IHG, or InterContinental Hotels Group, offers two prominent credit cards in its portfolio—the IHG One Rewards Traveler and the IHG One Rewards Priority Card. Each card caters to different needs and preferences, providing cardholders with unique benefits.

General Comparison

The IHG Traveler Card is a more basic option with no annual fee. It's ideal for occasional travelers or those looking to dip their toes into the IHG Rewards program.

On the other hand, the IHG Premier Card comes with an annual fee but offers a more comprehensive set of benefits such as better points rewards ratio, Global Entry/TSA PreCheck fee credit and automatic Platinum Elite status within the IHG Rewards program.

Here's a side-by-side comparison:

|

| |

|---|---|---|

IHG® One Rewards Premier | IHG® One Rewards Traveler | |

Annual Fee | $99 | $0 |

Rewards | Up to 10X points from IHG® on stays for being an IHG One Rewards member. Up to 6X points from IHG® on stays with Platinum Elite Status. 5X total points on travel, dining, and at gas stations and 3X points per $1 spent on all other purchases. | 10X points from IHG® on stays for being an IHG One Rewards member. Plus up to 6X points from IHG® on stays with Platinum Elite Status, a benefit of this card. 5X total points on travel, dining, and at gas stations. 3X points per $1 spent on all other purchases. |

Welcome bonus | 140,000 Bonus Points after spending $3,000 on purchases in the first 3 months from account opening | 140,000 Bonus Points after you spend $3,000 on purchases in the first 3 months from account opening. |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.49%–28.49% variable | 21.49%–28.49% variable |

Read Review | Read Review |

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

IHG Traveler vs. IHG Premier: Point Rewards Comparison

When comparing the points rewards of the two cards, the IHG One Rewards Traveler card stands out as the definitive winner. With a significantly superior rewards ratio, it consistently outperforms in accumulating points across various categories.

If your spending patterns mirror our example, the Premier card's higher estimated annual value has the potential to offset the difference in annual fees.

