SoFi is an online lender with a unique underwriting model. It's best for those who have a long, solid credit history.

APR

8.99% - 29.99%

Loan Amount

$5,000 – $100,000

Term

24-84 months

Min score

** include a 0.25% autopay discount and a 0.25% direct deposit discount

SoFi is an online lender with a unique underwriting model. It's best for those who have a long, solid credit history.

APR

8.99% - 29.99%

Loan Amount

$5,000 – $100,000

Term

24-84 months

Min score

680

** include a 0.25% autopay discount and a 0.25% direct deposit discount

Our Verdict

SoFi Personal Loans offer a way to borrow money for various needs, like consolidating debt, paying medical bills, or making home repairs. With SoFi, you can borrow anywhere from $5,000 to $100,000, giving you flexibility for your financial goals.

There are no hidden fees like late fees or origination fees, and you won't be penalized for paying off your loan early. Furthermore, SoFi provides borrowers with unemployment protection programs, career coaching services, and financial planning resources, adding significant value to the borrowing experience.

However, a higher minimum loan amount of $5,000 may not be suitable for individuals seeking smaller loan amounts. Additionally, borrowers with credit scores below 680

may have difficulty qualifying for a loan without a co-applicant.

Meeting SoFi Personal Loan Requirements

oFi offers personal loans to help you with your financial needs, whether it's consolidating debt or making a big purchase. Here are the requirements to apply:

Credit Score Requirements: While SoFi doesn't specify a minimum credit score, having a good to excellent credit score, typically 680

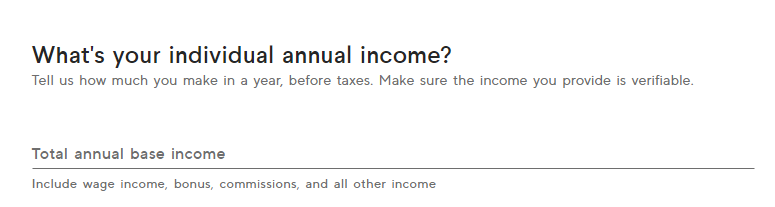

or higher, increases your chances of approval and may qualify you for lower interest rates.Income Requirements: You need to have a steady source of income to qualify for a SoFi personal loan. This can include employment income, self-employment income, or a job offer that starts within the next 90 days.

Co-signers and Co-applicants: SoFi allows applicants to add a co-borrower to their application, which can improve eligibility and potentially lead to lower interest rates. Both applicants share equal responsibility for repaying the loan.

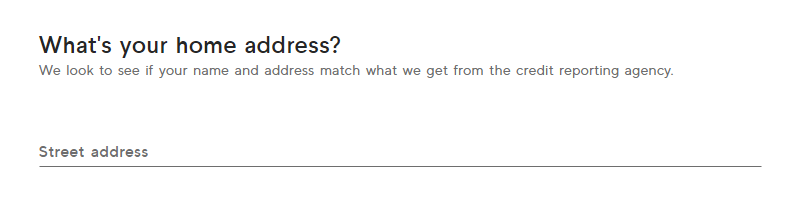

Additional Documentation: To complete your application, you'll need to provide documents such as a government-issued ID, proof of income (like pay stubs or tax returns), and possibly proof of address.

Eligibility Based on State: SoFi personal loans are available in certain states only, so you must reside in a state where SoFi is authorized to offer lending services.

Meeting these requirements can help you qualify for a SoFi personal loan and access the funds you need for your financial goals.

Navigating SoFi Repayment Options

SoFi offers various repayment options to make managing your personal loan convenient. Here's what you need to know:

Payment Options: You can choose to make payments through automatic deductions from your bank account, manual payments via the SoFi website or app, or by mailing a check.

Difficulties: If you're experiencing financial difficulties, such as job loss or unexpected expenses, SoFi offers assistance programs like unemployment protection and forbearance. Reach out to SoFi's customer service team to explore available options and solutions.

SoFi Personal Loan Pros & Cons

Like all lenders, SoFi has its own set of advantages and drawbacks that potential borrowers should consider:

Pros | Cons |

|---|---|

Joint Borrowers |

Limited State Availability |

Soft Pull Inquiry | Limited Uses |

Member Benefits | High Credit Score Needed |

Quick Funding | Higher Minimum Amount |

Unemployment Protection | |

No Fees Required | |

Flexible Payments | |

High Maximum Loan Amount | |

Multiple Rate Discounts |

- Joint Borrowers

SoFi allows for joint borrowers on their personal loans as of April 2018. Many loan providers do not allow for this.

