Ally Bank

Fees

Our Rating

Current Promotion

APY Savings

- Overview

- Pros & Cons

- FAQ

Ally Bank is an online bank that grew out of the banking division of General Motors Acceptance Corporation.

It offers a wide selection of products including home loans, money market accounts, investment products, certificates of deposit, checking accounts, and savings accounts.

Ally bank serves millions of customers and provides high-quality banking services.

Ally Bank is ideal for customers comfortable with banking entirely online. This high-quality banking service offers a reliable service that provides modern banking needs that are flexible and adaptable to your banking needs.

Ally Bank can be a perfect fit if:

You prefer an online bank with good CD & savings rates

You may need a mortgage soon

You don’t need a credit card

- Competitive rates on savings and CDs

- No maintenance fees or minimum balance requirement

- Large fee-free ATM network

- Full-service online bank including retirement services

- Ally doesn't have physical branches

- No deposit cash

- Lower rates on money market accounts

What promotion does Ally offer?

Ally’s primary promotion is that the accounts have no hidden fees or account minimums. This means that when you’re comparing rates, you don’t need to factor in an account maintenance fee or monthly charges. However, there is no cash promotions or welcome bonus as you can get on other banks.

Is Ally ready for a recession?

Since Ally is a fully online bank, it does not need to support the infrastructure of a large, branch network. This can help Ally weather more challenging financial times. However, since the bank has only been operating since 2009, we have no data on how it handled previous recessions.

- Can you be denied on an Ally checking account?

Ally does need to review your checking account application, and there is a risk that your application may be denied. However, according to consumer feedback, Ally seems to have quite relaxed criteria, so it is not likely that you will be denied unless there is a large red flag on your application.

- Does Ally work for Joint Accounts?

You can add another person to most types of Ally accounts. Ally has a standardized Additional Owner form, which you need to complete. You can then upload the signed form or return it to Ally via fax or mail. You will also need to provide a signature card for each account holder.

Ally Bank Review

Banking Services | Credit Options | ||

|---|---|---|---|

Savings Accounts | Mortgage | ||

Checking Accounts | Government Mortgage | ||

CDs | Credit Cards | ||

Money Market Account | Debit Card | ||

Investing Capabilities | Personal Loans |

Customer Experience

Ally provides customer service 24 hours a day, seven days a week, with a typical wait time of less than one minute. Ally's app has a rating of 4.7/5 on Apple and 4.2/5 on Google.

Also, Ally is one of the top digital banks when it comes to customer satisfaction. According to the J.D. Power 2023 U.S. direct banking satisfaction study Ally bank ranked much better than the average with 729 points (3 out of 10 banks), 3 points less than the top rates bank,

Ally's websites have a clean design and are simple to use, providing a great user experience. You can fully investigate and compare the products, as well as access support materials.

Ally Bank | |

|---|---|

App Rating (iOS)

| 4.7 |

App Rating (Android) | 4.1 |

BBB Rating (A-F) | C |

WalletHub (+1,000 reviews) | 3.4 |

Consumer Affairs (+1,000 reviews) | 3.4 |

Contect Options | phone/chat |

Availability | 24/7 |

Ally Savings Account

APY Savings

Minimum Deposit

Promotion

Fees

Ally Savings Account

APY Savings

Minimum Deposit

Promotion

Fees

Ally Bank offers a high-yield, competitive savings account that is competitive with other online banking services.

Another benefit to an online Ally Bank savings account is the lack of minimum deposit required to open an account and no monthly service fees. That's why Ally included on our best bank for saving accounts list of 2025.

Along with great incentives, they are some limitations to this savings account system. There is no ATM card, so you have to transfer your online funds, wire transfer, telephone transfer, or request a check to access your savings account funds.

Ally Checking Account

Fees

Minimum Deposit

Promotion

APY Checking

Ally Checking Account

Fees

Minimum Deposit

Promotion

APY Checking

Ally offers a single checking account, the Ally Bank interest checking account that offers interest on the balance. Ally's checking accounts also come with free checks and debit cards and there are no monthly maintenance fees or overdraft fees with your checking account.

