Table Of Content

When SoFi Money Wins?

SoFi’s banking product line has developed a great deal over recent years. In addition to its hybrid checking and savings account, you can access mortgages, loans, and investment products, there is even a selection of SoFi insurance products.

The only thing lacking from SoFi’s line is a conventional savings account and CDs.

SoFi Money can be a better choice than Bank of America if:

You want to earn interest on your checking account balance

You are happy with a hybrid savings and checking account

You want an online only bank

When Bank of America Wins?

Bank of America has an impressive banking product line . There are multiple credit card options, and different savings and checking accounts.

Bank of America also offers home loans, auto loans, and investments. This makes it far easier to switch from a conventional bank, as you won’t need to compromise on your choice of banking products.

Bank of America can be a better choice than SoFi Money if:

You are happy to meet the requirements to waive maintenance fees

- You want multiple credit card options

- You need a personal service

SoFi Money | Bank of America | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

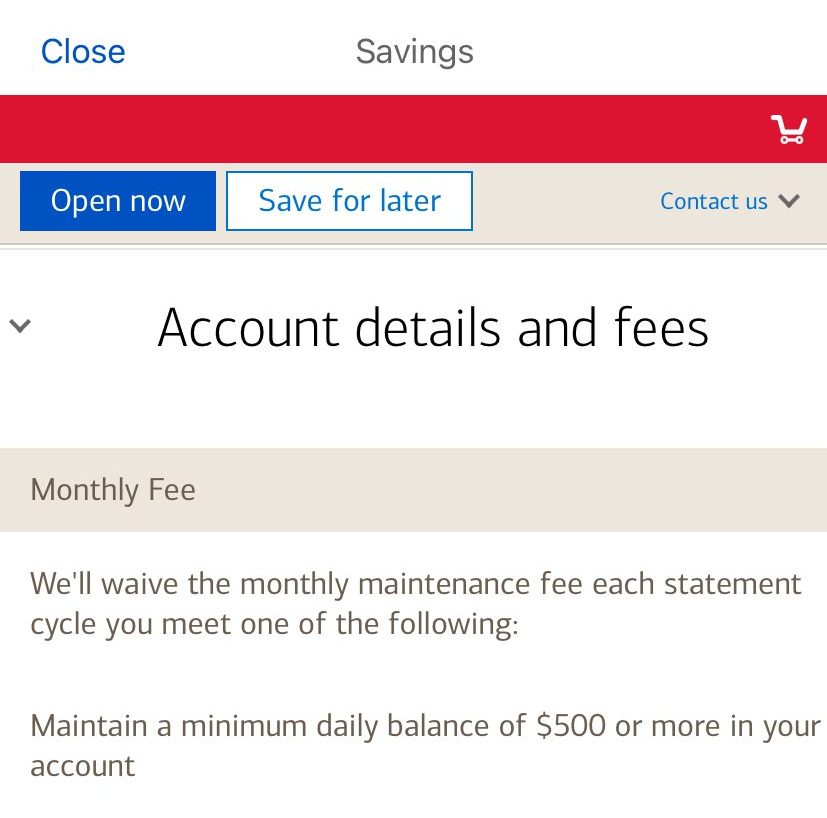

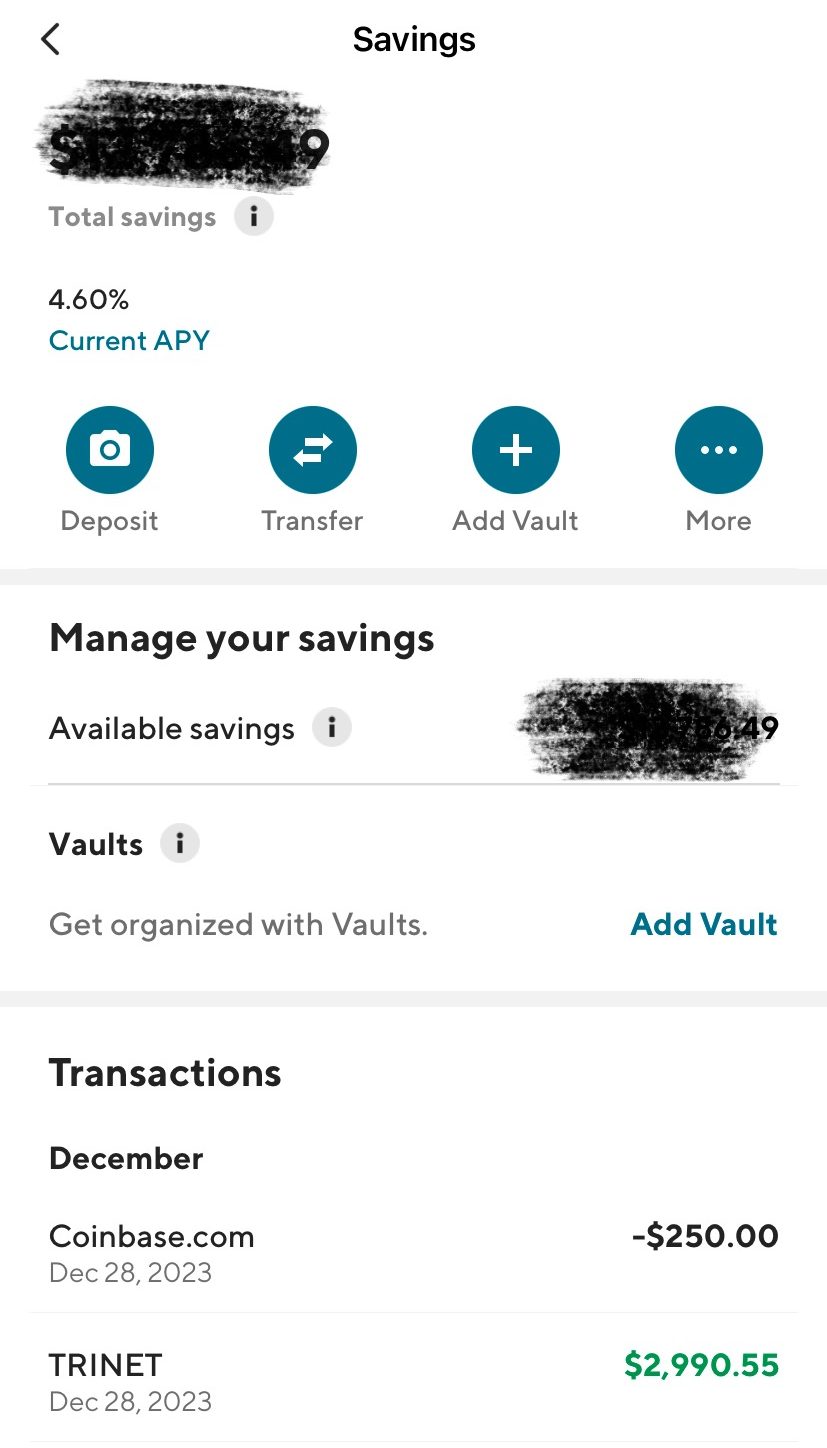

Bank of America has a more conventional savings account, but it pays far less interest (0.01% – 0.04%) depending on your Preferred Rewards status compared to the up to 4.60% offered with SoFi.

Additionally, the account has an $8 a month maintenance fee that can be waived by maintaining a balance of $500 or more, or linking your checking account. Linking your account also allows you to avoid accidentally going overdrawn with Balance Connect.

SoFi has a hybrid savings and checking account, called Spend and Save. For the purpose of this comparison, we’ll look at the savings features and there are some nice ones. The most obvious is the savings vaults.

These allow you to create separate funds to work towards different savings goals without needing multiple accounts. This helps you to keep your money organized and you can even specify a vault for your round up funds.

There is no comparison in terms of CDs, as SoFi does not currently offer CDs. So, if you are looking for CD products, then Bank of America would be the better option.

