Table Of Content

What is a CD?

The certificate of deposit, also known as CD, represents a savings product that pay a fixed interest rate to the customer for depositing funds for a specific period.

Both CDs and savings accounts are indeed deposited products. However, there are some key differences between them. In the case of CDs, the client cannot withdraw the money before the term expires. To be more accurate, some banks allow their clients to withdraw money from CDs prematurely, but they have to pay the penalty for doing so.

At the same time, people are not allowed to add money to the deposit with most CDs. Instead, they should wait until the term expires, and then they can open a new CD with a more significant sum.

In the case of savings accounts, people can withdraw or add money to the savings account without such restrictions. They do not have to pay the penalty to touch their money.

One of the advantages of CDs is that the interest rate is fixed for the term, ranging from 3 months to 5 years. In contrast, with a savings account, the bank can change the interest rate at any time. So for those people, who want to have predictable returns on their savings, CDs might be a better option.

How Are CD Interest Rates Determined?

Interest rates on CDs and other deposit and loan products are determined by the bank. However, in most countries, their decisions are heavily influenced by the central bank interest rates.

In the US, this is called the Federal Funds Rate. This essentially determines the interest rates at which commercial banks can borrow money from the federal reserve. What happens in most cases in the US is that the interest rates on savings accounts are close to the federal funds rate.

At the same time, US banks add at least 2-3% to this interest rate to determine the rate at which they lend money to their best clients. This is also known as the prime rate.

For example, as things stand in April 2024, the US Federal Funds rate stands on 5.25% – 5.50% . As a result, some banks offer around 5.25% – 5.50% on CDs while charging around 6-8% for mortgages to people with a high credit score.

Finally, it is worth noting that the interest rate on CDs is usually higher than on savings accounts. So if a bank offers 2% of instant access savings account, then it might offer 3% or more on certificates of deposit.

