Both Truist and TD Bank are active in a variety of states, such as Florida, Georgia, North And South Carolina, Virginia, New Jersey, and more. Let's compare their banking products side by side:

Checking Accounts

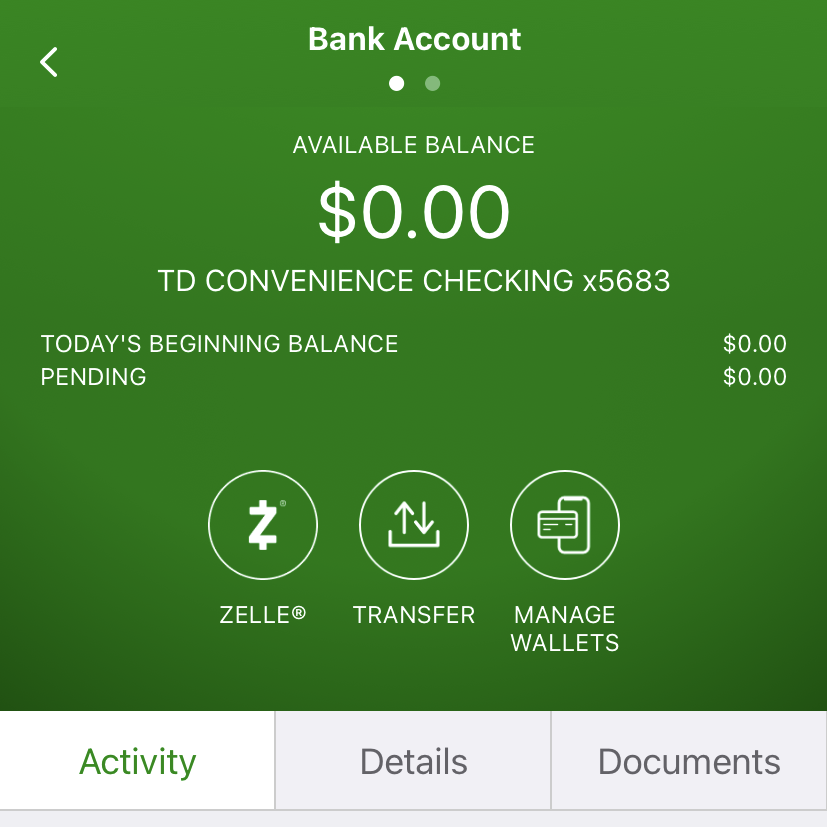

TD Bank emerges as our top choice for checking accounts, providing a diverse range of options tailored for personal customers.

Additionally, TD Bank extends specialized account offerings designed specifically for seniors and students, complete with enhanced features.

-

Account Types And Fees

TD Bank offers various checking accounts for individuals, including for particular audiences such as students and seniors, while most accounts monthly fees can be waived:

TD Checking Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

TD Convenience Checking Account | $15 | $100 |

TD Beyond Checking Account | $25 | $2,500 |

TD Simple Checking Account | $5.99 | Can't be waived |

TD Essential Banking | $4.95 | Can't be waived |

TD 60 Plus Checking Account | $10 | $250 |

Student Checking Account | $0 | N/A |

Truist bank offers personal checking accounts with many features and easily waived monthly fees. However, there is no wide selection of accounts as you have with TD Bank:

Truist Bank Account | Monthly Fee | Average Day Balance To Waive |

|---|---|---|

Truist One Checking account | $12 | $500 |

Truist Confidence Account | $5 | $500 |

-

Features

Truist offers two checking account options: the basic one is the Truist Confidence Account, which includes features like mobile bill pay, no overdraft fees, and no check cashing fees, and the Truist One Checking account, a regular checking option.

Truist Bank Account | Main Features |

|---|---|

Truist One Checking account | Loyalty Bonus on Truist credit cards, Free first order 10-pack checks |

Truist Confidence Account | mobile bill pay, No overdraft fees, No check cashing fees |

