Huntington Bank

Checking Fees

Savings APY

Minimum Deposit

CDs APY Range

Established in 1866 and presently based in Columbus, Ohio, Huntington stands as a regional bank catering to 11 states, mainly situated in the Midwest.

Huntington Bank basic checking account comes without fees, allowing customers to manage their finances more easily. The all-day deposit feature facilitates quick and convenient fund transfers.

Additionally, the 24-hour grace period on overdrafts provides a buffer for customers who accidentally overdraw their accounts. The bank is also praised for its strong customer support, ensuring clients receive assistance when needed.

However, there are some limitations to be aware of. Huntington Bank operates only in 11 states, which restricts its accessibility for potential customers elsewhere. The bank's interest rates on accounts are relatively low, potentially limiting earnings on deposited funds.

Huntington Bank has been selected as one of our top banks in Michigan and Ohio

Pros & Cons

Here are the main pros and cons of Huntington Bank:

Pros | Cons |

|---|---|

High money market rates | Active in 11 states |

Competitive CD rates | Low savings rates |

Variety checking accounts | There are better credit cards |

Savings Accounts: Lower Rates Than National Average

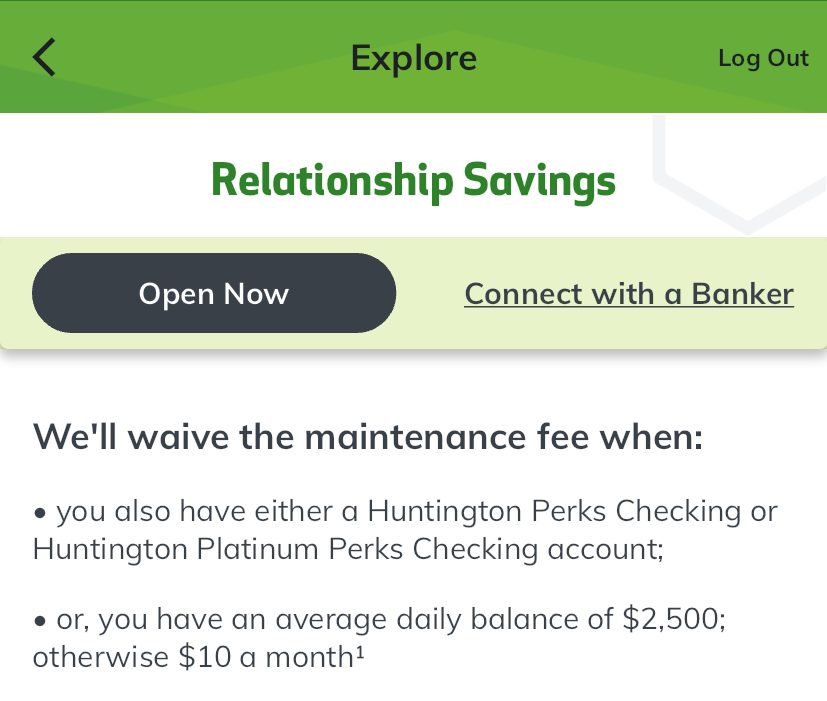

Huntington offers a higher interest-bearing savings account known as Relationship Savings. The non-relationship rate provides a low 0.01% – 0.06% APY, while the private client account offers the highest APY. This is much lower than what you can find on the top savings accounts.

Customers can avoid the $10 monthly maintenance fee by owning a Huntington Perks or Platinum Perks Checking account. The account allows unlimited transfers from checking to savings and offers access to relationship rates with qualifying checking accounts.

The bank provides innovative tools to support money management, including Savings Goal GetterSM, which helps set and track financial goals. Money Scout® analyzes spending habits and moves spare funds from checking to savings automatically.

Huntington's 24-Hour Grace® feature grants extra time to make a deposit and avoid overdraft fees or transaction rejections. Overdraft Protection is available through free fund transfers from linked accounts.

Huntington Bank Savings | |

|---|---|

Savings APY | 0.01% – 0.06% |

Savings Fees | $10

Can be waived if you also have a qualifying checking account or maintain a minimum balance of $2,500

|

Minimum Deposit | $0 |

Sign Up for

Our Newsletter

CDs: High Rates On Promotional CDs

Huntington provides a range of CD terms spanning from 7 days to 5 years. However, the standard rates for these CDs are relatively low, ranging from 0.05% to 0.10% APY, and may not be highly competitive.

