Both Upgrade and SoFi Bank offer various online banking products, including checking, savings, and credit cards. Let's compare them side by side

Checking Accounts

There is no clear winner when it comes to checking accounts as they are quite similar, but if we have to pick one – SoFi checking account is our choice due to its varied checking features for customers and better APY on balance than Upgrade.

-

Account Types

Upgrade's Rewards Checking Plus account is an appealing option with no monthly maintenance fees.

Users can earn up to 2% cash back on recurring purchases like utilities, streaming services, and gas stations, with a base rewards rate for other debit card transactions.

Bank Account | Monthly Fee | APY On Balance |

|---|---|---|

Upgrade Rewards Checking | $0 | Up to 2% cash back on purchases |

SoFi's Checking and Savings accounts offer innovative features to enhance financial experiences. Enrolling in their online checking account, which includes a savings component, allows users to receive paychecks up to two days early through direct deposit.

Users can earn up to 15% cash back on local purchases when using the SoFi debit card at qualifying businesses.

Bank Account | Monthly Fee | APY On Balance |

|---|---|---|

SoFi's Checking and Savings | $0 | 0.50% |

-

Features

With Upgrade, account holders enjoy rate discounts on Upgrade credit cards and loans and customers with direct deposit can get paid up to two days early. Additional benefits include no monthly maintenance fees, no account minimums and access to a high-yield savings account.

However, cash deposits aren't accepted, requiring transfers from external accounts or the use of direct deposit or mobile check deposit.

Bank Account | Main Features |

|---|---|

Upgrade Rewards Checking | Get paid up to two days early, debit card, loans rate discounts |

SoFi provides overdraft coverage up to $50 with no fees for accidental overspending, contingent on direct deposits of at least $1,000.

Access to a vast network of 55,000+ ATMs ensures convenient fund retrieval. Additionally, the accounts facilitate automatic roundups on all debit card purchases, directing the accumulated roundups to a savings Vault for further growth.

Bank Account | Main Features |

|---|---|

SoFi Checking and Savings | Get paid up to two days early, 55,000+ ATMs, debit card, overdraft coverage with no fees, cash back on local purchases |