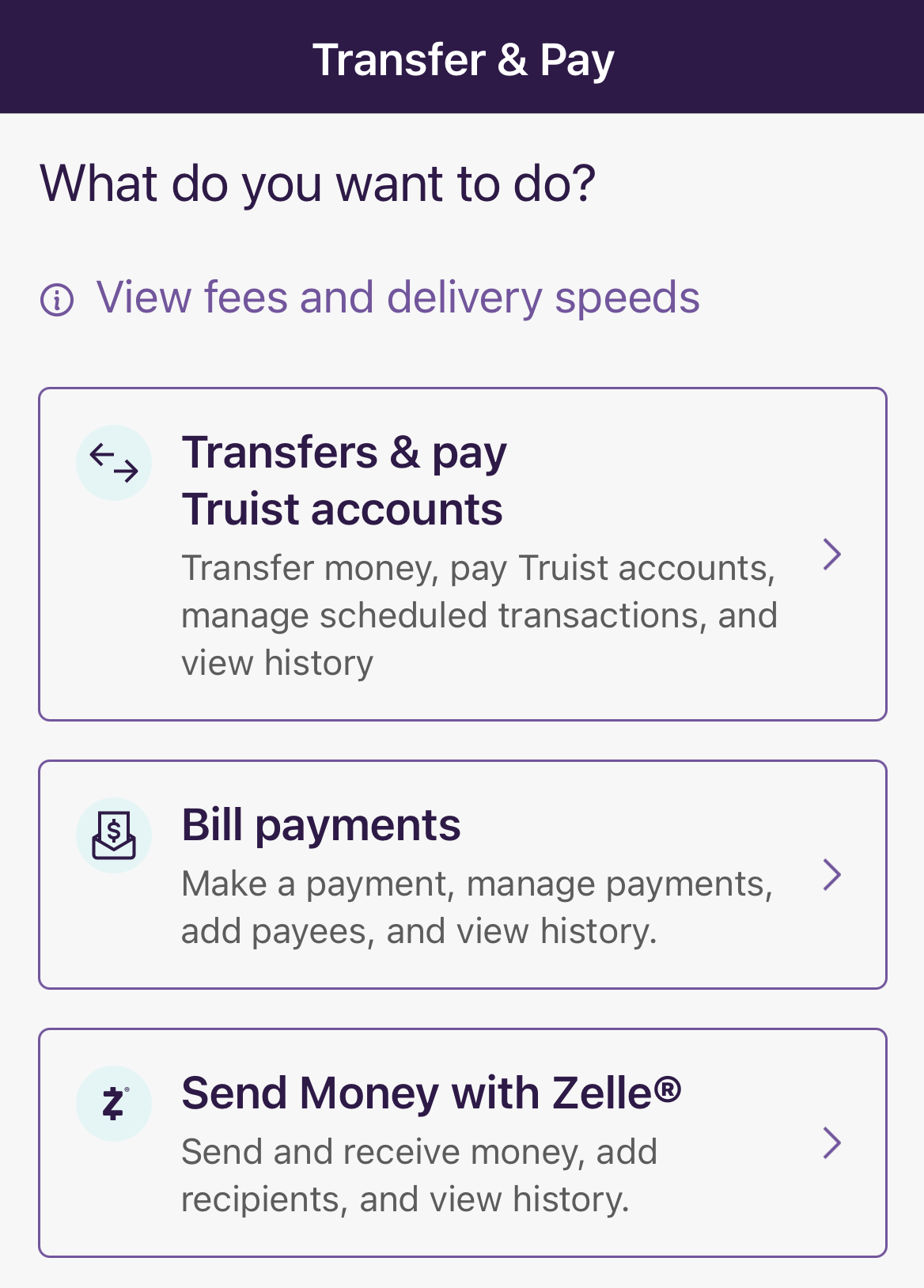

Truist is really good at helping you send money and make payments. The app gives you lots of choices, like moving money between your accounts or paying your Truist bills without any trouble.

You can also plan your spending by managing when your payments happen. And with Zelle, it's even easier to send money to others. So, Truist's app is like a super convenient place for all your money stuff.

TD Bank's standard checking accounts offer valuable features such as online bill payment, complimentary statements, mobile deposit, Zelle, and a debit card.

Upgrade to the premium account for an enhanced banking experience with additional benefits, including no ATM fees, the reversal of two overdraft fees, overdraft payback, interest on your balance, and complimentary checks.

TD Checking Account | Main Features |

|---|---|

TD Convenience Checking Account | Online banking, mobile deposit, Zelle, debit card |

TD Beyond Checking Account | No ATM fees, 2 overdraft fees reversed, overdraft payback, interest bearing |

TD Simple Checking Account | Online banking, mobile deposit, Zelle, debit card |

TD Essential Banking | digital tools, no overdraft fees, debit card |

TD 60 Plus Checking Account | Interest bearing, free checks, money orders and paper statements |

Student Checking Account | Online banking, mobile deposit, Zelle, debit card |

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Savings Accounts

TD Bank is the winner when it comes to savings accounts as it offers a competitive rate, much higher than customers can get with Truist Bank.

