Table of Content

How Does Amex Membership Work?

American Express has a wide variety of credit cards and many offer points or other membership rewards. Amex membership rewards vary according to the specific card and how you redeem them.

The most common membership benefit is membership rewards, which offer points each time you make a purchase. There are a number of American Express cards that offer points, including Green, Gold and Platinum cards. You’ll typically earn at least one point per dollar, but depending on the card, you may earn as much as five points per dollar with certain purchases.

You can also earn additional points through new cardholder bonus offers or targeted offers that provide bonus points if you shop with certain merchants.

However, some American Express cards offer different membership rewards. You may earn cash back, which takes the form of Reward Dollars you can redeem for statement credit. Alternatively, Amex cards with an airline or hotel partner tend to offer miles with the partner loyalty program rather than points or a percentage cash back.

Each time you make a purchase, the appropriate rewards are calculated and added to your account. You can choose to accumulate your rewards or spend them as soon as you like.

American Express Membership Rewards Benefits

Since there are lots of credit card options and various issuer reward programs, it is important to be aware of what sets the American Express Membership Rewards program apart. Some of the key benefits include:

-

Earn Points For Airline/Hotel/Package Bookings

With American Express Membership Rewards, cardmembers can earn points on eligible purchases, accumulating a valuable currency that can be redeemed for various travel-related expenses, including flights, hotel stays, and vacation packages.

-

Entertainment Access

Through the American Express Experiences program, cardholders gain access to presale tickets, exclusive events, and premium experiences, enhancing their entertainment options and providing unique opportunities.

-

Transfer Partners

Unlike many credit card reward platforms, the Amex Membership Rewards program has a great number of partnership programs that allow you to transfer your points to specific loyalty programs. There are more than 12 airlines and three hotels, which apart from JetBlue, offer at least a 1:1 ratio.

-

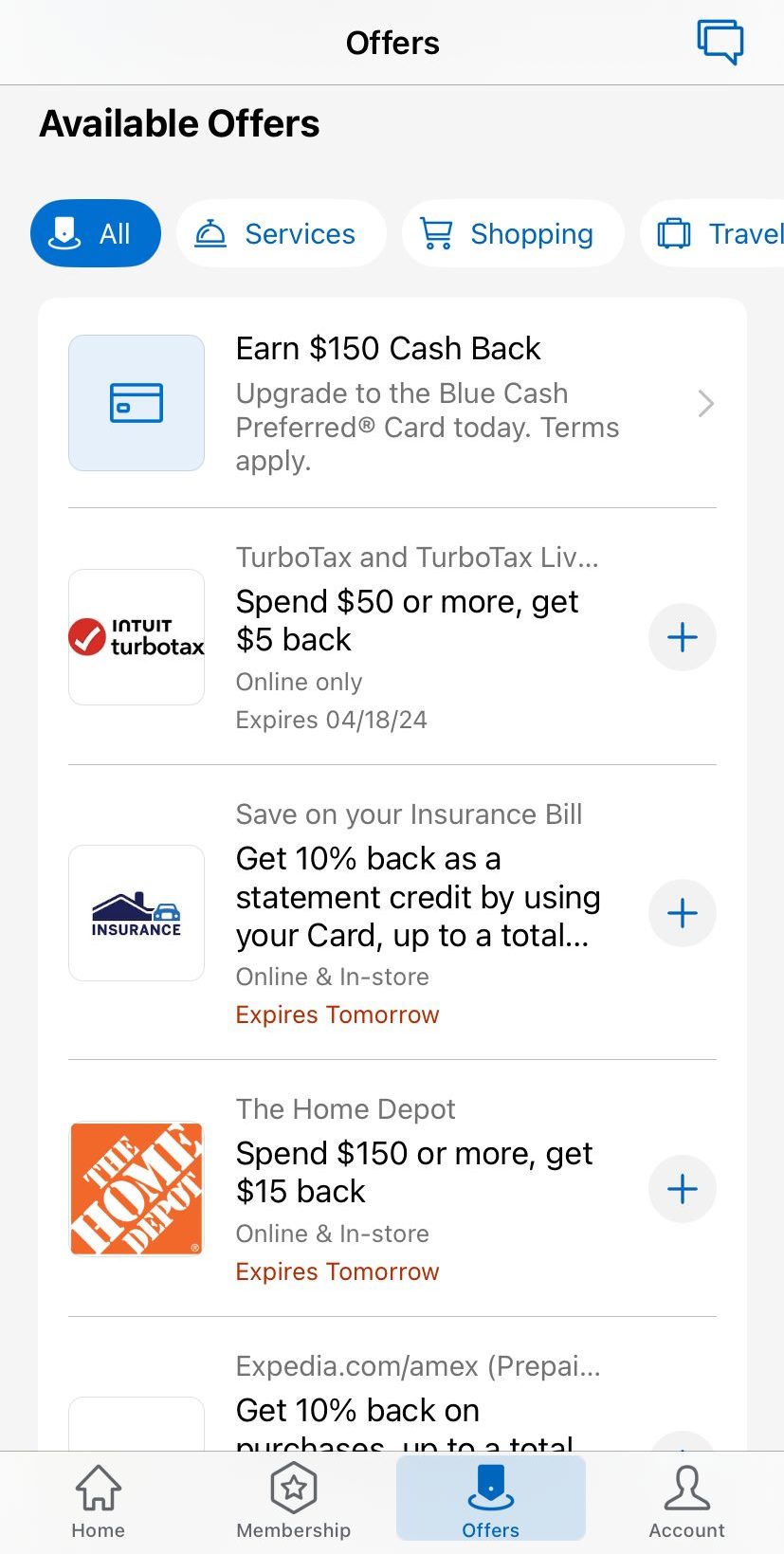

Amex Offers

Amex Offers deliver personalized discounts and cashback rewards at a variety of merchants. Cardmembers can enjoy savings on everyday purchases and special promotions, adding value to their Membership Rewards experience.

