Rewards Plan

Welcome Bonus

Our Rating

0% Intro

Annual Fee

APR

- Elite Status

- No Foreign Transaction Fees

- Lower Point Values

- Limited Redemptions

Rewards Plan

Welcome Bonus

Our Rating

PROS

- Elite Status

- No Foreign Transaction Fees

CONS

- Lower Point Values

- Limited Redemptions

APR

21.49%–28.49% variable

Annual Fee

$0

0% Intro

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

The IHG One Rewards Traveler Credit Card is a no-annual-fee card designed for occasional travelers looking to maximize points for IHG hotel stays. The card earns 10X points from IHG® on stays for being an IHG One Rewards member. Plus up to 6X points from IHG® on stays with Platinum Elite Status, a benefit of this card. 5X total points on travel, dining, and at gas stations. 3X points per $1 spent on all other purchases..

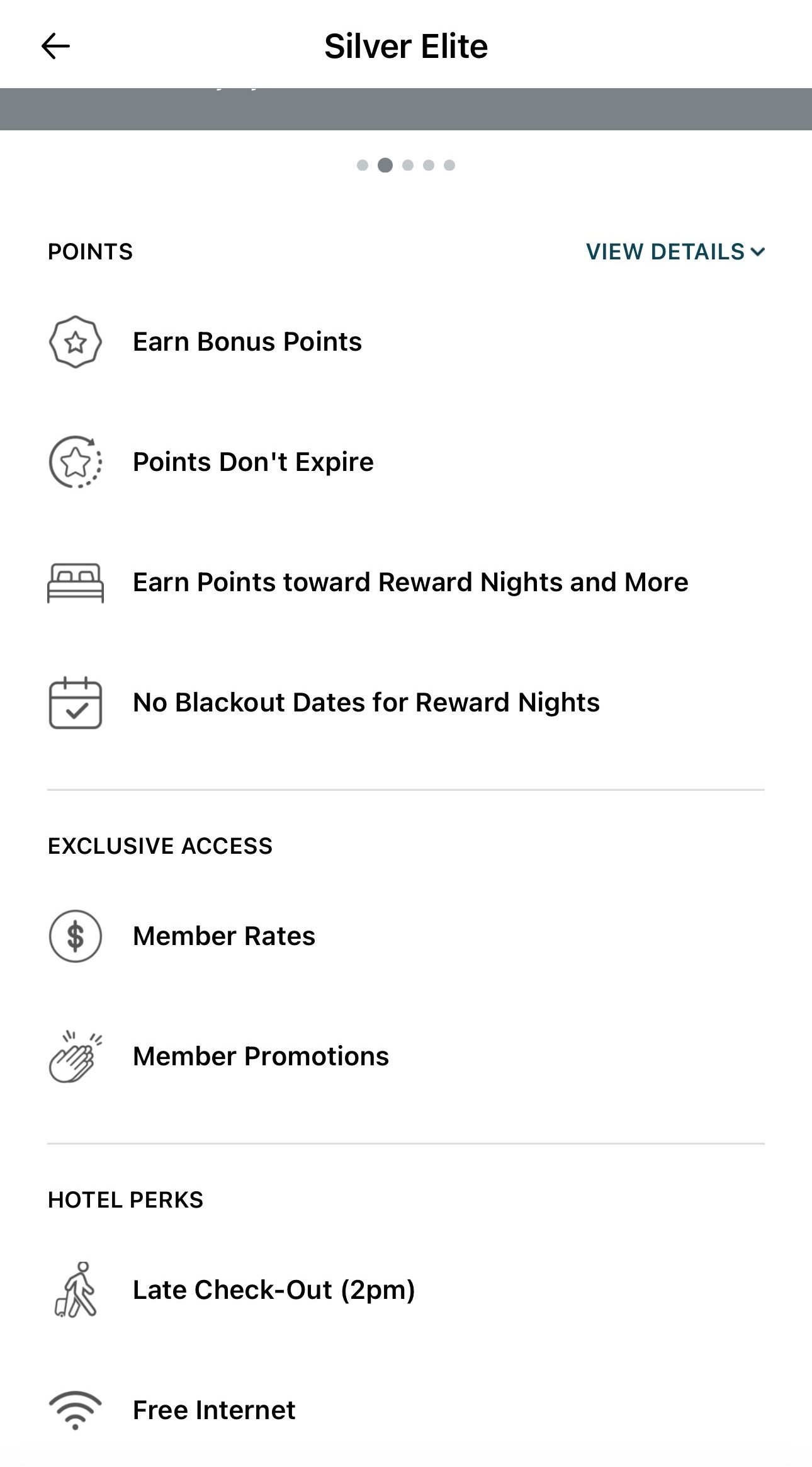

Additional perks include a complimentary fourth reward night, bonus points each calendar year, a fourth-night free benefit, automatic silver elite status, variety of redemption options and the potential for Gold Elite status with high annual spending.

