Zacks Free Membership

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

Zacks Investment Research’s free plan provides a solid starting point for investors and traders looking for market insights, stock rankings, and basic research tools.

One of its key features is the Zacks Rank, a widely recognized stock rating system that helps identify potential winners and losers.

Investors also get access to the Profit from the Pros daily newsletter, which delivers market updates, stock recommendations, and expert insights straight to their inbox.

The platform offers free stock screener tools, allowing users to filter stocks, ETFs, and mutual funds based on criteria like expense ratios, performance, and investment strategy.

While the free plan adds value with its analyst reports, earnings estimates, and fundamental stock data, it has some limitations.

Investors won’t find real-time quotes, advanced portfolio analysis, or detailed broker reports without upgrading to a premium plan. Technical traders may also find the charting tools too basic compared to platforms like TradingView.

- Zacks Rank Stock Ratings

- Stock Screener & Filters

- ETF & Mutual Fund Screener

- Style Scores (Value/Growth)

- Basic Stock Charting Tools

- Portfolio Tracker & Alerts

- Profit from the Pros Newsletter

- Industry Rank & Market Trends

- Stock Forecasts & Price Targets

- Dividend Stock Research

- Economic & Earnings Calendar

- Bull & Bear of the Day

- Strong stock ranking system

- Free stock screener tool

- ETF & mutual fund research

- Daily market insights

- Stock ratings for investors

- Limited real-time data

- Basic technical analysis tools

- No detailed portfolio analysis

- Lacks full stock reports

- No premium list access

Research With Zacks: Free Screener & Zacks Rank

We tested the free Zacks Stock Screener and found it helpful for filtering stocks by Zacks Rank, performance, and investment style:

-

Solid Selection Of Stock Research Tools

Zacks Investment Research’s free plan offers a solid selection of research tools, though with some limitations compared to its premium offerings.

Investors can access a snapshot of a stock’s key metrics, including price performance, valuation ratios, and zacks rank, making it a useful starting point.

The analyst report provides a summary of professional insights, while style scores rate stocks on value, growth, and momentum (more on this later).

Additional research tools include price target & stock forecasts, earnings dates and announcements, key company metrics, and dividend history, which are useful for tracking financial performance.

However, the free plan has limitations – full company reports, broker reports, and earnings transcripts require a premium subscription.

-

Zacks Rank for Stocks, Mutual Funds & ETFs

One of Zacks’ standout features is its proprietary Zacks Rank, a rating system that evaluates stocks, mutual funds, and ETFs based on earnings estimate trends.

We reviewed several stocks, ETFs, and mutual funds using this ranking, and it’s a helpful indicator for identifying potential winners.

The system categorizes stocks from Strong Buy (Rank #1) to Strong Sell (Rank #5), giving investors a quick way to gauge a stock’s potential.

The rankings update daily based on analysts’ earnings estimate revisions, meaning they reflect recent market sentiment.

Many investors use this as a starting point for stock screening, and based on our analysis, stocks ranked #1 do tend to outperform over time.

The free does allow to see rank for specific stocks, but investors can'te Zacks curated lists such as Zacks #1 Rank List.

-

Stock Screening Tool

As one of the top free stock screeners, Zacks allows investors to filter stocks based on criteria like Zacks Rank, price, sector, and Style Scores.

We experimented with it by screening for Strong Buy stocks with high growth potential, and the results were well-organized and easy to navigate.

This tool is particularly useful for quickly narrowing down stock choices based on predefined metrics.

The interface is simple and doesn’t require any technical knowledge, making it accessible to beginner investors.