TD Simple Savings has a lower interest rate and a small monthly fee. But TD Signature Savings offers higher interest rates (0.01% – 4.00%), but you need to keep at least $100,000 in your account to get the best rate.

Meanwhile, like many regular banks, Truist Bank's savings account doesn't give you very high rates. Truist also offers a money market account, but the rates are low – similar to their savings account.

TD Savings | Truist Bank Savings | |

|---|---|---|

Savings Rate | 0.01% – 4.00% | 0.01% |

Minimum Deposit | $0 | $50 |

Fees | $5

Can be waived if you carry $300 minimum account balance or $25+ recurring transfer

| $5

The monthly maintenance fee can be waived by maintain a minimum daily ledger balance of $300 OR

schedule a recurring preauthorized internal transfer of $25 or more per statement cycle into the Truist One Savings account OR

waived for a minor under the age of 18 OR

waived with ANY related Truist checking product

|

Certificate Of Deposits (CDs)

When it comes to CDs, TD is our winner. However, both TD and Truist banks offer high rates only on specific promotional terms. While TD Bank CD rates are competitive compared to other brick and mortar banks, Truist Bank doesn't publish its CD rates on its website, so it's a bit difficult to compare apples to apples.

Also, customers can only open Truist CD accounts in person at a branch, not online. with TD, customers can make it online.

-

TD Bank CD Rates

CD Term | APY |

|---|---|

3 Months | 1.00% – 2.50% |

6 Months | 1.00% – 5.00% |

12 Months | 1.00% – 4.00% |

18 Months | 1.00% – 2.50% |

24 Months | 1.00% – 2.50% |

36 Months | 1.00% – 2.50% |

48 Months | 0.05% |

60 Months (Step Rate CD) | 1.00% – 2.50% |

Sign Up for

Our Newsletter

Credit Cards

There is no clear winner when it comes to credit cards. TD Bank and Truist provide diverse credit card choices for consumers, featuring various reward types, including a secured card aimed at assisting individuals in establishing credit. Nonetheless, their redemption alternatives are relatively restricted when compared to major banks and issuers like Chase or Amex.

The old TD Cash offers a higher rewards rate on your chosen categories, while the DoubleUp card offers flat rate cashback. The TD First Class is best for travelers, and with the Flexpay card, customers can get a long intro APR

Card | Rewards | Bonus | Annual Fee | TD Cash Credit Card | 1% – 3%

3% and 2% Cash Back on your choice of Spend Categories (you can switch your categories quarterly), and 1% Cash Back on all other purchases | $200

$200 Cash Back when you spend $500 within 90 days after account opening | $0 |

|---|---|---|---|---|

TD Double Up Credit Card | 2%

2% unlimited Cash Back – no rotating Spend Categories, no caps or limits | $150

$150 Cash Back in the form of a statement credit when you spend $1,000 within the first 90 days after account opening | $0 | |

TD FlexPay Credit Card | N/A | 0% Intro APR: 18 billing cycles on balance transfers | $0 | |

TD First Class Visa Signature Credit Card | 1X – 3X

3X First Class miles on travel and dining purchases and 1X First Class miles on all other purchases | 25,000 miles

25,000 miles on $3,000 spent in first 6 cycles | $89 (waived first year) | |

TD Clear Visa Platinum Credit Card | N/A | N/A | $120 / $240 |

The Truist Enjoy Cash is best for those who want to earn cashback, while travelers may prefer the Truist Enjoy Travel which offers a higher point rewards ratio on travel categories. The Truist Enjoy Beyond offers even more travel benefits.

For those who don't have good credit, the Truist Future card can help those who need 0% intro APR, and there is also a secured card, with a modest annual fee.

Card | Rewards | Bonus | Annual Fee | Truist Enjoy Cash credit card | 1% – 3%

3% cash back on gas and EV charging, 2% on utilities and groceries (up to the $1,000 monthly spend cap) and 1% on all other eligible purchases

OR 1.5% cash back on all eligible purchases | 0% Intro APR 12 months on purchases | $0 |

|---|---|---|---|---|

Truist Enjoy Travel credit card | 1x – 2x

2x miles per $1 spent on airfare, hotels, and car rentals, 1x on all other eligible purchases | 20,000 miles

20,000 bonus miles when you spend $1,500 in first 90 days after account opening | $0 | |

Truist Future credit card | N/A | 0% Intro APR 15 months on balance transfers and purchases | $0 | |

Truist Enjoy Beyond credit card | 1x – 3x

3x points per $1 spent on airfare, hotels, and car rentals, 2x on dining and 1x on all other eligible purchases | 30,000 points

30,000 bonus points when you spend $1,500 in first 90 days after account opening | $195 | |

Truist Enjoy Cash Secured credit card | 1% – 3%

3% cash back on gas, 2% on utilities and groceries (up to the $1,000 monthly spend cap) and 1% on all other eligible purchase | N/A | $19 |

Mortgage And Loans

If you need to borrow money, Truist Bank offers more options than TD Bank..