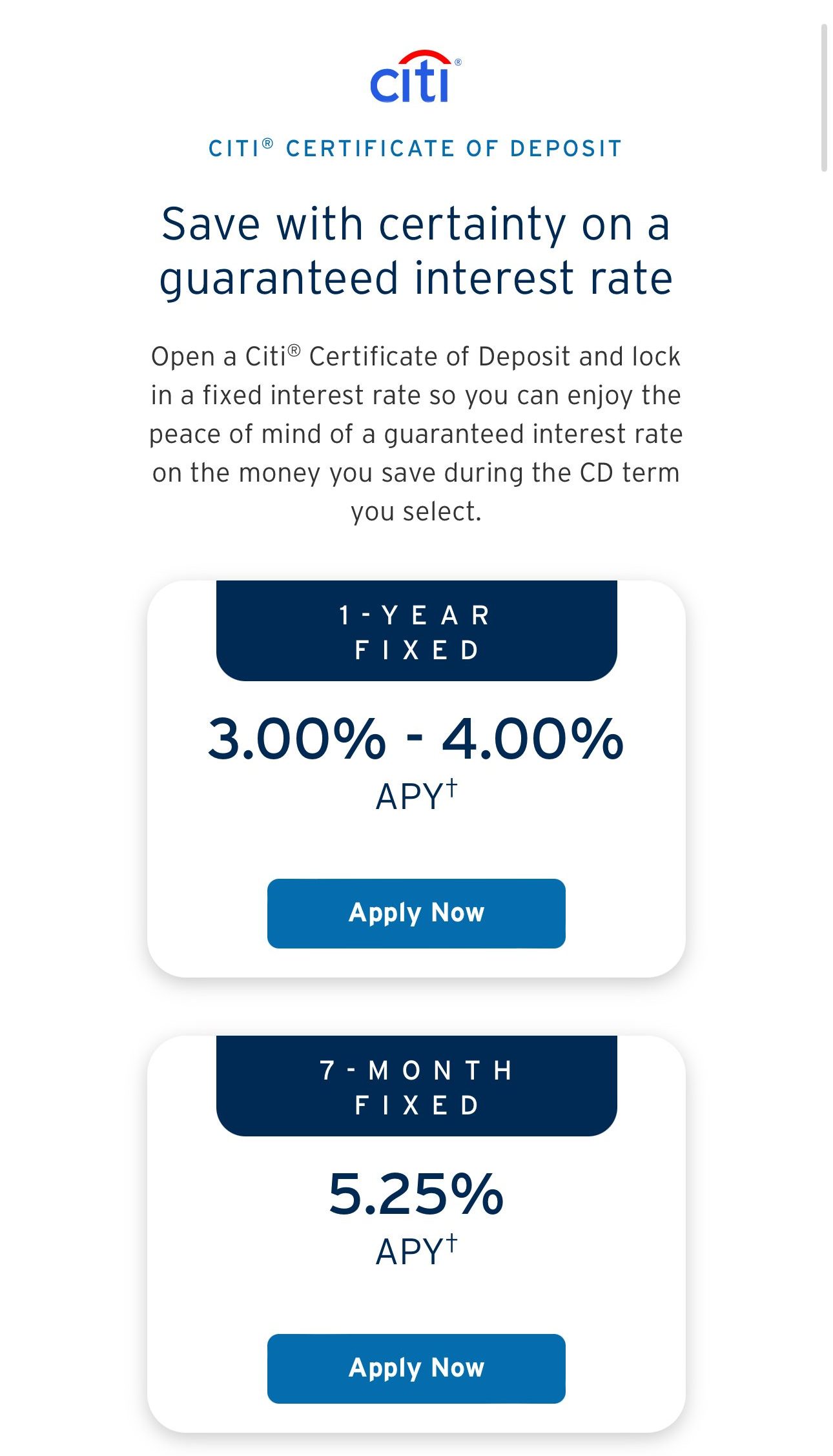

Financial Institution | CD Range |

|---|---|

Chase Bank | 3.00% – 4.75% |

Citi Bank | 0.05% – 4.75% |

Discover Bank | 2.00% – 4.70% |

Synchrony Bank | 2.05% – 5.15% |

American Express National Bank | Up to 4.75% |

Marcus | 4.00% – 5.05% |

Capital One | 4.00% – 5.10% |

Wells Fargo | 4.75%- 5.01% |

Bank Of America | 0.05% – 5.00% |

Ally Bank | 3.00% – 4.50% |

CIT Bank | 0.30% – 3.50% |

Types of CDs

Traditional CDs are naturally the most popular type, but there are more CD types to consider:

1. Traditional CDs

This is the most common type of CD. Its characteristics are:

- Fixed term (3 months, 6 months, a year, etc.)

- Fixed interest rate (for example, 1.5%)

- If you withdraw before the maturity ends – you have to pay a penalty.

- Protection by the FDIC if the deposit does not exceed $250,000

2. Brokered CDs

Stockbrokers and financial institutions may also offer deposits and they are called “brokered”. Actually, they represent a bank's offers, including those of online banking institutions. As a rule, brokered CDs are high-return, riskier and with a longer term.

In addition, not all of them are FDIC insured and might require a fee when purchasing the account. Moreover, sometimes there is a minimum limit of, for example, $10,000 to open an account.

3. Bump-Up CDs

CDs which do not offer a fixed interest rate are called variable- or flexible-rate CDs.

These usually carry a higher risk and a potential for greater returns. Normally, a person would buy a variable-rate CD with a longer term. There is an option of “bumping-up” which allows the account holder to adjust the interest rate according to market conditions. It's important to know how many times you can “bump-up” and when. Be sure to know all details, including when the interest is distributed.

I recommend this type to people who know the market very well. This is important because a person should know when exactly to adjust the interest rate and benefit the most.

4. IRA CDs

IRA CDs are Certificates of Deposit held within an Individual Retirement Account (IRA). Offering a secure way to save for retirement, these CDs provide tax advantages.

Contributions may be tax-deductible, and earnings can grow tax-deferred until withdrawal, aligning with long-term retirement savings goals.

5. Zero-coupon CD

The typical thing about this type is that it does not pay interest annually but rather distributes the amount after the end of the term. Banks offer zero-coupon CDs at great discounts, but you will have to pay taxes on the income. These CDs tend to offer higher rates.

6. Callable CD

Usually, brokers offer these types of CDs. The specific thing is that they contain a call feature. If the deposit has a term of 3 years, the bank might decide to end the contract prior to expiration.

Of course, there is a protection period, for example 6 months. If the bank does that, they have to pay the owner his money as well as the interest earned during the period.

7. Jumbo CD

This type of CD suits high-net-worth individuals seeking a secure investment option with a guaranteed return, albeit with a larger capital commitment.

