SD Bullion

Storage Fees

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

Founded in 2012, SD Bullion is an online precious metals dealer offering a wide range of gold, silver, platinum, palladium, and copper products.

If you’re interested in a Gold or Silver IRA, SD Bullion assists with setting up self-directed IRAs through custodians like New Direction Trust and Kingdom Trust.

SD Bullion has a higher than average reputation (but not top rated), with an A+ rating from the BBB and thousands of positive reviews on Trustpilot.

While their customer service is highly rated, note that support is only available on weekdays, and there's no live chat option.

- Competitive Pricing

- Wide Product Selection

- Buyback Program

- Free Shipping on Orders Over $199

- Flexible Payment Options

- Lack of Fee Transparency

- Order Cancellations Come with Fees

- No Live Chat Support

- Limited Business Hours for Support

Does SD Bullion have a physical store?

No, SD Bullion operates primarily as an online dealer. However, they do have a physical headquarters in Ottawa Lake, Michigan, but it is not open to walk-in customers.

Can I set up automatic purchases for precious metals?

No, SD Bullion does not currently offer an automatic investment plan. Customers must manually place orders for each purchase.

Can I track my SD Bullion order in real time?

Yes, once your order has shipped, you’ll receive a tracking number via email, allowing you to monitor your package until it arrives.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

SD Bullion’s Reputation: Trusted or Overhyped?

SD Bullion receives solid ratings across Trustpilot and other review sites.

However, while its scores are above industry average, it falls short of being among the highest-rated gold brokers.

Platform | Rating |

|---|---|

Trustpilot

| 4.3 (2,648 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2014 |

Consumer Affairs | 4.5 (790 reviews) |

Sitejabber | 3.3 (641 reviews) |

Positive reviews for SD Bullion often highlight the company's competitive pricing, wide selection of precious metals, and efficient customer service.

On the other hand, negative feedback primarily revolves around occasional shipping delays, return policies. and fees.

How SD Bullion Helps You Invest in a Gold IRA

SD Bullion provides a streamlined process for customers looking to invest in a Gold IRA.

This service allows individuals to hold physical gold in a self-directed IRA, which can serve as a hedge against inflation and economic instability.

Key Features of SD Bullion’s Gold IRA Services:

- Self-Directed IRA Setup – SD Bullion partners with trusted custodians like New Direction Trust, Kingdom Trust, and Equity Institutional to help investors set up their Gold IRA accounts.

