Noble Gold

Storage Fees

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

Noble Gold is a precious metals dealer that helps customers invest in gold, silver, platinum, and palladium—whether through direct purchases or a self-directed Gold IRA.

Founded in 2016, the company has built a strong reputation for transparency, customer service, and affordable investment options.

For new customers, getting started is straightforward. If you're interested in a Gold IRA, You can open an account online, and their team will assist with rollovers from existing retirement accounts.

One of Noble Gold’s standout features is its Royal Survival Packs, designed for investors who want access to physical gold and silver. These packs contain hand-selected precious metals and can be delivered directly to your home.

- Low Minimum for Physical Purchases

- Unique Royal Survival Packs

- High Customer Satisfaction Ratings

- Buyback Program

- Multiple Storage Options

- No Online Pricing for Precious Metals

- Limited International Storage Options

- No Live Chat / Mobile App

Can I visit my gold or silver in storage?

Yes, Noble Gold allows investors to schedule visits to their stored metals at the Texas, Delaware, or Canadian depositories with prior arrangements.

Are my investments insured while in storage?

Yes, all stored metals are fully insured by Noble Gold’s partnered depositories, protecting against theft, damage, or loss.

Does Noble Gold offer fractional gold or silver investments?

No, all purchases are for whole coins and bars, and fractional purchases are not currently available.

What types of retirement accounts can be rolled over into a Noble Gold IRA?

You can roll over funds from a Traditional IRA, Roth IRA, 401(k), 403(b), and other qualified retirement accounts into a Noble Gold IRA without tax penalties, as long as the transfer follows IRS guidelines.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

Trusted by Investors: Noble Gold’s Reputation & Ratings

Noble Gold has consistently received high customer ratings on platforms such as Trustpilot, Google Reviews, and the BBB, earning recognition as a highly rated gold and silver dealer over the years.

Platform | Rating |

|---|---|

Trustpilot

| 4.9 (537 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2017 |

Consumer Affairs | 4.9 (799 reviews) |

Google Reviews | 4.9 (562 reviews) |

Positive reviews focus on Noble Gold’s excellent customer service, with many customers praising their representatives for being knowledgeable, patient, and helpful.

On the negative side, some customers express frustration over the lack of pricing transparency online, as they have to call for exact metal prices.

Gold & Silver IRAs: What Noble Gold Offers

Noble Gold specializes in helping investors open and manage Gold IRA accounts. The minimum investment for a Gold IRA is $20,000.

Here’s what it offers:

- Gold & Silver IRAs – Noble Gold allows customers to open self-directed IRAs with gold, silver, platinum, and palladium.

- Secure Storage Options – Metals purchased through a Gold IRA are stored in IRS-approved depositories in Texas, Delaware, or Canada. Texas storage is a unique offering, as many competitors don’t provide this option.

- Rollover Assistance – If you already have a traditional IRA, Noble Gold helps with the rollover process, making the transition smooth and avoiding tax penalties.

- Buyback Guarantee – Investors can sell their metals back to Noble Gold when they need to liquidate.

- IRA-Approved Metals – Customers can choose from IRS-approved gold coins, bars, and bullion, including American Gold Eagles, Canadian Maple Leafs, and PAMP Suisse bars.

Noble Gold stands out for its personalized customer service, unique storage options, and investor-friendly approach.

Gold, Silver & More: Noble Gold’s Selection

Noble Gold offers a solid range of gold, silver, platinum, and palladium products for investors.

Here’s a breakdown of their main offerings:

- Gold Products – Noble Gold offers a mix of gold bullion and coins, including IRS-approved options for IRAs. Popular picks include American Gold Eagles, Canadian Maple Leafs, and PAMP Suisse gold bars.

- Silver Products – Investors can buy silver coins and bars, such as the American Silver Eagle, Canadian Silver Maple Leaf, and Austrian Philharmonic.

- Platinum & Palladium – For those looking to diversify, Noble Gold also carries platinum and palladium coins and bars, like the American Platinum Eagle and Canadian Palladium Maple Leaf.