Jumbo CDs are traditional Certificates of Deposit with a higher minimum deposit requirement, often exceeding $100,000. Despite the larger initial investment, Jumbo CDs typically offer slightly higher interest rates than standard CDs.

How Did CD's Interest Rates Change in Recent Years?

So what are the latest trends when it comes to CD interest rates? To answer this question, let us take a look at this chart:

This chart shows the upper range of the federal funds rate by the end of each year. There is no one standard CD interest rate to show here since the exact rates vary from bank to bank.

However, as mentioned before, CD rates are very closely tied to the federal funds rate, so this can give us some idea about the latest developments.

There is no denying the fact that savers had a hard time after the 2008 Financial Crisis. From late 2008 until 2014 the Federal Reserve kept rates close to 0.25%. As a result, the interest rates on most savings accounts were within the 0.01% to 0.25% range. CD offered slightly higher rates, mostly around 1%.

In 2022, the Federal Reserve faces a serious challenge, as inflation has surged above 8%, which is considerably higher than the long-term 2% target. As a result, the Fed has raised rates (currently 5.25% – 5.50% ). Consequently, some savers can now earn a 3% to 5% interest rate on CDs, depending on the financial institution.

How a CD Ladder Can Maximize Your Money?

The fact of the matter is that all savers face a dilemma:

- They can retain full access to their money by putting funds in a savings account. The only downside to this is that they have to accept lower interest rates.

- One alternative is to invest money in fixed-term CDs. In this case, they can earn higher returns but have no access to their money until the term expires.

Luckily, there is a third option. This is where CD laddering comes into play. This involves dividing the entire amount to be invested into several CDs at different maturities

To make this easier to understand, let's use an example. So let us suppose that you have $40,000 saved up and want to earn some interest on them and retain access to your money in the process.

One option is to put the entire amount in the savings account. At current rates, you can earn from 3% to 4%, depending on the financial institution. Now, earning 3-4% in a year is not that bad, but you can earn more with CDs (as long as you don't need the money).

So one alternative here is to open 4 CDs simultaneously:

- $10,000 CD for 3 months at 4.00%

- $10,000 CD for 6 months at 4.25%

- $10,000 CD for 9 months at 4.50%

- $10,000 CD for 12 months at 4.75%

Here are the expected earning if the interest compounded on a daily basis:

CD Term | APY | Interest Earned |

|---|---|---|

3 Months | 4.00% | $99

|

6 Months | 4.25% | $212

|

9 Months | 4.50%

| $339

|

12 Months | 4.75%

| $480

|

Once the 3-month term of the first CD expires, you can open a new 1-year CD at 4.27%. After some time, you can do the same with 6 and 9-month CDs.

Using this strategy, after 9 months you will be in a situation where all four CDs will be invested at 4.75%, but every 3 months you will have access to a quarter of your money, $10,000 plus interest earned.

Pros and Cons of CDs

- Higher Interest

CDs pay higher interest rates than savings accounts. The exact size of this differential varies, depending on the bank. However, in most cases, CDs pay 1% to 2% higher interest rates than instant access savings accounts.

- Fixed Rate

The interest rate on the CD is fixed until the end of the term. This is not the case with savings or money market accounts.

- Maximize by Laddering x benefits

People can use the CD laddering strategy to maximize their potential returns and retain a certain degree of access to their money in the process.

- FDIC Insured

CDs are insured for up to $250,000 per person per account.

- No Withdrawals

People might lose some portion of the principle if they decide to withdraw their money from CD before the term expires

- Inflation Risk

CDs are exposed to inflation risk. If the inflation rates are higher than CD interest rates, then savers will lose their purchasing power.

- Fixed Rate

With most CDs, savers cannot benefit from rising interest rates, since rates on CDs remain fixed, regardless of the latest rate changes.

What Makes for a “Good” CD Rate?

Here it is worth mentioning that in truth, there is no such thing as a ‘good’ CD rate. This is because such evaluation always depends on times and circumstances. For example, back in 2014, when the interest rates were at near zero levels, 2% CD seemed quite a decent option.

However, as the federal funds rate surpassed in the recent years, 2% does not seem as attractive. Now it’s possible to get 3.5% or even 4% CDs without much effort. It is also important to point out that brokered CD rates are higher than ones on regular CDs. This is because brokered CD involves a borrower, who needs funds and is ready to pay higher interest to the lender.

