Silver Gold Bull

Storage Fees

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

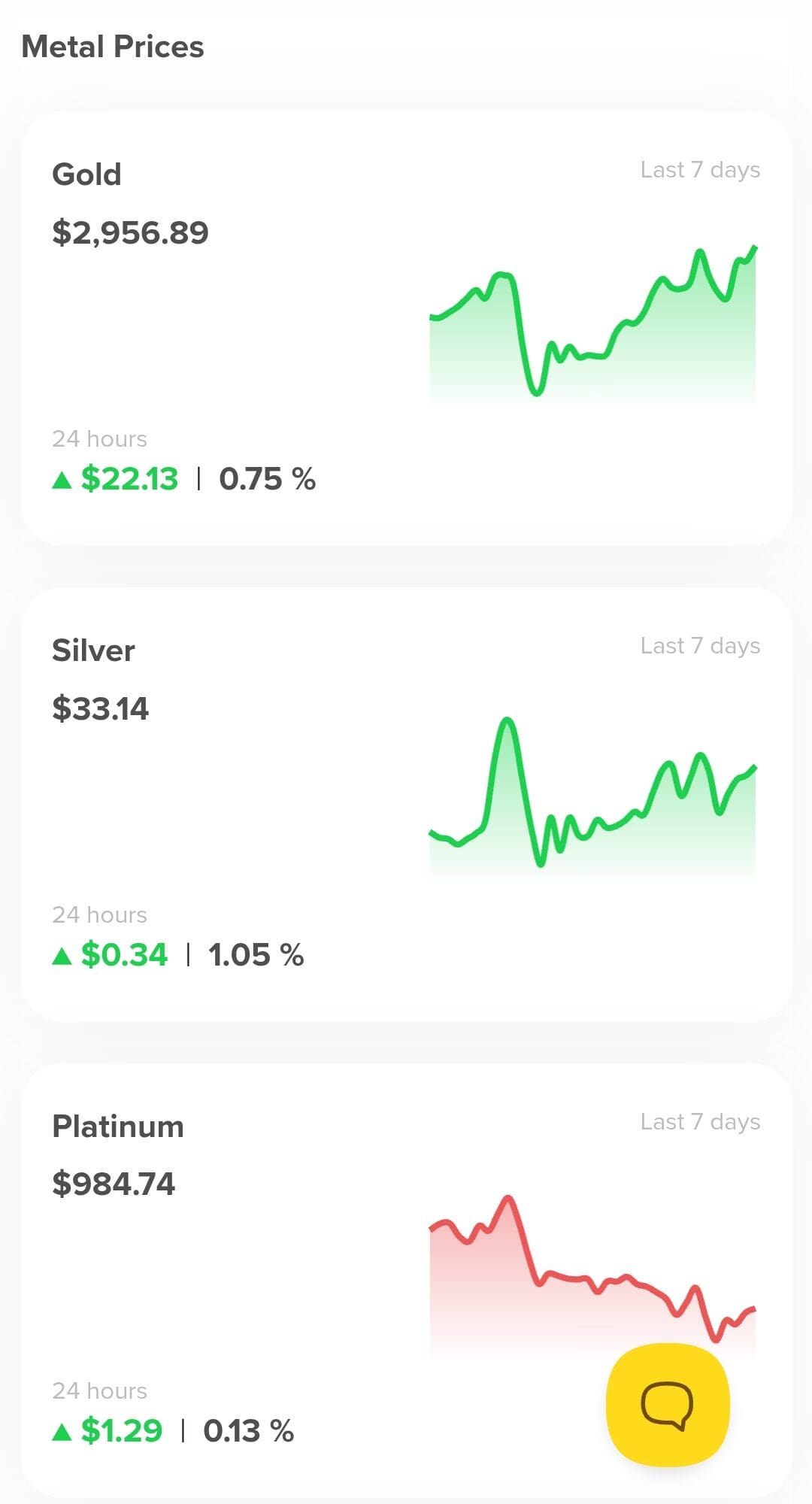

Silver Gold Bull is a well-established precious metals dealer that has been serving investors since 2009. Headquartered in Calgary, Canada, the company has grown into one of the largest online retailers for gold, silver, platinum, and palladium.

It caters to both beginner and seasoned investors by offering a vast selection of bullion bars, coins, collectibles, and even jewelry.

The company also helps investors set up Gold IRAs, working with third-party custodians to store metals in IRS-approved vaults.

