U.S. Bank is one of the largest brick-and-mortar banks in the US. On the other hand, Ally Bank is among the best online banks, and both offer a great portfolio of banking services.

Let's compare their banking products side by side.

Checking Accounts

There is no clear winner when it comes to checking accounts, but if we have to choose one – Ally Bank wins.

Ally has a free checking account with great features to manage your money and even interest on your balance. However, this is an online-only account, unlike U.S. Bank, which offers person-to-person customer service in hundreds of branches across the nation.

-

Account Types

U.S. Bank has two main types of checking accounts for customers: Smartly Checking and Safe Debit. Both charge a monthly fee, but with Smartly Checking, you can avoid the fee, while Safe Debit fees cannot be waived.

U.S. Bank Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

U.S. Bank Smartly Checking | $6.95 | $1,500 |

Safe Debit

| $4.95 | Cannot be waived |

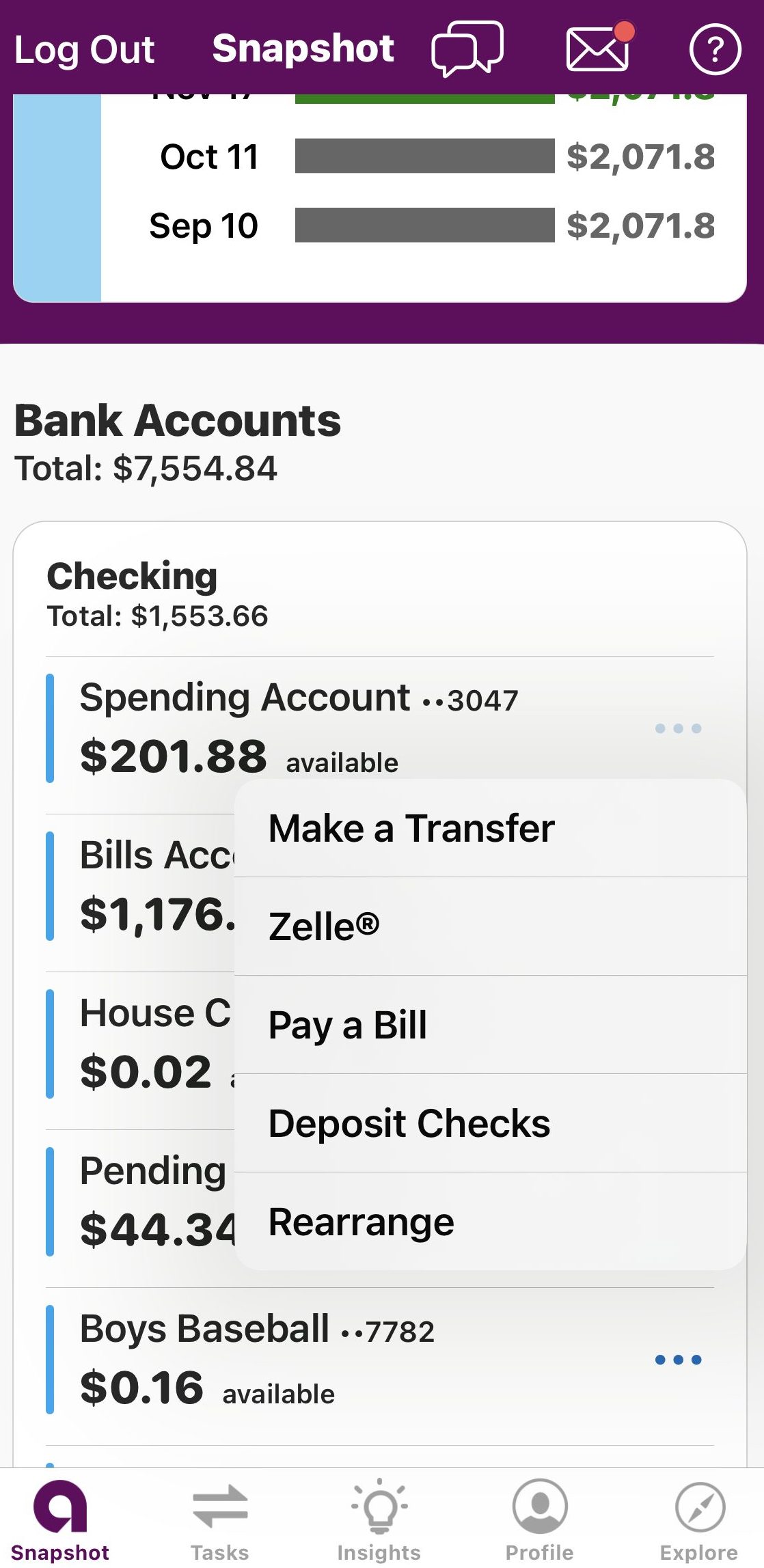

Ally provides a sole checking account known as the Ally Bank spending account, which earns interest on the balance. Ally's checking accounts include complimentary checks and debit cards, and there are no monthly maintenance fees associated with your checking account.

Bank Account | Monthly Fee | APY On Balance |

|---|---|---|

Ally Spending Account | $0 | 0.25% |

-

Features

The Safe Debit account is a checkless alternative with overdraft protection, no overdraft fees, and bonus features like free credit score access, alerts, and budget tools.

U.S. Bank's Smartly Checking is a budget-friendly option, featuring interest earnings, a $50 overdraft grace, and easy management with low balance alerts, mobile check deposit, and automated budgeting tools.

Both accounts provide mobile and online banking access, catering to diverse financial needs with a focus on affordability, convenience, and additional perks.

U.S. Bank Account | Main Features |

|---|---|

U.S. Bank Smartly Checking | Smart Rewards, transfer money, set alerts, $50 overdrawn available |

Safe Debit

| Directly deposit paychecks, pay bills for free, no overdraft fees |

The Ally Checking Account lets you use over 43,000 ATMs without any fees through Allpoint. If you use a different ATM and get charged, Ally will reimburse you up to $10 per month.

This account also helps you manage your spending better by dividing it into different categories. You can get your direct deposit money up to 2 days earlier.

