Table Of Content

Opening a CIT Bank savings account is a straightforward process that can help you kickstart your savings journey.

In this article, we will guide you through the steps required to open a CIT Bank savings account, from providing personal and employment information to selecting the right account type and product.

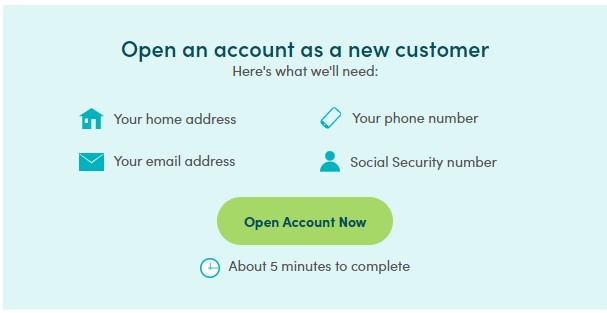

1. Start Application On CIT Bank Website

As CIT Bank operates as an online bank, the account opening process cannot be conducted in person at a branch or through phone communication. The entire process is conducted online, with CIT Bank reaching out to you if any additional information is required.

Therefore, to initiate the application, you will need to visit the CIT Bank website and follow the instructions provided.

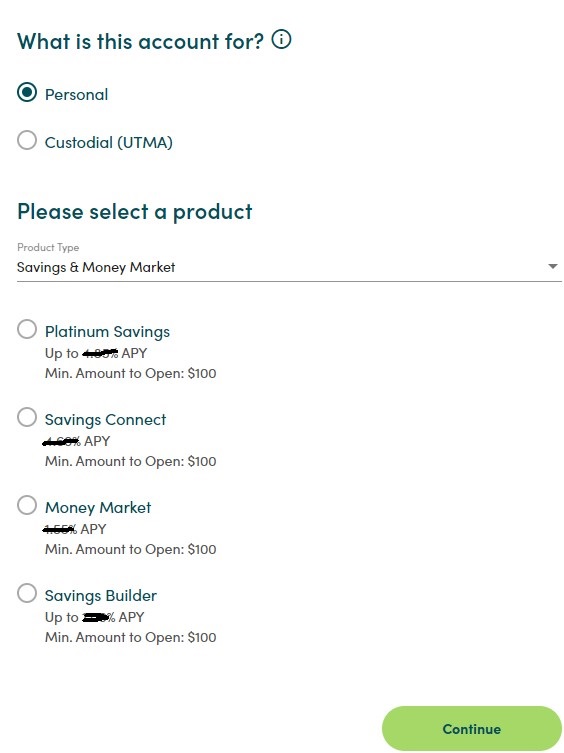

2. Choose Account Type

On the first step, you are asked to specify the purpose or type of account you want to open. Here are the available options:

Personal Account: This type of account is meant for individuals. You can open this account solely in your name. Additionally, you have the option to add a joint account owner, which means you can share the account with another person.

Custodial Account (UTMA): This account type is specifically designed for minors. It is managed and administered by an adult, who acts as a custodian on behalf of the minor. The account is opened in the minor's name, but the custodian has control over the account until the minor reaches a certain age (as determined by the Uniform Transfers to Minors Act or UTMA).

After selecting the account type that suits your needs (either Personal or Custodial), you are then prompted to choose a specific product within that account type. The available savings account options are:

Money Market

Savings Builder

You can select the product that best aligns with your savings goals and preferences.

Sign Up for

Our Newsletter

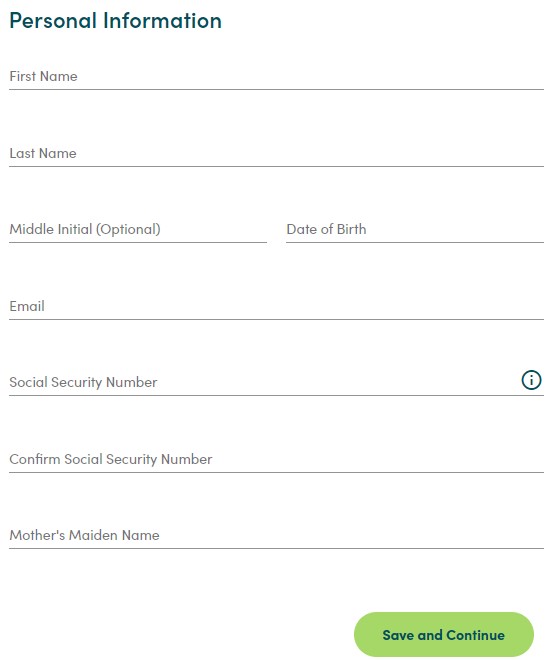

3. Enter Personal Information

When entering your personal information to open a CIT Bank savings account, here's what you'll be asked to provide:

First And Last Name: Enter your first and family name as it appears on your identification documents.

