Table Of Content

In this article, we'll guide you through the process of opening a Discover savings account. Discover is a trusted financial institution that offers a wide range of banking services, and their savings accounts are known for their competitive interest rates and convenient features.

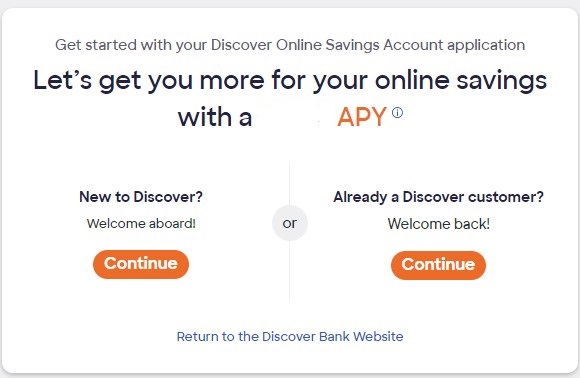

1. Start Your Application On Discover Website

To start the process of opening a Discover savings account, you can easily access their website since Discover primarily operates as an online bank, similar to other savings accounts such as SoFi or Amex. The entire account opening process is conducted digitally instead of following traditional methods like visiting a physical branch or making phone calls.

If you're new to Discover and don't have any existing accounts, you'll select “Continue with a new account.”

On the other hand, if you're already a Discover customer and have an existing account with them, you'll choose the option to ” log in to your account.”

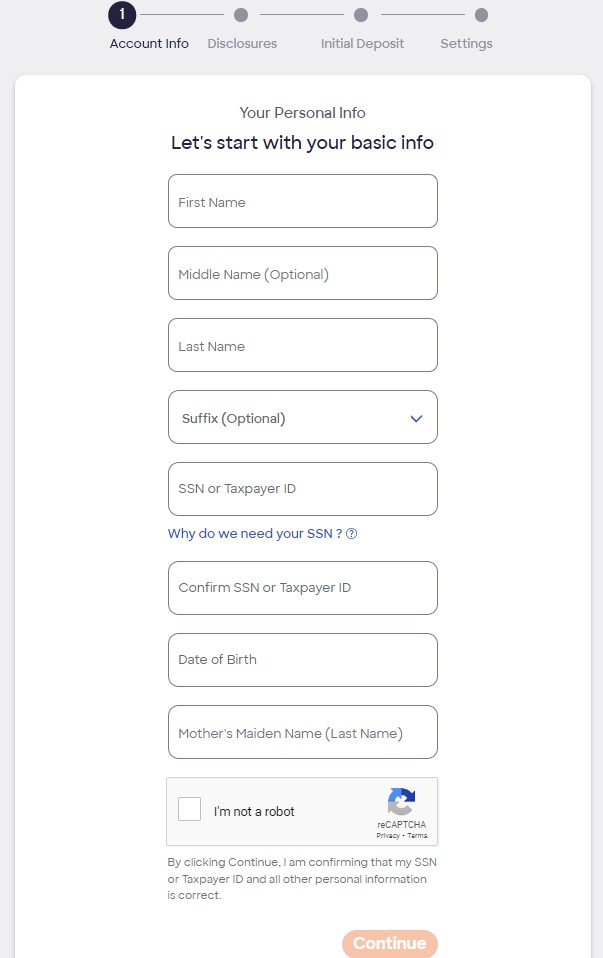

2. Enter Personal Info

In the next step of the Discover savings account application, you must provide certain personal information. Here's a breakdown of the steps related to the provided data:

Full Name: Enter your first and last name, which is your given name or the name you are commonly known by.

SSN or Taxpayer ID: Provide your Social Security Number (SSN) or Taxpayer Identification Number (TIN). This information is necessary for identity verification and tax purposes.

Mother's Maiden Name (Last Name): Enter your mother's maiden name, which is her last name before she got married. This information is commonly used as an additional security measure to verify your identity.