Truist offers a complete suite when it comes to mortgages including refinancing and government loans. It also offers auto loans and a variety of personal loans, including boat and RV loans.

On the flip side, TD Bank has fewer lending options including mortgages for buying homes, refinancing mortgages and personal loans.

Which Bank Is Our Winner?

Overall, TD Bank is our winner with a better set of banking products than Truist Bank, especially higher savings account rates and more options for checking.

But it's really important to think about different things, especially the ones that matter most to you. This might include looking at banking services, help with overdrafts, how often you use ATMs, how close the bank is to where you live, and other things that are different for each person.

Our Methodology for Comparing Banks

In our thorough banking comparison, The Smart Investor team carefully reviewed and compared banks across five key categories:

Checking Accounts (30%): We examined features like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers available to customers.

Savings Accounts and CDs (20%): Our focus was on important factors such as the Annual Percentage Yield (APY), minimum deposit requirements, account flexibility, FDIC insurance coverage, special savings offers, variety of CDs, automatic renewal options, and early withdrawal penalties.

Credit Cards (15%): We analyzed rewards programs, annual fees, introductory bonuses, travel benefits, APR, and balance transfer options offered by each bank's credit cards to provide a comprehensive comparison of available features.

Lending Options (15%): We assessed the variety of loan options provided, including personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, offering insights into the banks' lending capabilities.

Customer Experience and Bank Reputation (20%): Our evaluation included an analysis of online banking and mobile app usability and ratings, accessibility of customer support, online reviews, JD Power research, Trustpilot ratings, and overall financial stability, providing a holistic view of customer experience and reputation.

Compare Truist Versus Other Banks

While Truist is a full-service bank where you can find almost any financial product, Chase is our winner. Here's why – and what else to know: Chase vs. Truist Bank

There is no clear winner as to whether Truist Bank or Bank of America is a better choice, but we prefer the latter. Here's why.

Wells Fargo offers better savings rates than Truist Bank, more selection for checking accounts and better credit cards. Here's our comparison: Truist Bank vs. Wells Fargo Bank

Citibank is our winner due to its checking account options, various credit cards, and better savings account rates than Truist Bank.

Overall, we like Fifth Third a bit more than Truist bank, mainly due to the various checking options. Truist is better in credit cards.

Each bank excels in different categories, but our winner is M&T Bank over Truist. There are some reasons for that, here's our comparison: Truist Bank vs. M&T Bank

Our winner is PNC Bank as it offers more options for checking and higher savings rates than Truist bank. Here's our comparison: Truist Bank vs. PNC Bank

There is no clear-cut answer to which bank is better, but Regions Bank is better than Truist if we have to choose one. Here's why: Truist Bank vs. Regions Bank

Our preferred choice is American Express, which provides a comprehensive banking package that outshines Truist Bank. Here's how they compare: Truist Bank vs. American Express Bank

Compare TD Bank

Chase has some innovative features with the potential for comparable CD rates without TD Bank’s minimum deposit. However, there is little to separate the checking accounts, TD Bank’s savings rate is double that of Chase.

Chase does offer more credit card choices, but don’t rule out TD Bank, which has some interesting options.

We'll explore Bank Of America and TD Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner.

There is no clear winner when comparing Wells Fargo and TD bank, but if we have to pick, TD comes out ahead.

Citibank leads in credit cards, and TD Bank options for borrowers are broader. But what about the rest? Here's our comparison and winner:

TD Bank is our winner with better banking products compared to M&T, but there are cases when M&T wins. See our complete comparison

Capital One is our winner as it offers a full banking package, which is better than TD Bank, especially if you have deposit needs. Here's why.

While TD offers a better selection of checking accounts and credit cards, Ally is also a great option for those who want an online-only bank.

While TD offers a better selection of checking accounts and lending options, Amex is a great option for online banking. How do they compare?