The United Gateway Card and the American Airlines AAdvantage MileUp are both no-annual-fee airline credit cards issued by Chase and Citi, respectively. Let's compare them side by side:

General Comparison

While both cards don't charge an annual, the United card also offers 0% intro APR on purchases as well as no foreign transaction fee.

Here's a side-by-side comparison of the card's main features:

United Gateway | American Airlines AAdvantage MileUp | |

Annual Fee | $0 | $0 |

Rewards | 2X per $1 spent on United® purchases, at gas stations and on local transit and commuting and 1X on all other purchases | 2 AAdvantage miles per dollar on grocery stores and eligible American Airlines purchases, and 1 mile per dollar on other purchases |

Welcome bonus | 20,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open | 10,000 miles and $50 statement credit if you spend $500 in first 3 months |

0% Intro APR | 12 months on purchases | None |

Foreign Transaction Fee | $0 | 3% |

Purchase APR | 21.99% – 28.99% variable | 21.24% – 29.99% (Variable) |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Airline Miles Rewards Analysis: Which Card Is Better?

When you compare how many points you get for spending the same amount of money, it's clear that the American Airlines AAdvantage MileUp card comes out on top, especially due to the higher points rewards on groceries. It earns more points and has a higher annual value compared to the United Gateway Card.

Spend Per Category | United Gateway | AAdvantage MileUp |

$10,000 – U.S Supermarkets | 10,000 miles | 20,000 miles |

$4,000 – Restaurants

| 4,000 miles | 4,000 miles |

$5,000 – Airline | 10,000 miles | 10,000 miles |

$4,000 – Hotels | 4,000 miles | 4,000 miles |

$4,000 – Gas | 8,000 miles | 4,000 miles |

Total Miles | 36,000 miles | 42,000 miles |

Redemption Value (Estimated) | 1 mile = ~1.2 cents

| 1 mile = ~1.5 cents |

Estimated Annual Value | $444 | $630 |

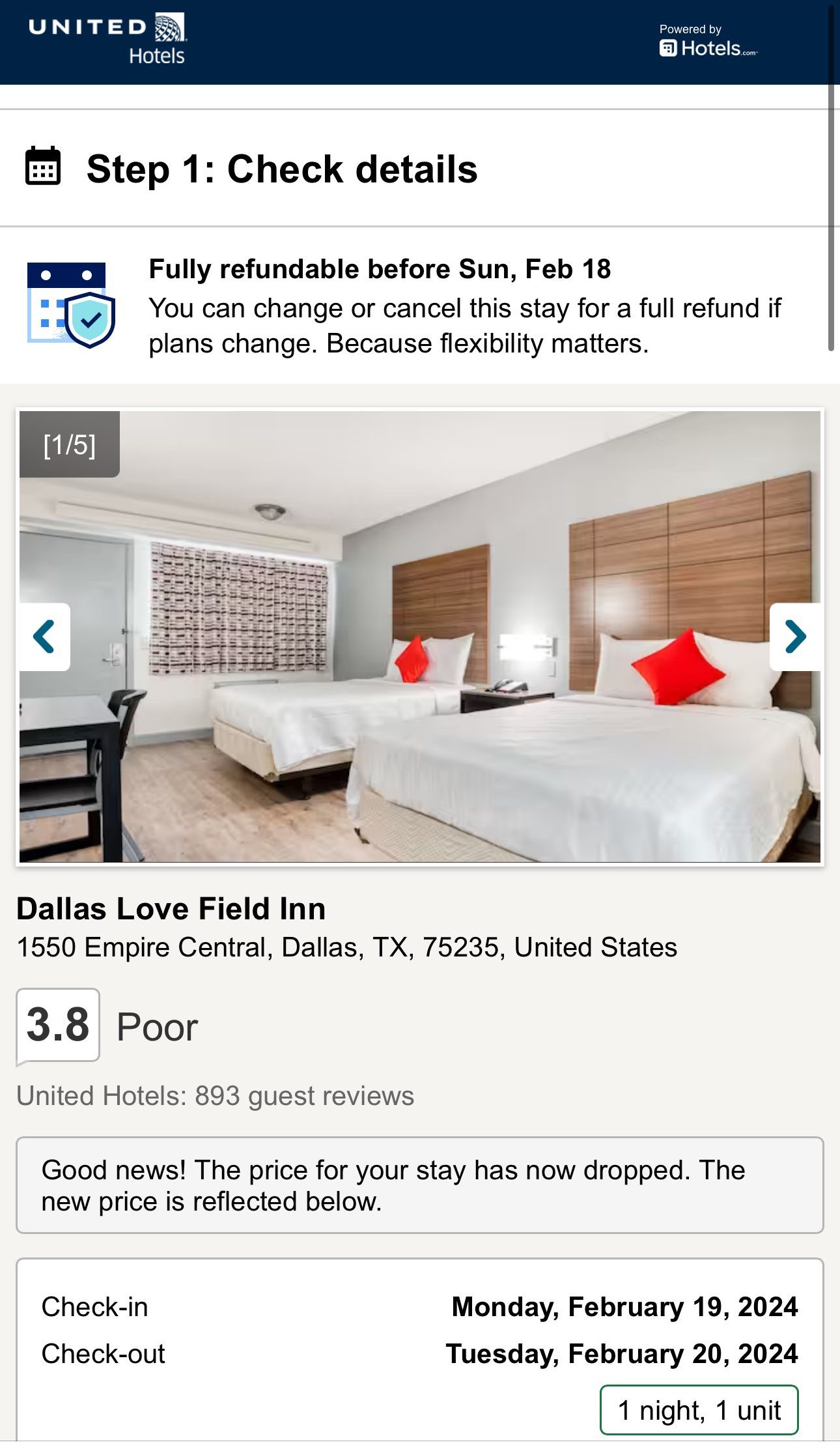

With the United Gateway Card, you can turn your miles into travel experiences. Use miles for flights with United or its partners, covering destinations worldwide. Additionally, explore options beyond flights, such as hotel stays, car rentals, and merchandise.

With the AAdvantage MileUp Card, you can redeem your points for a variety of options. This includes cash back, travel rewards, gift cards, and merchandise.

Whether you prefer getting money back, planning a getaway, or treating yourself with gift cards or items, the card provides flexible and straightforward redemption choices.

Airline Benefits And Protections: Comparison

Since neither card has an annual fee, their extra perks are somewhat limited. However, when it comes to added protections and travel insurance, the United Gateway card comes out on top.

United Gateway

- 25% Back on In-Flight Purchases: You'll get a 25% statement credit on purchases of food, beverages, and Wi-Fi on United-operated flights when you pay with your Explorer Card, saving you money during your travels.

- Auto Rental Collision Damage Waiver: Decline the rental company's collision insurance and charge the entire rental cost to your card. This provides primary insurance coverage for theft and collision damage for most rental cars in the U.S. and abroad.

- Trip Cancellation/Interruption Insurance: You can be reimbursed for pre-paid, non-refundable passenger fares if your trip is canceled or cut short due to covered situations like sickness or severe weather.

