In this Review

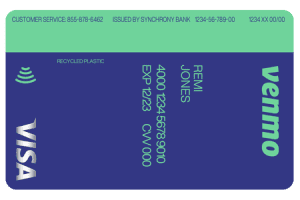

If you prefer to use Venmo to split bills or make quick payments, the Venmo credit card may be of interest to you. This is a no annual fee Visa credit card issued in partnership with Synchrony Bank, which allows you to earn rewards on your purchases.

Like the Venmo app, this credit card allows you to make a payment for a purchase and immediately split the bill. For example, if you’re dining out with friends, your companions can simply scan the QR code on the front of your Venmo credit card to pay you there and then for their share.

You can then use their payments towards the bill or leave them in your Venmo account. This eliminates the middle steps of needing to send your Venmo payments to your bank account before you can pay your credit card bill.

The card has automatic cash back categories, which don’t require you to opt in or track your spending. There is a tiered reward structure, with 3% and 2% in designated categories and 1% on all other spending. This makes it an easy to use card that is ideal for social users who like the convenience of being able to quickly split bills or payments.

Rewards Plan

Sign up Bonus

0% Intro

PROS

- Variety of Reward Categories

- Easy Reward Redemptions

CONS

- Low Base Rewards Rate

- Not a Starter Card

APR

15.99% - 24.99% variable

Annual Fee

$0

Foreign Transfer Fee

None

Credit Requirements

Good - Excellent

Main Features & Benefits

In addition to earning rewards, there are some other interesting benefits and features to know. These include:

- Unique QR Code on the Card

The front of the credit card features a unique QR code linked to your Venmo account. This makes it remarkably easy to split bills, as your companions can pay for part of the bill by scanning your card’s QR code.

- Automatic Rewards

Unlike many credit cards that require you to pick a bonus category at the start of the statement period, Venmo calculates the top rewards categories for you.

Venmo examines your spending to automatically and retroactively apply the top and second top spending categories. This eliminates the guesswork, so you can earn the highest cash back rewards.

- Easy Reward Redemptions

The cash back you earn with your Venmo credit card will appear in your Venmo balance when your statement closes.

From this point, you can apply the funds towards your bill, make purchases from merchants who accept Venmo, transfer it to a linked bank account or send money to someone else via Venmo.

- Easy Card Management

You can manage all aspects of your Venmo credit card via the Venmo app.

Whether you want to pay your balance, track your spending, see your rewards or change your notifications, you can do this through the app.

- Apply Payments To Your Bill or Leave Them In Your Account

When you receive payments for split bills, you can choose to apply them to your credit card balance or leave them in the account.

This is a very handy feature for those who tend to forget about the payments from their friends to avoid accidentally spending money elsewhere that is needed for the credit card bill.

- Broad Variety of Reward Categories

There are eight eligible spending categories to earn the top and second tier rewards.

These include dining and nightlife, health and beauty, grocery (which includes wholesale clubs), entertainment, transportation, bills and utilities, gas, and travel.

- Instant Access After Approval

When you’re approved for the Venmo credit card, you don’t need to wait for your physical card to arrive in the mail. You’ll find a virtual card within the Venmo app that will allow you to start making purchases.

In the event that your physical card is lost or stolen, you can disable your physical card in the app while you continue to shop using your virtual card.

Drawbacks

The Venmo credit card has a couple of potential drawbacks that may influence if this is the right option for you:

- Low Base Rewards Rate

While many other credit cards offer 1.5% or more on all purchases, unless they are in a bonus category, you’ll only earn 1% cash back with the Venmo credit card.

- Only Available to Venmo Customers

You need to be a Venmo user to apply for the Venmo credit card. Additionally, this card is only available if you’re using the latest version of the app.

If you’re not comfortable using Venmo or have no experience with this platform, this may not be the most appropriate credit card choice.

- Bonuses are Difficult to Understand

Many credit cards have a very clear welcome bonus, but Venmo has limited time offers, which may make it difficult to determine if you qualify.