-

Membership Rewards Exclusives

Membership Rewards Exclusives offer cardholders access to special promotions, unique events, and limited-time offers that are exclusive to members, creating opportunities for enhanced benefits and experiences.

-

Fine Hotels & Resorts

The Fine Hotels & Resorts program provides cardmembers with access to premium hotel benefits, including room upgrades, early check-in, late checkout, and other exclusive amenities when booking stays at select luxury properties worldwide.

This elevates the overall travel experience for American Express Platinum and Centurion cardholders.

Top Offers

Top Offers From Our Partners

What Redemption Options Are Available?

One of the most attractive features of the Amex membership program is its flexibility. You can log into the Amex Membership Rewards website at any time to check out your rewards total and see the redemption options.

All you need to do is log into the American Express homepage and click “Rewards” on the top banner, you’ll then see “Membership Rewards” on the drop down menu. This will take you to the Membership Rewards page, where you can explore the redemption options.

You can use your points as redemption for:

- Travel: Similar to Chase Ultimate rewards or Capital One Travel portal, You can use your reward points to book travel purchases through Amex Travel. Your points will be worth 0.7 cents to one cent each depending on what type of travel you are booking. So, if you have 10,000 points, it will provide a $70 travel credit.

- Statement Credit: You can use your reward points as a statement credit against one of the charges that you’ve made on your card. This has a typical redemption rate of 0.6 cents for each point. This means that if you have 1000 points, it would be worth $6 in statement credit.

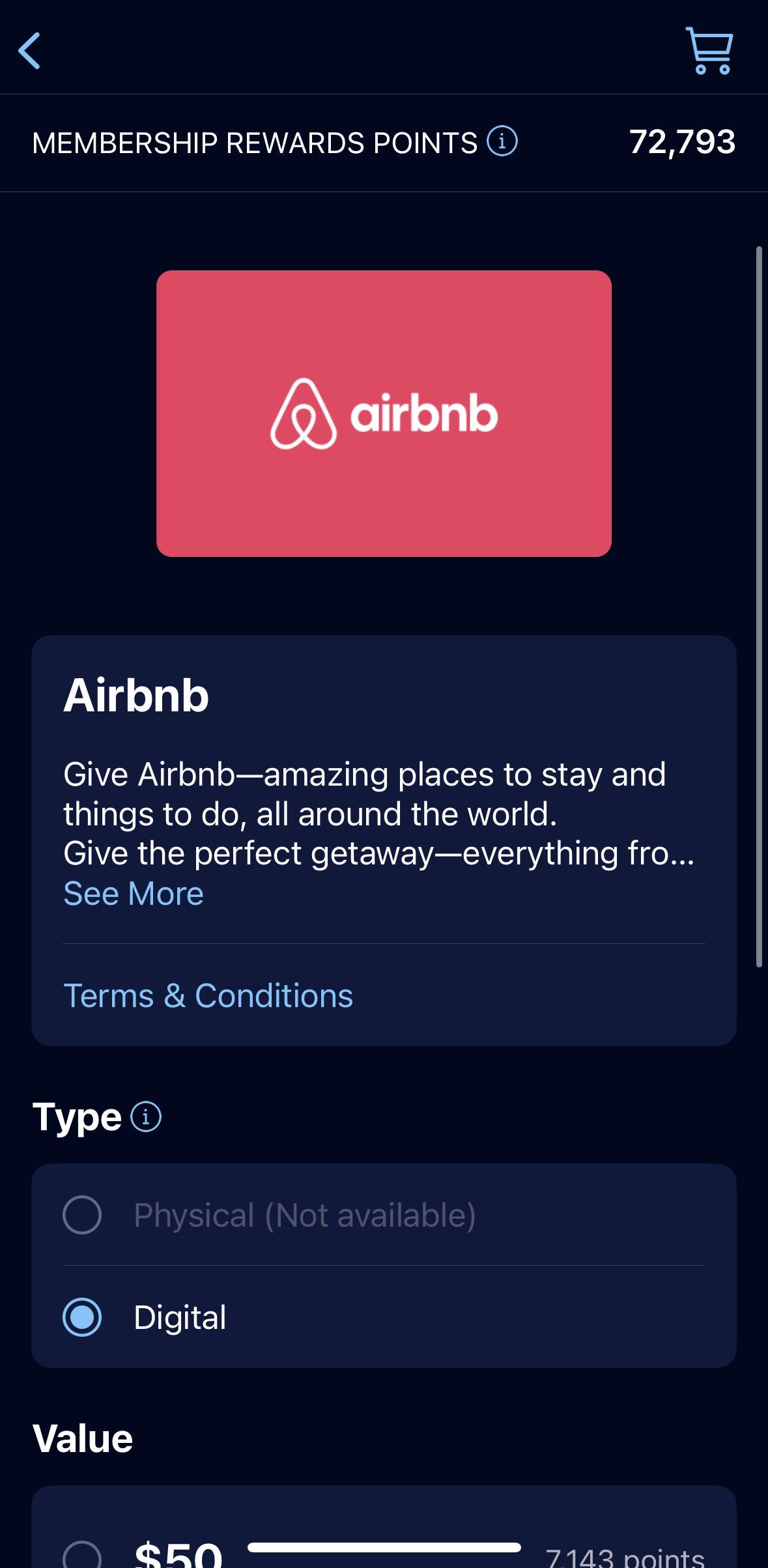

- Point Transfer to Partner Programs: You can also transfer your points to partner programs, such as miles to increase their versatility.