- Trip Delay Reimbursement: If your common carrier travel is delayed over 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging.

- Visa Concierge: Enjoy complimentary access to Visa Signature® Concierge Service 24/7, helping you find tickets to events, make dinner reservations, and more.

- Purchase Protection: Provides coverage for new purchases against damage or theft for 120 days.

American Airlines AAdvantage MileUp

- 25% Savings on Inflight Food and Beverage: When using the card on American Airlines flights, users receive a 25% discount on purchases of inflight food and beverages, providing additional savings during air travel.

- $0 Liability On Unauthorized Charges: ensuring you are not held responsible for charges you did not authorize.

When You Might Want The AAdvantage MileUp Card?

You might prefer the AAdvantage MileUp card in the following situations:

You Have High Spend On Groceries: as we can see on our points rewards analysis, if you plan to use the card for groceries and supermarkets, it may be a better choice than the United Gateway card due to its increased points rewards rate on this category.

You Live Close To American Airlines Hubs: Opt for the American Airlines AAdvantage MileUp if you reside near a major American Airlines hub. This card is beneficial for individuals who frequently fly with American Airlines, offering rewards and perks aligned with the airline's extensive network.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want The United Gateway Card?

You might prefer the United Gateway card in the following situations:

You Want Broader Travel Insurances: The United Gateway Card offers trip delay reimbursement and trip cancellation which is not available through the AAdvantage MileUp card.

You Mainly Spend On Gas & Airline: if you don't plan to spend on groceries and supermarkets since you have another card, the United Gateway card may be a preferred option.

You Live Close To United Airlines Hub Proximity: If you live near a major United Airlines hub and frequently fly with them, the United Gateway Card might be a better choice. It offers benefits and rewards tailored to United's network, potentially providing more value for your travel needs.

Compare The Alternatives

If you're looking for an airline credit card with travel rewards – there are some good alternatives you may want to consider:

| |||

|---|---|---|---|

United℠ Explorer Card | Delta SkyMiles® Gold American Express Card | Citi®/AAdvantage® Platinum Select® World Elite Mastercard® | |

Annual Fee | $95 ($0 first year) | $150, $0 intro first year. (See Rates and Fees.) | $99 (waived for the first 12 months)

|

Rewards |

1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

|

1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus |

50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

|

40,000 Miles

40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months

|

50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0 | $0. See Rates and Fees. | $0 |

Purchase APR | 21.99% – 28.99% variable | 20.99%-29.99% Variable | 21.24% – 29.99% (Variable) |

Compare United Gateway Card

The United Gateway and Explorer are two co-branded credit cards offered by Chase in partnership with United Airlines. Here's our winner.

The Delta SkyMiles Blue and United Gateway have similar cashback rates and airline perks. Where does each card shine? Here's our comparison.