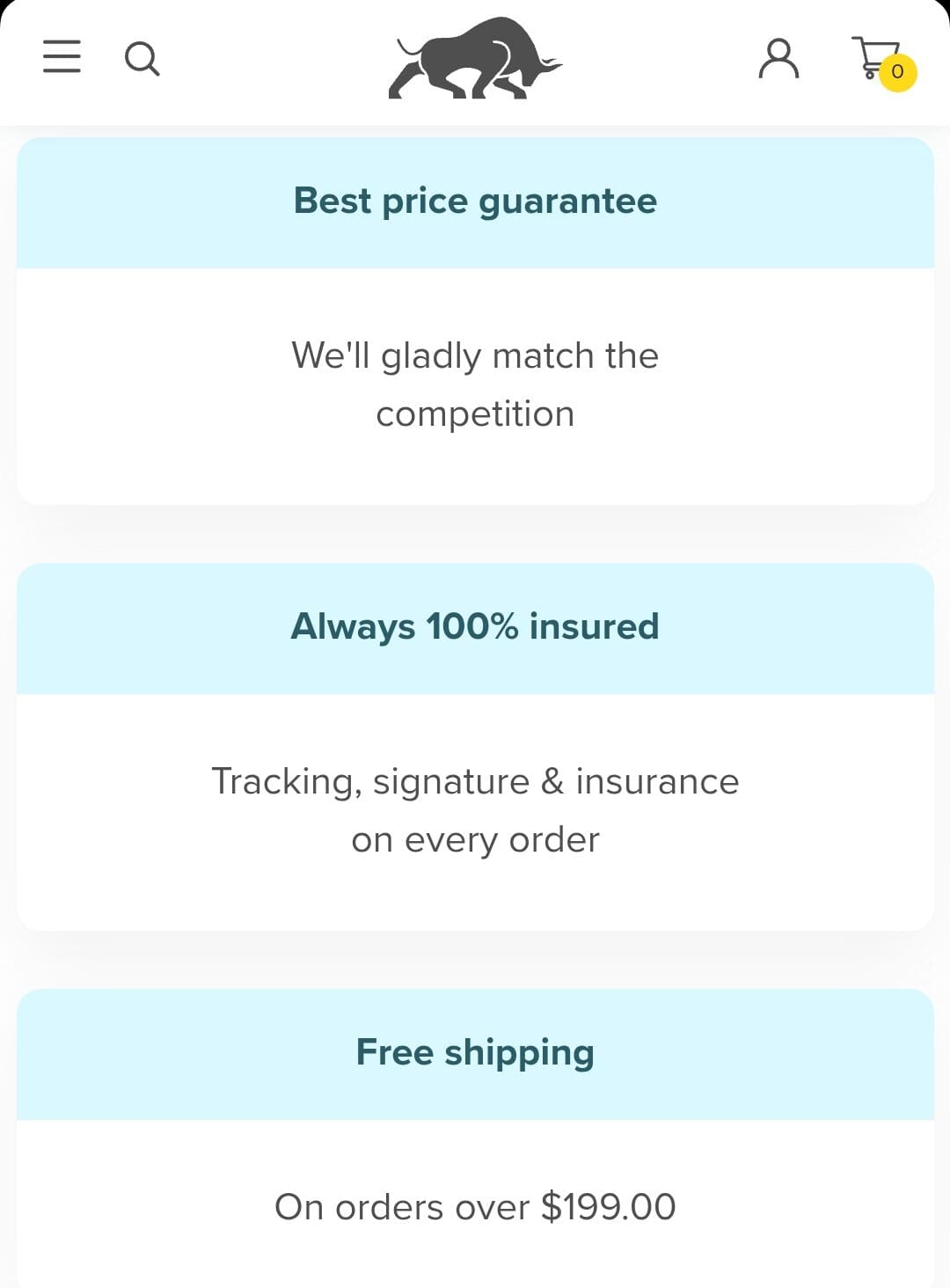

The company provides a price match guarantee, meaning if you find a better deal elsewhere, they’ll match it.

They also accept multiple payment methods, including credit cards, wire transfers, PayPal, e-checks, and even cryptocurrencies.

- Wide Selection of Products

- Price Match Guarantee

- Flexible Payment Options

- Free Shipping on Orders Over $199

- No Minimum for IRAs

- Strong Customer Service

- Third-Party Custodian for IRAs

- Limited Information on Fees

Do they accept international orders?

Yes, they ship internationally, but shipping costs and customs fees may apply depending on your location.

