Discover is one of the leading American Financial services companies. It owns and operates Discover Bank, plus Discover credit cards. The Discover Card brand is the third largest in the U.S, with almost 50 million cardholders.

Today, Discover aims to provide superb customer service with its 100% U.S based support team. The company offers products that are tailored to help people to achieve their financial goals. Discover offers a variety of cards to help you to find one that is best suited to your needs and spending habits.

Here are The Smart Investor select's picks of the best Discover credit cards:

Card | Rewards | Bonus | Annual Fee | Best For |

| 1-5%

5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

| Cashback Match

All cash back earned at the end of the first 12 months is matched.

| $0 | Cash Back Rewards |

|---|---|---|---|---|---|

| Discover it® Chrome Gas & Restaurants | 1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all your other purchases

| Match Bonus

Discover matches all cash back you earn at the end of your first year

| $0 | Low Spenders |

| Discover it® Miles | 1.5X

unlimited 1.5x miles for every dollar spent on all purchases

| Discover Match®

All miles earned at the end of the first year are matched.

| $0 | Travel Rewards |

| Discover it® Student Chrome | 1-2%

2% cashback at gas and restaurants (up to $1,000 every quarter) and 1% on groceries and other student related products

| Match Bonus

Discover will match all cash back earned at the end of your first year

| $0 | College Students |

| Discover it® Secured | 1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and unlimited 1% cash back on all other purchases

| Cashback Match™

Discover will match all the cash back you’ve earned at the end of your first year.

| $0 | Building Credit |

Discover It Cash Back

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Discover it® Cash Back is one of our favorites, mainly due to its high flexibility. This card offers a very high rewards rate on some categories that rotate every few months. The card gives a 5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases. Some of the categories include; restaurant, gas station, online shopping and many more each time you activate them. However, on all other purchases, excluding the ones in the category selected, you will only receive a 1% cashback.

The Discover it® Cash Back also offers 15 months on purchases and balance transfers and a great sign up bonus. This card is best for individuals who understand their spending habits and want to leverage the high reward rate the card offers, or those who plan a big purchase in the next couple of months.

- Rewards Plan: 5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

- APR: 17.24% – 28.24% Variable

- Annual fee: $0

- Balance Transfer Fee: 5%

- Foreign Transaction Fee: $0

- Sign Up bonus: All cash back earned at the end of the first 12 months is matched.

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- 0% Intro APR Period

- High Cash Back for Select Spending Categories

- Matches Cash Back in the First 12 Months

- No Annual Fee

- Limit on Cash Back Spending Per Quarter

- Keeping Track of Bonus Categories

- Balance Transfer Fee

- What are the cash-back rewards limit? There is a $1,500 cap on purchases each quarter that allows you to get the bonus cashback rates. Otherwise, no cap.

- Does Discover it Cash Back ask for proof of income? No out and out request for proof of income and no transparent income requirements.

- Does card rewards points expire? No expiry date for these points.

- Can I get pre-approved on card Discover it Cash Back? Yes, you can get pre-approval.

- What is the initial credit limit of card Discover it Cash Back Card? The minimum credit limit will be $300.

- How do I redeem cash back? You can get the rewards in the form of cash, statement credit, or gift cards.

- What purchases don't earn cash back ? All purchases will earn cashback.

- Should You Move to Discover it Cash Back Card? If you want to get good rewards from bonus categories and want access to a good signup offer.

- Why did Discover deny me? What to Do Next? You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

Discover it® Chrome Gas & Restaurants

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Discover it® Gas & Restaurants card is a decent cash back cards for low spenders. The card offers higher cash back for gas and restaurants which is very useful categories, but the quarterly cap is not so high, therefore high spenders couldn't get too much from this card.

When it comes to rewards, cardholders earn 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all your other purchases. As any other Discover card, new applicants enjoy a nice sign up bonus – Discover matches all cash back you earn at the end of your first year. In addition, the card can be relevant for those who are looking for a generous 0% intro APR.

