Investing in certificates of deposit (CDs) is an excellent way to grow your savings while enjoying a predictable return on your investment. However, unforeseen circumstances may arise, necessitating an early withdrawal from your CD account.

This is where understanding the early withdrawal penalties associated with different CDs becomes crucial. To help you make an informed decision, we have compiled a comprehensive list of the best CDs with low early withdrawal penalties.

In this article, we explore various financial institutions and their CD offerings, focusing on those that strike a balance between competitive interest rates and minimal penalties for early withdrawal.

Ally Bank

APY Range

Minimum Deposit

Terms

Fees

If you decide to withdraw your money from the CD before it reaches its maturity date, Ally Bank will apply a penalty. The amount of the penalty depends on how long you initially agreed to invest your money.

If your CD term is 24 months or less, the penalty will be equivalent to 60 days‘ worth of interest. However, if you chose a CD term of four years or longer, the penalty will increase to 150 days' worth of interest.

If you want to avoid penalty at all, you can consider Ally No-penalty CD, which allow you to withdraw your money without any penalties after a six-day waiting period.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 3.00% | 60 days of interest

|

6 Months | 4.40% | 60 days of interest

|

9 Months | 4.45% | 60 days of interest

|

12 Months | 4.50% | 60 days of interest

|

36 Months | 4.00% | 90 days of interest

|

60 Months | 3.90% | 150 days of interest |

11 Months | 4.00%

| No Penalty |

Ally has different types of CDs, each with its own unique features. The “High Yield CD” guarantees a fixed interest rate, but if you withdraw your money before the CD matures, you will face penalties.

The “Raise Your Rate CD” gives you the ability to increase your interest rate if Ally decides to raise rates for new CDs within the same time period.

Consumers Credit Union

APY Range

Minimum Deposit

Terms

Fees

Consumers Credit Union presents an enticing opportunity with its special CDs, offering highly competitive rates. However, it's important to note that some aspects of the terms could be improved.

One notable advantage is the low early withdrawal fee: if you withdraw funds from a certificate with a term of 12 months or less, you'll incur a penalty equivalent to 60 days of interest on the amount withdrawn. For certificates with longer terms, the penalty increases to 120 days.

Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 0.50%

| 60 days of interest |

6 Months | 0.65%

| 60 days of interest |

11 Months (Special) | 4.55%

| 60 days of interest |

12 Months | 0.99% | 60 days of interest |

17 Months (Special) | 4.22% | 120 days of interest |

24 Months | 1.19% | 120 days of interest |

36 Months | 1.29% | 120 days of interest |

48 Months | 1.34% | 120 days of interest |

60 Months | 1.49% | 120 days of interest |

Keep in mind that regardless of the term you select, a minimum deposit of $250 is required. However, rest assured that your funds are safeguarded by NCUA coverage.

Sallie Mae

APY Range

Minimum Deposit

Terms

Fees

All CDs require a minimum deposit of $2,500 upon opening, and your account will accumulate interest on a monthly, quarterly, annual, or maturity basis. You also have the option to have the interest transferred to a linked bank account at these intervals.

For CDs with terms of 12 months or less, the penalty is equivalent to 90 days of simple interest. For CDs with longer terms, the penalty is equivalent to 180 days of simple interest.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

6 Months | 4.80% | 90 days of interest |

9 Months | 4.85% | 90 days of interest |

12 Months | 4.95% | 90 days of interest |

18 Months | 4.75% | 180 days of interest |

24 Months | 4.50% | 180 days of interest |

30 Months | 4.00% | 180 days of interest |

36 Months | 4.00% | 180 days of interest |

60 Months | 4.00% | 180 days of interest |

Regrettably, Sallie Mae Bank does not offer CDs without penalties. If you need to withdraw funds before the CD reaches maturity, a penalty will be applied. The amount of the penalty is determined based on the duration of your CD.