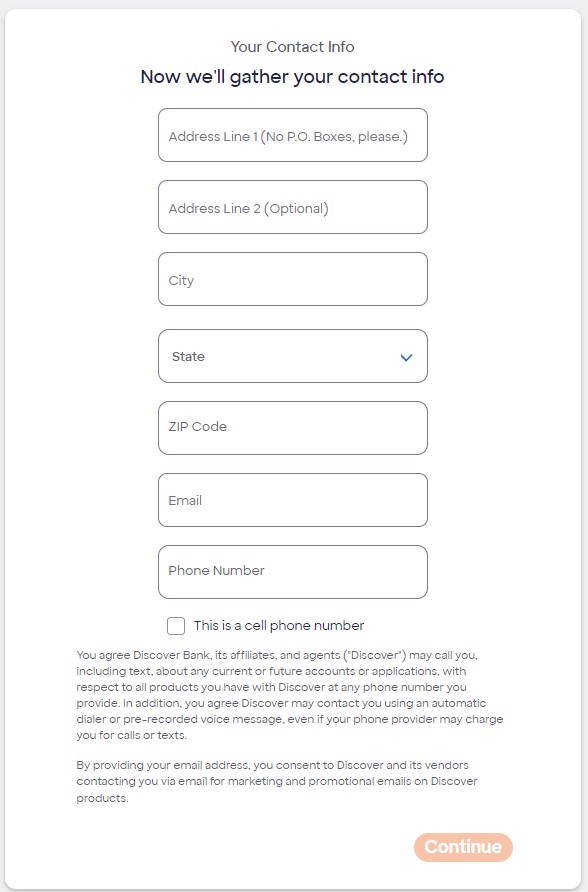

3. Enter Your Contact Info

In the next step, you will be required to provide your contact information.

Address: Enter the street address of your current residence. Also, add city, state, and ZIP code.

Email: Enter a valid email address that you regularly use. This email will be used for communication related to your account, statements, and other important information.

Phone Number: Provide a contact number where you can be reached. This could be your mobile or landline number. Discover may use this number to verify your identity or contact you regarding your account.

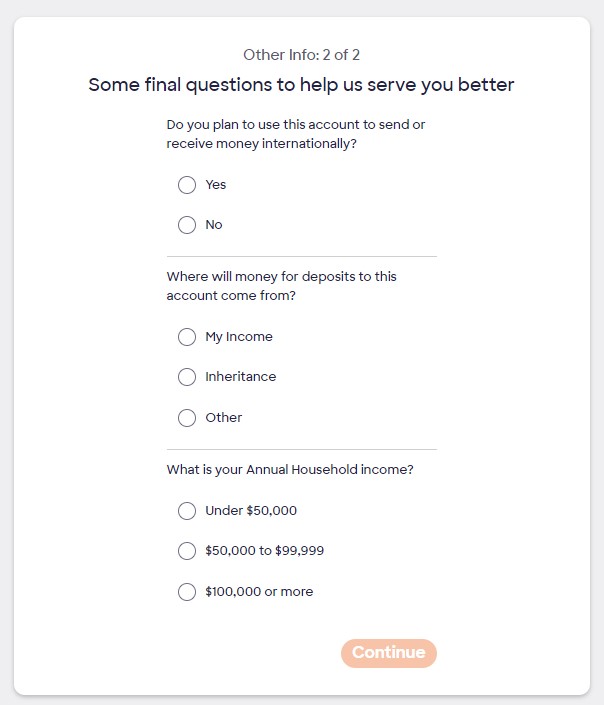

4. Answer Questions On Account Use And Income

Now, youll need to answer whether you plan to use the account for international money transfers. You have two options to choose from: “Yes” or “No.”

The next step asks where the money for deposits into your account will come from. You have three options to select from: “My Income,” “Inheritance,” or “Other.”

