Table Of Content

One of the most important pieces of information about your bank account is the routing number. Whenever you make a transaction from your account, you will likely be asked for the routing number to identify what the account is.

Let’s get into what a routing number is, what it means, and how to use it!

What Is A Routing Number?

A routing number is a nine-digit number used to identify your bank during a transaction involving funds.

This distinct number is meant to reduce complications when identifying a bank that is participating in a transaction. The routing number is used exclusively to identify your bank, not your account, which is a different number we’ll get into a little later.

With each bank having a distinct number, this makes it easy for banks and clearinghouses to know who to send funds to and who to expect funds to come in from.

What is a Routing Number Used For?

A routing number is needed in most transactions involving your bank.

Most commonly, whenever you are setting up automatic transactions from your account, including setting up direct deposits, automatic loan payments, and recurring transfers. In instances like this, the routing number informs the counterparty to what bank the recurring payment will be sent.

Other instances where routing numbers are used are for submitting tax returns or conducting transfers between accounts at different banks through a clearing house.

What Do the Digits of a Routing Number Mean?

To most, a routing number just looks like a random series of digits. However, the routing number is broken up into three distinct parts, each of which identifies a certain piece of information.

- The first four digits of the routing number refer to the federal reserve routing symbol. The first two digits tell which of the 12 Federal Reserve Districts the bank originates in. The next two digits describe what specific city or area within the district the bank is located.

- The next piece of the routing number is the bank identifier. This four-digit number identifies the exact financial institution where you opened your account. These numbers are assigned by the American Bankers Association and are distinct to each bank. The final number is a mathematical check digit.

Based on an algorithm that takes the first 8 numbers in the set, the last digit is calculated. This is utilized to verify the validity of a routing number.

Routing numbers can have more than 9 digits as well. Mainly in the case of credit unions, the routing number will be up to 12 digits.

Where Is The Routing Number On A Check?

Knowing what you know about what a routing number is, it should be easy to identify on a check.

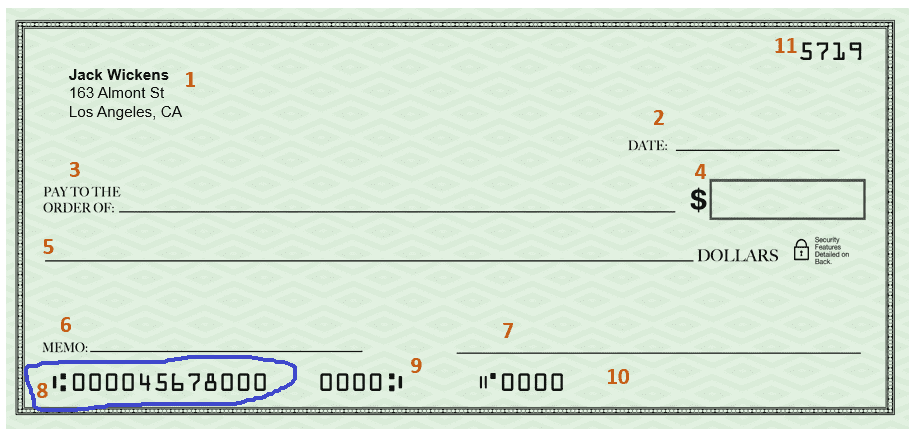

- The routing number will be the nine-digit number in the bottom left corner.

- If your check is issued by a credit union or another type of financial institution other than a bank, it may be longer than nine digits, but it will be in the same location.

The routing number typically appears on the bottom left-hand corner of a check.

What Else Appear On A Check?

While checks are not used as commonly as they once were, they contain a lot of important information about your bank and your account.

With them being used less frequently, many aren’t aware about what other information is provided on the check. This figure provided by NerdWallet provides a great image of what is on a check and what it means.

1. Personal information 2. Date when check was written 3. Name of recipient 4. Payment amount numbers 5. Payment amount text | 6. Memo line 7. Signature 8. Routing number 9. Account number 10. Check number |

The information on a check is used in tandem to coordinate transactions. Knowing what each piece of information is and how its used can prevent you from making mistakes and help you quickly get an understanding of your account information.

