Issued by Chase, the Southwest Rapid Rewards Premier and United Explorer credit cards cater to different airlines and provide unique benefits for loyal customers and cardholders.

Let's compare these cards side by side.

General Comparison

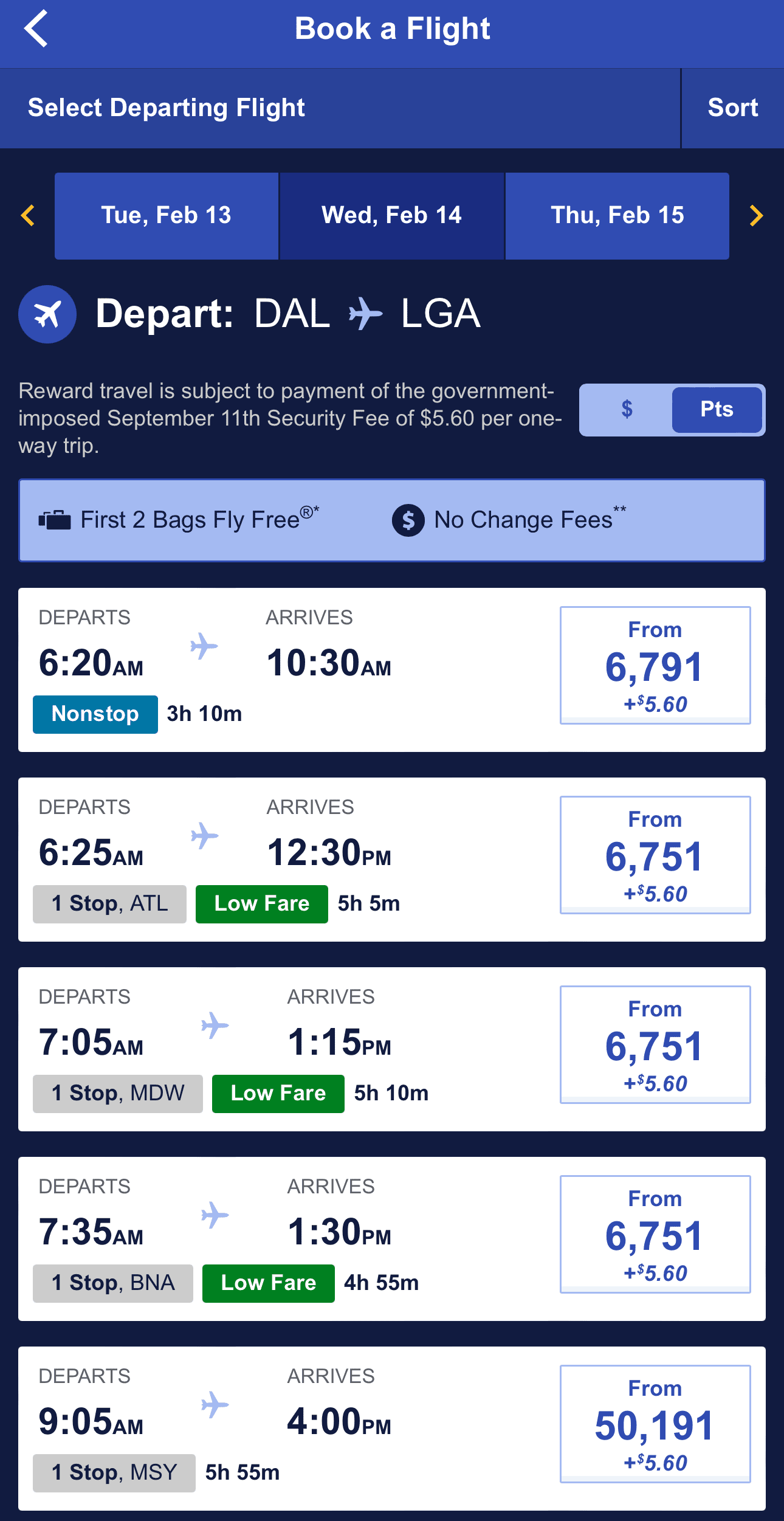

The Southwest Rapid Rewards Premier card is linked to Southwest Airlines, and earns Rapid Rewards points, which can be redeemed for Southwest flights, hotel stays, car rentals, and more.