To address this, Huntington offers promotional rate CDs with terms of 7 and 11 months, where customers can enjoy significantly higher APYs that are competitive compared to other banks and credit unions. To open a CD account, a minimum deposit of $1,000 is required.

Term | Huntington Bank CD Rates |

|---|---|

7 Month | 5.13% |

11 Month | 4.34% |

Minimum Deposit | $1,000 |

Additionally, Huntington offers CD IRAs, combining the benefits of a fixed-rate CD with the advantages of an Individual Retirement Account (IRA). These CD IRAs come with various term options and require a minimum opening deposit of $1,000.

Here you can compare CD rates for 9 months with other banks.

Variety Of Checking Options

Huntington Bank offers four different checking account options with varying features and fees:

Asterisk-Free | Perks Checking | Platinum Perks | SmartInvest | |

|---|---|---|---|---|

Monthly maintenance fee | $0 | $10 | $25 | $0 |

Balance to waive fee | / | $5,000 | $25,000 | $100,000 |

Interest Bearing | / | Yes | Yes | Yes |

Out-of-network ATM fee refunds | None | $5/month | Unlimited | Unlimited |

Free checks | None | None | Unlimited | Unlimited |

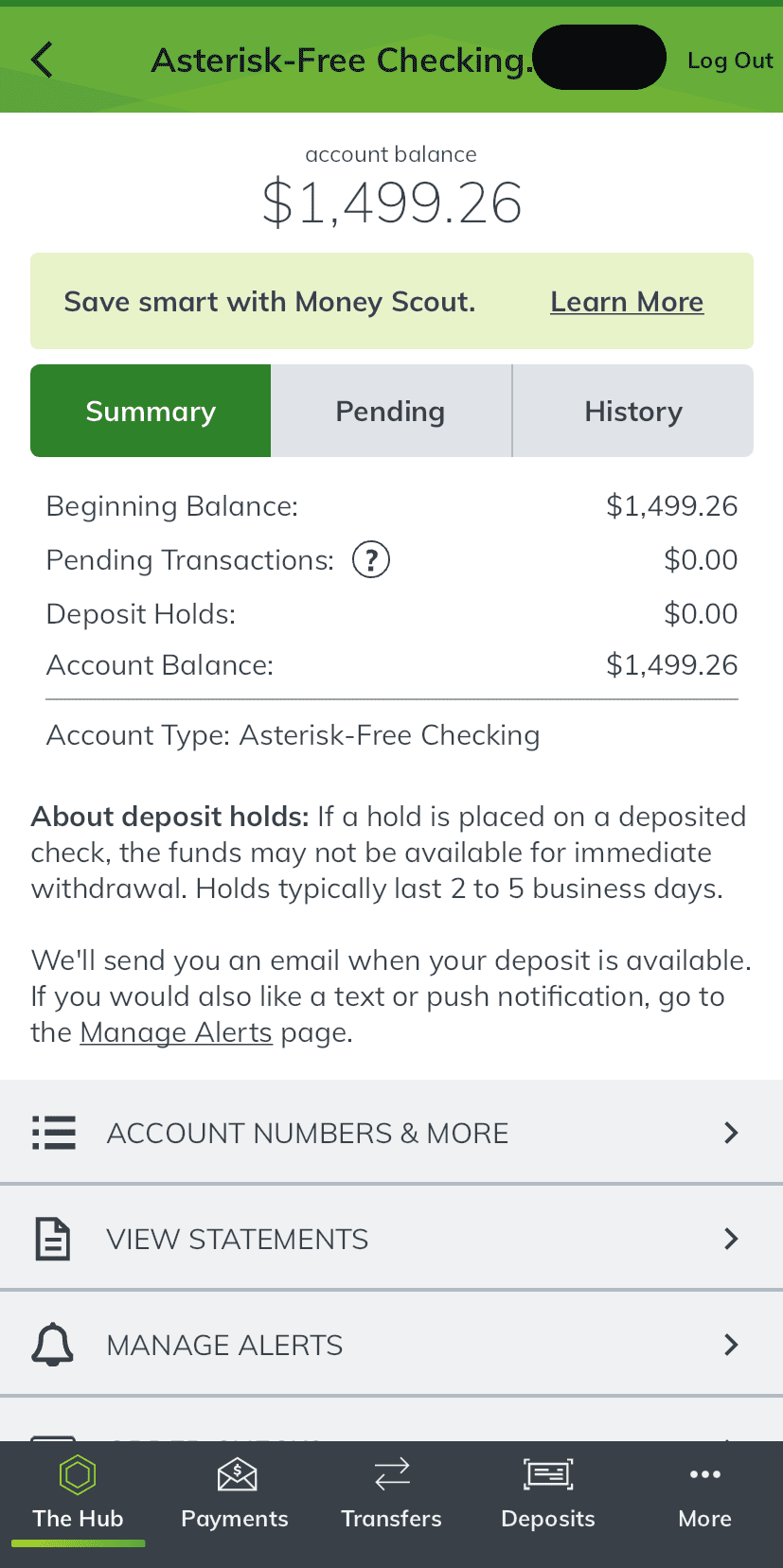

- Huntington Asterisk-Free Checking® Account: This account stands out for its lack of opening deposit or minimum balance requirements, and it doesn't charge a monthly fee. However, it does not offer any interest on your deposited money, and there's a $3.50 fee for using out-of-network ATMs.

