Table Of Content

Managing finances efficiently and securely is a crucial aspect of personal finance. In an increasingly digital world, linking multiple bank accounts offers a convenient and streamlined approach to financial management.

This article explores the concept of linking bank accounts, discussing the benefits and functionality, and addressing concerns regarding safety and security.

Linking Between Bank Accounts: How Does It Work?

Linking between bank accounts refers to the process of connecting or integrating multiple bank accounts, typically held at different financial institutions, to facilitate seamless financial management.

When it comes to linking bank accounts, individuals typically have several options based on their preferences and the services provided by their financial institutions. Here are the three primary options for linking bank accounts:

-

Same Bank

If you have multiple accounts with the same bank, most banks offer the option to link these accounts together. This enables seamless transfer of funds between accounts and provides a consolidated view of your finances within the bank's online or mobile banking platform.

Linking accounts within the same bank is usually straightforward and requires minimal additional authentication.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

-

Between Different Banks

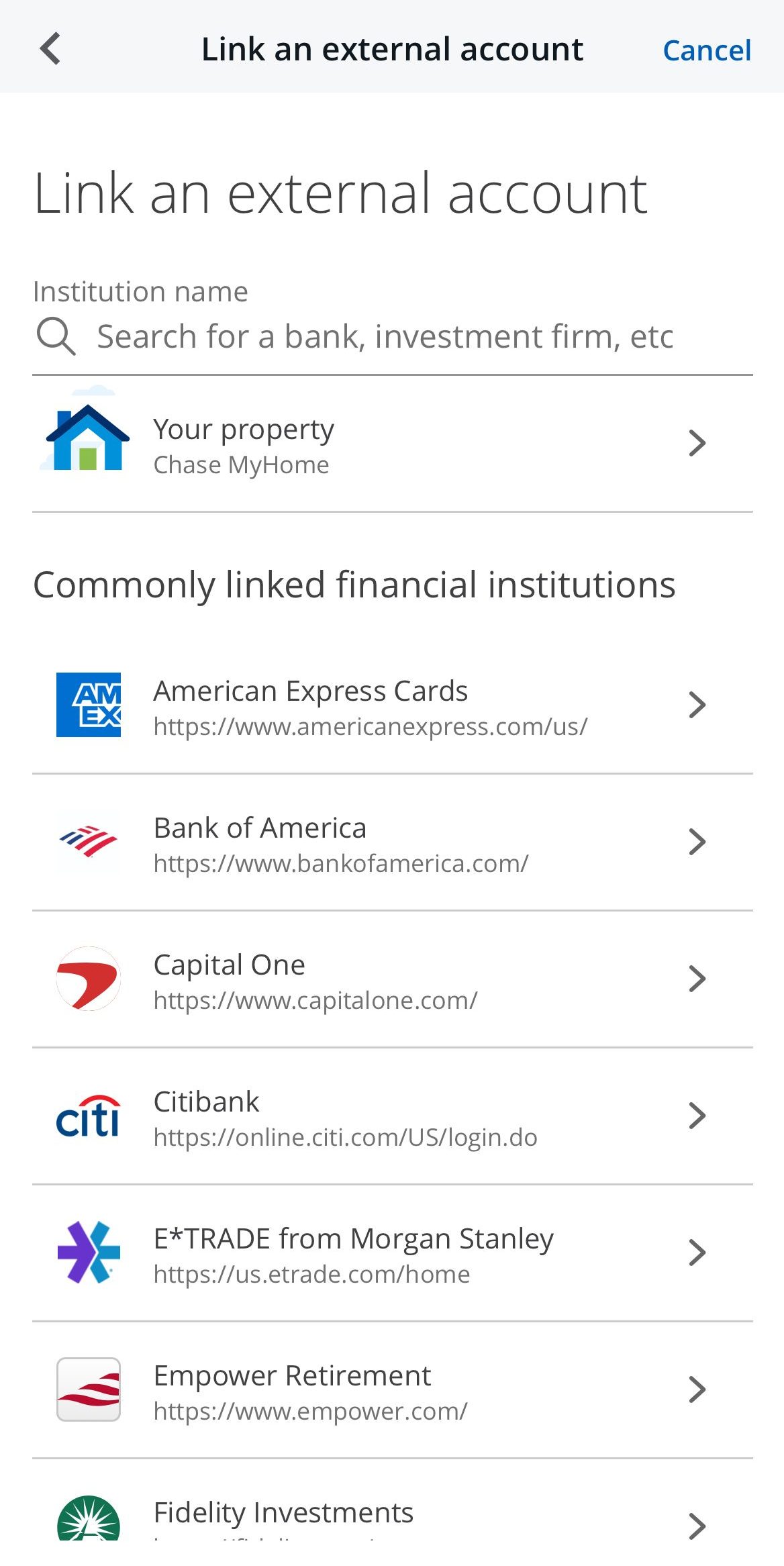

Some financial institutions allow customers to link accounts held at different banks. This feature enables you to view and manage accounts from multiple banks through a single interface, usually provided by your primary bank.

The process typically involves providing the necessary information for the external account, such as the account number and routing number, to establish the link. This option is particularly useful if you maintain accounts at different banks and wish to centralize their management.

-

Third-Party Apps

There are also third-party financial apps and platforms that offer the ability to link and manage multiple bank accounts. These apps act as intermediaries, connecting to your different bank accounts securely and providing a consolidated view of your finances.