Citibank

APY Range

Minimum Deposit

Terms

Fees

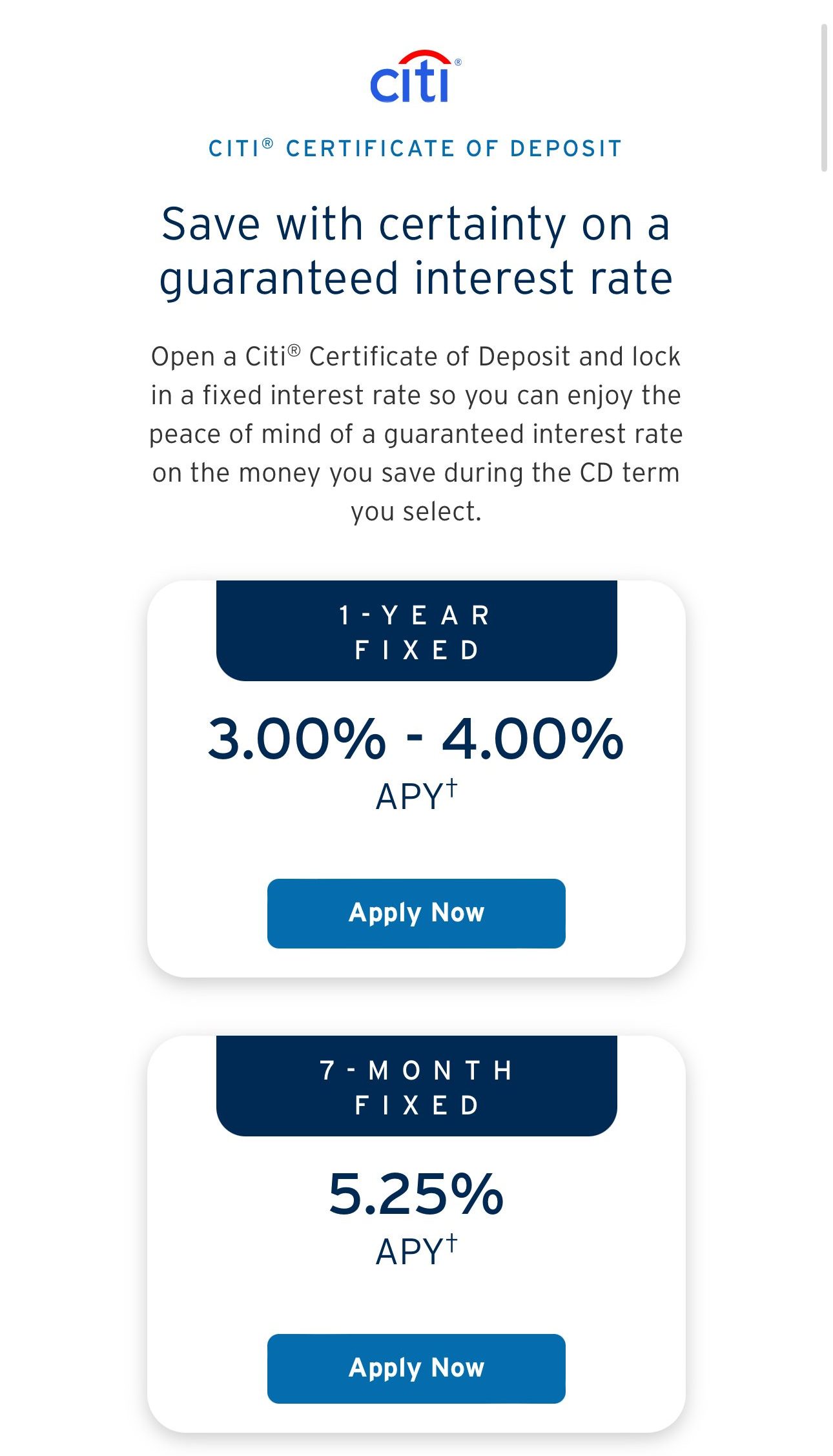

Citibank, one of the largest banks in the United States, offers a diverse range of CDs that cater to different preferences. They provide both fixed-rate CDs and no penalty CDs, which is uncommon for a traditional bank.

