The Citi/AAdvantage Platinum Select and United Explorer credit cards are both co-branded airline cards, each with own benefits and drawbacks. Let's compare them side by side:

General Comparison

The Citi® / AAdvantage® Platinum Select® card is linked to American Airlines, allowing cardholders to accumulate AAdvantage miles for each dollar spent. Bonus miles are granted for specific categories such as airfare, dining, and gas expenses.

In contrast, the United Explorer card is tailored for United Airlines enthusiasts. Similar to the Southwest card, it usually offers a significant sign-up bonus in the form of United MileagePlus miles. Everyday spending earns cardholders miles, with additional rewards for purchases made with United, as well as on dining and hotel accommodations.

Here's a side by side comparison of the cards main features:

|

| |

|---|---|---|

United Explorer Card | Citi/AAdvantage Platinum Select | |

Annual Fee | $95 ($0 first year) | $99 (waived for the first 12 months)

|

Rewards | 2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases | Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus | 50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open. | 50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.99% – 28.99% variable | 21.24% – 29.99% (Variable) |

Read Review | Read Review |

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

Airline Miles Rewards Analysis: Which Card Is Better?

When we analyze the number of points cardholders can get for each card for the same spend, we can see no significant difference between the cards when it comes to miles earnings – but the AAdvantage Platinum cards wins overall due to higher value of each mile:

|

| |

|---|---|---|

Spend Per Category | United Explorer Card | AAdvantage Platinum Select |

$10,000 – U.S Supermarkets | 10,000 miles | 10,000 miles |

$4,000 – Restaurants

| 8,000 miles | 8,000 miles |

$5,000 – Airline | 10,000 miles | 10,000 miles |

$5,000 – Hotels | 10,000 miles | 5,000 miles |

$4,000 – Gas | 4,000 miles | 8,000 miles |

Total Points | 42,000 miles | 41,000 miles |

Redemption Value (Estimated) | 1 mile = ~1.2 cents

| 1 mile = ~1.5 cents |

Estimated Annual Value | $504 | $615 |

With the United Explorer Card, you can turn your miles into travel experiences. Use miles for flights with United or its partners, covering destinations worldwide. Additionally, explore options beyond flights, such as hotel stays, car rentals, and merchandise.

With the Citi Platinum Select Card, you can redeem your points for a variety of options. This includes cash back, travel rewards, gift cards, and merchandise. Whether you prefer getting money back, planning a getaway, or treating yourself with gift cards or items, the card provides flexible and straightforward redemption choices.

Airline Benefits And Protections: Comparison

The United Explorer is the winner when it comes to extra perks and protections, as it offers benefits such as TSA PreCheck reimbursement, the option to earn PQP to achieve an Elite status and travel insurance coverage that you won't be able to get wth the AAdvantage Platinum card.

United Explorer Card

- Global Entry/TSA Precheck® Reimbursement: You can receive up to $100 as a statement credit every four years to cover the application fee for Global Entry, TSA Precheck®, or NEXUS, making your airport security process faster and more convenient.

- 25% Back on In-Flight Purchases: You'll get a 25% statement credit on purchases of food, beverages, and Wi-Fi on United-operated flights when you pay with your Explorer Card, saving you money during your travels.

- Priority Boarding: You and your companions on the same reservation can board United-operated flights before the general boarding process.

- Earn Premier Qualifying Points (PQP): You can earn PQP to help you achieve MileagePlus Premier® status, enhancing your travel experience with United Airlines.

- Auto Rental Collision Damage Waiver: Decline the rental company's collision insurance and charge the entire rental cost to your card. This provides primary insurance coverage for theft and collision damage for most rental cars in the U.S. and abroad.

- Trip Cancellation/Interruption Insurance: You can be reimbursed for pre-paid, non-refundable passenger fares if your trip is canceled or cut short due to covered situations like sickness or severe weather.

- Trip Delay Reimbursement: If your common carrier travel is delayed over 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging.

- Visa Concierge: Enjoy complimentary access to Visa Signature® Concierge Service 24/7, helping you find tickets to events, make dinner reservations, and more.

- Free First Checked Bag: You and a companion can save up to $140 per roundtrip by receiving a free checked bag when flying with United, reducing your travel expenses.

- Purchase Protection: Provides coverage for new purchases against damage or theft for 120 days.

Baggage Delay Insurance: Reimburses essential purchases like toiletries and clothing for baggage delays exceeding 6 hours by a passenger carrier.

Lost Luggage Reimbursement: Offers coverage for damaged or lost luggage when checked or carried on by you or an immediate family member.