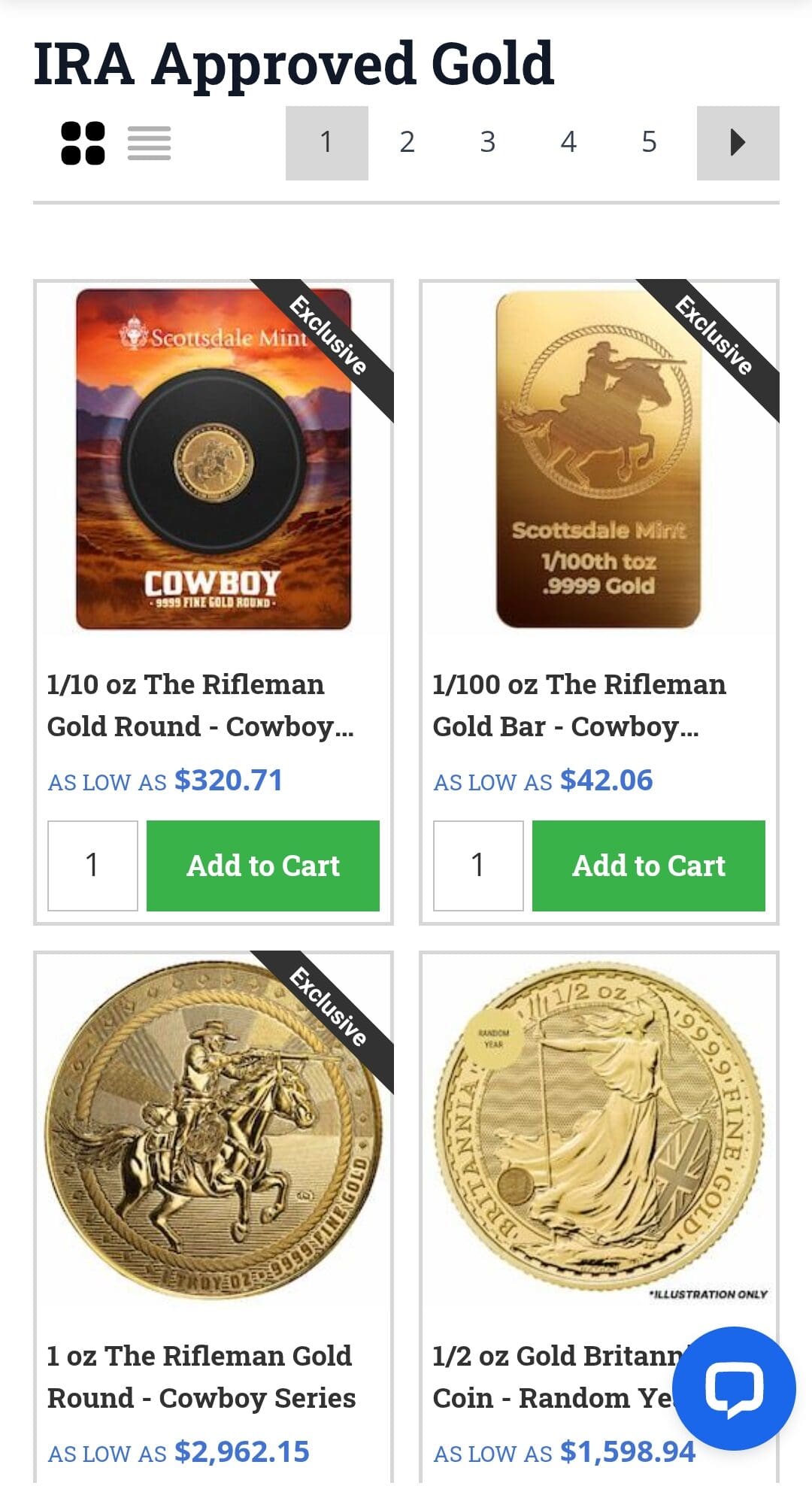

- Wide Selection of IRA-Approved Gold – Customers can choose from IRS-approved gold coins and bars, including American Gold Eagles, Canadian Gold Maples, and other highly regarded bullion options.

- Multiple Funding Options – Investors can roll over funds from an existing 401(k), IRA, or other retirement accounts or fund the account via bank transfer or check.

- Secure Storage – Precious metals purchased for an IRA are stored in SD Depository, a fully insured non-bank facility.

- Three-Month Free Storage – New customers receive three months of free storage before monthly storage fees apply.

- Buyback Option – Investors can sell their gold back to SD Bullion at competitive spot prices when they wish to liquidate their holdings.

- Expert Assistance – SD Bullion provides customer support to help investors navigate the Gold IRA setup and purchasing process.

While SD Bullion offers solid Gold IRA services, fee transparency is lacking, as setup and maintenance costs are not clearly listed on their website.

SD Bullion offers a solid Gold IRA service, but it didn’t make our list of the best gold IRA brokers.

Coins, Bars & Rounds: SD Bullion’s Product Range

SD Bullion has a huge selection of precious metals, making it a great option for both investors and collectors.

Here’s a breakdown of their main product categories:

Gold Products – SD Bullion offers gold coins, bars, and rounds from top mints worldwide. Popular choices include American Gold Eagles, Canadian Maple Leafs, and gold bars ranging from 1g to 1kg. These are ideal for investment and Gold IRAs.

