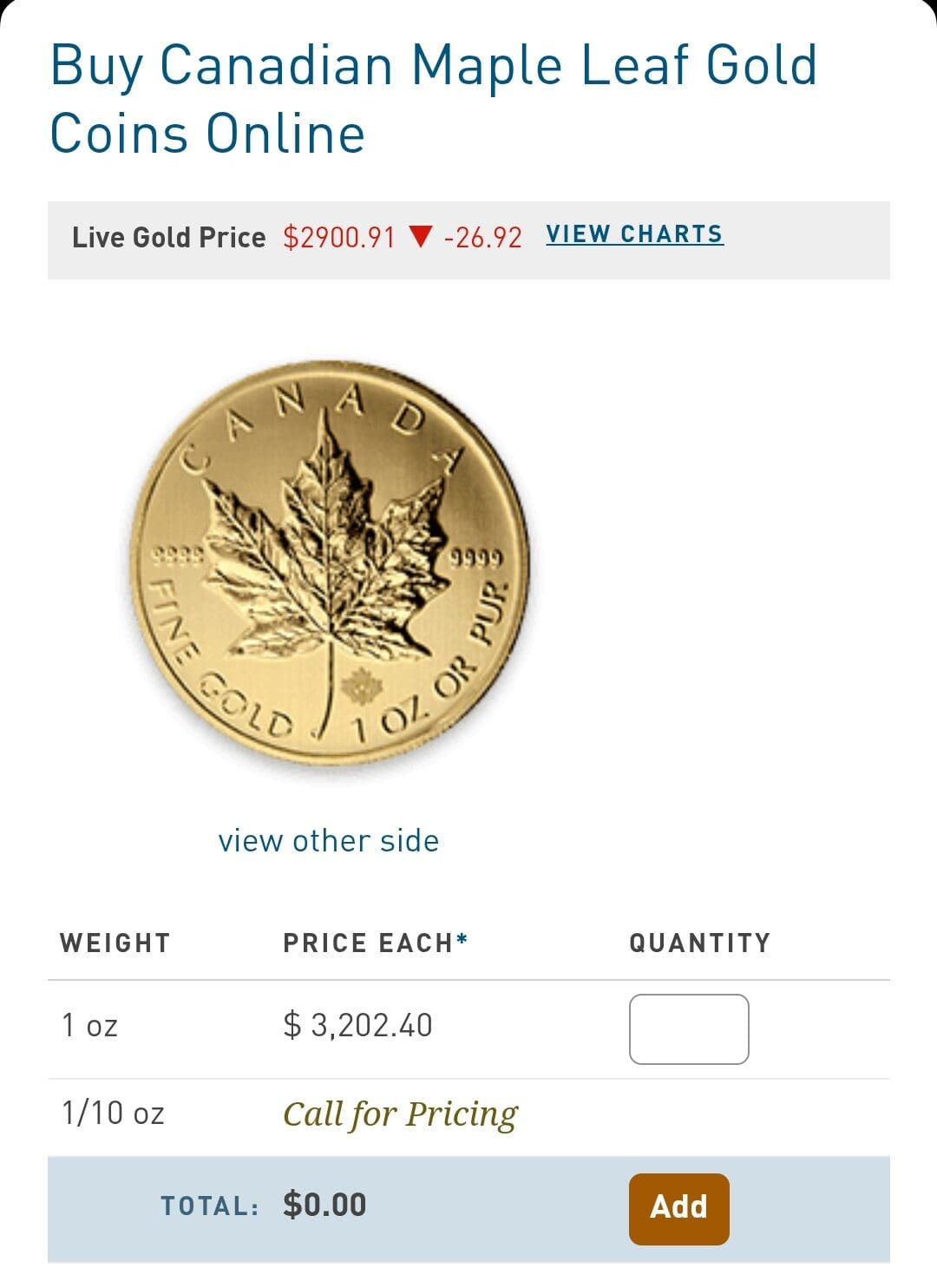

Gold Products

Lear Capital offers investment-grade gold coins and bars including popular items such as American Gold Eagles and Canadian Gold Maple Leafs in various sizes.

For collectors, they provide numismatic gold coins like Pre-1933 U.S. gold coins and certified graded coins, which are valued for both their historical significance and collector appeal.

