The United Gateway Card and the United Explorer Card are two co-branded credit cards offered by Chase in partnership with United Airlines. Both cards offer a variety of benefits to frequent United flyers, but they also have different annual fees and rewards structures.

General Comparison

The United Gateway Card is positioned as a no-annual-fee option, appealing to cost-conscious consumers. Despite its lack of an annual fee, it provides a gateway to United's MileagePlus program, allowing cardholders to earn miles on their everyday purchases. However, it has fewer premium perks compared to its counterpart.

On the other hand, the United Explorer Card comes with an annual fee but offers a more comprehensive set of benefits and a better points reward ratio.

Here's a side by side comparison of the cards main features:

|

| |

|---|---|---|

United Explorer Card | United Gateway Card | |

Annual Fee | $95 ($0 first year) | $0 |

Rewards | 2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases | 2X per $1 spent on United® purchases, at gas stations and on local transit and commuting and 1X on all other purchases |

Welcome bonus | 50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open. | 20,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open |

0% Intro APR | N/A | 12 months on purchases |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.99% – 28.99% variable | 21.99% – 28.99% variable |

Read Review | Read Review |

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

Airline Miles Rewards Analysis: Which Card Is Better?

When we analyze the number of miles cardholders can get for each card for the same spend, we can see the United Explorer card is the winner, but the difference is not significant:

|

| |

|---|---|---|

Spend Per Category | United Explorer Card | United Gateway Card |

$10,000 – U.S Supermarkets | 10,000 miles | 10,000 miles |

$4,000 – Restaurants

| 8,000 miles | 4,000 miles |

$5,000 – Airline | 10,000 miles | 10,000 miles |

$5,000 – Hotels | 10,000 miles | 5,000 miles |

$4,000 – Gas | 4,000 miles | 8,000 miles |

Total Points | 42,000 miles | 37,000 miles |

Redemption Value (Estimated) | 1 mile = ~1.2 cents

| 1 mile = ~1.2 cents

|

Estimated Annual Value | $504 | $444 |

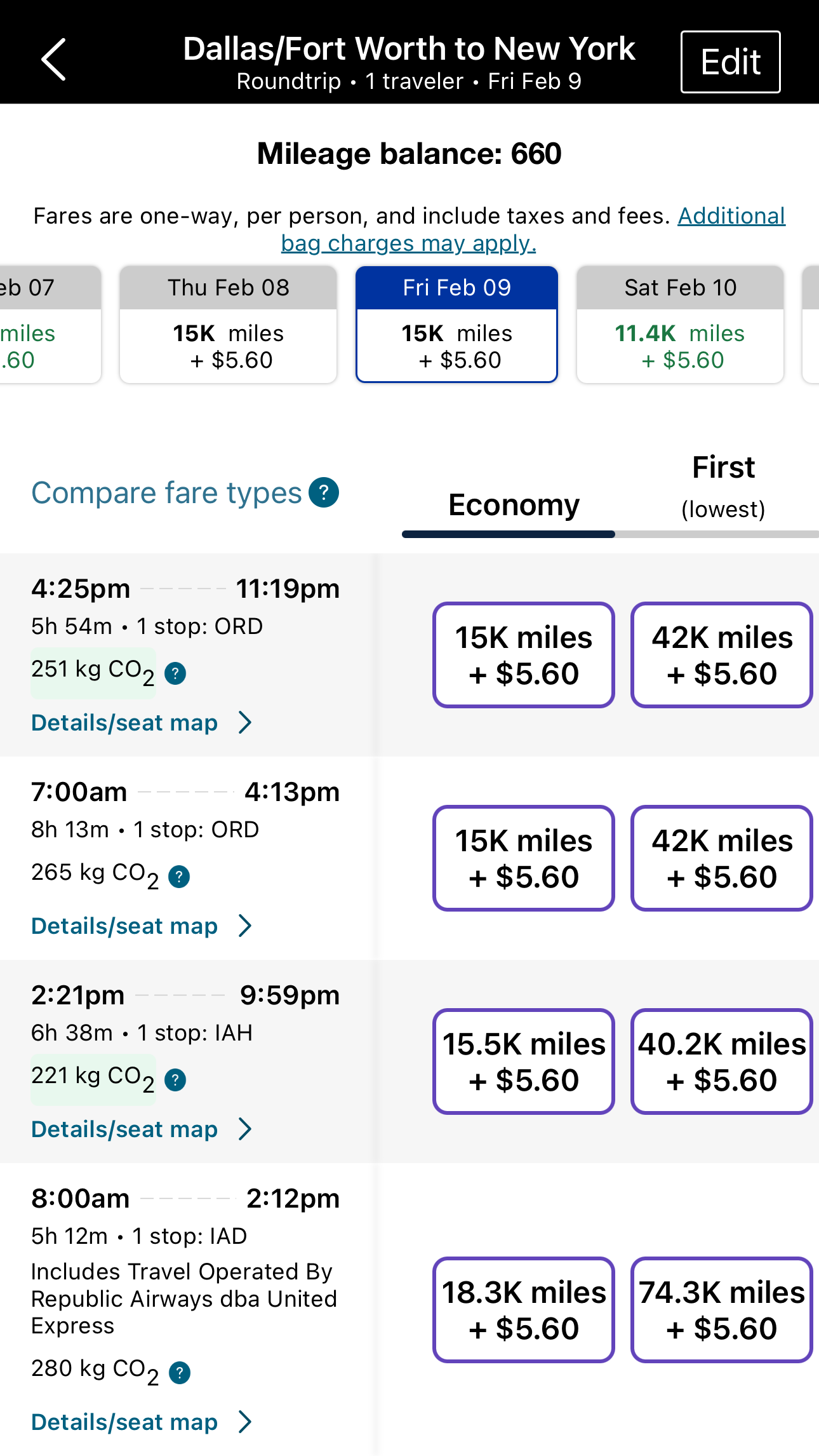

With the United credit card, you can redeem points for flights on United Airlines or its partners, hotel stays, car rentals, and merchandise. The more flexible miles can be used for any available seat, while the fixed-value miles let you book without worrying about seat availability.

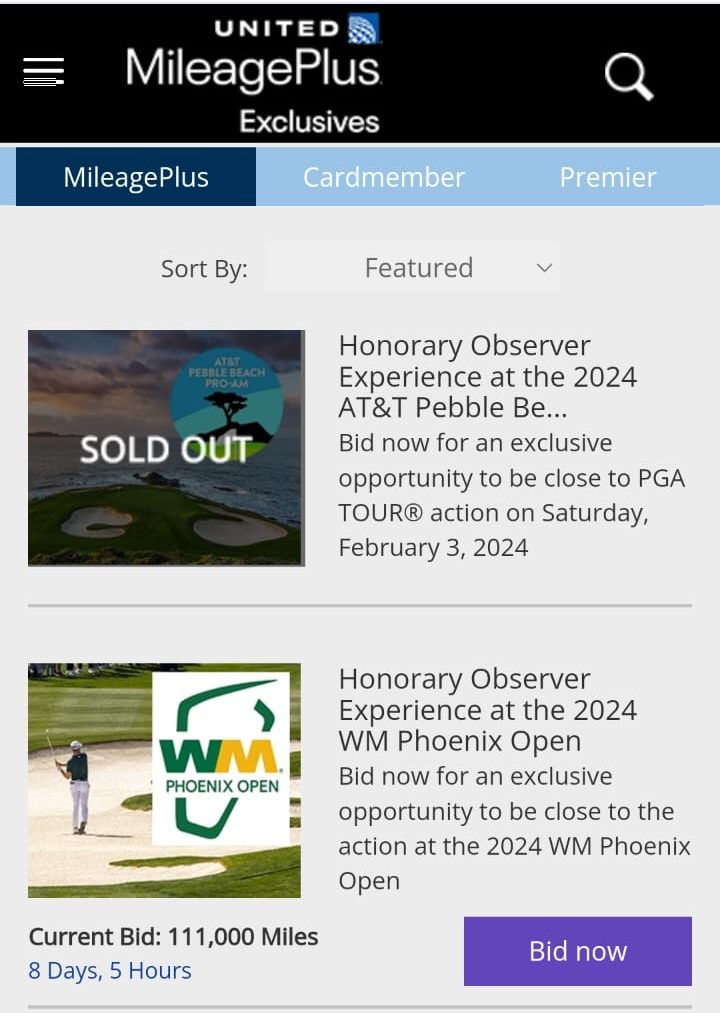

There are no blackout dates and access to exclusive events. Plus, there are options like transferring miles to other loyalty programs or donating them to charities.

What Airline And Travel Benefits You'll Get On Both Cards?

Both the United Gateway and United Explorer offer the following benefits:

- Auto Rental Collision Damage Waiver: Decline the rental company's collision insurance and charge the entire rental cost to your card. This provides primary insurance coverage for theft and collision damage for most rental cars in the U.S. and abroad.

- Trip Cancellation/Interruption Insurance: You can be reimbursed for pre-paid, non-refundable passenger fares if your trip is canceled or cut short due to covered situations like sickness or severe weather.

- Trip Delay Reimbursement: If your common carrier travel is delayed over 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging.

- 25% Back on In-Flight Purchases: You'll get a 25% statement credit on purchases of food, beverages, and Wi-Fi on United-operated flights when you pay with your Card, saving you money during your travels.