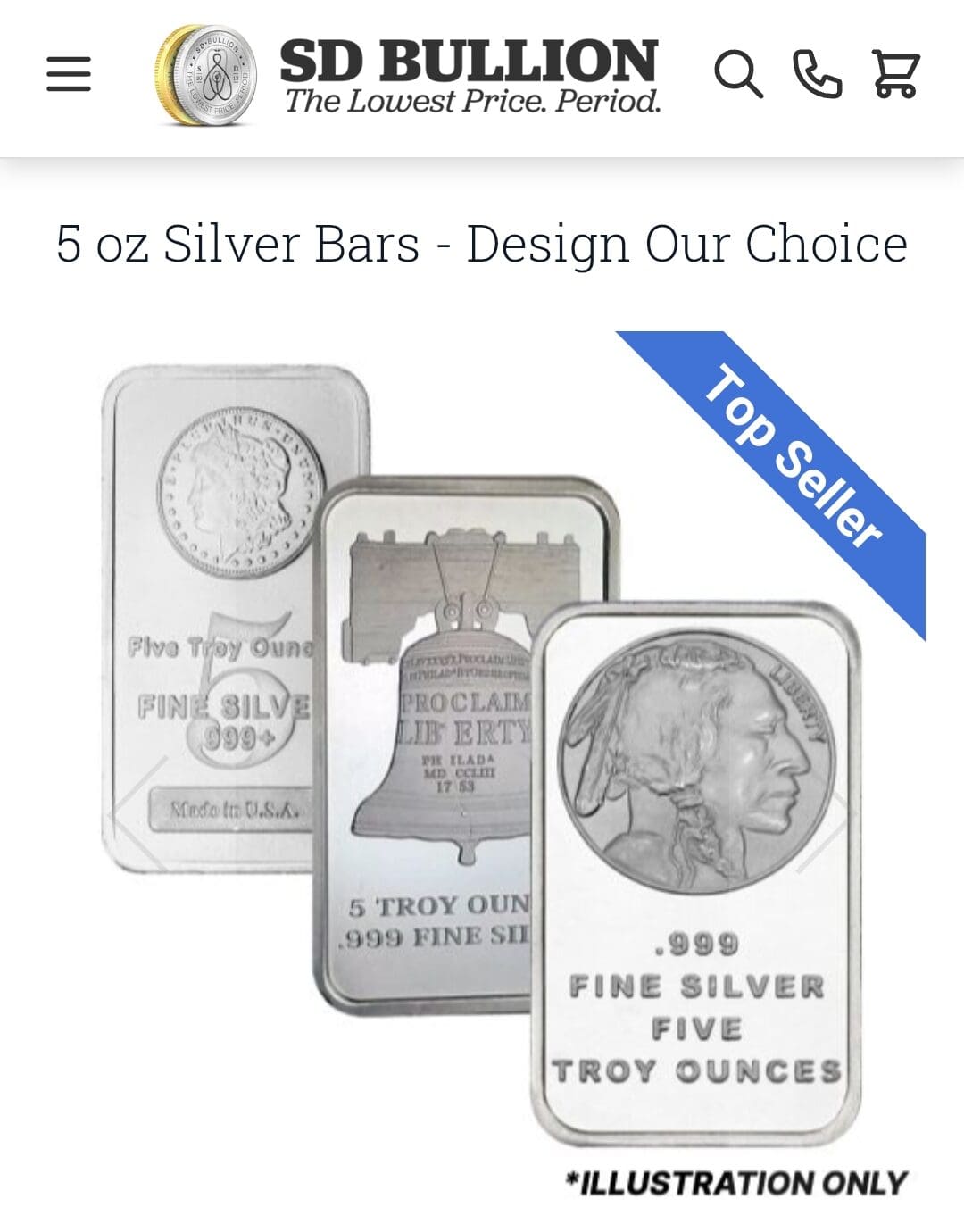

Silver Products – Their silver selection includes coins, bars, rounds, and even unique options like silver bullets and silver banknotes. If you're stacking silver for investment, they have 1 oz to 1000 oz bars, plus IRA-approved silver coins.

Platinum & Palladium – For those looking to diversify, SD Bullion carries Platinum Eagles, Maples, and international bars, along with palladium coins and bars, which are rarer but valuable for long-term investing.

