Truist Bank

Checking Fees

Savings APY

Minimum Deposit

CDs APY Range

Truist Bank provides an extensive array of financial solutions tailored for both individuals and businesses. Their offerings include savings and checking accounts, CDs, and a money market account, complemented by a network of approximately 3,000 ATMs. Although Truist may not boast the most competitive rates, their accounts are associated with comparatively low fees.

The birth of Truist occurred in 2019 when BB&T and SunTrust merged, resulting in one unified entity. Currently, Truist Bank holds a prominent position as one of the top 10 largest banks in the United States. With over 2,100 branches distributed across 17 states and the District of Columbia, Truist effectively caters to a wide range of customers nationwide.

This bank made it to our list of top banks in Florida and North Carolina.

Pros & Cons

Here are the main pros and cons of Truist bank:

Pros | Cons |

|---|---|

Many branches in Florida, North Carolina, Virginia, Georgia and Maryland | Active in 17 states |

Competitive CD rates | Low savings and MMA rates |

Variety of financial products | Fees |

Great ATM network |

Sign Up for

Our Newsletter

Truist Checking Accounts

Truist One Checking offers a straightforward option with no overdraft fees, and a $12 or $0 monthly maintenance fee depending on qualifications. Eligible clients receive a $100 Negative Balance Buffer for overdraft protection. Additionally, they offer 10%-50% more rewards, providing increased cash back or miles on select Truist credit cards.

Truist Bank offers different levels of benefits and rewards based on the total monthly average balance maintained in your accounts. Here are the differences between each level:

-

Level 1 ($0 - $9,999.99):

- 10% loyalty bonus on Truist credit cards.

- 10% more rewards from Truist credit cards.

- $100 Negative Balance Buffer for eligible clients.

- 10-pack free personal checks.

- Truist One Savings account with no monthly maintenance fee.

- Personal debit card included, with the option to request a Delta SkyMiles® Debit Card for a $95 annual fee (with a $25 safe deposit box discount).

Here's what you can also get if you have level 2,3,4 or 5:

Level 2 | Level 3 | Level 4 | Level 5 | |

|---|---|---|---|---|

Amount | $10K-$25K | $25K-$50K | $50K-$100K | $100,000 + |

loyalty bonus on Truist credit cards | 20% | 30% | 40% | 50% |

No-fee, non-Truist ATM transactions | 1 | 3 | 5 | Unlimited |

Savings Accounts: Rates Could Be Better

Truist One Savings account offers a secure way to build savings and work towards personal goals. The account earns a low 0.01% APY, calculated and compounded daily, with monthly crediting of interest. To maximize your savings, you should look for other savings accounts.

With a minimum opening deposit of $50, it provides the option to waive the monthly fee through various methods. This includes maintaining a daily ledger balance of $300, scheduling a recurring preauthorized transfer of $25 or more per statement cycle, being a minor under the age of 18, or having any related Truist checking product.

Relationship Savings | |

|---|---|

Savings APY | 0.01% |

Savings Fees | $5

The monthly maintenance fee can be waived by maintain a minimum daily ledger balance of $300 OR

schedule a recurring preauthorized internal transfer of $25 or more per statement cycle into the Truist One Savings account OR

waived for a minor under the age of 18 OR

waived with ANY related Truist checking product

|

Minimum Deposit | $50 |

Truist bank also offers a money market account. The conditions and rates for Truist money market account are quite similar to Truist savings accounts.

CDs: Limited Terms, Competitive Rates

Truist offers Certificates of Deposit (CDs) as a secure and rewarding option for saving and growing your money. However, they don't disclosure CD rates on their website – a big drawback compared to other banks.

With flexible terms ranging from 7 days to 60 months, you have the freedom to choose the duration that suits your needs. There is no monthly maintenance fee associated with these CDs, making them cost-effective.

To open a CD with terms ranging from 7 to 31 days, a minimum deposit of $2,500 is required, while terms from 32 days to 60 months require a minimum deposit of $1,000. This allows customers to start their CD investment with varying amounts depending on their chosen term length.

To get started, interested individuals can visit a Truist branch and schedule an appointment. On the website, Truist presents rates of featured CD.