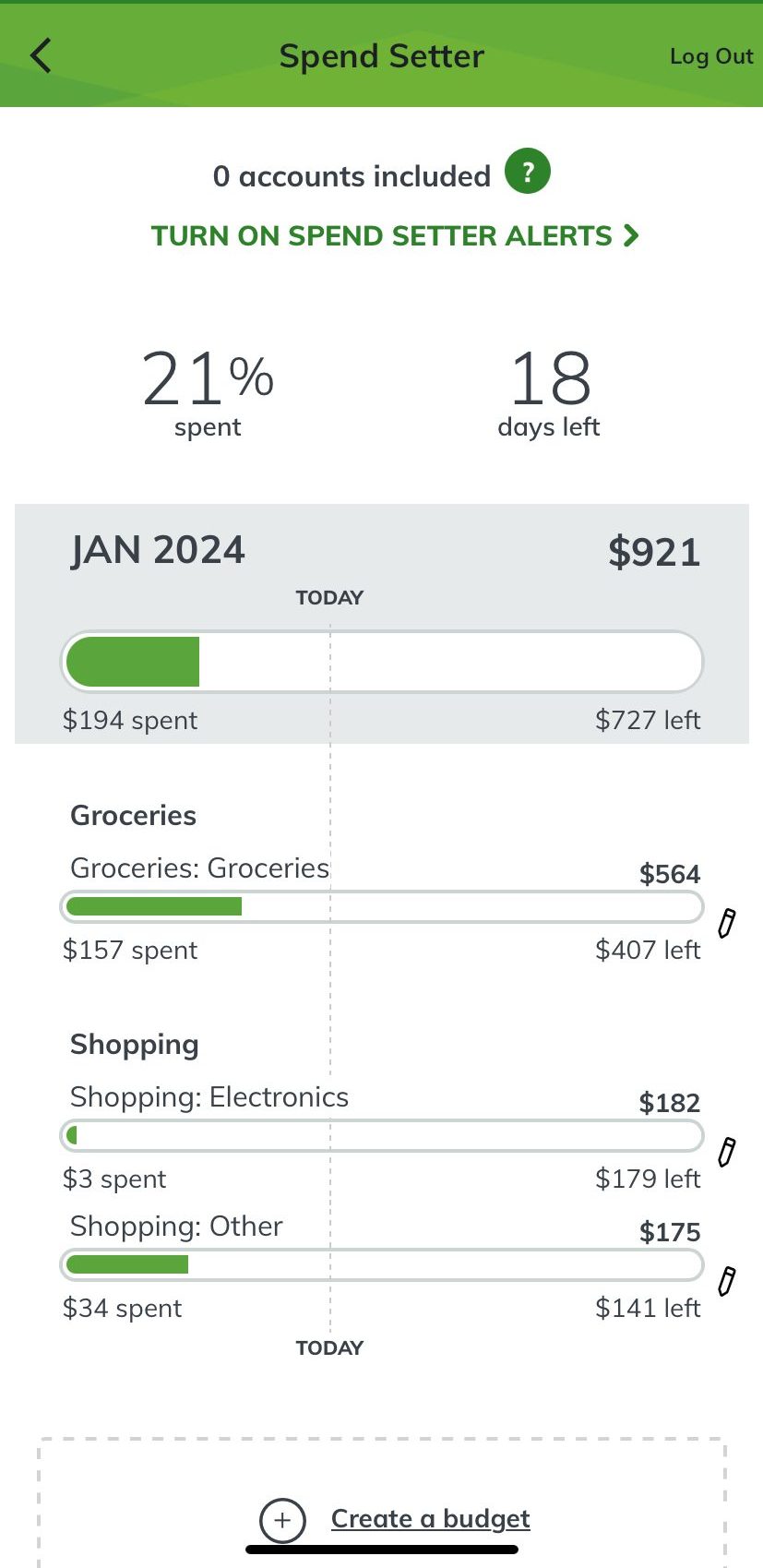

Examples of popular third-party apps include budgeting tools like Mint, personal finance apps like Personal Capital, or mobile payment apps like CashApp. These apps often require you to provide your bank account credentials or establish secure connections using APIs (Application Programming Interfaces).

Benefits Of Linking Between Bank Accounts

Linking between bank accounts offers numerous benefits that can enhance your financial management and provide a more seamless banking experience. Here are some key advantages of linking bank accounts:

Convenience and Efficiency: One of the primary benefits of linking accounts is the convenience it offers. Instead of logging into multiple bank accounts or visiting different banking portals, you can access and manage all your linked accounts from a single platform or application. This streamlined approach saves time and effort by providing a centralized view of your finances and simplifying tasks such as transferring funds between accounts or monitoring transactions.

Comprehensive Financial Snapshot: By linking your accounts, you gain a holistic view of your financial situation. You can see all your balances, transactions, and account details in one place, making it easier to track your overall financial health. This comprehensive snapshot helps you analyze your spending patterns, identify areas where you can save or cut back, and make more informed financial decisions.

