In this article, we'll embark on a comparative journey, pitting the Delta SkyMiles® Gold Card against the American Express® Gold Card.

Whether you're a frequent flyer seeking enhanced travel rewards, this showdown will help you make an informed decision about which card best aligns with your financial goals and lifestyle.

Delta SkyMiles Gold vs. Amex Gold: General Comparison

The choice between these two cards largely depends on your spending habits, travel preferences, and priorities. If you're a dedicated Delta traveler, the Delta SkyMiles Gold Card may be your top pick, while the American Express Gold Card offers a broader range of benefits, making it a great choice for those who enjoy dining out and traveling regularly.

|

| |

|---|---|---|

Delta SkyMiles® Gold | Amex Gold Card | |

Annual Fee | $150, $0 intro first year.See Rates and Fees. | $250. See Rates and Fees. |

Rewards | 2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases. Terms Apply. | 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases. Terms Apply.

|

Welcome bonus | 40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months | 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

|

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0. See Rates and Fees. | None. See Rates and Fees. |

Purchase APR | 20.99%-29.99% Variable | 21.24% – 29.24% Variable

|

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Compare Rewards: Delta SkyMiles Gold vs. Amex Gold

When comparing points rewards for the same spend, Amex Gold is our winner with more points and higher reward value compared to Delta SkyMiles Gold.

|

| |

|---|---|---|

Spend Per Category | Delta SkyMiles® Gold | Amex Gold Card |

$15,000 – U.S Supermarkets | 30,000 miles | 60,000 points |

$5,000 – Restaurants

| 10,000 miles | 20,000 points |

$5,000 – Airline | 10,000 miles | 9,000 points |

$4,000 – Hotels | 4,000 miles | 4,000 points |

$4,000 – Gas | 4,000 miles | 4,000 points |

Total Miles/Points | 58,000 miles (About $754) | 97,000 points (About $582 – $1,552 ) |

Additional Benefits You'll Get On Both Cards

There are some additional types of perks that you will see with both of these cards:

- ShopRunner: Enjoy free 2-day shipping at 100+ online stores when you enroll in complimentary ShopRunner membership with your Delta Platinum card.

- Car Rental Loss and Damage Insurance: When you use your card to reserve and pay for a rental vehicle and decline the collision damage waiver (CDW), you can be covered for damage or theft of the rental vehicle in a covered territory.

- Baggage Insurance Plan: Travel with peace of mind knowing your baggage is covered for loss, damage, or theft when you purchase a common carrier ticket with your card.

- Global Assist Hotline: If you’re more than 100 miles away from home, you can access the Global Assist Hotline 24/7 for emergency assistance and coordination. This includes help with missing luggage, emergency cash wires or medical and legal referrals.

Unique Benefits For Each Card

However, there are special benefits each card offer for cardholders:

Delta SkyMiles® Gold

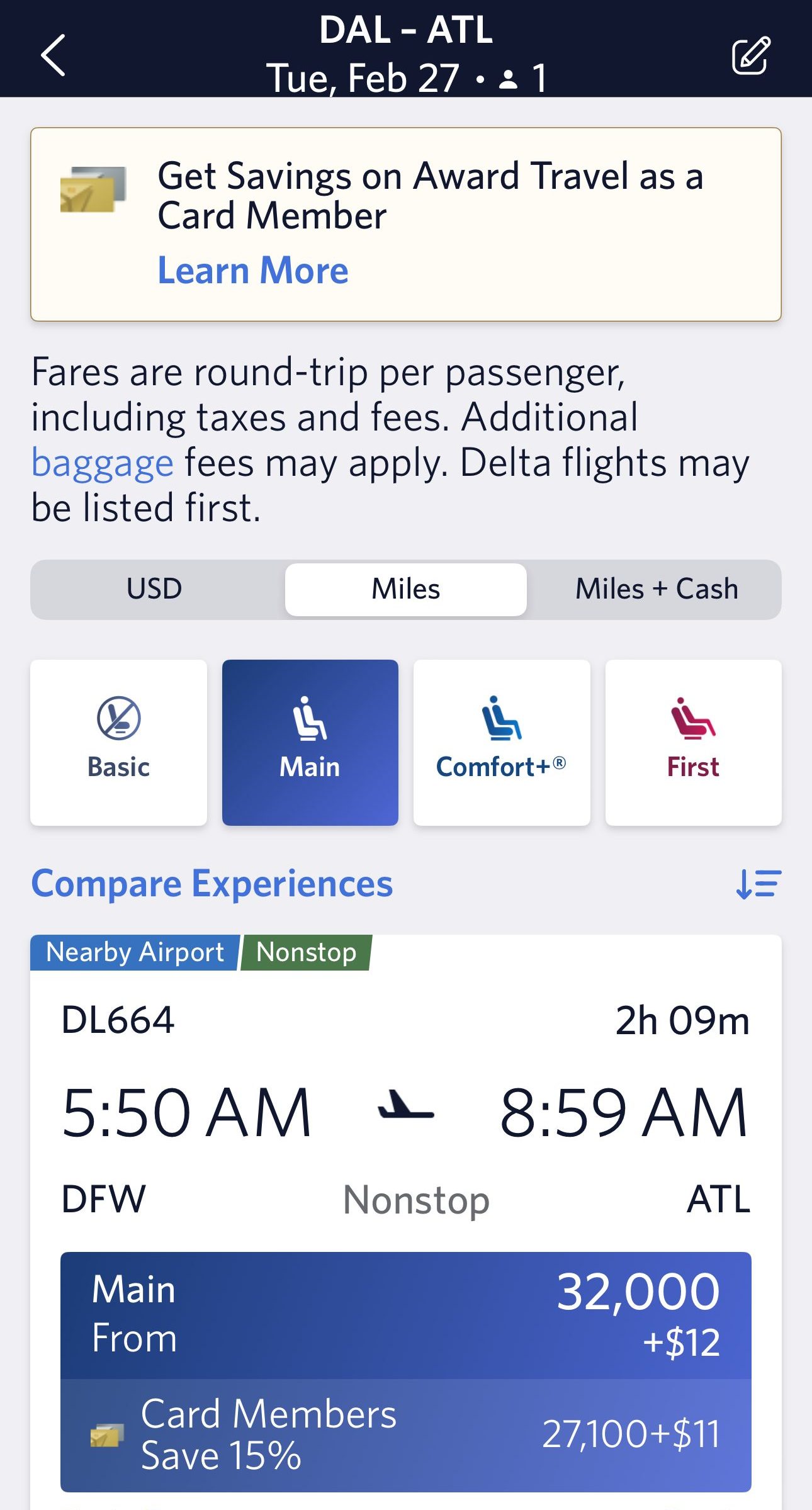

- TakeOff 15: Save 15% on Award Travel when booking Delta flights (excluding partner-operated flights and taxes/fees).

- First Checked Bag Free: Receive complimentary first checked bag on Delta flights.

$100 Delta Stays Credit: Get up to $100 back each year on eligible prepaid Delta Stays bookings at delta.com with the Delta SkyMiles® Gold American Express Card.

$200 Delta Flight Credit: When you spend $10,000 on purchases in a year, you'll get a $200 Delta Flight Credit to use for your next travel.

- Pay with Miles Discount: You can receive up to $50 off the cost of your Delta flight for every 5,000 miles you redeem.

- No Foreign Transaction Fees: You can use your card outside of the U.S without incurring any foreign transaction fees

- 20% Back on In–flight Purchases: Receive a 20% statement credit on eligible Delta in-flight purchases of food and beverages.

American Express Gold Card

- Up to $120 Uber Credit: If you link your new Gold Card to your Uber account, you can automatically receive $10 per month in Uber Cash to use for Uber rides or UberEats orders, up to a maximum of $120 per year.

- Up to $120 Dining Credit: You can also earn up to $10 in statement credit per month when you use your Amex Gold card to pay for dining out at The Cheesecake Factory, Wine.com, Goldbelly, Shake Shack and Milk Bar locations.

- Up to $100 Experience Credit – receive a $100 experience credit when you reserve The Hotel Collection through American Express Travel for a delightful getaway of at least two nights. The specific value of the experience credit may vary depending on the property you choose.

- Signature Perks: Amex Gold cardholders can access the Amex Hotel Collection to enjoy signature perks at some fantastic upscale hotels to enhance your travel experience.

Terms apply to American Express benefits and offers.

Top Offers

Top Offers From Our Partners

Top Offers

Main Drawbacks: Comparison

Delta SkyMiles® Gold

Limited Redemption Options: The primary use of Delta SkyMiles is for Delta flights, limiting your redemption options compared to the more versatile Membership Rewards points offered by the Amex Gold Card. With the Amex Gold Card, you can redeem points for a variety of travel options, merchandise, or even cash back.