- Huntington Perks Checking℠: With this account, customers can avoid the $10 monthly service fee by maintaining at least $5,000 in total balances across their Huntington Bank accounts or by receiving $1,000 in total direct deposits each month. It comes with added benefits such as credit score monitoring. There is no monthly maintenance fee if you have $1,000 or more in total monthly deposits or $5,000 or more in total relationship balances.

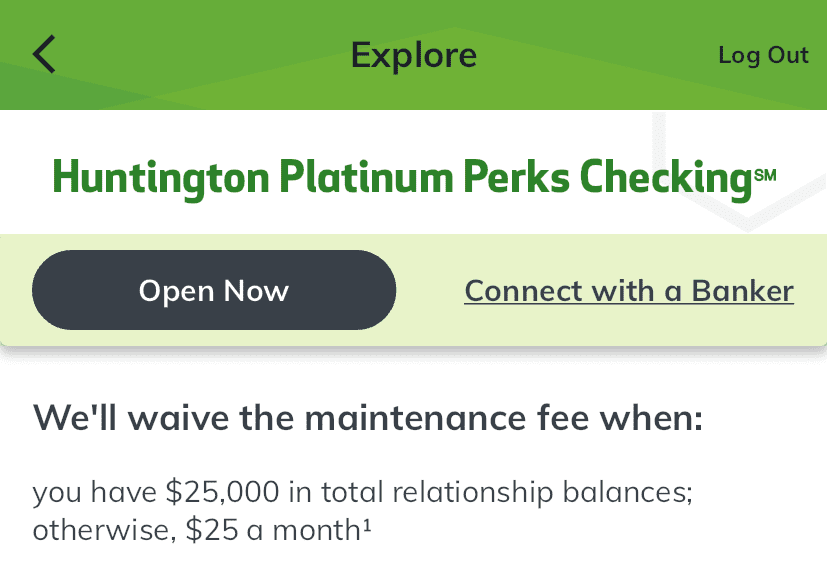

- Huntington Bank Platinum Perks Checking: This account doesn't require an opening deposit or minimum balance but has a $25 monthly service fee. To avoid the fee, customers need at least $25,000 in total balances across their Huntington Bank accounts. The account also provides unlimited reimbursements for out-of-network ATM fees and credit score monitoring.

- Huntington SmartInvest Checking℠: Huntington offers the SmartInvest account, an exclusive relationship package for investment advisory customers with $100,000 or more in total relationship balances. The package includes exclusive access to the SmartInvest Money Market℠, offering competitive rates as well as other perks.

High Rates On Money Market Accounts

The Relationship Money Market Account offered by Huntington provides a better interest rate and several benefits. Customers can earn interest on balances above $25,000 and enjoy relationship rates when they have a Perks Checking or Platinum Perks Checking account.