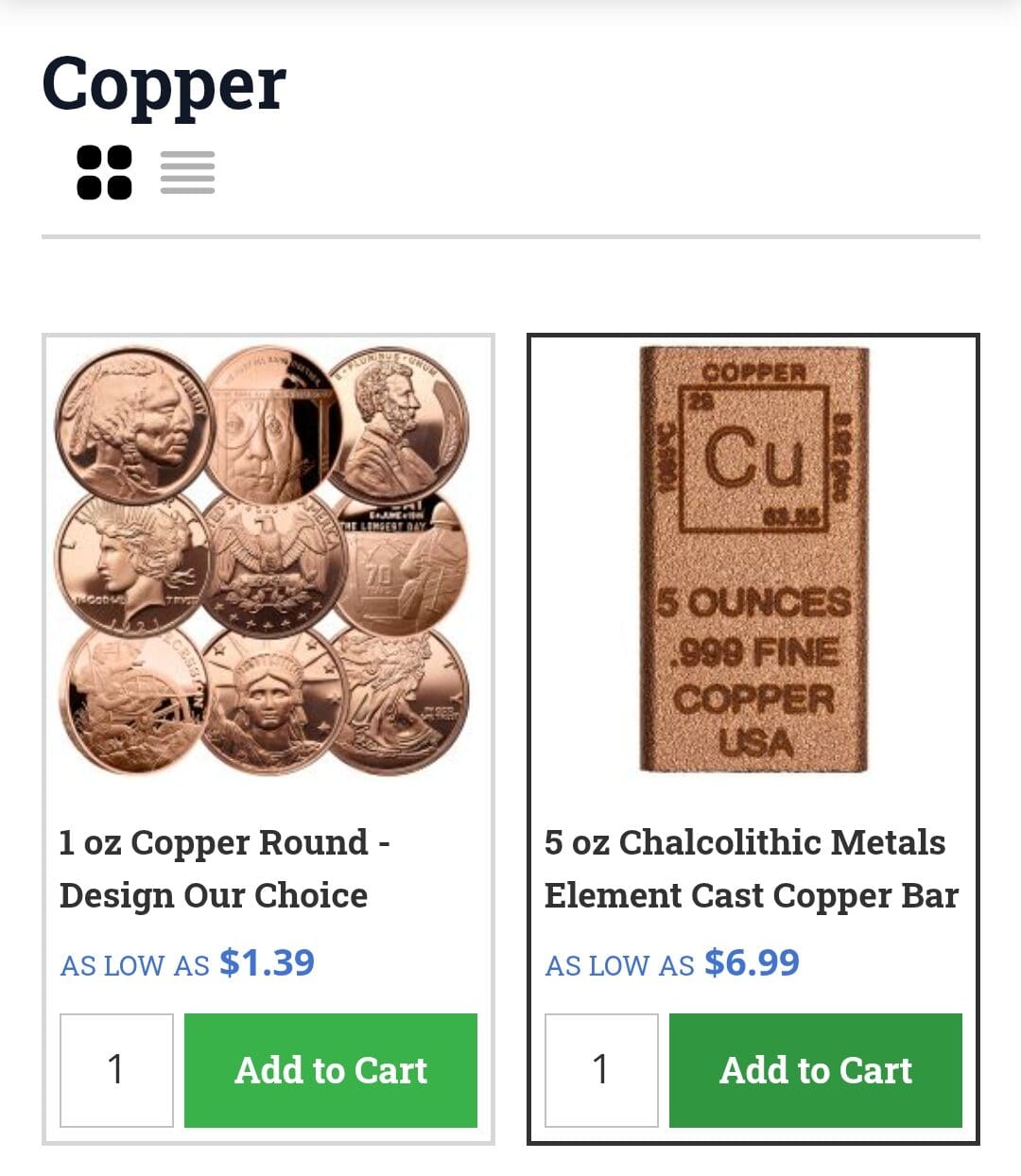

Copper Bullion – While not as common for investing, SD Bullion sells copper bars and rounds, which can be a fun and affordable way to start collecting precious metals.

Jewelry & Accessories – They also offer gold and silver jewelry, coin capsules, storage boxes, and magnifiers, perfect for collectors who want to protect their investments.

Offering both beginner-friendly options and bulk investment choices, SD Bullion is one of the best websites to buy gold online.

Affordable Storage & High Liquidity

SD Bullion offers secure and insured storage through its SD Depository, a non-bank storage facility designed for investors who prefer not to keep their metals at home.

Key Features:

- Fully Insured Storage – All assets stored in the SD Depository are fully insured by Lloyd’s of London, a globally trusted insurance provider.

- Segregated & Allocated Storage – Customers can choose segregated storage, ensuring their metals are stored separately, or allocated storage, where metals are assigned but not separated.

- No Minimum Deposits – Investors can store any amount of gold, silver, platinum, or palladium, making it flexible for both small and large holdings.

- Affordable Pricing – Storage fees start at $9.99 per month, with the first three months free for new customers.

- High Liquidity – Stored metals can be easily sold back to SD Bullion when needed.