You can easily deposit checks by taking a picture with your smartphone using Ally eCheck Deposit. Plus, you can send and receive money easily with Zelle.

Bank Account | Main Features |

|---|---|

Ally Spending Account | Deposit checks remotely, early pay, interest bearing, debit card, overdraft solutions, savings buckets |

Savings Accounts

When it comes to savings accounts, Ally is a clear winner with competitive rates, no fees, and a bunch of perks for savers.

With Ally Savings, users can utilize savings buckets to organize and visualize their financial goals effectively. It also offers recurring transfers, which provide a “set it and forget it” option, enabling scheduled transfers into the savings account.

Like many brick-and-mortar banks, U.S. bank savings accounts offer relatively low rates.

U.S Bank Savings Account | Ally Bank Savings Account | |

|---|---|---|

Savings Rate | 0.01% | 4.25% |

Minimum Deposit | $0 | $0 |

Fees | $4

can be waived by $300+ daily ledger balance or $1,000 average monthly balance

| $0 |

Certificate Of Deposits (CDs)

If you need a CD, Ally is a much better option than U.S. Bank.

Unlike U.S. Bank, which gives high rates only on certain CD terms, Ally offers high rates on almost all terms. Plus, Ally lets you use smart strategies like CD laddering with both short and long-term CDs. They even have a no penalty CD option, making it even more appealing.

-

U.S. Bank CD Rates

CD Type | CD Term | APY |

|---|---|---|

Standard CD

| 6 Months | 0.05% |

Standard CD

| 12 Months | 0.05% |

Standard CD

| 24 Months | 0.05%

|

Standard CD

| 36 Months | 0.10%

|

CD Special | 7 Months | 4.00% |

CD Special | 11 Months | 3.80% |

CD Special | 13 Months | 4.80% |

CD Special | 19 Months | 4.95%

|

Step Up CD

| 28 Months | 0.35% |

Trade Up CD | 30 Months | 0.10% |

Trade Up CD | 60 Months | 0.40% |

-

Ally Bank CD Rates

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 3.00% | 60 days of interest

|

6 Months | 4.40% | 60 days of interest

|

9 Months | 4.45% | 60 days of interest

|

12 Months | 4.50% | 60 days of interest

|

11 Months – No Penalty | 4.00%

| / |

36 Months | 4.00% | 90 days of interest |

60 Months | 3.90% | 150 days of interest

|

Credit Cards

When it comes to credit cards, U.S. Bank is our winner. While not as famous as some other credit cards, U.S. Bank has a lineup that suits a variety of consumers.