The Ally Checking Account customer can access 43,000+ no-fee Allpoint ATMs is provided, with reimbursement of up to $10 per statement cycle for fees from other ATMs.

The account introduces spending buckets for better expense management, and early direct deposit ensures funds are available up to 2 days sooner.

To prevent accidental overspending, the account features a double line of defense with the Overdraft Transfer Service and CoverDraft service, offering a comprehensive and convenient banking solution.

Along with the multitude of positive aspects of the Ally Bank checking account system, there are drawbacks to using this service. You must be aware that there are no physical branches, so your internet connection must be reliable. Also, Ally does not accept cash deposits.

Ally CDs

APY Range

Minimum Deposit

Terms

Fees

Ally Bank CDs

APY Range

Minimum Deposit

Terms

Fees

There are three different types of CDs you can pick from at Ally Bank. The three offers include high-yield CDs across multiple terms, a couple of bump-up CDs, and an 11-month no-penalty CD. All of these incur interest daily that do not require a minimum deposit to open any CD.

You can also qualify for a high-interest rate along with the daily compounded interest. Qualifying for a high-interest rate depends on your balance amount and CD term.

Your rate will rise within 10 days of opening and funding your account. This provides a great incentive to have long-term savings plans to reach a specific financial goal.

Ally Bank has many positive aspects to the CD services due to the many types of CDs available and the lack of minimum deposits required to open a CD and less harsh early withdrawal penalties, which are better than competitive banks.

Overall, Ally offers some of the highest CD rates you can find and a variety of options for depositors.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 2.90% | 60 days of interest

|

6 Months | 4.05% | 60 days of interest

|

9 Months | 4.00% | 60 days of interest

|

12 Months | 3.90% | 60 days of interest

|

11 Months – No Penalty | 3.75%

| / |

36 Months | 3.40% | 90 days of interest |

60 Months | 3.40% | 150 days of interest

|

Money Market Account

The Ally Money Market account offers tiered interest rates that change based on your minimum daily balance.

There are free checks and debit cards provided with a money market account, which differs from the savings account service. The money market account does not offer as high an APY that the savings account has.

The money market account offers many ways for you to grow and access your money.

You should be aware that the money market accounts offered through Ally are less than twice the APYs available with other accounts.

You are also reimbursed up to $10 per statement cycle for any fees at non-Allpoint ATMs, which is a great program when you are traveling.

Top Offers From Our Partners

Mortgage & Personal Loan Options

Ally provides mortgage products for both home purchases and refinancing. You can choose between adjustable and fixed rate loans, but Ally also offers jumbo loans.

Customers, according to the bank, can get pre-approval in minutes. Furthermore, the website contains a wealth of tools and resources, such as guides and calculators, to assist you in determining the best product for your needs and circumstances.

Ally Bank's Ally Lending division provides personal loans for home improvements and medical bills. There are no application or down payment requirements.

Investing Options (Ally Invest)

Ally Invest is a digital financial services industry leader. It assists businesses with dealer financial services, corporate finance, banking, and direct-to-consumer home loans.

Ally Invest provides two ways to invest: self-directed trades and managed portfolios.

Hands-on investors can trade stocks, options, and ETFs in a low-commission environment using self-directed trade.

However, Ally took into account potential investors with limited knowledge or those who do not want to be responsible for investing their own money.

Every type of individual investor has a choice with Ally thanks to its managed portfolios. Furthermore, the minimum deposit is only $100.

Ally Invest is an excellent choice for those interested in margin trading. The company's margin account rates are among the lowest in the industry, and there is a wide range of products available for trading.

The low commission structure, on the other hand, makes it competitive for any US citizen looking for a broker. As a result, Ally Invest is a solid all-arounder that caters to both experienced and novice traders.

Navigating Ally Through the User's Eyes

We took a closer look at the Ally App's features to gauge their functionality for regular users. Dive into our thoughts and findings on each feature below.