- Visa Concierge: Enjoy complimentary access to Visa Signature® Concierge Service 24/7, helping you find tickets to events, make dinner reservations, and more.

- Purchase Protection: Provides coverage for new purchases against damage or theft for 120 days.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

What Benefits You'll Get Only With The Explorer Card?

Given its higher cost, the United Explorer Card naturally provides a broader array of travel and airline benefits:

- Global Entry/TSA Precheck® Reimbursement: You can receive up to $100 as a statement credit every four years to cover the application fee for Global Entry, TSA Precheck®, or NEXUS, making your airport security process faster and more convenient.

- Priority Boarding: You and your companions on the same reservation can board United-operated flights before the general boarding process.

- Earn Premier Qualifying Points (PQP): You can earn PQP to help you achieve MileagePlus Premier® status, enhancing your travel experience with United Airlines.

- Free First Checked Bag: You and a companion can save up to $140 per roundtrip by receiving a free checked bag when flying with United, reducing your travel expenses.

Lost Luggage Reimbursement: Offers coverage for damaged or lost luggage when checked or carried on by you or an immediate family member.

Trip Delay Reimbursement: Covers unreimbursed expenses such as meals and lodging if your common carrier travel is delayed by more than 12 hours or requires an overnight stay.

Baggage Delay Insurance: Reimburses essential purchases like toiletries and clothing for baggage delays exceeding 6 hours by a passenger carrier.

When You Might Prefer The United Gateway Card?

Here are situations when you might prefer the United Gateway over the Explorer card:

Mileage Accumulation Focus: If your primary goal is to accumulate United miles through everyday purchases rather than accessing premium travel perks, the United Gateway Card offers a straightforward way to earn miles without the higher annual fee associated with the Explorer Card.

Cost-Conscious Consumers: If minimizing annual fees is a priority and you prefer a more budget-friendly option, the United Gateway Card could be preferable, as it typically comes with no annual fee, allowing you to access United's MileagePlus program without additional costs.

- You Need 0% Intro APR: if you plan a large purchase and want to leverage 0% Intro APR on purchases, you can do it only with the Gateway card.

When You Might Prefer The United Explorer Card?

Here are situations when you might prefer the United Explorer over the Gateway card:

- Desire for Enhanced Travel Perks: If you prioritize a more comprehensive travel experience, including perks like priority boarding, and free first checked bag, the Explorer Card offers a suite of benefits that goes beyond the basic mileage accumulation features of the Gateway Card.

- Better Travel Insurance Options: The United Explorer Card is a preferred choice for those who want broader coverage that includes lost luggage and trip delay reimbursement as well as baggage delay insurance.

Compare The Alternatives

If you're looking for an airline credit card with travel rewards – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

The JetBlue Plus Card | Southwest Rapid Rewards® Premier Credit Card | Citi/AAdvantage Platinum Select World Elite | |

Annual Fee | $99 | $99 | $99 (waived for the first 12 months)

|

Rewards | 1X – 6X

6X points on JetBlue purchases, 2X points at restaurants and grocery stores and 1X points on all other purchases

| 1X – 3X

3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus | 50,000 points

50,000 bonus points after spending $1,000 on purchases and paying the annual fee in full, both within the first 90 days

| 50,000 Points

50,000 points after you spend $1,000 on purchases in the first 3 months from account opening

|

50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 21.24% – 29.99% variable | 21.49%–28.49% variable

| 21.24% – 29.99% (Variable) |

Compare United Explorer Card

The Quest card has recently launched in order to provide a premium alternative to the old Explorer card. How they compared & is it worth it?

United℠ Explorer Card vs United Quest℠ Card: Which is Better?

In this comparison, we will delve into the key features, benefits, and considerations of both the United Explorer and Infinite Card.

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The United Explorer and the Southwest Premier card have numerous shared features. Let's explore the distinctive strengths of each card.

Southwest Rapid Rewards Premier vs. United Explorer: Comparison

While the AAdvantage Platinum Select and the United Explorer Card have many common features, the Explorer card is our winner. Here's why.

Citi/AAdvantage Platinum Select vs. United Explorer: How They Compare?

The Delta SkyMiles Gold and the United Explorer Card offer airline benefits and similar fees. The SkyMiles Gold is our winner – here's why.

United Explorer vs Delta SkyMiles Gold: Side By Side Comparison

The Alaska Visa offers higher annual cashback value than United Explorer, but the latter takes the lead when it comes to airline perks.

Alaska Visa Signature vs United Explorer: Side By Side Comparison

Compare United Gateway Card

The Delta SkyMiles Blue and United Gateway have similar cashback rates and airline perks. Where does each card shine? Here's our comparison.

The AAdvantage MileUp is our winner, especially if you plan to use the card for more categories besides travel. Here's why.

United Gateway Card vs American Airlines AAdvantage MileUp : Comparison