- Rewards Plan: 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all your other purchases

- APR: 17.24% – 28.24% Variable

- Annual fee: $0

- Balance Transfer Fee: 5%

- Foreign Transaction Fee: 0%

- Sign Up bonus: Discover matches all cash back you earn at the end of your first year

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- 0% Intro APR Period

- Gas & Restaurants cash back

- Matches Cashback in the First 12 Months

- No Annual Fee

- Limit on Cash Back Spending Per Quarter

- Low cap for Hhigher Cashback

- There are Better Cashback Cards

- Balance Transfer Fee

Does the Chrome Card have a cash-back rewards limit?

There is a $1,000 cap on purchases each quarter that allows you to get the bonus cashback rates. Otherwise, no limit.

Does Discover it chrome Card ask for proof of income?

No out and out request for proof of income and no transparent income requirements.

How do I redeem cash back?

You can get the rewards in the form of cash, statement credit, or gift cards.

Why did Discover it chrome Card deny me?

You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

How to maximize rewards on Discover it chrome Card?

Try to make the most of the quarterly cap on the 2% cashback for gas and dining, as well as the signup offer.

Discover it® Miles

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

The Discover it® Miles credit card is a solid entry level option for the occasional traveler who is looking to earn rewards towards flights, hotels, and car rentals. It has a flat rate of rewards and a very simple redemption process. The card offers unlimited 1.5x miles for every dollar spent on all purchases with no annual fee. Also, Discover will match your points earned in the first 12 months of opening an account.

If you frequently travel abroad, the card does not charge any foreign transaction fees. However, you'll need good-excellent credit score to get the Discover it® Miles. Overall it can be a great fit for people who travel occasionally and would like to avoid an annual fee.

- Rewards Plan: unlimited 1.5x miles for every dollar spent on all purchases

- APR: 17.24% – 28.24% Variable

- Annual fee: $0

- Balance Transfer Fee: 5%

- Foreign Transaction Fee: $0

- Sign Up bonus: All miles earned at the end of the first year are matched.

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- Matches the Miles You Earn in Your First Year

- Flexible Redemption Options

- No Foreign Transaction Fee

- No Annual Fee

- Balance Transfer Fee

- Not the Highest Rewards Rate as a Travel Credit Card

- Not For Everyday Spending

Discover it® Student Chrome

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

Discover it® Student chrome offers 2% cashback at gas and restaurants (up to $1,000 every quarter) and 1% on groceries and other student related products.

This card also rewards you with a cashback match by doubling all the cashback you've accumulated in the first year. This means that $100 could turn to $200, which you could redeem for statement credit, gift cards, and other options. This card does not charge an annual fee, and new cardholders enjoy a 0% APR for 6 months on purchases.

- APR: 17.74% – 26.74% Variable APR

- Annual fee: $0

- Balance Transfer Fee: 5%

- Foreign Transaction Fee: $0

- Rewards Plan: 2% cashback at gas and restaurants (up to $1,000 every quarter) and 1% on groceries and other student related products

- Sign Up bonus: Discover will match all cash back earned at the end of your first year

- 0% APR Introductory Rate period: 6 months on purchases

- No Annual Fee

- Cash Back Rewards

- No Foreign Fees

- Higher Cashback on Specific Categories

- Cap on Higher Cashback

- Is there a limit to cash back rewards? Quarterly cap on 2% cashback rate for gas and dining purchases up to $1,000 in purchases.

- Can I get car rental insurance with Student Chrome Card? No.

- What are the income requirements? None, but fair/no credit is required.

- Can I get pre-approved? Yes.

- What is the initial credit limit? Usually $500.

- How do I redeem cash back? The rewards can be redeemed at any time for the likes of electronic deposits, statements credits, charitable donations or to pay at certain retailers like Aamzon.com.

- What purchases don't earn cash back with the Student Chrome Card? All purchases get cashback.

- Should You Move to Student Chrome Card? If you want something simple that offers decent rewards that are consistent.

- Why did Student Chrome Card deny me? You should ask the customer service team. Otherwise, you can look at other options.