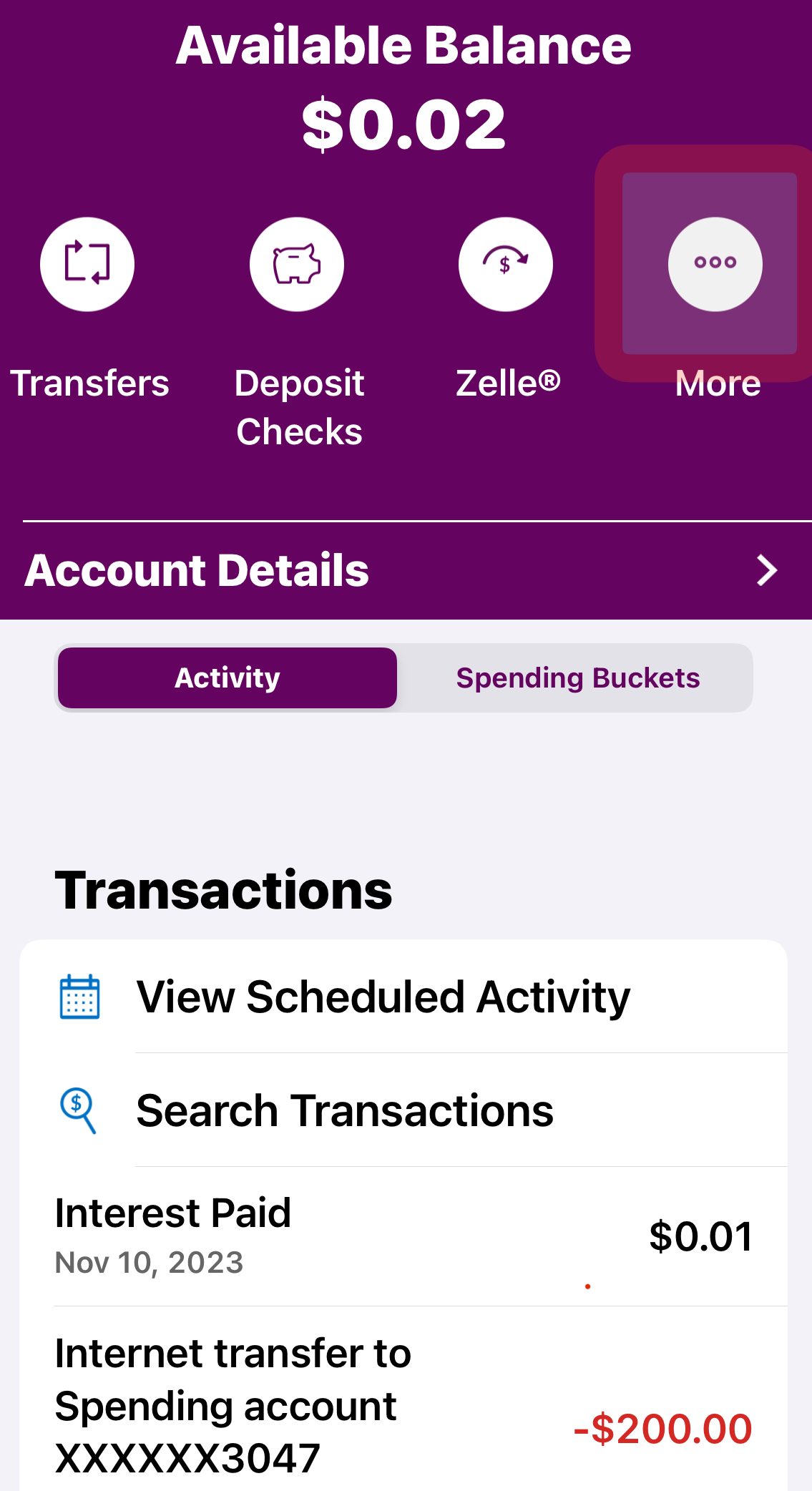

Ally's account details summary is like a one-stop shop for all your banking essentials. Upon logging in, you're greeted with a comprehensive overview of your account. This includes your current balance, recent transactions, pending deposits or withdrawals, and even a quick snapshot of your monthly spending patterns

