The Delta SkyMiles® Blue American Express and Delta SkyMiles® Gold American Express are two of Delta's frequent flyer credit cards. Let's compare them side by side.

General Comparison

The Delta SkyMiles Blue card is designed for the cost-conscious traveler, offering a no-annual-fee option with essential benefits. While it lacks some of the premium perks of its Gold counterpart, it provides a solid entry point for those seeking a straightforward rewards card without the financial commitment of an annual fee.

On the other hand, the Delta SkyMiles Gold card is tailored for individuals who desire a more comprehensive travel experience. Despite having an annual fee, the Gold card comes with added benefits, such as Delta flight credit (upon required spend), a free checked bag on Delta flights, and a bigger welcome bonus.

Here's a side-by-side comparison of the card's main features:

|

| |

|---|---|---|

Delta SkyMiles® Gold | Delta SkyMiles® Blue | |

Annual Fee | $150, $0 intro first year. (See Rates and Fees.) | $0 . See Rates and Fees. |

Rewards | 2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases. | 2X miles for every dollar spent at restaurants worldwide and Delta purchases and 1X miles for every dollar spent on other eligible purchases |

Welcome bonus | 40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months | 10,000 bonus miles after you spend $1,000 in purchases on your new Card in your first 6 months |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0. See Rates and Fees. | $0 |

Purchase APR | 20.99%-29.99% Variable | 20.99%-29.99% Variable |

Read Review | Read Review |

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

Airline Miles Rewards Analysis: Which Card Is Better?

When comparing how many points you can get for spending the same amount, we can see the Delta Gold is the winner – mainly due to the increased points rewards ratio on groceries:

|

| |

|---|---|---|

Spend Per Category | Delta SkyMiles® Gold | Delta SkyMiles® Blue |

$10,000 – U.S Supermarkets | 20,000 miles | 10,000 miles |

$4,000 – Restaurants

| 8,000 miles | 8,000 miles |

$5,000 – Airline | 10,000 miles | 10,000 miles |

$4,000 – Hotels | 4,000 miles | 4,000 miles |

$4,000 – Gas | 4,000 miles | 4,000 miles |

Total Points | 46,000 miles | 36,000 miles |

Redemption Value (Estimated) | 1 mile = ~1.3 cents

| 1 mile = ~1.3 cents

|

Estimated Annual Value | $598 | $468 |

Delta Gold and Blue Card holders can redeem miles for Delta flights, seat upgrades, and merchandise.

Additionally, explore partner airlines, hotel stays, car rentals, and more. Access exclusive benefits, making the most of your Delta rewards.

What Airline And Travel Benefits You'll Get On Both Cards?

Both the Delta Blue and Gold card offer the following benefits:

20% Back on In-flight Purchases: Enjoy a 20% statement credit on eligible Delta in-flight purchases of food and beverages when using the Delta SkyMiles Blue American Express Card.

