Both Barclays Bank and Synchrony Bank offer great savings products for their customers, but lack a checking account. Which bank offers better deals?

Let's compare their savings accounts, CDs, credit cards and lending options.

Savings Accounts

Synchrony Bank is our winner as it offers slightly higher savings rates than Barclays.

Barclays provides seamless online transfers to and from other banks and the convenience of direct deposit. Barclays also provides tools such as the Savings Assistant to aid customers in reaching their savings goals.

Barclays Online Savings | Synchrony Savings | Synchrony Money Market | |

|---|---|---|---|

Savings Rate | up to 4.10%

| 3.80% | 2.00% |

Minimum Deposit | $0 | $0 | $0 |

Fees | $0 | $0 | $0 |

On the other hand, customers can have the convenience of banking with Synchrony anytime and manage online savings accounts using the Synchrony Bank app. The added convenience of accessing funds through an ATM card enhances the overall banking experience.

Synchrony also offers money market accounts, but the rates are low compared to its savings account.

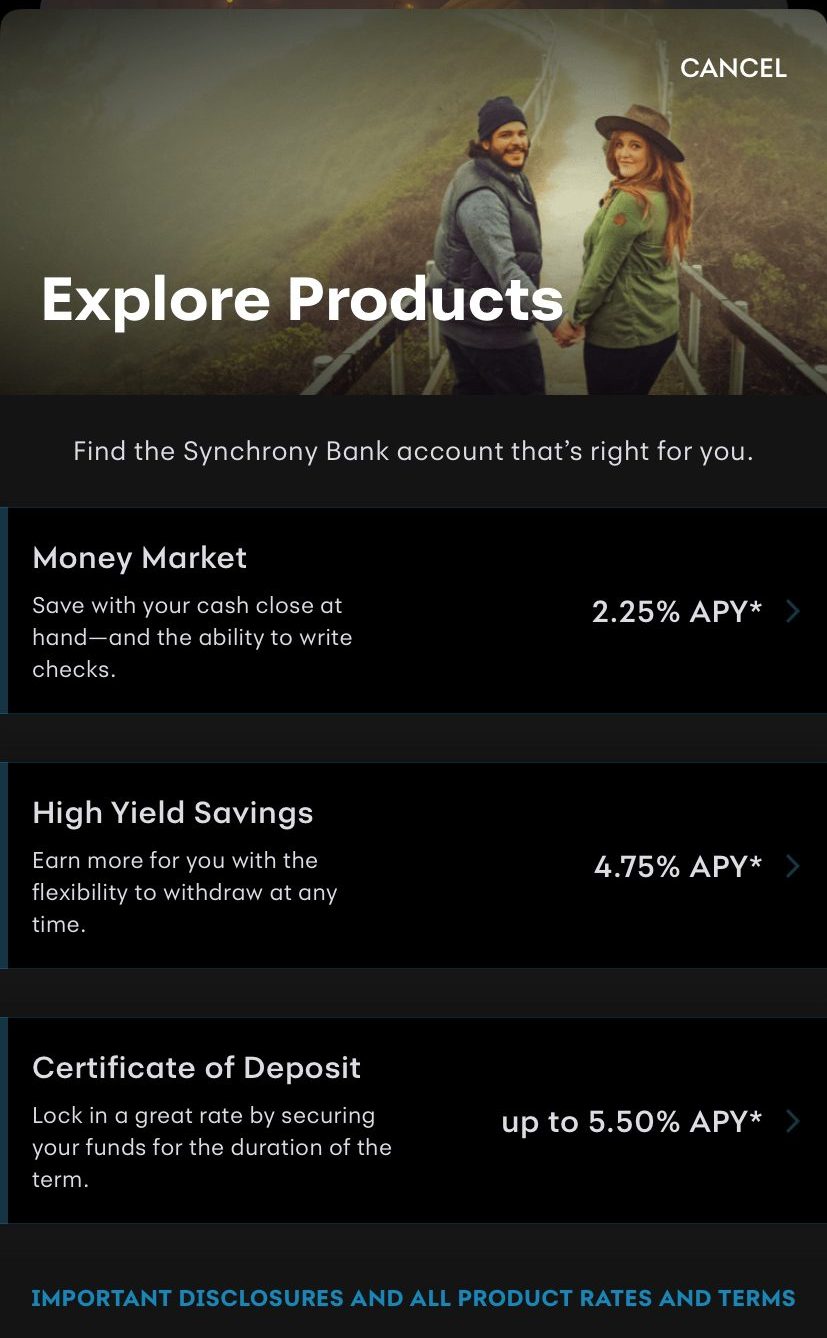

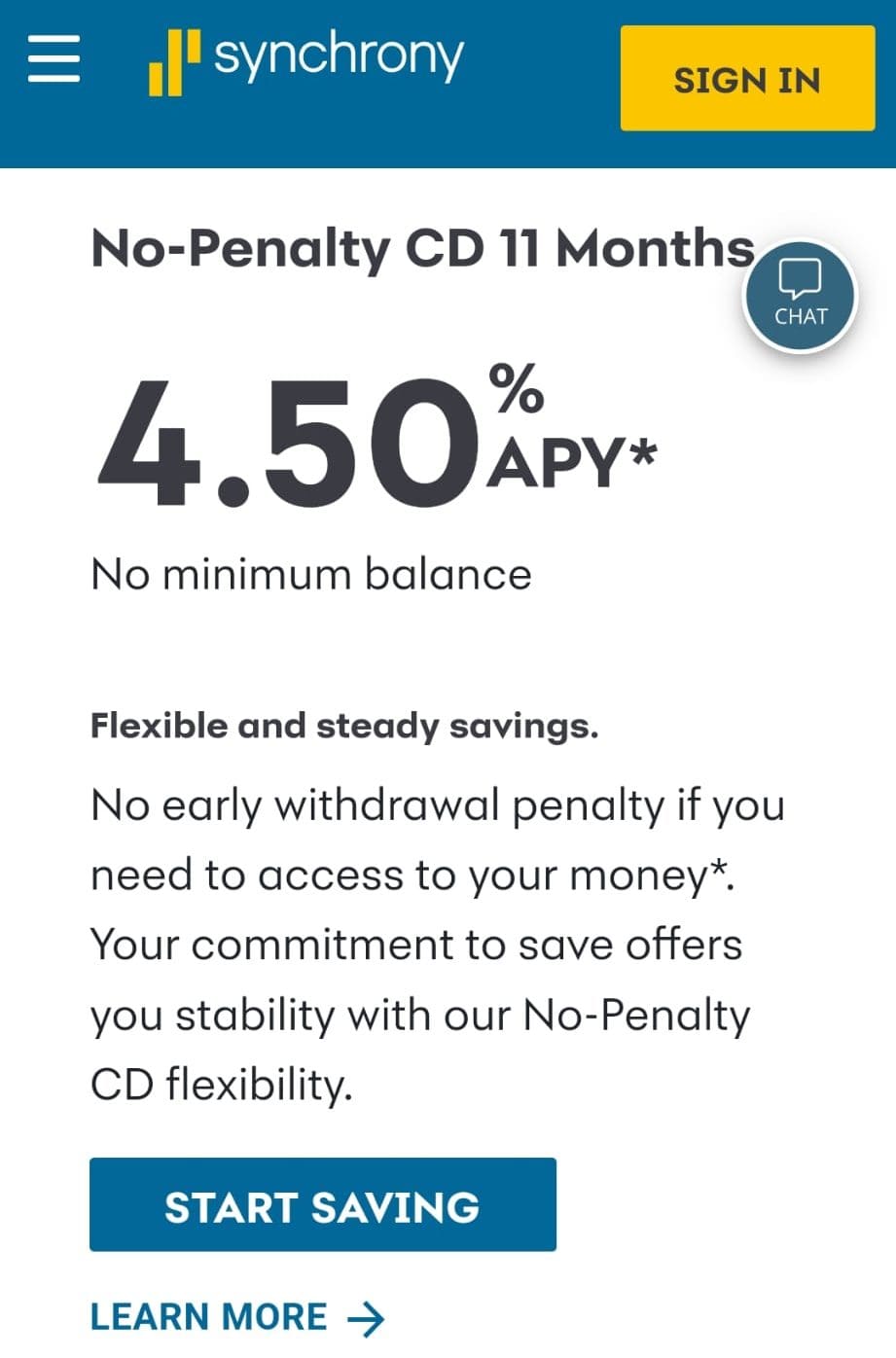

Certificate Of Deposits (CDs)

While both Synchrony and Barclays offer great options when it comes to CDs, Synchrony Bank is our winner with more terms and even no penalty CD.