This secure option is great for long-term investors who want professional-grade security without worrying about home storage risks.

SD Bullion’s Fees & Pricing

SD Bullion is known for low-cost pricing on precious metals, but their fee structure isn't fully transparent, especially when it comes to Gold IRA account setup and maintenance fees.

However, here’s what we do know:

Fee | Cost |

|---|---|

Storage Fee | Starts at $9.99/month |

Shipping Fee | $9.95 (Free for orders $199+) |

Cancellation Fee | 3-5% + market loss fee |

Gold IRA Setup/Maintenance Fee | N/A |

For exact IRA fees, you’ll need to contact SD Bullion directly.

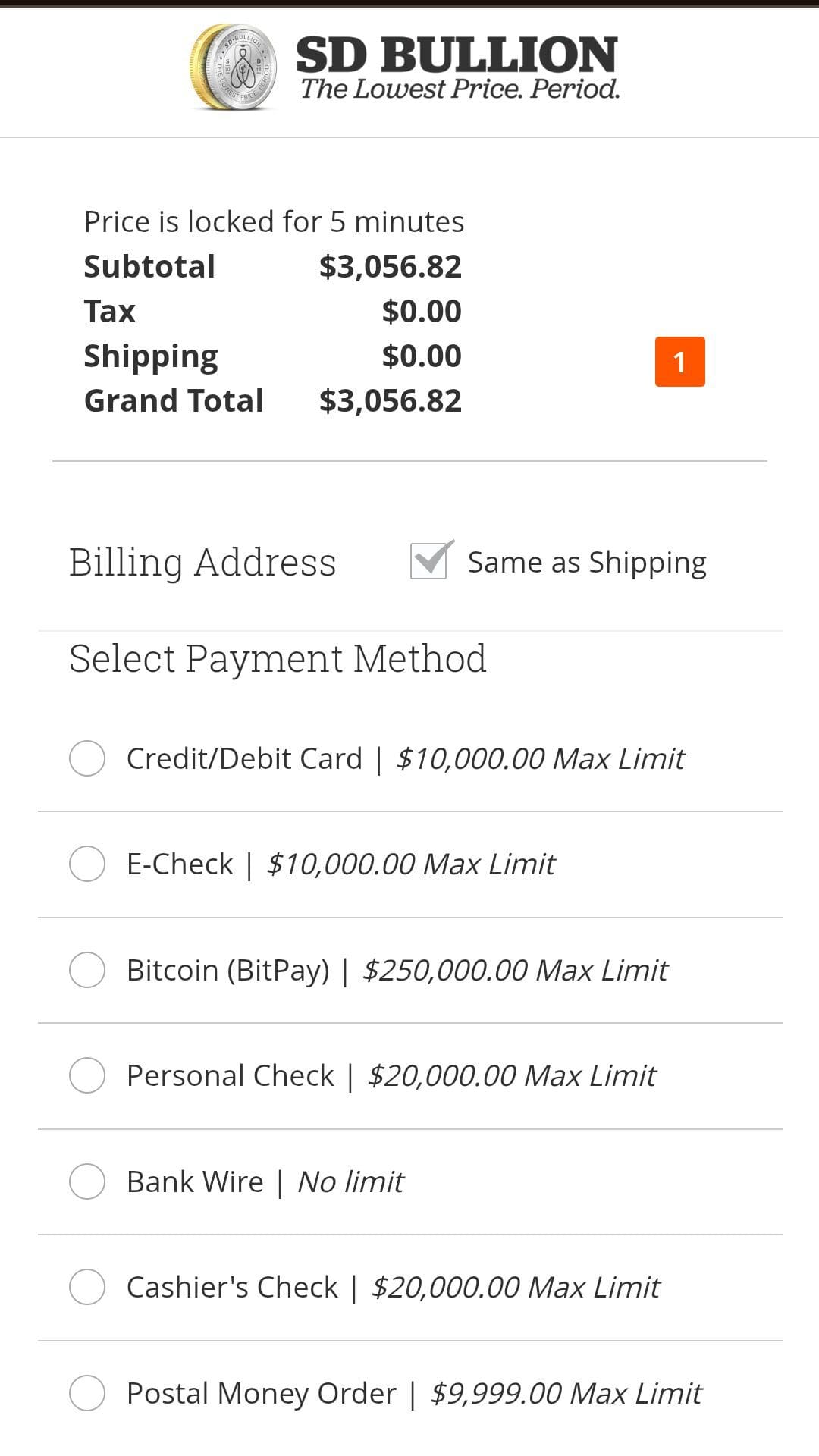

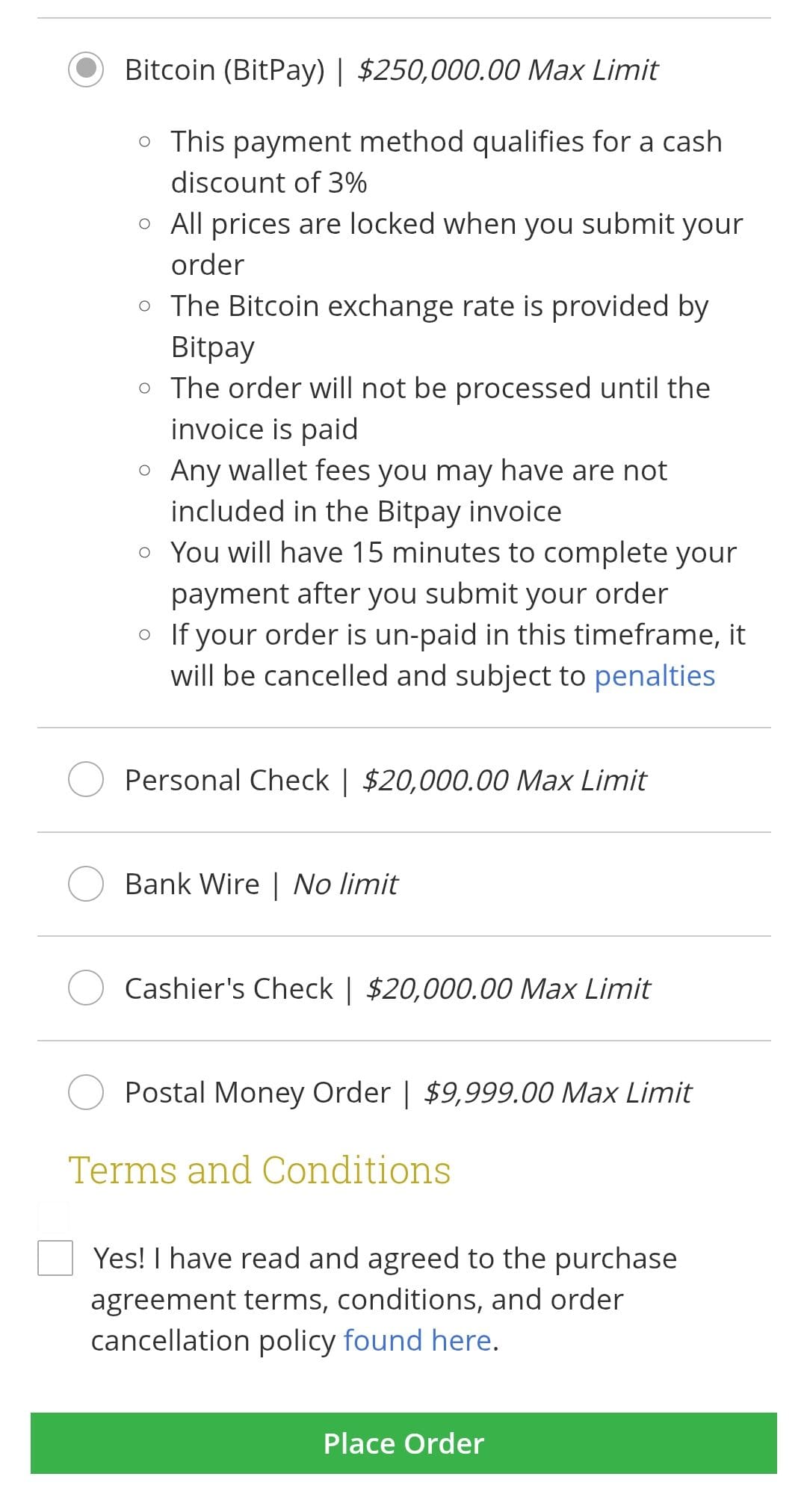

SD Bullion’s Payment Methods: What’s Accepted?