SoFi Money | Bank of America | |

|---|---|---|

APY | up to 4.60% | 0.01% – 0.04% |

Fees | $0 | $8 per month

Can be waived by maintaining a balance of $500+, becoming a Preferred Rewards member or linking to your B of A Advantage Banking account. Fees are also waived for enrolled students aged under 24

|

Minimum Deposit | $0 | $100 |

Checking Needed? | Yes | No |

Main Benefits |

|

|

Checking Account

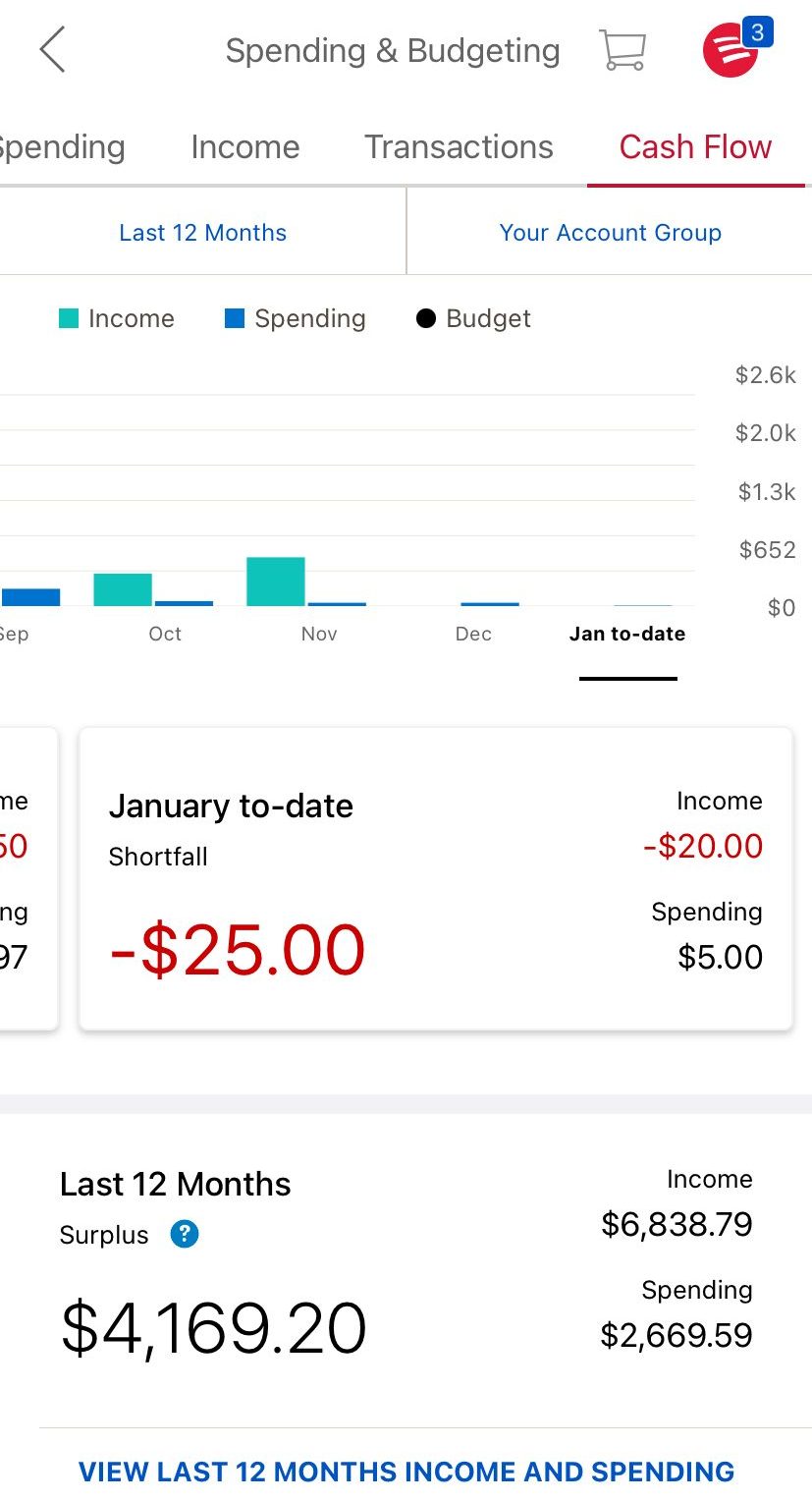

The hybrid SoFi account also has some nice checking account features including round ups and overdraft protection with no account fee. You’ll also earn 0.50% on your checking account balance, making it one of the top interest-bearing accounts, while the Bank of America account is not interest-bearing.

