Chase and Huntington Bank share several common features in their banking services, and have a presence in multiple states, contributing to their accessibility for a broad customer base. Despite their similarities, there are notable differences between Chase and Huntington Bank.

In this comprehensive comparison, we will delve into the key aspects of both banks, including savings accounts, checking accounts, CDs, credit cards, and lending products, to help you make an informed decision.

Checking Accounts

Chase Bank is our winner when it comes to checking accounts. The diversity and multiple options it offers, in addition to the banking options it offers, make this bank our preferred choice in this category.

-

Account Types And Fees

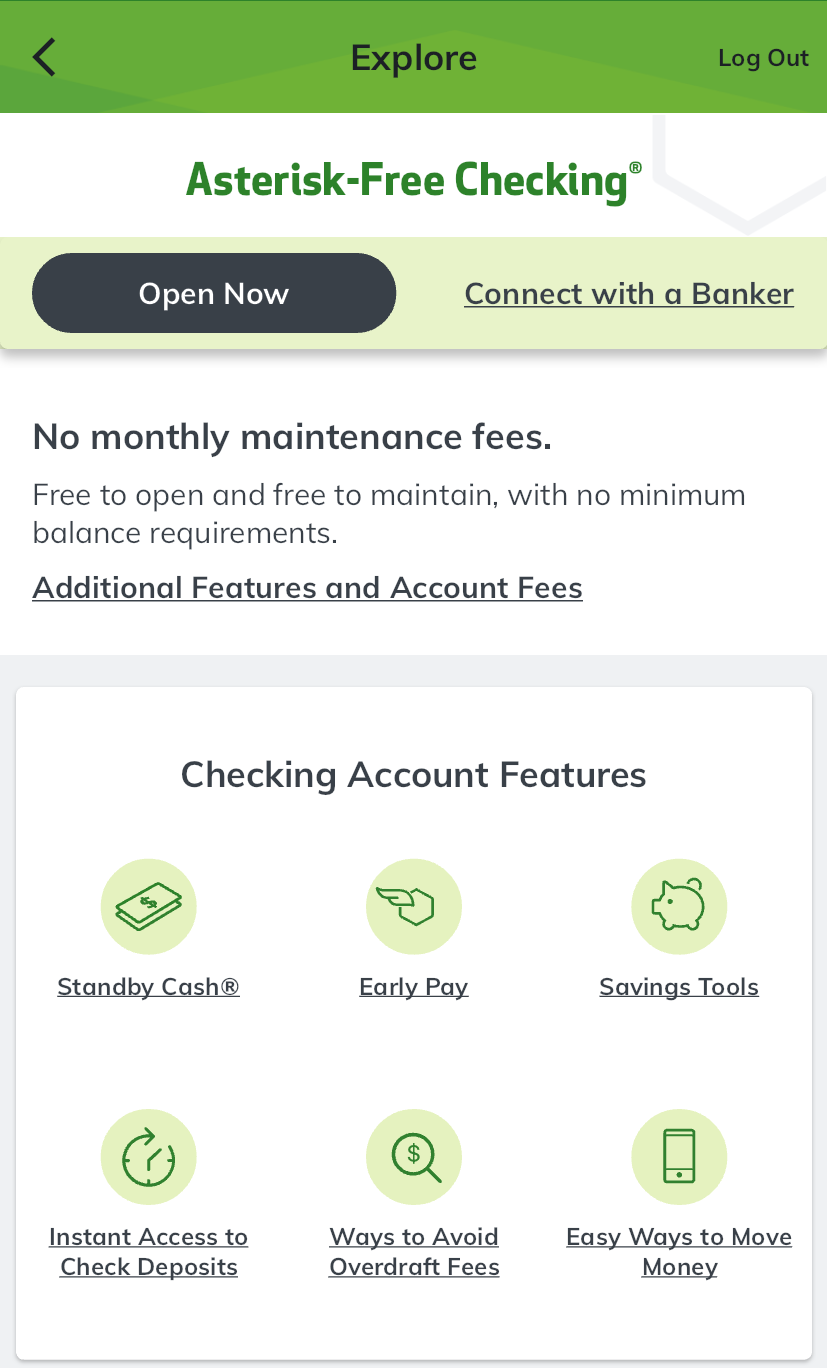

Huntington Bank's checking accounts include Asterisk-Free Checking, which is a no-frills account with no monthly fees.

