If you're a Pennsylvaniaresident in search of the perfect bank to meet your needs, you're likely aware of the plethora of options available. From small community banks to larger regional and national banks, not to mention the convenience of online banks, the choices can be overwhelming.

To ease this decision-making process, we have meticulously curated a list of the finest banks in Pennsylvania. Our selection criteria encompass various factors, including the number of branches, the diversity of products offered, the interest rates provided for deposits, the quality of their online banking services, and their commitment to customer care.

Best Pennsylvania Regional And Community Banks

In Pennsylvania, there is an abundance of community and regional banks to choose from. Here are the banks that caught our attention:

M&T Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

M&T Bank is a regional bank that offers a bunch of different financial services for regular people and businesses. They have more than 120 branches in about 80 cities, so you can find them in many places.

They provide things like checking accounts, savings accounts, CDs (which are like special savings accounts with fixed terms), credit cards, and loans. They say they have good rates for CDs that last for a certain time, and they offer four different types of checking accounts. They got an A+ rating from the Better Business Bureau, which is good. People also like their mobile app for iPhones.

But there are some things about M&T Bank that are not so great. The interest rates on their savings accounts are not very high, which means you won't earn much money from it. There are other banks that have better credit card options than what they offer. Also, if you want to open a CD for a certain period, you may have to go to one of their branches. And for many accounts, they charge monthly fees for maintenance.

First National Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

First National Bank offers different types of checking accounts with fees that are easy to manage and low minimums, which is great for people who want a convenient banking option. They have ways to avoid extra charges, which makes customers happy. They also have good rates for CDs that last for a specific time.

However, when it comes to the interest rates they offer, they don't give you much back on your savings. So, if you're looking to earn more on your savings, you might want to check out other banks. Another downside is that their ATM network is limited, so if you rely on ATMs a lot, it might be inconvenient for you.

The bank's main office is in Greenville, Pennsylvania, and they have grown to have 160 branches in 100 different cities across Pennsylvania.

key Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

KeyBank has a presence in over 80 locations across Pennsylvania. They offer checking accounts that won't charge you a monthly fee, which is pretty cool. Besides that, they have a range of financial products like credit cards, lines of credit, personal loans, and mortgages.

But the good thing is that KeyBank provides excellent customer service. They have 24/7 phone assistance, they support customers on Twitter, and they have chat support with extended hours. If you have multiple accounts with them, they offer some extra benefits, just like many other traditional banks with physical branches do.

The downside is that their savings account rates are not very high, so you won't earn much interest on your savings. If you want a promotional rate on their money market account, you'll need to have at least $25,000 in it.

Best Pennsylvania National Banks

We carefully looked into a few top national banks in Pennsylvania. We did a thorough evaluation, considering many important factors.

We checked things like how many branches they have and where they are located. We also looked at the different products they offer. One thing we paid special attention to was how good their deposit rates are, especially for CDs compared to regular savings accounts.

Citizens Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Citizens Bank, one of the largest and oldest banks in the US, operates over 240 branches in Pennsylvania, serving 130 cities. They offer a diverse array of financial products and services, such as checking accounts, savings accounts, credit cards, and private student loans. While some accounts come with monthly maintenance fees, there are options to avoid them.

The bank has attractive features like no minimum opening deposits for checking and savings accounts, highly rated mobile apps, and access to over 3,000 ATMs across the country.

On the downside, Citizens Bank has a costly overdraft fee and offers relatively low interest rates on interest-bearing deposit accounts. Though they have monthly fees, customers can find ways to waive them. Additionally, there is a $3 fee for using out-of-network ATMs on certain accounts.

Wells Fargo Bank

Checking Fees

Promotion

Savings APY

CDs APY

Wells Fargo is one of the biggest banks in the US, and it has over 180 branches all over Pennsylvania, in 110 different cities. They provide many ATMs and offer various financial products. The fees for their basic bank accounts can be waived easily, but the interest rates for their savings accounts are generally low.

Their checking account is highly regarded because they don't charge you for having insufficient funds (NSF), and they have customer service available by phone 24/7. They also have a large network of free ATMs all over the country,options early direct deposit and usually you can find promotions on checking accounts.