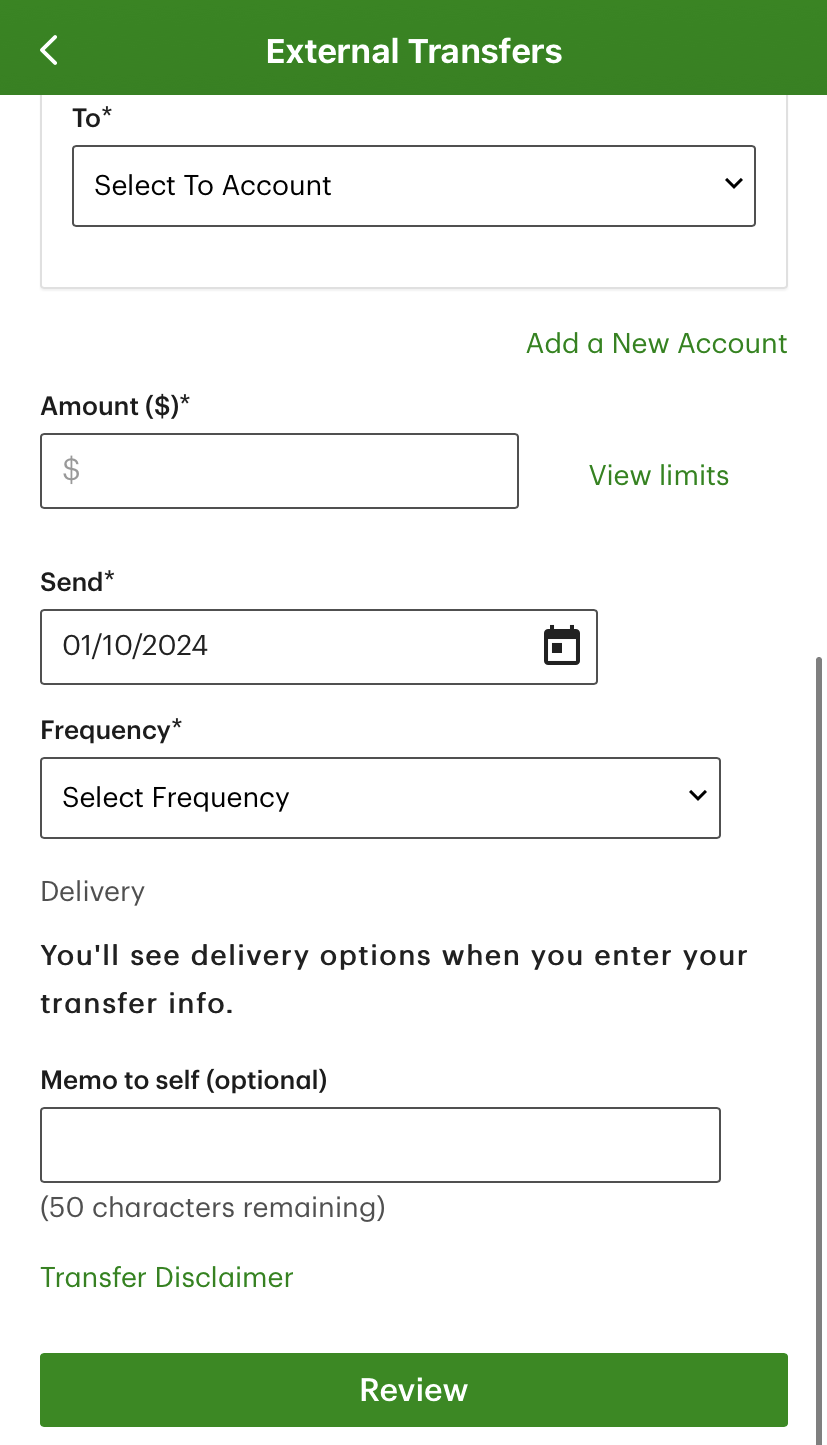

- Enhanced Fund Transfers: Linking between accounts facilitates seamless fund transfers. You can easily move money between your linked accounts without the need to initiate external transfers, write checks, or visit physical bank branches. This feature is particularly useful if you have accounts at different banks or need to transfer funds regularly between personal and business accounts.

- Consolidated Budgeting and Planning: With linked accounts, you can create and maintain a consolidated budget. By having a centralized view of all your income and expenses, you can better allocate funds, set financial goals, and track your progress. This can be especially helpful for individuals who want to maintain a comprehensive budgeting system or monitor multiple financial goals simultaneously.

While the benefits of linking between bank accounts are significant, it's important to consider the safety and security aspects as well. Ensure that you link accounts with trusted financial institutions or secure third-party apps that employ robust security measures to protect your sensitive financial information.

Is It Safe To Link Between Bank Account?

Linking between bank accounts can be safe if proper precautions are taken and reputable financial institutions or secure third-party apps are utilized. However, it's important to understand and address the potential risks involved.

Here are some considerations regarding the safety of linking between bank accounts – and how to deal with them:

-

Security Measures

Reputable banks and financial institutions employ robust security measures to protect customer data and transactions. These may include encryption protocols, secure authentication methods, and ongoing monitoring for suspicious activities.