- Shopping: You can use Amex Membership Rewards to pay for online purchases with a list of retailers. The redemption rate is typically 0.5 cents to one cent per point. For example, Amazon, Walmart, Best Buy and Dell.com offer a rate of 0.7 cents per point, Ticketmaster is 0.5 cents per point and NYC Taxi is one cent per point. You can also use your points via PayPal at a rate of 0.7 cents per point.

- Charity Donations: Amex allows you to redeem points via the JustGiving site. You can select your preferred cause and make a donation at a rate of 0.7 cents per point.

- Merchandise: You can also use your points to purchase merchandise at a typical rate of 0.5 cents per point.

- Gift Cards: The Amex Membership Rewards portal has a number of gift card options from a comprehensive list of shopping, dining and travel retailers. The redemption values can vary according to the specific retailer, but you can expect 0.5 cents to one cent per point. This means that 1000 points would be worth $5 to $10.

What Are the Most Attractive Redemption Options?

Here are some redemption options that are often considered attractive in terms of maximizing the value per point:

- Transferring points to Airline And Hotel Partners: This often delivers the highest value, especially with occasional transfer bonuses. Airlines like Singapore Airlines, Delta, British Airways, and Emirates offer fantastic redemptions for premium cabin seats or unique experiences. You can sometimes achieve 2-3 cents per point value, significantly exceeding standard redemption rates.

- Shopping Portals: Earning bonus points when shopping through the Amex portal can be a good way to maximize points on everyday purchases, especially with targeted offers. While the value per point might not be top-tier (usually around 1-1.5 cents), it's a convenient way to accumulate points.

What Are the Least Attractive Redemption Options?

Here are some redemption options that are often considered less attractive in terms of maximizing the value per point:

- Statement credits: This can be useful for covering specific expenses, but the value per point is usually 1 cent, offering lower returns than travel-focused options.

- Gift Cards: This option is straightforward and convenient, but the value per point is typically just 1 cent, making it less attractive compared to travel-related redemptions.

How to Sign Up For Amex Membership Rewards?

Signing up for the Amex Membership Rewards program is easy. After receiving your eligible American Express card, simply enter your new card details on the American Express website or log in if you're already an existing customer. New customers can click the “Create a new online account” link, while current customers can log in and link their new card.

Be sure to link all your eligible Amex cards to get the most out of your points. Once your cards are connected, you’ll automatically start earning Membership Rewards points.

Top Offers

Top Offers From Our Partners

Top Offers

How To Book a Flight With Amex Points?

