The Chase Marriott Bonvoy Bountiful Credit Card and Marriott Bonvoy Brilliant® American Express® Card are two premium hotel credit cards that offer a variety of rewards and benefits for frequent Marriott Bonvoy travelers.

Let's compare them side by side to see which is best for your needs.

General Comparison: Marriott Bountiful vs Brilliant

The Bonvoy Brilliant Card, issued by Amex, comes with a hefty annual fee but provides a variety of perks such as Priority Pass Select membership for airport lounges, a statement credit for Global Entry or TSA PreCheck application fees, and Platinum Elite Status.

On the other hand, the Bountiful, which Chase issues, offer more or less the same rewards in terms of points, but doesn't include most of the premium perks the Brilliant card offers.

Here's a comparison of the cards ,ani features:

|

| |

|---|---|---|

Marriott Bonvoy Bountiful | Marriott Bonvoy Brilliant | |

Annual Fee | $250 | $650. See Rates and Fees. |

Rewards | 6X points for every $1 spent at hotels participating in Marriott Bonvoy, 4X points on the first $15,000 spent in combined purchases each year on grocery stores and dining, 2X points on other purchases.

| 6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases |

Welcome bonus | 85,000 Bonus Points after you spend $4,000 in purchases in your first 3 months from your account opening | 185,000 Marriott Bonvoy bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | |

Purchase APR | 21.49%-28.49% Variable APR | 20.99% – 29.99% Variable

|

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

Compare Rewards: Marriott Bountiful vs Brilliant

Based on our assessment, although the Marriot Brilliant card carries a greater annual fee than the Bountiful card, the Bountiful card accumulates more points for equivalent spending, resulting in an overall higher value compared to the Brilliant card.

This discrepancy is primarily attributed to the Bountiful card's superior rewards ratio on expenditures related to groceries and dining.

|

| |

|---|---|---|

Spend Per Category | Marriott Bonvoy Bountiful | Marriott Bonvoy Brilliant |

$10,000 – U.S Supermarkets | 40,000 points | 20,000 points |

$5,000 – Restaurants | 20,000 points | 15,000 points |

$6,000 – Hotels | 36,000 points | 36,000 points |

$8,000 – Airline

| 16,000 points | 24,000 points |

$4,000 – Gas | 8,000 points | 8,000 points |

Total Points | 120,000 points | 103,000 points |

Redemption Value (Estimated) | 1 point = ~0.8 cent | 1 point = ~0.8 cent |

Total Points | $960 | $824 |

Earn and use points with the Marriot cards for complimentary nights at Marriott hotels, exclusive travel experiences, and special events. Additionally, transfer points to airlines, pay for car rentals, or use them for shopping.

Explore unique experiences with Marriott Moments by booking activities and adventures using your accumulated points.

Travel Benefits: Comparison

The Brilliant card offers a variety of credit statements, lounge access, and Marriot-focused benefits such as free night award and Platinum elite status.

The Bountiful card doesn't offer premium benefits such as priority pass access or TSA Precheck reimbursement.

Marriott Bonvoy Bountiful

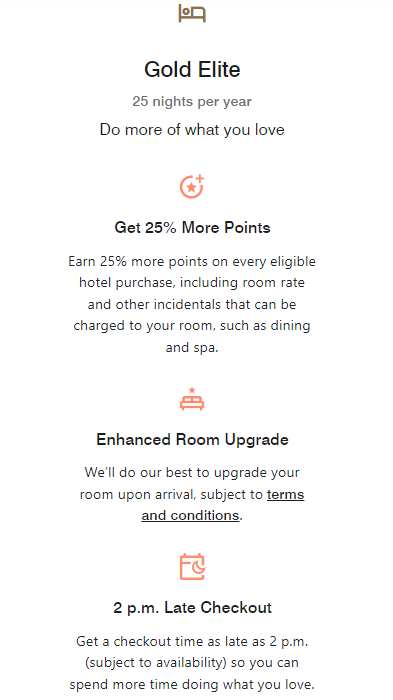

- Automatic Gold Elite Benefits: Cardmembers enjoy automatic Gold Elite Status each account anniversary year, unlocking various privileges and perks during their stays.

