Quontic Bank

Fees

Minimum Deposit

Our Rating

APY Savings

- Overview

- Pros & Cons

- FAQ

Quontic Bank is an online bank with its headquarters in New York. The bank has been operating since 2009 and it operates in all 50 states for online customers. This bank provides access to savings, checking, CD and money market accounts. There are also residential and commercial real estate products.

Quontic Bank is also designated as a Community Development Financial Institution. CDFIs focus on lending to underserved and economically distressed communities and individuals. This bank has a solid rating with consumer review sites, where current and previous customers praise the ease of account opening and helpful team.

Quontic bank can be a good choice if:

- You’re ok with an online only bank

- You have at least 100K to put in a savings account

- You may need a mortgage/home equity loan

- Competitive Rates

- Interest Compounds Daily

- Large ATM Network

- Minimal Fees

- Reward Checking Accounts

- No Physical Location

- No Special CDs

- High Balance Needed for Highest Rates

- Cash Deposits Tricky

What are the requirements to open a Citi account?

Citi requires applicants to prove their identity before opening an account, as do the majority of banks. A genuine home address, name, and Social Security number must be provided. A legitimate government ID, such as a passport, driver's license, or state ID, is also required.

Naturally, if you already have an account with Citi, you can open a new one without having to go through the ID verification procedure once more.

Can I open a Citi checking account online?

It's true that opening a Citi checking account online is among the simplest processes. Citi has developed a six-step application procedure that, from start to finish, should barely take a few minutes.

You will have to set up your online access, submit your personal information, validate your ID, and confirm your employment information. Following that, you will be shown your finance and documentation options.

Is there a free checking account offered by Citi?

Despite the fact that Citi offers a variety of checking account choices, each one includes a monthly maintenance charge. If you meet the requirements for the fee waiver, though, you might be able to avoid paying it.

For instance, the $10 charge for the Access Account package is removed if you keep your balance at $1,500 or make one eligible deposit or bill payment per statement period.

Can Citi fail during a recession?

Despite having a long history, Citi has a history of experiencing difficulties during lean economic times. After the financial crisis of 2007–2008, the federal government provided Citi with a sizable $517 billion bailout loan.

The government didn't sell the final bailout bonds from this fund until 2013. Naturally, Citi is FDIC insured, so even if the bank experiences financial difficulties, customer deposits up to $250,000 are safeguarded.

Can I Open a Joint Checking Account with Citi?

Citi does permit shared account ownership. You and your friend can open a joint account or you can add a second person to your current Citibank account.

Although Citi must verify the identity of both parties, if you are already a customer, you simply need to go through the process for the other party. This can be done in person or online at a nearby branch.

Quontic Bank Review

Banking Services | Credit Options | ||

|---|---|---|---|

Savings Accounts | Mortgage | ||

Checking Accounts | Government Mortgage | ||

CDs | Credit Cards | ||

Money Market Account | Debit Card | ||

Investing Capabilities | Personal Loans |

Pros And Cons

While Quontic Bank offer a couple of great benefits, there are some drawbacks to consider before opening an account:

Pros | Cons |

|---|---|

Highly Competitive Rates | No Special CDs |

Minimal Fees | Digital Bank |

Interest Compounds Daily | Cash Deposits Tricky |

Large ATM Network | No Promotions |

Reward Checking Accounts |

- Competitive Rates

While Quontic Bank offers some of the highest rates, they are highly competitive in its savings, checking, and CD accounts.

- Minimal Fees

Most accounts don’t have a monthly maintenance fee and the fees for incidentals are nominal. As of 2022, fees for cashier's checks, money orders and domestic incoming wire transfers have no fees.

- Interest Compounds Daily

You’ll earn interest every day and it compounds to be credited each statement period.

- Large ATM Network

Quontic customers have access to a large ATM network, with over 90,000 surcharge free machines.

- Reward Checking Accounts

All three checking account options at Quontic offer some form of rewards. Whether it is interest on your balance, cash back on debit card purchases or Bitcoin, you’ll get perks from each time of account.