They have two solid options with no annual fee – the Cash+ card for cashback and the Altitude Go card for point rewards. If you prefer a premium card, there's the new U.S. Bank Shopper Cash rewards with a high cashback rate and the Altitude Connect card that's great for travelers.

Lastly, for frequent travelers, there's the luxury Reserve Visa Infinite with premium benefits. U.S. Bank's credit card options offer something for everyone, from cashback enthusiasts to frequent flyers.

Card | Rewards | Bonus | Annual Fee |

| U.S. Bank Shopper Cash Rewards | 1.5% – 6%

6% cash back on your first $1,500 in combined eligible purchases each quarter at two retailers you choose, 3% back on your first $1,500 in eligible purchases each quarter on your choice of one everyday category, 1.5% back on all other qualifying purchases. Also, 5.5% back on reservations for hotels and prepaid car rentals when you book through the U.S. Bank Rewards Center.

| $250

$250 bonus after you spend $2,000 in eligible purchases within the first 120 days of account opening

| $95 ($0 on first year) |

|---|---|---|---|---|

| U.S. Bank Cash+® Visa Signature® Card | 1% – 5%

5% cash back on purchases in two categories of your choice (up to $2,000 in combined purchases per quarter, then 1 percent). 5% back on prepaid air, hotel, and car reservations through the Rewards Center. 2% cash back on one choice everyday category. 1% back on all other purchases

| $200

$200 bonus after spending $1,000 in eligible purchases within the first 120 days of account opening.

| $0 |

| U.S. Bank Altitude® Go Visa Signature® Card | 1X – 4X

4x points at restaurants, take-outs & deliveries, 2x points at supermarkets, gas stations & streaming servicesm and 1 point for 1 dollar on all other purchases

| 20,000 points

20,000 bonus points when you spend $1,000 in eligible purchases within the first 90 days of account opening

| $0 |

| U.S. Bank Altitude Connect Visa Signature Card | 1X – 5X

5X points on prepaid hotels and car rentals booked directly in the Altitude Rewards Center; 4X points on travel, gas stations, and EV charging stations; 2X points on grocery stores, grocery delivery, dining, and streaming services; and 1X points on all other eligible purchases

| 60,000 points

60,000 points after spending $6,000 in eligible purchases on the account owner's card within the first 180 days from account opening

| $95 (waived first year) |

| U.S Bank Altitude Reserve Visa Infinite Card | 1X – 5X

5 points per dollar on prepaid hotels and car rentals booked directly in the Altitude Rewards Center, 3 points per dollar on eligible travel purchases and mobile wallet spending and 1 point per dollar on all other eligible net purchases

| 50,000 points

50,000 points worth $750 on travel after spending $4,500 in the first 90 days of account opening

| $400 |

After a long time without a credit card, Ally launched a series of three credit cards. They have one cashback card with flat rate cashback, one card with cashback on specific categories, and a Platinum card for those who want to build their credit.

However, the rewards are limited other features are basic, and there is no wide selection as U.S. Bank offers.

Card | Rewards | Bonus | Annual Fee |

| Ally Unlimited Cash Back | 2%

Unlimited 2% cash back on all purchases

| N/A | $0 |

|---|---|---|---|---|

| Ally Everyday Cash Back | 1% – 3%

3% cash back at gas stations, grocery stores, and drugstores, with 1% cash back on everything else | N/A | $0 – $39 |

| Ally Platinum Credit Card | N/A | N/A | $0 |

Mortgage And Loans

When it comes to borrowing money, both banks offer decent options but do not include all types of loans.

Both U.S. Bank and Ally Bank focus more on mortgages for homebuyers, mortgage refinancing, home equity loans, personal loans, and car financing for both new and used vehicles.

None of them offer student loans or other special loans such as boat or RV loans.