|

| |

|---|---|---|

Spend Per Category | IHG® One Rewards Premier | IHG® One Rewards Traveler |

$10,000 – U.S Supermarkets | 20,000 points | 20,000 points |

$4,000 – Restaurants

| 8,000 points | 12,000 points |

$4,000 – Airline | 4,000 points | 8,000 points |

$5,000 – Hotels | 50,000 points | 25,000 points |

$4,000 – Gas | 8,000 points | 12,000 points |

Total Points | 90,000 points | 77,000 points |

Redemption Value (Estimated) | 1 point = ~0.7 cent | 1 point = ~0.7 cent |

Estimated Annual Value | $630 | $539 |

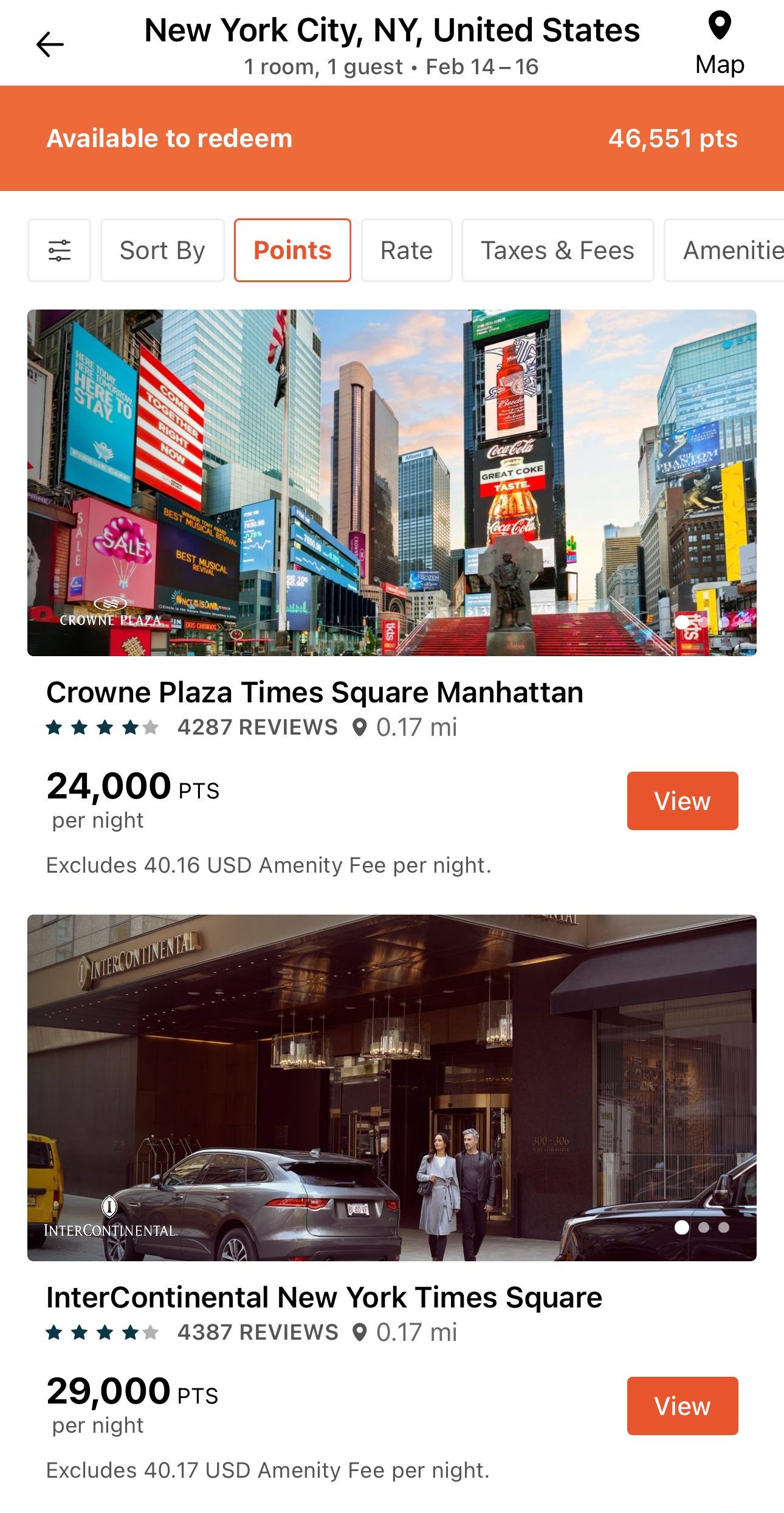

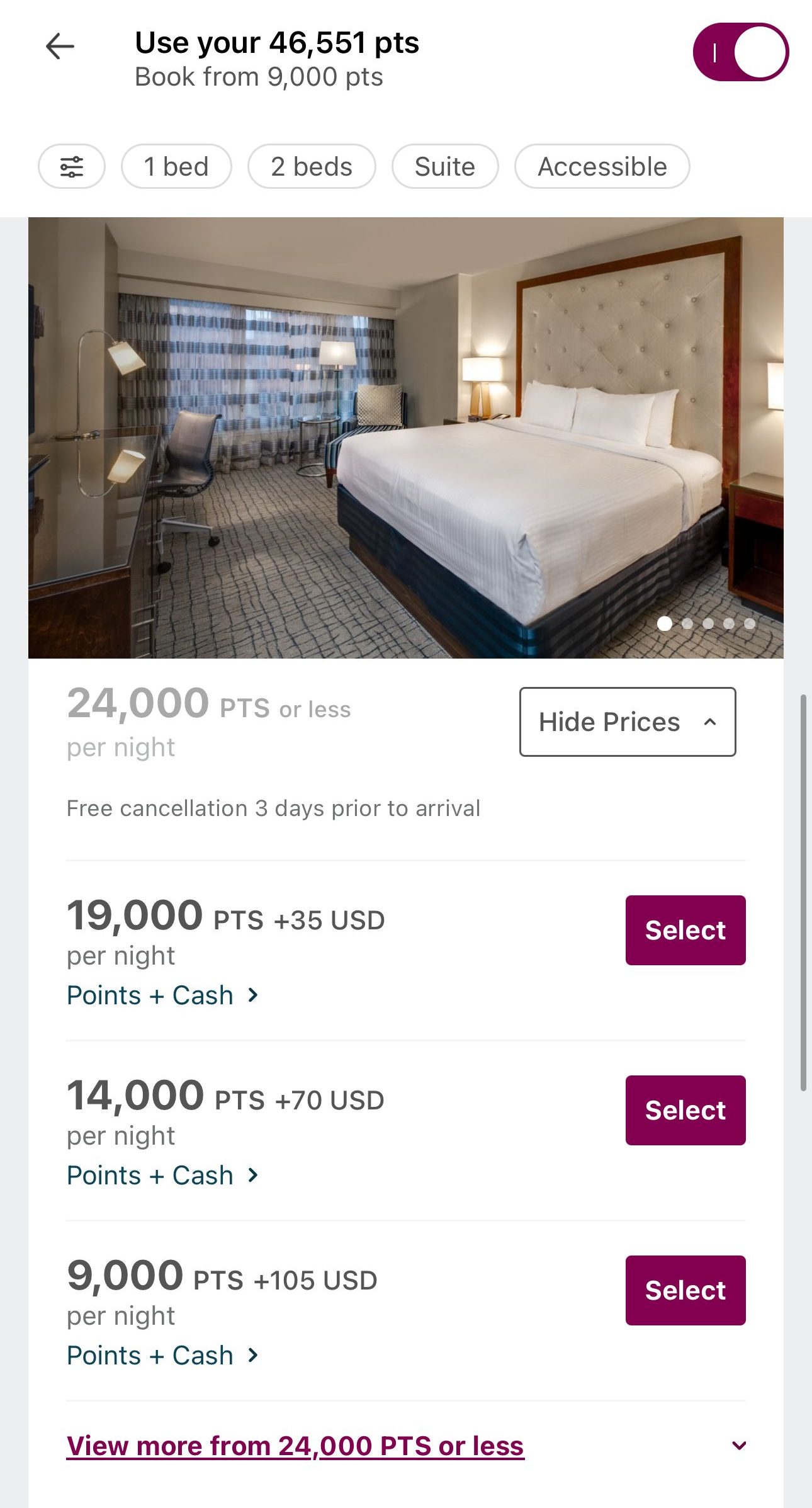

IHG cards offers a range of flexible and rewarding redemption options, including free nights at InterContinental, Holiday Inn, and more. Cardholders can choose from various gift cards,shop for merchandise, book unique experiences or converted into airline miles.

Which Benefits Of You'll Get On Both Cards?

There are some additional types of perks that you will see with both of these cards:

- Redeem 3 Nights, Get 4th Night Free: Enjoy a complimentary fourth night when redeeming points for a consecutive four-night stay at an IHG hotel.

- 20% Discount on Reward Points Purchases: Save 20% on purchases of IHG reward points when using your IHG One credit card, allowing you to maximize your point accumulation and potentially unlock additional benefits within the IHG loyalty program.

- Baggage Delay Insurance: Receive reimbursement, up to $100 a day for 3 days, for essential purchases like toiletries and clothing in the event of baggage delays over 6 hours by a passenger carrier.

- Lost Luggage Reimbursement: Obtain coverage up to $3,000 per passenger if checked or carry-on luggage is damaged or lost by the carrier, extending protection to immediate family members.

- Purchase Protection: Benefit from coverage on new purchases for 120 days against damage or theft, offering reimbursement up to $500 per claim and $50,000 per account.