How to protect yourself: When considering linking accounts, ensure that the financial institution or third-party app you choose follows industry-standard security practices to safeguard your sensitive information.

-

Authentication and Access Controls

Linked accounts often require authentication and access controls to establish connections and perform transactions. These may include password-based login, two-factor authentication (2FA), biometric authentication, or unique security codes.

How to protect yourself: It's crucial to choose strong and unique passwords, enable any additional security features provided, and regularly update your login credentials to minimize the risk of unauthorized access.

-

Privacy and Data Protection

Before linking accounts, review the privacy policies and data protection practices of the financial institution or third-party app. Understand how they handle and protect your personal and financial information.

Look for reputable institutions that prioritize customer privacy and employ secure data storage and transmission protocols.

Sign Up for

Our Newsletter

-

Regular Monitoring

It's essential to regularly monitor your linked accounts for any suspicious activities or unauthorized transactions.

How to protect yourself: Review your transaction history, account balances, and notifications from your financial institution or app. Promptly report any discrepancies or concerns to your bank or the relevant customer support channels.

-

Trusted Institutions and Apps

Choose to link accounts only with trusted and well-established financial institutions or reputable third-party apps. Research their reputation, read reviews, and verify their credentials before providing any sensitive information or establishing connections.

Be cautious of unknown or suspicious platforms that may pose a higher risk to your financial security.

How To Link Between Bank Accounts?