The Huntington Platinum Perks Checking and Huntington Perks Checking accounts offer tiered interest rates and various perks, but carry monthly maintenance fees (that can be waived in a couple of ways).

Huntington Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Huntington Asterisk-Free | $0 | N/A |

Huntington Perks Checking | $10 | $5,000 |

Huntington Platinum Perks | $25 | $25,000 |

Huntington SmartInvest | $0 | $100,000 |

Chase Bank offers a variety of checking account types to suit the diverse needs of its customers. One notable option is the Total Checking account, which provides access to a widespread network of ATMs and a range of digital banking tools.

For customers with a premium banking preference, Chase presents the Sapphire Checking account and private client checking, renowned for its exclusive benefits like enhanced travel rewards.

Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Chase Total Checking | $12 | $1,500 |

Chase Premier Plus Checking | $25 | $15,000 |

Chase Sapphire Checking | $25 | $75,000 |

Chase College Checking | $12 | $1,500 |

Chase Private Client Checking | $30 | $150,000 |

Chase Business Complete Banking | $15 | $2,000 |

Chase Performance Business Checking | $30 | $35,000 |

Chase Platinum Business Checking | $95 | $100,000 |

-

Features

Huntington Bank offers a range of perks across its checking accounts, enhancing the overall banking experience for customers. For the Platinum Perks account, these include discounts on mortgages and home equity loans, identity monitoring services add an extra layer of security and unlimited free checks, and waived ATMs fees contribute to cost savings.

Additional perks of all accounts encompass modern banking conveniences such as Zelle for easy money transfers, Early Pay for quicker access to funds, and comprehensive online and mobile banking services.

Huntington Account | Main Features |

|---|---|

Huntington Platinum Perks Checking | Mortgage & Home Equity discounts, identity monitoring, unlimited free checks and ATMs fees |

Huntington Perks Checking | 5 free non-Huntington withdrawals, interest bearing, MMAS/Savings Relationship rate |

Asterisk-Free Checking®

| Zelle, Early Pay, online and mobile banking, $50 Safety ZoneSM and 24-Hour Grace |

Huntington SmartInvest Checking®

| Credit Score & Identity Monitoring, speical rates, investing, unlimited free checks and ATMs fees |