-

Silver Products

Lear Capital offers a range of IRA-eligible silver products, including well-known coins such as the American Silver Eagles and Canadian Silver Maple Leafs, along with silver bars available in sizes from 1 oz to 100 oz.

They also carry junk silver and numismatic silver coins, which are prized for their historical value and silver content, catering to both investors and collectors.

-

Platinum & Palladium Products

Lear Capital provides platinum and palladium coins and bars for investors seeking to diversify, featuring products like the American Platinum Eagles and Canadian Palladium Maple Leafs.

With Lear Capital, you’re working with a reputable gold dealer, reducing the chances of falling for counterfeit or overpriced gold coin scams.

How Lear Capital Handles Metal Storage

Lear Capital provides secure, IRS-approved storage for all precious metals held in Gold IRAs through the Delaware Depository.

Here’s an overview of Lear Capital’s storage and security features:

- Delaware Depository: An IRS-approved facility that meets all required standards for IRA custodianship. It offers 24/7 monitoring, armed guards, and physical security measures like vaults and high-security storage areas.

- Full Insurance Coverage: All precious metals are insured for their full market value, giving you peace of mind knowing that your assets are protected.

- Secure Shipping: If you choose to have your metals shipped to you, insured shipping is provided to ensure the safe delivery of your investment.

- Personalized Support: Your account executive helps coordinate everything, from storage setup to ensuring all regulatory requirements are met.

Breaking Down Lear Capital’s Fees & Pricing

Lear Capital offers a straightforward fee structure for their Gold IRAs, with competitive rates that are based on your investment amount:

Fee | Cost |

|---|---|

First Year IRA Setup | $280 |

Annual IRA Maintenance | $200 |

Storage Fee | $200 annually |

Setup Fee Waivers | $50 waived for investments over $10,000 |

Storage Fee Waivers | 1st Year Waived for $25K-$50K, 1st & 2nd Years Waived for $50K-$75K, 1st-3rd Years Waived for $75K+ |

Payment Methods: What’s Accepted & What’s Not

Lear Capital provides multiple payment methods for purchasing precious metals, making it easy for investors to fund their transactions.

- Bank Wire Transfers – The preferred option for large transactions due to their speed and security.

- Checks – Accepted for purchases, but may take longer to process compared to wire transfers.

- Credit Cards – Available for smaller transactions, though limits may apply.

- IRA & 401(k) Rollovers – Funds from retirement accounts can be transferred to a Gold IRA seamlessly, tax and penalty-free.

Price Match Guarantee

Lear Capital’s Price Match Guarantee ensures that customers get the best deal on their precious metals investments.

If you find a lower price on the same product from another dealer, Lear Capital will match it, giving you confidence that you are getting competitive pricing.

This guarantee applies to gold, silver, and platinum bullion, as well as rare coins, helping investors avoid overpaying in a fluctuating market.

With this policy, Lear Capital reinforces its commitment to transparency and value, ensuring you receive fair pricing on your investment.

Buyback: Can You Liquidate Gold with Lear?

Lear Capital does not have a formal buyback program, meaning they do not guarantee repurchasing metals from customers.

However, they assist investors with liquidation by providing guidance on selling metals, whether within an IRA or as a direct purchase.

Customers looking to liquidate their holdings can work with their personal account executive, who will help them navigate the process and secure competitive pricing in the market.

For Gold IRA investors, liquidation can be done in two ways:

- Physical Delivery – Investors can request their metals to be shipped securely to their homes.

- Cash Conversion – Customers can sell their metals, and Lear Capital will assist in finding a buyer, converting assets into cash.

Lear Capital does not publish specific details about buyback pricing or the timeline for liquidation.

Website Features & Tools for Investors

Lear Capital offers a user-friendly website designed to make navigating their services easy. The site is well-organized, providing quick access to information about Gold IRAs, precious metals products, and educational resources.

While the lack of live chat support is a downside, the rest of the website compensates by being informative and straightforward, with plenty of tools and market data available.

The website offers a simple IRA setup form, and once you submit it, a personal account executive reaches out to walk you through the process.