Generally speaking, a good CD rate might be an interest rate that at least matches the average inflation rate. This will allow people to retain the purchasing power for their savings. However, it is worth noting that in a low-interest rate environment, finding such CDs can be a challenging task.

When It May Make Sense to Get a CD?

There are some cases when getting a CD might be beneficial:

- Not For The Short Term – CDs can useful for medium-term goals, such as saving money for a car purchase or down payment. In this case, people can earn interest on their funds, which are higher than a savings account. At the same time, by investing in CDs, their money is not exposed to market volatility.

- Not For Investing – The certificates of deposit can also be useful for those individuals who are not yet comfortable with investing in the stock market or real estate or prefer not to take the risk. It will make sense to put savings on CD, before gaining the necessary knowledge about those investment vehicles (in case you believe you can get a higher yield on investing).

It is also important to recognize that some people are psychologically not ready to invest in stocks or mutual funds. Seeing the value of an investment account going up and down by several percentage points daily can be very challenging for many people.

Failure to control one’s emotions and the lack of knowledge are two main reasons why some people lose money in the stock market. Therefore, if an individual is facing one or both of those problems, then it might be better to put money on CDs. This can be a good way to avoid unnecessary losses.

Which Banking Institutions Offer High CD Rates?

The FED has drastically increased the Federal Fund rates in 2022, and consequently, we can higher rates on CD deposits. Here are some of the bank offering competitive rates on CDs:

When It May Not Make Sense Yo Get A CD?

At this stage, it is important to recognize that investing money in CDs might not make sense for some people:

- Retirement Savings: CDs might not be the best option for those people investing in retirement.

- Emergency Fund: It might make more sense to put an emergency fund in a savings or money market account, rather than on a CD.

Discussing those points in greater detail, the obvious question is: Why CD might not be the best option for retirement?

The fact of the matter is that since 2008 people who invested their money in CDs were losing their purchasing power most of the time. From 2008 to 2014, as well as from 2020 to early 2022, interest rates on most CDs were within the 0.1% to 1.5% range.

Here it is important to remember that the long-term average inflation in the US is close to 3%. So, in real terms savers were losing 1.5% to 2.9% per year. This might not seem much for a single year, but over time, this can wipe out most of the purchasing power of the retirement fund.

So as we can see here, most of the time, CDs pay lower interest rates than inflation. This diminishes the purchasing power of the savings over the long term.

It is also worth mentioning that CDs are not the best place for an emergency fund. The main purpose of the emergency fund is to have some cash at hand in case of unexpected expenses. So in this case, putting those funds in the savings or money market account might be more appropriate.

Where Can I Get a CD?

There are several places one can get a CD, including:

- Traditional Banks

- Credit Unions

- Online Banks

Opening a CD at a bank is quite simple. You can do this by visiting the branch, or through the website. Some banks even allow their customers to open CDs, using the mobile banking app.

Credit unions generally offer higher interest rates on CDs. However, you first have to become a member, before being able to open CD. You can apply for membership in a credit union, but there is no 100% guarantee that they will approve your application.

Another way to earn higher rates on CDs is to open an account at one of the online banks. They typically offer higher rates, because they have fewer expenses. They do not have to pay rent for dozens of branches. Also, those institutions do not have to hire hundreds of bank tellers and managers, as regular brick-and-mortar banks must do.

As a result, they pass some of those cost savings to their customers by paying higher interest rates on CDs. Online banks are always looking for new customers and provide the highest rates if you open an online account. Therefore, opening a CD with them might be easier than with credit unions.

How to Find the Best CD?