The process of linking between bank accounts may vary depending on the financial institution and the platform or application you are using. However, here are general steps that can guide you through the process:

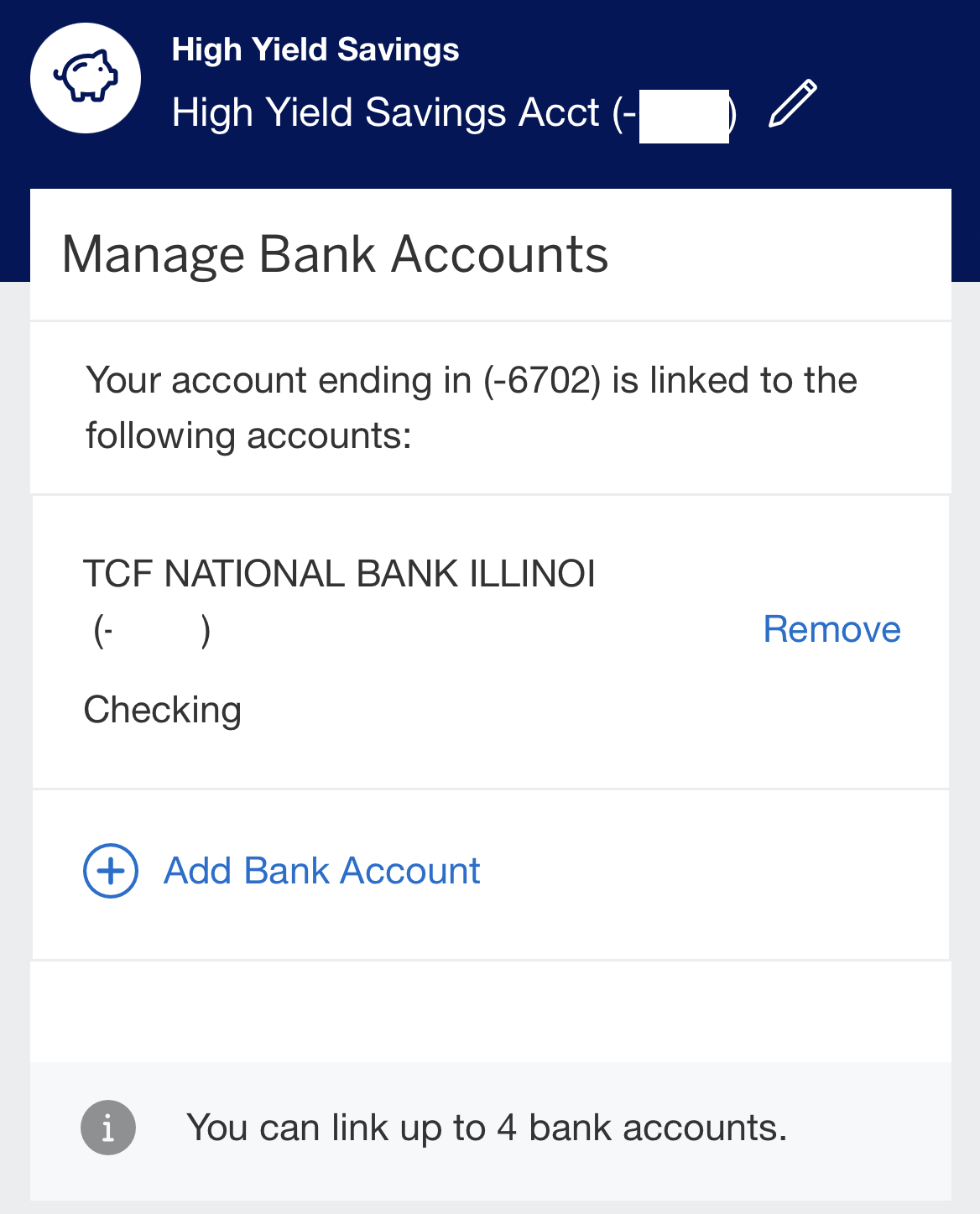

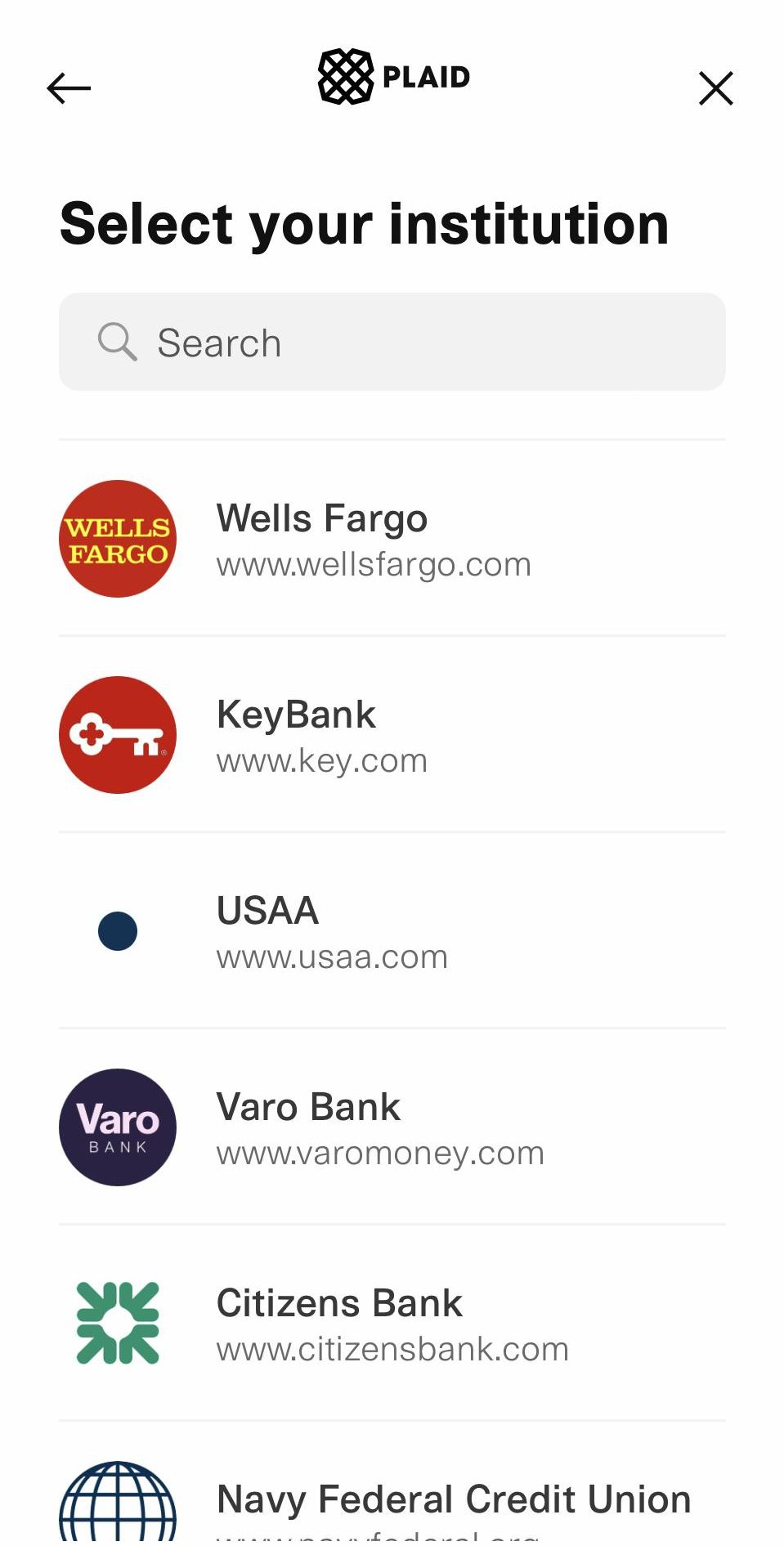

Determine the Linking Method: Identify the method you will use to link your bank accounts. This could be within the same bank, between different banks, or through a third-party app. Ensure that the banks or app you choose support the linking functionality.

Gather Necessary Information: Collect the required information for the accounts you want to link. This typically includes the account number, routing number, and the name of the financial institution where the account is held. You may find this information on your account statements or by contacting your bank directly.