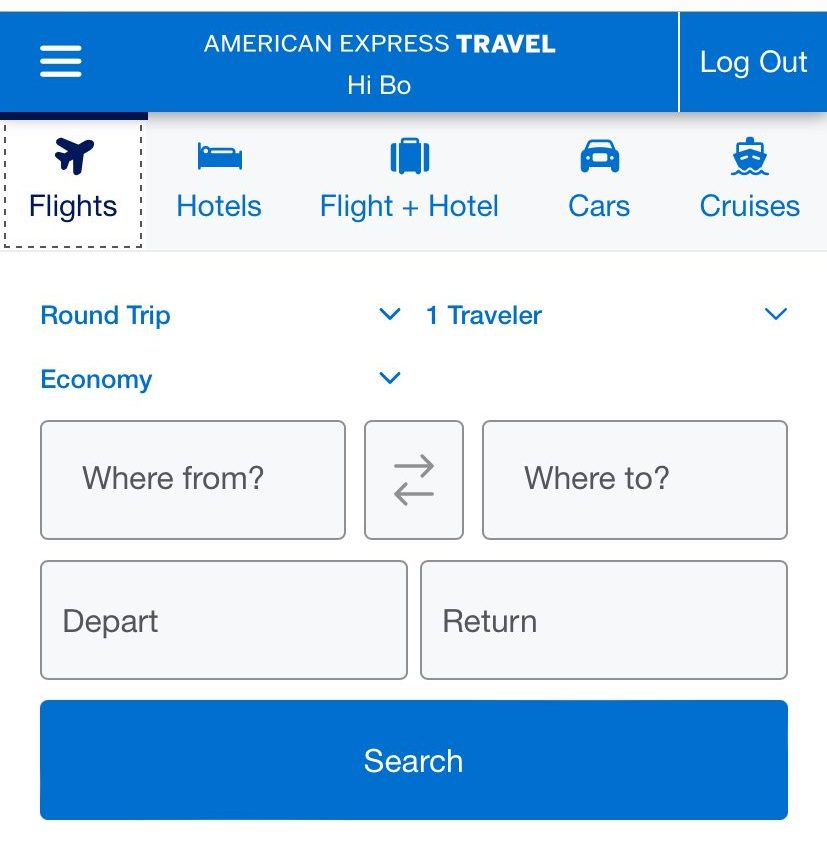

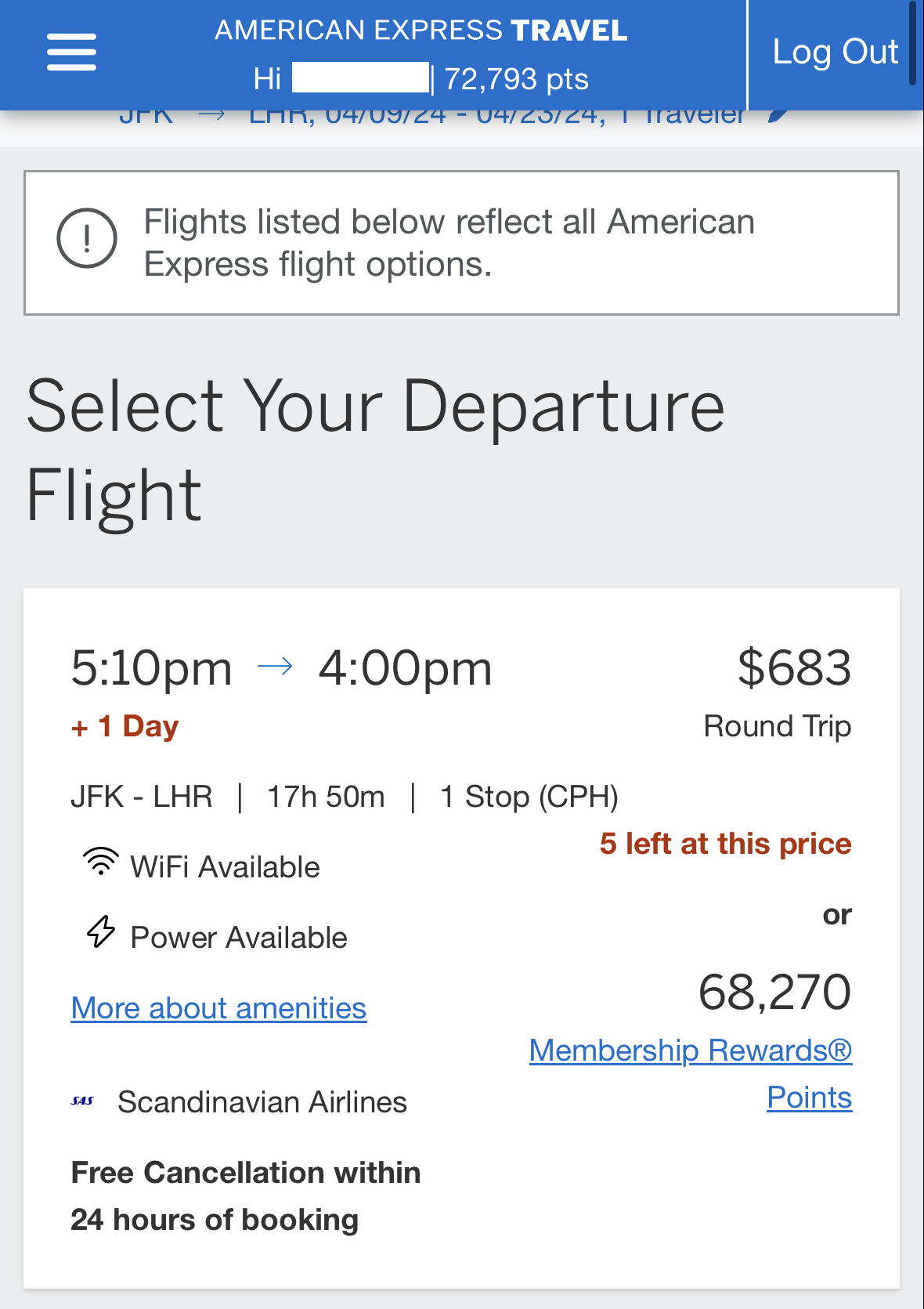

The Amex Travel Portal is an easy way to book a flight using your points. This is an online travel agency, similar to Expedia, and you can use it to book flights and other travel purchases. All you need to do is select “Travel” on the homepage and then click “Book a Trip”. If you already carry an airline miles credit card, you may want to use it instead, and book something else such as hotels or rental car with your points.

1. Start Your Search

To book flights, select your departure and arrival cities, dates and if you want to book a round trip or multi city itinerary. You can also click if you want to book a flight and hotel package.

Once you click “Search” Amex will compile all the ticketing options. You can then filter the results according to various parameters including airline, departure time, arrival time, travel duration and number of stops. You can also order the results via the number of points needed.

2. Look For The Best Redemption Value

When you use your Membership Rewards for flights, the best value tends to be with domestic economy flights, where you can get an average redemption value of 1.15 cents per point.

Some examples include:

- New York to Miami: If you book an economy flight from New York City to Miami, the cash value is $269 and it will cost 23,365 points. This works out at a redemption rate of 1.15 cents per point.

- Los Angeles to Honolulu: Another economy flight, which has a cash cost of $549, but will cost you 48,240 points. This has a redemption rate of 1.14 cents per point.

- Boston to London: If you don’t want to travel domestically, you can still get some great deals. For example, the Boston to London economy flight at a cost of $804. This will cost 75,832 points, which is a redemption rate of 1.07 cents per point.