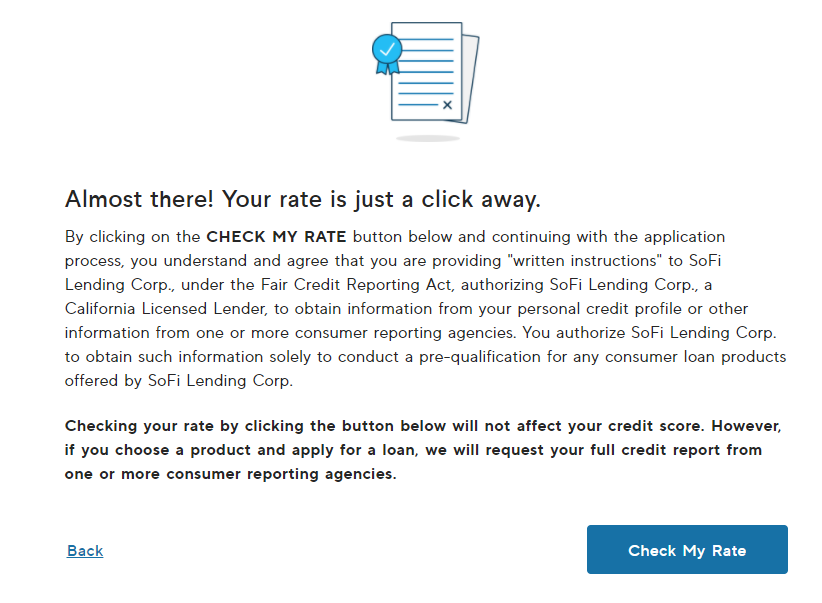

- Soft Pull Inquiry

SoFi does an initial soft pull inquiry so the borrower can get an idea of the options for which they may qualify.

- Member Benefits

SoFi offers additional perks like free career coaching, financial planning, and access to exclusive events for its members.

- Quick Funding

You can receive funds as soon as the same day you apply, allowing you to address urgent expenses promptly.

- Unemployment Protection

SoFi's unemployment protection program adjusts your payments if you lose your job, providing financial relief during tough times.

- No Fees

SoFi personal loans have no origination or late fees. They also do not have a prepayment penalty so the loan can be paid off early without additional costs.

- Flexible Payments

SoFi gives borrowers flexibility in payments. They allow you to change payment due dates and do not charge late fees.

- High Maximum Loan Amount

SoFi’s highest maximum loan amount is $100,000 for personal loans.

- Multiple Rate Discounts

You can qualify for rate discounts by enrolling in autopay, being an existing SoFi member, or using your loan to consolidate debt.

- Limited State Availability

SoFi personal loans are not available in all states, restricting access for some borrowers.

- Limited Uses

SoFi has more restrictions regarding how their personal loans can be used.

- High Credit Score Needed

If you do not have the best credit history, you may not be able to get a loan through SoFi. They cater to those with very good to excellent credit histories and very strong cash flows.

- Higher Minimum Amount

The lowest personal loan amount you can get with SoFi is $5,000.

SoFi Customer Experience

Customer reviews for SoFi personal loans are generally positive, with many borrowers praising the easy application process, fast approval times, and helpful customer support. SoFi has earned a TrustScore of 4.7 out of 5 on Trustpilot, based on over 7,000 reviews.

SoFi | |

|---|---|

iOS App Score | 4.8 |

Android App Score | 4.2 |

BBB Rating | A+ |

TrustPilot Rating | 4.7 |

Contact Options | phone/social |

Availability | 5 am – 7 pm (PT) |

You can reach SoFi's customer service for personal loans by calling (855) 456-SOFI (7634) during their operating hours.

The customer service team is available Monday through Thursday from 5 a.m. to 7 p.m. Pacific Time (PT) and Friday through Sunday from 5 a.m. to 5 p.m. PT. Additionally, you can access support through online chat on the SoFi website.

Additional Insights to Keep in Mind

Before applying for a personal loan with SoFi, it's important to understand additional factors that could impact your borrowing experience:

-

What is the funding time?

SoFi typically provides quick funding, with borrowers often receiving funds as soon as the same day they apply.

However, the exact funding time may vary depending on factors such as the time of application, verification processes, and banking procedures.

-

What Happens If I miss a payment?

If you miss a payment with SoFi, you may incur a late fee, and it could negatively impact your credit score.

However, SoFi offers assistance options for borrowers facing difficulties in making payments. These options may include forbearance or modified repayment plans through their unemployment protection program, providing temporary relief during financial hardships.

It's crucial to contact SoFi's customer service team as soon as possible if you anticipate difficulties in making payments to explore available solutions.

Which Loan Purposes Are Allowed? Which Aren't?

A SoFi personal loan can be used for a variety of purposes, including debt consolidation, home repairs, medical bills, auto repairs, financing a vehicle, and more.

However, there are certain purposes for which a SoFi personal loan cannot be used. These include postsecondary education expenses, business costs, and investments.