Similar to CDs, these are promotional rates and not standard rates.

APY | |

|---|---|

Non-relationship rate: | Up to 4.49% |

Huntington Perks Checking | Up to 4.54% |

Huntington Platinum Perks Checking | Up to 4.59% |

Private Client Account | Up to 4.70% |

Minimum deposit | $25,000 |

Cashback & Rewards Credit Cards

Huntington Bank offers three credit cards for different purposes:

Huntington® Cashback Credit Card: With this card, you can earn 1.5% unlimited cash back on every purchase with no annual or foreign fees. Enjoy cash back on all purchases without caps or categories.

Huntington Voice Rewards Credit Card: this is a point rewards card where you can get higher point rate in a chosen category, changeable each quarter, up to $2,000 quarterly spending. Switch categories as needed and earn 1x points on other purchases.

Huntington Voice Credit Card: This is a lower APR card instead of rewards. Pay less and get an additional day to pay the minimum if you miss a payment without incurring a late fee.

Huntington Credit Cards offer a range of standard benefits to customers. Late Fee Grace® provides an additional day to pay the minimum payment without incurring late fees.

There are no foreign transaction fees for Voice cardholders on purchases made outside the US. The cards come with no annual fees, and Card Lock allows customers to easily lock and unlock their cards through the mobile app and online banking. Additionally, customers can check their FICO® Credit Score for free every month.

The credit cards have no penalty pricing, ensuring APRs do not increase due to exceeding credit lines or missing payments. Contactless payment capability and the option to add authorized users simplify financial transactions.

A User's Journey on Huntington's Banking App

We closely examined the features of the Huntington Bank app to assess their user-friendliness and functionality for everyday users. Let's dive into our detailed assessment of each feature.

The Checking Dashboard on the Huntington Bank app serves as our financial command center. Upon logging in, we're greeted with a comprehensive overview of our account.

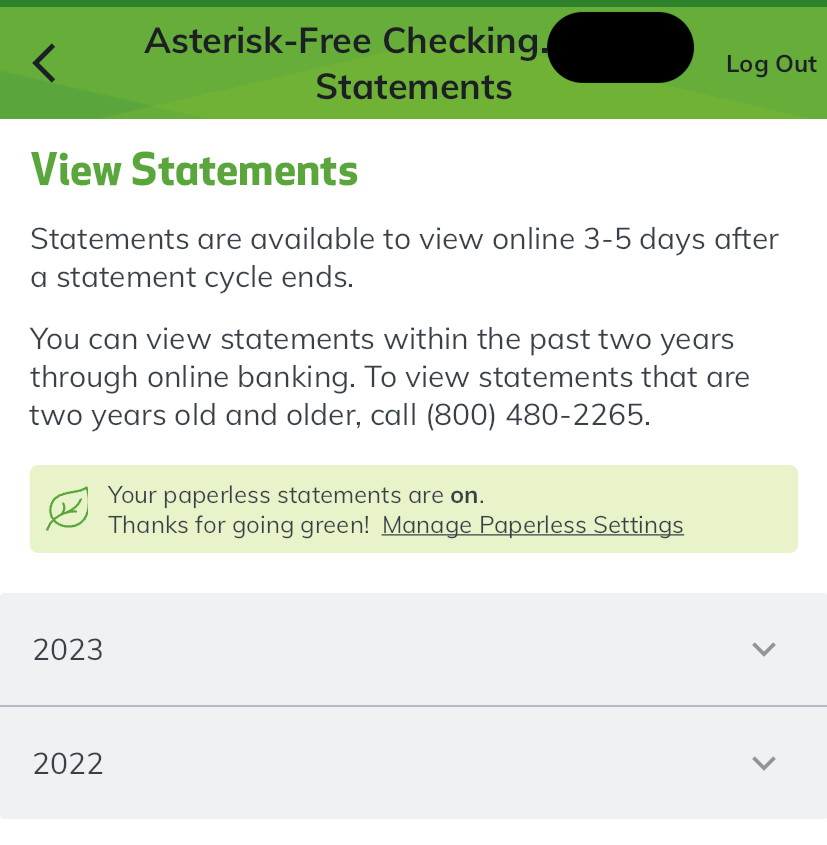

The View Statements feature within the app allows us to retrieve electronic statements at our convenience. The organized layout ensures easy navigation through historical transactions, providing a comprehensive view of our financial journey