On the other hand, the United Explorer card is geared towards United Airlines enthusiasts. Like the Southwest card, it typically provides a substantial sign-up bonus in the form of United MileagePlus miles. Cardholders earn miles for their everyday spending, with extra miles awarded for purchases with United and on dining and hotel accommodations.

Here's a side by side comparison of the cards main features:

|

| |

|---|---|---|

United Explorer Card | Southwest Rapid Rewards Premier | |

Annual Fee | $95 ($0 first year) | $99 |

Rewards | 2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases |

3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

|

Welcome bonus | 50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open. |

50,000 points after you spend $1,000 on purchases in the first 3 months from account opening

|

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.99% – 28.99% variable | 21.49%–28.49% variable

|

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Which Card Offer Higher Point Rewards Value?

When we analyze the number of points cardholders can get for each card for the same spend, we can see that there is a significant difference between the cards. Of course, the results can change based on spending habits.

|

| |

|---|---|---|

Spend Per Category | United Explorer Card | Rapid Rewards Premier |

$10,000 – U.S Supermarkets | 10,000 miles | 10,000 points |

$4,000 – Restaurants

| 8,000 miles | 4,000 points |

$5,000 – Airline | 10,000 miles | 15,000 points |

$5,000 – Hotels | 10,000 miles | 10,000 points |

$4,000 – Gas | 4,000 miles | 4,000 points |

Total Points | 42,000 points | 43,000 points |

Redemption Value (Estimated) | 1 point = ~1.2 cents

| 1 point = ~1.3 cents

|

Estimated Annual Value | $504 | $559 |

United Airlines provides diverse redemption choices for MileagePlus miles, enabling users to book flights, upgrade seats, or offset fees. Beyond air travel, miles are versatile for hotel stays, car rentals, and merchandise via the MileagePlus Shopping portal.