Credit And Lending Products

Truist offers a variety of credit cards with different rewards and features to cater to diverse preferences and needs.

Each card is designed to meet specific financial needs, whether it's maximizing cash back, earning travel rewards, establishing credit, or benefiting from a 0% intro APR:

- Truist Enjoy Cash Visa® Credit Card:

- Truist Enjoy Travel Visa® Credit Card:

- Truist Future Visa® Credit Card:

- Truist Enjoy Beyond Visa® Credit Card:

- Truist Enjoy Cash Secured Visa® Credit Card:

Truist offers various levels of financing to cater to diverse borrowing needs:

- Mortgage: Truist offers mortgages and pre-approval options, including jumbo and FHA mortgages.

- Personal Loans: This category includes loans and lines of credit, such as the Truist Ready Now Loan, Personal Line of Credit, and Physician Line of Credit. These options provide flexibility and coverage for personal expenses.

- Home Equity Line of Credit (HELOC): Ideal when refinancing isn't the right choice, a HELOC allows access to cash with a choice of fixed or variable rates. Interest paid on a HELOC may also be tax-deductible, and borrowers can access up to 90% of their home's value.

- Auto Loans: Offering the freedom to choose the desired car, Truist provides auto loans for purchasing or refinancing. Terms range up to 84 months.

- Boat & RV Loans: For adventurers seeking financing for boats, marine vessels, or RVs, Truist offers fixed-rate loans, making weekend getaways and travel dreams achievable.

Truist Bank: How Does It Look Like As A User?

Exploring the ins and outs of the Truist, we've dissected its features to see how they stack up for everyday users. Let's dive into our real experiences with key features, shedding light on what each one looks like in the app.