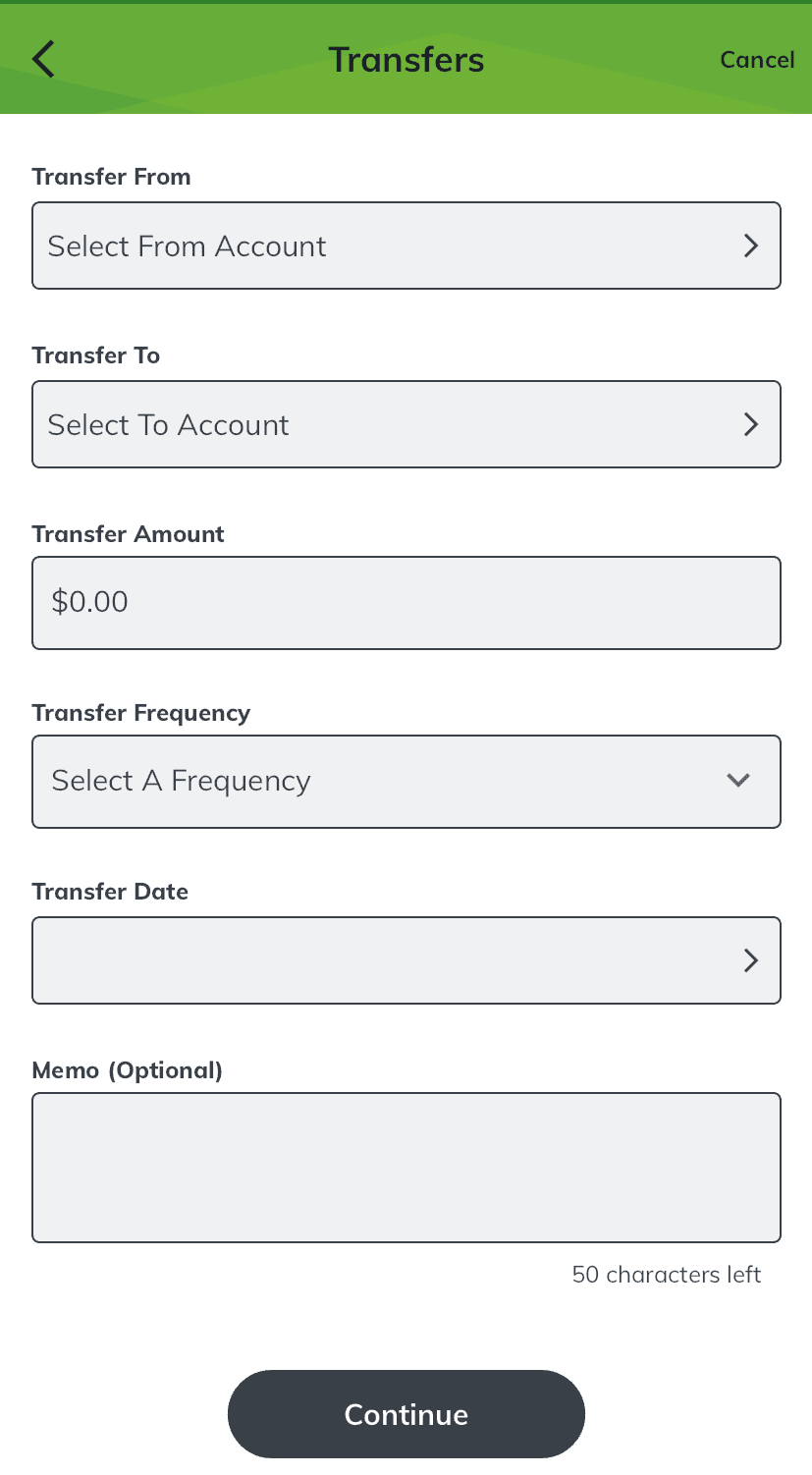

Setting up a transfer from the Huntington app is easy and quick. Customers need to fill in from which account they want to transfer the funds and target account, as well as the amount, frequency, and date.

