Table Of Content

This article explores the ongoing discussion surrounding short-term and long-term certificates of deposit (CDs) and aims to assist you in determining which option suits your financial goals.

Additionally, we will analyze and contrast the current offerings of short-term and long-term CDs from leading banks and credit unions to uncover any disparities and shed light on their underlying reasons.

What is Short-Term CD?

The specific durations that are considered “short term” can vary depending on the context and the financial institution. However, in general, short-term CDs typically have durations of one year or less.

Common short-term CD options may include terms of 3 months, 6 months, 9 months, or 12 months. These durations offer a relatively quick return on investment and are suitable for individuals who prefer liquidity and flexibility with their funds.

A key benefit of short-term CDs is their enhanced liquidity compared to longer-term alternatives. This characteristic makes short-term CDs ideal for individuals who anticipate needing prompt access to their funds or value flexibility in managing their financial resources.

By including short-term CDs in their investment strategy, individuals can securely park their funds while earning a modest amount of interest, thereby aligning with a conservative approach to wealth management.

What is Long-Term CD?

On the surface (but not in reality) long-term CDs offer a higher interest rate compared to short-term CDs due to the longer commitment from the depositor.

Long-term CDs often encompass a variety of options, typically including terms such as 2 years, 3 years, 4 years, and beyond. These extended durations provide individuals with the opportunity to invest their funds for an extended period and potentially earn higher interest rates compared to shorter-term alternatives.

One key characteristic of long-term CDs is their limited liquidity. Once you deposit your funds into a long-term CD, you generally cannot withdraw them before the CD reaches its maturity date without incurring penalties.

Short Or Long Term CDs: Which Offer Higher Rates?

Typically, longer-term certificates of deposit (CDs) tend to offer higher interest rates compared to shorter-term CDs due to the increased level of commitment required from depositors.

When you opt for a shorter-term CD, such as a 6-month CD, you are making a relatively brief commitment, which may result in lower interest rates. On the other hand, choosing a longer-term CD, say a 5-year CD, entails leaving your funds with the bank for an extended period, and in return, the bank is willing to provide a higher rate of return.

Nevertheless, it's important to note that higher rates on long term CDs are not always guaranteed when compared to short term CDs. While certain banks do offer elevated rates on long term CDs, there are others that provide similar or even higher rates on short term CDs. This may appear contradictory, but there is a logical explanation behind it.