- How hard is it to get Student Chrome Card? Not hard as no/fair credit score is needed.

- How to maximize rewards on Student Chrome Card? Maximize quarterly caps and use them in conjunction with higher-paying cards if possible.

- Top Reasons NOT to get the Student Chrome Card? If you are not a student or you have good credit, there are better cashback cards out there.

Discover it® Secured

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

The Discover It Secured credit card is a great way to build your credit history while still earning cash back rewards like a normal credit card. This is a great credit card option for students as well as folks trying to repair their credit history. Establish your credit line by providing a refundable security deposit from $200-$2,500 after being approved.

Bank information must be provided when submitting your deposit. Automatic reviews starting at 8 months to see if Discover can transition you to an unsecured line of credit and return your deposit.

- Rewards Plan: 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and unlimited 1% cash back on all other purchases

- APR: 28.24% Variable

- Annual fee: $0

- Balance Transfer Fee: 5%

- Foreign Transaction Fee: 3%

- Sign Up bonus: Discover will match all the cash back you’ve earned at the end of your first year.

- 0% APR Introductory Rate period: None

- Build Credit History

- Cash Back Rewards

- Flexible Redemption Options

- Refer a Friend for Cash Back

- Put Down a Refundable Deposit

- Less Merchant Acceptance

- High Purchase APR

How to Compare Discover Credit Cards

Discover is one of the leading American Financial services companies. It owns and operates Discover Bank, plus Discover credit cards. The Discover Card brand is the third largest in the U.S, with almost 50 million cardholders.

The Different Types of Discover Credit Cards

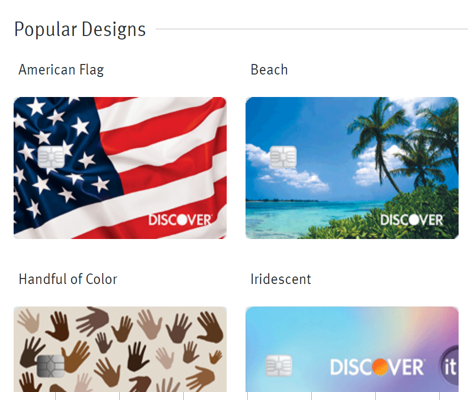

Discover offers a variety of cards to help you to find one that is best suited to your needs and spending habits. The current selection of cards include:

Cash Back Card

As the name suggests, the Discover it® Cash Back Card offers cash back on your spending. You can earn 5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases.

The card has no annual fee and there is a 0% APR introductory rate for 15 months on purchases and balance transfers . After this time, the rate increases to 17.24% – 28.24% Variable APR depending on your circumstances.

Gas Station and Restaurants

The Discover it® Gas Station and Restaurant card earn 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all your other purchases, including a nice sign up bonus of Discover matches all cash back you earn at the end of your first year

Travel Rewards

If you are looking for a travel rewards card, the Discover it® Miles card could be a good option for you. You’ll earn unlimited 1.5x miles for every dollar spent on all purchases. Discover automatically matches the miles you earn in your first year, with no minimum spending or maximum rewards. So, you’ll earn miles for miles match.

The card has no annual fee with a 0% APR introductory rate for 15 months on purchases and balance transfers.

Secured

The Discover It Secured credit card offers a solution for those looking to rebuild or establish a credit file. You’ll need to open your account with a refundable security deposit. This amount of deposit will influence your approved credit line.

In addition to offering this option for a genuine credit card, you can also earn 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and unlimited 1% cash back on all other purchases.

NHL Cards

This is a great option for hockey fans. You can not only pick your team to adorn your new card, but enjoy some superb rewards. You can earn higher cashback in selected categories that change each quarter. There is a maximum cap of $1,500 per quarter, but you’ll earn 1% unlimited cash back on all your other purchases.

You’ll also save 10% when you shop at the NHLShop.com site and pay with your Discover Card, using the code ITPAYS. There is no annual fee and you can enjoy a 0% APR introductory rate .