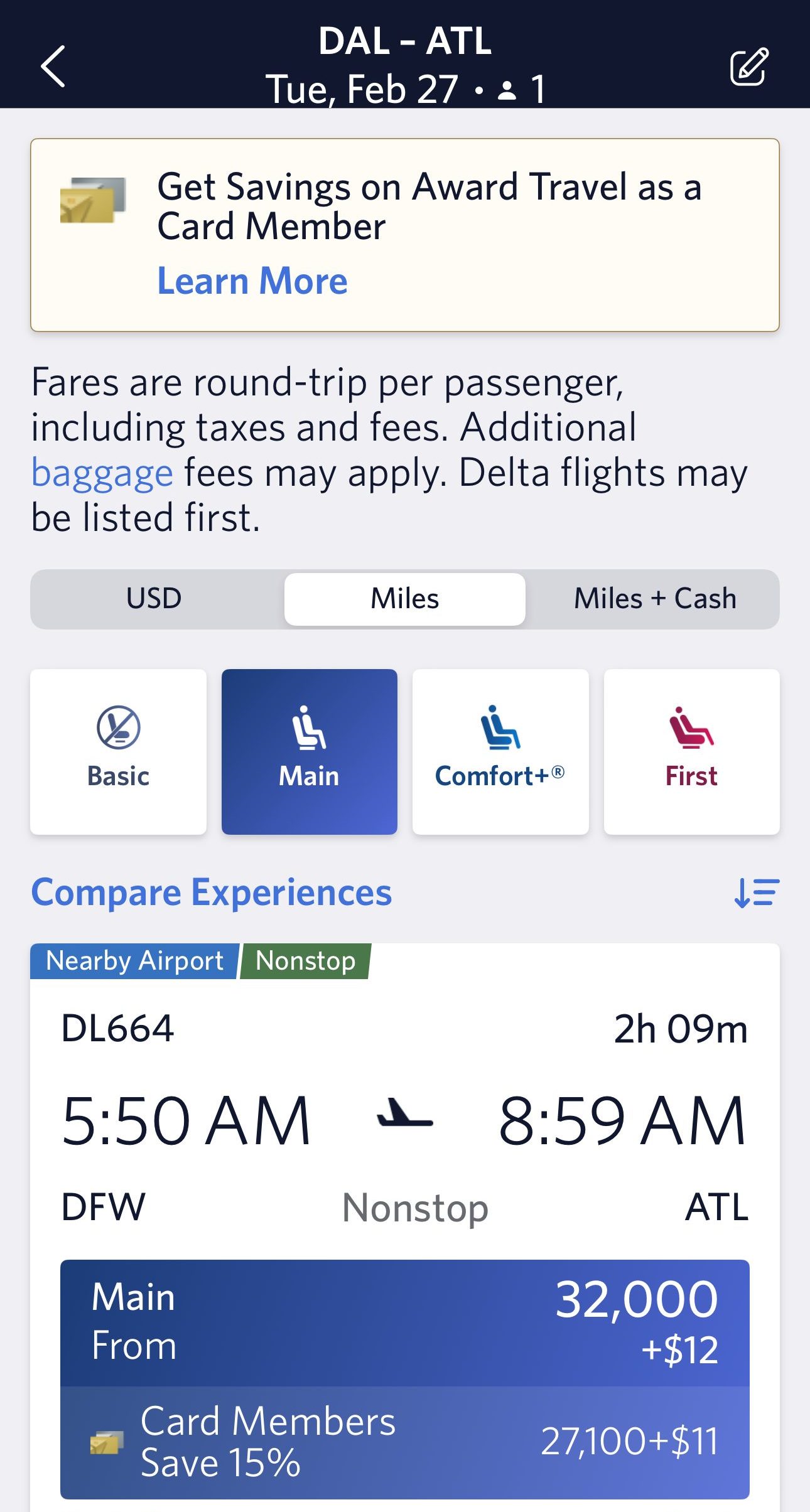

Pay with Miles: Gain flexibility by redeeming miles with “Pay with Miles” on delta.com, allowing you to take up to $50 off the cost of your flight for every 5,000 miles redeemed.

Car Rental Loss and Damage Insurance: Receive coverage for damage or theft of a rental vehicle in a covered territory when you use the card to reserve and pay for the entire rental, and decline the collision damage waiver at the rental counter.

Global Assist® Hotline: Access 24/7 emergency assistance and coordination services, including medical and legal referrals, emergency cash wires, and missing luggage assistance.

ShopRunner: Enjoy complimentary ShopRunner membership, offering free 2-day shipping and free return shipping on eligible items at 100+ online stores.

Purchase Protection: Receive protection for covered purchases from accidental damage or theft for up to 90 days from the purchase date when using the card.

Extended Warranty: Extend the warranty on covered purchases by matching the original manufacturer's warranty for up to one additional year when using the card.

Terms apply to American Express benefits and offers.

What Benefits You'll Get Only With The Gold Card?

