Table Of Content

The reasons given for avoiding banks include not having enough money (to meet minimum deposit requirements), a lack of trust in banks, a desire to guarantee privacy, and long distances to the nearest branch.

Despite their diminished reputation, banks offer advantages through access to an account that outweighs the downsides. From keeping your money safe to building credit, smart use of financial services is an essential part of modern life.

So, what do you need to start a banking relationship that serves your needs?

Required Documents Needed To Open A Bank Account

It’s important to realize banks have been under increased scrutiny since 2009. Banks must, by law, accurately determine your identity, understand your banking habits and treat your fairly or suffer penalties. These obligations are overseen by federal watchdogs like the FDIC and CFPB.

1. Proof Of Identity

It’s important to realize banks have been under increased scrutiny since 2009. Banks must, by law, accurately determine your identity, understand your banking habits and treat your fairly or suffer penalties.

These obligations are overseen by federal watchdogs like the FDIC and CFPB.

- Which Documents Are Accepted as Proof Of Identity?

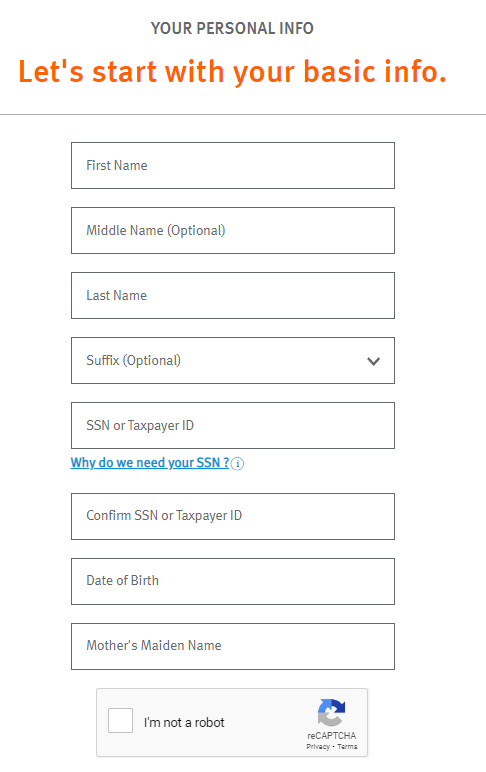

Banks will ask for two forms of identification to verify your name, address and date of birth. The typical documents they will ask for include:

- Social Security Number

- Driver’s license

- Individual Taxpayer Identification Number (ITIN)

However, banks often also accept the following, depending on the customer’s circumstances:

- Passport number and country of issuance

- Birth certificate

- Alien identification card

- Other government-issued ID number

Why it’s needed: Banks are at the frontlines of the fight against illegal money laundering, fraudulent activity, and terrorist financing. KYC (Know Your Customer) rules for banks assist in detecting unusual transactions by establishing patterns of behavior, flagging individuals and businesses in high-risk industries and reviewing account information frequently so changes are noted.

Banks also use your identity to run a type of credit check to make sure your financial character adequately meets their standards.

- Where To Find The Documents?

If you do not already have a valid, government-issued ID, then you will need to apply for one before opening a bank account:

- An ITIN, for example, can be applied for at the Internal Revenue Service using Form W-7

- A State driver’s license can be pursued at your local Department of Motor Vehicles

- A U.S. passport is obtainable by various methods shown on this government website

Is it required: Yes, while some smaller and non-traditional banks will work with you on the forms of identification they accept, there is zero tolerance for skipping proof of identity.

Proof of Identity Documents | Proof of Address Documents | Additional Details |

|---|---|---|

Social Security Number | Utility bill | E-mail address |

Driver’s license / passport | Existing bank or credit card statement | Phone number |

Individual Taxpayer Identification Number (ITIN) | Lease agreement | Job title |

2. Proof of Address

Proof of Address is another important document you should bring with you when opening a new bank account.

- What is required: Most often, your primary form of ID will include your verified address. When it does not or you have recently moved, then proof of a U.S.-based address is required through one of the following:

- Utility bill

- Existing bank or credit card statement

- Lease agreement

- Mortgage statement

- Why it’s needed: Banks need to know your residential address to send you account documents and as a way to reach you if phone and e-mail fail.

- Where to find it: Your landlord will be able to provide a lease agreement if you rent and didn’t receive one before. Some utility bills, mortgage statements and similar bills have moved online and no longer mail you a copy so check your online account for a printable statement.

- Is it required: Not if your current address is already shown on your proof of identity, otherwise yes.