Business

The Discover It Business card offers 1.5% cash back on all your purchases with no expiration for the rewards. This card is the only business card offering Discover Cashback Match. Discover will match all the cash back from your first year automatically, with no maximum rewards or minimum spending.

The card has no annual fee and there is a 0% APR intro rate for 12 months on purchases.

Student

Discover offers some great credit cards for students and young customers:

- Student Cash Back – If you’re still studying, you can still get some great rewards with the Discover It Student Cash Back card. This card offers 5% cash back on activated rotating category purchases (up to $1,500 in purchases each quarter, then 1%) and 1% on all other purchases. The card has no annual fee and 0% APR for 6 months on purchases.

What makes this card special is that you can earn a $20 statement credit each year for up to five years, if you maintain a GPA of 3.0 or higher.

- Student Chrome – This is another card aimed at students with the same $20 per year GPA bonus for five years. However, where the Chrome card differs is the reward structure.You can earn 2% cashback at gas and restaurants (up to $1,000 every quarter) and 1% on groceries and other student related products. Like the Student Cash Back, there is no annual fee and 0% APR for 6 months on purchases.

As you can see, this is an impressive selection of cards that all offer some superb rewards. So, you can choose a card that fits your typical spending habits to maximize your rewards

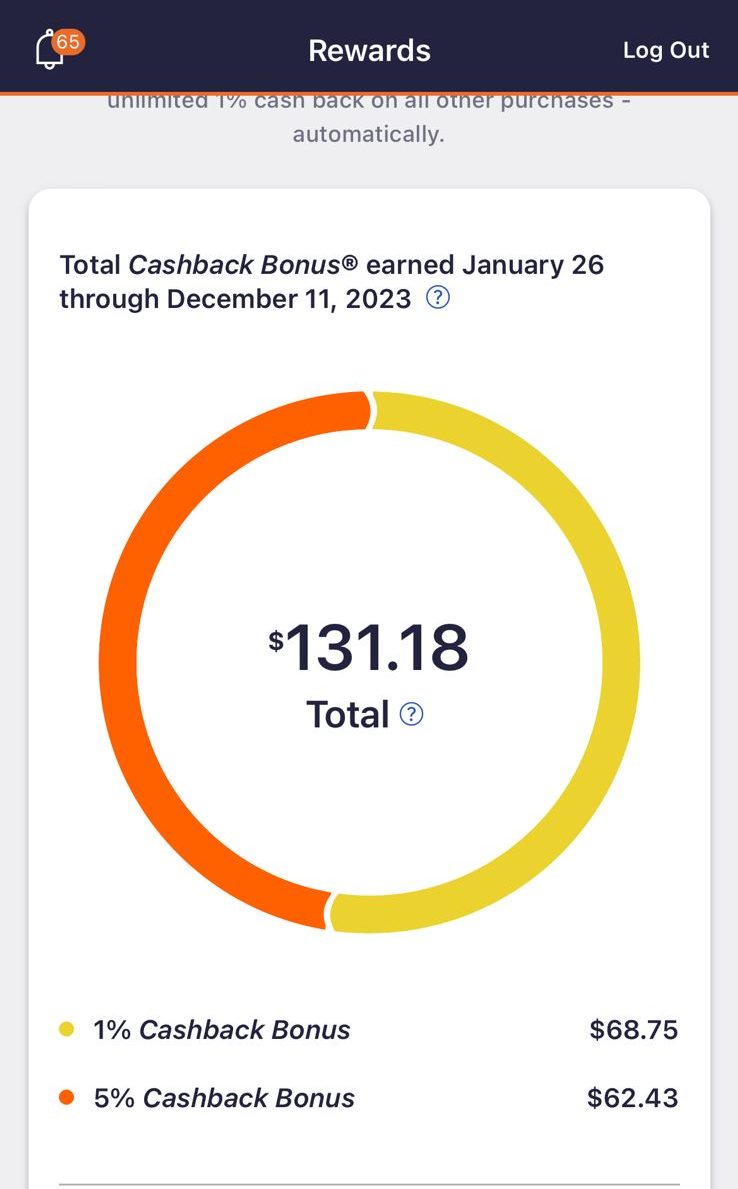

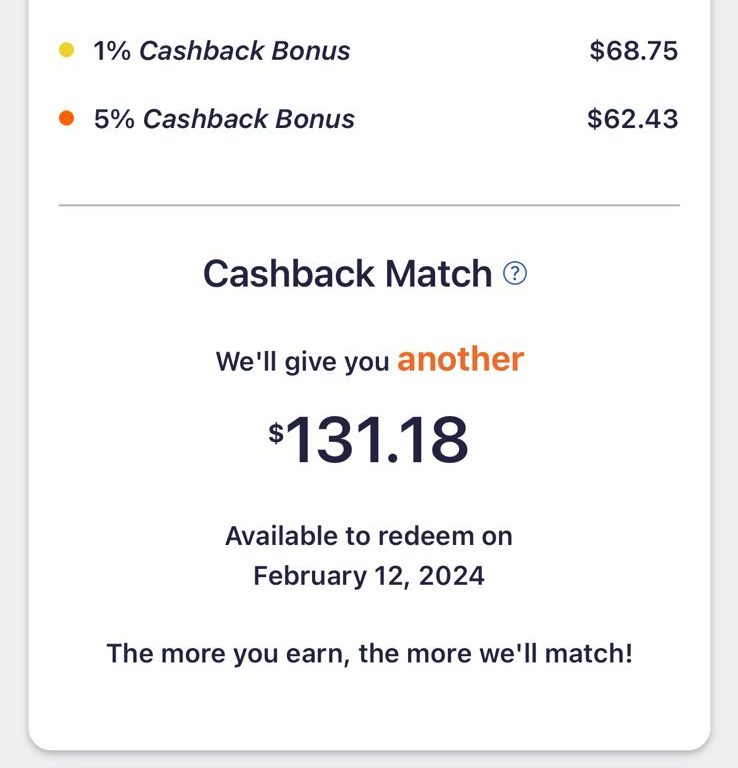

What is the Discover Cashback Match?

Unlike many issuers that have specific minimum spends or time restrictions, the Discover Rewards Program offers some great bonuses. The Cash Match scheme allows you to get a dollar for dollar, mile for mile bonus.

Discover calculates the amount of your rewards in your first year and provides a credit for the same amount.