- Trip Cancellation/Trip Interruption Insurance: Receive reimbursement, up to $5,000 per person and $10,000 per trip, for pre-paid, non-refundable travel expenses in case of trip cancellation or interruption due to covered situations like sickness or severe weather.

Which Benefits Are Unique For Each Card?

There are some additional types of perks which available specifically for each card:

IHG® One Rewards Premier

- Anniversary Free Night: Receive a complimentary night each account anniversary year, redeemable for stays at IHG hotels, with a redemption cap of 40,000 points.

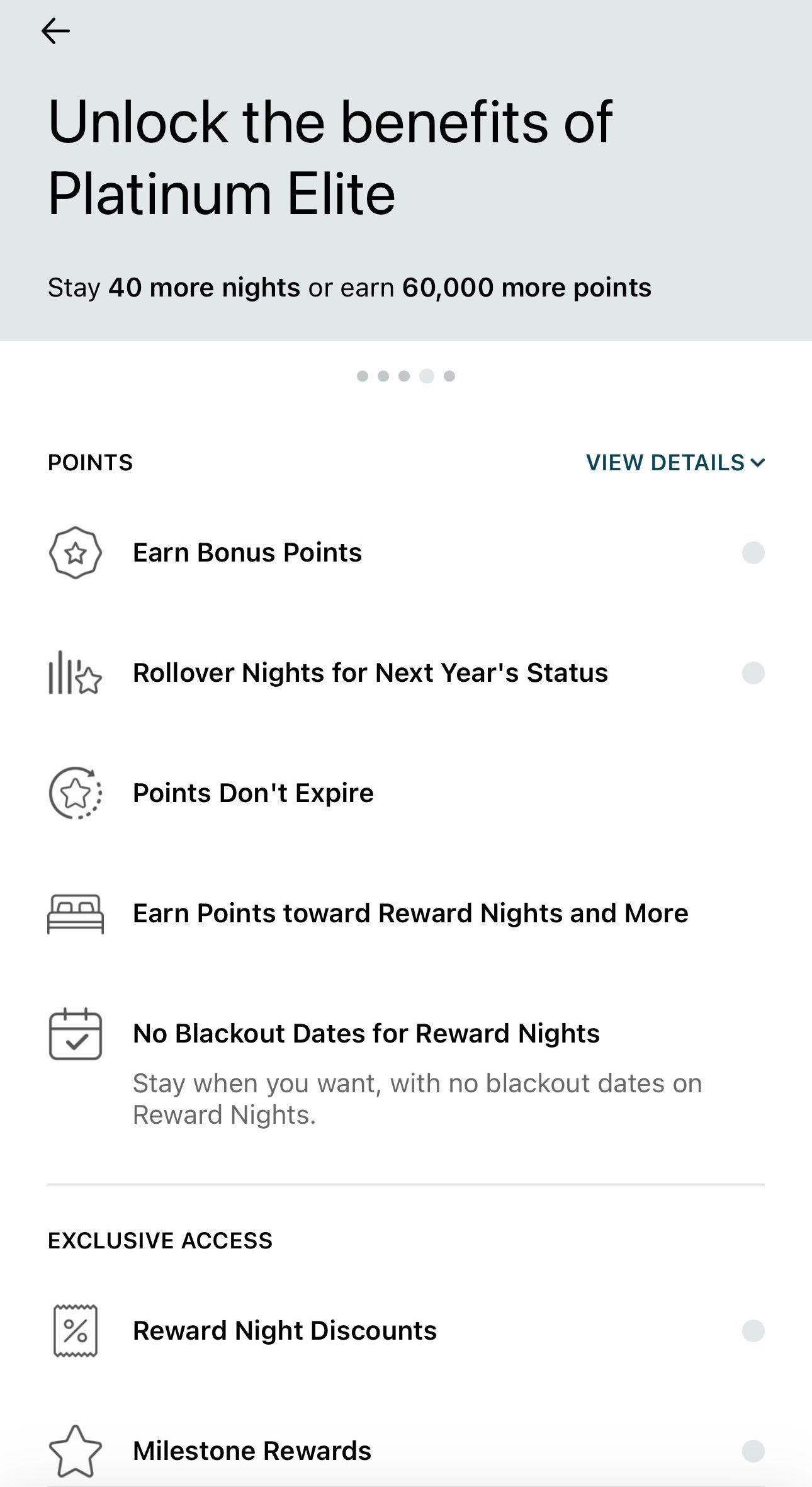

- IHG One Rewards Platinum Elite Status: Enjoy Platinum Elite status in the IHG Rewards program as an IHG One Rewards Premier cardmember.

IHG® One Rewards Traveler

- 10,000 Bonus Points: Earn 10,000 bonus points after spending $10,000 on purchases each calendar year, providing additional rewards for cardholders.