Date of Birth: Enter your birthdate in the specified format. This information is required to verify your identity and ensure you meet the age requirements for opening a bank account.

Email: Provide your valid email address. CIT Bank will use this email to communicate with you regarding your account.

Social Security Number (SSN): Enter your Social Security Number, which is a unique identification number issued by the government. This information is required to comply with federal regulations and to verify your identity.

Phone: Select the type of phone and enter your primary phone number. Make sure you have access to this number during the application process as CIT Bank may need to contact you for verification purposes.

Address: Enter your primary home address, including the street name and number. Enter the name of the city and state where you reside.

ZIP Code: Enter your ZIP code, which is a numerical code used to identify your specific postal area.

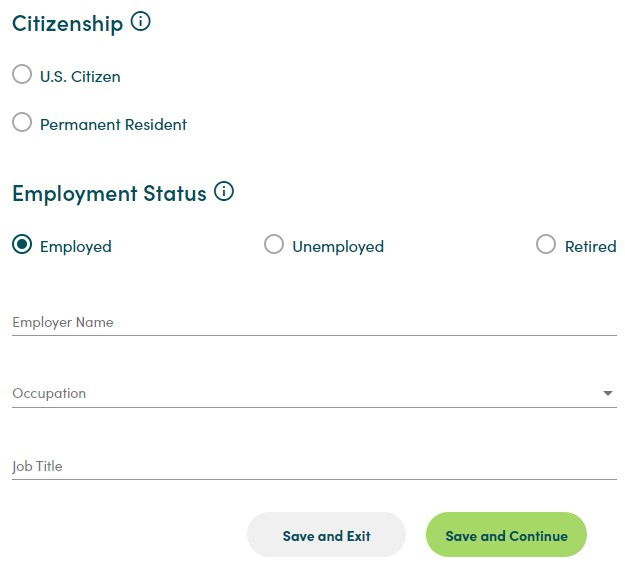

4. Citizenship and Employment

When providing employment details to open a CIT Bank savings account, you will be asked to enter the following information:

Citizenship: You need to specify your citizenship status. Choose either “U.S. Citizen” if you are a current citizen of the United States or “Permanent Resident” if you have lawful permanent resident status, such as having a Green Card. Please note that CIT Bank is unable to open accounts for non-permanent residents.

Employment Status: Indicate your current employment status from the provided options

Employer Name: Enter the name of your current employer or the organization you were most recently employed by. If you are retired, you can mention your previous employer or simply indicate “Retired” in this field.

Occupation: Specify your occupation or profession. For example, you can enter “Software Engineer,” “Teacher,” or “Accountant.”

Job Title: Provide your job title or the role you held in your previous or current employment. If you are retired, you can mention your previous job title or simply indicate “Retired” in this field.

These employment details are required by federal regulations to establish your account and comply with anti-terrorism and anti-money laundering laws.

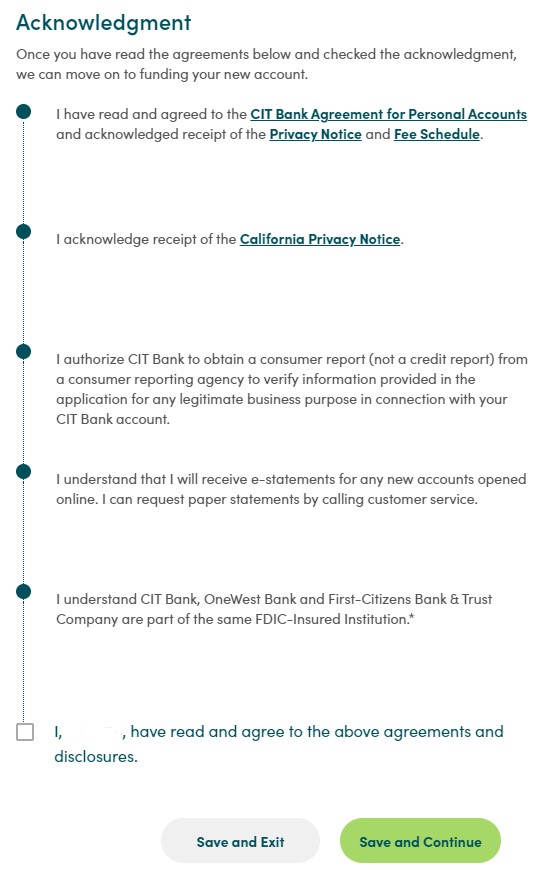

5. Review CIT Terms And Conditions

Here's what you should pay attention to:

Agreements: By checking the acknowledgment, you confirm that you have read and agreed to the CIT Bank Agreement for Personal Accounts. It outlines the terms and conditions that apply to your savings account. Make sure you understand the rules and responsibilities mentioned in this agreement.