Naturally, as the more expensive card – the Delta Gold card offers more travel and airline benefits:

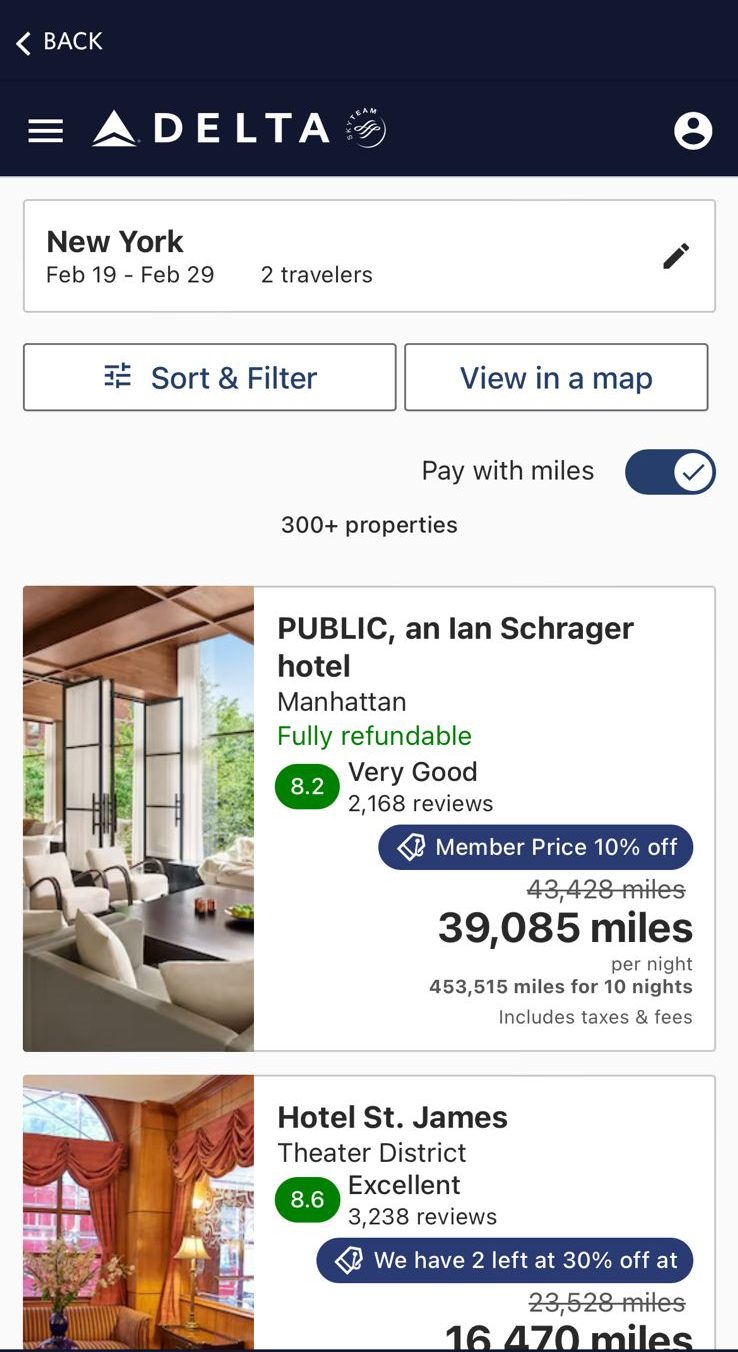

- TakeOff 15: Save 15% on Award Travel when booking Delta flights (excluding partner-operated flights and taxes/fees).

$100 Delta Stays Credit: Members of the Delta SkyMiles® Gold American Express Card are eligible to receive an annual rebate of up to $100 on qualifying prepaid Delta Stays bookings made on delta.com.

$200 Delta Flight Credit: Upon reaching $10,000 in annual purchases, cardholders can enjoy a $200 Delta Flight Credit, applicable towards upcoming travel expenses.

- First Checked Bag Free: Receive complimentary first checked bag on Delta flights.

- Pay with Miles Discount: You can receive up to $50 off the cost of your Delta flight for every 5,000 miles you redeem.