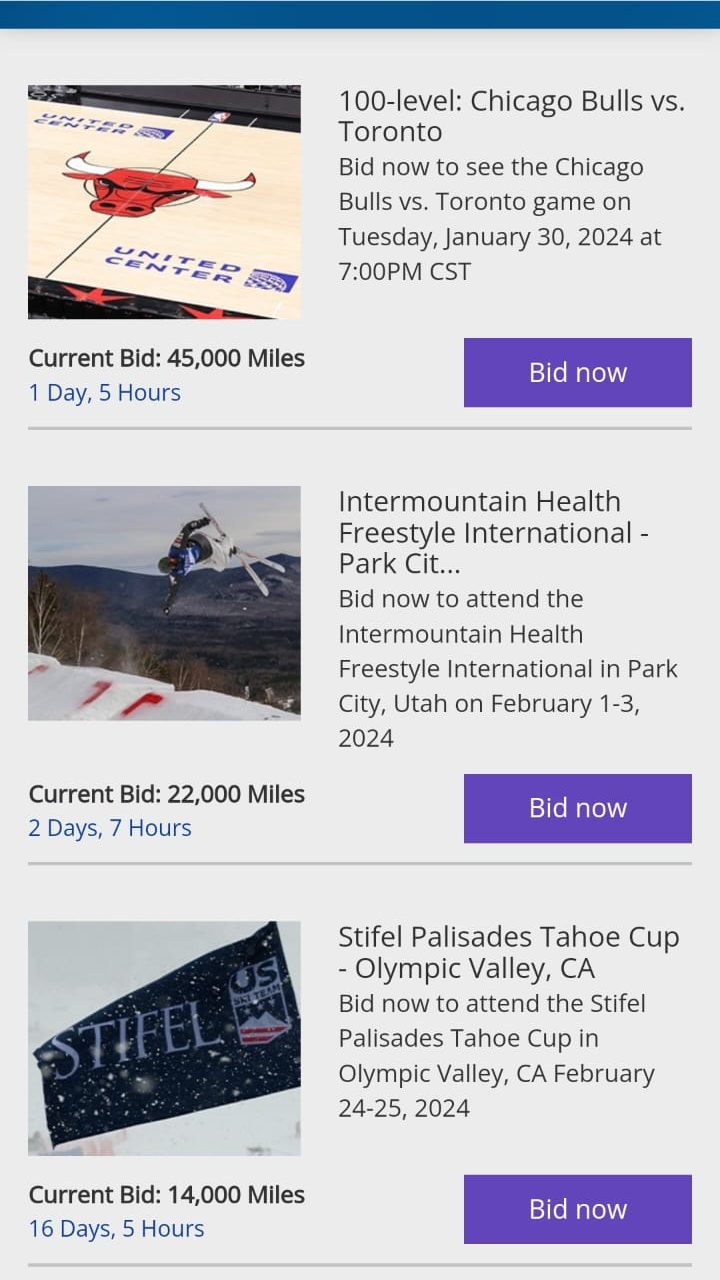

Southwest Airlines offers flexible redemption options for Rapid Rewards points. Use points for flight bookings without blackout dates or seat restrictions, simplifying travel planning. Additionally, points can be utilized for hotel stays, car rentals, gift cards, and unique experiences through the More Rewards program.

Airline Benefits And Protections: Comparison

The United Explorer is the winner when it comes to extra perks and protections, as it offers benefits such as TSA PreCheck reimbursement, free first checked bag and option to earn PQP to achieve an Elite status.

Both cards offer the following benefits and protections:

- DoorDash Benefits: Cardholders receive a complimentary one-year DashPass membership.

- Lost Luggage Reimbursement: Receive coverage up to $3,000 per passenger for lost or damaged checked or carry-on luggage.

- Baggage Delay Insurance: Get reimbursed for essential purchases (up to $100 per day for 3 days) in case of baggage delays over 6 hours.

- Extended Warranty Protection: Extend the manufacturer's warranty by an additional year on eligible warranties of three years or less.

- Purchase Protection: Enjoy coverage for new purchases against damage or theft for 120 days, up to $500 per claim and $50,000 per account, providing added security for your acquisitions.

Which Unique Benefits Each Card Offer?

Here are the unique benefits of each card:

United Explorer Card

- Global Entry/TSA Precheck® Reimbursement: You can receive up to $100 as a statement credit every four years to cover the application fee for Global Entry, TSA Precheck®, or NEXUS, making your airport security process faster and more convenient.

- 25% Back on In-Flight Purchases: You'll get a 25% statement credit on purchases of food, beverages, and Wi-Fi on United-operated flights when you pay with your Explorer Card, saving you money during your travels.

- Priority Boarding: You and your companions on the same reservation can board United-operated flights before the general boarding process.

- Earn Premier Qualifying Points (PQP): You can earn PQP to help you achieve MileagePlus Premier® status, enhancing your travel experience with United Airlines.

- Free First Checked Bag: You and a companion can save up to $140 per roundtrip by receiving a free checked bag when flying with United, reducing your travel expenses.

- Auto Rental Collision Damage Waiver: Decline the rental company's collision insurance and charge the entire rental cost to your card. This provides primary insurance coverage for theft and collision damage for most rental cars in the U.S. and abroad.

- Trip Cancellation/Interruption Insurance: You can be reimbursed for pre-paid, non-refundable passenger fares if your trip is canceled or cut short due to covered situations like sickness or severe weather.

- Trip Delay Reimbursement: If your common carrier travel is delayed over 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging.

- Visa Concierge: Enjoy complimentary access to Visa Signature® Concierge Service 24/7, helping you find tickets to events, make dinner reservations, and more.

Southwest Rapid Rewards Premier

- 25% Back on Inflight Purchases: Receive a 25% rebate on inflight purchases, making onboard snacks, drinks, and entertainment more affordable for travelers.

6,000 Points Annually on Cardmember Anniversary: Cardholders receive an additional 6,000 bonus points every year on their Cardmember anniversary, further enhancing the annual point accumulation and boosting the overall rewards potential.