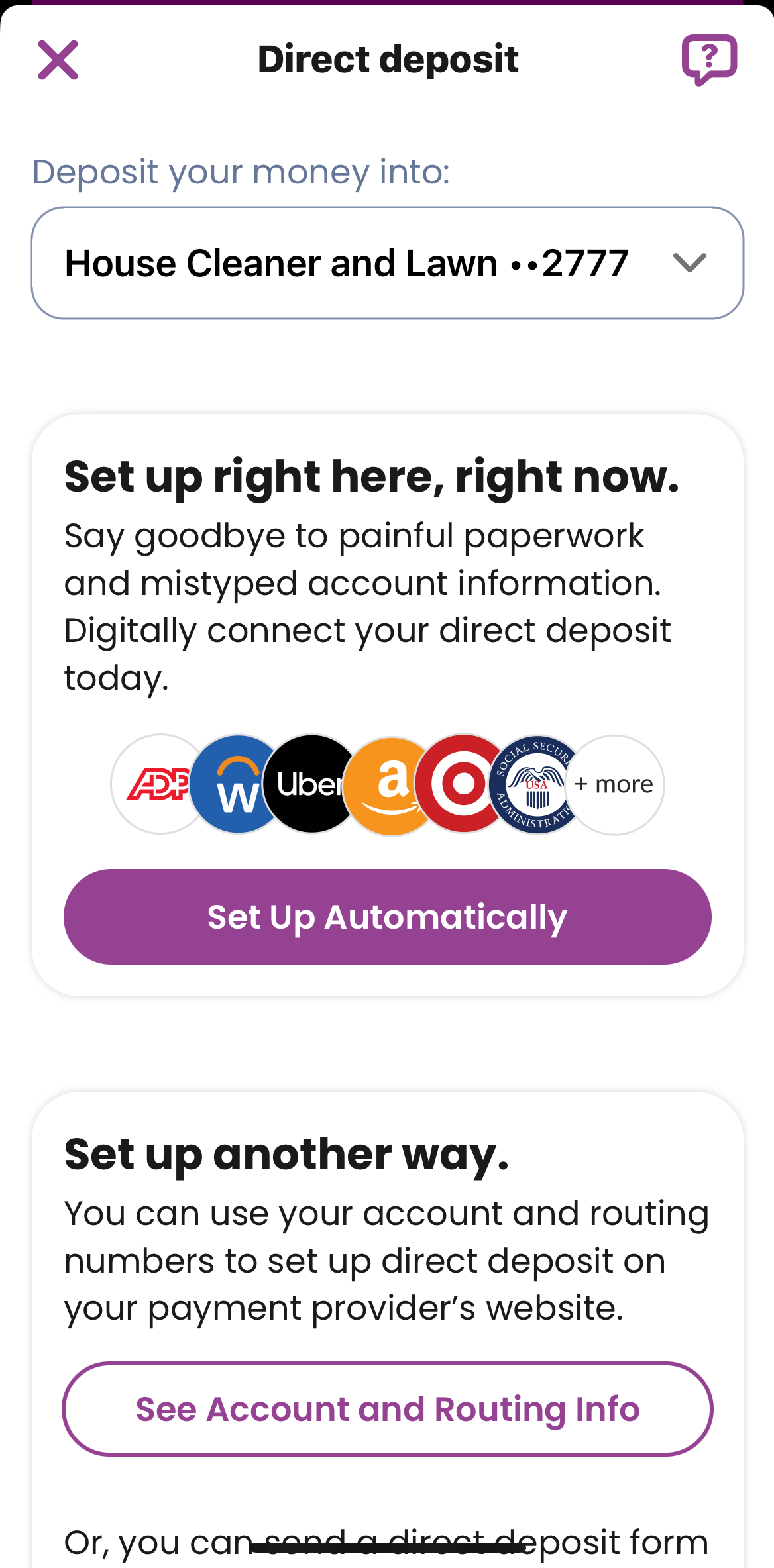

Setting up direct deposit with Ally is a breeze. The app guides you through a user-friendly process, requesting essential information like your employer details, your bank account number, and routing number.