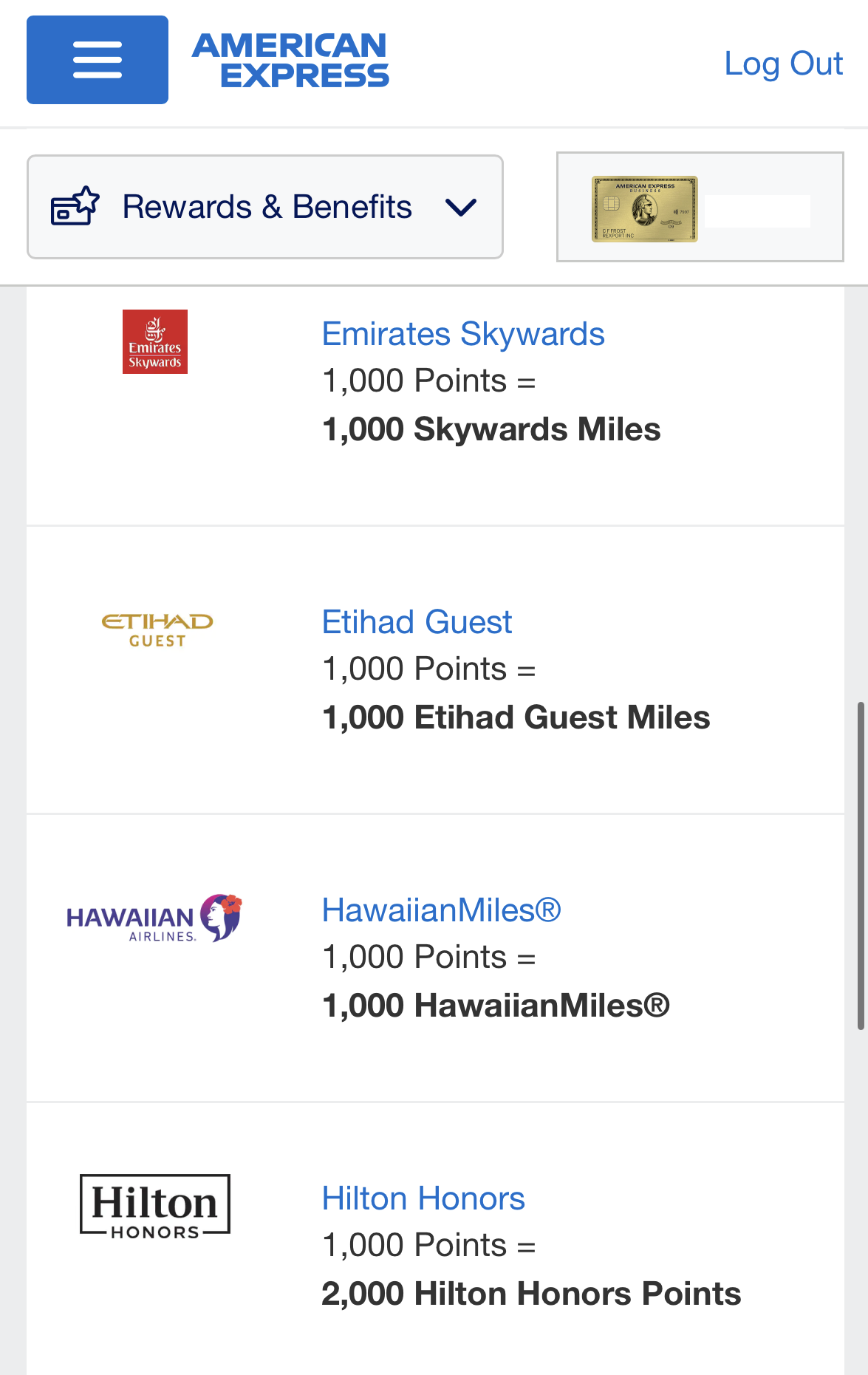

Transfer Partners: The Amex Gold Card allows you to transfer Membership Rewards points to various airline and hotel partners, providing flexibility and potentially higher redemption values. Delta SkyMiles do not offer the same level of flexibility when it comes to transfer partners.

Statement Credits – The Amex gold card offers a bunch of statement credits, something you won't get with the Delta gold card.

American Express Gold Card

Airline-Specific Rewards: Unlike the Delta SkyMiles Gold Card, which is designed for Delta loyalists and offers rewards specific to Delta flights, the Amex Gold Card provides Membership Rewards points that can be used with various airlines. This might be less appealing if you primarily fly with Delta.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit

Limited Delta-Specific Benefits: If you are a frequent Delta flyer, the Delta SkyMiles Gold Card provides perks like priority boarding, free checked bags, and in-flight discounts that are not available with the Amex Gold Card.

Annual Fee: The American Express Gold Card typically has a higher annual fee compared to the Delta SkyMiles Gold Card. While it offers numerous benefits to offset the cost, the annual fee might be a concern for budget-conscious individuals.

, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Terms apply to American Express benefits and offers.

When You Might Prefer the Amex Gold Card?