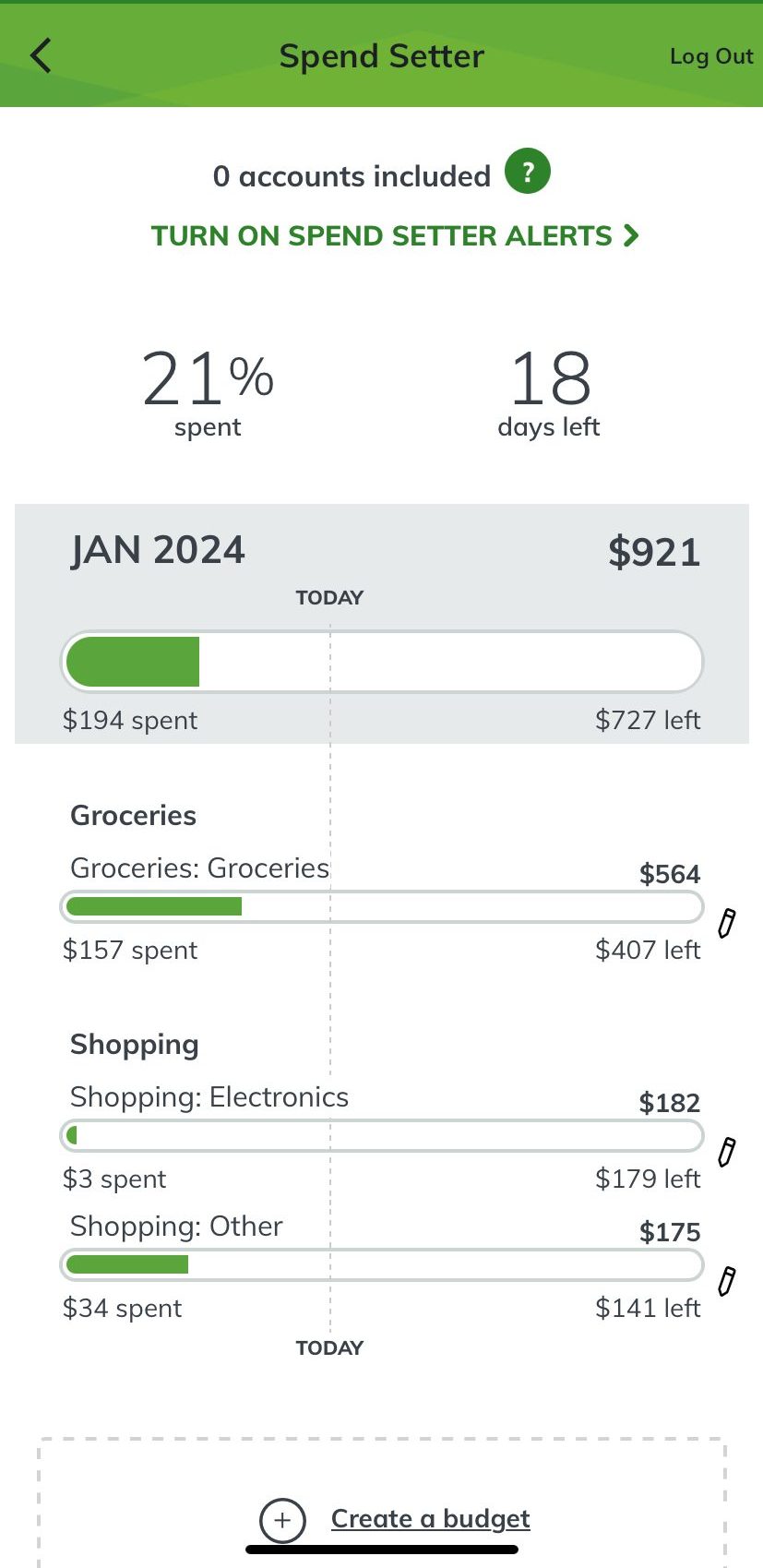

Huntington Bank Spend Setter is a budgeting tool enabling users to set monthly spending limits for various categories. It provides real-time tracking of expenses, alerts for approaching budget limits, and a 12-month spending history.

Chase provides checking accounts that come with a bunch of helpful features to meet different money needs. The Chase Everyday Accounts are easy to get started with since there's no need for a big initial deposit. Plus, with over 15,000 ATMs and 4,700 branches, it's super easy to access your money.