Additionally, the Bank of America checking account requires a minimum deposit to open the account and you need to maintain an account balance, have qualifying deposits or become a Preferred Rewards member to have the $12 maintenance fee waived.

Unlike SoFi, Bank Of America offers a variety of checking accounts. For basic use, customers can apply for the BofA SafeBalance account, while those who need more advanced features can choose the Advantage Banking or the Advantage Relationship account.

SoFi Money | Bank of America | |

|---|---|---|

APY | 0.50% | 0.01% – 0.02% |

Fees | $0 | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

|

Minimum Deposit | $0 | $25 – $100 |

Main Benefits |

|

|

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Compare CDs

While SoFi doesn't offer CDs, BofA offers decent CD rates. However, Bank Of America only offer “featured” terms to get higher rates, which are different than the standard CD rates.

Bank of America | |

|---|---|

Minimum Deposit | $1,000 |

APY Range | 0.05% – 5.00%

|

APY 7 months | 4.75% |

APY 13 months | 4.30% |

APY 25 months | 3.20% |

APY 36 months | 0.03% |

No Penalty CD | / |

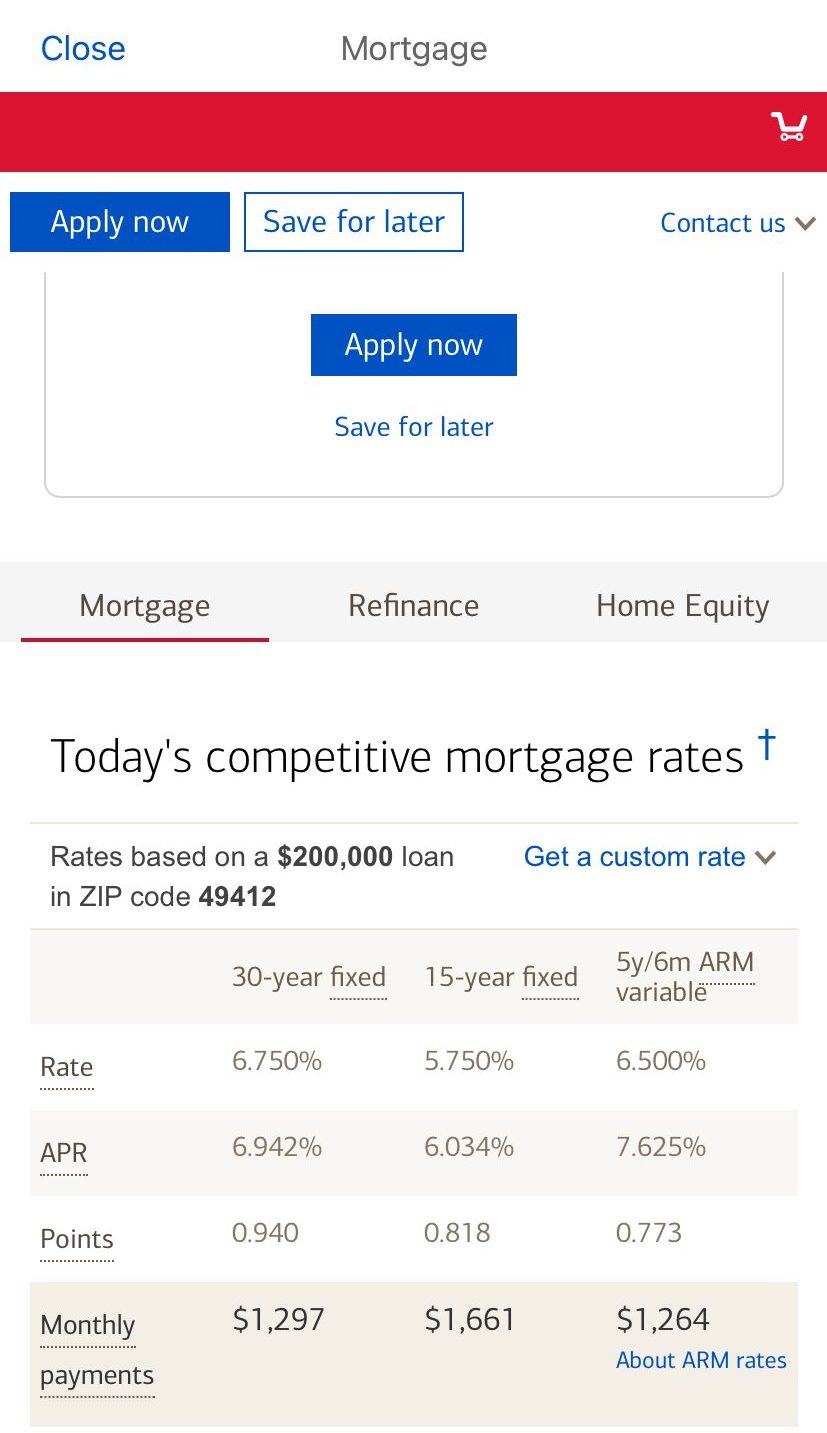

Mortgage Options

SoFi has various mortgage and home loan products including fixed rate mortgages, home equity loans and cash out refinance.

The bank permits applicants to become prequalified and you can choose the term and associated rate that is right for you. SoFi allows its customers to have a down payment of 5% or more with a loan to value of 80% or more. The bank even offers members a $500 discount on the fees for your home loan or refinancing.

Bank of America also has a decent choice of mortgages and home loans including fixed rate, ARM and home equity lines of credit. There are also VA and FHA loans. The Bank of America website has a number of tools and calculators to estimate your costs and Preferred Rewards members could qualify for a discount of up to $600 in mortgage origination fees, based on eligibility.