The Travel portal separately displays each flight segment. This means that you need to select your outbound flight before you can see the inbound options. Once you decide on a flight, simply click select. You’ll then see another page with the inbound options and your outbound flight will appear at the top of the page.

For each of the inbound flights, you’ll see the additional cost for this segment, but there are often options that will not increase your trip costs.

3. Confirmation

After choosing an outbound and inbound flight, you’ll see a full itinerary, and you can confirm your selection. After confirmation, when you click “Continue Booking,” you’ll be directed to a Traveler Information page where you must provide standard details, including name and birthdate. You’ll then proceed to the payment page, where you can pay with your points, your Amex credit card, or a combination of the two.

It is important to note that occasionally, American Express offers Featured Itineraries. This could provide complimentary lounge access with a particular flight or other perks. These will always appear at the top of the page regardless of how you sort the search results.

Top Offers

Top Offers From Our Partners

Top Offers

Top Offers From Our Partners

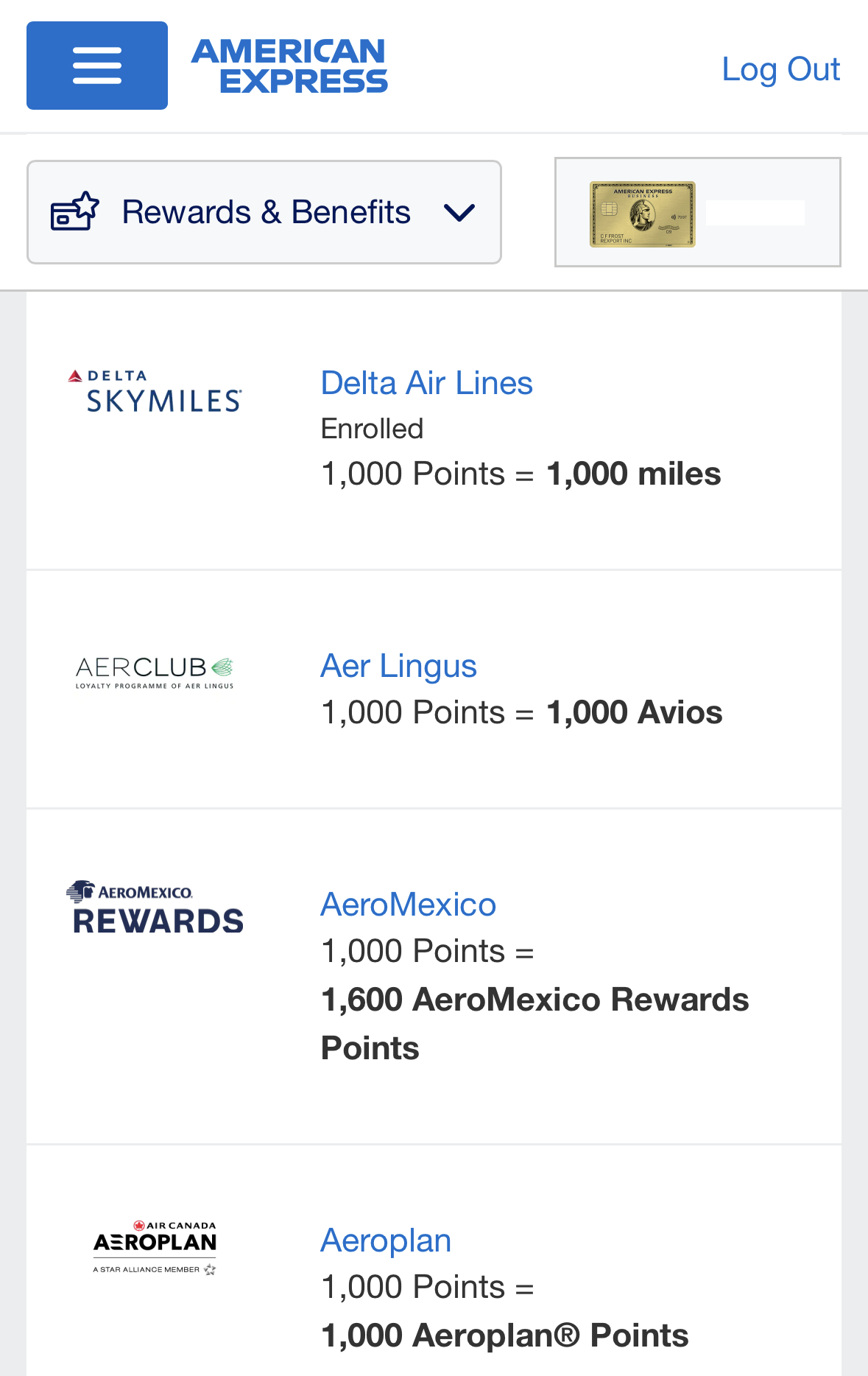

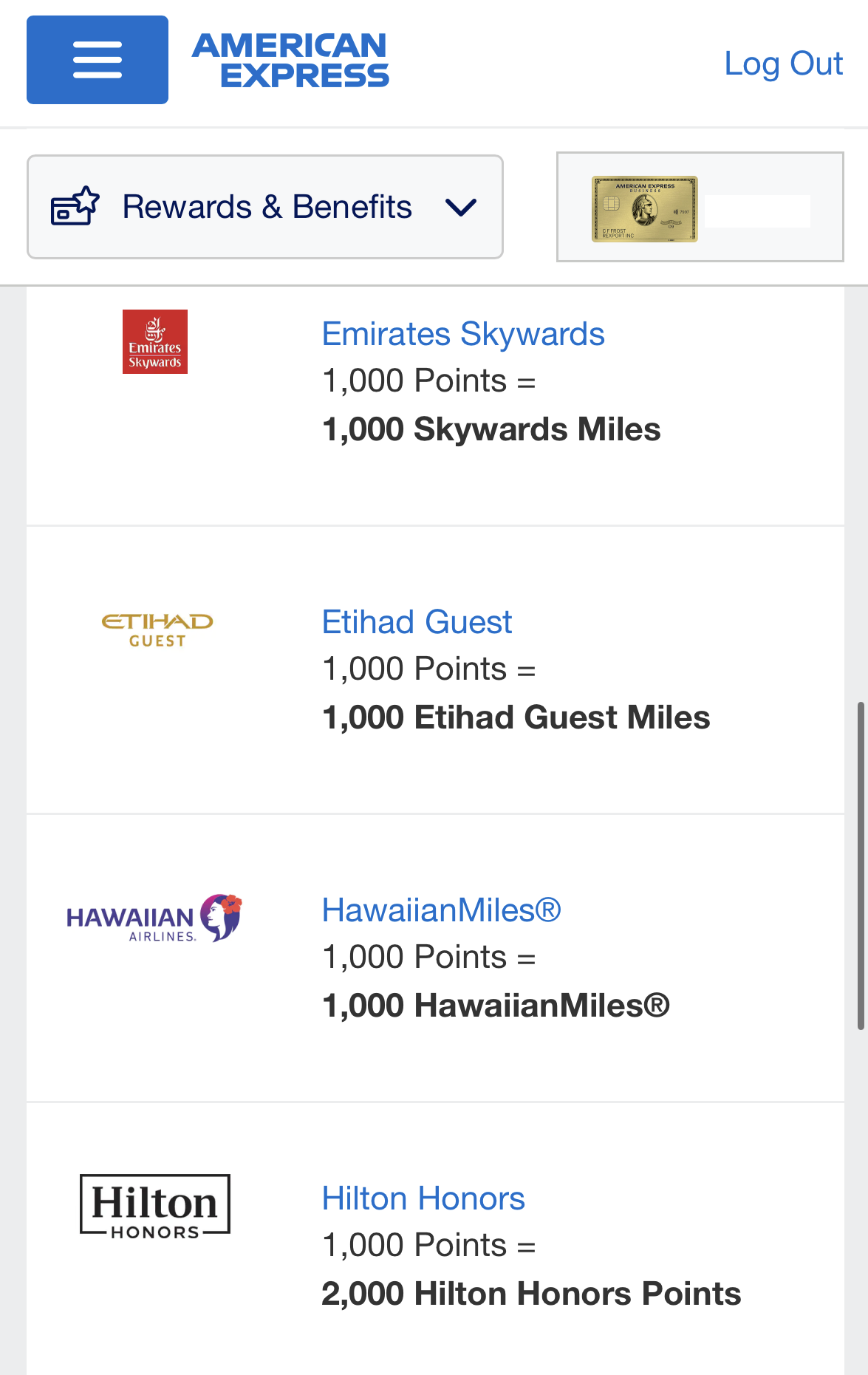

How To Transfer Points To Partners?

You can transfer points when you log in to the Membership Rewards site. When you click “Use Points” you’ll see “Transfer Points” on the drop down menu.

There are full instructions to transfer points, but first you need to link your loyalty account. You can then select how many points you want to transfer and to which travel partner. Although the transfer ratios are typically 1:1, there are some programs that offer better value.

For example, if you transfer your points to the AeroMexico Club Premier scheme, you’ll get 1.6 points for each Amex point.

When you click on the icon for the right program, you’ll need to enter your loyalty program account number and your Membership Rewards card details. Just keep in mind that you can only transfer points to your own account or to an authorized user’s account. Linking loyalty programs to your Membership Rewards won’t automatically transfer points, but you can check for award availability before making any transfers.

Most partner programs require points to be transferred in increments. For example, you need to transfer in 1,000 point increments for Iberia Plus.

The transfers are one way, so once you authorize a transfer you cannot reverse it. This means that you need to take care that you correctly enter the number of points you want to transfer and the information is correct before you click Confirm.

Most transfers complete instantly, but you may need to log out and back in to see an updated balance with the partner program.