-

Zacks Style Scores

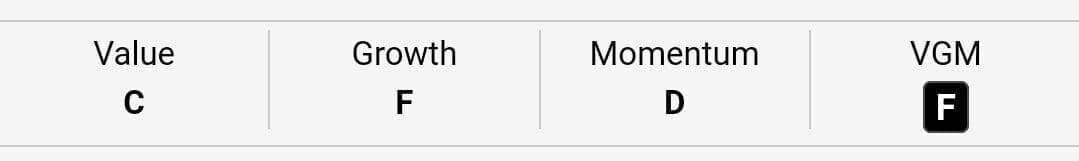

Zacks Style Scores provide an additional layer of analysis by grading stocks based on three key factors: Value, Growth, and Momentum.

We tested this feature by analyzing various stocks, and it does a good job of breaking down a company's investment potential beyond just earnings estimates.

Each stock receives a grade from A (best) to F (worst) for these three categories.

The Value Score highlights undervalued stocks, Growth Score focuses on companies with strong earnings potential, and Momentum Score identifies stocks with strong price performance.

This scoring system is particularly useful for investors who have a preference for a specific investing style. If you’re looking for growth stocks, for example, you can easily filter for those with an A in Growth Score.

How To Analyze Stocks With Zacks Free Plan?

We reviewed Zacks' charting features, which offer basic stock trend analysis, but they’re limited compared to advanced platforms:

-

Charting Tools

Zacks provides basic interactive charts that allow investors to analyze stock price trends over different timeframes.

When you access a stock chart on Zacks, the charting interface is actually an embedded TradingView widget. Users can select different timeframes to analyze price trends.

The free version on Zacks allows you to overlay some technical indicators, such as moving averages (e.g., 50-day and 200-day). You can compare stock performance against indices like the S&P 500, Dow Jones, and Nasdaq.

The Zacks-integrated version does not allow advanced charting tools. Also, you can explore up to 2 indicators in the chart, while the higher tier plan offers up to 25 indicators, which makes it a bit limited.

-

Portfolio Tracker & Email Alerts

The Zacks Portfolio Tracker lets you monitor your holdings and watchlist in one place.

We tested it by adding a sample portfolio, and it instantly displayed relevant metrics, including Zacks Rank and Style Scores.

The interface is simple and easy to use, making it convenient for tracking stock performance. The tracker also includes email alerts, which notify you about changes in Zacks Rank or major market news affecting your stocks.

The ability to see Zacks' proprietary ratings alongside your portfolio is a nice touch, giving a quick snapshot of your stocks' potential.

-

Mutual Fund & ETF Screeners

Zacks Investment Research provides free Mutual Fund and ETF Screeners that help investors filter and analyze funds based on various criteria.

-

Mutual Funds

For mutual funds, the screener includes key filtering options such as fees & expenses, performance metrics, portfolio statistics, and risk factors.

Investors can sort funds based on factors like expense ratio, past performance over different timeframes, and stock holding statistics.

Additionally, style allocation and shareholder information are available, making it easier to assess fund composition.