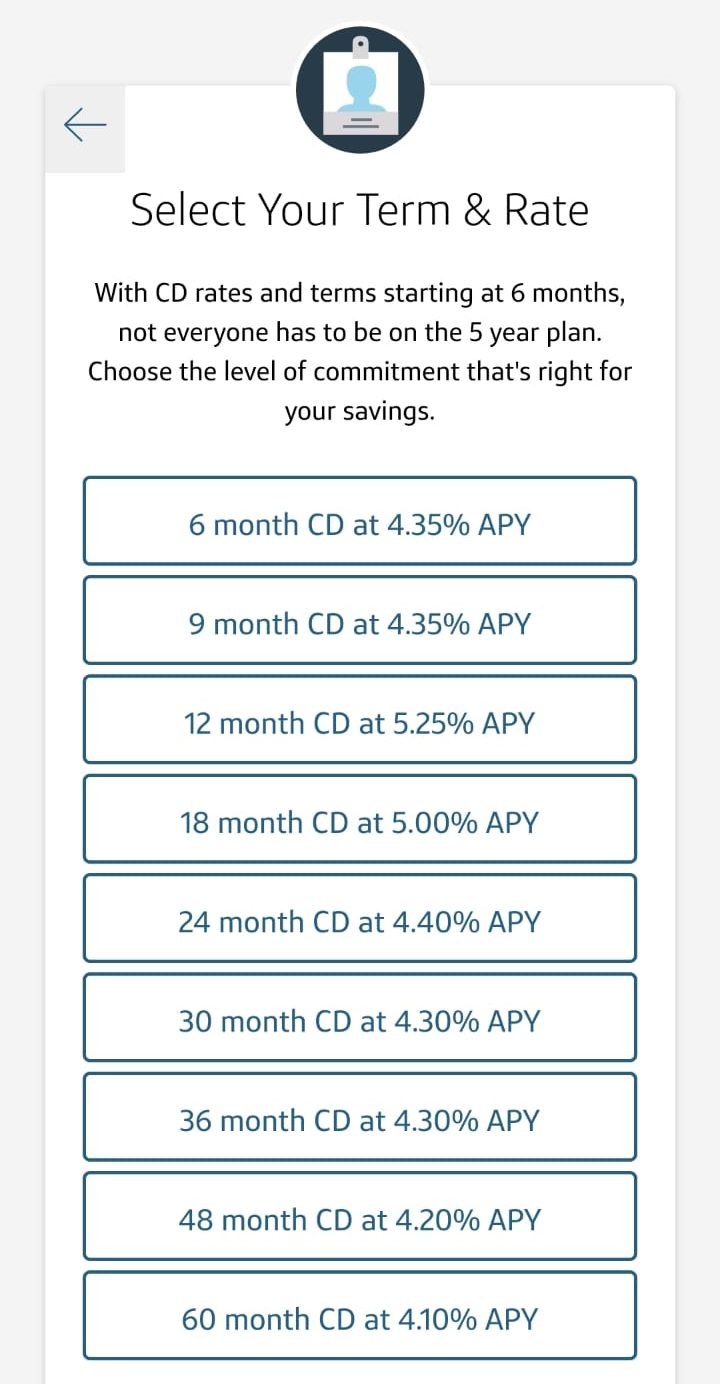

Before starting to research CD rates it is important to know how long you can afford to lock away the funds you want to invest in CDs. As mentioned before, the CD terms range from 3 months to 5 years.

Generally speaking, longer-term CDs have higher rates than shorter-term CDs. It is also worth keeping in mind that some banks might offer better rates for 3-month CDs, while others might have higher interest rates for 1-year CDs. This is why it is important to know beforehand what you are looking for.

You can search for the best rates by visiting individual sites of banks and credit unions. Alternatively, you can check some financial blogs and other websites which show the latest CD rates. Then you can write down some of the best rates you have seen and choose from this list.

One thing to pay attention to is the minimum amount required to open a CD. The fact of the matter is that the bank might offer a good rate for CD, but the minimum deposit required might be larger than what you have saved up. So this is something to keep in mind.

What is the Connection Between Inflation and CDs?

At this point, it is important to realize that there is some positive correlation between the inflation rate and interest rate on CDs. Why this is the case?

Well, one of the mandates of the US Federal Reserve is to maintain price stability. They define price stability as the inflation rate running at 2%. However, it is important to note that instead of CPI, they use personal consumption expenditures, also known as PCE.

The difference between those two varies depending on the period and circumstances. However, it’s safe to assume that CPI is on average around 0.5% higher than PCE. So if the Fed were still using CPI, then its target would likely be around 2.5%.

When inflation rises significantly above the target, then the Fed is likely to hike its Federal funds' rate. As a result, the interest rates on CDs will rise. The opposite is also true. So one way to get an idea of where CD rates are headed in the future is to look at BLS inflation data.