Finally, the application inquires about your annual household income. You will need to select the appropriate range from the provided options: “Under $50,000,” “$50,000 to $99,999,” or “$100,000 or more.”

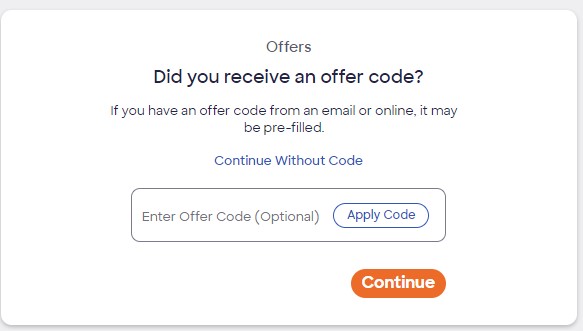

5. Add Promo Code (Optional) And E-sign Consent

If you have received an offer code through an email or Discover online promotion, it's time to enter it and get your bonus.

However, if you don't have an offer code or choose not to use it, you can select the option to “Continue Without Code.

Then, Discover is requesting your permission to deliver documents and communications electronically instead of using traditional paper documents. This process is known as E-sign Consent and Disclosure. By agreeing to this, you allow Discover to use electronic records and signatures for your interactions with them.

Sign Up for

Our Newsletter

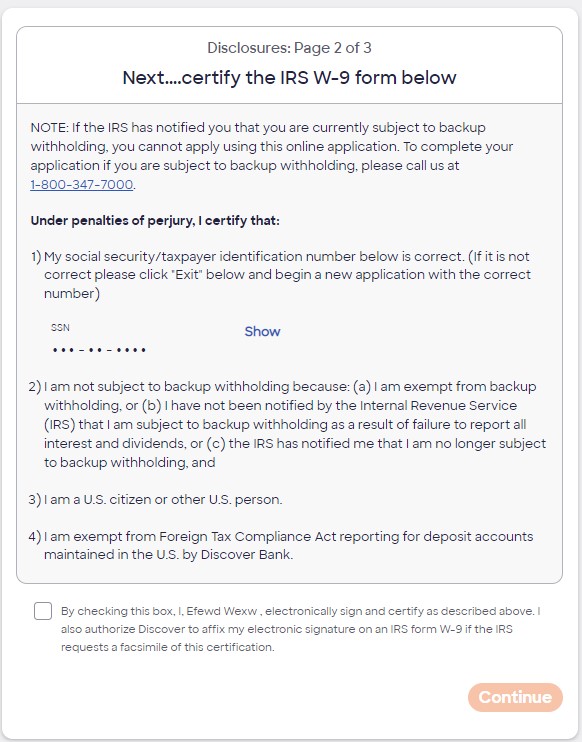

6. Certify the IRS W-9 Form

In simple terms, this step requires you to certify the accuracy of the information provided in the IRS W-9 form. The form is used to gather your taxpayer identification number (such as your social security number) and to determine if you are subject to backup withholding, which is when a percentage of your income is withheld for tax purposes.

By certifying this information, you are legally affirming that it is true and accurate to the best of your knowledge, under the risk of penalties for providing false information.