Top Offers

Top Offers From Our Partners

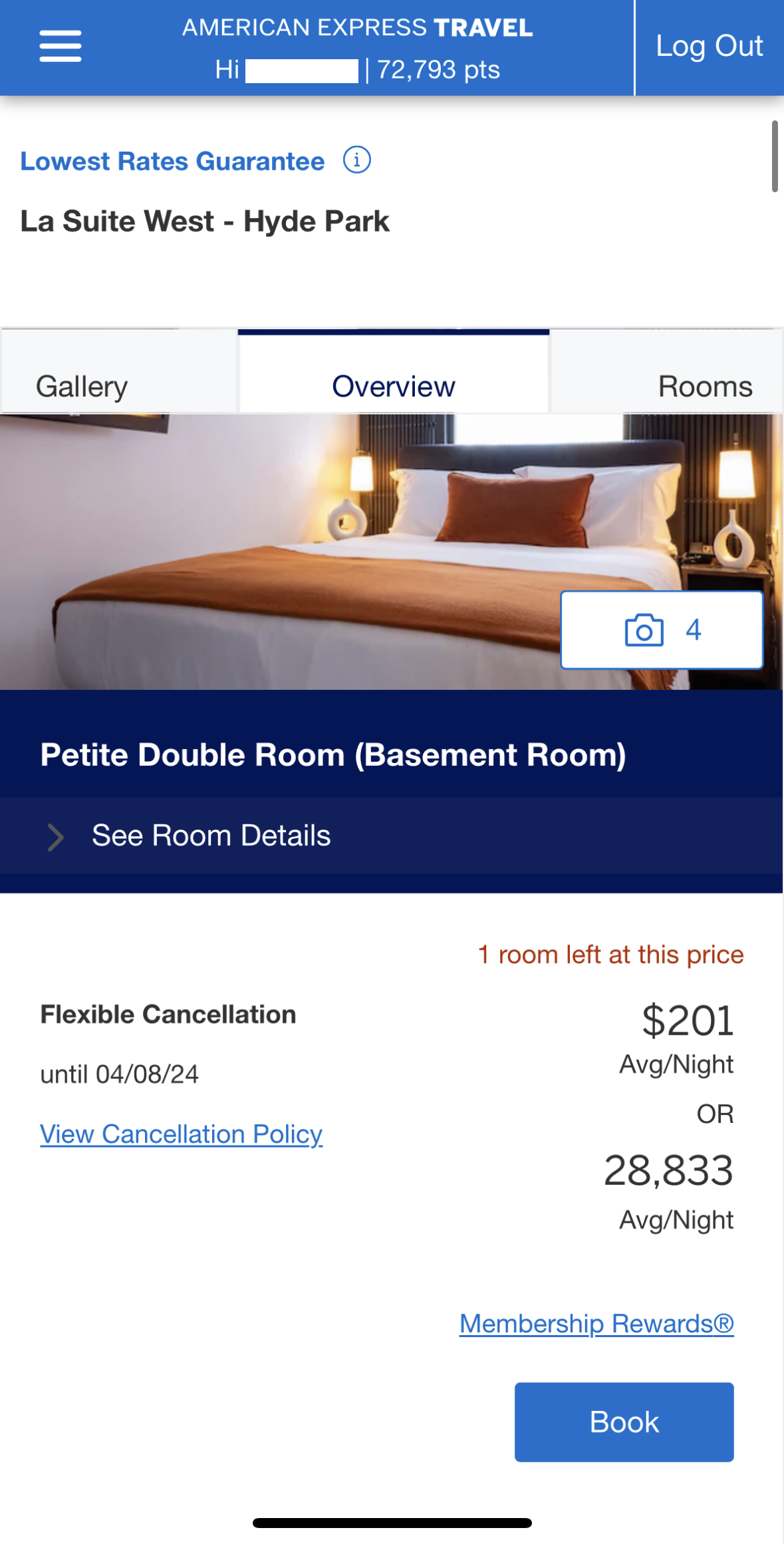

How to Book a Hotel with Amex Points?

Booking a hotel through the Amex travel portal is similar to flights. You’ll need to provide a designation, number of travelers and dates for check in and check out. When you click search, you’ll be presented with a list of available options with both a cash price and points cost.

-

Do Hotel Orders Are More Accessible Than Flights?

Hotel stays typically provide a lower redemption rate compared to flights, as you’re likely to get a redemption of less than one cent per point. But, it is possible to shop around and get some good deals, particularly if you are not tied to specific dates or a set destination.

One drawback of using this portal to book your hotel stays is that you will not enjoy elite status benefits. This means that you won’t receive hotel points, stay credits or other perks. If you already carry an hotel rewards credit card, you may want to use it instead, and book something else such as flights or rental car with your points.

Transferring to a Partner Hotel Chain

For this reason, one of the best ways to book a hotel stay using your Amex points is to transfer them to a partner hotel chain. Hotel loyalty programs typically work the same as the airline programs we discussed above, with a similar transfer process.

Good options include:

-

Hilton Honors

The Hilton Honors program offers a transfer ratio of 2:1. So, you’ll get two Hilton Honors points for each Amex point. This program has a variety of redemption options at different price points to suit your budget.

For example, you could book a night at Hampton Inn in Reynosa Mexico for 5,000 Hilton Honors points. Alternatively, if you want a more luxurious stay, you can book a Conrad Maldives Rangali Island standard room for 95,000 points or for similar points a room in the Waldorf Astoria Beverly Hills.

These rooms typically go for $700+ per night, so you’re getting a redemption value of almost 1.5 cents per point.

-

Choice Privileges

The Choices program offers a 1:1 ratio, with deals from 6,000 to 35,000 per night. While this brand is not known for its luxury, it is a good option for families, particularly in more expensive destinations.

For example, you can book a hotel room in Times Square for 30,000 points per night. There are also deals for the San Diego SeaWorld area for as little as 12,000 points per night.

-

Marriott Bonvoy

You can transfer points to this program at a 1:1 ratio. The Marriott Bonvoy program includes Marriott, Ritz Carlton and Starwood locations. There are redemption options to suit a variety of budgets. However, some of the best deals are for more luxurious locations.