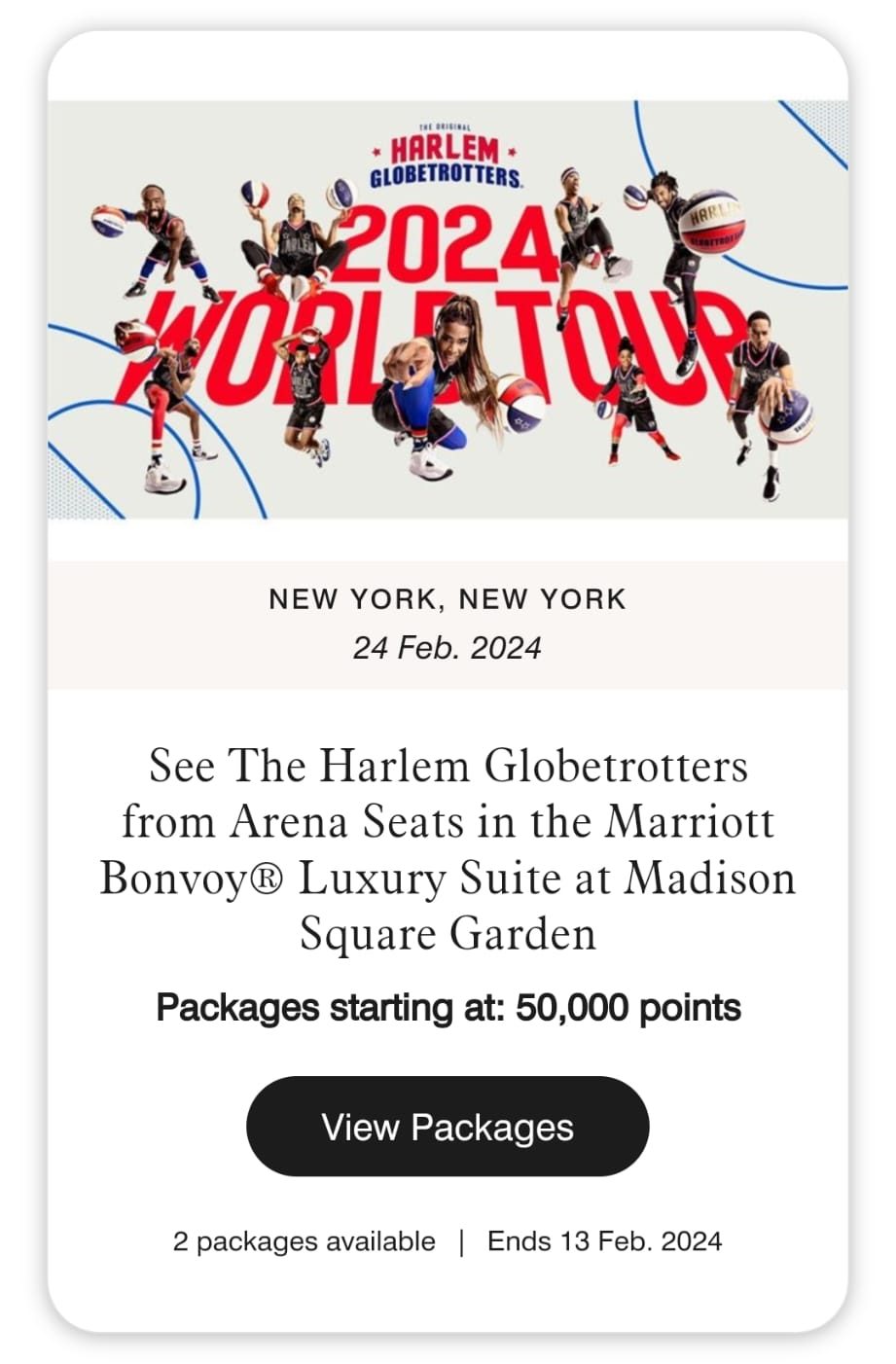

- Free Night Award Every Year: Cardmembers receive a Free Night Award annually after spending $15,000, valid for a one-night stay at a property with a redemption level of up to 50,000 points.

- 15 Elite Night Credits: Cardholders are granted 15 Elite Night Credits each calendar year, contributing towards elite status within the Marriott Bonvoy program.

- Additional Marriott Bonvoy Stay Points: Earn 1,000 Bonus Points per eligible stay at participating Marriott Bonvoy hotels, enhancing the points accumulation for rewards.

- Visa Concierge: Access complimentary Visa Signature Concierge Service 24/7 for assistance with various tasks, including event ticket bookings, restaurant reservations, and gift selection.

- DoorDash: Cardholders receive a one-year complimentary DashPass membership for DoorDash and Caviar, offering unlimited deliveries with $0 delivery fees and reduced service fees on eligible orders.

Marriott Bonvoy Brilliant

- Marriott Bonvoy Platinum Elite Status: Enjoy complimentary Platinum Elite status with the card, allowing you to earn up to 5X points on eligible hotel purchases with the 50% Bonus Points on stays benefit.