-

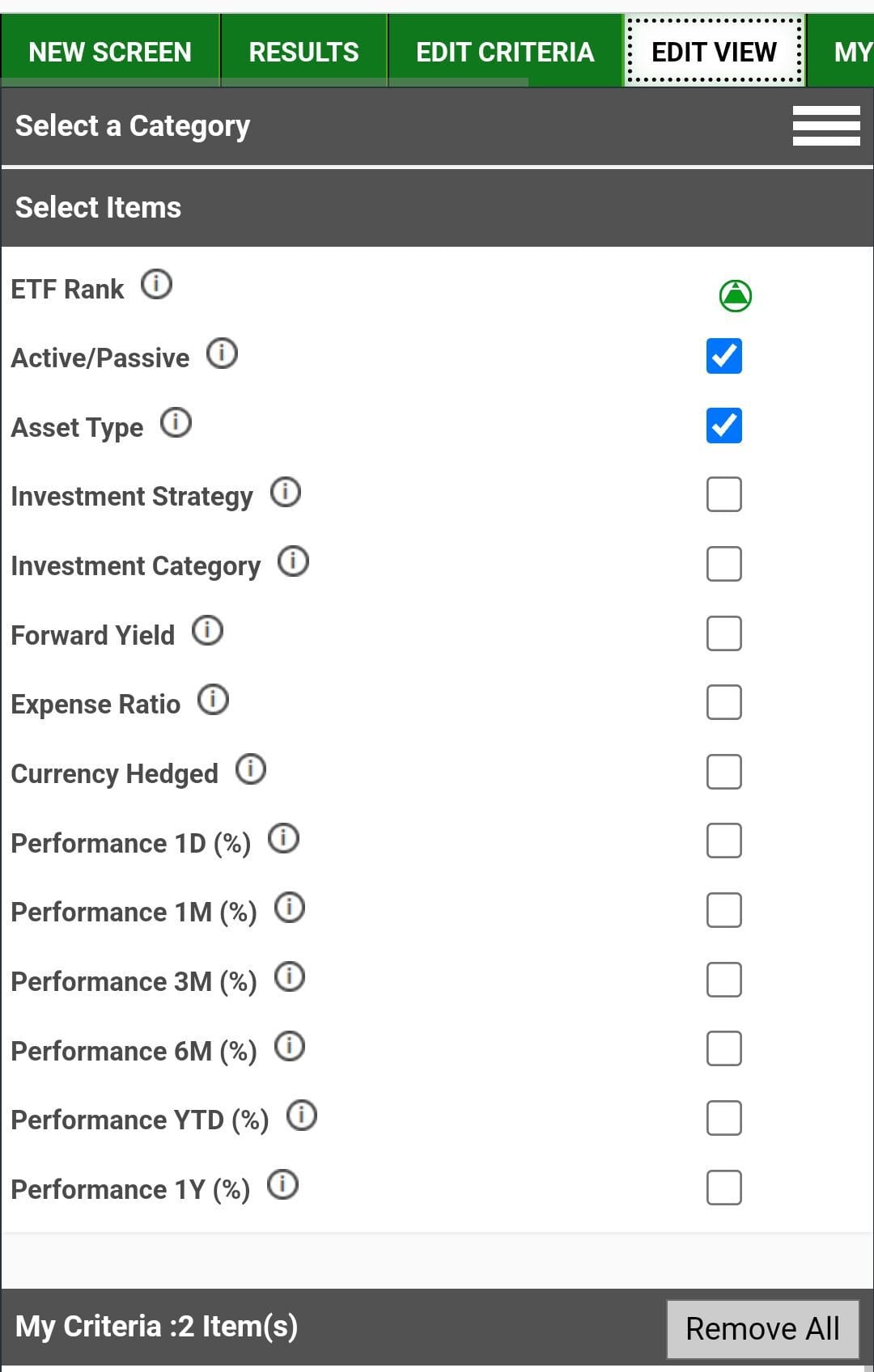

ETFs

The ETF screener provides an even more detailed selection of criteria. Investors can filter ETFs based on ETF Rank, asset type, investment strategy, and active/passive management style.

It also allows sorting by forward yield, expense ratio, currency hedging, and various performance metrics from one day to one year.

-

Free Daily Newsletter & Free Articles

Zacks Investment Research provides free market insights through its Profit from the Pros newsletter and a wide selection of free articles.

The daily newsletter delivers a concise yet valuable summary of market trends, stock recommendations, and expert opinions, making it an easy way to stay informed without spending hours on research.

Meanwhile, Zacks' free articles cover various investment topics, including earnings reports, analyst ratings, and stock analysis.

These articles break down complex financial concepts into digestible insights, helping both beginner and intermediate investors navigate the market.

-

Industry Rank & Market Trends

Zacks’ Industry Rank groups stocks into industry sectors and ranks them based on earnings estimate trends. We reviewed this feature and found it useful for identifying strong-performing industries at a given time.

Since certain industries tend to outperform the market during different economic cycles, knowing which sectors have positive earnings momentum can help investors make informed decisions.

For example, if the technology sector shows a rising Industry Rank, it may signal that tech stocks are gaining strength.