Once configured, your paychecks seamlessly land in your Ally account, eliminating the hassle of manual deposits and ensuring a swift, secure transfer of funds.

Sending money to friends or family is hassle-free with Ally's integration of Zelle. You input the recipient's email or phone number, specify the amount, and voilà – the funds are swiftly transferred.

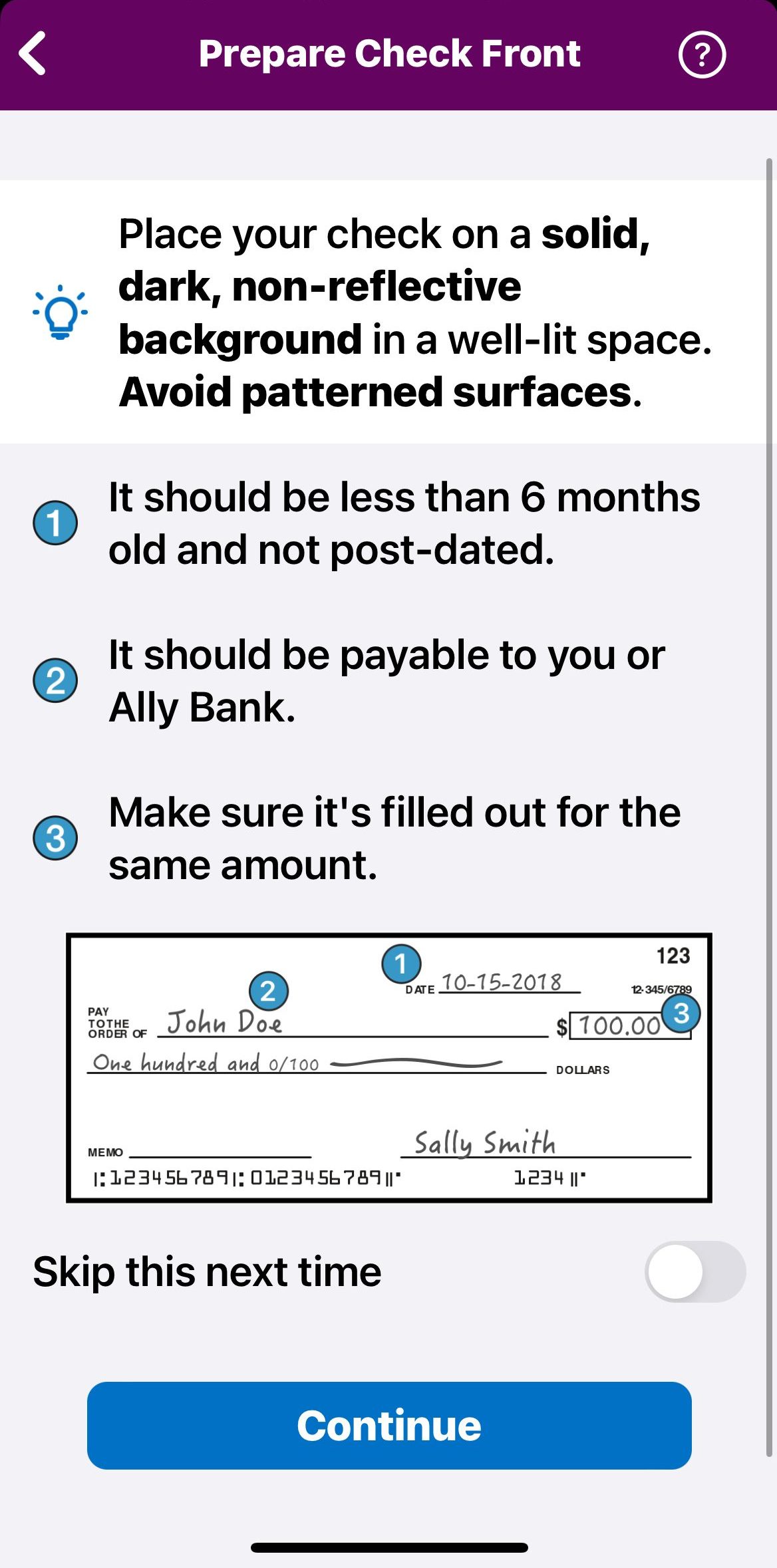

Lastly, say goodbye to traditional banking trips for check deposits. Ally's mobile check deposit feature lets you capture images of your checks using your smartphone camera.

After a few simple steps, the funds are deposited into your account. It's a convenient and time-saving alternative to in-person check deposits.

Ally Bank FAQs

Is Ally Bank trustworthy?

Ally Bank has a history dating back over 100 years, as part of the General Motors Acceptance Corporation (GMAC). Additionally, Ally Bank is FDIC insured. This is federal government insurance that protects depositors for up to $250,000 each in the event of a bank failure.

Who is Ally Bank owned by?

Ally Bank was part of the GMAC, but the company changed its name in 2010 to Ally Financial. This was because the company was close to bankruptcy and received $16.3 billion in federal funding.

At the height of its financial difficulty, the US government owned almost 75 percent of the company, but today its stake is down to 64 percent.

Is Ally Bank a good bank overall?

Ally Bank is a leader in the online banking industry. This bank offers a variety of accounts with attractive rates, making it one of the top options for most consumers.

You can access full-service online banking, but you must be prepared not to access in-person banking services at a local branch. At the same time, the checking accounts don’t have great rates, but opening a savings account can be beneficial. as a whole, Ally Bank offers an excellent financial package.

Which is better: Ally Bank or Synchrony Bank?

Both Ally and Synchrony offer online banking services, offering higher interest rates compared to traditional banks, as they typically don’t have the same overhead due to a lack of branches. However, there are some key differences between Ally and Synchrony.