Is SoFi Loan Right for You?

SoFi personal loans are suitable for individuals who meet certain criteria and have specific financial needs.

- Borrowers with good to excellent credit: SoFi offers competitive interest rates, making it an attractive option for those with strong credit histories.

- Borrowers need funds for major expenses: Whether it's home repairs, medical bills, or financing a vehicle, SoFi's high loan amounts make it suitable for covering significant expenses.

- Those who value borrower benefits: SoFi provides additional perks like unemployment protection and career coaching, appealing to individuals seeking comprehensive financial support.

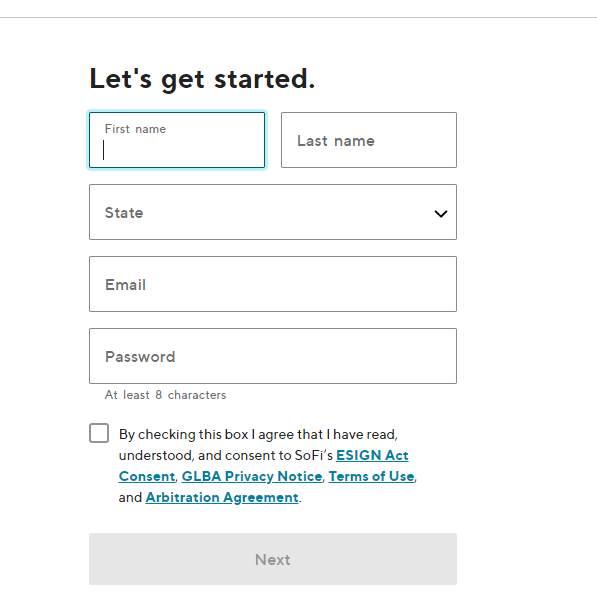

How to Apply For SoFi Personal Loan?

SoFi takes a broader look at its borrowers than just evaluating their credit scores. SoFi requires a better understanding of their borrowers’ ability to repay.

Taking this into consideration, understand that SoFi will have more questions and require more documentation than some other personal loan companies.

The application process begins with you creating an account and answering a few questions. SoFi will do a soft pull on your credit. A soft pull does not affect your credit report.

At this point, you could be declined. Otherwise, SoFi will give you a list of options for which you can apply. If you want to move forward, SoFi will do a hard credit check and you will then be asked to upload documents to verify information.

You may need to provide pay stubs, bank statements, W-2s, social security card, or state ID. You can sign loan documents online. SoFi also offers a .25% discount if you set up auto pay.

SoFi will usually let you know whether you are approved within one day. Because SoFi checks your documentation, it usually takes up to 7 days for your loan to be funded. SoFi may also call you directly to verify some information.

SoFi FAQs

Is SoFi a good place to get a loan?

SoFi is a great lender for excellent credit borrowers, offering a large maximum loan amount at reasonable rates. The loans also have zero fees, flexible repayment terms and fast funding. However, you do need to have a credit score of more than 680 to qualify.

What makes SoFi a good place to get a loan is that there are also perks offered to customers. As a SoFi member, you’ll have access to an active online community, referral bonuses, financial advice, and complimentary estate planning.

If you're still not sure, you can compare lenders on comparison websites to find a lower rate before you apply for personal loans.

Does SoFi check your bank account?

SoFi does evaluate loan applications based on credit score, financial history and income vs expenses.

This typically involves a soft credit pull, but in some cases, SoFi may need to verify your details by checking your bank transactions. This will allow SoFi to finalize your application and issue a formal offer with a confirmed rate.

Compared to similar credit lenders for good credit, the required score is reasonable. For example, Marcus requirements include a minimum score of 660 (FICO) , while Rocketloans minimum score is 640 .

Is SoFi better than Best Egg?

SoFi does offer more favorable terms compared to Best Egg. The maximum loan amounts are higher and you can take a longer-term with a SoFi Loan. While Best Egg interest rates are quite similar, the maximum rate is higher. Additionally, Best Egg loans have an origination fee of up to 5.99%.

So, unless you are only looking to borrow a small amount, SoFi is a far better choice.

Is LightStream better than SoFi?

SoFi has more similarities to LightStream compared to Marcus. Both companies offer loans up to $10,000 with no fees. Additionally, SoFi’s rates are similar if you have good credit and use autopay.

Both lenders are suited to those with good to excellent credit. SoFi is best suited to those who want a shorter-term loan, as LightStream offers longer terms of up to 12 years, rather than the 7 offered by SoFi. However, SoFi does have less stringent criteria, so if you may struggle to meet the LightStream requirements, SoFi could be a good alternative.