In terms of early withdrawal penalties, Citibank demonstrates reasonable policies, particularly for long-term CDs. If your CD matures within a year or less, you will forfeit 90 days of simple interest upon early withdrawal. However, for CDs with terms exceeding one year, the penalty increases to 180 days of simple interest.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 0.05% | 90 days interest |

6 Months | 4.75% | 90 days interest |

9 Months | 3.75% | 90 days interest |

12 Months | 2.00% – 3.00% | 90 days interest |

12 Months – No Penalty | 0.05% | / |

18 Months | 2.00%

| 180 days interest |

24 Months | 2.00% | 180 days interest |

30 Months | 0.10% | 180 days interest |

36 Months | 2.00% | 180 days interest |

48 Months | 2.00% | 180 days interest |

60 Months | 2.00% | 180 days interest |

One intriguing feature of Citibank CDs is the availability of fixed-rate CDs, no penalty CDs, and step-up CDs. The step-up CD offers an interest rate that automatically increases every 10 months.

Marcus by Goldman Sachs

APY Range

Minimum Deposit

Terms

Fees

Marcus, among the numerous online banks available, stands out for its competitive CD rates. It boasts a diverse range of CD products with varying terms, and the process of opening a CD on their website is quick and efficient, taking only a few minutes.

To initiate a CD with Marcus by Goldman Sachs, a minimum deposit of $500 is required. Customers have a window of up to 30 days from the CD's opening to fully fund it, after which additional contributions cannot be made.

When it comes to early withdrawal fees, Marcus offers reasonable terms, particularly for long-term CDs. Moreover, they also provide one of the highest no-penalty CD rates.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

6 Months | 4.80% | 90 days interest |

9 Months | 4.90% | 90 days interest |

12 Months | 4.90% | 180 days interest |

13 Months – No Penalty | 4.15% | / |

18 Months | 4.60% | 180 days interest |

24 Months | 4.90% | 180 days interest |

36 Months | 4.15% | 180 days interest |

48 Months | 4.05% | 180 days interest |

60 Months | 4.00% | 180 days interest |

72 Months | 3.90% | 270 days interest |

The interest earned on a Marcus CD is automatically added to the principal balance on a monthly basis. However, you have the choice to withdraw the accumulated interest without any penalties and transfer it to a Marcus savings account or an external bank account that you have linked.

It's important to note that withdrawing the earned interest during the CD's term will reduce the overall amount you earn from your CD.