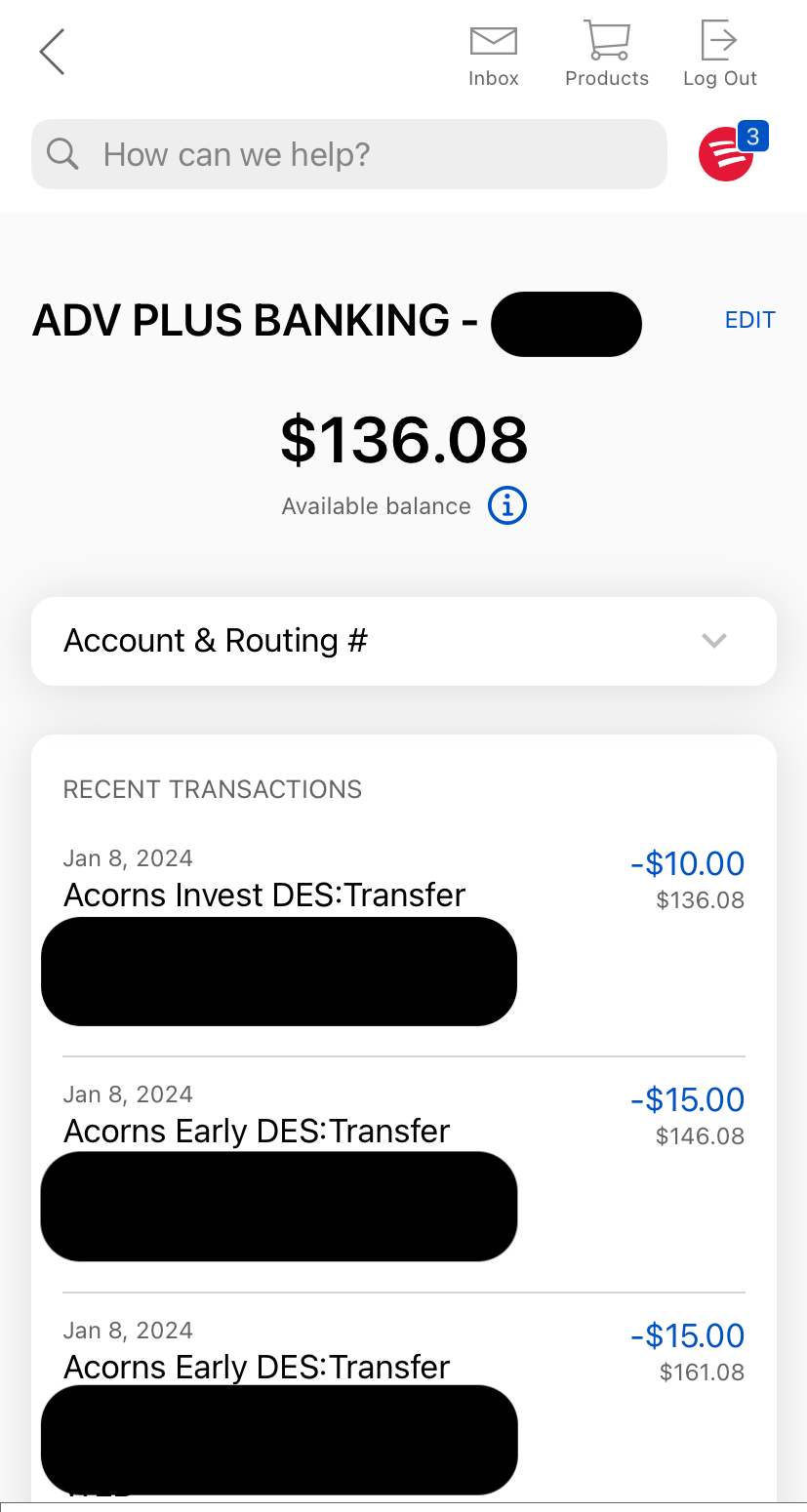

Log into the Primary Account: If you're linking accounts within the same bank, log into your primary bank account through the online banking portal or mobile app. If you're using a third-party app, download and install the app on your device and create an account.