Are there any taxes on my purchase?

Taxes depend on your state of residence. Some states charge sales tax on precious metal purchases, so it’s important to check local regulations.

How can I track my order?

After your order is shipped, you will receive a tracking number to monitor your delivery.

Can I change or cancel my order once it’s placed?

Once an order is confirmed, it typically cannot be canceled or changed, so it’s important to review your order carefully before purchasing.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping (on orders over $199) | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

Silver Gold Bull: Trustworthy or Risky?

Finding a trustworthy gold broker isn’t always easy, especially when there aren’t enough customer reviews to gauge other investors' experiences.

While its website could provide more background details, its strong reputation, A+ rating from the Better Business Bureau, and high Trustpilot scores confirm its credibility.

Platform | Rating |

|---|---|

Trustpilot

| 4.8 (4,464 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2012 |

Sitejabber | 3.4 (233 reviews) |

Silver Gold Bull is a reputable precious metals dealer offering a wide range of products, including gold, silver, platinum, and collectibles. They have received numerous positive reviews from customers, highlighting their competitive pricing, extensive selection, and reliable customer service.

However, some customers have reported issues such as receiving items in less-than-perfect condition or experiencing delays in delivery.

Silver Gold Bull Gold IRA: What’s Included?

Silver Gold Bull offers a range of services for investors looking to include precious metals in their retirement plans through a Gold IRA.

Here’s what they provide:

- Self-Directed IRA Setup: Silver Gold Bull helps you set up a self-directed IRA, which allows you to include physical gold, silver, platinum, and palladium in your retirement portfolio.

- IRA-Approved Metals: The company offers a variety of IRA-approved products, including bullion coins and bars that meet IRS standards for fineness and weight.

- Third-Party Custodian: They work with third-party custodians, like Equity Trust, to manage your IRA and store your precious metals in secure, IRS-approved facilities.

- Storage Options: You can choose from allocated and segregated storage, ensuring that your metals are safely stored and properly identified.

While the company itself doesn’t manage the IRA directly, they do charge for the purchase of metals.

The custodian charges setup fees and annual storage fees based on the type of storage you choose.