This is a fantastic incentive that doesn’t require you, as the cardholder to do anything. Unlike other cards where you need to meet spending requirements within a specific timeframe to qualify for the introductory reward bonus, the Discover Cash Match doesn’t require that you do anything.

This means that you don’t need to track your spending or watch the calendar to make sure you qualify. Just make purchases with your card as normal and every dollar you spend will effectively qualify for double cash back or double miles.

There are no stipulations on how you redeem your bonus cash back. It will simply accumulate on your account after your one year card anniversary. Discover will process your rewards and add them to your account within two billing periods. There are no purchase minimums to qualify.

You need to maintain an active account to receive your bonus rewards. Discover will not pay the bonus on a closed account. So, if you’re planning on closing out your account, be sure to wait until your bonus rewards have been processed.

Discover Redemption Options

As we touched on above, Discover has a flexible redemption policy. The company offers several redemption options to claim your rewards. Unlike many other types of card, there is no minimum redemption.

So, even if you only have $0.01 in rewards, you can redeem them. Additionally, redeeming your rewards does not impact the Discover Cash Match. So, you don’t need to worry about claiming your rewards at any point.

The simplest way to redeem your cash back is as statement credit. Once you request redemption, it takes approximately three business days for it to appear on your account. This is a good way to pay down your card balance. It also counts towards making the minimum payment for that statement period.

Another option is to request a direct deposit into your bank account. Again, this takes approximately three days. You’ll need to provide Discover with your banking information.

You can also use your rewards to purchase gift cards or pay with your rewards at checkout at PayPal or Amazon.com.

Finally, you can use your rewards to make a charitable donation. There is a full list of charitable causes that you can check on the Charity Redemption page when you log into your account.