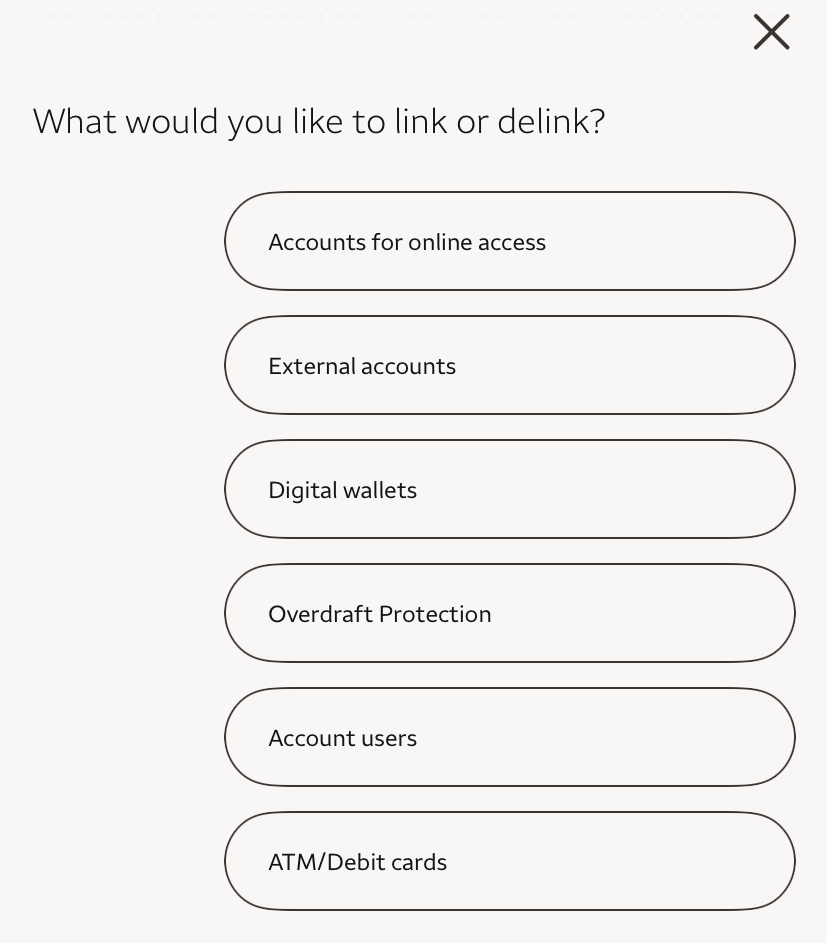

4. Navigate to the Linking Section: Within your primary bank account or the third-party app, locate the section or option for linking accounts. This is usually found in the settings, account management, or linked accounts section. Follow the prompts or instructions provided to initiate the linking process.

5. Provide Account Information: Enter the required information for the account you want to link. This typically includes the account number, routing number, and the name of the financial institution where the account is held.

6. Verify: Review the information you provided for the linked account and confirm that it is correct. Some banks or apps may require additional authentication or verification steps to ensure the security of the linking process.

7. Confirm Successful Linking: After completing the linking process, verify that the accounts have been successfully linked. You should be able to see the linked accounts within your primary bank account or the third-party app's interface.

It's important to note that the specific steps and options may differ based on the banks or apps you are using. If you encounter any difficulties or have questions, it's recommended to reach out to your bank's customer service or refer to the help documentation provided by the app or platform you are using for further guidance.

I Don't Want To Link My Accounts. What Are The Alternatives?

While linking between bank accounts offers convenience, there are alternative methods to manage multiple accounts without establishing direct links. Here are some alternatives to consider:

Manual Transfers: Instead of linking accounts, you can manually transfer funds between your accounts when needed. This involves initiating transfers through online banking, mobile apps, or visiting a physical bank branch. While this method requires more effort and may not provide real-time updates, it offers a level of control and separation between accounts.

Third-Party Payment Apps: If your goal is to make payments or transfer funds between accounts, using third-party payment apps can be an alternative. Apps like Venmo, PayPal, or Zelle allow you to link your bank accounts within the app and transfer funds between them seamlessly. While this method is more focused on payments, it offers a simple way to manage transactions between accounts.

Sign Up for

Our Newsletter

FAQs

Can I link accounts with different currencies?

Depending on the bank or platform, it may be possible to link accounts with different currencies. However, currency conversion fees and exchange rates may apply when transferring funds between linked accounts with different currencies.

Can I transfer funds between my linked accounts instantly?

Transferring funds between linked accounts can vary depending on the banks involved. In some cases, transfers can be processed instantly, while others may require a processing period of a few business days. Check with your bank for specific details on fund transfer times.

Are there any fees associated with linking between bank accounts?

Banks typically do not charge fees for linking accounts within the same institution. However, there may be fees or service charges associated with specific transactions or services related to linked accounts. It's best to check with your bank to understand any potential costs involved.

Can I unlink my bank accounts later if I change my mind?

Yes, in most cases, you can unlink your bank accounts at any time. Contact your bank or the relevant customer support to initiate the unlinking process, and they will guide you through the necessary steps.

Will linking accounts affect my credit score?

Linking accounts does not impact your credit score.