Furthermore, both banks let you be flexible with your CD investments. You can use strategies like CD laddering and mix short and long-term CDs. This flexibility means you have more say in how you invest your money, and you can adjust your CD strategy to match your financial goals.

-

Barclays Bank vs Synchrony CD Rates

CD Term | Synchrony | Barclays |

|---|---|---|

3 Months | 0.25% | N/A |

6 Months | 3.70% | N/A |

9 Months | 3.90% | N/A |

12 Months | 4.00% | 4.00% |

18 Months | 3.80% | 3.25% |

24 Months | 3.50% | 3.00% |

No Penalty CD – 11 Months | N/A

| N/A |

36 Months | 4.00% | 3.00% |

48 Months | 3.50% | 3.00% |

60 Months | 4.15% | 3.25% |

Credit Cards

When it comes to credit cards, Synchrony Bank is our winner despite the differences are not signficiant.

Barclays offers many options but mainly offers co-branded cards and not general reward cards. If you're a big fan of flying with American Airlines, you might want to check out the AAdvantage Aviator Red World card. It gives you awesome stuff like airline miles, better boarding, and other cool travel perks.

Now, if you're more into shopping at Banana Republic and other Gap Inc. brands, the Banana Republic Rewards Mastercard is the way to go. This card hooks you up with rewards you can use at their stores, plus you get discounts, early access to sales, and bonus points for things outside of those brands.

Card | Rewards | Bonus | Annual Fee |

| AAdvantage Aviator Red World Elite Mastercard | 1X – 2X