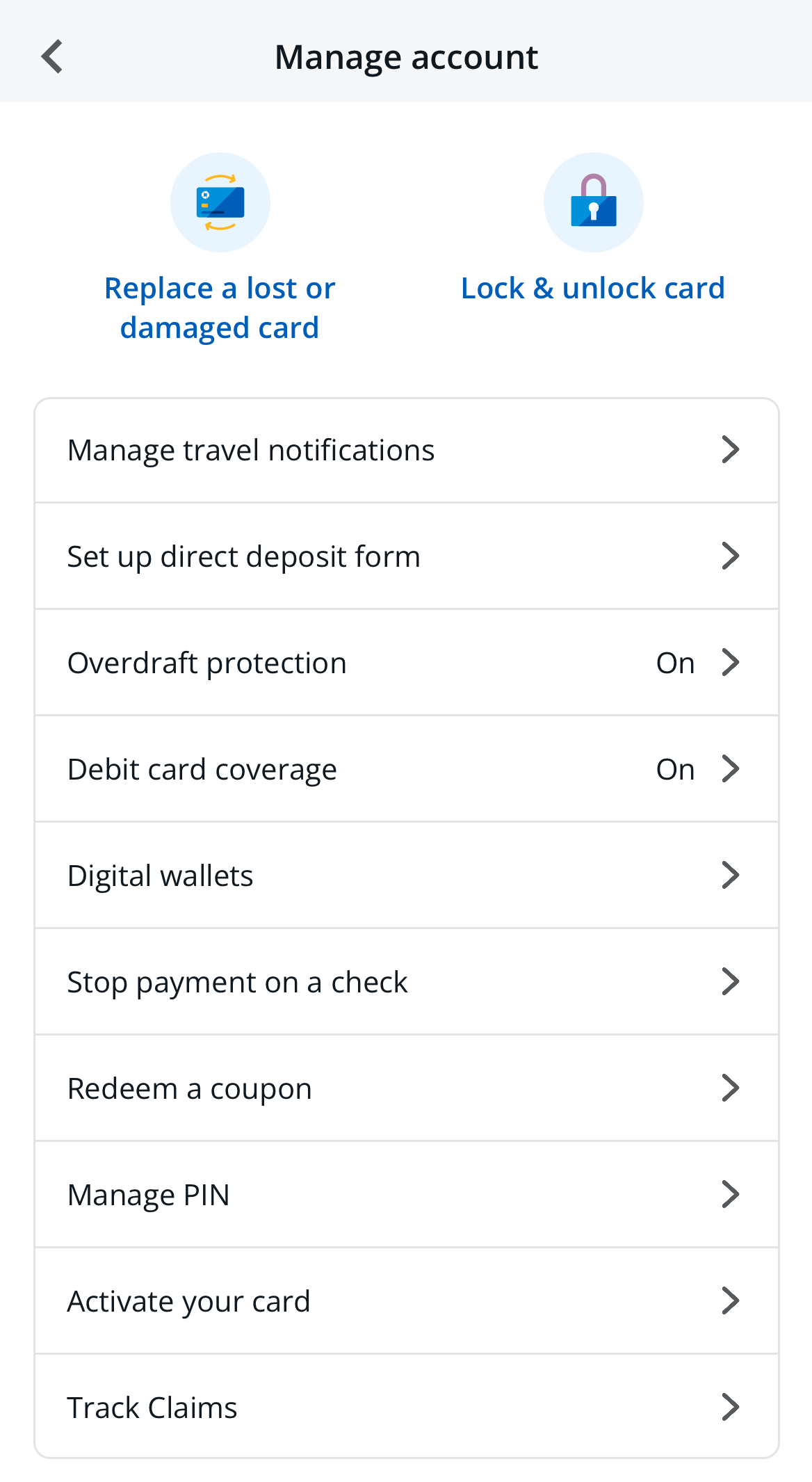

If you go for a Chase Premium Account, you get even more perks for a top-notch banking experience. You won't be charged by Chase for using ATMs outside their network, giving you lots of places to get cash without extra costs. Customers can apply and manage debit card on Chase app:

There's also a special 24/7 banking service line, so you can get help anytime you need it. Premium account holders enjoy higher daily purchase and ATM withdrawal limits for added flexibility.