Alternative Lenders For Fair - Good Credit

APR Range

The annual percentage rate (APR) is the total annual cost of borrowing money. This rate includes the interest rate as well as any additional finance charges. When you take out a personal loan, for example, you may be required to pay loan origination fees.

| 9.57% – 35.99%

| 5.20% – 35.99%

| 8.99% – 35.99%

|

Term

The term of your loan is the amount of time you have to repay it. For example, if you get a 24 months personal loan, the loan term is 24 months.

| 24 – 60 months

| 36-60 Months

| 36-60 months

|

Loan Amount | $1,000 – $40,000

| $1,000 – $50,000

| $2,000 -$50,000

|

Minimum Score | 600

| 300

| 640

|

Funding Time | Up to 7 days

| 1-2 Days

| N/A |

Review Personal Loan Top Lenders

Compare Alternative Lenders

SoFi vs Upstart

SoFi primarily serve people with good credit, whereas Upstart will serve people with poor or no credit. When it comes to providing quick access to funds, Upstart will be faster, while SoFi will offer autopay discounts.

Read Full Comparison: Upstart Vs SoFi: Which Personal Loan Is Best?

SoFi vs Prosper

SoFi is widely regarded as the best option for people with excellent credit who require larger loan sizes while paying low fees. Prosper is best suited to people with low credit scores.

Read Full Comparison: SoFi Vs Prosper: Which Personal Loan Is Better?

SoFi vs Happy Money vs OneMain

Each of these three lenders will be appropriate for a different type of person. OneMain is generally beneficial for accepting applications from people with less-than-perfect credit.

SoFi, on the other hand, caters to people with good credit who are looking for large loan amounts. Happy Money is somewhere in the middle, and it gives you quick access to your borrowed funds.

Read Full Comparison: Happy Money Vs SoFi Vs OneMain: Compare Personal Loan Providers

SoFi vs Best Egg

SoFi is regarded as one of the best lenders in the industry, with zero fees, a diverse range of loan options, and favorable repayment terms. It was founded in 2011 and began as a student loan lender before expanding into other areas.

Best Egg was founded in 2014 and has since funded over 788,000 loans totaling more than $14 billion. It has a wide range of loan amounts to choose from, as well as a secured loan option, and accepts lower credit scores than many other lenders.

Read Full Comparison: SoFi Vs Best Egg: Which Personal Loan Suits You Best?

SoFi vs Discover

SoFi has a reputation for being one of the best in the business, with no fees, a wide range of loan options, and a flexible set of repayment terms.

Discover is another high-quality lender that does not charge origination fees, has a wide range of repayment options, and can provide funding the same day. This article will compare and contrast the similarities and differences between SoFi and Discover.

Read Full Comparison: SoFi Vs Discover: Which Personal Loan Suits You Best?

SoFi vs LendingClub

Both of these companies have advantages and disadvantages that will be discussed throughout this comparison. LendingClub, based in California, has over 3 million customers in the United States, while SoFi has won numerous awards in recent years for its offering.

LendingClub is better suited to people with low credit scores, whereas SoFi has better rates and more repayment flexibility. Both of these options are centered on their online operations and offer a simple way for you to obtain a personal loan without having to jump through a lot of hoops.

Read Full Comparison: SoFi Vs LendingClub: Which Personal Loan Is Better?

SoFi vs PenFED vs Axos

Each of these lenders prefers to work with borrowers who have good credit. Because there is no origination fee, SoFi is an excellent choice for people looking for low-cost personal loans.

When it comes to repayments, Axos is flexible, whereas PenFED offers some of the smallest loans in the online lending space.

Read Full Comparison: SoFi Vs PenFED Vs Axos: Which Personal Loan Is Best?

SoFi vs Upstart

Upstart is a one-of-a-kind proposition because it employs an artificial intelligence (AI)-based system rather than relying solely on FICO scores. The Consumer Financial Protection Bureau has determined that it is a reputable lender. Upstart is a good option for people who do not have a long credit history and who need funds quickly.

SoFi has been in business since 2011, and in that time it has served over 2.5 million people and funded loans totaling more than $50 million. It is regarded as one of the best in the industry and an excellent choice for those with excellent credit.

Read Full Comparison: Upstart Vs SoFi: Which Personal Loan Is Best?

SoFi vs RocketLoans vs Marcus

SoFi has been around for a long time and is regarded as one of the best options. It has no fees, a flexible repayment system, and a wide range of loan options. Marcus, a Goldman Sachs subsidiary, is yet another high-quality online lender. It is an excellent choice for anyone with good credit who wants to avoid fees and customize their repayment terms.

Finally, while Rocket Loans does not have a competitive offering in many ways compared to the other two options, it does have an extremely fast funding speed.

Read Full Comparison: Rocketloans Vs SoFi Vs Marcus: Which Personal Loan Is the Best?