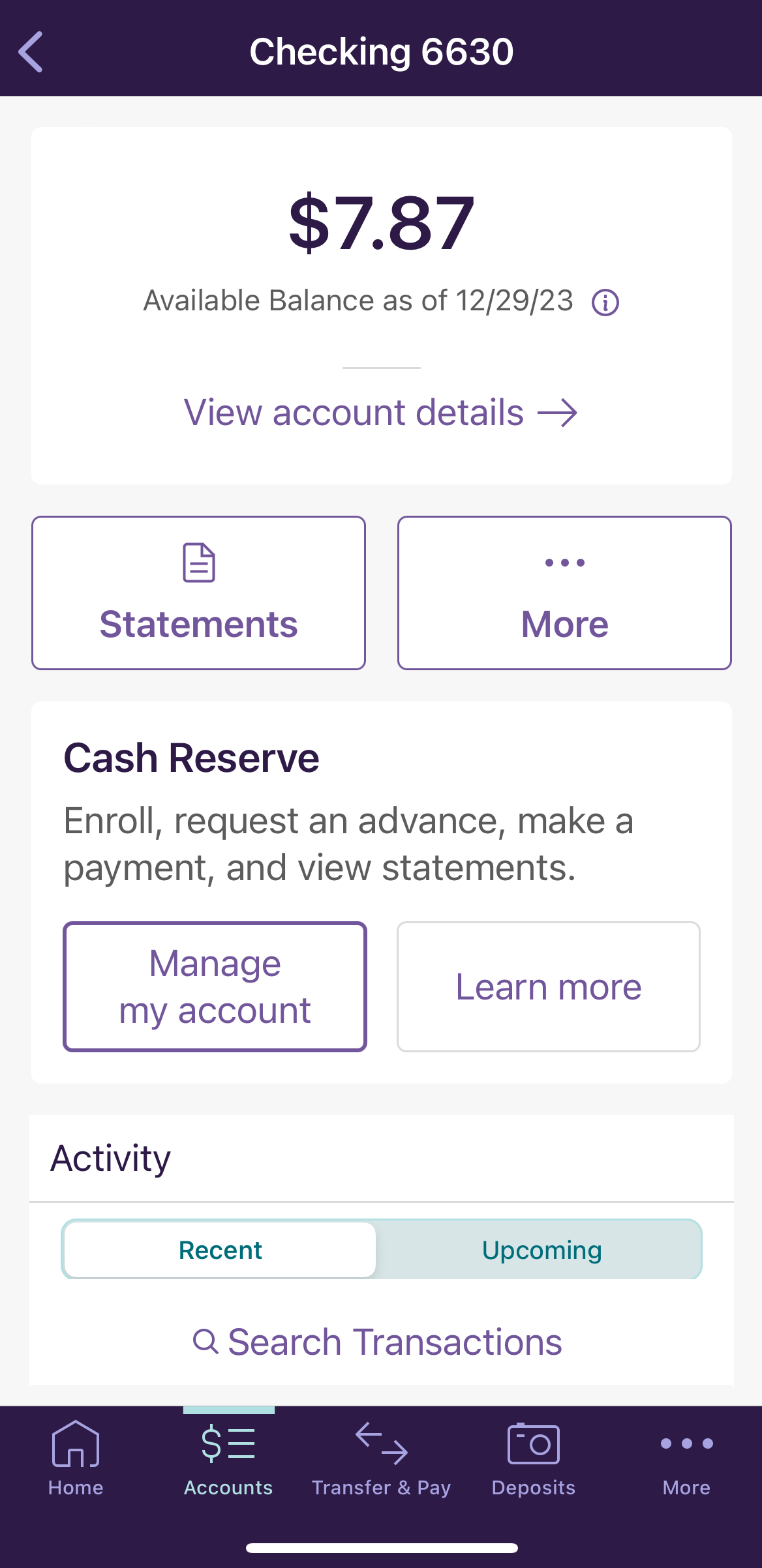

Navigating through the Truist app, accessing a comprehensive overview of your checking account is a breeze.