SD Bullion makes buying precious metals easy by offering a variety of payment methods to fit different budgets and preferences.

- Wire Transfers – Best for large purchases over $20,000, and you get up to a 4% discount when using this method.

- Personal & Cashier’s Checks – Accepted for orders up to $20,000 with a 4% discount, but payment must clear within 7 business days.

- Credit/Debit Cards & PayPal – Ideal for smaller purchases up to $5,000, with instant processing. However, these methods don’t qualify for discounts.

- E-Check – Allows purchases up to $20,000 with a 4% discount, making it a cost-effective choice.

- Bitcoin & Cryptocurrency Payments – You can buy up to $250,000 worth of precious metals using Bitcoin, with quick transactions.

This flexibility makes it easy for both small and large investors to buy from SD Bullion. However, keep in mind that missed payment deadlines may lead to cancellation fees.

Spot Price Tracking

One of SD Bullion’s standout features is its real-time spot price tracking, which updates every 10-15 seconds.

- Unlike some competitors, SD Bullion locks in your price at the time of order placement, even if you're paying via check or bank transfer, which can take a few days to clear.

- This feature helps investors take advantage of dips in gold and silver prices before they rise again.

- The website also has historical price charts, allowing you to analyze trends before making a purchase.

This feature is perfect for investors who want to buy at the right time and maximize their returns.

Exclusive Deals & Promotions

SD Bullion frequently offers special promotions and discounts, helping investors save money on their purchases.

- They regularly have “Dealer Specials” on gold, silver, and platinum products at discounted prices.

- Customers can sign up for their email newsletter to get early access to exclusive deals.

- Some payment methods, like wire transfers and e-checks, come with an automatic 4% discount on purchases.

For investors looking to get the most value, these deals make SD Bullion one of the most budget-friendly bullion dealers.

SD Bullion Buyback Program: How It Works

SD Bullion offers a buyback program , allowing customers to sell their precious metals back to the company at competitive spot prices.

However, there are minimum requirements for selling metals, and exact buyback prices are not publicly listed.

Key Features:

- Minimum Sell Amounts – Customers must sell at least 20 oz of silver, 1 oz of gold, 1 oz of platinum, or 1 oz of palladium.

- Spot Price Lock-In – Prices are locked in at the time of order confirmation, ensuring customers get a fair market rate.

- Shipping & Inspection – Sellers must ship their metals to SD Bullion, where they undergo authentication before payment is issued.

- Quick Payment Processing – Once the metals are received and verified, payment is processed within three business days.

Overall, SD Bullion is one of the better places to sell your gold, offering competitive buyback prices even if you didn’t purchase from them.

Customer Service

SD Bullion offers customer support via phone and email, but it lacks a live chat option, which some competitors provide.

Their support team is knowledgeable and responsive, especially for investors needing help with Gold IRAs, order tracking, or general bullion purchases.

Contact Option | Details |

|---|---|

Phone Support | 1-800-294-8732 |

Email Support | sales@sdbullion.com |

Availability | Monday – Thursday: 8:00AM ET – 8:00PM ET, Friday: 8:00AM ET – 6:00PM ET |

SD Bullion: Pros & Cons You Should Know

While SD Bullion offers notable benefits, there are also a few points to consider.

Here’s an overview of what the company excels at and where it could improve:

- Competitive Pricing

SD Bullion is known for offering below-market prices on gold, silver, and other precious metals, making it an affordable choice for investors.

- Wide Product Selection

From gold and silver bars to platinum, palladium, and copper, SD Bullion provides a diverse range of investment options, including IRA-approved metals.

- Buyback Program

Investors can sell their metals back to SD Bullion at spot prices, ensuring they have a quick and reliable exit strategy.

- Free Shipping on Orders Over $199

Customers enjoy free, insured shipping on larger orders, while smaller orders have a reasonable $9.95 shipping fee.

- Flexible Payment Options

Unlike many competitors, JM Bullion accepts credit/debit cards, PayPal, wire transfers, checks, and even crypto for payments.

- Lack of Fee Transparency

SD Bullion does not clearly list Gold IRA setup or maintenance fees on its website, requiring customers to contact them for details.

- Order Cancellations Come with Fees

If a customer cancels an order, they may face a 3-5% restocking fee, along with market loss penalties.