- Baggage Insurance Plan: Travel with peace of mind knowing your baggage is covered for loss, damage, or theft when you purchase a common carrier ticket with your card.

Terms apply to American Express benefits and offers.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

When You Might Prefer The Delta SkyMiles Blue?

You might prefer the Delta SkyMiles Blue card in the following situations:

You're On A Budget: The Delta SkyMiles Gold Card has an annual fee, which can be a deterrent for some budget-minded travelers. The Delta SkyMiles Blue Card is a good option for budget travelers because it has no annual fee and still offers some valuable benefits, such as free first-check bags on Delta flights and priority boarding.

- You Spend Mainly On Airline & Dining: If you plan to spend only on these categories and you have another card for everyday spending, the difference in miles between the cards is minor. In such a case, you may prefer to avoid the annual fee.

Improve Credit History: For individuals looking to improve their credit history without the commitment of an annual fee, Delta SkyMiles Blue provides an entry-level option. It allows users to establish a positive credit record while still enjoying the benefits of earning miles on everyday purchases.

When You Might Prefer The Delta SkyMiles Gold?

You might prefer the Delta SkyMiles Gold card in the following situations:

You Spend At Least $10,000 On Groceris: If you spend a high amount on groceries, the difference in miles earning between the cards is signficant and may cover the annual fee difference.

You're Looking For Additional Travel Perks: The Delta SkyMiles Gold Card includes other travel perks, such as a first checked bagd free or baggage insurance plan. If these perks are valuable to you, the Delta SkyMiles Gold Card may be worth the annual fee.

Compare The Alternatives

If you're looking for an airline credit card with travel rewards – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

United℠ Explorer Card | Southwest Rapid Rewards® Premier Credit Card | Citi/AAdvantage Platinum Select World Elite | |

Annual Fee | $95 ($0 first year) | $99 | $99 (waived for the first 12 months)

|

Rewards |

1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| 1X – 3X

3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus |

50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

| 50,000 Points

50,000 points after you spend $1,000 on purchases in the first 3 months from account opening

|

50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 21.99% – 28.99% variable | 21.49%–28.49% variable

| 21.24% – 29.99% (Variable) |

Compare Delta SkyMiles Gold Card

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

If you're looking for airline travel rewards, there is a clear winner. But what about other premium travel benefits? Here's our comparison.

Delta SkyMiles Gold vs Southwest Rapid Rewards Priority: Which Gives You More?

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

While the Delta SkyMiles Gold extra perks are better, the JetBlue Plus Card is our winner in this comparison due to its higher cashback value.

The JetBlue Plus Card vs Delta SkyMiles Gold: Side By Side Comparison

The Delta SkyMiles Gold and the United Explorer Card offer airline benefits and similar fees. The SkyMiles Gold is our winner – here's why.

United Explorer vs Delta SkyMiles Gold: Side By Side Comparison

The Delta Gold and AAdvantage Platinum Select offer similar cashback value, but the Delta card is the winner due to its diverse travel perks.

Delta SkyMiles Gold vs. Citi/ AAdvantage Platinum Select: Which Card Wins?

While Alaska Visa Signature card offers higher miles rewards ratio on airline, the Delta SkyMiles Gold is our winner. Here's why.

Alaska Visa Signature vs Delta SkyMiles Gold: Side By Side Comparison

Both Hawaiian and Delta SkyMiles Gold have similar annual cashback values and diverse airline benefits, so there is no clear winner.

Hawaiian World Elite Mastercard vs. Delta SkyMiles Gold: Side By Side Comparison

Compare Delta SkyMiles Blue Card

Paying an annual fee with higher rewards rate & benefits, or getting a no annual fee card with access to Amex membership? Here's our analysis.

Both JetBlue and Delta SkyMiles Blue offer basic airline benefits and no annual fee. We think the JetBlue card is a clear winner, here's why.

The JetBlue Card vs Delta SkyMiles Blue Amex: How They Compare?

The Delta SkyMiles Blue and United Gateway have similar cashback rates and airline perks. Where does each card shine? Here's our comparison.