Privacy Notice: You acknowledge receipt of the Privacy Notice. This document explains how CIT Bank collects, uses, and protects your personal information. It's essential to review this notice to understand how your data will be handled.

Fee Schedule: You also acknowledge receipt of the Fee Schedule. This document lists any fees associated with your savings account, such as monthly maintenance fees or transaction fees. Take note of these fees to avoid any surprises later.

Consumer Report: You authorize CIT Bank to obtain a consumer report from a consumer reporting agency. This is not a credit report but rather a verification process to confirm the information you provided in your account application.

Statement Delivery: You understand that for any new accounts opened online, you will receive e-statements instead of paper statements. If you prefer paper statements, you can request them by contacting customer service.

It's crucial to carefully read and understand these terms and conditions before proceeding with funding your new account. If you have any questions or need clarification on any of the mentioned points, it's advisable to reach out to CIT Bank's customer service for assistance.

6. Fund Your Account

To fund your CIT Bank savings, money market, or CD account, you have several options:

Electronic Fund Transfer: This is the easiest method. During the application process, you can initiate an electronic transfer from your other bank accounts to CIT Bank. You will need the information from a bank check of the institution holding your account. It may take up to two business days for the funds to be deposited into your CIT Bank account.

Check: If you prefer to fund your account by check, you can mail the check to CIT Bank's Deposit Services at the provided address: CIT Bank, Attn: Deposit Services, P.O. Box 7056, Pasadena, CA 91109-9699.

Wire Transfer: For funding a CIT Bank CD account via wire transfer, you will need to follow specific instructions. Use the provided bank name, bank address, and contact number to initiate the wire transfer. The routing/transit number for CIT Bank is also provided. You need to include your beneficiary account number, your name, address, and the confirmation email's account number. Note that if you are a CIT Bank commercial, listing service, or institutional client, you should contact a specific number for the routing number to use for wire instructions.

Choose the funding method that is most convenient for you. Electronic fund transfers are typically the quickest and easiest option, while sending a check or initiating a wire transfer may take a bit longer.

Which CIT Bank Savings Account Should You Open?

CIT Bank offers different savings account options to cater to various savings goals and preferences. Here are the main savings accounts they offer and their differences:

Platinum Savings: This account provides a competitive APY of up to 5.00% and requires a minimum opening deposit of $100. It is suitable for individuals looking to earn a higher interest rate on their savings and it has one of the best rates available.

Savings Connect: With an APY of 4.65% and a minimum opening deposit of $100, this account is designed to reward customers who maintain a qualifying eChecking account with an average monthly balance of at least $200 and make a monthly deposit of $200 or more. It is a good choice for those who want to maximize their savings by combining a savings account with a checking account.

Money Market: The Money Market account offers an APY of 1.55% and requires a minimum opening deposit of $100. It provides a higher interest rate than a traditional savings account and allows limited check-writing capabilities, making it suitable for customers who want both accessibility and a competitive interest rate.

Savings Builder: This account offers an APY of up to 1.00%and requires a minimum opening deposit of $100. To earn the highest APY, you need to maintain a balance of $25,000 or make a monthly deposit of at least $100.

FAQs

What distinguishes the various savings and money market accounts from each other?

Each account may have different Annual Percentage Yields (APYs) and features that set them apart.

How is interest calculated and compounded?

Interest is compounded daily based on the interest rate applicable to your end-of-day balance. CIT Bank uses the daily balance method to calculate interest. The interest earned is credited to your account on a monthly basis.

Is CIT Bank, a division of First-Citizens Bank & Trust Company, FDIC insured?

Yes, CIT Bank is a division of First-Citizens Bank & Trust Company, and it is a member of the Federal Deposit Insurance Corporation (FDIC). This means that your deposit accounts with CIT Bank are insured by the FDIC for up to $250,000 per depositor.

Does CIT Bank provide business savings accounts?

No, CIT Bank does not offer accounts specifically tailored for businesses. However, it does offer personal savings accounts, eChecking accounts, and Certificates of Deposit (CDs) for individual customers. Some savings accounts and CDs can be opened as custodial accounts.