However, Wells Fargo has faced a lot of scrutiny from regulators in recent years because of different issues, like opening fake accounts. Also, the interest rates on their savings accounts are not very good, and some accounts still have monthly fees that you can avoid. You should be aware that their overdraft fee is relatively high as well.

PNC Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

PNC Bank is a popular banking option in Pennsylvania, and they have more than 240 branches spread across 140 cities in the state. One of their basic checking accounts, called Virtual Wallet Spend, lets you do mobile banking and pay bills online for free. They also reimburse some of the fees charged when you use ATMs that don't belong to PNC, though the ATM owner might still charge you separately.

The bank has some good things going for it. They offer a competitive interest rate on their online-only savings account (but it might only be available in certain states). They also give you access to around 60,000 ATMs where you won't be charged any fees.

On the downside, PNC has a higher overdraft fee compared to other banks, at $36, which is one of the highest in the country. If you want to open a CD with PNC, you'll have to do it in person at a branch. Some accounts might come with monthly fees, but you can avoid them if you meet certain conditions.

Best Pennsylvania Online Banks

When we were looking into online banks in Pennsylvania, we focused mainly on their savings and CD rates. We also wanted to know if they offer a variety of financial products, like checking accounts, loans, credit cards, and mortgages.

Laurel Road

Checking Fees

Money Market APY

Savings APY

CDs APY

Laurel Road is an online financial institution known for its student loan refinancing service. It's a part of KeyBank, an FDIC member, which means deposits are insured up to $250,000 per person.

Apart from student loan refinancing, they offer two checking accounts, two savings accounts, mortgages, personal loans, and a student loan cash-back credit card. Their mobile apps for both Android and iOS enable easy access to financial services like checking balances, paying bills, and depositing checks. They also facilitate money transfers through Zelle.

The pros of using Laurel Road include high savings rates and no monthly fees. However, there are no physical branch locations as it is an online-only bank. Additionally, they don't offer CDs or money market accounts.