- Rare Coins & Collectibles – Noble Gold provides graded and certified rare coins, including historic gold and silver pieces.

Texas, Delaware & Canada: Noble Gold’s Vaults

Noble Gold offers secure and insured storage solutions for investors who don’t want to keep their precious metals at home:

- Texas Storage Option – Noble Gold is one of the only companies offering a secure gold storage facility in Texas, which is a big plus for investors who prefer domestic storage outside of traditional financial centers.

- Delaware Depository – A popular choice among investors, known for its high-level security, insurance protection, and tax advantages.

- International Storage (Canada) – For those who want to store their metals outside the U.S., Noble Gold provides a secure vault in Mississauga, Ontario.

All depositories are fully insured and protected against theft or damage, ensuring your investment is safe at all times.

If you prefer home storage, Royal Survival Packs can be discreetly shipped to your address.

Is Noble Gold Affordable? Costs & Fees Breakdown

Noble Gold is transparent about its fees, which is a big plus for investors who want to avoid hidden charges.

Here's a breakdown of the main fees:

Fee | Cost |

|---|---|

Annual Account Fee | 80 |

Annual Storage Fee | $150

|

Setup Fee

| $50

|

Wire Fee

| $30

|

Buyback Program

Noble Gold offers a buyback program, making it easier for investors to sell their precious metals when needed. Here's how it works:

- Investors can sell their gold, silver, platinum, or palladium back to Noble Gold at any time.

- The company handles all logistics, so you don’t have to worry about finding buyers or shipping.

- This feature is especially useful for Gold IRA investors, allowing them to exit their investment smoothly when they need to cash out.

The buyback program adds an extra layer of security and flexibility, ensuring investors always have an easy way to liquidate their assets.

Royal Survival Packs

One of Noble Gold’s most unique offerings is its Royal Survival Packs, designed for those who want physical gold and silver on hand in case of emergencies.

These packs provide a quick and convenient way to own precious metals without going through the standard IRA process.

Here are the main features to know:

- Each pack contains a carefully selected mix of gold and silver coins that are easily recognizable and liquidatable in times of crisis.

- Noble Gold offers multiple tiers, ranging from $10,000 to $500,000, catering to different investment levels.

- Investors can choose to store the pack in a secure depository or have it delivered discreetly to their home.

- The packs are a great option for those who want financial security outside of traditional banking systems.

What Can You Do on Noble Gold’s Website?

Noble Gold’s website is clean, easy to navigate, and packed with useful information, making it beginner-friendly for those new to precious metals investing.

- Educational Focus – The site includes detailed guides, FAQs, and a Precious Metals 101 course, making it easy for investors to learn the basics.