Citi/AAdvantage Platinum Select

First Checked Bag Free: Travelers with the Citi® / AAdvantage® Platinum Select® card enjoy the benefit of a first checked bag free on domestic American Airlines itineraries for themselves and up to four companions on the same reservation.

- Preferred Boarding: Cardholders also receive preferred boarding on American Airlines flights, allowing them to save time and enhance productivity during the boarding process.

- 25% Savings on Inflight Food and Beverage: When using the card on American Airlines flights, users receive a 25% discount on purchases of inflight food and beverages, providing additional savings during air travel.

- $125 American Airlines Flight Discount: By spending $20,000 or more in purchases during the cardmembership year and renewing the card, users can earn a $125 American Airlines Flight Discount.

When You Might Want The United Explorer Card?

Here are situations when you might prefer the United Explorer over the AAdvantage Platinum Select:

You Want Broader Travel Insurance Coverage: The United Explorer card offers protections and travel insurance that you won't be able to get with the Citi platinum credit card. If you are looking for a card with protections, it may be a better option.

You Want Global Entry or TSA PreCheck Priority: Choose the United Explorer if you prioritize expedited security processes, as the card provides a statement credit for Global Entry or TSA PreCheck, streamlining your airport experience.

You're Near United Hub Proximity: Opt for the United Explorer if you reside near a United Airlines hub, as it often results in more convenient flight options, potentially maximizing the card's benefits like priority boarding and free checked bags.

Top Offers From Our Partners

Top Offers From Our Partners

Top Offers From Our Partners

When You Might Want The AAdvantage Platinum Select?

Here are situations when you might prefer the AAdvantage Platinum Select over the United Explorer:

You're Loyal To American Airlines: Choose the Citi/AAdvantage Platinum Select if you frequently fly with American Airlines or prefer their extensive route network, maximizing the benefits such as free checked bags and priority boarding.

You Prefer The Oneworld Alliance: Opt for the Citi/AAdvantage Platinum Select if you are loyal to the Oneworld alliance, as this card aligns with American Airlines' partnership within the alliance, potentially providing advantages when flying with other member airlines.