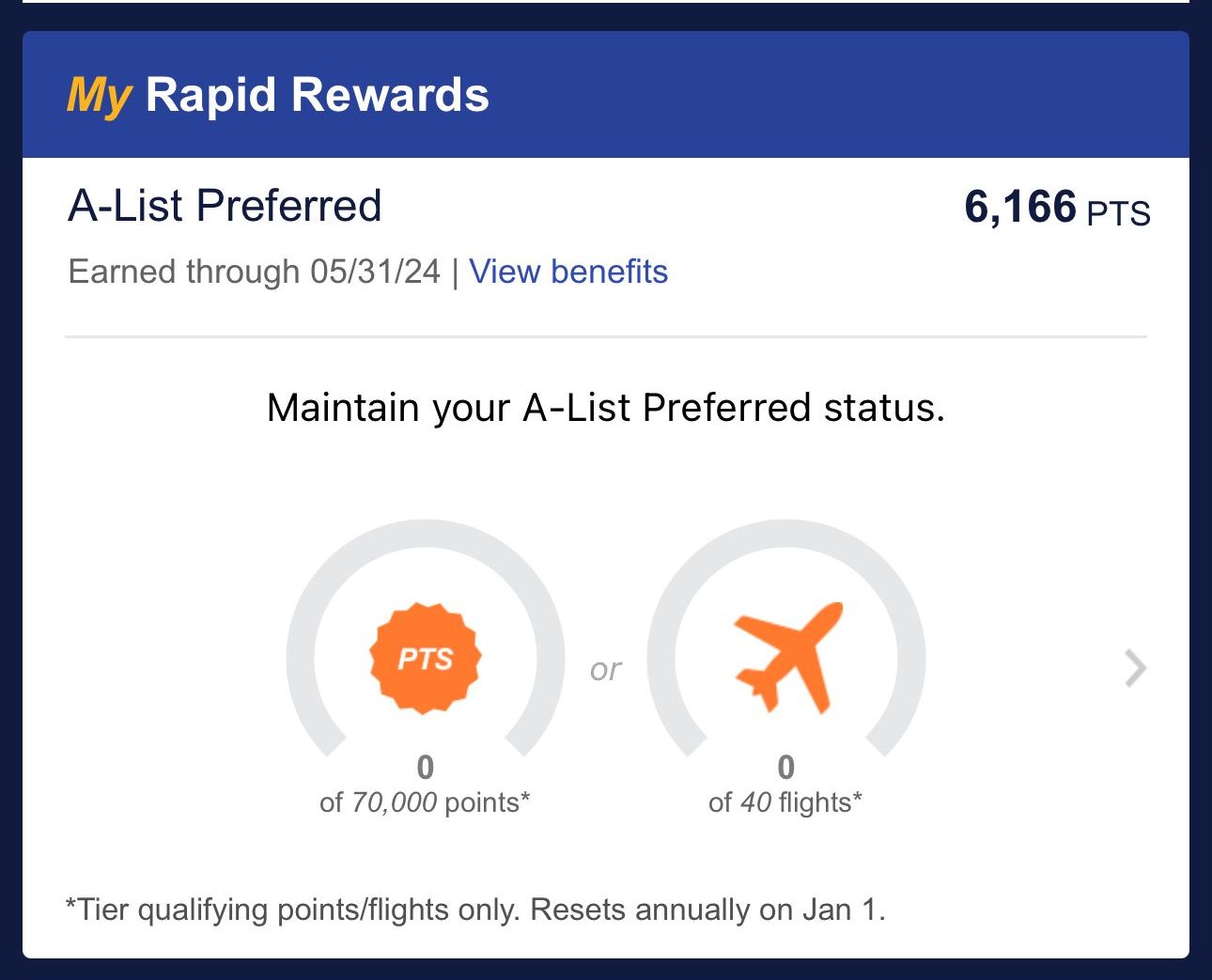

- Unlimited Tier Qualifying Points (TQPs): For every $10,000 spent, earn 1,500 TQPs toward A-List status, with no limit on the amount of TQPs you can accumulate, facilitating progress towards elite status and associated benefits.

- 10,000 Companion Pass Qualifying Points Boost: The card provides an annual boost of 10,000 Companion Pass qualifying points, bringing cardholders closer to earning the highly coveted Southwest Companion Pass.