Loan Options

SoFi offers various personal loans including credit consolidation loans and home improvement loans that allow you to borrow up to $100,000 and SoFi has no origination fees. The bank also offers some bonuses, as you can get a $10 cash bonus for viewing your specific rate and up to $1,000 in cash if you proceed with a loan.

Although Bank of America does not have a personal loan option, the bank does have auto loans with no fees. You can get a decision in approximately 60 seconds and Bank of America allows you to lock in your rate, so you can comparison shop.

Credit Cards

SoFi has only one credit card, but this is designed to help you to save, invest and pay down debts. If you redeem your rewards to save, invest or pay down your SoFi loan, you’ll earn 2% unlimited cash back. However, if you want to redeem your rewards as statement credit for your SoFi credit card, you’ll earn 1%.

Another perk of the card is that SoFi will lower your rate by 1% if you make your minimum payments on time for 12 months.

Bank of America has an impressive selection of credit card options. One of the most popular is Customized Rewards that has cash back tiers tailored to your preferences or if you prefer simplicity, the Unlimited Rewards card offers 1.5% cash back on all purchases with no spending categories. There is also a BankAmericard that has a 0% intro rate for 18 months, a travel card offering miles, and Premium Rewards that offers unlimited points.

Bank of America also has student cards and a secured card that allows those who want to build credit and earn rewards. There are also partnership cards including Free Spirit, Alaska Airlines, Always, Amtrak, and Susan G Komen, so you can earn rewards with your preferred brands.