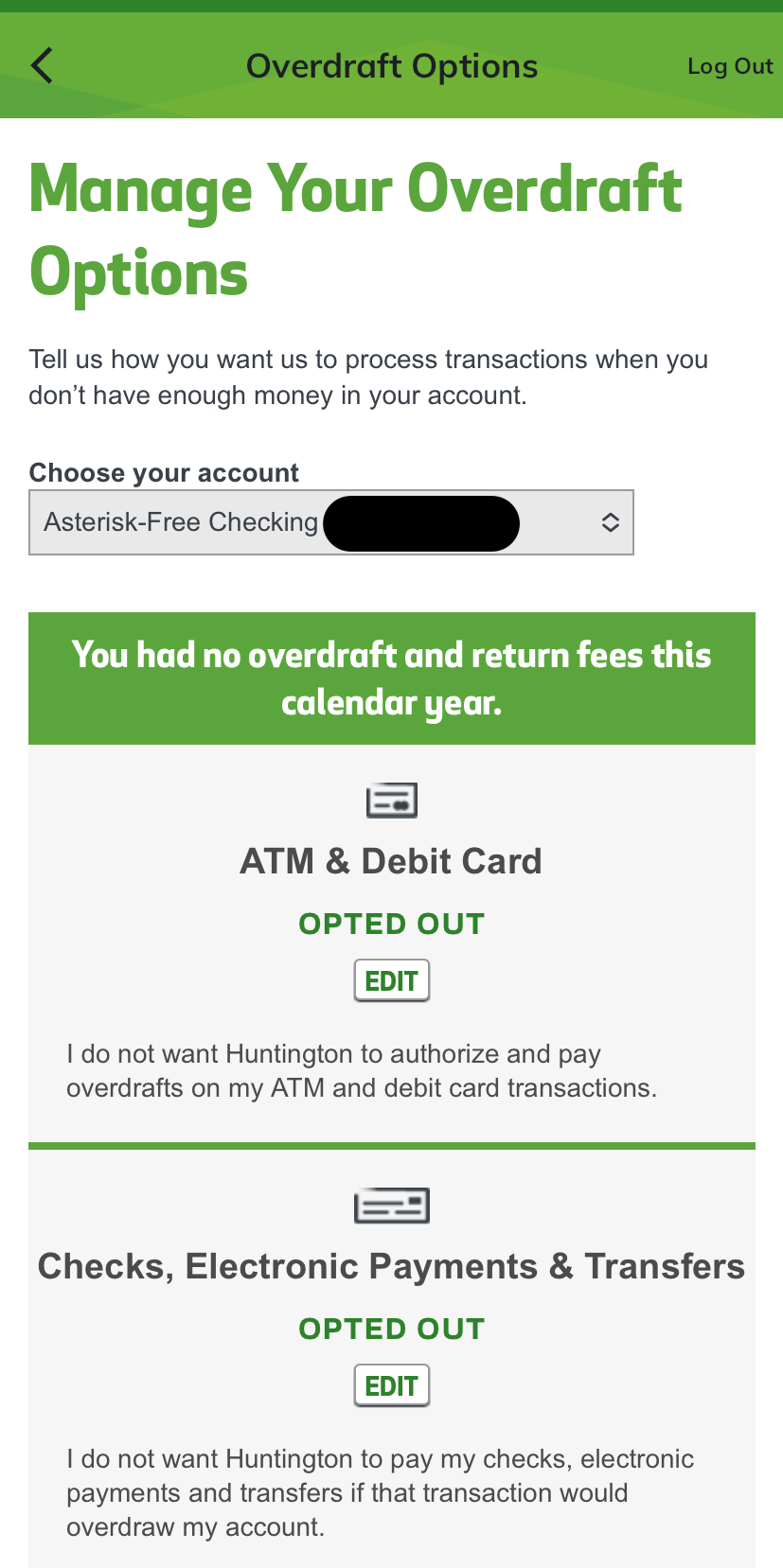

The Overdraft feature is a safety net that Huntington Bank has fine-tuned for our peace of mind. The app allows us to monitor our overdraft settings and provides timely notifications if our balance is approaching a critical threshold.