What Credit Score Will I Need in Order to Get Approved?

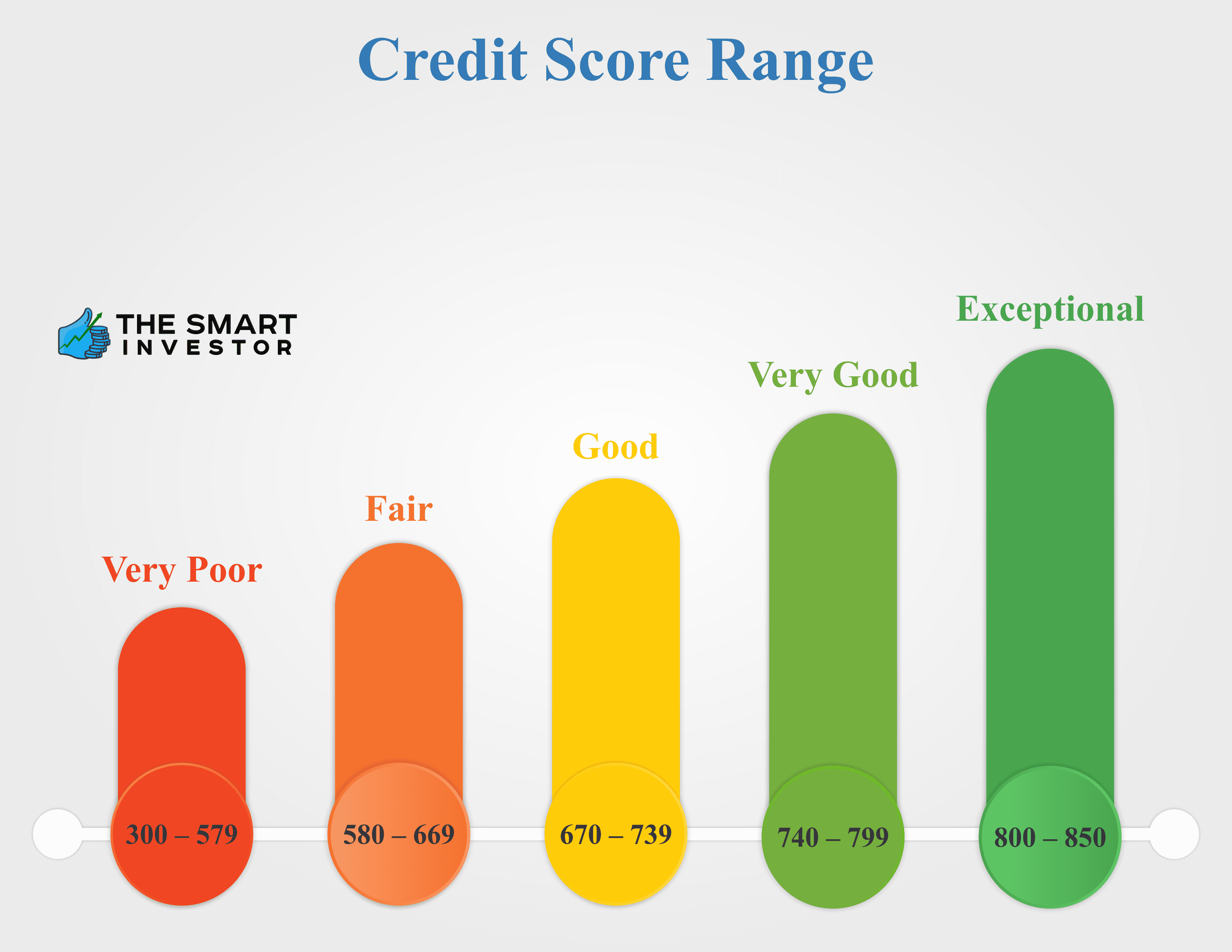

Like most credit card issuers, Discover uses your credit score to determine approval for its cards. Your credit score number will determine whether you have excellent, good, fair or bad credit.