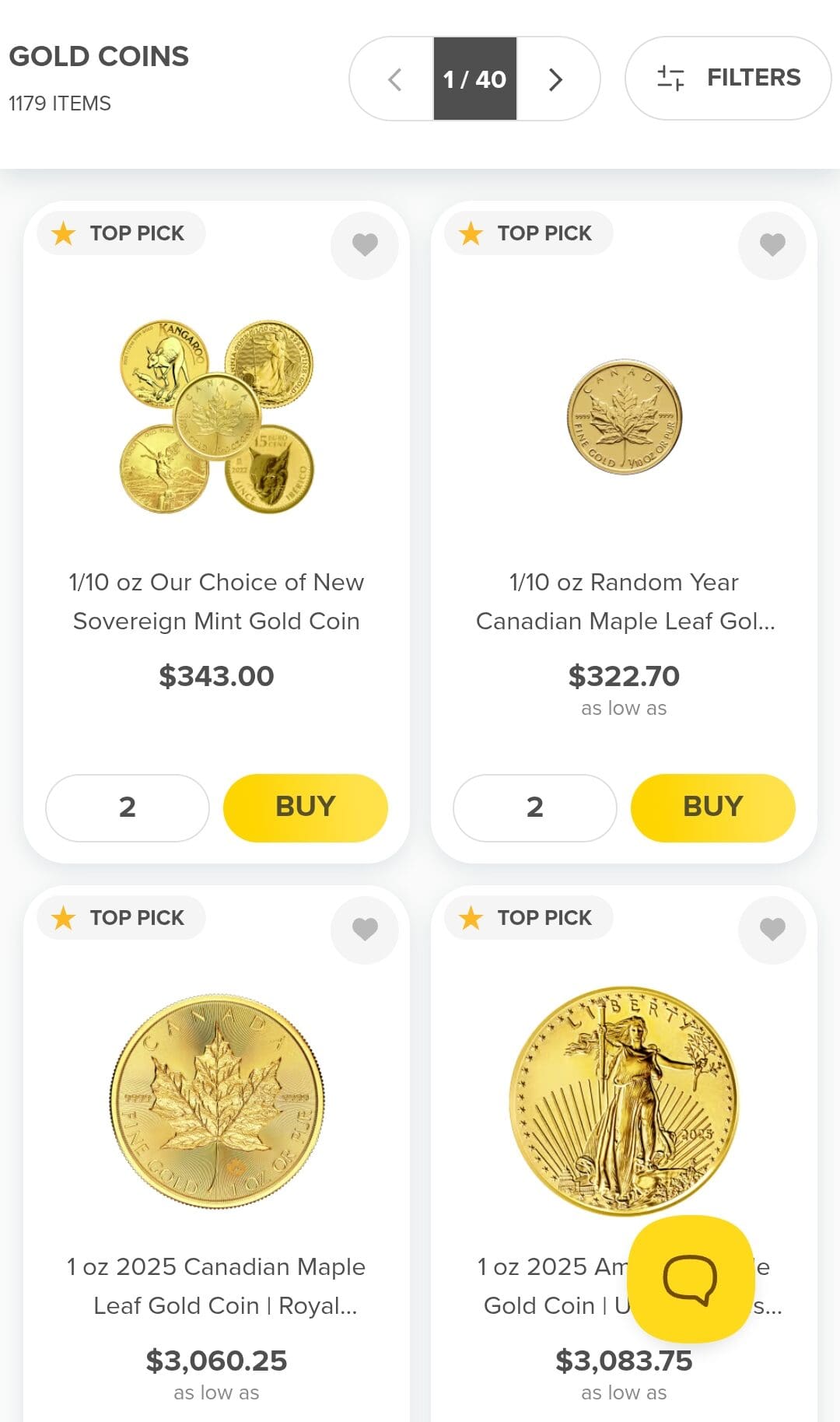

Silver Gold Bull’s Product Selection

Silver Gold Bull offers an extensive selection of physical precious metal products to cater to both investors and collectors.

Below are the main products they offer:

-

Gold Bars and Coins

These are the most popular products for investors looking to buy precious metals.

Gold bars range from small 1-ounce pieces to larger sizes, while coins like the American Gold Eagle and Canadian Gold Maple Leaf are also highly sought after for their purity and collectible value.

-

Silver Bars and Coins

Like gold, silver is available in both bars and coins.

Silver bars come in various sizes, while silver coins include well-known options like the American Silver Eagle and the Canadian Silver Maple Leaf. These are great for diversifying a precious metals portfolio.

-

Platinum and Palladium

For those looking to diversify further, Silver Gold Bull offers platinum and palladium products.

These metals are rarer and tend to have industrial demand in addition to investment appeal.

-

Numismatic Coins

These are rare, collectible coins that may carry a premium over their metal content due to their historical significance or condition.

Silver Gold Bull offers a range of numismatic coins from various mints, including limited-edition releases and vintage coins.

-

Jewelry and Collectibles

Beyond traditional bullion, Silver Gold Bull also offers a variety of jewelry and other precious metal collectibles.

These products combine beauty with value and are often sought after by collectors and investors alike.

For investors who want more control over their assets, buying physical gold is a strong alternative to a Gold IRA.

Silver Gold Bull Storage Options: Which Is Best for You?

Silver Gold Bull offers a variety of secure storage solutions to ensure that your precious metals are safe. After purchasing precious metals, customers can either store their metals at home or opt for secure storage at an IRS-approved facility.

- Allocated Storage: Your metals are individually identified and stored separately, providing a direct claim to your assets.

- Segregated Storage: This ensures your metals are stored separately from others' holdings, providing added security.

- Fully Insured: All storage options come with comprehensive insurance coverage against loss, theft, or damage.

These options give investors peace of mind knowing that their assets are stored securely and insured, with the added benefit of being compliant with IRS regulations.

Silver Gold Bull Pricing: Transparent, No Hidden Fees

Silver Gold Bull’s fee structure is straightforward, though some costs are not listed directly on the website and require you to contact the company for specific details.

Here’s a summary of what to expect:

Fee | Cost |

|---|---|

IRA Setup Fee | $50 (third-party custodian) |

Pooled Storage Annual Fee | $225 |

Segregated Storage Annual Fee | $275

|

Shipping & Insurance | $9.95 (Free for orders over $199) |

These fees are reasonable for the industry, but it’s important to inquire for exact pricing on individual items or services.

How to Pay for Metals at Silver Gold Bull

Silver Gold Bull provides a wide variety of secure payment methods to suit different buyer preferences, making transactions seamless and accessible.

- Credit Cards: Accepted for purchases up to certain limits.

- PayPal: Offers a convenient option for online payments.

- Wire Transfers & eChecks: Suitable for larger transactions.