- Not a Starter Card

While Venmo is geared towards the younger customer, you need to have good to excellent credit to qualify for the Venmo credit card.

So, even if you’re a seasoned Venmo user, if you’re still trying to build your credit, you may struggle to qualify for this card.

How's Venmo Customer Service?

Venmo offers a number of ways to access the customer service team. The main Venmo phone number is available Monday to Friday 10 am to 6 pm, EAT, but there is a 24/7 dedicated line for credit cards. You can also email the customer service department or speak to a representative via Facebook, Twitter and Instagram.

However, the easiest way to contact customer support is through the app. There is a live chat feature in the app, which is available 7 am to 1 am Monday through Friday and 9 am to 11 pm on the weekend. You simply need to click the “Get Help” icon at the bottom of the menu and tap “Contact Us”. From there, you can select “Chat with Us”.

How to Maximize Venmo Credit Card Benefits

There are a number of ways to maximize the benefits and rewards of your Venmo credit card. These include:

1. Strategic Spending

While Venmo will automatically calculate your two highest spending categories to get the top two tier rewards, you can maximize your rewards with strategic spending. Try to think about when you make larger purchases.

For example, if you’re planning a busy month of socializing, this is likely to be calculated as your primary reward category. If you make a large purchase during this month, you will only qualify for tier two or basic rewards.

A better idea is to hold off on a larger purchase until you have a quieter socializing month. So, if you’re planning on booking a vacation, try to do this on a month when you’re not spending much in other categories.

2. Make Use of Visa Benefits

The Venmo credit card is a Visa card, so it does come with standard Visa benefits. This includes Travel and Emergency Assistance and Emergency Cash.

However, if you’re approved for the Visa Signature version of this card, you can also access rental discounts, concierge services and the Visa Signature Luxury Hotel Benefits. So, read through the literature included with your card and make sure you make use of these benefits.