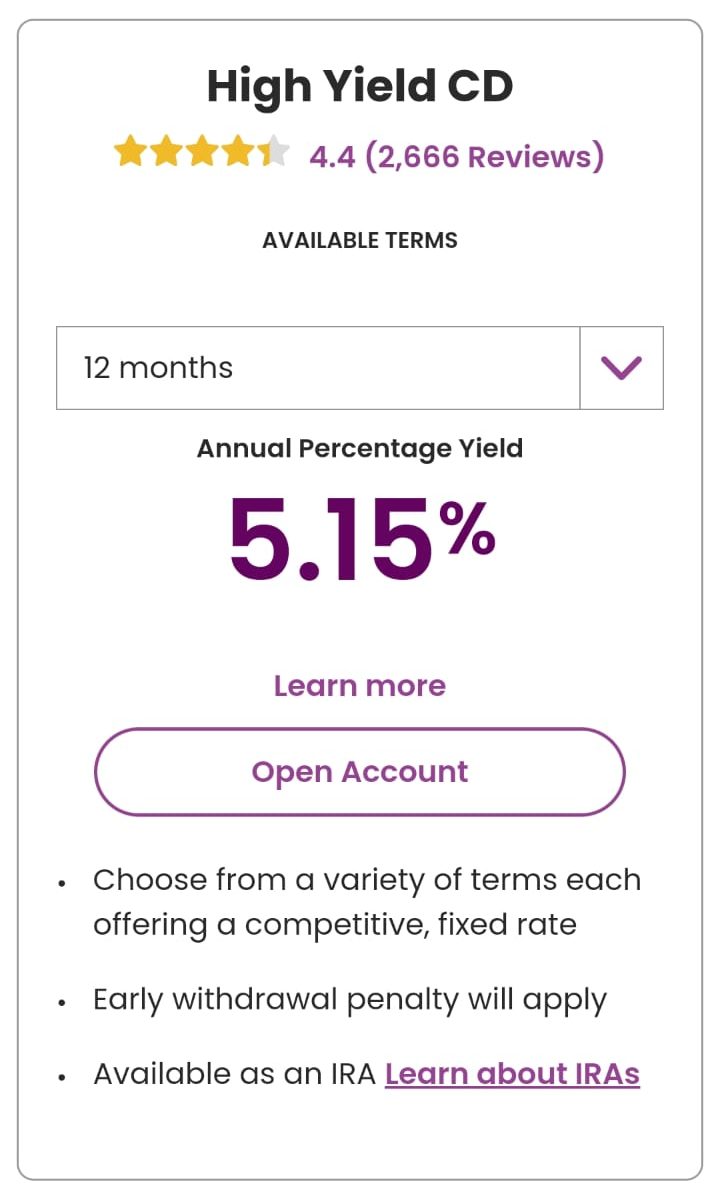

Institution | 6-Month APY | 12-Month APY | 3-Year APY | 5-Year APY |

|---|---|---|---|---|

5.15% | 4.80% | 4.15% | 4.00% | |

4.35% | 4.90% | 4.10% | 4.00% | |

4.25% | 4.70% | 3.75% | 3.75% | |

3.00% | 4.20% | 3.60% | 3.50% | |

4.40% | 4.50% | N/A | 3.90% | |

4.80% | 4.90% | 4.15% | 4.00% | |

4.75% | 2.00% – 3.00% | 2.00% | 2.00% | |

N/A | 4.00% | 3.00% | 3.00% |

Why Short Terms CDs Offer Higher Rates?

The primary reason for this is the market's expectation of declining Federal Reserve (Fed) rates in the medium to long term. It is believed that the Fed will need to reduce interest rates within the next 1-2 years, causing rates to fall from their current levels.

This expectation creates an opportunity for investors who anticipate this scenario, as they can lock in the current rate for a longer duration, such as 3 years, ensuring a guaranteed return on their investment.

When To Consider A Short Term CD?

A short-term CD is worth considering when you want to invest your money for a relatively brief period and have the flexibility to access your funds sooner.

Let's say you have some extra cash that you don't immediately need, but you might require it in a few months for a specific expense, like a vacation, a down payment on a car, or some home improvements. In this case, a short-term CD can be a good option.

With a short-term CD, you agree to keep your money with the bank for a specific period, typically ranging from a few weeks to a year. During this time, the bank pays you interest on your deposit, but the rates may be lower compared to longer-term CDs.

The benefit of a short-term CD is that it offers more flexibility. Once the CD matures, you have the option to withdraw your money, including the interest earned, and use it for your intended purpose. You won't have to wait for an extended period before accessing your funds.

Sign Up for

Our Newsletter

When To Consider A Long Term CD?

A long-term certificate of deposit (CD) can be considered under certain circumstances when you have specific financial goals and preferences. Here are some situations where a long-term CD might be appropriate:

Saving for a long-term goal: If you have a specific financial goal that is several years away, such as buying a house, funding a child's education, or saving for retirement, a long-term CD can provide a stable and low-risk way to save money over an extended period.

Risk aversion: If you have a low tolerance for risk and prefer to protect your principal investment, a long-term CD can be a suitable option. CDs are FDIC-insured in the United States (up to certain limits), meaning your money is guaranteed by the government even if the bank fails.

Expecting interest rates to decline: If you anticipate that interest rates will decrease in the future, locking in a long-term CD at a higher rate can ensure you maintain that interest rate for the duration of the CD term.

FAQs

Do CDs protect against inflation?

While CDs offer stability and guaranteed returns, they may not provide significant protection against inflation. The fixed interest rates on CDs may not keep pace with inflation, potentially eroding the purchasing power of your funds.

Are short-term CDs less risky than long-term CDs?

Both short-term and long-term CDs are considered low-risk investments. However, long-term CDs carry a slightly higher risk of inflation eroding the purchasing power of your funds over an extended period.

What factors should I consider when choosing between a short and long-term CD?

Factors to consider include your financial goals, liquidity needs, interest rate expectations, risk tolerance, and the potential impact of inflation.

Are there any alternatives to CDs for conservative investors?

For conservative investors, alternatives to CDs include high-yield savings accounts, money market accounts, or Treasury securities. These options offer varying levels of liquidity and potential returns.

Do short-term CDs have a higher level of liquidity?

Yes, short-term CDs are generally more liquid compared to long-term CDs. They have shorter terms, making it easier to access your funds sooner.

Can I add funds to my CD before it matures?

In most cases, you cannot add funds to an existing CD. Once you open a CD, the deposit amount is fixed until the CD matures.