The main difference is that Synchrony does not offer checking accounts, but its savings rates are competitive. So unless you are only looking for savings options, you are likely to find Ally a more attractive option. You can access live customer support, an overdraft program, and full product offerings including competitive rate checking accounts.

Here's our Synchrony bank review.

Is Ally Bank better than Discover Bank?

Ally Bank offers a complete line of banking products, including savings, checking, and CD accounts. Discover is a good bank that offers similar products with comparable interest rates. Either bank is a good option if you want to keep all your accounts with the same institution.

Bot Ally and Discover offer online banking services, but the Ally platform is more user-friendly. You can access classic banking features, but the Ally Assist app has a voice-enabled, built-in banking expert.

Both banks got the same ratings on our banking reviews, 4.5 stars out of 5.

Is Aspiration Bank better than Ally?

Ally is another online bank offering low-fee services. However, while their services may appear similar, Aspiration is a better choice. Aspiration bank account offers a higher rate on balances in linked saving accounts or Aspiration plus accounts. Additionally, Ally does not offer any sign-up bonuses or promotional offers. The only advantage for new customers is there is a brokerage sign-up bonus, but this is not related to the bank account.

Another advantage of Aspiration is that there are automatic saving features offering a better interest rate on your idle cash compared to Ally.

Which is better: Capital One 360 or Ally checking account?

Both Capital One 360 and Ally Bank are primarily online banking service providers. They offer higher deposit rates than many traditional banks and attractive checking account features.

Our Capital One rating is similar to Ally's, 4.5 out of 5, and they appear on our top online banking list for 2025.

Is Axos Bank better than Ally bank?

Although Ally Bank does offer no account minimums and reasonable interest rates, Axos bank rates are competitive. In contrast, it provides a broader variety of products and access to an extensive no-fee ATM network. Additionally, Axos Bank has a solid online presence, making accessing services easier.