Card | Rewards | Bonus | Annual Fee |

| Bank of America® Customized Cash Rewards credit card

| 1-3%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

| $200

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

| $0 |

|---|---|---|---|---|

| Bank of America® Travel Rewards credit card | 1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

| 25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

| $0 |

| BankAmericard® credit card | N/A |

N/A

N/A

| $0 |

| Bank of America® Premium Rewards® credit card | 1.5X – 2X

Unlimited 2X points on travel and dining purchases. Unlimited 1.5X points on all other purchases

|

60,000 points

60,000 online bonus points for spending $4,000 on new purchases in the first 90 days of opening their card account. | $95 |

| Bank of America Unlimited Cash Rewards credit card | 1.5%

unlimited 1.5% cash back on all purchases

|

$200

$200 online cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

| $95 |

| Bank of America® Premium Rewards® Elite | 1.5x – 2x

2 points for every dollar you spend on travel or dining purchases, with 1.5 points per dollar on all your other purchases | 75,000 points

75,000 bonus points if you spend $5,000 or more within 90 days of opening your account

| $550 |

Customer Service

SoFi has multiple customer service phone lines, but the hours vary according to the banking product. While most lines are only available from 5 am to 7 pm, the credit card line is 24/7.

As a larger bank, Bank of America does have a large customer service department. You can access live support 8 am to 9 pm ET Monday to Friday, at weekends 8 am to 8 pm on Saturday and 8 am to 5 pm on Sunday. You can also speak to the customer service team via the Bank of America Twitter or on the website.

This is supported by the bank’s ratings on Trustpilot. While SoFi has a rather average 3 out of 5 rating, Bank of America has a more impressive 3.5 out of 5.

Online/Digital Experience

Both SoFi and Bank of America have an app to help you to manage your accounts on the go. The SoFi app is rated 4.4 out of 5 on Google Play and 4.8 out of 5 on the Apple Store. Bank of America’s app is rated 4.8/5 on the Apple Store and 4.6/5 on Google Play.

The bank’s websites are both easy to use, but Bank of America’s site does have more learning resources. There is a comprehensive help section that allows you to explore all aspects of the bank’s products and finance in general, with Erica a virtual assistant to provide further help and guidance.

SoFi does have a great site and FAQ help, but many of the blog posts center around improving your financial health in terms of reducing debt. So, if this is not a priority for you, you may find the online experience a little lacking.

Which Bank is The Winner?

To sum up, we’ll need to look at which bank is better, depending on what you’re looking for.

While SoFi lacks some banking products in its line, it does have some innovative products. The hybrid Spend and Save account offers the best of both worlds in terms of saving and checking. You can also access a variety of other banking products including a credit card that is weighted towards helping you save or improve your levels of debt.

However, if you want to keep most of your financial products with the one bank, you are likely to appreciate the volume of Bank of America products. There is a wealth of credit card options, and you can manage your mortgage, auto loan, savings and checking account under one roof.

APY Savings

The annual percentage yield (APY) is a percentage that represents the amount of money or interest earned on your savings account over the course of a year. The APY factored in compound interest. A savings calculator can help you quickly determine how much you'll earn with a given APY.

| up to 4.60% | 0.01% – 0.04%

| Up to 5.02%

|

Checking Fee

The monthly fee on checking account

| $0 | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

| Compare Banking |

Mobile App Rating | 4.8/5 on iOS 4.2/5 on Android | 4.8/5 on iOS 4.6/5 on Android | Various Banks

|

Open Account

| Open Account

| Compare

|

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

FAQs

Does Bank of America offers a promotion for new accounts?

Bank of America offers a welcome bonus of $200 for new personal checking customers who open an account online.

Many of the cards have a decent welcome bonus (or points equivalent) if you meet the spending criteria within the time limit. For example, with the Bank of America Customized Cash Rewards card, you can get a $200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening.

Does SoFi offers a promotion for new accounts?

Based on the sum of their first month's direct deposits, new members will receive a tiered direct deposit welcome bonus of up to $50-$300 paid straight to their SoFi Checking & Savings accounts.

Is SoFi bank can collapse in a case of recession?

SoFi has only been trading since 2011, so we have no data about how it has handled previous recessions. SoFi is rates A+ on BBB, means strong financial situation.

However, SoFi has established a recession help center that is a great resource to help its customers learn more about what they can do if the economic climate starts to impact their finances

Can you buy gold via SoFi ?