However, the free version only provides a high-level overview of industry rankings without deeper insights.

-

ETF & Mutual Fund Research

Zacks offers research on ETFs and mutual funds, making it easier for investors to compare different investment options.

We tested this feature by looking up various ETFs and found that Zacks provides essential details like fund performance, expense ratios, and Zacks Rank.

The free version offers basic fund rankings and performance data, but it lacks deeper analysis such as holdings breakdowns, risk assessments, or fund manager insights.

Additional Features & Tools

Zacks Investment Research’s free plan includes several additional tools.

While these tools don’t offer the depth of the premium versions, they still provide valuable insights for those looking to track the market, research stocks, and manage their portfolios:

- Stock Market Today: Provides daily updates on major stock market movements, economic news, and key events impacting investors. This feature helps users stay on top of market trends without needing to browse multiple news sources.

- Bull & Bear of the Day: Highlights two stocks each day—one with strong bullish potential and another facing bearish pressure. It’s a quick way to see what’s trending based on Zacks’ analysis.

- Economic & Earnings Calendar: Displays key economic events such as Fed meetings, inflation reports, and job market data. Economic calenders lists upcoming earnings reports for publicly traded companies

- Sector and Industry Performance: Shows how different sectors and industries are performing relative to the broader market. This can help investors identify strong or weak areas in the economy.

- Dividend Stock Research: Highlights dividend-paying stocks, including recent dividend increases and high-yield options. Useful for income-focused investors.

- Stock Splits & IPO Calendar: Tracks upcoming stock splits and newly listed companies. Investors looking for growth opportunities can use this to stay informed about fresh market entries.

Limitations: Where Zacks Free Plan Falls Short?

While Zacks' free plan offers useful stock research and market insights, it has several limitations compared to its premium plans and competitors:

-

Limited Depth in Stock Analysis

The free plan provides Zacks Rank and basic stock data, but it lacks the detailed research reports available in premium plans.

Investors can see which stocks have a Strong Buy rating, but they don’t get a full breakdown of why those stocks are ranked highly. There are no earnings call transcripts, valuation models, or deep fundamental analysis.

-

Real-Time Data & Technical Analysis

For active traders, Zacks' free plan falls short when it comes to real-time data and technical analysis tools. Many of the stock quotes have a delay, and the charting features – powered by TradingView – are very basic.

Traders who rely on fast, detailed charting will likely find Zacks’ free version too limited for short-term or technical-based strategies.

-

Limited Portfolio Analysis Tools

Zacks Investment Research’s free plan includes a basic portfolio tracker, but it lacks in-depth portfolio analysis features.

Unlike premium services or competitors like Morningstar Investor, Empower, or Seeking Alpha, the free version does not provide insights into risk exposure, asset allocation, diversification, or expected returns.

Which Type of Investors/Traders May Be a Good Fit?

Zacks Investment Research’s free plan is a great starting point for certain types of investors and traders.

Here’s who might benefit the most:

- Long-Term Investors: Those looking to buy and hold stocks or ETFs can use Zacks’ rankings, earnings estimates, and market insights to identify strong investment opportunities without needing deep technical analysis.

- Investors Who Need ETF & Mutual Fund Research: Zacks offers a free ETF and mutual fund screener, allowing investors to filter funds based on basic metrics like expense ratios, performance history, and investment strategy.

- Fundamental Analysis Investors: Those who focus on earnings estimates, stock valuations, and industry comparisons will find Zacks' tools helpful, especially for identifying undervalued or growth stocks.

- Investors Who Want Stock Ratings: Zacks Rank is widely recognized, and investors who believe in its ranking system can use the free plan to track Strong Buy and Strong Sell stocks.

Who Might Find Zacks Too Limited?

Zacks Investment Research’s free plan is useful for basic market insights, but it may not be the best choice for everyone.