- Earned Choice Award: After spending $60,000 on eligible purchases in a calendar year, you can choose an Earned Choice Award benefit such as getting Suite Night Awards™ (five) to redeem for upgrades to select premium rooms and suites, gift Marriott Bonvoy® Silver Elite Status to a family member or friend and more.

- $300 Dining Credit: Get up to $300 in statement credits annually ($25 per month) for eligible restaurant purchases with the Brilliant card.

- Free Night Award: Receive one Free Night Award each year after your card renewal month, valid for a one-night stay (up to 85,000 Marriott Bonvoy points) at participating Marriott Bonvoy hotels.

- $100 Marriott Bonvoy Property Credit: Get up to a $100 property credit for qualifying charges at The Ritz-Carlton or St. Regis hotels when booking a special rate for a minimum 2-night stay.

- Fee Credit for Global Entry or TSA Precheck: Receive a statement credit every 4 years for Global Entry or every 4.5 years for TSA PreCheck application fees when paid with your card.

- 25 Elite Night Credits: Get 25 Elite Night Credits each calendar year toward achieving higher levels of Marriott Bonvoy Elite status.

- Priority Pass Select: Enjoy unlimited lounge visits for yourself and up to two guests at no extra charge with complimentary Priority Pass Select membership, offering access to over 1,200 airport lounges worldwide.

- Premium Internet Access: Receive complimentary in-room premium Internet access at participating Marriott Bonvoy properties.

- American Express Experiences: Gain exclusive access to ticket presales and Card Member-only events, including entertainment options like Broadway shows, concerts, family events, and more. Visit the American Express website for more information.

Terms apply to American Express benefits and offers.

Insurance Benefits And Protections

Both cards offer the following protections

- Baggage Insurance Plan: When you purchase a common carrier vehicle ticket with your Eligible Card, you can receive coverage for lost, damaged, or stolen baggage.

- Trip Cancellation and Interruption Insurance: Buying a round-trip with your s Card can provide assistance in the event of trip cancellation or interruption, following the specified terms and conditions.

- Trip Delay Insurance: If your trip faces a delay of more than 6 hours due to a covered reason and you paid for the round-trip with your Eligible Card.

- Purchase Protection: Eligible purchases made with your card can be protected for up to 90 days from the purchase date, offering coverage for theft, accidental damage, or loss.

But, there are protections unique to the Brilliant card:

- Cell Phone Protection: This embedded benefit provides reimbursement for repair or replacement costs after cell phone damage or theft.

- Car Rental Loss and Damage Insurance: When you reserve and pay for a rental vehicle with your Card, declining the rental counter's collision damage waiver, you can be protected against damage or theft in specific regions, subject to certain exclusions and limitations.

- Extended Warranty: When you use your card for eligible purchases, you can receive an extra year of warranty coverage for warranties lasting 5 years or less in the United States or its territories.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

When You Might Want the Marriott Bonvoy Brilliant?

You might prefer the Marriott Bonvoy Brilliant card over the Marriott Bonvoy Bountiful card in the following situations:

You frequently stay at Marriott Bonvoy hotels: Choose the Marriott Bonvoy Brilliant if you frequently stay at Marriott properties and travel extensively. The higher annual fee may be justified by the card's additional features, including enhanced points earning on Marriott spending and a potentially more valuable annual free night benefit.

You Want Luxury Travel Benefits: Opt for the Marriott Bonvoy Brilliant if you prioritize luxury travel perks. The Brilliant card often comes with premium benefits such as Platinum elite status, statement credits, and airport lounge access, providing an elevated travel experience.

You Want Broader Travel Insurance: The Brilliant card offers rental car insurance, extended warranty and cell phone protection, all of which are not available through the Bountiful card.

When You Might Want the Marriott Bonvoy Bountiful?

You might prefer the Marriott Bonvoy Bountiful if:

- You Want A Lower Annual Fee: Opt for the Marriott Bonvoy Bountiful if you prefer a more cost-conscious approach, as it typically comes with a lower annual fee compared to the Brilliant card.

- You Focus on Points Accumulation: If your primary goal is to accumulate Marriott Bonvoy points efficiently, the Bountiful card's superior points-earning potential for similar spending makes it a preferable option over the Brilliant card, even with the lower annual fee.

- Frequent Grocery and Dining Spending: If you find yourself frequently spending on groceries and dining out, the Marriott Bonvoy Bountiful may be the better choice due to its higher rewards ratio in these categories, offering more points for your everyday expenses.