- No Special CDs

While you can choose different terms and there is a tiered interest rate, Quontic only has one CD product. This means that it is only your term that can impact your rate.

- Digital Bank

Quontic is an online only bank. So, if you have any queries or questions, you need to rely on email, chat or phone support.

- Cash Deposits Tricky

Since Quontic is a digital bank, the only way to make cash deposits for most customers is via an ATM. If you don’t have an accessible machine in your area, you’ll need to pay cash into your account with another bank and initiate a transfer to your Quontic account.

- No Promotions

If you're a new customer looking for a promotion, Quontic may not be the perfect place for you.

Customer Experience

Since it is a primarily online bank, Quontic does provide access to customer support via phone and online chat. However, these contact avenues are only open weekdays 9 am to 5 pm Eastern time. You can also email.

You can also access customer support and manage your account via the Quontic app. The app is available for Android and iOS devices with decent reviews on both Google Play and the Apple Store. The app allows for Touch ID log in, mobile check deposit and an ATM locator.

Quontic | |

|---|---|

App Rating (iOS)

| 4.5 |

App Rating (Android) | 3.4 |

BBB Rating (A-F) | A+ |

Contact Options | phone/mail |

Availability | 9:00am – 6:00pm EST |

Quontic Bank Savings

Quontic Bank Savings

Fees

Minimum Deposit

APY Savings

APY MMA

While either of these savings accounts offers some of the top HYSA on the market, Quontic aims to make the account opening process as seamless and smooth as possible.

Since Quontic is an online-only bank, all processes are conducted online, and Quontic claims it takes less than five minutes to open one of its savings accounts.

Quontic has two savings account options.

-

High Yield Savings Account

The key features of this account include:

- High rate of 4.50% APY

- Interest compounds daily and is credited each month

- No monthly fees

- $100 minimum account opening requirement

- Only takes three minutes to open an account

- Access to over 90,000 surcharge free ATMs

-

Money Market Account

The key features include:

- Tiered interest rates but you’ll need $150,000+ to access the top rates

- Interest compounds daily and is credited monthly

- $100 minimum account opening requirement

- No monthly service fees

- Comes with checks and a debit card, but if you have more than six pre authorized transactions during a billing cycle, Quontic has the right to change your account to a transactional account.

Quontic CDs

Quontic has a variety of CD options with terms from six months to five years. The rates are tiered to encourage committing to a longer-term CD, but even on the six-month CDs, the rates are competitive. Additionally, you can open a Quontic CD account with $500 or more.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

6 Months | 5.05% | All interest earned |

12 Months | 4.50% | 12 months of interest |

24 Months | 4.50% | 12 months of interest |

36 Months | 4.40% | 24 months of interest |

60 Months | 4.30% | 24 months of interest

|

However, unlike some financial institutions, there is no flexibility to withdraw your funds before the end of the term. If you do need to withdraw early, you will incur an interest penalty. If your CD has a term of less than 12 months, you’ll pay a penalty equal to the full interest earned. On CDs with a term of 12 to 24 months, the penalty is one full year of interest and for CDs with terms of over 24 months, the penalty is two full years of interest.

The process to open a CD account is quite straightforward and only takes a few minutes online. You can fund your new account with a funds transfer from another bank via wire transfer, ACH transfer or mail. Alternatively, you can use the funds from an existing Quontic account.

You’ll start to earn interest from the day your account is opened and funded. It compounds daily and is paid each statement cycle. When your CD is due to mature, Quontic will send you notice and provide a 10 day grace period. During this time, you can withdraw the funds, renew your CD or close the account and open a new CD. If you don’t take any action, Quontic will automatically renew the CD for another term.