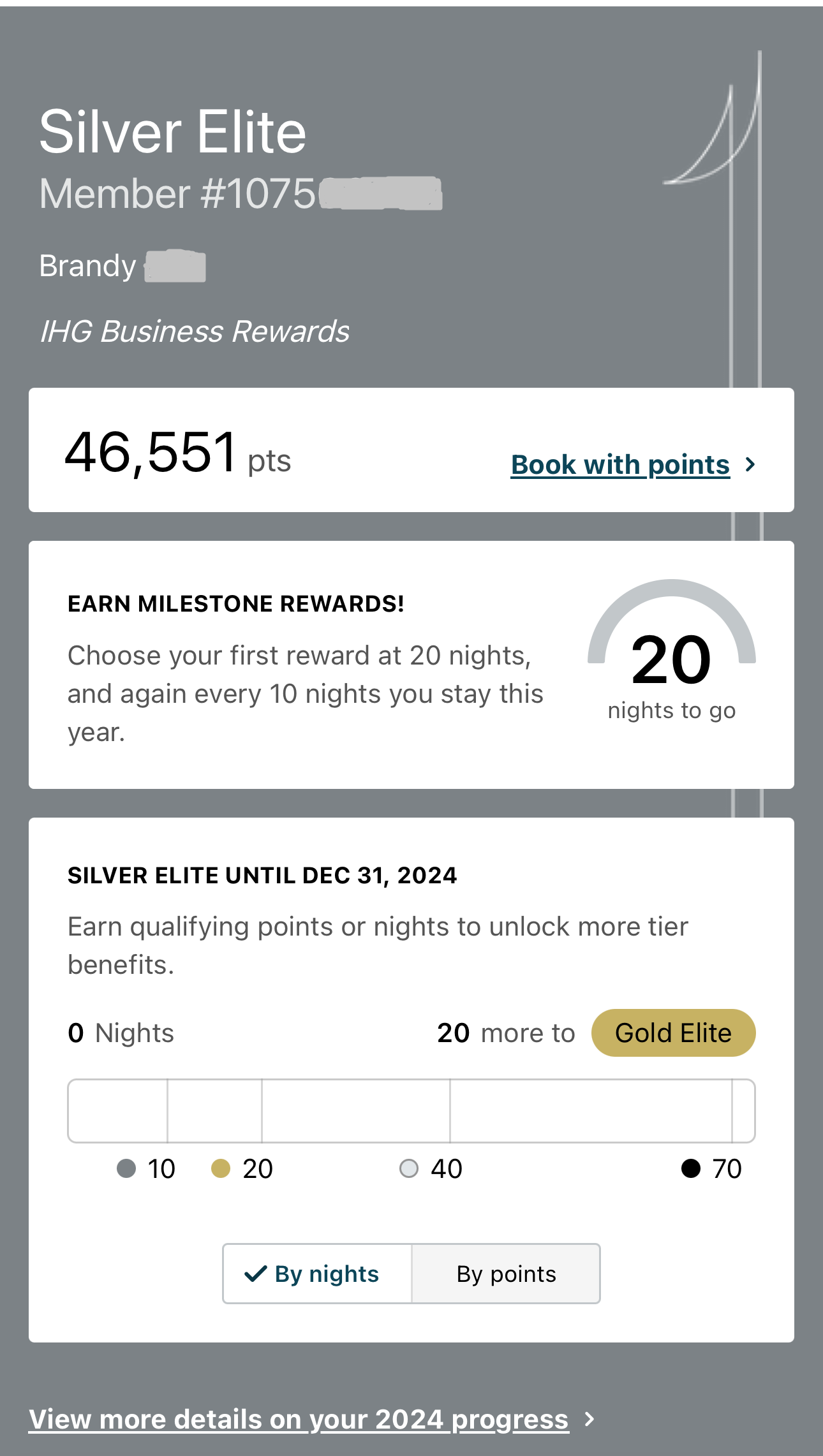

- Silver Elite Status: You are upgraded to IHG One Rewards Silver Elite status for as long as you remain a Traveler cardmember.

When You Might Want the IHG Premier Card?

You Might Prefer the IHG One Rewards Premier over the Traveler if:

Frequent Travelers and IHG Hotel Enthusiasts: The IHG Rewards Premier Card is ideal for those who frequently stay at IHG properties, offering a range of premium benefits such as a free reward night each year, elevated point-earning potential on IHG purchases, and automatic Platinum Elite status. If you're a hotel enthusiast, the additional perks can outweigh the annual fee.

Value Premium Travel Benefits: If you frequently travel and value premium travel benefits, the IHG Rewards Premier Card provides extras like a Global Entry/TSA PreCheck fee credit and enhanced travel insurance, making it a valuable companion for those seeking a more comprehensive travel experience.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

When You Might Want the IHG Traveler Card?

You Might Prefer the IHG One Rewards Traveler over the Premier card if:

Infrequent Travelers on a Budget: The IHG Traveler Card is a more suitable option for individuals who travel infrequently and are on a budget, as it doesn't come with an annual fee. It allows you to earn IHG Rewards points without incurring additional costs, making it a cost-effective choice for occasional travelers.

New to Rewards Programs: For individuals new to rewards programs or credit card perks, the IHG Traveler Card provides a gentle introduction. Without the annual fee, it's a low-risk entry point into the IHG Rewards ecosystem, allowing you to explore and understand how loyalty programs work without a substantial financial commitment.