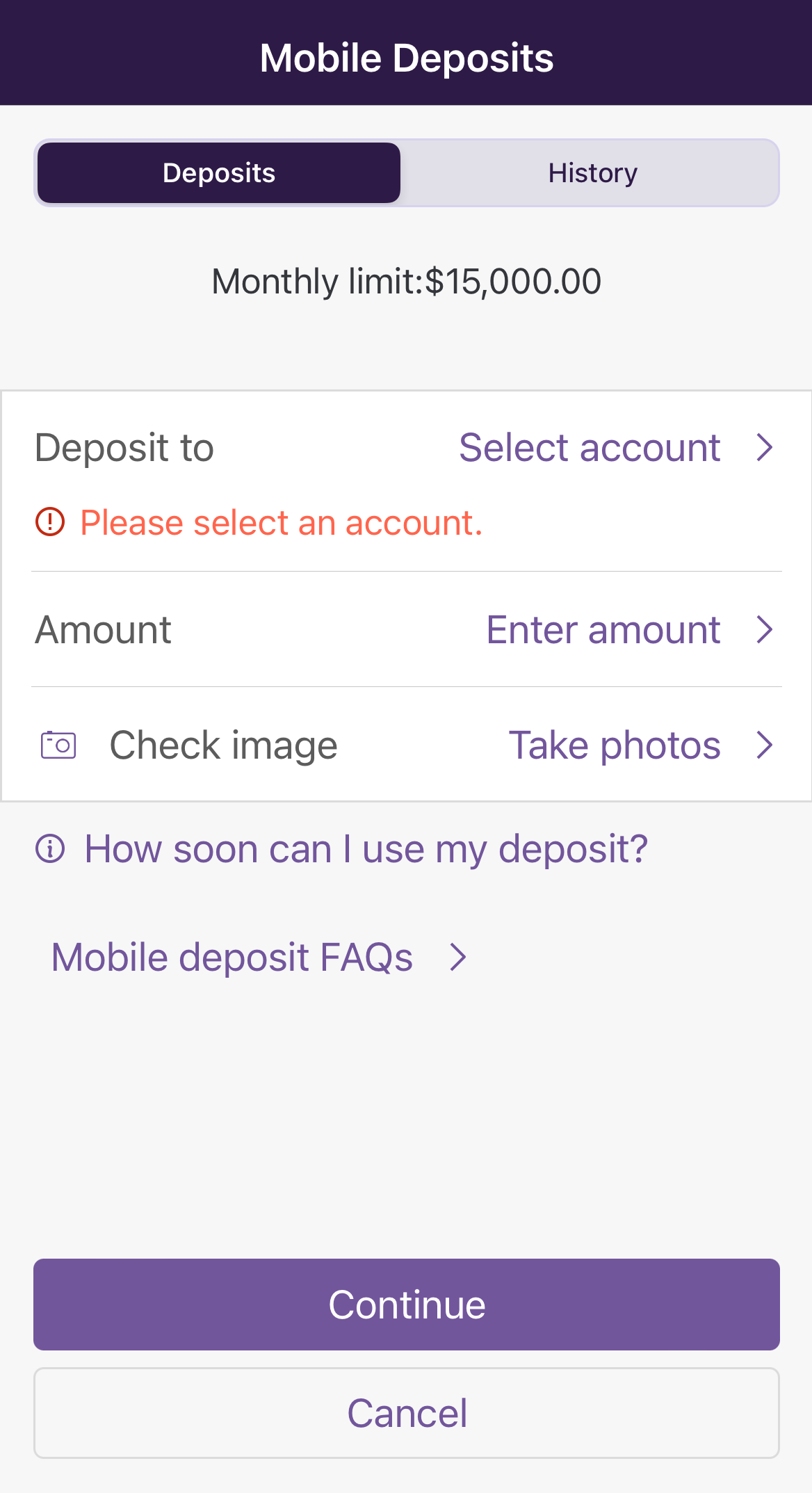

Our experience has shown that depositing a check is as simple as snapping a photo. The app guides you through the process, ensuring proper image capture for a seamless and quick deposit.