Here’s who might find it lacking:

- Active Traders: Those who rely on real-time data, advanced charting, and technical indicators may find Zacks’ free tools too limited. It lacks Level 2 data, advanced screeners, and fast trade execution features.

- Options and Futures Traders: The platform does not provide in-depth options chains, futures contracts, or derivatives analysis, making it unsuitable for traders who focus on complex strategies.

- Personalized Portfolio Managers: Those who want automated portfolio analysis, risk assessment, or customized stock recommendations may prefer platforms that offer AI-driven insights or advanced portfolio tracking.

- Short-Term News Traders: Zacks’ free plan provides delayed quotes and limited breaking news updates, which may not be fast enough for those who trade based on real-time market events.

Zacks Research: Exploring Higher-Tier Plans

Zacks offers multiple subscription tiers, each catering to different levels of investors.

- Zacks Premium includes full access to Zacks Rank lists, premium stock screeners, industry rankings, and equity research reports, making it ideal for investors focused on earnings-based stock selection.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Zacks Premium | Annual: $249 ($20.75/month)

No monthly plan | 30-day free trial |

Zacks Investor Collection | $59

$495 ($41.25 / month) if paid annually | 30-day free trial |

Zacks Ultimate | $299

$2,995 ($249.5 / month) if paid annually | 30-day free trial |

- Zacks Investor Collection offers everything in Premium plus hand-picked stock recommendations, such as Zacks Top 10 Stocks, Home Run Investor, and Value Investor, giving a curated stock-picking experience.

- Zacks Ultimate delivers all Premium and Investor Collection features, plus exclusive short-term trading services, like Surprise Trader, Insider Trader, and Black Box Trader, for active traders and earnings-focused investors.

FAQ

Zacks Rank is updated daily based on changes in analysts’ earnings estimate revisions, providing a frequently refreshed stock rating system.

The free plan offers delayed stock quotes, while real-time data is available with Zacks Real Time Quotes Platinum or Gold plans.

Yes, Zacks has a mobile app for iOS and Android, allowing users to track stocks and read market insights.

No, exporting data is only available in Zacks Premium and Zacks Ultimate plans.

Zacks focuses mainly on U.S.-listed stocks, with limited coverage of international markets.

Zacks does not provide dedicated research for commodities or forex trading.

Review Free Stock Analysis Tools

Investment Analysis & Research Tools : Review Methodology

At The Smart Investor, we evaluated free investment research platforms based on the quality and depth of their features compared to other free alternatives. Each platform was rated based on the following criteria:

- Fundamental Analysis Tools (25%): We assessed the availability of key financial data, including income statements, balance sheets, cash flow, valuation metrics, and analyst estimates. Platforms with more in-depth historical data, forward-looking projections, and research reports scored higher.

- Technical Analysis Features (20%): We examined the variety and quality of technical indicators, charting tools, and real-time price data. Platforms that offered customizable interactive charts, trend analysis, and multiple timeframes received better ratings.

- Stock Screener & Free Filters (15%): A strong stock screener is crucial for research, so we rated platforms based on the number and depth of filtering options. Higher scores were given to platforms that allowed customized searches using fundamental, technical, and sector-based criteria.

- Portfolio Tracking & Alerts (15%): We reviewed the ability to track multiple portfolios, set up watchlists, and receive alerts on stock movements. Platforms offering real-time updates, dividend tracking, and personalized notifications ranked higher.

- Ease of Use & User Experience (15%): Platforms were rated on their design, navigation, and accessibility across devices. Those with intuitive layouts, easy-to-read data, and smooth user experiences received better scores.

- Additional Perks & Limitations (5%): We considered unique tools, premium research access, and potential feature restrictions. Platforms with added perks like AI analysis or fewer paywalls scored higher, while those with aggressive ads or major limitations were rated lower.

- Community & Social Features (5%): Platforms with investor discussion forums, sentiment tracking, or social trading features were rated higher. Those lacking community-driven insights or engagement tools scored lower.