Since Discover offers some generous rewards, you will need to have good to excellent credit to be approved. While Discover does not specify minimum scores for cards, it will be helpful if you have a score of 670 or more to qualify for the Discover It Cash Back, Miles, NHL or Business Cards.

The two Discover student cards are a little more flexible. You can qualify for one of these cards with a fair credit rating. However, you may still qualify if you lack a credit history.

What Are The Options For Poor Credit?

If you have a poor credit rating or no credit history, your best option may be the Discover It Secured. This allows you to pay a deposit to secure your card. This offsets the need to have a higher score.

Of course, these are only approximate guidelines, since there are no official minimum requirements. Fortunately, Discover makes it easy to determine if you would qualify for a card with its pre-approval.

This is the easiest way to find out if there is a Discover card that matches your financial profile. The pre-approval tool only uses a soft credit check that will not impact your credit score. It will show you which cards you can be pre-approved for.

Bear in mind that pre-approval doesn’t guarantee approval on the application, but it does indicate a high probability that you could qualify for those cards.

Discover Cashback Cards: Is it Worth It?

Like many credit card issuers, Discover has a cash back program that allows you to earn cash on the purchases you make on your card. You can earn 1% to 5% cash back depending on your specific card and the most lucrative spending categories.

Some cards have set categories that offer a higher cash back rate, such as the Gas Station and Restaurant card. While others have rotating categories, such as the NHL card. This allows you to earn a higher rate of cash back in different quarters, so you can plan your spending for the most rewards.

Obviously you should choose a card that offers the best rewards for your everyday spending. There is no point in a card that offers a large cash back amount for items you wouldn’t typically buy.

However, what makes Discover different is that you can redeem your cash back at any time. There is no minimum redemption, so even if you’ve only earned $0.01, you can claim it.

Discover also offers a number of ways that you can redeem your cash back.

- Apply it as statement credit

- As a direct deposit into your bank account

- Pay using your cash back. You can use your rewards during checkout at PayPal and Amazon.com

Discover Has Only Few Points Rewards Cards

While many card issuers do have points rewards, Discover currently only has one card that does not have a percentage cash back. This is the Discover It Travel card, which offers Air Miles rather than a cash back percentage.

This works in a similar way to the cash back offers. However, instead of receiving a percentage on your purchases, you’ll earn 1.5 miles for each dollar you spend. There are no limits to the number of miles you can earn.

You can accumulate your miles and then redeem them for statement credit or cash towards a travel purchase. Your miles can help you with the cost of your trips and travel, with no blackout dates. This allows you to cover airfare, hotels or even gas station purchases.

As with the cash back, you can also use your points at checkout with PayPal or Amazon.com.

This makes the Travel card a great option for those who typically travel a lot. You can not only earn cash back on your everyday expenses and travel costs, but you can use your accumulated miles to offset the costs of your travels.

How to Maximize Your Discover Rewards

While Discover offers a generous reward program, there are ways to maximize your rewards to get even more cash back. These include:

- Plan Your Spending

While it is easy to impulsively spend, this is not the best way to gain the maximum rewards. The best approach is to plan your spending. Focus on the areas where you will earn the most rewards.

So, if you have Discover It Cash Back, look at the 2021 calendar and think about the timing of your purchases. Stock up for the year at your warehouse club between April and June. This will allow you to earn 5% cashback on up to $1,500.

- Pay Off Your Balance

The more interest that you pay each month, the more it will offset your rewards. There is no point in spending like crazy only to leave the balance on your card accruing interests.

So, where possible, pay off your balance. This will also allow you to clear your card and then make more purchases each month, maximizing your potential rewards.

- Watch Your Spending Caps

Most of the Discover cards have spending caps for the higher rates of cash back. So, it is important that you take advantage of these. Try to plan your spending each month, so you don’t miss it one month and then go over the cap in the next.

If you’re consistently getting the maximum cash back from these particular categories, you’ll maximize your rewards.

- Remember Your Year One Cash Match Bonus

We’ve already discussed that Discover will automatically calculate your total rewards and match it dollar for dollar or mile for mile for your first year. However, if you miss this anniversary by even a day, your reward will not get matched.