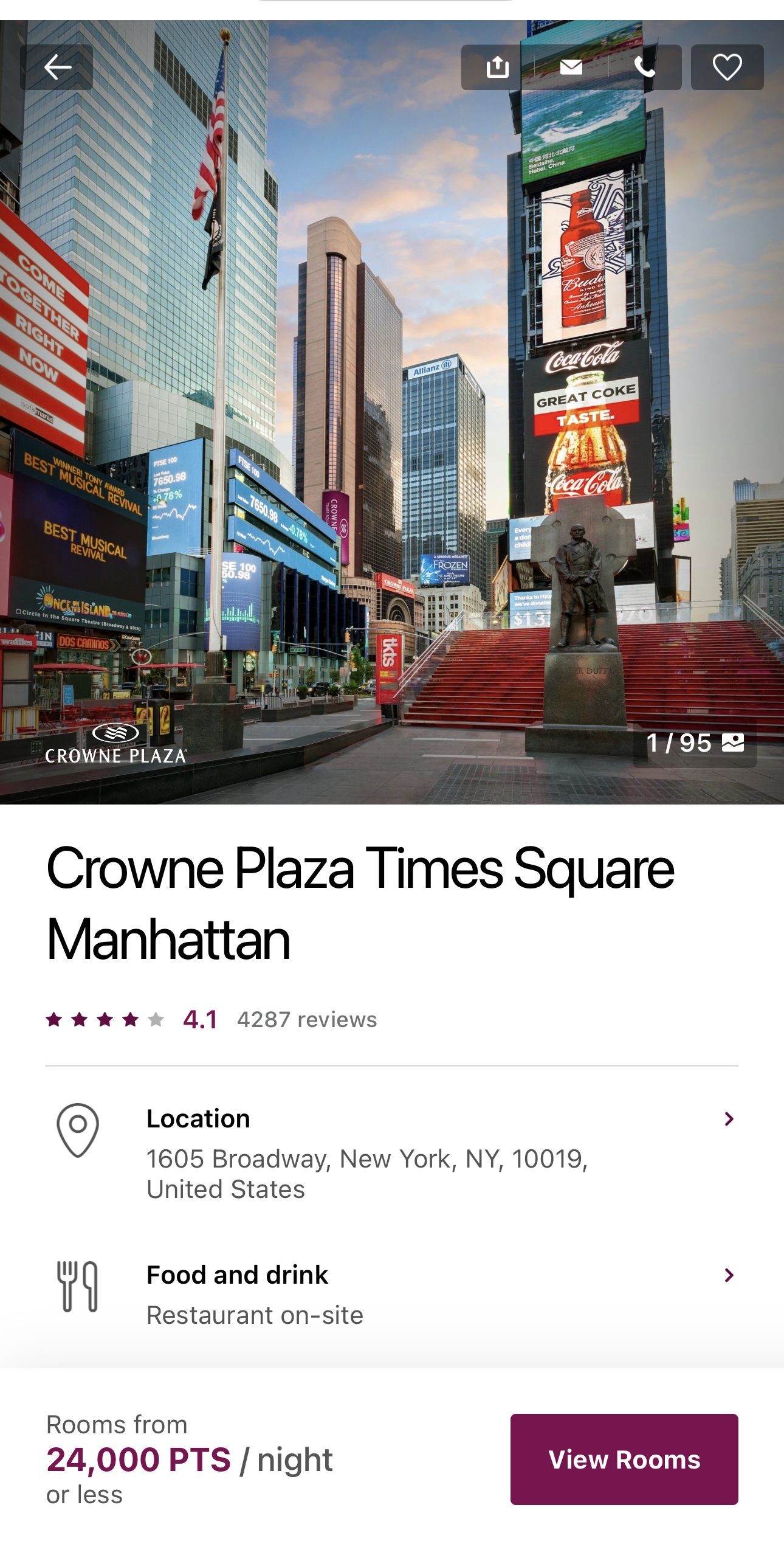

As an IHG Rewards Traveler member, you earn points for every eligible stay at IHG hotels, including brands like InterContinental, Crowne Plaza, Holiday Inn, Holiday Inn Express, Kimpton, and more. You can redeem your IHG Rewards points for a variety of rewards. This includes free nights at IHG hotels, airline miles, merchandise, gift cards, and even experiences.