Yet, it is important to keep in mind that if the inflation rate is just slightly above its target, then the Fed might decide not to act as a response. So there is no 100% correlation between inflation and interest rates on CDs.

Are CDs Safe?

Certificates of deposit are considered to be a low-risk investment. There are several reasons for this.

Firstly, CDs offer a fixed rate of return and the principal amount invested is not subject to stock market fluctuations. So regardless of how the stock and bond markets perform, the owner of the CD will not lose the principal.

It is also worth keeping in mind that CDs are FDIC insured for up to $250,000 per account per person. This means that if you hold on to your CD of $250,000 or less, you will not lose your money if the bank fails.

Finally, it is helpful to point out that the interest rate is fixed for the term of the CD. For example, let us suppose that you open a 4% CD for 5 years. Even if rates on new CDs drop to 1% or less in the future, the bank will still pay you 4% until the 5-year term expires.

What are CD Rollovers?

CD rollover represents a renewal of the CD once its term expires. Banks can offer their clients to automatically renew CDs if they so wish. However, in this case, the regulations state that banks should still notify their customers about the renewal.

One thing to keep in mind here is that there is no guarantee that the interest rate on CD after the rollover will be the same as before. At that time the interest rate offered on that CD might be higher or lower, depending on the Federal funds rate and other factors.

Therefore, it might make sense to check the interest rate and other terms on your CD, before renewing it. This is because interest rates could be too low. You might feel locking away your money for 1% or 0.5% on your CD might not be worth it.

How Are CDs Taxed?

The first $10 interest earned on CDs is tax-exempt. Any amount above that is taxed as an ordinary income. So the actual rate earned interest is taxed depending upon your tax bracket.

Therefore, if the amount on CD is small and the total amount of interest earned per year is lower than $10, you do not have to pay any taxes on that. For higher amounts, you have to report it on your tax return and pay taxes.

If the term of the CD is larger than the year, you have to calculate and report the amount of interest earned annually. For example, if you hold 5 year CD and earned $100 in interest, then the annual amount of interest would be $20.

The only way to legally avoid paying taxes on CD is to place it in tax-deferred accounts, such as 401K or IRA.

FAQs

What Is a “No-Penalty” CD Rate?

No penalty CD represents the certificate of deposit, where clients do not have to pay a penalty if they decide to withdraw their money from the CD before the term expires.

In most cases, Interest rates on CDs generally tend to be slightly lower compared to regular CDs.

How does a certificate of deposit work?

The main idea behind CD is that bank pays the client a fixed amount of client interest, in exchange for a deposit for a specific term.

Unlike savings accounts, banks do not change interest rates until the term ends. At the same time, in most cases, the client has to pay a penalty if he or she withdraws funds from CD prematurely.

How long does a certificate of deposit last?

Terms on certificates typically range from 3 months to 5 years. The exact number of options offered depends on the bank itself.

For example, with most banks, you can open CDs with 3,6,9, and 12 months as well as 2,3,4, and 5-year terms.

Is a certificate of deposit FDIC insured?

Certificates of deposit are FDIC insured. This means that if the bank fails, each depositor will receive its money back with the upper limit of $250,000 per person per account.

With this in mind, it might be a good idea not to invest more than $250,000 in a single CD.

Can you add money to a certificate of deposit regularly?

In most cases, depositors are not allowed to add any money to CD until the term ends. What they can do instead, is to add funds to the amount on the CD, once the term expires and open a certificate of deposit for a larger amount.

One alternative to this is to open a savings or money market account, where you can add money without any limitations.

Are certificates of deposit liquid?

Certificates of deposit are not the most liquid instruments. This is because in most cases people have to pay a penalty for withdrawing money from CD prematurely.

Therefore, CDs might not be the best place for putting the emergency fund money

Why CDs rates are usually higher than savings accounts?

Banks typically pay higher rates with CDs because of their predictability. With a savings account, you can withdraw money at any moment.

On the other hand, with CDs, bankers know when they have to return your money. So this allows them to lend it out at a higher rate before the term on CD expires.

Why CDs rates are usually higher than money market accounts?

Funds are money market accounts that are mostly invested in treasuries or other short-term fixed-income securities. This is because people can withdraw money from money market accounts at any time. So it has to stay liquid.

On the other hand, with CDs banks can use the money to issue loans, mortgages, and other types of debt products, earning interest in the process.