Behind the Scenes: Our In-Depth Dive into SoFi App

From mobile check deposit to paying bills, we tested the Ally App's features from a user's standpoint. Read on for our genuine thoughts and revelations on each feature.

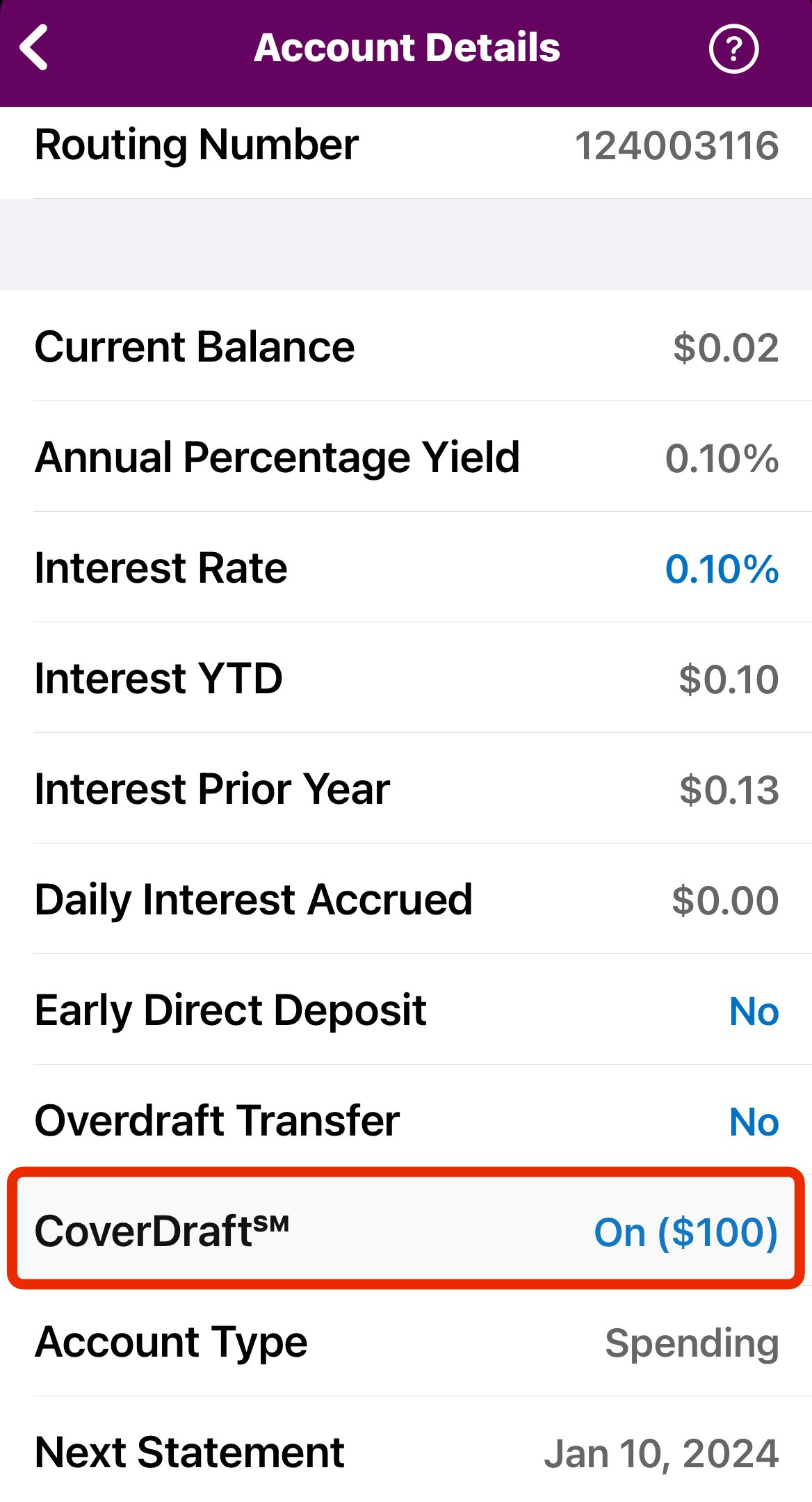

Ally's Coverdraft settings offer a safety net for unexpected financial hiccups. You have the flexibility to customize how Ally handles overdraft situations:

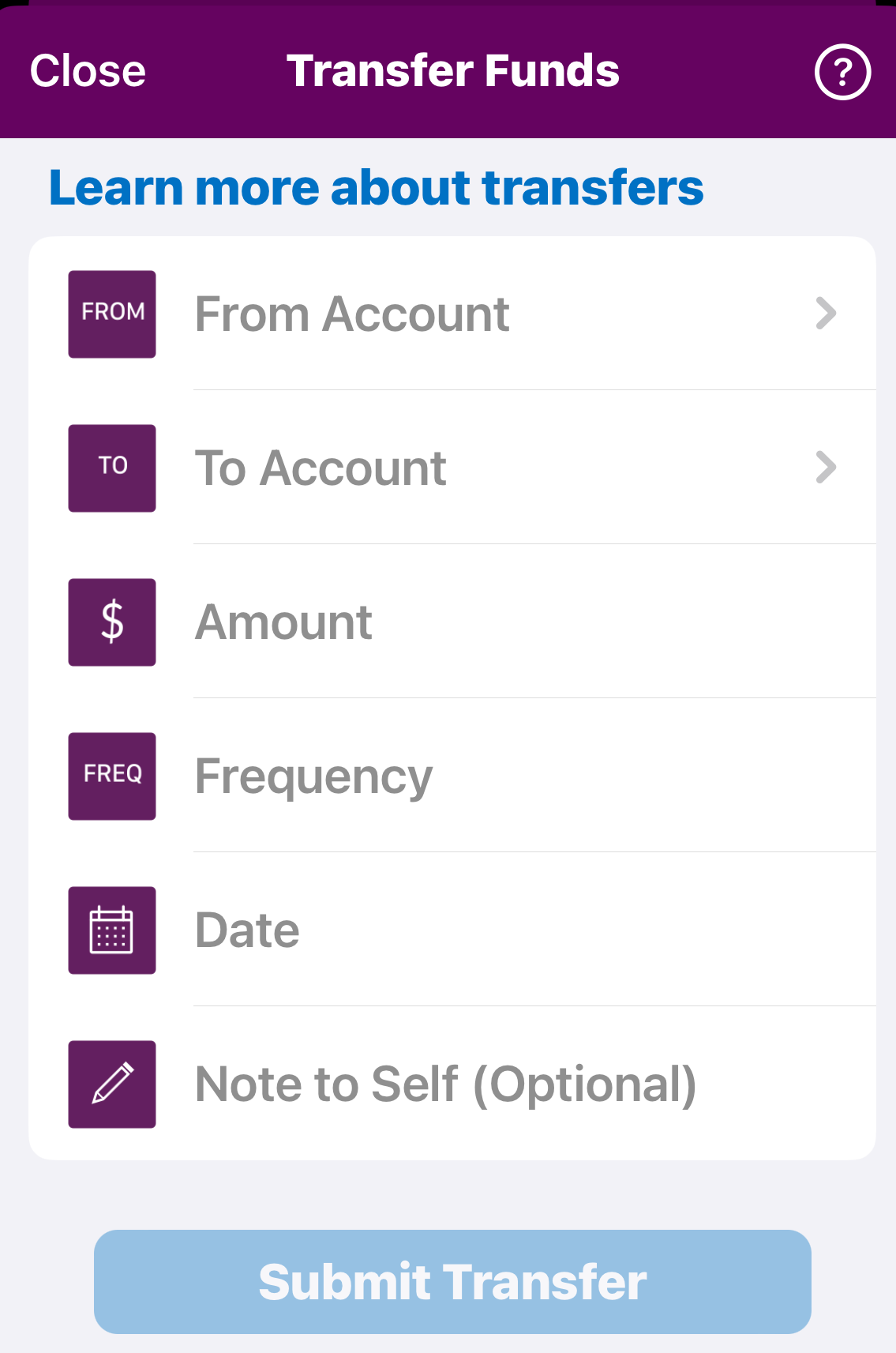

Move money seamlessly between your accounts with Ally's transfer funds feature. The app walks you through the steps, whether you're transferring funds between Ally accounts or external banks.