Top Offers From Our Partners

Alliant Credit Union

APY Range

Minimum Deposit

Terms

Fees

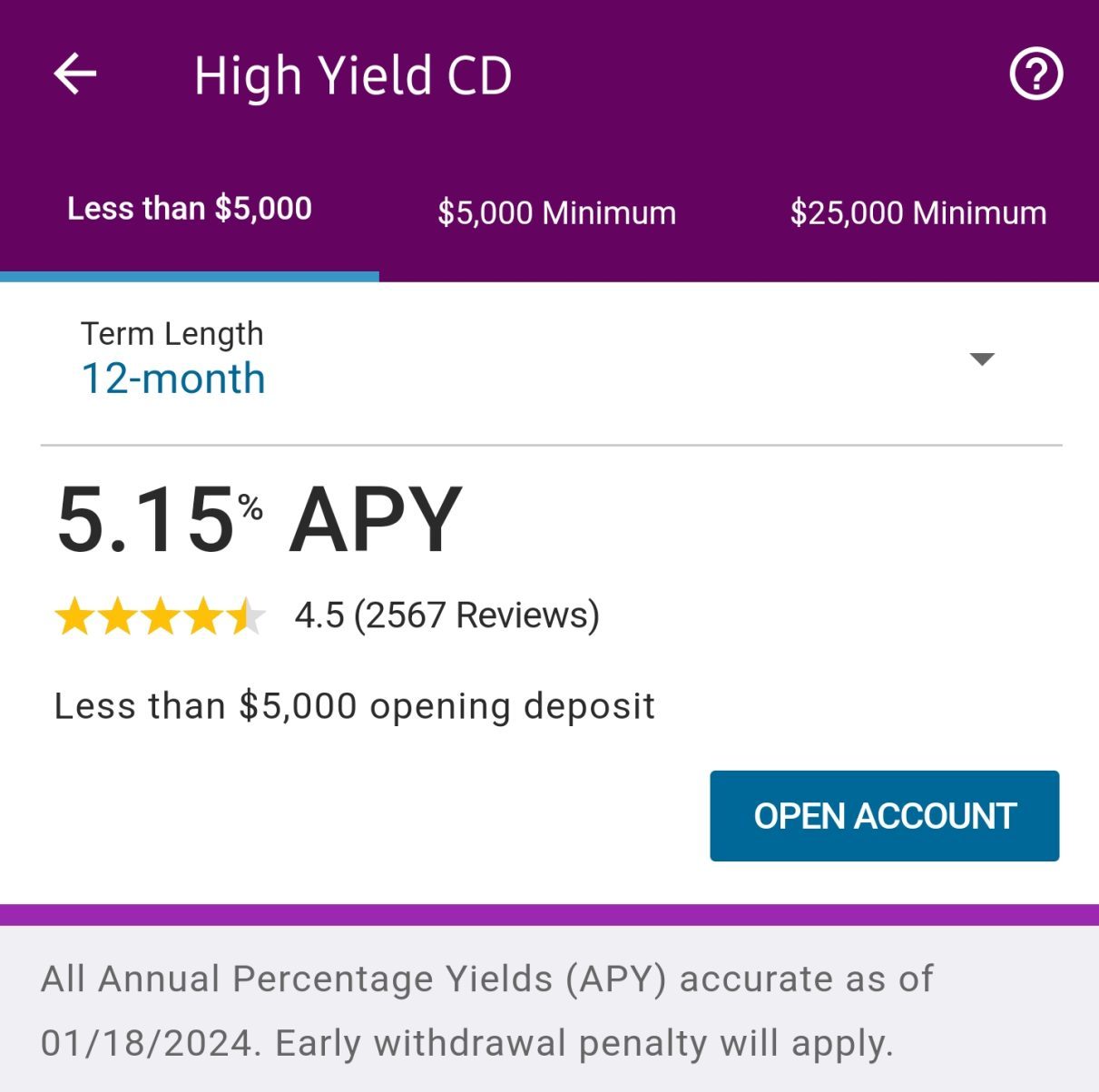

Alliant Credit Union provides competitive rates for their certificates, which vary depending on the chosen term. Their rates are highly competitive nationwide across a wide range of terms, including certificates with durations longer than one year. Currently, Alliant Credit Union offers a range of 5.08%-5.20% APY for their certificates.

For certificates with terms of 17 months or less, the penalty for early withdrawal is based on the number of days the certificate has been open, up to a maximum of 90 days.

For certificates with terms of 18 to 23 months, the penalty can be up to 120 days. For certificates with terms between 24 and 48 or 60 months, the penalty can be up to 180 days.

Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 4.25% | 90 days of interest |

6 Months | 5.00% | 90 days of interest |

12 Months | 5.15% – 5.20 | 90 days of interest |

18 Months | 4.90% – 4.95% | 120 days of interest |

24 Months | 4.30% – 4.40% | 180 days of interest |

36 Months | 4.20% – 4.30% | 180 days of interest |

48 Months | 4.05% – 4.10% | 180 days of interest |

60 Months | 4.00% – 4.05% | 180 days of interest |

During the 7-day grace period for new certificates, if an early withdrawal occurs, there is a penalty of 7 days. It's important to note that no dividends are earned during this period, and a penalty will be deducted from the principal balance.