Compare The Alternatives

If you're looking for an hotel rewards credit card– there are some excellent alternatives you may want to consider:

|

|

| |

|---|---|---|---|

Marriott Bonvoy Brilliant® American Express® Card

| The Platinum Card® from American Express | Hilton Honors American Express Card | |

Annual Fee | $650. See Rates & Fees | $695. See Rates & Fees | $0 |

Rewards | 2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

|

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

|

Welcome bonus | 185,000 points

185,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership

|

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

100,000 points

100,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

|

Foreign Transaction Fee | $0 | $0. See Rates & Fees | $0. See Rates and Fees. |

Purchase APR | 20.99% – 29.99% Variable

| 21.24% – 29.24% APR Variable | 20.99%-29.99% Variable

|

Compare IHG One Rewards Premier Card

Both cards offer similar rewards ratio and hotel perks, so overall it comes down to which hotel chain you like better – IHG or Marriot?

IHG One Rewards Premier vs. Marriott Bonvoy Boundless: Side By Side Comparison

With this hotel rewards cards battle, the World of Hyatt Card is our winner as it offers a higher annual cash back for the average consumer

World of Hyatt Card vs IHG One Rewards Premier: Side By Side Comparison

Compare IHG One Rewards Traveler Card

Both Hilton Honors Amex and Wyndham Rewards Earner cards offer a decent point rewards ratio and basic extra hotel perks.

Hilton Honors American Express vs. IHG One Rewards Traveler: Side By Side Comparison