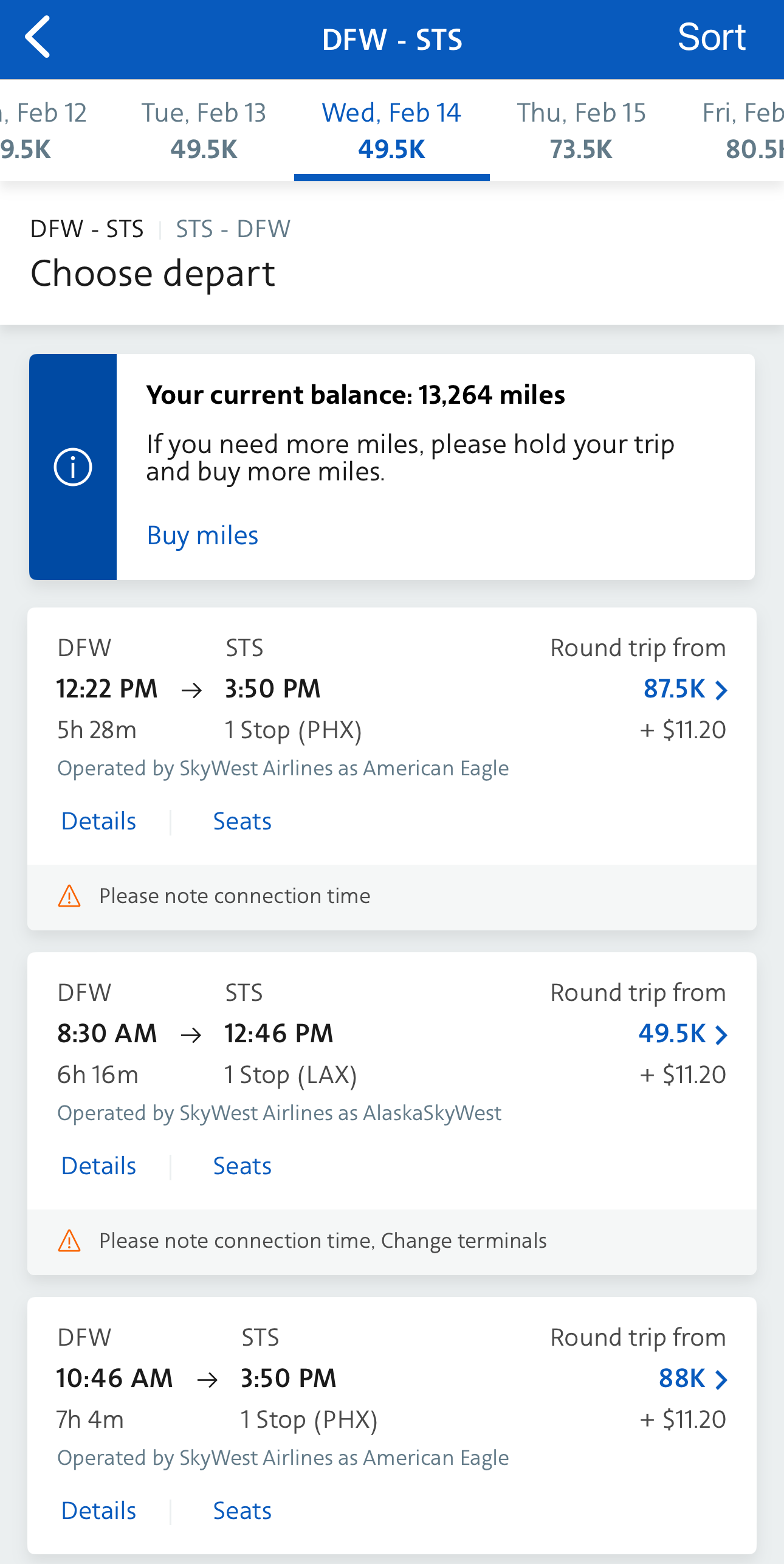

Compare The Alternatives

If you're looking for an airline miles credit card– there are some excellent alternatives you may want to consider:

|

|

| |

|---|---|---|---|

United Club Infinite Card

| The Platinum Card® from American Express | Delta SkyMiles® Reserve American Express | |

Annual Fee | $525 | $695. See Rates & Fees | $650. See Rates & Fees |

Rewards | Up to 4x miles

4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases

|

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

| 1X – 3X

3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases

|

Welcome bonus | 90,000 miles

80,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening

|

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

| 60,000 miles

Earn 60,000 bonus miles after you spend $5,000 in purchases on your new card in your first six months

|

Foreign Transaction Fee | $0 | $0. See Rates & Fees | $0

|

Purchase APR | 21.99% – 28.99% variable | 21.24% – 29.24% APR Variable | 20.99%-29.99% Variable |

Compare AAdvantage Platinum Select

We think that for most consumers, the no-annual-fee AAdvantage MileUp card may be a better option. When you may consider the Platinum Select?

Paying an annual fee with higher rewards rate & benefits, or getting a no annual fee card with access to Amex membership?

Here's our analysis: Delta SkyMiles Blue vs AAdvantage Platinum Select

The AAdvantage Platinum Select and the Southwest Premier card share many common features.

Here's where each card shines: AAdvantage Platinum Select vs. Southwest Rapid Rewards Premier

The Citi/AAdvantage Executive offers better cashback value and perks than the Platinum Select, but usually it doesn't worth the annual fee.

Citi/AAdvantage Executive World Elite vs. Citi/AAdvantage Platinum Select

While the Citi/AAdvantage Platinum Select wins at cashback value, the Aviator Red World card offers better airline perks.

AAdvantage Aviator Red World Elite Mastercard vs AAdvantage Platinum Select

The Delta Gold and AAdvantage Platinum Select offer similar cashback value, but the Delta card is the winner due to its diverse travel perks.

Delta SkyMiles Gold vs. Citi/ AAdvantage Platinum Select: Which Card Wins?

While the airline perks are quite comparable, the JetBlue Plus Card emerges as the preferred choice thanks to higher cashback rates

Citi/ AAdvantage Platinum Select vs JetBlue Plus Card: Side By Side Comparison

Compare United Explorer Card

The United Gateway and Explorer are two co-branded credit cards offered by Chase in partnership with United Airlines. Here's our winner.

The Quest card has recently launched in order to provide a premium alternative to the old Explorer card. How they compared & is it worth it?

United℠ Explorer Card vs United Quest℠ Card: Which is Better?

In this comparison, we will delve into the key features, benefits, and considerations of both the United Explorer and Infinite Card.

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The United Explorer and the Southwest Premier card have numerous shared features. Let's explore the distinctive strengths of each card.

Southwest Rapid Rewards Premier vs. United Explorer: Comparison

The Delta SkyMiles Gold and the United Explorer Card offer airline benefits and similar fees. The SkyMiles Gold is our winner – here's why.

United Explorer vs Delta SkyMiles Gold: Side By Side Comparison

The Alaska Visa offers higher annual cashback value than United Explorer, but the latter takes the lead when it comes to airline perks.

Alaska Visa Signature vs United Explorer: Side By Side Comparison