2X miles for every one dollar spent on eligible American Airlines purchases and 1X miles on all other purchases | 60,000 miles

60,000 AAdvantage miles after making one purchase and paying the $99 annual card fee in full, both within the first 90 days

| $99 |

|---|---|---|---|---|

| The JetBlue Card | 1X – 3X

3 points per $1 spent on JetBlue purchases, 2 points per $1 at restaurants and grocery stores and 1 point per $1 on all other purchases

| 10,000 points

10,000 points when you spend $1,000 in the first 90 days after opening your account

| $0 |

| Banana Republic Credit Card | 1X – 5X

5 points for every dollar spent at Banana Republic, Gap, Athleta and Old Navy. 1 point per dollar on all other purchases | 20% off your first order

20% off your first order at Banana Republic

| $0 |

| Wyndham Rewards Earner Card | 1x – 5x

5X points on eligible purchases made at Hotels by Wyndham as well as on qualifying gas purchases. Earn 2X points on eligible dining and grocery store purchases (excluding Target® and Walmart®) and 1X points on all other purchases (excluding Wyndham Vacation Club down payments).

| 45,000 points

Earn 45,000 bonus points after spending $2,000 on purchases in the first 180 days

| $0 |

Synchrony Bank offers a variety of credit cards, including many co-branded cards.

The Synchrony Home card with promotional financing, allowing cardholders to enjoy six to twelve months of deferred interest on qualifying purchases. Some partner locations extend this benefit up to 60 months.