Chase Bank Account | Main Features |

|---|---|

Chase Total Checking | Overdraft assist, chase credit journey, alerts |

Chase Premier Plus Checking | Interest on balance, free checks , free counter checks |

Chase Sapphire Checking | JPM wealth management, no ATM fees, no wire transfer |

Chase College Checking | No monthly fees, free credit score, new account promotion |

Chase Private Client Checking | Priority service, preferred rates, J.P. Morgan advisor |

Chase Business Complete Banking | Chase QuickAccept, fraud protection, chase business online |

Chase Performance Business Checking | No cost wires, unlimited electronic deposits, Chase business |

Chase Platinum Business Checking | No fee transactions, cash management support, platinum service |

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Savings Accounts

Huntington Bank is our winner when it comes to savings accounts. While both banks offer low savings rates, its money market account can earn you decent yield, which is not available through Chase bank.

Huntington Bank provides a savings account called Relationship Savings that offers a higher interest rate. If you don't have a special account with them, the regular interest rate is quite low, as shown by the 0.01% – 0.06% APY. However, if you have their private client account, you can get the highest interest rate.

Yet, the Relationship Money Market Account from Huntington stands out, offering a more attractive interest rate along with various perks. Customers can earn at least Up to 4.49% APY on balances exceeding $25,000, and they receive special relationship rates if they have a Perks Checking or Platinum Perks Checking account.

Huntington Bank Savings | Huntington Money Market | Chase Premier Savings | |

|---|---|---|---|

Savings Rate | 0.01% – 0.06% | Up to 4.49% | 0.01% |

Minimum Deposit | $0 | $25,000 | $25 |

Fees | $10

Can be waived if you also have a qualifying checking account or maintain a minimum balance of $2,500

| $25

Can be waived if you also have a qualifying checking account or maintain a minimum balance of $25,000

| $25 per month

Can be waived if you carry $300 account balance at the start of the month, $25+ autosave or linking a Chase checking account

|

Certificate Of Deposits (CDs)

When it comes to CDs, Huntington Bank is our winner due to its better CD rates. Both Chase and Huntington Bank offer higher rates only on specific CD terms, so customers have no options to combine short and long-term CD options or use strategies such as CD laddering.

-

Chase Bank CD Rates

Chase offers two primary CD categories: Standard and Relationship. Individuals without a Chase checking account can opt for the Standard CD. On the other hand, those with an existing Chase checking account can link it to their CD account to unlock slightly higher APYs through Relationship CDs.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

3 Months | 2.00% | 90 days of interest |

6 Months | 3.00% | 180 days of interest |

9 Months | 4.00% – 4.75% | 180 days of interest |

12 Months | 2.00% | 180 days of interest |

18 Months | 2.50%

| 180 days of interest |

24 Months | 2.50% | 365 days interest |

30 Months | 2.50% | 365 days interest |

36 Months | 2.50% | 365 days interest |

48 Months | 2.50% | 365 days interest |

60 Months | 2.50% | 365 days interest |

120 Months | 2.50% | 365 days interest |

-

Huntington CD Rates

Huntington Bank offers a variety of CD terms ranging from 7 days to 5 years. However, the regular rates for these CDs are comparatively modest and may not stand out in terms of competitiveness.

In response to this, Huntington provides promotional rate CDs, presenting customers with the opportunity to benefit from notably higher APY.

Term | Huntington Bank CD Rates |

|---|---|

7 Month | 5.13% |

11 Month | 4.34% |

Minimum Deposit | $1,000 |

Top Offers From Our Partners

Credit Cards

In the realm of credit cards, Chase takes the lead as our top choice. This is attributed to the bank's diverse array of credit cards catering to every type of customer, whether interested in travel, cash back, store-specific cards, or luxury offerings. Chase stands out not only for the variety of cards it offers but also for the multitude of redemption options available to cardholders.

Whether you seek rewards for travel adventures, cash back on everyday purchases, or exclusive perks with luxury cards, Chase's comprehensive credit card selection ensures there's a suitable option for every discerning customer.