Quontic Checking

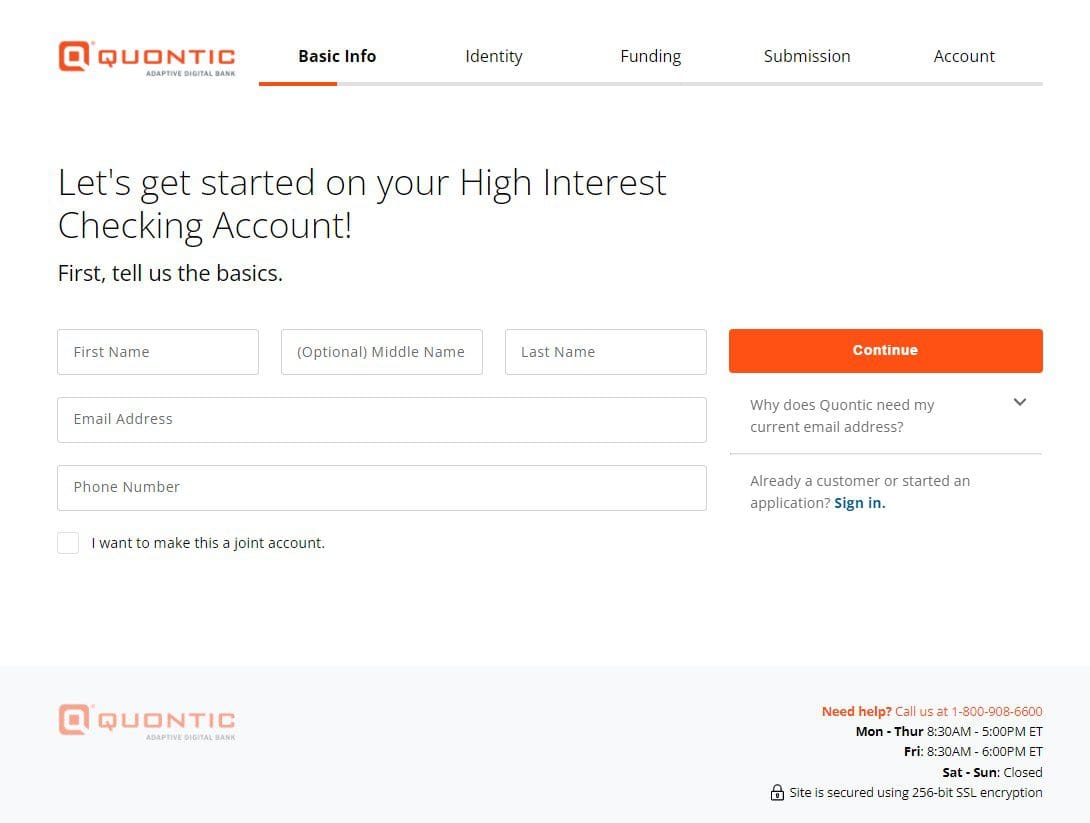

Quontic Bank has three checking accounts that you can open fully online with some basic contact information, your date of birth, and your Social Security Number.

You can fund the account from another bank or with an existing Quontic account, and manage your checking account online, via the app or using one of 90,000+ ATM machines.

-

High Interest Checking

As the name suggests, the Quontic High Interest checking account is designed to provide a higher rate of Up to 1.10% on any balance you hold in the account and is considered one of the best interest-bearing checking accounts.

This is a good alternative to putting the funds in savings where you may incur a penalty if you need to quickly withdraw some or all of the cash.

The key features of the account include:

- No monthly fees

- $100 minimum opening deposit

- Access the higher rate if you make 10+ debit card transactions each month

- Inactivity fee of $5 if there are no transactions on the account for one year

- Cash deposits only possible via ATM

-

Cash Rewards Checking

The Cash Rewards checking account gives up to 1% cash back on all your qualifying debit card transactions. This includes practically any transaction except peer to peer payments and ATM withdrawals.

The cash back you earn is accumulated and credited to your account at the start of every statement cycle.

Other notable features of the account include:

- No monthly fees

- $100 minimum opening deposit

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Quontic Mortgage Options

Quontic provides a diverse range of mortgage options to suit various needs.