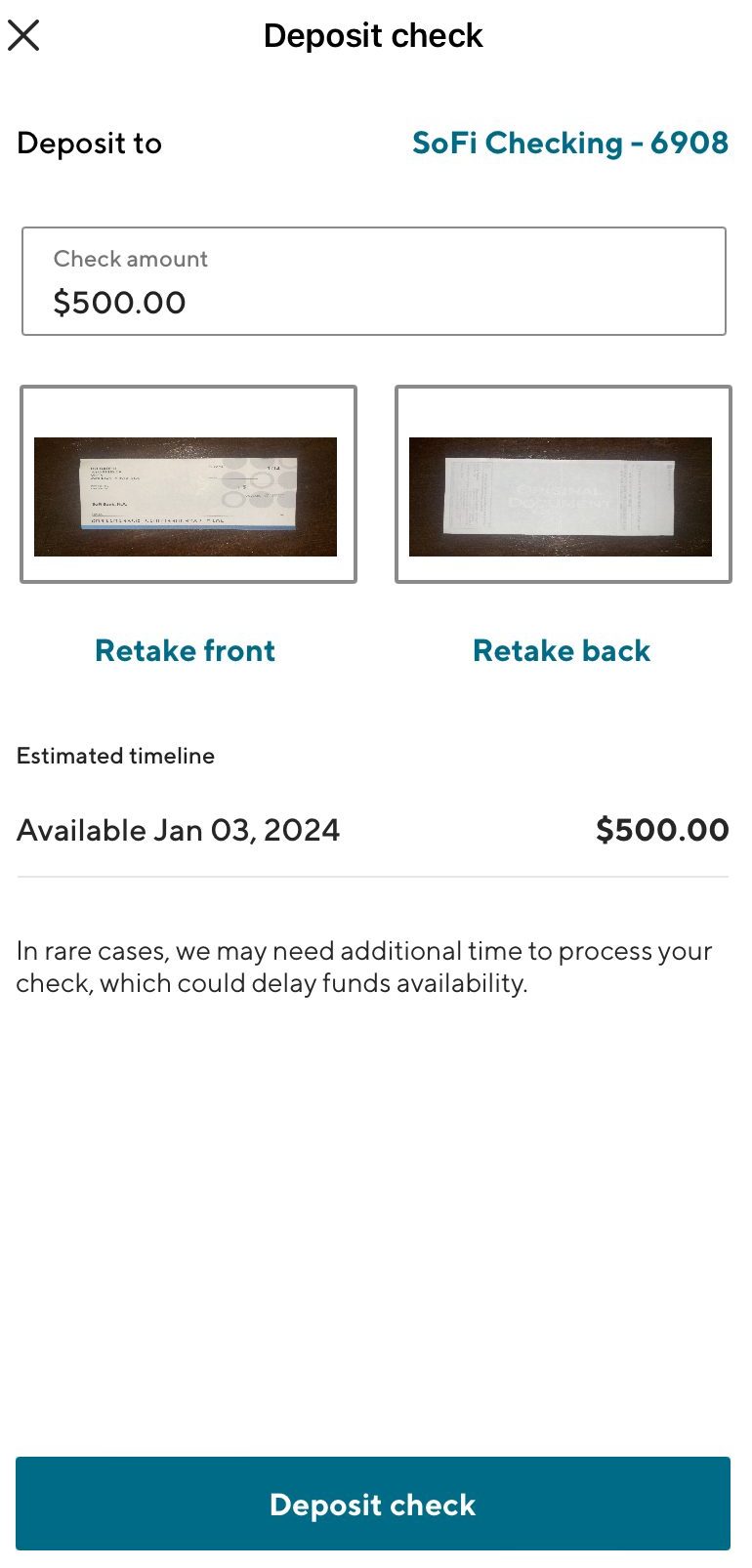

SoFi streamlines financial management through a comprehensive app that enables bill payments, check deposits, money transfers, and digital wallet management. Here's an example of deposit a check inside the SoFi app:

Savings Accounts

Upgrade is our winner in the savings account competition with higher rates than customers can get with SoFi.

SoFi's savings account offers a roundups feature ensures continuous saving by automatically rounding up debit card purchases to the nearest dollar, channeling the excess into a dedicated savings Vault. Also, the AutoSave function enables seamless, hands-free saving by automatically allocating a portion of one's paycheck to the savings account.

Since Upgrade is a financial technology company and not a bank, the account is offers FDIC or NCUA insurance through Cross River Bank or participating institutions. The account requires no minimum initial deposit and allows same-day transfers up to $100,000 with no fees. However, to earn the advertised interest rate, the daily balance must be $1,000 or more.

Both Upgrade and SoFi don't have money market accounts.

SoFi Savings | Upgrade Savings Account | |

|---|---|---|

Savings Rate | up to 4.60% | 5.21% |

Minimum Deposit | $0 | $0 |

Fees | $0 | $0 |

Credit Cards

Upgrade is our winner when it comes to credit cards, with more credit card options, rewards, and sign-up bonuses compared to SoFi.

Upgrade offers a range of credit cards tailored to individuals with average to excellent credit scores (630 to 850).

The Upgrade Cash Rewards Visa® provides 1.5% cash back on all purchases,while the Upgrade OneCard provides 3% cash back on everyday purchases and 2% on others if linked to an Upgrade Rewards Checking Plus account.

The Upgrade Life Rewards Card rewards 3% cash back on gas, groceries, health, streaming, and utilities, and 1% on other purchases. All cards convert unpaid balances into installment plans with fixed interest rates.

The Upgrade OneCard uniquely combines a credit card and personal loan, allowing immediate full payment if linked to a checking account. Ongoing rewards include 3% cash back on specified categories, capped at $500 yearly, and 2% on other purchases, contingent on maintaining a qualifying active account.

Card | Rewards | Bonus | Annual Fee | Upgrade OneCard | 1-3%

3% cash back for everyday purchases and 2% unlimited cash back on everything else

| $200

Earn a $200 bonus after you open & fund a Rewards Checking Plus account & make 3 debit card transactions within 60 days. If you previously opened a checking account through Upgrade or do not do so as part of this process, you are not eligible. Payout made within 60 days of meeting the conditions.

| $0 |

|---|---|---|---|---|

Upgrade Life Rewards | 1% – 3%

3% cash back on gas, grocery, health, streaming, and utilities purchases and 1% cash back on all other purchases

| $200

$200 bonus when you also open a Rewards Checking Plus account and make 3 debit card transactions

| $0 | |

Upgrade Cash Rewards | 1.5%

1.5% cash back on payments

| $200

Earn a $200 bonus after you open & fund a Rewards Checking Plus account & make 3 debit card transactions within 60 days. If you previously opened a checking account through Upgrade or do not do so as part of this process, you are not eligible. Payout made within 60 days of meeting the conditions.

| $0 | |

Upgrade Select

Card | N/A | N/A | $39

|

SoFi Credit Card offers unlimited 2% cash back rewards on all purchases, and 3% cash back on trips booked through SoFi Travel.

Beyond cash back, the card provides additional benefits, including Zero Fraud Liability Protection, ID Theft Protection, and no annual fee. Users can enjoy global transactions without foreign transaction fees.

The card also includes Mastercard World Elite Benefits, and users receive up to $1,000 of complimentary cell phone insurance coverage.

Card | Rewards | Bonus | Annual Fee | SoFi Credit Card | 1-3%

3% cash back rewards on trips booked through SoFi Travel. After that, earn 2% unlimited cash back on purchases when redeemed toward investing, saving, or paying down an eligible loan with SoFi

| N/A | $0 |

|---|

Mortgage And Loans

When it comes to borrowing money, SoFi is much better for borrowers than Upgrade with a complete package of lending options.