- Cryptocurrency: For those who prefer to use digital assets, Silver Gold Bull accepts Bitcoin and Bitcoin Cash.

What to Know About Silver Gold Bull’s Buyback Program

Silver Gold Bull offers a clear buyback program, providing liquidity options for investors looking to sell their precious metals back to the company.

The buyback price is based on current market conditions and the spot price of the metal at the time of the transaction, which provides fair market value.

Customers looking to sell can contact Silver Gold Bull to lock in a price, arrange shipping, and either send their metals back or use the company's secure storage services for the transaction.

Price Match Guarantee

One of Silver Gold Bull’s standout features is their price match guarantee.

If you find a better price for a comparable product elsewhere, Silver Gold Bull will match it, ensuring that you’re getting the best deal possible.

- Excludes promotions or discounts: Price match is valid only on products sold by authorized dealers.

- Includes shipping and taxes: Silver Gold Bull factors in shipping and insurance costs when matching prices, providing even more value.

This feature gives customers added confidence in their purchases, knowing they can always get competitive pricing on the metals they choose.

It is especially valuable for those purchasing large quantities, as it could lead to significant savings.

Customer Service

Silver Gold Bull places a strong emphasis on customer satisfaction, offering robust support through various channels.

Customers can reach out via phone, email, or live chat, and there is a dedicated team ready to assist with any questions or concerns.

Many users have praised the company's helpful and knowledgeable customer service representatives, making it easy to feel confident in their purchase process.

Contact Option | Details |

|---|---|

Phone Support | (877) 646-5303 |

Email Support | support@silvergoldbull.com | sales@silvergoldbull.com |

Live Chat | Available on the website |

IRA Customer Support | Dedicated line: (877) 300-4205 |

Availability | Monday-Friday (7:30 AM – 7:00 PM MST), Saturday (10:00 AM – 4:00 PM MST) |

The company’s support team is available during business hours and has a dedicated phone line for IRA-related inquiries.

They also offer an extensive FAQ section and educational resources on their website

Military Discount

Silver Gold Bull offers a special discount to military personnel as a token of appreciation for their service.

- Eligibility: Available to both active duty and veterans.

- Discount Application: You need to contact customer service to apply the discount to your purchase.

- No Minimum Purchase: This discount can be applied regardless of the size of the order, making it accessible to military members at any stage of their precious metals investment journey.

This benefit sets Silver Gold Bull apart from many other dealers in the industry, providing an added incentive for those who serve or have served in the military to invest in precious metals.

How User-Friendly is Silver Gold Bull’s Online Experience?

Silver Gold Bull provides a user-friendly online platform that makes buying precious metals easy and efficient. Their website is well-organized, with products listed in clear categories, allowing customers to quickly find what they're looking for.

Navigating the site is straightforward, even for first-time visitors. The checkout process is simple, with multiple payment options available, including PayPal, wire transfer, and even cryptocurrencies like Bitcoin.

For those investing in a Gold IRA, the website offers helpful resources and guides, although some users have noted that additional IRA-related information could be easier to find.

Is Silver Gold Bull the Right Choice for You? Pros & Cons

Like any service, there are both advantages and drawbacks to consider before making a decision.

Below are some of the key pros and cons of using their platform.

- Wide Selection of Products

Silver Gold Bull offers a vast range of precious metals, including gold, silver, platinum, and even collectibles, making it easy to diversify your investment.

- Price Match Guarantee

If you find a better deal on the same product elsewhere, they’ll match the price, ensuring you get competitive rates on your metals.

- Flexible Payment Options

The company accepts various payment methods, including credit cards, PayPal, and even cryptocurrencies, making it accessible for all types of investors.

- Free Shipping on Orders Over $199

Silver Gold Bull offers free shipping and insurance on orders over $199, which adds value to your purchase, especially on large orders.

- No Minimum for IRAs

There's no minimum purchase requirement for opening a Gold IRA, which is an accessible gold IRA company for those just starting to invest in precious metals.

- Strong Customer Service

With responsive support available via phone, email, and live chat, you can get help whenever you need it, making the process easier for new investors.

- Third-Party Custodian for IRAs

For Gold IRAs, you have to use a third-party custodian like Equity Trust, which means you can’t manage your account directly through Silver Gold Bull.

- Limited Information on Fees

The website doesn’t provide full details about fees, meaning you have to call or email to get specifics, which can be a bit inconvenient.