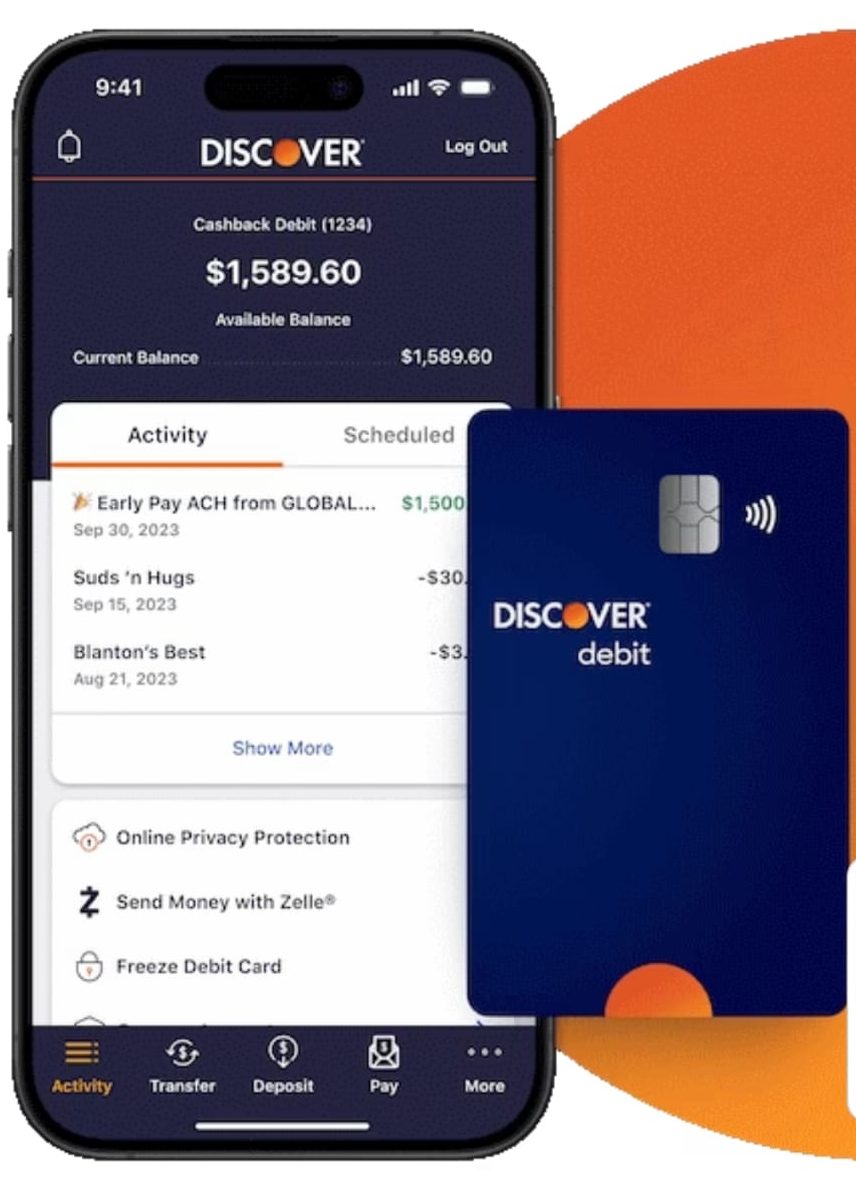

Discover Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Discover Bank is a popular online bank that offers various financial services like savings accounts, credit cards, personal loans, and student loans. Unlike traditional banks with physical branches, it operates entirely online. To make up for this, it gives its customers access to a vast network of over 415,000 ATMs all across the country (with access to over 60,000 surcharge-free ATMs through the Allpoint® or MoneyPass® networks).

The bank has some great perks for its customers. You can get cashback on debit card purchases, and avoid monthly maintenance, insufficient funds, and overdraft fees. Discover savings rates are very competitive as well as its CD accounts, meaning you can earn more on your money.

The downside of an online-only model is that there are no physical branches for in-person banking. So, if you prefer face-to-face interactions with bank staff, this might not be the best option for you. Additionally, if you frequently use ATMs from other banks, Discover won't reimburse the fees, which could result in extra costs for you.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

FAQs

Which banks have the largest presence in Pennsylvania?

As of 2024, PNC Bank, Citizens Bank, and Wells Fargo maintain the highest number of branches in Pennsylvania, boasting over 180 branches each.

What is the best bank in Pennsylvania?

The greatest bank in Pennsylvania depends on what you're looking for – whether it's bank with many branches, high deposit rates, or no-fee checking accounts. See our recommended banks above, each with its specialty.

Which Pennsylvania bank has the best CD interest rates?

Pennsylvania's CD rates differ between terms. One bank may offer the best 1-year rates, while another provides the best 18-month rates. Explore our suggested Pennsylvania banks for superior CD rates and compare them with credit unions.

Which bank has the best savings rates in Pennsylvania?

It's not easy to find the best savings rates in Pennsylvania, but a few banks and credit unions stand out. Discover the some of top performers for high savings rates in 2024.

Best Bank In Pennsylvania: Ranking Methodology

The Smart Investor team conducted an extensive review to identify the best banks in Pennsylvania. We assessed them based on four main categories, each with specific features:

- Financial Products and Services (40%): We evaluated the range and quality of financial products and services offered by each bank, including checking accounts, savings accounts, CDs, loans, credit cards, and investment options. Banks offering a diverse array of financial products with competitive rates and terms received higher ratings in this category.

- Banking Features and Tools (30%): This category assessed the availability and functionality of banking features and tools, such as transfer options, the ability to set savings goals, account linking capabilities, mobile app usability, check deposit options, and other features important for banks. Banks offering a comprehensive suite of features and user-friendly tools earned higher scores.

- Customer Experience (20%): We closely examined the overall customer experience, including the ease of account opening, communication with customer service representatives, the usability of online banking platforms and mobile apps, and the responsiveness of customer support. Banks with user-friendly interfaces, efficient digital banking tools, and responsive customer service received higher ratings.

- Bank Reputation (10%): Our team analyzed each bank's reputation based on factors such as customer satisfaction ratings, JD Power scores, TrustPilot reviews, and any notable awards or recognitions received. Banks with positive reputations and a history of providing excellent service to customers in Pennsylvania received higher ratings.

Within each category, we assigned weights to various features and qualities to ensure a comprehensive evaluation of each bank.