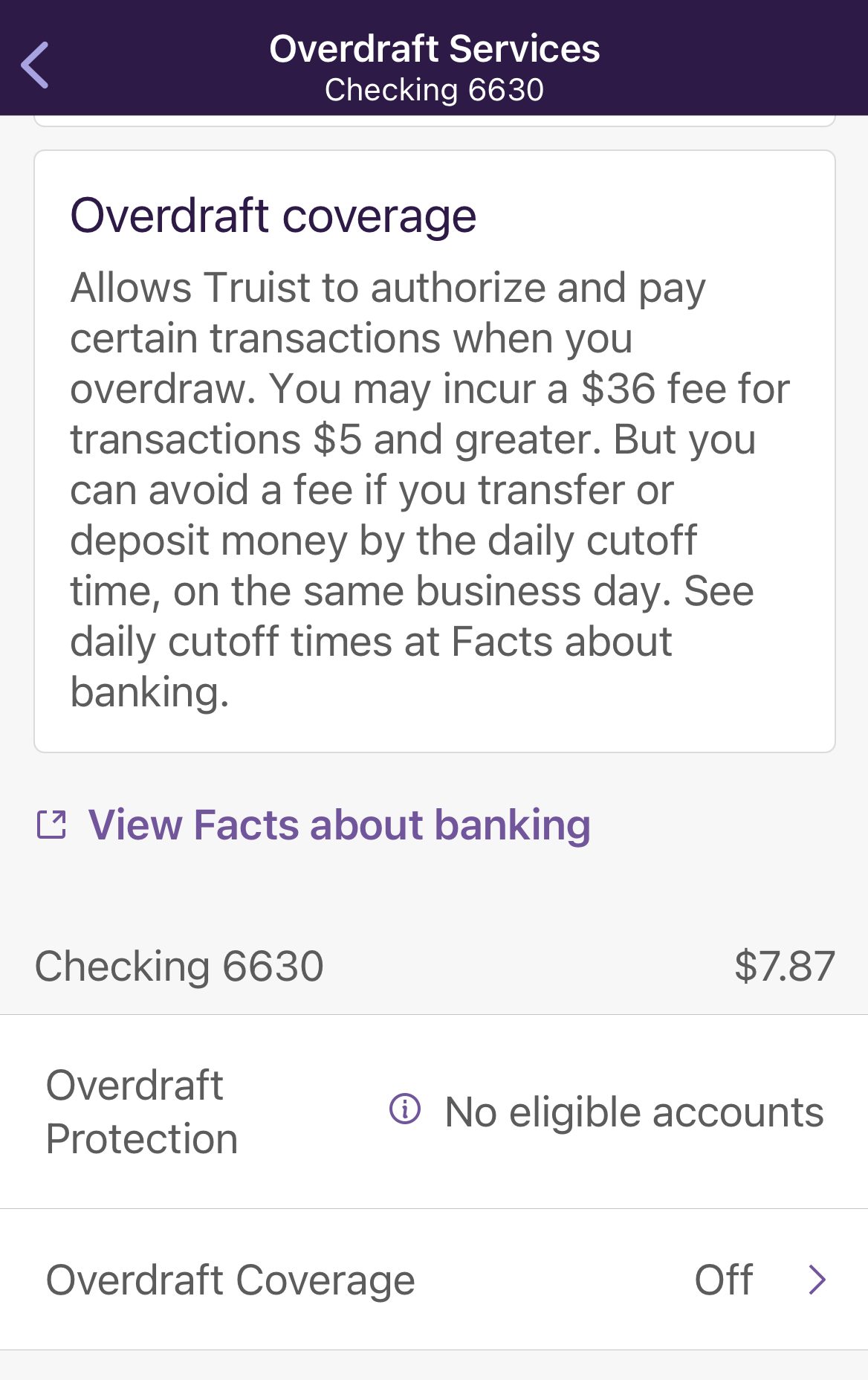

Through the app, users can easily toggle overdraft coverage on and off according to their preferences. Moreover, the app transparently displays associated fees, ensuring users are fully informed about the financial implications of their choices.