What Else To Consider When Choosing A CD?

When choosing a CD, there are several factors besides interest rates and early withdrawal penalties. Here are additional factors to take into account:

Term Length: Determine the length of time you are willing to commit your funds. CDs come in various term lengths, such as three months, six months, one year, or even longer. Longer-term CDs typically offer higher interest rates.

Minimum Deposit Requirement: Check the minimum deposit required to open a CD. Some banks have high minimum deposit requirements, while others offer options with lower minimums. Choose a CD that aligns with your financial capabilities.

Renewal Options: Understand the renewal options available once the CD reaches maturity. Some CDs automatically renew at the same term length, while others offer the flexibility to choose a different term or withdraw the funds.

Interest Payment Frequency: Determine how frequently the CD pays interest—monthly, quarterly, annually, or at maturity. Consider your cash flow requirements and choose a payment frequency that suits your needs.

Bank Reputation and Ratings: Research the bank's reputation and financial stability. Check ratings from independent agencies such as Moody's, Standard & Poor's, or Fitch to gauge the bank's strength and reliability.

By considering these factors, you can make an informed decision when choosing a CD that aligns with your financial goals and preferences.

FAQs

Are there any alternatives to CDs with low early withdrawal fees?

If liquidity is a primary concern, you may consider other savings options such as no-penalty CDs, high-yield savings accounts or money market accounts, which generally offer more flexibility but lower interest rates.

Can I negotiate the early withdrawal penalty with the bank?

In most cases, the early withdrawal penalty is set by the bank and cannot be negotiated. However, it's always worth inquiring with the bank to see if they offer any flexibility.

Are there any disadvantages to CDs with low early withdrawal fees?

While these CDs offer flexibility, the interest rates might be lower compared to CDs with stricter withdrawal penalties. Additionally, they might have higher minimum deposit requirements or shorter terms.

How do I find CDs with low early withdrawal fees?

Research and compare different banks and financial institutions that offer CDs, paying attention to the early withdrawal penalty terms and conditions they provide. If you are not sure, you can always find it in the bank’s website.

Why should I consider CDs with low early withdrawal fees?

These CDs offer flexibility and liquidity, allowing you to access your funds if needed without incurring substantial penalties, providing a balance between earning higher interest rates and maintaining access to your money.

How We Picked The Best CD Accounts With Low Early Withdrawal Fees: Methodology

The Smart Investor team meticulously reviewed numerous banks and credit unions to uncover the best CD accounts with low early withdrawal fees. We focused on four main categories to rate them:

Early Withdrawal Fees and Terms (50%): We evaluated the APY offered and fees associated with early withdrawals from CD accounts, including penalties for withdrawing funds before the maturity date. CD accounts with lower early withdrawal fees and higher rates received higher ratings in this category.

Account Features (20%): This category assessed the features and benefits offered by each CD account, such as the minimum deposit required to open the account, options for interest payouts (e.g., monthly, quarterly, or at maturity), and whether the CD account offers flexible terms. CD accounts with additional features and flexibility earned higher scores.

Customer Experience (20%): We closely examined the ease of opening a CD account, communication with customer service representatives, the usability of online banking platforms (tested by our team), and the availability of support channels. CD accounts offered by banks with user-friendly interfaces, responsive customer support, and efficient digital banking tools received higher ratings.

Bank Reputation (10%): Our team analyzed each bank's reputation based on factors such as customer satisfaction ratings, JD Power scores, TrustPilot reviews, and the bank's Better Business Bureau (BBB) profile. Banks with positive reputations and minimal customer complaints regarding CD account services received higher ratings.

Within each category, we assigned weights to various features and qualities to ensure a comprehensive evaluation of each CD account.