In the realm of Traditional Mortgages, they offer Conventional Mortgages, VA Loans, and FHA Loans, catering to different borrower profiles. For those seeking refinancing, Quontic offers Mortgage Refinance solutions.

In the Non-Traditional Mortgages category, they present innovative choices such as Lite Documentation, Bank Statement, Asset Utilization, ITIN, Foreign National, and DSCR Loans. These options accommodate self-employed individuals, those with unique financial circumstances, and even foreign nationals.

Quontic's comprehensive array of mortgage products reflects their commitment to addressing a wide spectrum of client requirements.

How to Apply for a Quontic Bank Account?

All Quontic bank accounts are designed to be opened and operated online. You can see the full line of Quontic products on the official website. If you find an account that is of interest to you, you can start the account opening process by clicking the “Get Started” button.

Quontic states that the account opening process for savings, checking and CD accounts takes less than five minutes. You’ll need to complete the form and supply some basic information including your full name, address, phone number, and email address. You may also need to provide your Social Security Number and verify your ID by sending in pictures of your driver’s license or passport.

Once you submit the form, Quontic will provide you with the account details, so you can set up a transfer to fund your new account.

You can then log in to the online dashboard or download the app to manage your account or accounts online or on the go.

Bottom Line

Quontic Bank offers the features you are likely to expect and want from an online bank. You’ll have access to mobile and online banking, a large ATM network and a variety of accounts with low fees.

There are also several ways to access the customer service team. Of course, with no physical branches, Quontic is not a good option for those who like the reassurance of being able to speak to a representative face to face.

What makes Quontic one of the greatest digital banks is its competitive rates on its savings, money market, and CD accounts, which are very good compared to other banks. Additionally, all three checking account options offer some form of reward, from high yield interest on your balance to rewards on your debit card purchases.

Compare Alternative Banks

APY Savings

The annual percentage yield (APY) is a percentage that represents the amount of money or interest earned on your savings account over the course of a year. The APY factored in compound interest. A savings calculator can help you quickly determine how much you'll earn with a given APY.

| 4.50%

| 4.25%

| 0.01%

|

Checking Account Fee

The monthly fee on checking account

| $0 | $0 | $12

Can be waived if you maintain a $1,000 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $2,500 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

|

Checking Minimum Deposit | $100 | $0 | $0 |

Mobile App Rating | 4.5/5 on iOS, 3.4/5 on Android | 4.9/5 on iOS, 4.7/5 on Android | 4.8/5 on iOS, 4.3/5 on Android

|

BBB Rating | A+ | A+ | B- |

How We Rate And Review Banks: Our Methodology

The Smart Investor team extensively reviewed hundreds of banks and credit unions. We assessed them based on four main categories, each with specific features:

-

Diversity of Products and Their Attractiveness (40%): We extensively analyzed the breadth and appeal of each bank's product offerings, including savings accounts, checking accounts, loans, investment options, and more. Higher ratings were assigned to banks with a diverse range of products that are attractive in terms of interest rates, fees, terms, and additional features. This category provides insights into the variety and value of the bank's offerings, crucial for meeting customers' diverse financial needs.

-

Account Features (30%): This category delves into the features and benefits accompanying each bank's accounts. We scrutinized factors such as promotions, deposit and withdrawal options, ATM accessibility, online and mobile banking functionalities, as well as additional perks like overdraft protection and rewards programs. Banks offering comprehensive and convenient features received higher ratings, reflecting the overall value of their accounts to customers.

-

Customer Experience (20%): A positive customer experience is paramount in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Bank Reputation (10%): The reputation of a bank is a critical consideration for customers. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were awarded to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories, individuals can make informed decisions that align with their financial needs and preferences, ensuring they choose a bank that offers competitive products, excellent features, a positive customer experience, and a solid reputation.

Banking Reviews

Alliant Credit Union Review

Sign Up for

Our Newsletter