How to Begin Your Investment Journey with Silver Gold Bull

Investing with Silver Gold Bull can be approached in two primary ways: through a Gold IRA or by making direct physical gold purchases.

Here's a straightforward guide to each method:

-

Gold IRA Investment

Investing in a Gold IRA with Silver Gold Bull involves a few key steps to get started. Here’s how to do it:

Set Up Your IRA: First, you’ll need to set up a self-directed IRA. Silver Gold Bull works with a third-party custodian, like Equity Trust, to help you establish your account. This involves completing some paperwork and transferring funds from an existing IRA or making a cash contribution.

Fund Your Account: Once your IRA is set up, you can fund it through a rollover, transfer, or direct contribution. You’ll need to ensure that your IRA is properly funded before you can purchase precious metals.

Choose Your Precious Metals: After funding, Silver Gold Bull will help you select IRS-approved products for your Gold IRA, such as gold bars and coins. They’ll ensure that the metals meet IRS standards for fineness and weight.

Metals Sent to Custodian’s Storage: Once you’ve selected your metals, Silver Gold Bull arranges to have them sent to a secure, IRS-approved storage facility. The custodian will hold them for you in your IRA.

Manage and Monitor: You can track your IRA’s performance and adjust your holdings as needed. However, keep in mind that all metals in the IRA are for long-term growth, so it’s a great way to hedge against market volatility.

-

Physical Precious Metals Purchase

Buying physical precious metals with Silver Gold Bull is a straightforward process. Here’s how you can invest:

Browse the Selection: Start by browsing Silver Gold Bull’s wide range of precious metals. You can find gold, silver, platinum, and even collectible coins. The site has detailed descriptions, so you can choose the items that fit your investment goals.

Add to Cart: Once you’ve selected the products you want to buy, add them to your cart. You can choose from bullion bars, coins, or even jewelry depending on your preferences.

Checkout and Payment: During checkout, you’ll provide your shipping and payment information. Silver Gold Bull accepts multiple payment methods, including credit cards, PayPal, and even cryptocurrencies, making it easy for different buyers.

Choose Delivery or Storage: Decide whether you want the metals delivered directly to your home or stored in a secure vault. If you're buying for an IRA, your metals will be sent to a third-party storage facility. Otherwise, you can choose to have them shipped to you.

Receive Your Precious Metals: After completing the purchase, Silver Gold Bull will ship your metals, typically insured for added protection. You'll receive tracking information, so you can monitor the delivery. If you opt for secure storage, you can rest assured that your investment is protected.

FAQ

Yes, Silver Gold Bull offers shipping options if you prefer to store your precious metals at home.

While you don’t need an account to buy, having one makes tracking your orders and managing your investment easier.

Silver Gold Bull guarantees the authenticity and quality of its products, but specific warranties may vary depending on the item.

Yes, Silver Gold Bull offers a buyback program where you can sell your precious metals back to them based on the current market price.

Review Gold Dealers For Direct Purchase & Gold IRA

How We Rated Gold & Silver Dealers: Review Methodology

At The Smart Investor, we evaluated gold brokers & dealers based on their overall value, pricing transparency, and investment options compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to precious metals investors, including fees, security, product selection, and IRA investment options. Each broker was rated based on the following criteria:

- Pricing & Fees (15%): We prioritized brokers with transparent pricing, low markups on gold and silver, and fair premiums. Some platforms had hidden costs, including storage and liquidation fees.

- User Experience & Buying Process (20%): A smooth, intuitive, and secure buying process scored highest. Some brokers had complex procedures, slow transactions, or unclear order processing.

- Reputation & Ratings (10%): We factored in customer reviews, industry ratings, and regulatory compliance. Highly rated brokers had strong reputations for reliability, trustworthiness, and investor protection. Some had mixed reviews or unresolved complaints.

- Customer Support & Service (15%): We tested response times, availability, and helpfulness of support via phone, chat, and email. The best brokers provided knowledgeable assistance with fast, professional service, while others were slow or unresponsive

- Security & Storage Options (10%): We favored brokers offering secure vault storage, insured holdings, and direct delivery options. Some lacked proper security measures, increasing investment risks.

- IRA & Retirement Investment Options (20%): The best brokers offered Gold & Silver IRA accounts with IRS-approved metals, simple setup, and rollover assistance. Some lacked IRA services or charged high fees.

- Precious Metals Selection (10%): We rated brokers higher if they offered a wide range of gold and silver products, including bullion, coins, and bars. Some had limited selections, restricting investment choices.