You might want to choose the American Express Gold Card over the Delta SkyMiles Gold Card in several situations:

- Diverse Travel Interests: If you enjoy traveling with various airlines and want flexibility in redeeming rewards across different airlines or for hotel stays, the American Express Gold Card, with its Membership Rewards points, is a better choice. It offers a broader range of travel options beyond just Delta flights.

- Dining Enthusiast: If you are a foodie who frequently dines out or orders in, the Amex Gold Card is particularly appealing. It provides dining credits, restaurant reservations through the Global Dining Collection, and bonus points on dining expenses.

- Desire for Versatile Redemption Options: The Membership Rewards points earned with the Amex Gold Card can be used for various redemption options, including travel, statement credits, merchandise, and more. This flexibility can be appealing if you want choices beyond just airline rewards.

When You Might Prefer the Delta SkyMiles Gold Card?

You might want to choose the Delta SkyMiles Gold Card over the American Express Gold Card in the following situations:

- Frequent Delta Traveler: If you are a loyal Delta Airlines customer and frequently fly with Delta, the Delta SkyMiles Gold Card is tailored to provide specific benefits for Delta flyers, such as priority boarding, free checked bags, and in-flight discounts.

- Delta-Specific Rewards: If you want to maximize your rewards on Delta-related expenses, such as flights, in-flight purchases, and Delta Vacations packages, the Delta SkyMiles Gold Card offers bonus miles and exclusive perks for these expenditures.

- Lower Annual Fee: The Delta SkyMiles Gold Card typically has a lower annual fee compared to the American Express Gold Card, which can be appealing for those looking to minimize their annual card costs.

Top Offers

Top Offers From Our Partners

Top Offers

Compare The Alternatives

If you're looking for an airline or travel credit card that can help you get more miles on your flights – there are some good alternatives:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare Delta SkyMiles Gold Card

The Delta SkyMiles Gold offers higher annual cashback and better perks than the Delta Blue card. But is it worth the annual fee? It depends.

Delta SkyMiles Blue vs Delta SkyMiles Gold: How They Compare?

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

If you're looking for airline travel rewards, there is a clear winner. But what about other premium travel benefits? Here's our comparison.

Delta SkyMiles Gold vs Southwest Rapid Rewards Priority: Which Gives You More?

The Delta SkyMiles Platinum is more expensive but offers more premium benefits than the Delta Gold. Here's our complete comparison.

While the Delta SkyMiles Gold extra perks are better, the JetBlue Plus Card is our winner in this comparison due to its higher cashback value.

The JetBlue Plus Card vs Delta SkyMiles Gold: Side By Side Comparison

The Delta SkyMiles Gold and the United Explorer Card offer airline benefits and similar fees. The SkyMiles Gold is our winner – here's why.

United Explorer vs Delta SkyMiles Gold: Side By Side Comparison

The Delta Gold and AAdvantage Platinum Select offer similar cashback value, but the Delta card is the winner due to its diverse travel perks.

Delta SkyMiles Gold vs. Citi/ AAdvantage Platinum Select: Which Card Wins?

While Alaska Visa Signature card offers higher miles rewards ratio on airline, the Delta SkyMiles Gold is our winner. Here's why.

Alaska Visa Signature vs Delta SkyMiles Gold: Side By Side Comparison

Both Hawaiian and Delta SkyMiles Gold have similar annual cashback values and diverse airline benefits, so there is no clear winner.

Hawaiian World Elite Mastercard vs. Delta SkyMiles Gold: Side By Side Comparison

Compare American Express Gold Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

The Amex Gold Card may be more appealing if you dine out frequently and value premium travel perks than the Apple card.

While the Amex Gold Card is more expensive than the Blue Cash Preferred, its rewards program and other benefits are more lucrative.

The Autograph is great for travelers who want to stay on budget, while Amex Gold provides premium travel benefits and redemption options.

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Venture X offers better travel rewards than the Amex Gold but is less appealing if you're looking for everyday spending rewards.

Amex Gold Card vs. Capital One Venture X : Which Premium Card Is Best?

The Amex Gold Card focused on everyday spending and general travel rewards, the Delta SkyMiles Reserve Card offer premium airline benefits.

Amex Gold Card vs. Delta SkyMiles Reserve: Side By Side Comparison

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Gold Card focuses on everyday spending rewards, while the Delta SkyMiles Platinum is tailored for frequent Delta travelers.

Amex Gold Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Hilton Honors Surpass wins at estimated cashback, while the Amex Gold card is the winner for everyday spending and extra benefits.

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Premium Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison.

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

Related Posts

Review Airline Credit Cards

Delta SkyMiles Blue American Express

- Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.