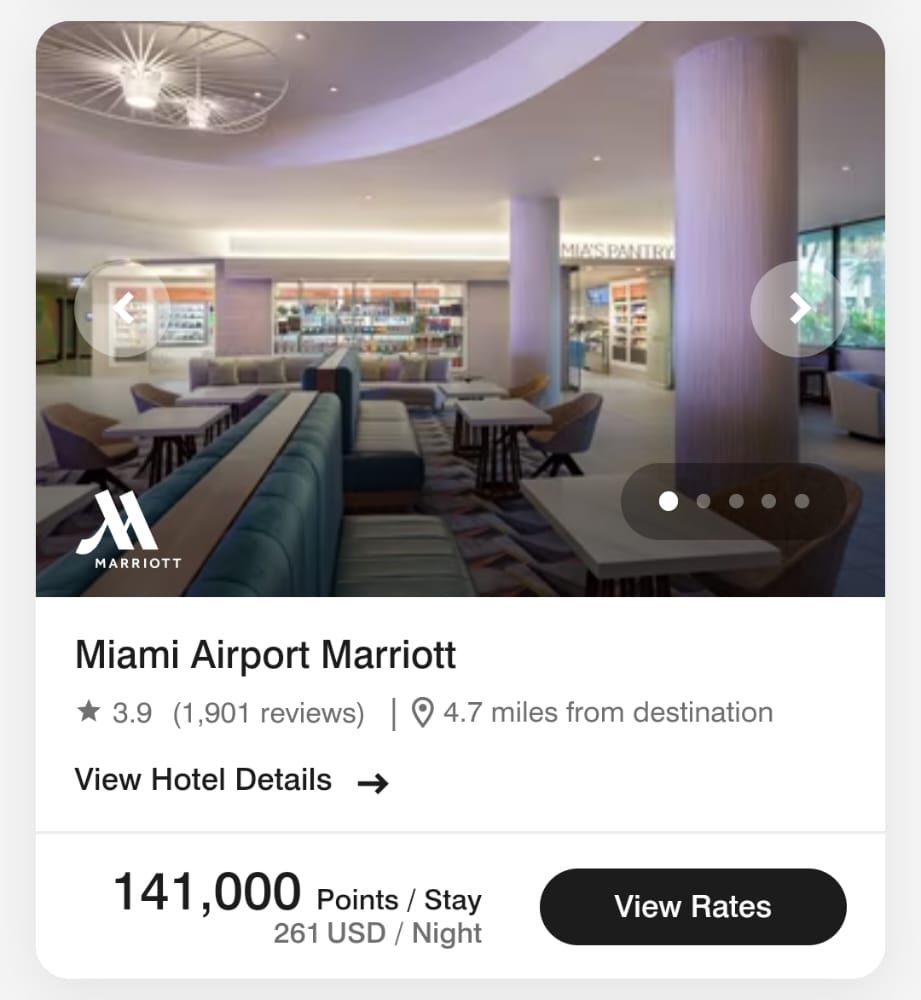

Compare The Alternatives

If you're in search of a credit card that offers travel benefits with a focus on hotel rewards, there are several noteworthy alternatives worth exploring.

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Hilton Honors Aspire Card from American Express

Hilton Honors Aspire Card is no longer available through The Smart Investor.

| Chase Sapphire Reserve® | |

Annual Fee | $695. See Rates & Fees | $550 | $550 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

3x – 14x

14X Hilton Honors bonus points when you make eligible purchases on your card at participating hotels or resorts within the Hilton Portfolio, 7X Hilton Honors bonus points on eligible purchases on your card for: Flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and U.S. restaurants, 3X Hilton Honors bonus points on other eligible purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. |

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

150,000 points

150,000 Hilton Honors Bonus Points after you spend $4,000 in purchases on the Card within your first 3 Months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0 |

Purchase APR | 21.24% – 29.24% APR Variable | 20.99% – 29.99% variable | 22.49%–29.49% variable |

Compare Marriott Bonvoy Brilliant Card

While there is no big difference when it comes to points rewards, the Brilliant offers lounge access, credit statements, and Platinum status.

The Brilliant is more expensive than the Bevy card but offers more premium perks such as dining credit, lounge access, and TSA PreCheck.

While the Amex Platinum offers extensive travel perks and redemption options, the Marriott Brilliant Card has better hotel-specific perks.

Amex Platinum Card vs. Marriott Bonvoy Brilliant Card: Which Luxury Travel Card Is Best?

While the Brilliant card focuses on benefits tailored to Marriott enthusiasts, the Chase Reserve focuses on general, luxury travel perks.

Marriott Bonvoy Brilliant vs. Chase Sapphire Reserve: Which Luxury Travel Card Is Best?

Surprisingly, while having a lower annual fee, the Hilton Amex Aspire's estimated cashback value is higher than the Marriot Brilliant's card.

Marriott Bonvoy Brilliant vs. Hilton Amex Aspire: : Which Luxury Hotel Card Is Best?

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.