Checking your transactions with Ally is like having a detailed financial diary at your fingertips. The app categorizes each transaction, displaying merchant names, amounts, and dates in an easy-to-read format.

Which Bank Is Our Winner?

Overall, Ally bank is our winner.

Ally offers great checking account with many features and better savings and CD rates. However, U.S. Bank offer personalized service and better credit cards.

Anyway, it's always important to think about different things when choosing a bank that's right for you. Consider what services they offer, like help with overdrafts, how often you use ATMs, how close their branches are to you, and other things that matter to you personally.

Compare U.S. Bank With Other Banks

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Bank of America offers a wide range of banking services. There are numerous credit cards available, as well as various checking and savings accounts, home loans, investments, and auto loans.

Read Full Comparison: Bank of America vs US Bank: Which is Best For You?

Wells Fargo offers a diverse range of products, including checking accounts, savings accounts, loans, mortgages, and investments such as 401ks, IRAs, and wealth management options.

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Read Full Comparison: Wells Fargo vs US Bank: Which Bank Account Is Better?

While Chase and U.S. Bank offer many banking services, Chase Bank is our winner in this competition. Here's why – and what else to know: Chase vs. U.S. Bank

While U.S. Bank offers some better conditions when it comes to lending options, Citibank is our winner in this comparison. Here's why.

Citibank vs. U.S. Bank: Which Bank Account Is Better?

There is no clear winner in this battle, as both banks offer similar bank account types. But what about the rest? Here's our winner: U.S. Bank vs. KeyBank

There is no clear winner when comparing Huntington and U.S. Bank , but if we have to pick one – Huntington is our first choice. Here's why.

U.S. Bank vs. Huntington Bank: Which Bank Account Is Better?

Picking the right bank account can be confusing, especially when looking at big banks like U.S. Bank and Capital One. Here's our winner: U.S. Bank vs. Capital One

While PNC offers better savings rates than U.S. Bank, the latter has better credit cards. Which is best for bank account? Here's our verdict: U.S. Bank vs. PNC Bank

Our winner is U.S. Bank as it offers better package banking than Fifth Bank, but there are cases when Fifth Bank wins. Here's our comparison: U.S. Bank vs. Fifth Third Bank

Both U.S. Bank and BMO Bank are active in various states, such as Illinois, Wisconsin, Montana, and Minnesota. Here's our winner: U.S. Bank vs. BMO Bank

While Regions offers better checking options, U.S. Bank offers better credit card options. Let's compare them and see which is our winner: Regions Bank vs. U.S. Bank

U.S. Bank is one of the largest brick-and-mortar banks in the US, while Amex Bank is among the best online banks. Let's compare them: U.S. Bank vs. American Express Bank

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Compare Ally With Other Banks

Ally has a robust banking product offering that rivals that of a traditional bank. Savings accounts, checking accounts, CDs, investments, retirement products, personal loans, auto loans, and mortgages are all available.

Chime's product line has been simplified. All Chime products are designed to assist customers in rebuilding or establishing credit. There are only two savings accounts, one checking account, and one credit card available.

Read Full Comparison: Ally vs Chime: Which Banking Account Wins?

Since the bank's inception, the SoFi product line has come a long way. You can now get access to investment products, mortgages, and loans, in addition to its hybrid checking and savings account. SoFi even offers insurance. The only thing missing from this bank are CDs and traditional savings accounts.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: SoFi Money vs Ally Bank: Compare Banking Options

Ally has a decent banking product lineup that would make switching from a traditional high street bank relatively simple. Checking, savings, CDs, auto loans, personal loans, mortgages, investments, and retirement products are among the products available. The only obvious omission from the Ally line is the absence of a credit card.

Capital One began as a credit card company, but it has since expanded into a variety of other banking services. You can access auto finance, loan refinancing, and children's accounts in addition to savings and checking accounts.

Read Full Comparison: Ally vs Capital One: Compare Banking Options

Marcus' banking product offering is more specialized. Marcus' product line reflects its investment pedigree as part of the Goldman Sachs Group. CDs, high-yield savings, investment options, and a variety of loans are available.