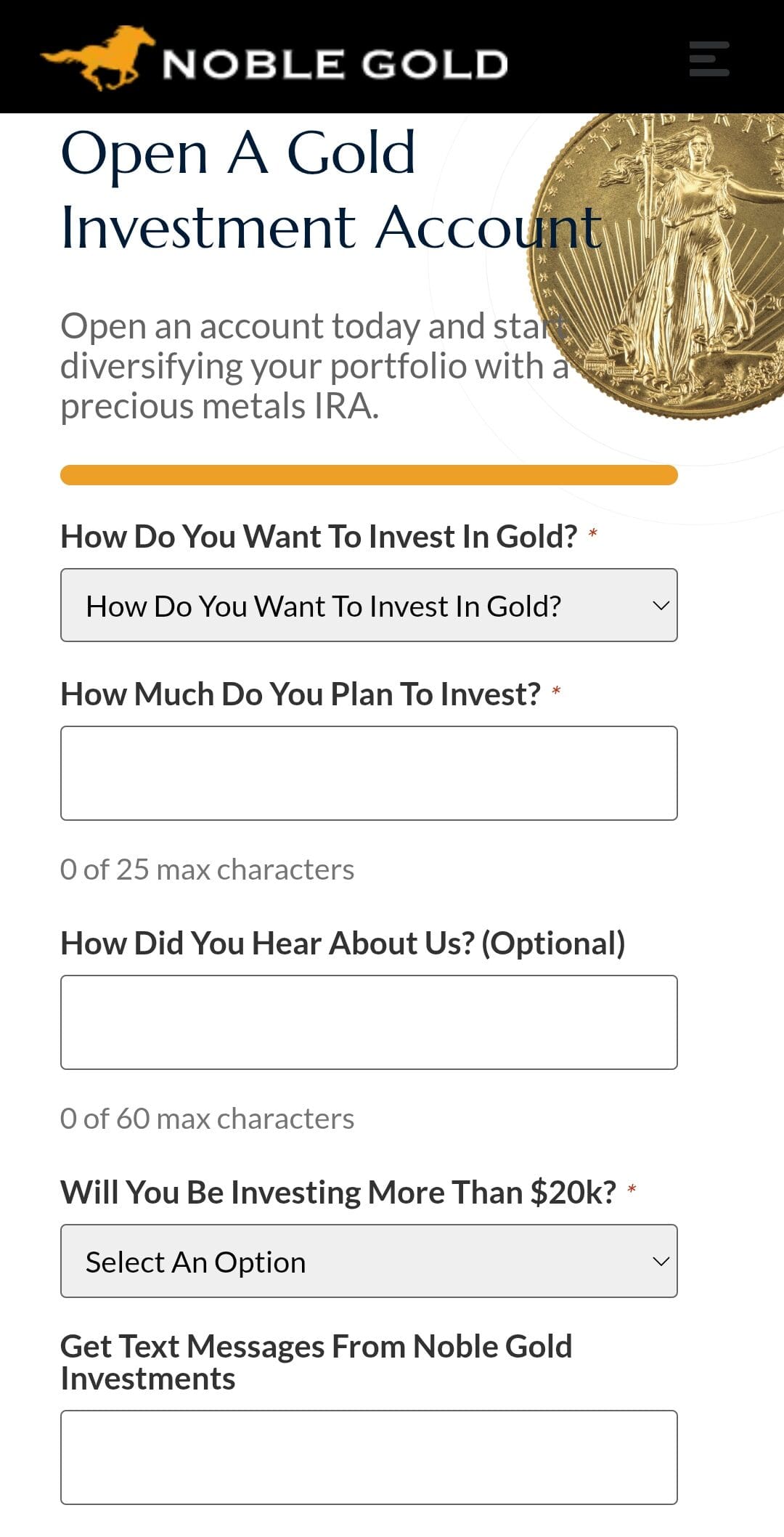

- Online Account Opening – While you can start the Gold IRA application online, a follow-up phone call and Docusign confirmation are required to finalize it.

- No Online Pricing – The website does not list current metal prices, so you have to contact the company for quotes.

How to Get Help from Noble Gold’s Team

Noble Gold is known for its personalized and knowledgeable customer service, making it a solid choice for both new and experienced investors.

Investors can reach out via phone or email, and Noble Gold’s team is known for quick and helpful responses. However, Noble Gold does not offer live chat support.

Contact Option | Details |

|---|---|

Phone Support | 877-646-5347

|

Email Support | info@nobleira.com

|

Availability | Mon-Fri: 6:30 AM – 6 PM PST, Sat: 8 AM – 1 PM PST |

Pros & Cons

Below is a breakdown of the key benefits and considerations when choosing Noble Gold:

- Low Minimum for Physical Purchases

With a $2,000 minimum for direct purchases, Noble Gold is more accessible than many competitors that require higher amounts.

- Unique Royal Survival Packs

These pre-selected gold and silver packs are ideal for investors looking for quick-access emergency assets in case of economic instability.

- High Customer Satisfaction Ratings

With excellent reviews across platforms like BBB, Trustpilot, and Consumer Affairs, Noble Gold is highly rated for customer service and transparency.

- Buyback Program

Noble Gold offers a guaranteed buyback service, allowing investors to easily liquidate their metals without the hassle of finding a buyer.

- Multiple Storage Options

Investors can choose from secure depositories in Texas, Delaware, and Canada, with Texas storage being a rare industry option.

- No Online Pricing for Precious Metals

Unlike some competitors, Noble Gold does not list live metal prices, requiring customers to call for quotes.