Card | Rewards | Bonus | Annual Fee |

| Chase Sapphire Preferred® Card | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $95

|

|---|---|---|---|---|

| Chase Freedom Flex℠ Card | 1-5%

| $200

| $0 |

| Chase Freedom Unlimited® | 1.5% – 5%

5% on travel purchased through Chase Ultimate Rewards, 3% on dining at restaurants, including takeout and eligible delivery services, 3% on drugstore purchases and 1.5% cash back on all purchases

| $200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| $0 |

| Chase Sapphire Reserve® | 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $550 |

| Marriott Bonvoy Boundless Card | 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 3 Free Nights

3 Free Nights (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months from your account opening

| $95 |

| United Explorer Card | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| 50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

| $95 ($0 first year) |

Huntington Bank offers a selection of credit cards with features like cash back rewards and low APRs.

While the options may be more limited compared to Chase, Huntington's credit cards can be suitable for those seeking straightforward rewards and lower interest rates.

Card | Rewards | Bonus | Annual Fee |

| Huntington Cashback Credit Card

| 1x – 3x

3x reward points (3% cash back) when you use your credit card to make a purchase in your category of choice, up to $2,000 in spend per quarter, 1x on all other purchases | N/A | $0 |

|---|---|---|---|---|

| Huntington Voice Rewards Credit Card | 1x – 3x

3x reward points (3% cash back) when you use your credit card to make a purchase in your category of choice, up to $2,000 in spend per quarter, 1x on all other purchases | N/A | $0 |

| Huntington Voice Credit Card | N/A | N/A | $0 |

| The Ohio State Voice Credit Card | $100

$100 when you spend $1,000 within the first 60 days after account opening. For the Cashback Card, you will receive $100 cash bonus, which can be redeemed for a $100 statement credit or direct deposit. For the rewards card, you will receive 10,000 bonus points which can be redeemed for a $100 statement credit or direct deposit. For the lower rate card, you will receive a $100 statement credit | N/A | $0 |

Mortgage And Loans

Chase and Huntington Bank are prominent financial institutions offering a range of lending products, including mortgages and loans, to meet diverse financial needs.

Huntington Bank provides a comprehensive suite of lending options, covering mortgages, home equity, specialty mortgages, and personal loans.

In the realm of mortgages, customers can explore various options such as fixed-rate and adjustable-rate loans, FHA/VA/USDA loans, and specialty mortgages tailored for physicians or those seeking jumbo, renovation, construction, state bond, or employee relocation services.

Home equity options include first mortgage equity loans, home equity loans, and home equity lines of credit. Huntington also extends personal loans and auto loans, with additional resources for auto buyers.

Chase excels in mortgage and auto loans. Their mortgage options cater to homebuyers, offering various loan types, fixed or adjustable rates, and personalized advice.

Additionally, Chase extends auto loans, providing financial flexibility to its customers. The online platform simplifies the application process, making it convenient for borrowers to explore and secure the financing they require.

Which Bank Is Our Winner?

While Huntington Bank offers some better conditions when it comes to CDs and lending options, Chase is our winner due to its extensive checking account options and various credit cards.

However, it is crucial to assess various factors, with a primary focus on those that are significant for your specific needs. This could include considerations such as banking services, overdraft assistance, frequent ATM usage, proximity to bank locations, and other elements that vary from person to person.

Comparing Chase and Huntington Bank: Methodology

In our detailed banking comparison, The Smart Investor team thoroughly looked in five main areas in both banks and compare them side by side:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Huntington Versus Other Banks

There is no clear winner when comparing Huntington and U.S. Bank , but if we have to pick one – Huntington is our first choice. Here's why: U.S. Bank vs. Huntington Bank

Huntington and Fifth Third Bank provide various banking services, and figuring out which is best can be tricky. Here's our comparison: Fifth Third Bank vs. Huntington Bank

PNC is our winner in this competition with a better banking package than Huntington Bank. But there are more things to consider: PNC Bank vs. Huntington Bank

Compare Chase Versus Alternative Banks

Although Chase Bank has a modern, trendy image, it is one of the oldest banks in the United States. JP Morgan Chase's consumer division, Chase Bank, is one of the largest banks in the United States. Even though its interest rates aren't particularly competitive when compared to online banks and credit unions, loyal Chase customers who keep a significant amount of money with the bank can earn slightly better rates.