How to Find Your Routing Number Without a Check?

If you do not have access to a paper check, it may be difficult to locate your routing number.

- If you can see a bank statement, follow the instructions above to locate the number there.

- If you cannot find a bank statement, you can likely find the routing number through their website. If you go to your account information or account summary page, the routing number should be listed.

- You can also perform an internet search by looking up your bank’s name, location, and routing number.

- The final and most straightforward way is to call or call the bank and directly ask them.

Bank/Institution | Customer Service Number |

|---|---|

Chase | 1-800-935-9935 |

Capital One | 1-877-383-4802

|

Bank of America | 1-800-432-1000 |

PNC Bank | 1-888-762-2265

|

Wells Fargo | 1-800-869-3557 |

Citibank | 1-800-374-9700

|

Discover | 1-800-347-2683 |

US Bank | 1-800-872-2657 |

TD Bank | 1-888-751-9000 |

PenFED | 1-800-247-5626 |

Alliant Credit Union | 1-800-328-1935 |

Citizens Bank | 1-800-922-9999 |

Ally Bank | 1-877-247-2559 |

How to Find Your Routing Number on a Bank Statement?

If for whatever reason, you do not have access to a checkbook associated with your account and need your bank’s routing number, a bank statement is probably the next easiest place to find the routing number.

The routing number is typically shown on the top right-hand side of a bank statement is tends to be next to the account number.

Check If You Have The Right Number

If you are unsure if you have the correct number, first ask yourself if it is a nine-digit number. If its not and you aren’t dealing with a credit union, it likely isn’t the routing number.

If you are still unsure, just type the number you found into any web browser and then the name of the bank. You can just look up routing numbers associated with your bank. If the internet doesn’t verify the number you have, its wrong

How to Find a Bank with a Routing Number?

Often, you will know your bank but need to know your bank’s routing number. In a few instances, you may have only the routing number but not the bank information.

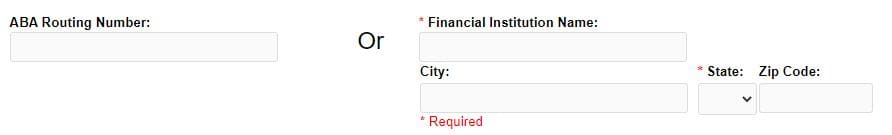

Just like how you can find any routing number with bank information, you can also find any bank information with a routing number. You can easily do this by visiting ABA Routing Number Lookup.

This website from the American Bankers Association allows you to type in any routing number and returns all relevant bank information. I recommend this to find a bank with a routing number.

How Do I Find My Bank’s Routing Number?

Now that you know what a routing number is and where to look to find it, you can begin to find your bank’s routing number.

- As stated before, the easiest place to find it is on a paper check. If you already have a checkbook associated with the account, follow the directions above to locate the routing number. You can also request a checkbook and wait until it arrives to find the number on the check.

- If you have your account’s online login, you can access the number through your account information page, and it should be clearly labeled.

- If you have a representative at the bank who you have a good relationship with, you can ask them directly for the routing number.

- The customer service number can provide help if you have exhausted all of the previous options.

Do Savings Accounts Have Routing Numbers?

Similarly, to checking accounts, savings accounts have rating numbers as well.

Savings account routing numbers work in a very similar way to those of checking accounts. They are used to identify banks that are apart of transactions when they occur. Routing numbers associated with savings accounts are typically used less frequently than checking accounts.

Checking accounts are primarily used for everyday spending while savings accounts are more used for the long term, so there are less transactions involved.

Why Do Banks Have Multiple Routing Numbers?

Large banks especially can have multiple routing numbers associated with that bank. The two primary reasons why banks have multiple routing numbers is to differentiate the specific state and region the bank is located in and the type of transaction.

For example, Bank of America has a different routing number for each state and for each type of transaction. While this may be difficult for customers to understand, it makes it much easier for banks to distinguish specific banks.