Variety Of Loans

Huntington Bank offers various types of loans to meet different financial needs.

Mortgages: Huntington provides home loans to help customers purchase or refinance properties. Mortgages are a common way to finance homes, and Huntington offers competitive rates and terms.

FHA/VA/USDA Loans: These are government-backed loan programs that offer different benefits to eligible borrowers. FHA loans are insured by the Federal Housing Administration, VA loans are available to qualifying veterans and military personnel, and USDA loans assist in rural home financing.

Home Equity Loan: This loan allows homeowners to borrow against the equity they have built in their property. The loan is given as a lump sum and is repaid over a fixed term.

Home Equity Lines of Credit (HELOC): A HELOC is a revolving credit line that allows homeowners to borrow against their home equity as needed. It provides flexibility in accessing funds over time.

Personal Loans: Huntington offers personal loans for various purposes, such as debt consolidation, home improvements, or other personal expenses. These loans typically have fixed interest rates and set repayment terms.

Auto Loan: Customers can finance a new or used vehicle through Huntington's auto loans. The bank offers competitive rates and terms to help customers purchase their desired vehicles.

These loan options cater to different financial situations, allowing customers to choose the most suitable loan product based on their needs and eligibility.

Sign Up for

Our Newsletter

FAQs

What is Total Relationship Balance?

Your Total Relationship Balance is the average daily balance of your deposits, investments, and personal agency accounts across Huntington and its affiliated institutions.

Can I open a Perks Checking account online?

Yes, you can easily open a Perks Checking account online or in person. The online application process is quick and straightforward. Just select “Apply Online” and follow the instructions.

Can I open a Perks Checking account if I'm under 18?

Absolutely! Whether you're a minor in middle or high school, or an adult in college, you can open a checking account at Huntington. If you're under 18, you'll need to apply in person with a co-signer or a joint account holder who is over 18.

How much are ATM fees with Asterisk-Free Checking?

With Asterisk-Free Checking, non-Huntington ATM fees are $3.50 per transaction, in addition to any fees charged by the ATM owner. For Huntington ATMs, the extended statement fee is $2.00.

Which accounts come with credit score monitoring?

Asterisk-Free Checking does not include credit score monitoring. However, Perks Checking, Platinum Perks Checking, and SmartInvest Checking offer credit score monitoring at no additional cost, providing valuable alerts and insights to help improve your credit score

How We Rate And Review Banks: Our Methodology

The Smart Investor team extensively reviewed hundreds of banks and credit unions. We assessed them based on four main categories, each with specific features:

-

Diversity of Products and Their Attractiveness (40%): We extensively analyzed the breadth and appeal of each bank's product offerings, including savings accounts, checking accounts, loans, investment options, and more. Higher ratings were assigned to banks with a diverse range of products that are attractive in terms of interest rates, fees, terms, and additional features. This category provides insights into the variety and value of the bank's offerings, crucial for meeting customers' diverse financial needs.

-

Account Features (30%): This category delves into the features and benefits accompanying each bank's accounts. We scrutinized factors such as promotions, deposit and withdrawal options, ATM accessibility, online and mobile banking functionalities, as well as additional perks like overdraft protection and rewards programs. Banks offering comprehensive and convenient features received higher ratings, reflecting the overall value of their accounts to customers.

-

Customer Experience (20%): A positive customer experience is paramount in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Bank Reputation (10%): The reputation of a bank is a critical consideration for customers. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were awarded to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories, individuals can make informed decisions that align with their financial needs and preferences, ensuring they choose a bank that offers competitive products, excellent features, a positive customer experience, and a solid reputation.

Compare Huntington Versus Other Banks

While Huntington Bank offers some better conditions when it comes to CDs and lending options, Chase is our winner. Here's why: Chase vs. Huntington Bank

There is no clear winner when comparing Huntington and U.S. Bank , but if we have to pick one – Huntington is our first choice. Here's why: U.S. Bank vs. Huntington Bank

Huntington and Fifth Third Bank provide various banking services, and figuring out which is best can be tricky. Here's our comparison: Fifth Third Bank vs. Huntington Bank

PNC is our winner in this competition with a better banking package than Huntington Bank. But there are more things to consider: PNC Bank vs. Huntington Bank