- No Live Chat Support

SD Bullion only offers phone and email support, which can delay responses for urgent issues.

- Limited Business Hours for Support

Customer service is only available on weekdays, meaning customers needing assistance on weekends have to wait.

Investing in a Gold IRA: SD Bullion’s Process

Investing with SD Bullion is relatively easy, especially when acquiring physical precious metals.

Follow this step-by-step guide to navigate the process with ease.

-

Investing in a Gold IRA

SD Bullion offers a straightforward process for opening a Gold IRA, allowing investors to diversify their retirement savings with physical gold. Here’s how it works:

Set Up a Self-Directed IRA – SD Bullion partners with custodians like New Direction Trust and Kingdom Trust to help investors open an IRS-compliant Gold IRA. You’ll need to provide financial and personal details to get started.

Fund Your IRA – You can fund your account via direct contribution, bank transfer, or a rollover from an existing 401(k) or IRA. The SD Bullion team coordinates directly with your custodian to ensure a smooth rollover.

Choose Your Gold – Once your account is funded, you’ll pick IRA-approved gold, such as American Gold Eagles, Canadian Maple Leafs, or gold bars.

Secure Storage – The purchased metals are stored in SD Depository, a fully insured, non-bank vault. You can track your assets online or through physical audits.

Manage & Withdraw – Your gold remains in storage until you decide to take distributions, following IRS regulations. If you choose to liquidate, SD Bullion offers a buyback program at spot prices.

-

Buying Physical Precious Metals

If you want to buy gold, silver, platinum, or palladium for personal investment, SD Bullion makes the process simple:

Browse & Select Products – Visit SD Bullion’s website and explore their wide range of gold, silver, platinum, and palladium in the form of coins, bars, and rounds.

Add to Cart & Choose Payment – Once you’ve selected your metals, proceed to checkout. Payment options include wire transfer, e-check, credit/debit card, PayPal, and Bitcoin.

Lock in the Price – The price is locked in at checkout, even if you pay later via check or wire transfer. This ensures you get the best rate, regardless of market fluctuations.

Shipping & Tracking –Once processed, SD Bullion provides tracking details, and all shipments are fully insured.

FAQ

Yes, they sell fractional gold and silver bars and coins, including 1/10 oz, 1/4 oz, and 1/2 oz options for investors looking to buy smaller amounts.

No, SD Bullion does not offer financing or payment plans. All orders must be paid in full at checkout.

SD Bullion primarily focuses on bullion-grade metals, but they occasionally carry collector coins and rare editions. However, they are not a numismatic specialist.

Yes, all shipments are fully insured, meaning if your package is lost or damaged in transit, you’re covered for the full value of your order.

Review Gold Dealers For Direct Purchase & Gold IRA

How We Rated Gold & Silver Dealers: Review Methodology

At The Smart Investor, we evaluated gold brokers & dealers based on their overall value, pricing transparency, and investment options compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to precious metals investors, including fees, security, product selection, and IRA investment options. Each broker was rated based on the following criteria:

- Pricing & Fees (15%): We prioritized brokers with transparent pricing, low markups on gold and silver, and fair premiums. Some platforms had hidden costs, including storage and liquidation fees.

- User Experience & Buying Process (20%): A smooth, intuitive, and secure buying process scored highest. Some brokers had complex procedures, slow transactions, or unclear order processing.

- Reputation & Ratings (10%): We factored in customer reviews, industry ratings, and regulatory compliance. Highly rated brokers had strong reputations for reliability, trustworthiness, and investor protection. Some had mixed reviews or unresolved complaints.

- Customer Support & Service (15%): We tested response times, availability, and helpfulness of support via phone, chat, and email. The best brokers provided knowledgeable assistance with fast, professional service, while others were slow or unresponsive

- Security & Storage Options (10%): We favored brokers offering secure vault storage, insured holdings, and direct delivery options. Some lacked proper security measures, increasing investment risks.

- IRA & Retirement Investment Options (20%): The best brokers offered Gold & Silver IRA accounts with IRS-approved metals, simple setup, and rollover assistance. Some lacked IRA services or charged high fees.

- Precious Metals Selection (10%): We rated brokers higher if they offered a wide range of gold and silver products, including bullion, coins, and bars. Some had limited selections, restricting investment choices.