What is ACH Routing Number and How to Find it?

A common mistake many make is misinterpreting the ABA routing number to be the ACH routing number.

Throughout this article when I refer to just a routing number, it is to the ABA routing number. The ABA numbers are used for paper or check transactions while ACH numbers are used for electronic transactions.

While banks sometimes have the same ABA and ACH routing number this isn’t always the case. To find the ACH routing number, perform an internet search and type in your banks name and then ACH routing number.

I recommend looking directly on the company website to find the correct ACH routing number.

Routing Number vs Account Number: What’s the Difference?

Routing numbers and account numbers are often used interchangeably, but they are used to identify two different entities.

As talked about before, routing numbers are used to identify a specific bank or credit union location where you hold your money. An account number, on the other hand, identifies what account your money is in within the financial institution.

You can look at the routing number as more used for external purposes and account number is more for internal purposes. However, both need to be used in tandem for a transaction to take place correctly.

SWIFT vs IBAN Codes: What’s the Difference?

SWIFT and IBAN codes work in a very similar way to routing and account numbers. While routing numbers and account numbers are used to identify banks and accounts during domestic transactions, SWIFT and IBAN codes do the same for international transactions.

You can equate the SWIFT code to the routing number. Both are used to identify what bank is involved in a location. Larger banks often have both multiple SWIFT and routing numbers to distinguish between different branches in different locations.

The IBAN code works just like the account number during a transaction. After using the SWIFT code to determine what bank is apart of the transaction, the IBAN number is used to determine what account in the bank the money should be sent to or from.

ACH vs Wire Transfer: What’s the Difference?

Both ACH and Wire Transfers are methods to send money from one bank account to another. They are similar in nature but have a few distinct differences.

- ACH

- Transaction of funds between two financial entities that is processed through an automated clearing house

- Typically, are free and can take multiple days to process

- Used in most fintech payment technologies as well as B2C and C2C transactions

- Wire Transfer

- Transaction of funds initiated through a bank that allows money to be transferred quickly

- Typically charged a fee for processing the transaction and is typically completed same day

- Not processed through a central clearing house so more susceptible to fraud

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

FAQs

How to find routing number on Chase?

You can easily access your Chase routing number by logging into the Chase website of mobile app. Once you’re in, choose your account tile and then select Show Details.

Your routing number and account number should be provided. If you have a checkbook connected to your account as well, you can find it on the paper check.

How to find routing number on Citi?

The easiest way to find your Citi routing number is by looking in the lower left corner of a check connected to your account.

If you do not have access to a check, you can search Citi and the name of the state where your bank is located or call the customer service number to see the routing number.

How to find routing number on Wells Fargo?

Again, the simplest way to find your Wells Fargo routing number is on a check. However, if you do not have this, Wells Fargo has a tool on their website that gives you your routing number based on a few questions.

Type “Wells Fargo Routing Number” into any search engine and find the routing numbers and account numbers page on the Wells Fargo website. Answer all questions honestly to receive the routing number.

How to find routing number on Bank of America?

The Bank of America routing number for your account will be located on any check associated with your account as well as the account information tab on the mobile app of website.

The Bank of America website also has a tool that allows you to input the zip code where your bank is located, and it will return the routing number.

How to find routing number on Cash App?

If you need the routing number associated with your Cash App account, you can find it directly on the app. First, select the money tab that is on the home screen.

You will then see an option to select the routing number of the account number below the display of your balance. Press this button to see your routing number.

How to find credit card routing number?

Credit cards do not have routing numbers. If you are being asked for your credit card’s routing number, there must be some sort of mistake, or you are being scammed, so be aware!

How to find credit union routing number?

If you have a checkbook associated with your credit union account, the routing number will be displayed in the bottom left corner of the check.

If not, you can find the credit union routing number by either searching the name of your credit union followed by routing number online or call the customer service number.

Remember that credit union routing numbers can be longer than 9 digits, so don’t assume the number is incorrect if you see more digits.