However, its cons include a lack of introductory APR for purchases or balance transfers, low points value outside of IHG stays, and limited luxury benefits. Considering there is no annual fee, the card offers some impressive perks, but if you’re not brand loyal to IHG, there are other travel reward cards that could offer greater rewards.

How do I redeem rewards?

You can redeem your points for hotel stays, transfer them to airline reward programs or purchase items from the IHG Rewards Catalog. You can explore all of these options by logging into your account.

If you want to use your points for a hotel stay, you can search for your travel dates and location as you would normally, but you’ll see a cost in points with each option. You can then select an option and proceed with the booking as you typically would.

How hard is it to get an IHG Rewards Traveler card?

You do need good to excellent credit for the IHG Rewards Traveler card and it is also subject to Chase’s 5/24 rule. This means that regardless of your credit, if you’ve opened five new credit card accounts within the last 24 months, your application will be declined.

When it may not be a good idea?

Since this is a co-branded card, it is obviously not a good idea if you’re not brand loyal to IHG. If you don’t have a preference of where you stay, a general travel rewards card is likely to be a better fit for you and could potentially offer greater rewards.

In this Review

Estimating Your Rewards: A Practical Simulation

The following table is a simulation of rewards that showcases the potential benefits of using the IHG One Rewards Traveler Credit Card. It provides an estimated breakdown of the rewards you could earn based on your typical spending habits in various categories.

While this table can help you understand the potential advantages of the card, it is important to keep in mind that the figures presented are only estimates, and your actual rewards may vary depending on your individual spending patterns and other factors.

Spend Per Category | IHG® Rewards Traveler Credit Card

|

$10,000 – U.S Supermarkets | 10,000 points |

$3,000 – Restaurants

| 9,000 points |

$4,000 – Airline | 4,000 points |

$4,000 – Hotels | 68,000 points |

$4,000 – Gas | 12,000 points |

Estimated Annual Points | 103,000 Points |

Estimated Redemption Value | 1 point ~ 0.7 cent |

Estimated Annual Value | $721 |

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

Pros and Cons

Just like any other credit card, the IHG One Rewards Traveler Credit Card has some advantages and disadvantages:

Pros | Cons |

|---|---|

Elite Status | Lower Point Values |

Free Nights | Limited Redemptions |

No Foreign Transaction Fees | High Annual Spend Needed for Gold Elite |

Savings on Reward Point Purchases | No Luxury Perks or Benefits |

Baggage Insurance | No Introductory APR |

Trip Cancellation/Interruption Insurance | |

Purchase Protections |

- Elite Status

Providing you maintain your IHG Rewards Traveler Credit Card, you’ll receive Silver Elite status. You can also receive an upgrade to Gold Status if you spend $20,000 or more during the calendar year.

- Free Nights

When you redeem your points for a four night consecutive stay at IHG hotels, you’ll receive a free reward night. This means that you’ll only need to use your points to pay for three nights.

- No Foreign Transaction Fees

When you make purchases outside the United States using your card, you won't be charged any foreign transaction fees.

- Savings on Reward Point Purchases

When you purchase points using your IHG Traveler credit card, you can save 20% on your purchases.

- Baggage Insurance

This coverage reimburses you for essential purchases if your baggage is delayed by your passenger carrier for over six hours. The coverage offers up to $100 per day for three days.

There is also lost luggage reimbursement if your checked or carry on bags are damaged or lost by your carrier. This coverage has a limit of $3,000 per passenger.

- Trip Cancellation/Interruption Insurance

If your trip is cut short or canceled by severe weather, sickness or other covered circumstances, you can receive up to $5,000 per person and $10,000 per trip in reimbursement for non refundable, pre paid travel expenses such as passenger fares, hotels and tours.

- Purchase Protections

When you make purchases with your card, your items are covered against theft or damage for 120 days. The coverage limits are $500 per claim and $50,000 per account.

- Lower Point Values

IHG point worth about 0.7 cent.

While a low point value for individual points is not necessarily a bad thing if you can earn sufficient points to make up for the lower value. However, when you’re comparing hotel loyalty programs, it is something to bear in mind.

Although you can earn a lot of points, they may not provide as much value as you would get with other hotel reward programs or travel reward programs in general.