Ally has a banking product line that competes with traditional, high-street banks. A checking account, savings account, CDs, mortgages, auto loans, personal loans, retirement products, and investments are among the numerous products available.

Read Full Comparison: Ally vs Marcus: Which Online Bank Is Better?

Discover is a completely online bank, so there are no local branches where customers can go for banking services. Customers can get in touch with Discovery via customer service, which is available 24 hours a day, seven days a week. You can log in to your account in a number of ways. All accounts are accessible online.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: Discover vs Ally: Which Bank Wins?

Ally Bank is an online bank that arose from the banking division of General Motors Acceptance Corporation. GMAC used to be an auto financing company before being purchased by Ally Bank. This bank now offers a wide range of products. Among the products available are credit cards, home loans, investing products, savings accounts including certificates of deposit, and checking account options. Ally Bank serves millions of customers and provides high-quality banking services.

Axos is a well-established online-only banking service. It has been in business since 2000 and is constantly expanding its services for both individuals and businesses. The bank is a subsidiary of Axos Financial and is headquartered in San Diego, California. Despite the fact that the bank has three locations, the vast majority of its customers are served online.

Read Full Comparison: Axos Vs Ally Bank Comparison – Which Is Better?

Aspiration has a streamlined banking product line that includes a hybrid account with a $7.99 per month upgrade option and only one credit card option. Aspiration's premise is to help you live a greener life, so the products are heavily weighted in this category. This means that you can earn cash back and other rewards for making environmentally conscious purchases and taking action.

Ally offers a much broader range of banking products. In addition to checking, savings, and CD accounts, you can also get investment and retirement products, mortgages, auto loans, and personal loans. This brings it more in line with a traditional bank, which may make switching from your high street bank easier.

Read Full Comparison: Aspiration vs Ally Bank: Where to Save Your Money?

While Wells Fargo has a far more comprehensive product line, Ally does offer better rates on savings, CDs and even its checking account. The only areas where Wells Fargo has the edge is its credit cards and its impressive selection of mortgage products and loans.

Chase is the largest brick-and-mortar bank, while Ally Bank is among the best online banks. Here's our comparison and our winner: Chase vs. Ally Bank

If you feel comfortable with online-only banking and depending on your needs – Ally may be a better option than Bank Of America. Here's why.

Ally Bank vs. Bank of America: Which Bank Account Is Better?

Citi is our winner for most consumers, but Ally is also a great option if you are willing to manage your account online. Here's why:

While TD offers a better selection of checking accounts and credit cards, Ally is also a great option for those who want an online-only bank.

While Amex has a decent checking account and better credit card options, Ally's CD and lending options are superior. Here's our comparison: American Express Bank vs. Ally Bank

Ally Bank is one of the top online banks, while HSBC Bank focuses on serving wealthier customers. Let's compare them side by side: Ally Bank vs. HSBC Bank

Barclays provides a comprehensive range of services to US customers, while Ally bank is among the best online banks. How do they compare? Barclays Bank vs. Ally Bank

Ally Bank is our winner with a complete banking package, including a checking account ( not available with Synchrony) and high savings rates.

Both Ally and Upgrade offer a complete banking package, including savings, checking, and credit cards. Here's our side by side comparison.

Our Methodology: Breaking Down Bank Comparisons

In our thorough banking comparison, The Smart Investor team carefully reviewed and compared banks across five key categories:

Checking Accounts (30%): We examined features like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers available to customers.

Savings Accounts and CDs (20%): Our focus was on important factors such as the Annual Percentage Yield (APY), minimum deposit requirements, account flexibility, FDIC insurance coverage, special savings offers, variety of CDs, automatic renewal options, and early withdrawal penalties.

Credit Cards (15%): We analyzed rewards programs, annual fees, introductory bonuses, travel benefits, APR, and balance transfer options offered by each bank's credit cards to provide a comprehensive comparison of available features.

Lending Options (15%): We assessed the variety of loan options provided, including personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, offering insights into the banks' lending capabilities.

Customer Experience and Bank Reputation (20%): Our evaluation included an analysis of online banking and mobile app usability and ratings, accessibility of customer support, online reviews, JD Power research, Trustpilot ratings, and overall financial stability, providing a holistic view of customer experience and reputation.