So, take a note of your anniversary date and ensure that you don’t leave any eligible purchases to the last possible minute. You don’t want a processing delay to compromise you getting the most possible rewards.

- Redeem Your Rewards as Statement Credit

Unless you have a massive credit limit, every dollar will count. So, if you want to be able to put more purchases on your card, you need to clear your balance as frequently as possible. Your rewards can actually help you with this. You can redeem your rewards at any point from any amount above $0.01 as statement credit.

This will count as part of your minimum monthly payment, but it will also free up part of your credit limit. So, you can make more purchases on your card and get even more cash back.

What are the Other Benefits of Having a Discover Card?

In addition to the generous reward program and Cash Match, Discover cards also offer a number of other benefits. These include:

- No annual fee: Many card issuers charge an annual fee for offering generous rewards. This is not the case with Discover cards. Regardless of which card option you choose, there are no annual fees. This could save you as much as several hundred dollars per year.

- No minimum reward redemptions: While there are some minimums for gift cards, generally, there are no minimum reward redemptions. So, even if you only have one cent, you can claim your rewards.

- No Reward Expiry: Another benefit of Discover cards is that there are no expiration dates to worry about for your rewards. Some card issuers require that you redeem your rewards within 18 months, so if you lose track of time, you can miss out.

- Free Security Alerts: Discover will alert you if your social security number is used on Dark Web sites or if a new credit request appears on your credit report. You can also freeze your account within seconds if you detect any security issues.

- Fraud Liability Protection: You’ll not be responsible for any unauthorized purchases on your card.

- Reasonable Fees: There are no foreign transaction fees or overlimit fees. Additionally, you won’t be charged a late fee on your first late payment.

- Flexible Payments: You can pay your bill online or by phone up to midnight on the day it’s due.

- Authorize User: cardholders can add an authorize user on Discover cards.

How Many Discover Credit Cards Can I Have at One Time?

Most providers cap the number of credit cards customers can have at any one time. This also applies to Discover and the company has its own credit card limitation rules.

Customers are limited to two Discover credit cards at any one time. Typically, you need to have held your first card for at least one year, before you can open a second card. However, it may be possible to get a second card a little sooner.

Discover also allows you to have two versions of the same card. This allows you to maximize your rewards. However, Discover may require additional security checks to confirm that your application is genuine.

Since Discover does not have annual fees, you can pair the rewards in different categories to maximize your cash back.

According to Experian Data, the average, Americans hold an average of 3.84 credit card:

How do I Cancel a Discover Credit Card?

Discover makes it easy to cancel a credit card and close your account. All you need to do is call the helpline at 1-800-DISCOVER (1-800-347-2683). There are no fees for closing your account and you do not need to clear your account balance before you close your account. However, you will need to continue making payments on your balance until it is cleared.

Bear in mind that before you close your account, you will need to redeem your rewards. If you close your account before you redeem your rewards, Discover will credit you with your balance, but you will not get to decide the most preferable redemption method.

How We Picked The Best Discover Credit Cards: Methodology

To select the best Discover credit cards, our team thoroughly researched various offerings from Discover, analyzing their features and benefits across two key categories:

Rewards Program (50%): We evaluate the rewards structure, including the type of rewards offered (points, cash back, or miles), earning rates per dollar spent, bonus categories for accelerated rewards, and flexibility in redemption options. Discover cards with generous rewards rates, diverse redemption choices, and valuable sign-up bonuses receive higher scores in this category.

Card Features & Benefits (50%): This category assesses additional features that enhance the overall value of the card, such as introductory APR offers, absence of foreign transaction fees, complimentary airport lounge access, travel credits, purchase protection, and extended warranty coverage. Discover cards offering a wide range of benefits without excessive fees earn higher scores.

This comprehensive evaluation ensures that the best Discover credit cards offer valuable rewards, benefits, and a seamless user experience while maintaining a positive reputation, catering to the preferences of cardholders seeking Discover products.