SoFi does have an investment platform that allows you to trade stocks including gold stocks. You can even receive a $1,000 bonus when you download the app and open an investment account.

The great thing about this platform is that you can trade stocks with no commission and you can even purchase fractional shares for as little as $5. So, if you want to try your hand at buying gold, you don’t need to sink your entire investment fund into one product.

What does Bank of America have to offer for people with bad credit?

At first glance, it does not appear that Bank of America offers products for people with bad credit. While there are basic checking accounts and savings tools available, the Customized Cash Rewards Secured credit card is one of the best options.

This card allows you to earn up to 3% cash back while improving or establishing your credit. To establish a credit line, you can use a refundable deposit of up to $4,900, as well as your income and ability to pay. Bank of America will review your account on a regular basis, and you may be eligible for a refund of your security deposit.

Is it possible to open a joint account with Bank of America?

All Bank of America savings and checking accounts are co-ownership eligible, so you can open a Bank Of America joint account with any of these accounts. To open the account, both applicants must provide their personal information as well as a form of identification.

SoFi vs Bank of America: Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked at SoFi and Bank of America in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare BofA With Alternative Banks

Since its inception as a credit card provider, Discover has come a long way.Of course, credit cards are available, but you can also get home loans, personal loans, and a variety of checking and savings products such as retirement accounts, CDs, and money market accounts.

Bank of America offers a far more comprehensive range of banking services. There are numerous credit card options, as well as various savings and checking accounts.

Bank of America also provides mortgages, auto loans, and investments. This makes switching from a traditional bank much easier because you won't have to compromise on your banking products.

Read Full Comparison: Discover vs Bank of America: Compare Bank

Bank of America is a nationwide network that offers deposit, loan, and credit card services. There are also increased daily limits on ATM and debit purchases, which is an excellent incentive to improve your financial situation. Aspiration's company was presented in a very different manner than their bank competitors.

One feature that sets them apart from their competitors is that they let their customers decide how much they want to pay for their services. The fee that the customer believes is fair or appropriate for the level of service they receive is set by the customer.

Read Full Comparison: Aspiration vs Bank of America: Which Bank Account Is Better?

Wells Fargo's product offering is even more extensive. This bank offers checking accounts, a variety of savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management services. This makes switching from another bank even easier because you'll have access to all of your favorite banking products.

Bank of America offers a diverse range of banking services. Checking and savings accounts, auto loans, home loans, credit cards, and investment options are all available.

Read Full Comparison: Bank of America vs Wells Fargo: Which Bank Is Better?

Bank of America has an impressive line of banking products, as one would expect from a large banking institution. Aside from various checking and savings accounts, there are auto loans, home loans, a variety of credit cards, and investment options. This makes switching from your current bank easier because you'll find many familiar products.

Chase also has a good selection of banking products. There are checking and savings accounts, auto loans, home loans, and home equity options, as well as a fantastic selection of credit cards.

Read Full Comparison: Bank of America vs Chase: Where to Save Your Money?

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Bank of America offers a wide range of banking services. There are numerous credit cards available, as well as various checking and savings accounts, home loans, investments, and auto loans.

Read Full Comparison: Bank of America vs US Bank: Which is Best For You?

Bank of America is a large banking institution, and its impressive banking product line reflects this. Aside from savings and checking accounts, there are home loans, auto loans, investment options, and a variety of credit cards. Citi also has a diverse product offering. Credit cards, CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and checking and savings accounts are all available.

As a result, if you want to switch from your current bank, either bank is a viable option because you won't have to make any compromises in terms of banking products.

Read Full Comparison: Bank of America vs Citi: Which Bank Suits You Best?

Both banks have a decent selection of banking products, but there are some gaps in each line up. If you’re looking for the best returns, Capital One does have the edge in terms of CD and savings rates.

There is no clear winner as to whether Truist Bank or Bank of America is a better choice, but we prefer the latter. Here's why.

Truist Bank vs. Bank Of America: Which Bank Account Is Better?