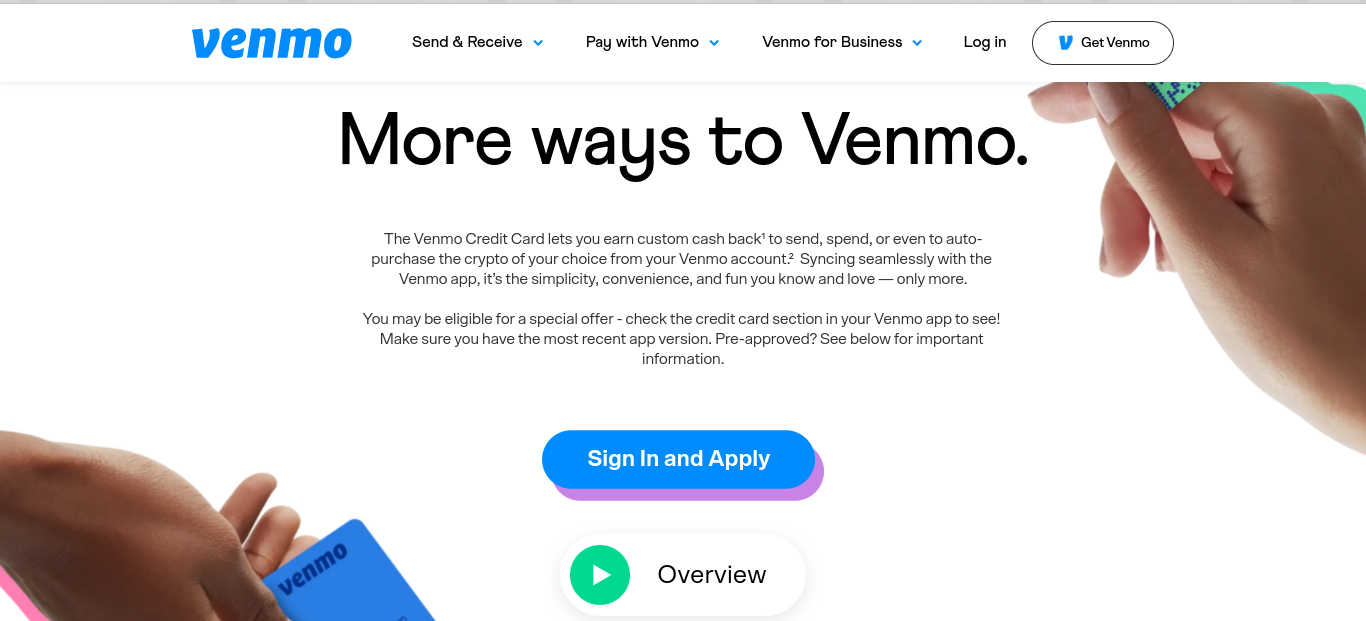

How to Apply for the Venmo Credit Card

You need to be a Venmo customer to apply for the Venmo credit card. On the main page, you’ll see a “sign in and apply” button.

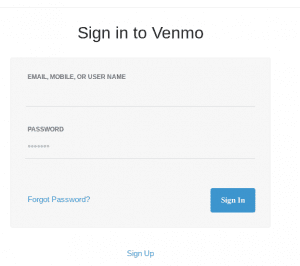

When you click this button, it will automatically open a new tab for you to sign into your account.

You will also see a link to sign up, if you’re not already a Venmo customer. However, do bear in mind that you need to have a Venmo account for a minimum of 30 days and keep the account in good standing to apply for the Venmo credit card.

Once you sign into your Venmo account, you’ll need to complete a short application form and submit it. The Venmo team will then assess your application and determine if you qualify. It is important to note that you can’t prequalify for the Venmo credit card and you do need good to excellent credit.

So, if you are unsure if you have a sufficiently high credit score, it may be better to wait to apply.

FAQs

What Are The Venmo Credit Card Income Requirements?

Venmo does not specify a minimum income requirement to qualify for its credit card. However, you do need good to excellent credit.

Can I Get Pre Approved On The Venmo Credit Card?

Venmo does not advertise pre approval for the Venmo credit card. There is no pre approval option on the website.

However, select customers may receive a notification that they have been pre approved.

What Is The Initial Credit Limit Of The Venmo Credit Card?

Venmo does not specify an official minimum initial credit limit. However, some users have reported a temporary limit of $250, which is adjusted according to your income, credit score and account standing.

The Venmo team will periodically review your card activity to determine if you qualify for a limit increase. If you don’t hear anything, you could request a limit review after two or three months.

What Are The Top Reasons Not To Get The Venmo Credit Card?

The top reason not to get the Venmo credit card is that you are not a Venmo user. The card is only available to Venmo account holders, but if you are not a keen user of the platform, you are not likely to find this card beneficial.

Can I Add An Authorized User?

Unfortunately, Venmo does not support joint accounts or allow you to add authorized users to your credit card account. So, if you do want a card that you can add authorized users to the account, Venmo is not the right choice for you.

What’s The Main Uniqueness Of The Venmo Credit Card?

The main unique feature of the Venmo credit card is the QR code printed directly on the front of the card. This means that when you’re splitting a bill with your friends, they can scan the QR code and you can apply the funds directly to your credit card bill.

Which Type Of Customer Can Most Benefit From This Card?

Frequent or keen users of the Venmo platform are likely to gain the most benefit from this card. Since these customers are already familiar with Venmo, they will simply gain more benefits from using the associated credit card.

Does The Venmo Credit Card Offer Good Digital Experience?

Venmo has a good reputation for providing a solid user experience. You can manage your credit card directly through the Venmo app, and Venmo provides a virtual credit card, so you can start earning rewards while you’re waiting for your physical card to arrive.

How Long It Takes To Get Approved For The Venmo Credit Card?

Most users will get an approval decision almost immediately. However, in some cases, you may need to wait seven to 10 days for Venmo to gather more information and process your application.

How’s The Venmo Credit Card Customer Service Availability?

You can access the customer service team via social media, email or chat. However, Venmo does have a dedicated 24/7 phone line for credit card issues.