For example, you can book a night in the Aruba Marriott Resort and Stellaris Casino for 60,000 points. Considering the cash prices start at $360, this is a redemption rate of 0.6 cents per point.

Bear in mind that with certain Amex cards, you can get extra benefits with Marriott and Hilton. This includes complimentary Marriott Bonvoy Brilliant or Hilton Honors Gold status. These offer some great perks when you stay at properties.

American Express also operates its Fine Hotels and Resorts program, which offers increased benefits at more than 1,100 properties around the world. This program is available with specific cards including the Platinum Card.

The perks include welcome amenities, early check in, late check out breakfast for two, and room upgrades when available. When you book through this program, your points are worth one cent each and you can earn elite credit and hotel loyalty program points with your stay.

Maximizing Your Amex Membership Rewards

While the tactics for maximizing how you earn Amex Membership Rewards points, the way to maximize the point redemptions is fairly universal, regardless of which American Express card you hold. These include:

- Transfer to Partner Programs: One of the best ways to get more value for your Rewards points is to transfer to partner programs. This can allow you to enjoy a higher redemption rate and additional perks through the Partner loyalty program. You will need to understand the intricacies of the appropriate program, but you can enjoy benefits such as room upgrades or lounge access without needing to pay more.

- Amex Offers: The Amex Offers program allows you to enjoy certain deals through a variety of merchants including dining, travel and shopping. You can add the offer to your card and make an eligible purchase to receive bonus points or statement credit.

- Referral Bonuses: Most Amex cards allow you to participate in its refer a friend program. When you refer a friend and they get approved, you’ll get bonus points. For example, if you refer a friend for a Blue Business Plus card, you can get 15,000 bonus points when they are approved. Your referee may also get bonus points when they use your referral link and meet certain requirements. You’ll need to check the details of the program for your specific card when you log in.

- Limited Time Offers: American Express periodically sends email offers where you can earn bonus points. For example, you may earn bonus points if you add an authorized user to your account within a set time.

- Rakuten: This is an online shopping portal that can also boost your Rewards balance. Rakuten offers cash back on your purchases at more than 2,500 stores. You can shop online or link your credit card to enjoy in-store offers. You’ll need to log into Rakuten and follow the link to the store where you want to shop. You can link your Membership Rewards account and have the points you earn transferred to your Amex account.

Which Cards Are Best To Leverage Amex Membership?

The best American Express cards to leverage the Membership Rewards program depend on your individual spending habits, travel preferences, and financial goals. Here are a few popular American Express cards known for their strong Membership Rewards programs:

- The Platinum Card® from American Express: Offers a premium travel experience with benefits like airport lounge access, travel credits, and Membership Rewards points that can be redeemed for travel, statement credits, or transferred to airline and hotel partners.

- American Express® Gold Card: Ideal for food and travel enthusiasts, this card earns elevated points on dining and U.S. supermarkets. Points can be redeemed for travel, statement credits, or transferred to loyalty programs.

- American Express® Green Card: A travel-focused card with bonus points on travel and dining. It's a more accessible option compared to the Platinum Card and offers various travel and shopping benefits.

- American Express® Business Gold Card: Tailored for business owners, this card provides bonus points in categories where businesses often spend the most, such as advertising and technology.

- The Blue Business® Plus Credit Card from American Express: A no-annual-fee business card that earns Membership Rewards points on everyday business purchases, offering simplicity and flexibility in rewards.

- The Centurion Card (Amex Black Card): An exclusive and invitation-only card, the Centurion Card offers a wide range of benefits, including enhanced Membership Rewards, luxury travel perks, and concierge services.

Choosing the best card depends on your specific needs and lifestyle. Consider factors such as annual fees, bonus categories, travel benefits, and redemption options.

Top Offers

Top Offers

Top Offers From Our Partners

FAQ

What is the Amex Membership Fee?

There is no fee associated with the Membership Rewards program, but some eligible cards do carry an annual fee. This fee can vary according to the card, so be sure to check the terms and conditions before applying.

If you don’t want to pay an annual fee, there are card options such as the American Express EveryDay card, which still allows you to earn Membership Rewards points.

Which Amex Cards have Membership Rewards?

There are a number of Amex cards that offer Membership Rewards including Platinum, Gold, Green, EveryDay and EveryDay preferred. There are also business card options including the Business Gold and Business Platinum.

What Can You Use American Express Membership Rewards Points For?

There are numerous ways that you can use your Membership Rewards Points.

The best value redemption method is travel purchases, but you can also purchase gift cards, get statement credit, online shop through a variety of retailers, buy merchandise, make a charitable donation or even transfer them to a partner loyalty program.

Each method has different redemption methods, so check all the options before you decide to use your points.

Are Amex Membership Rewards Points Worth It?

This depends on your spending habits, redemption preferences and general financial practices. If your Amex card provides rewards for your typical spending and you can earn sufficient points for your preferred rewards, then you’re likely to consider the program invaluable.

However, if you rarely use your card and have no real interest in the various redemption options, you’re not likely to find it worthwhile.

Can You Transfer Membership Rewards Points to Someone Else?

It is possible to transfer your Membership Rewards points to another person, but there is a caveat. The recipient of the points must be an authorized user on your card account.

This means that you can transfer the points, but you will need to add them to the account, and potentially give them access to making charges that you’ll be responsible for.

So, think carefully about whether you want to take on this responsibility.