Bank of America and PNC Bank offer various banking products, but which is a better fit for you? Let's compare and see our winner: PNC Bank vs. Bank Of America

We'll explore Bank Of America and TD Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: TD Bank vs. Bank Of America

BMO is the winner when it comes to savings products, while Bank Of America offers many more credit card options. Here's our winner: Bank of America vs. BMO Bank

There is no clear-cut winner, but we prefer Bank Of America. But, there are cases when Citizens is best. Here's our comparison: Bank of America vs. Citizens Bank

While Bank of America and Fifth Third Bank offer a range of banking services, Fifth Third is our winner in this competition. Here's why.

Bank of America vs. Fifth Third Bank: Which Bank Account Is Better?

We'll explore Bank of America and M&T Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Bank of America vs. M&T Bank

We believe Bank Of America is the preferred option in this battle. But, there are significant differences to know. Here's our comparison: Bank of America vs. KeyBank

While Regions Bank offers better checking accounts, Bank of America wins in credit cards and CDs. Here's our side by side comparison: Regions Bank vs. Bank of America

If you feel comfortable with online-only banking and depending on your needs – Ally may be a better option than Bank Of America. Here's why.

Ally Bank vs. Bank of America: Which Bank Account Is Better?

For most consumers, Bank of America may be a better option. American Express is a solid option for customers with higher wealth. Here's why.

American Express Bank vs. Bank of America: Which Bank Account Is Better?

Compare SoFi With Alternative Banks

Since the bank's inception, the SoFi product line has come a long way. You can now get access to investment products, mortgages, and loans, in addition to its hybrid checking and savings account. SoFi even offers insurance. The only thing missing from this bank are CDs and traditional savings accounts.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: SoFi Money vs Ally Bank: Compare Banking Options

SoFi has developed a respectable banking product line. Aside from its hybrid savings and checking account, it also offers mortgages, loans, and investment products. The only thing missing from the offering is a traditional savings account and CDs.

Since its inception as a credit card provider, Discover has come a long way. Of course, credit cards are available, but you can also get home loans, personal loans, and a variety of checking and savings products such as retirement accounts, CDs, and money market accounts.

Read Full Comparison: SoFi Money vs Discover: Which Online Banking Suits You Best?

Marcus is a subsidiary of Goldman Sachs, which is reflected in its banking products. Marcus provides high-yielding savings and CDs, as well as investment options and a variety of loans. This does not, however, include a checking account.

SoFi's banking products are more akin to those of traditional banks. While there are no checking or savings accounts available, rather a hybrid account, you can access loans, mortgages, and investment products. SoFi also offers insurance. CDs and traditional savings accounts, on the other hand, are not available in the SoFi catalog.

Read Full Comparison: Marcus vs SoFi Money: Which Banking Service Is Better?

SoFi offers a Spend and Save account that is part savings account and part checking account. You can earn 0.25 percent on your entire balance, but you can also establish savings vaults. These are separate funds within the account that allow you to allocate funds to various savings goals. This allows you to save for both short and long-term goals without having to manage multiple savings accounts.

Varo, on the other hand, has a more traditional savings account that offers an impressive up to 3% interest rate. Higher rates are available if you keep a savings balance of $5,000 or more or receive $1,000 or more in direct deposits during the qualifying period.

Read Full Comparison: SoFi vs Varo Bank: Which Account Is Better For Your Money?

SoFi's online Spend and Save account, like the Chime online checking account, is fee-free, but it has some different checking account features. Chime, for example, offers a $200 fee-free overdraft facility subject to terms, whereas SoFi provides cash back if you have recurring direct deposits of $500 or more each month.

Read Full Comparison: SoFi vs Chime: Which Online Banking Wins?

Upgrade and SoFi Bank offer various online banking products, including checking, savings, and credit cards. Let's compare them side by side: Upgrade vs. SoFi Bank

Chase Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.

There is no clear winner between SoFi and Wells Fargo as each bank excels in different areas – but Wells Fargo is our winner. Here's why.

PNC Bank is our winner with a complete package of banking services. SoFi is best for savings rates, online experience, and lending options.

Banking Reviews

Alliant Credit Union Review