- 2 EarlyBird Check-In® Each Year: Enjoy the convenience of two EarlyBird Check-Ins per year, allowing cardholders to secure earlier boarding positions.

When You Might Want The United Explorer Card?

Here are situations when you might prefer the United Explorer over the Southwest Rapid Rewards Premier:

You Want Global Network and Star Alliance Benefits: If your travel often takes you to international destinations, the United Explorer card might be preferable. United Airlines is part of the Star Alliance, offering a broader global network

You Want Better Travel Insurance: the Explorer card offers broader coverage than what you can get with the Southwest Premier card, so if you are looking to maximize your coverage, it may be a better option.

You Want A Variety Of Redemption Options: If you prefer the flexibility to redeem miles for various travel options beyond flights, the United Explorer might be more suitable. United MileagePlus miles can be used for flights, hotel stays, car rentals, and more, providing versatility in how you use your earned rewards.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want The Southwest Premier Card?

The Southwest Rapid Rewards Premier may be a better option if:

You Plan To Spend Mainly On Airline: The Southwest Rapid Rewards Premier card earns 3x points on Southwest flights while the United Explorer card earns 2x miles on United purchases. If you are mainly looking to earn points on flights, the Premier card may be better.

You Need Flexible Change and Cancellation Policies: Choose the Southwest Rapid Rewards Premier if you appreciate flexibility in your travel plans. Southwest is known for its customer-friendly change and cancellation policies, allowing you to modify your travel dates without hefty fees. This flexibility can be a significant advantage, especially for those with unpredictable schedules.

You Want No Blackout Dates or Seat Restrictions: If you want to avoid blackout dates and seat restrictions when redeeming rewards, the Southwest Rapid Rewards Premier may be more suitable. Southwest's redemption system is based on the cost of the flight, offering flexibility in choosing travel dates and availability without the limitations often associated with traditional airline loyalty programs.

Compare The Alternatives

There are other travel cards worth mentioning, here are some of our best premium travel credit cards:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare Southwest Rapid Rewards Premier

We think the Southwest Rapid Rewards Premier wins – it's cheaper and there is no significant difference in points rewards or airline perks.

Southwest Rapid Rewards Premier vs Priority: Side By Side Comparison

If you're a frequent flyer, the Premier card has the edge so that you can cover the annual fee difference. If not, the Plus card is enough.

Southwest Rapid Rewards Plus vs Premier: Side By Side Comparison

The AAdvantage Platinum Select and the Southwest Premier card share many common features.

Here's where each card shines: AAdvantage Platinum Select vs. Southwest Rapid Rewards Premier

While the Southwest Premier card extra travel perks are better, the JetBlue Plus Card is our winner in this comparison. Here's why.

JetBlue Plus Card vs Southwest Rapid Rewards Premier: Side By Side Comparison

Both cards have similar annual cashback value and diverse airline benefits. While there is no clear winner, each card has its unique perks.

Frontier World Mastercard vs. Southwest Rapid Rewards Premier: Side By Side Comparison

Both Alaska and Southwest Premier have similar annual cashback values. While there is no clear winner, each card has its own unique perks.

Alaska Airlines Visa Signature vs Southwest Rapid Rewards Premier: Comparison

Compare United Explorer Card

The United Gateway and Explorer are two co-branded credit cards offered by Chase in partnership with United Airlines. Here's our winner.

The Quest card has recently launched in order to provide a premium alternative to the old Explorer card. How they compared & is it worth it?

United℠ Explorer Card vs United Quest℠ Card: Which is Better?

In this comparison, we will delve into the key features, benefits, and considerations of both the United Explorer and Infinite Card.

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

While the AAdvantage Platinum Select and the United Explorer Card have many common features, the Explorer card is our winner. Here's why.

Citi/AAdvantage Platinum Select vs. United Explorer: How They Compare?

The Delta SkyMiles Gold and the United Explorer Card offer airline benefits and similar fees. The SkyMiles Gold is our winner – here's why.

United Explorer vs Delta SkyMiles Gold: Side By Side Comparison

The Alaska Visa offers higher annual cashback value than United Explorer, but the latter takes the lead when it comes to airline perks.

Alaska Visa Signature vs United Explorer: Side By Side Comparison