- Limited Redemptions

Unless you’re booking a travel night, you’re not likely to get a great redemption rate on other offers. This represents poor options beyond the reward nights.

- High Annual Spend Needed for Gold Elite

Although the card does offer automatic status, if you’re aiming for Gold Elite, you’ll need to meet a high annual spend requirement.

- No Luxury Perks or Benefits

Unlike with other programs or higher-level IHG cards such as the Premier Club, you’ll not get luxury perks or benefits with this card, such as lounge access or airline credit.

- No Introductory APR

Unfortunately, this card does not have an introductory rate for either purchases or balance transfers. This means that you’ll be paying the standard rate from day one.

IHG Traveler Redemption Options

The IHG One Rewards Traveler Credit Card provides various redemption options for cardholders:

Free Nights: Use your IHG points to book free nights at participating IHG hotels and resorts.

Points and Cash Combinations: Enjoy flexibility by combining points and cash to cover the cost of your stay, allowing you to use as few or as many points as you prefer.

Transfer to Airline Partners: Transfer your IHG points to airline partners, including American Airlines, Delta, JetBlue, and United Airlines.

IHG Rewards Catalog: Redeem points for a range of items from the IHG rewards catalog, including jewelry, electronics, household items, and more.

Gift Cards: Exchange your points for gift cards from various retailers and brands.

Offset Travel Costs: Use points to offset expenses related to flights, car rentals, and other travel-related costs.

Transfer or Gift Points: Transfer points to other IHG cardholders or gift them to friends or family.

Charitable Donations: Contribute to charitable causes by using your points for donations.

Who Should Consider The IHG® One Rewards Traveler Card?

If you tend to stay at IHG locations when you travel, and you don’t want to pay an annual fee on your credit card, the IHG Rewards Traveler is a good option for you. With so many brands owned by IHG, the locations are easy to find around the world, which means that you can access elite status perks each time you stay.

The card is also a good choice if you are interested in IHG elite status. With the generous welcome bonus and automatic Silver status, it can be easier to reach Gold status, particularly if you’re a high spender.

If you do travel but still want to compare hotel cards, here's an overview:

Card | Rewards | Bonus | Annual Fee | |

|---|---|---|---|---|

1X – 4X

4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.

| Up to 60,000 Bonus Points

30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening.*Opens offer details overlay Plus, up to 30,000 More Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Point, on up to $15,000 spent.

| $95 | ||

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $95

| ||

3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

| 80,000 points

80,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

| $0 (Rates & Fees) | ||

1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 3 Free Nights

3 Free Nights (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months from your account opening

| $95 | ||

2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

| 95,000 points

95,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership

| $650 |

How To Maximize Card Benefits?

While this card is quite straightforward, there are some tips that can help you to get the most from it. These include:

-

Book Award Stays of at Least Three Nights

While it can be great to get away for the weekend, if you only stay at IHG locations for two nights, you’ll be missing out on free award nights.

You’ll get one free night when you book three award nights, so make sure that your stays are four days for maximum value.

-

Book Other Travel Plans with Your Card

Although this is a hotel chain co-branded card, you can benefit from some excellent insurance coverage when you book your common carrier fares with this card.

This includes baggage insurance and trip cancellation/interruption coverage.

-

Consider the Card for Other Purchases

Likewise, you can benefit from purchase protections when you use the card to buy everyday items. Your items will then be covered against damage or theft for up to 120 days.

FAQs

Does the card provide car rental insurance?

Unfortunately, while this card does offer some insurances, there is no car rental insurance coverage included in the card perks.

What are card income requirements?

There are no official income requirements for this card, but you do need good to excellent credit. Although Chase will evaluate your income, it will not be the only factor considered when making an approval decision for your application.

Can I get pre-approved?

Chase does typically offer pre approval for its cards including the IHG Rewards Traveler. You can log in as a customer or as a guest to see if you are likely to be approved for the card.

Chase also sends out mailers and other promotional materials which may offer select customers pre approval for this or other cards.

Compare IHG One Rewards Traveler Card

In our opinion, the IHG One Rewards Premier wins only if you plan to spend a significant amount on hotels. If not, the differences are minor.

IHG One Rewards Traveler vs. Premier: Side By Side Comparison

Both Hilton Honors Amex and Wyndham Rewards Earner cards offer a decent point rewards ratio and basic extra hotel perks.

Hilton Honors American Express vs. IHG One Rewards Traveler: Side By Side Comparison