Axos Bank also has extended banking hours, no foreign transaction fees, and low requirements to waive monthly fees. So, in most cases, Axos Bank will be a better option.

How We Rated Ally Bank : Review Methodology

The Smart Investor team extensively reviewed hundreds of banks and credit unions. We assessed them based on four main categories, each with specific features:

-

Diversity of Products and Their Attractiveness (40%): We extensively analyzed the breadth and appeal of each bank's product offerings, including savings accounts, checking accounts, loans, investment options, and more. Higher ratings were assigned to banks with a diverse range of products that are attractive in terms of interest rates, fees, terms, and additional features. This category provides insights into the variety and value of the bank's offerings, crucial for meeting customers' diverse financial needs.

-

Account Features (30%): This category delves into the features and benefits accompanying each bank's accounts. We scrutinized factors such as promotions, deposit and withdrawal options, ATM accessibility, online and mobile banking functionalities, as well as additional perks like overdraft protection and rewards programs. Banks offering comprehensive and convenient features received higher ratings, reflecting the overall value of their accounts to customers.

-

Customer Experience (20%): A positive customer experience is paramount in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Bank Reputation (10%): The reputation of a bank is a critical consideration for customers. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were awarded to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories, individuals can make informed decisions that align with their financial needs and preferences, ensuring they choose a bank that offers competitive products, excellent features, a positive customer experience, and a solid reputation.

Compare Ally With Other Banks

Ally has a robust banking product offering that rivals that of a traditional bank. Savings accounts, checking accounts, CDs, investments, retirement products, personal loans, auto loans, and mortgages are all available.

Chime's product line has been simplified. All Chime products are designed to assist customers in rebuilding or establishing credit. There are only two savings accounts, one checking account, and one credit card available.

Since the bank's inception, the SoFi product line has come a long way. You can now get access to investment products, mortgages, and loans, in addition to its hybrid checking and savings account. SoFi even offers insurance. The only thing missing from this bank are CDs and traditional savings accounts.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: SoFi Money vs Ally Bank: Compare Banking Options

Ally has a decent banking product lineup that would make switching from a traditional high street bank relatively simple. Checking, savings, CDs, auto loans, personal loans, mortgages, investments, and retirement products are among the products available. The only obvious omission from the Ally line is the absence of a credit card.

Capital One began as a credit card company, but it has since expanded into a variety of other banking services. You can access auto finance, loan refinancing, and children's accounts in addition to savings and checking accounts.

Read Full Comparison: Ally vs Capital One: Compare Banking Options

Marcus' banking product offering is more specialized. Marcus' product line reflects its investment pedigree as part of the Goldman Sachs Group. CDs, high-yield savings, investment options, and a variety of loans are available.

Ally has a banking product line that competes with traditional, high-street banks. A checking account, savings account, CDs, mortgages, auto loans, personal loans, retirement products, and investments are among the numerous products available.

Read Full Comparison: Ally vs Marcus: Which Online Bank Is Better?

Discover is a completely online bank, so there are no local branches where customers can go for banking services. Customers can get in touch with Discovery via customer service, which is available 24 hours a day, seven days a week. You can log in to your account in a number of ways. All accounts are accessible online.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: Discover vs Ally: Which Bank Wins?

Ally Bank is an online bank that arose from the banking division of General Motors Acceptance Corporation. GMAC used to be an auto financing company before being purchased by Ally Bank. This bank now offers a wide range of products. Among the products available are credit cards, home loans, investing products, savings accounts including certificates of deposit, and checking account options. Ally Bank serves millions of customers and provides high-quality banking services.

Axos is a well-established online-only banking service. It has been in business since 2000 and is constantly expanding its services for both individuals and businesses. The bank is a subsidiary of Axos Financial and is headquartered in San Diego, California. Despite the fact that the bank has three locations, the vast majority of its customers are served online.

Read Full Comparison: Axos Vs Ally Bank Comparison – Which Is Better?