Investors can access real-time price charts, RMD calculators, and even a mobile app for on-the-go updates (though the app's availability is limited to specific devices).

How to Contact Lear Capital Support

Customer service is available during business hours, with a direct line to your account executive, reducing wait times and providing more efficient solutions.

However, live chat support is currently unavailable, which could be a drawback for some users seeking immediate assistance.

Contact Option | Details |

|---|---|

Phone (General Inquiries) | 800-576-9355 |

Phone (Customer Support) | 800-855-5327 |

Email Support | customercare@learcapital.com |

Availability | Monday to Friday, 9:00 AM to 5:00 PM PT |

Lear Capital: Pros, Cons & Key Takeaways

Lear Capital provides several strong features, but there are also factors worth considering.

Here’s a closer look at its strengths and areas that may need improvement.

- Wide Range of Precious Metals

Lear Capital offers a variety of gold, silver, platinum, and palladium products, including investment-grade bullion and rare coins, giving investors plenty of options.

- Price Match Guarantee

If you find a better price elsewhere for the same product, Lear Capital will match it, ensuring you’re getting a competitive deal.

- Free Shipping

They offer free, insured shipping on all qualifying purchases, making it easier and more affordable to get your metals delivered securely.

- Flexible Payment Options

Lear Capital accepts various payment methods, including credit cards, checks, bank wire, and rollovers from IRAs, making the buying process smooth and flexible.

- Excellent Ratings

The company has an A+ rating with the BBB and high ratings on Trustpilot, showing a strong reputation for reliability and customer service.

- Minimum Investment Requirement

There’s a $15,000 minimum purchase for direct precious metal transactions, which may be a barrier for smaller investors.

- No Formal Buyback Program

Lear Capital doesn’t have an official buyback guarantee, which could make selling your metals a bit more complicated.