7. Disclosures And Agreements

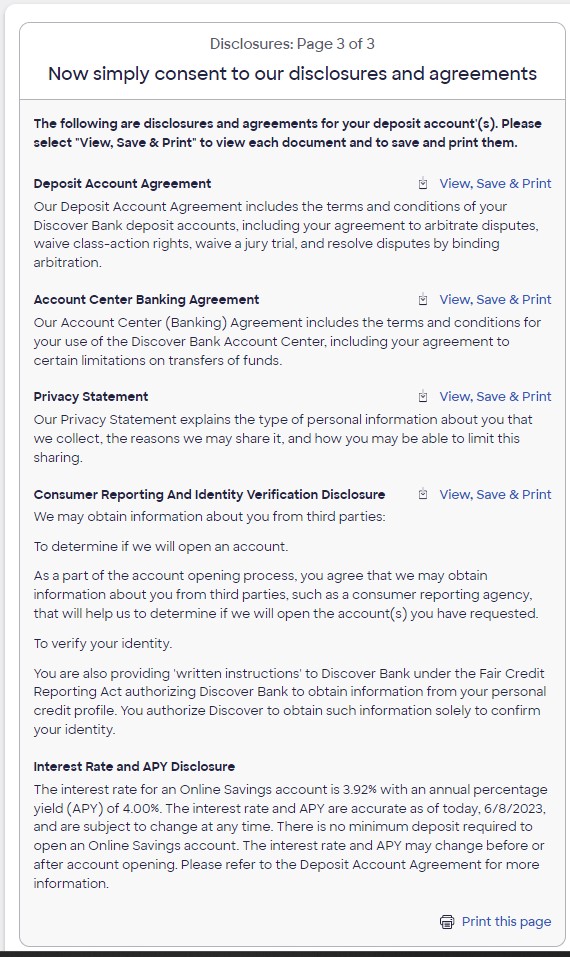

Now it's time to review and agree to the disclosures and agreements related to your deposit account. These documents outline important terms and conditions that govern your relationship with Discover Bank. To proceed, you will need to view, save, and print each document for your records.

The first document is the Deposit Account Agreement, which includes the rules and regulations for your Discover Bank deposit accounts. It covers various aspects such as how disputes are handled, your agreement to resolve disputes through arbitration, and the waiver of certain rights like class-action lawsuits and jury trials.

Next, we have the Account Center Banking Agreement. This agreement outlines the terms and conditions for using the Discover Bank Account Center, which is the online platform for managing your account. It may include limitations on fund transfers and other important details.

The Privacy Statement is another document that explains how Discover Bank collects and uses your personal information. It provides insights into the types of information collected, the reasons for sharing it, and your options to limit this sharing.

The Consumer Reporting and Identity Verification Disclosure informs you that Discover Bank may obtain information about you from third parties. This information is used to determine whether to open the account(s) you've requested and to verify your identity. By agreeing, you authorize Discover Bank to access your credit profile for identity confirmation purposes.

Lastly, the Interest Rate and APY Disclosure provides details about the current interest rate and annual percentage yield (APY) for the Online Savings account

8. Make A Deposit

In the last step, you have the option to make a deposit. It's optional, and you can do it after that as well.

To make a deposit to your Discover savings account, you will need to provide the necessary details. Here's a breakdown of the information required:

Deposit Amount: Specify the amount you wish to deposit into your Discover savings account. This could be the initial deposit or an additional contribution.

External Routing Number: Enter the routing number of the external bank account from which you will transfer the funds. The routing number is a nine-digit code that identifies the financial institution.

External Account Number: Provide the account number of the external bank account you want to transfer the funds from. This is the unique identifier for your account at the external bank.

Confirm External Account Number: Re-enter the account number of the external bank account to ensure accuracy and avoid any mistakes.

Account Type: Indicate whether the external account is a checking or savings account. This helps Discover process the deposit accurately.

Once you have entered these deposit details, Discover will handle the transfer of funds from the specified external bank account to your Discover savings account

FAQs

Is the interest rate on Discover savings accounts competitive?

Yes. As of May 2024, Discover Savings proudly offers customers a competitive APY of 4.25%. This APY outshines the rates provided by other financial institutions, ensuring that your savings can grow at a competitive pace with Discover.

What is the minimum amount required?

Discover Online Savings account can be opened with no minimum deposit requirement.

How is the interest calculated on my Online Savings Account?

Interest on your Online Savings Account is compounded daily and credited to your account on a monthly basis.

Is the Online Savings Account FDIC-insured?

Yes, funds deposited in Discover Bank are FDIC-insured up to the maximum limit allowed by law. For more details, please visit our FDIC information page.