SoFi Bank provides mortgages for homebuyers, mortgage refinancing, home equity loans, personal loans, auto loan refinance. In addition, SoFi offers student loans and student loan refinancing.

Upgrade only offers personal loans and lines of credit.

Which Bank Is Our Winner?

There is no clear winner in this comparison, but SoFi has more options for consumers. Both SoFi and Upgrade offer a complete banking package, including savings, checking, and credit cards, with small benefits to each, depending on the product.

However, it's important to think about different things, especially the ones that matter most to you. This might include looking at banking services, help with overdrafts, how often you use ATMs, how close the bank is to where you live, and other things that are different for each person.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

How We Compared Upgrade and SoFi Bank: Methodology

In our comprehensive banking comparison, The Smart Investor team meticulously reviewed and compared banks across five vital categories:

Checking Accounts (30%): We thoroughly examined features such as direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. Special offers available to customers were also taken into account.

Savings Accounts and CDs (20%): Our focus centered on critical factors including the Annual Percentage Yield (APY), minimum deposit requirements, account flexibility, FDIC insurance coverage, special savings offers, variety of CDs, automatic renewal options, and early withdrawal penalties.

Credit Cards (15%): We carefully analyzed rewards programs, annual fees, introductory bonuses, travel benefits, APR, and balance transfer options provided by each bank's credit cards to offer a comprehensive comparison of available features.

Lending Options (15%): We evaluated the variety of loan options offered, encompassing personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, providing valuable insights into the banks' lending capabilities.

Customer Experience and Bank Reputation (20%): Our assessment included an analysis of online banking and mobile app usability and ratings, accessibility of customer support, online reviews, JD Power research, Trustpilot ratings, and overall financial stability, delivering a holistic perspective on customer experience and reputation.

Compare SoFi With Alternative Banks

Spend and Save is a SoFi savings and checking account hybrid. For the purposes of this comparison, we'll look at the savings features, of which there are a few. The most visible are the savings vaults. These enable you to set up separate funds to work toward different savings goals without the need for multiple accounts. This helps you organize your money, and you can even designate a vault for your round-up funds.

Bank of America offers a more traditional savings account, but it pays far less interest, ranging from 0.01 percent to 0.04 percent depending on your Preferred Rewards status, compared to SoFi's 0.25 percent. In addition, there is a $8 monthly maintenance fee that can be waived by keeping a balance of $500 or more in the account or linking your checking account. By linking your accounts, you can avoid going overdrawn with Balance Connect.

Read Full Comparison: SoFi Money vs Bank of America: Which Is Better For Your Needs?

SoFi has developed a respectable banking product line. Aside from its hybrid savings and checking account, it also offers mortgages, loans, and investment products. The only thing missing from the offering is a traditional savings account and CDs.

Since its inception as a credit card provider, Discover has come a long way. Of course, credit cards are available, but you can also get home loans, personal loans, and a variety of checking and savings products such as retirement accounts, CDs, and money market accounts.

Read Full Comparison: SoFi Money vs Discover: Which Online Banking Suits You Best?

Since the bank's inception, the SoFi product line has come a long way. You can now get access to investment products, mortgages, and loans, in addition to its hybrid checking and savings account. SoFi even offers insurance. The only thing missing from this bank are CDs and traditional savings accounts.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: SoFi Money vs Ally Bank: Compare Banking Options

Marcus is a subsidiary of Goldman Sachs, which is reflected in its banking products. Marcus provides high-yielding savings and CDs, as well as investment options and a variety of loans. This does not, however, include a checking account.

SoFi's banking products are more akin to those of traditional banks. While there are no checking or savings accounts available, rather a hybrid account, you can access loans, mortgages, and investment products. SoFi also offers insurance. CDs and traditional savings accounts, on the other hand, are not available in the SoFi catalog.

Read Full Comparison: Marcus vs SoFi Money: Which Banking Service Is Better?

SoFi offers a Spend and Save account that is part savings account and part checking account. You can earn 0.25 percent on your entire balance, but you can also establish savings vaults. These are separate funds within the account that allow you to allocate funds to various savings goals. This allows you to save for both short and long-term goals without having to manage multiple savings accounts.

Varo, on the other hand, has a more traditional savings account that offers an impressive up to 3% interest rate. Higher rates are available if you keep a savings balance of $5,000 or more or receive $1,000 or more in direct deposits during the qualifying period.

Read Full Comparison: SoFi vs Varo Bank: Which Account Is Better For Your Money?

SoFi's online Spend and Save account, like the Chime online checking account, is fee-free, but it has some different checking account features. Chime, for example, offers a $200 fee-free overdraft facility subject to terms, whereas SoFi provides cash back if you have recurring direct deposits of $500 or more each month.

Read Full Comparison: SoFi vs Chime: Which Online Banking Wins?

Chase Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.

There is no clear winner between SoFi and Wells Fargo as each bank excels in different areas – but Wells Fargo is our winner. Here's why.

PNC Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.