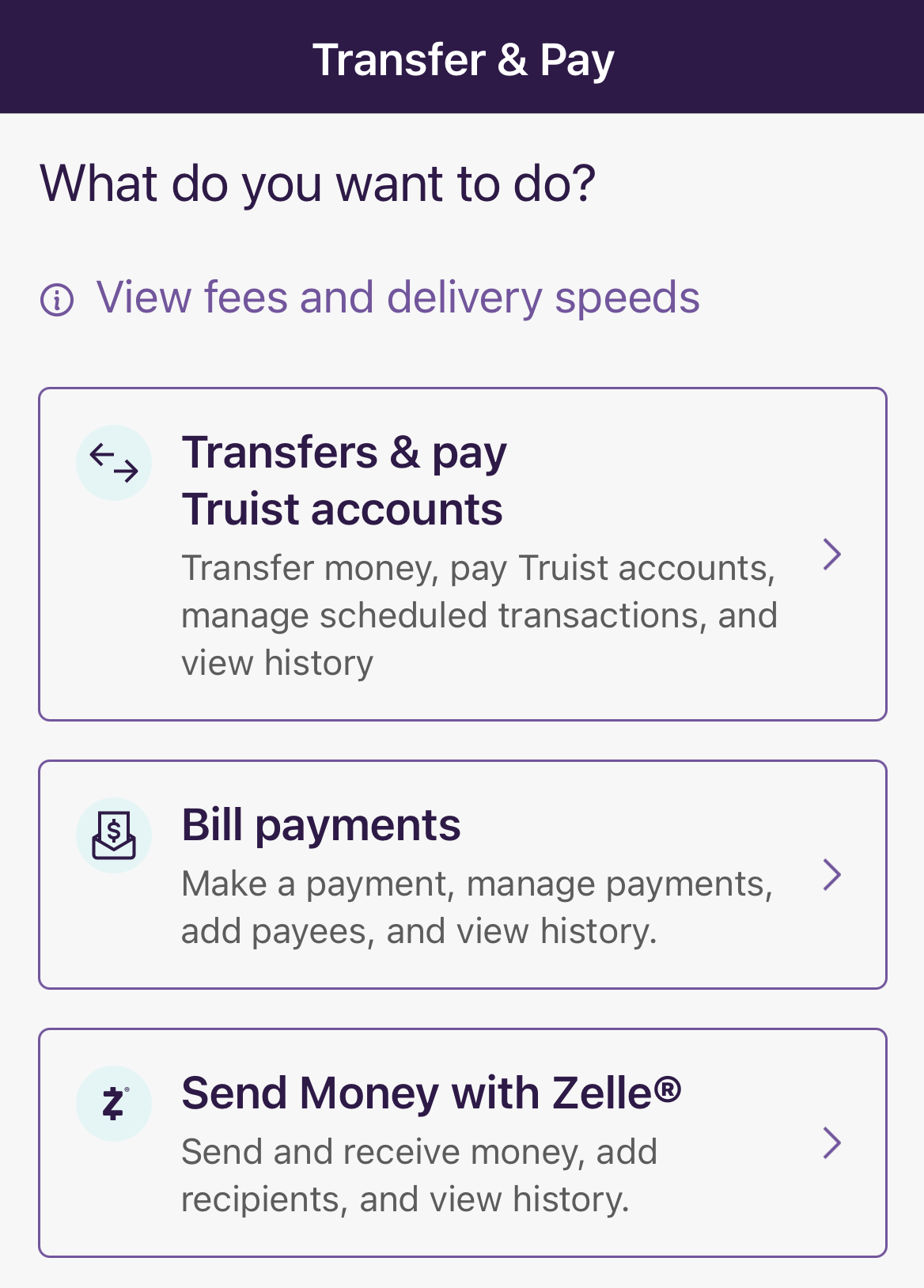

Lastly, Truist app offers a range of options, from transferring money between accounts to paying Truist accounts seamlessly. The ability to manage scheduled transactions adds a layer of control, allowing users to plan their financial moves effectively.

The integration of Zelle for sending money further expands the app's functionality, making it a one-stop-shop for various financial transactions.

Compare Truist Versus Other Banks

While Truist is a full-service bank where you can find almost any financial product, Chase is our winner. Here's why – and what else to know: Chase vs. Truist Bank

There is no clear winner as to whether Truist Bank or Bank of America is a better choice, but we prefer the latter. Here's why.

Wells Fargo offers better savings rates than Truist Bank, more selection for checking accounts and better credit cards. Here's our comparison: Truist Bank vs. Wells Fargo Bank

Citibank is our winner due to its checking account options, various credit cards, and better savings account rates than Truist Bank.

Overall, we like Fifth Third a bit more than Truist bank, mainly due to the various checking options. Truist is better in credit cards.

Each bank excels in different categories, but our winner is M&T Bank over Truist. There are some reasons for that, here's our comparison: Truist Bank vs. M&T Bank

Our winner is PNC Bank as it offers more options for checking and higher savings rates than Truist bank. Here's our comparison: Truist Bank vs. PNC Bank

Both Truist and TD Bank are active in a variety of states, such as Florida, Georgia, North And South Carolina, and more. Here's our winner: Truist Bank vs. TD Bank

There is no clear-cut answer to which bank is better, but Regions Bank is better than Truist if we have to choose one. Here's why: Truist Bank vs. Regions Bank

Our preferred choice is American Express, which provides a comprehensive banking package that outshines Truist Bank. Here's how they compare: Truist Bank vs. American Express Bank

Related Posts

How We Rate And Review Banks: Our Methodology

The Smart Investor team extensively reviewed hundreds of banks and credit unions. We assessed them based on four main categories, each with specific features:

-

Diversity of Products and Their Attractiveness (40%): We extensively analyzed the breadth and appeal of each bank's product offerings, including savings accounts, checking accounts, loans, investment options, and more. Higher ratings were assigned to banks with a diverse range of products that are attractive in terms of interest rates, fees, terms, and additional features. This category provides insights into the variety and value of the bank's offerings, crucial for meeting customers' diverse financial needs.

-

Account Features (30%): This category delves into the features and benefits accompanying each bank's accounts. We scrutinized factors such as promotions, deposit and withdrawal options, ATM accessibility, online and mobile banking functionalities, as well as additional perks like overdraft protection and rewards programs. Banks offering comprehensive and convenient features received higher ratings, reflecting the overall value of their accounts to customers.

-

Customer Experience (20%): A positive customer experience is paramount in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Bank Reputation (10%): The reputation of a bank is a critical consideration for customers. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were awarded to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories, individuals can make informed decisions that align with their financial needs and preferences, ensuring they choose a bank that offers competitive products, excellent features, a positive customer experience, and a solid reputation.