Aspiration has a streamlined banking product line that includes a hybrid account with a $7.99 per month upgrade option and only one credit card option. Aspiration's premise is to help you live a greener life, so the products are heavily weighted in this category. This means that you can earn cash back and other rewards for making environmentally conscious purchases and taking action.

Ally offers a much broader range of banking products. In addition to checking, savings, and CD accounts, you can also get investment and retirement products, mortgages, auto loans, and personal loans. This brings it more in line with a traditional bank, which may make switching from your high street bank easier.

While Wells Fargo has a far more comprehensive product line, Ally does offer better rates on savings, CDs and even its checking account. The only areas where Wells Fargo has the edge is its credit cards and its impressive selection of mortgage products and loans.

Chase is the largest brick-and-mortar bank, while Ally Bank is among the best online banks. Here's our comparison and our winner: Chase vs. Ally Bank

If you feel comfortable with online-only banking and depending on your needs – Ally may be a better option than Bank Of America. Here's why.

Ally Bank vs. Bank of America: Which Bank Account Is Better?

U.S. Bank is one of the largest brick-and-mortar banks, while Ally is among the best online banks. Let's compare them and find our winner: Ally Bank vs. U.S. Bank

Citi is our winner for most consumers, but Ally is also a great option if you are willing to manage your account online. Here's why:

While TD offers a better selection of checking accounts and credit cards, Ally is also a great option for those who want an online-only bank.

While Amex has a decent checking account and better credit card options, Ally's CD and lending options are superior. Here's our comparison: American Express Bank vs. Ally Bank

Ally Bank is one of the top online banks, while HSBC Bank focuses on serving wealthier customers. Let's compare them side by side: Ally Bank vs. HSBC Bank

Barclays provides a comprehensive range of services to US customers, while Ally bank is among the best online banks. How do they compare? Barclays Bank vs. Ally Bank

Ally Bank is our winner with a complete banking package, including a checking account ( not available with Synchrony) and high savings rates.

Both Ally and Upgrade offer a complete banking package, including savings, checking, and credit cards. Here's our side by side comparison.

Compare Ally Savings

Ally and Marcus Savings account offer competitive rates on savings with no monthly fees. Compare account features, benefits and drawbacks.

Ally Bank Savings Account vs Marcus Online Savings Account: Which Is Better?

Compare Ally and Capital One Savings account rates, features, benefits, and limitations to determine which one is the best option for you.

Ally Bank Savings Account vs. Capital One 360 Performance Savings: Which Is Best?

Ally and SoFi savings account rates are among the highest in the market and no monthly fees required. Compare account features and drawbacks.

SoFi High Yield Online Savings Account vs. Ally Bank Savings Account: Compare Side By Side

Compare Citi Accelerate Savings and Ally Savings rates, features, benefits, and limitations to determine which one is the best option for you.

Citi Accelerate Savings vs Ally High-Yield Savings: Comparison

Ally and Amex savings offers lucrative savings rates and many other benefits for savers. Here's our side by side savings account comparison: Ally Bank Savings Account vs American Express High Yield Savings Account

Discover and Ally offer online only savings accounts with several benefits, tools and sometimes even promotions. Here's our full comparison: Ally Bank Savings Account vs Discover Online Savings

Ally and Amex savings offers lucrative savings rates and many other benefits for savers. Here's our side by side savings account comparison: Chase Savings vs Ally Bank Savings Account

Compare Ally CDs

Discover and Ally offer online only savings accounts with several benefits, tools and sometimes even promotions. Here's our full comparison: Discover CDs vs Ally CDs

Synchrony Bank and Ally CDs offer competitive rates, including no penalty CDs. Which one is the winner? Check out our full comparison: Synchrony CDs vs Ally CDs

Citi Bank and Ally offer competitive CD rates, including no penalty CDs. Which one is the winner? Check out our full comparison: Citibank CDs vs Ally CDs

Banking Reviews

Aspiration Review

Alliant Credit Union Review