Aside from these two essential types of document, expect to be asked to provide:

- e-mail address and phone number

- job title and employer details

These aid the bank in understanding your needs and communicating with you.

What Does A Teen Need To Open A Bank Account?

Since minors cannot enter legal contracts like owning a bank account, a legal guardian will need to set up a joint account with the teen.

Setting up an account for your teen (or younger child) is an excellent way to teach them financial responsibility and marks an important step towards independence.

The documents needed for both teen and parent include:

- Valid identification document (SSN, state ID, driver’s license or passport) with photo is required

- Possibly also second form of ID (student ID, major credit card)

- Proof of address (utility bill, financial statement) is required

Your teen’s account will have limited features and small, if any, maintenance fees, but be prepared to monitor the balance (against minimum levels) and avoid overdrafts before this particular lesson grows costly.

What Does A Couple Need To Open A Joint Bank Account?

Joint accounts make managing a couple’s finances easier by pooling their income, saving toward shared goals and directing payments from one convenient place.

Many financial experts praise this financial union as critical to the strength of the relationship. The higher balance can also help avoid maintenance fees and allow access to financial products that were previously out of reach.

When opening a joint bank account, both co-applicants will need to show the exact same documents as when applying alone. These include:

- two forms of identification

- proof of address

- e-mail address

- an opening deposit

- completed signature form

Banks often encourage co-applicants to schedule an appointment if they are missing any of the above so alternatives can be found and the application proceed smoothly.

Once both applications complete all requirements, they should receive login information digitally and account documents by mail about 7-10 days later. Not all banks allow joint account applications online, requiring instead the co-applicants to come into a branch once one of them has set up an account.

Do You Need Money To Open A Bank Account?

It depends on your bank. In some cases, the bank will ask for a small deposit in an amount equal to or greater than the minimum requirement for the account type applied for. It is only deposited once the account is approved and will be returned if the bank denies your application.

The minimum deposit is generally between $25 and $100 for checking or savings accounts but could be much higher for certificates of deposit and investment accounts. Some banks have no opening deposit requirement to incentivize new applicants, these are often online banks that maximize technology (thus, save costs) in opening your account.

The form of deposit can be in cash, a money order, a check, or a transfer from an existing bank account.

Bank/Institution | Minimum Deposit |

|---|---|

Chase | $0 |

PNC Bank | $0 |

Bank of America | $25 – $100 |

Capital One | $0 |

Wells Fargo | $25 |

Discover | $0 |

Citibank | $0 |

US Bank | $25 |

TD Bank | $0 |

What Credit Score Do You Need To Open A Bank Account?

Banks and credit unions do not run full credit reports like those used by credit card companies. Instead, using the identity documents you provide, they pull a type of report that looks at your history of deposit accounts, identifying any overdrafts, unpaid fees, bounced checks and potential fraud.

You can access a free copy of your report once every 12 months using the reporting agency’s website. Requesting a report does not impact your credit score.

FAQs

For anyone under the age of 18, a legal guardian must be present and the account is set up as joint between the child and adult. The documents required are no different than an ordinary joint account except that banks will also accept a student ID and enrollment letter as proof of identity.

Past 18 years of age, students can apply alone and many banks offer special account types with limited features and, often, lower fees.

No, SSN is not required by federal law. You can open an account so long as you can provide other forms of ID which satisfy the banks account opening requirements, which vary slightly from institution to institution.

Yes, it's easy to open an account online. In fact, most banks encourage the use of their app or website and compete on ease of use.

Not all types of accounts can be opened online, for example, joint accounts at some banks can only be added later in the branch, with both co-applicants present.

No, cash is not required. Banks accept multiple other forms of deposit too, including: check, money order and bank transfer.

It is possible to open a bank account without a government-issued ID so long as you can provide a passport, social security number, Individual Taxpayer Identification Number or other easily verifiable form of identification.

Whether online or in-person, you will need proof of your identification and address to open a checking account with Chase. Other needs, like the amount of opening deposit and further information about your personal financial situation depend on the Chase account you choose.

Opening an American Express deposit account requires an SSN or ITIN, your date of birth, address, employment information, your phone number and e-mail. Moreso than other banks, American Express explains the purpose of each ask, including whether it is required by federal law.

Capital One outlines various documents to show your identity and prove a residential address. They require two forms of ID from the following: driver’s license, Social Security card, passport or birth certificate. Address is provable with a utility bill, mortgage statement, lease or similar document.

Capital One offers online applications, including for joint accounts, and explain alternative identification if you don’t drive (ID card) or are a non-U.S. citizen (ITIN).