American Express is best known for its credit card business. The financial services firm, on the other hand, has a banking subsidiary that offers high-yield savings and CD accounts. For those looking to save money with a well-known financial institution, the American Express High Yield Savings Account is a popular option.

Read Full Comparison: American Express vs Chase Bank

Chase and Wells Fargo appear to offer very similar products at first glance, so we need to dig a little deeper. There is little to distinguish the savings accounts, and both banks provide a variety of checking accounts.

While Chase's account maintenance fee is slightly higher, it does have some more interesting features. Chase also has an advantage in terms of CDs, but Wells Fargo is a better option for loans and mortgages.

Read Full Comparison: Chase vs Wells Fargo: Where to Save Your Money?

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

The Discover checking account is more traditional. While the account does not pay interest, you can earn 1% cash back on debit card purchases. There are also no fees if you require a replacement debit card, have a deposit item returned, or have insufficient funds in your account.

Chase offers a wide range of banking products, including savings accounts, checking accounts, home loans, home equity options, auto loans, and a wide range of credit cards. In addition, Chase's customer service system is quite extensive.

Read Full Comparison: Discover vs Chase: Which Bank Account Suits You Best?

Chase has some great features including a massive selection of credit card options. Both banks also offer some great mortgage packages. PNC also has some innovative credit card options, and you can also access personal loans.

Read Full Comparison: Chase vs PNC Bank: Which Bank Account Is Better?

Because both Chase and TD Bank provide a comprehensive range of products, we'll need to summarize the benefits and drawbacks to determine which bank is superior.

Chase offers some novel features, including the possibility of comparable CD rates without the TD Bank's minimum deposit. However, there is little to distinguish the checking accounts, as TD Bank's savings rate is twice that of Chase.

Although Chase has more credit card options, don't discount TD Bank, which has some interesting options.

Read Full Comparison: Chase vs TD Bank: Which Bank Suits You Best?

Chase and Capital One both have banking product lines that compete with traditional high street banks.

Capital One also has a competitive advantage in terms of checking accounts. The Capital One checking account is not only fee-free, but you can also earn interest on your account balance. Chase's checking account does not pay interest, and you must meet certain requirements to have the $12 monthly fee waived.

However, when you open a qualifying account, Chase will give you a welcome bonus, and its checking account has some nice features such as paperless statements for up to seven years and checking account upgrade options.

Read Full Comparison: Chase vs Capital One: Compare Banking Options

Both banks have account maintenance fees that can be waived by meeting one of several requirements. The rates are also quite similar, so which bank is best will come down to what products you’re looking for.

While Chase and U.S. Bank offer many banking services, Chase Bank is our winner in this competition. Here's why – and what else to know:

While Truist is a full service bank where you can find almost any financial product, Chase is our winner. Here's why – and what else to know:

We'll explore Chase and BMO Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison:

In our opinion, Chase is the preferred option in this battle. But, there are significant differences between products. Here's our comparison.

We believe Chase is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Chase vs. Fifth Third Bank

Even though Regions Bank has better terms for CDs and loans, we're leaning towards Chase. Here's why, and our complete banking comparison: Chase vs. Regions Bank

Chase is the largest brick-and-mortar bank, while Ally Bank is among the best online banks. Here's our comparison and our winner: Chase vs. Ally Bank

Chase Bank is our winner, while Amex and Chase offer great banking services and credit card portfolios. Here's our side-by-side comparison: American Express Bank vs. Chase Bank

Chase is our winner as it is a better fit for most consumers than HSBC bank. But, there are important things to consider when comparing them: Chase Bank vs. HSBC Bank

Both Chase and Barclays offer a significant portfolio of banking services for US-based customers, but Chase is our winner. Here's why: Chase Bank vs. Barclays Bank

Chase Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.