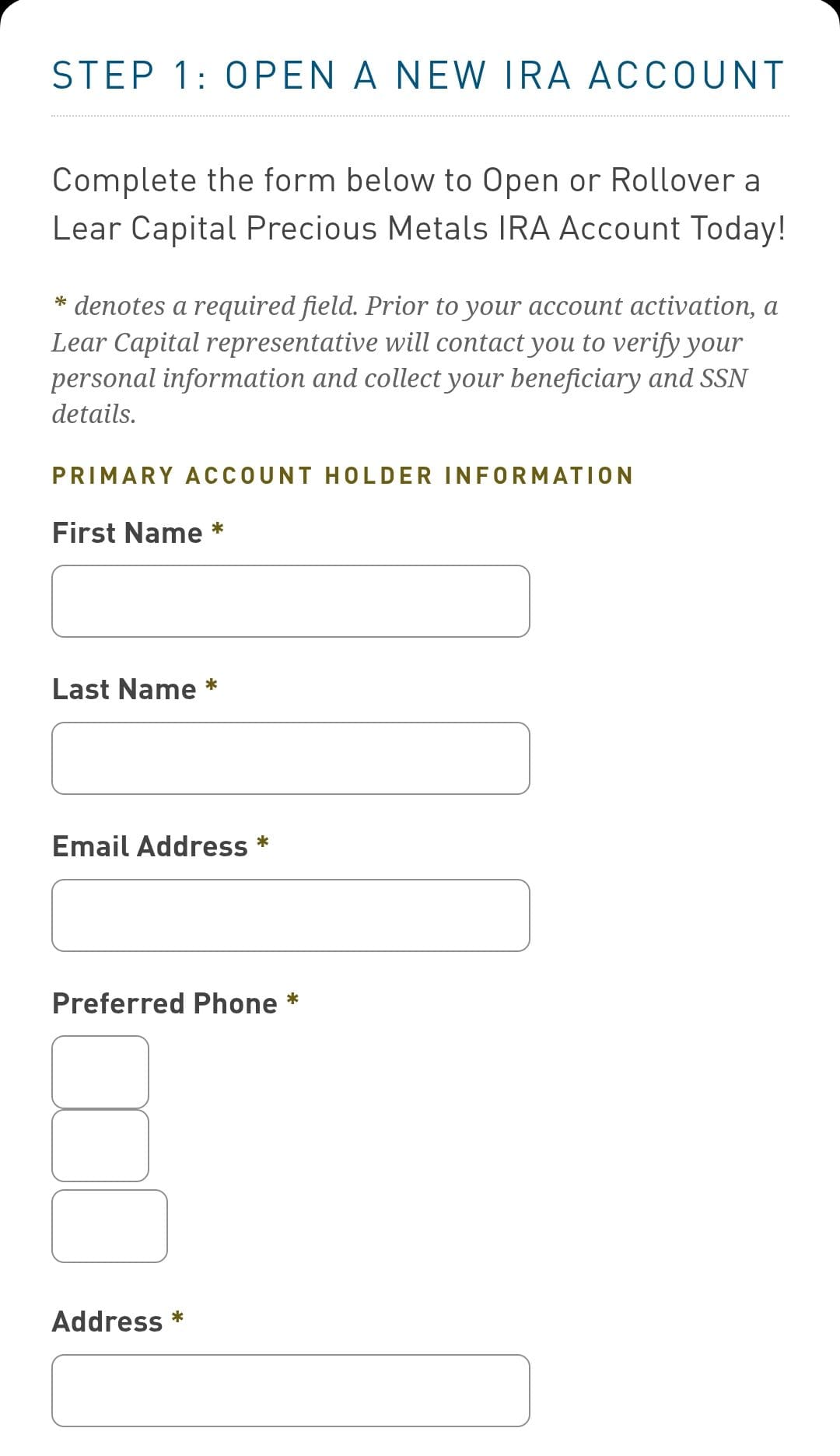

Step-by-Step: How to Invest with Lear

Lear Capital makes investing simple, whether you're opening a Gold IRA or buying physical precious metals. Below is a step-by-step guide for both options.

-

Gold IRA

Lear Capital is one of the top companies for Gold IRA, which makes the process simple as they guide you through every step.

Here’s how to get started:

Submit an Inquiry: Start by filling out the online form to express interest in a Gold IRA. This includes your personal and financial details. Once submitted, Lear Capital will assign you a personal account executive who will contact you to discuss your investment goals.

Account Setup: You’ll complete a short application (about 10 minutes) to open your IRA. Your account executive will ensure that everything is in place, helping you select the appropriate precious metals and navigate the rollover process from your existing IRA or 401(k) to a Gold IRA.

3. Fund Your IRA: After your account is set up, you can transfer funds into your new Gold IRA. Lear Capital handles the paperwork for any rollovers, ensuring everything is tax and penalty-free. This process typically takes up to five business days.

4. Choose Your Metals: Once funded, you’ll work with your account executive to choose IRS-approved gold, silver, platinum, or palladium. Lear Capital offers a range of options that fit your IRA requirements.

5. Storage & Monitoring: Your metals will be stored securely in an IRS-approved vault (Delaware Depository). You’ll have 24/7 online access to track your metals and receive quarterly statements.

-

Physical Purchase

If you're looking to purchase precious metals directly, here’s how the process works:

Choose Your Metals: Browse Lear Capital's range of gold, silver, platinum, and palladium products. You can call your account executive for recommendations based on your investment goals.

2. Payment Options: Once you’ve decided on the metals you want to purchase, you can choose your payment method.

3. Finalize Your Purchase: After payment is made, you’ll receive a confirmation of your order. Lear Capital offers a Price Match Guarantee, so if you find a better deal elsewhere, they’ll match it. Your metals will be confirmed, and the transaction will be locked in at the current market price.

4. Secure Shipping: Lear Capital provides free insured shipping for all direct purchases. Your metals will be shipped directly to your home or stored at a secure facility. If you opt for home delivery, they ensure that the shipment is fully insured during transit.

5. Track Your Investment: After the transaction is complete, you can track the value of your purchase via real-time price charts on Lear Capital’s website or app.

FAQ

The Gold IRA setup process usually takes 1-2 business days to complete, and the funding process can take up to 5 business days.

Yes, Lear Capital allows customers to buy metals directly for home delivery or secure storage outside of an IRA.

Yes, all metals held in an IRA and those delivered to you are fully insured during storage and shipment.

Lear Capital does not offer an official buyback program, but they assist customers in selling their metals by connecting them to the market and offering guidance.