- Limited International Storage Options

Noble Gold only offers one international storage option (Canada), while some competitors provide global vault choices.

- No Live Chat / Mobile App

Investors cannot track their holdings or investments via a mobile app, and there is no live chat for real time help.

Gold IRA or Direct Purchase? Noble Gold’s Process

Whether you're interested in setting up a Gold IRA or purchasing physical precious metals, Noble Gold provides a straightforward way to get started.

Follow this step-by-step guide to navigate the process.

-

Investing in a Gold IRA

Here are the main steps to open gold IRA with Noble:

Step 1: Request the Free Gold IRA Guide

Before starting, Noble Gold provides a free investment guide to help you understand self-directed Gold IRAs. You can also schedule a consultation with their specialists.

Step 2: Open a Gold IRA Account

Contact Noble Gold’s team to set up your account and handle the paperwork. If you already have an existing IRA or 401(k), they will assist with the rollover process.

Step 3: Fund Your Account

Once your IRA is set up, you’ll need to transfer funds (minimum $20,000) to start investing.

Step 4: Choose Your Precious Metals

Select from IRS-approved gold, silver, platinum, or palladium coins and bars. Noble Gold will guide you through the best options.

Step 5: Secure Storage & Management

Your metals will be stored in a secure, IRS-approved depository in Texas, Delaware, or Canada. Noble Gold also provides photographic confirmation of your holdings.

-

Investing in Physical Precious Metals

Here are the main steps to buy physical precious metals with Noble:

- Select Your Metals: Browse Noble Gold’s offerings, including gold, silver, platinum, and palladium bars and coins.

- Place Your Order: Contact Noble Gold via phone or email to confirm pricing and complete your purchase (minimum $2,000).

- Choose Storage or Delivery: Decide if you want secure storage at a depository or home delivery. For larger investments, consider Royal Survival Packs for emergency gold storage.

- Receive Your Metals: If you opt for home delivery, your precious metals will be discreetly shipped and insured for safety.

FAQ

Setting up a Gold IRA typically takes 24 to 48 hours, but the transfer of funds from an existing IRA may take a few more days, depending on your custodian.

Noble Gold buys back metals at the current market rate, minus any applicable fees. You can request a quote before selling.

While Noble Gold doesn’t offer a mobile app, you can check your account details through your IRA custodian’s online portal.

All direct purchases are shipped fully insured, requiring a signature upon delivery to ensure security.

Review Gold Dealers For Direct Purchase & Gold IRA

How We Rated Gold & Silver Dealers: Review Methodology

At The Smart Investor, we evaluated gold brokers & dealers based on their overall value, pricing transparency, and investment options compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to precious metals investors, including fees, security, product selection, and IRA investment options. Each broker was rated based on the following criteria:

- Pricing & Fees (15%): We prioritized brokers with transparent pricing, low markups on gold and silver, and fair premiums. Some platforms had hidden costs, including storage and liquidation fees.

- User Experience & Buying Process (20%): A smooth, intuitive, and secure buying process scored highest. Some brokers had complex procedures, slow transactions, or unclear order processing.

- Reputation & Ratings (10%): We factored in customer reviews, industry ratings, and regulatory compliance. Highly rated brokers had strong reputations for reliability, trustworthiness, and investor protection. Some had mixed reviews or unresolved complaints.

- Customer Support & Service (15%): We tested response times, availability, and helpfulness of support via phone, chat, and email. The best brokers provided knowledgeable assistance with fast, professional service, while others were slow or unresponsive

- Security & Storage Options (10%): We favored brokers offering secure vault storage, insured holdings, and direct delivery options. Some lacked proper security measures, increasing investment risks.

- IRA & Retirement Investment Options (20%): The best brokers offered Gold & Silver IRA accounts with IRS-approved metals, simple setup, and rollover assistance. Some lacked IRA services or charged high fees.

- Precious Metals Selection (10%): We rated brokers higher if they offered a wide range of gold and silver products, including bullion, coins, and bars. Some had limited selections, restricting investment choices.