Synchrony provides three tiers of Mastercard credit cards: the Preferred, Plus World, and Premier World. It also offers many co-branded cards with the top brands in the US, such as JCPenney, American Eagle, Walgreens, and more.

Card | Rewards | Credit Requirementss | Annual Fee | |

|---|---|---|---|---|

| Synchrony Home Credit Card | Promotional Financing

six months of promotional financing on purchases of $299-$1,998.99, or 12 months of promotional financing on purchases of $1,999 or more. Some Synchrony partner locations defer interest for up to 60 months.

| Excellent | $0 |

| Synchrony Premier World Mastercard | 2%

2% cash back on all purchases | Good – Excellent | $0 |

| JCPenney Credit Card | 5%

1 point for every dollar at JCPenney, 200 points worth $10 -> $10 per $200 spend on JCPenney = 5% back

| Fair – Good | $0 |

| American Eagle Credit Card | 30X – 40X

15 points Instant for cardmembers. 30 points per dollar spent at American Eagle, 20 points if you spend more than $350 annually | Fair – Good | $0 |

Mortgage And Loans

None of these banks offers many options for borrowers. Barclays offers personal loans while Synchrony doesn't offer options for borrowers.

If you need broad lending options, you may want to choose a brick-and-mortar bank.

Checking Accounts

Both Barclays and Synchrony don't offer a checking account, a significant drawback for personal consumers who want to manage their money and not only deposit it in a savings accounts.

Also here, brick-and-mortar banks such as Chase, Bank Of America, Citibank, and others may be a better option.

Which Bank Is Our Winner?

Overall, there is no clear winner but if we have to choose one – Synchrony bank is our winner. It offers better savings account rates, more options when it comes to CDs, and a variety of credit cards.

However, it's important to think about different things, especially the ones that matter most to you. This might include looking at banking services, help with overdrafts, how often you use ATMs, how close the bank is to where you live, and other things that are different for each person.

How We Compared Barclays and Synchrony: Methodology

In our comprehensive banking comparison, The Smart Investor team meticulously reviewed and compared banks across five vital categories:

Checking Accounts (30%): We thoroughly examined features such as direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. Special offers available to customers were also taken into account.

Savings Accounts and CDs (20%): Our focus centered on critical factors including the Annual Percentage Yield (APY), minimum deposit requirements, account flexibility, FDIC insurance coverage, special savings offers, variety of CDs, automatic renewal options, and early withdrawal penalties.

Credit Cards (15%): We carefully analyzed rewards programs, annual fees, introductory bonuses, travel benefits, APR, and balance transfer options provided by each bank's credit cards to offer a comprehensive comparison of available features.

Lending Options (15%): We evaluated the variety of loan options offered, encompassing personal loans, student loans, mortgages, secured loans, HELOCs, and Home Equity Loans, providing valuable insights into the banks' lending capabilities.

Customer Experience and Bank Reputation (20%): Our assessment included an analysis of online banking and mobile app usability and ratings, accessibility of customer support, online reviews, JD Power research, Trustpilot ratings, and overall financial stability, delivering a holistic perspective on customer experience and reputation.

Compare Synchrony Bank

Marcus distinguishes itself through its investment options. With a variety of IRA options, you can experiment with different account types and portfolios. Marcus may appeal to you if you want the convenience of having your funds in a high yield savings account or if you are new to investing.

Synchrony focuses on accounts that help you save money. So there are high yield savings accounts, CDs, and money market accounts. You can also gain access to IRAs. Synchrony does, however, offer a variety of credit cards.

Read Full Comparison:: Marcus vs Synchrony Bank: Where to Save Your Money?

American Express is our winner with a decent checking account, an impressive savings account, and a great selection of credit cards.

Synchrony Bank vs. American Express Bank: Which Bank Account Is Better?

Capital One is our winner with a full banking package, including a decent checking option, high savings rates, and great credit cards.

Ally Bank is our winner with a complete banking package, including a checking account ( not available with Synchrony) and high savings rates.

Compare Barclays Versus Other Banks

Citi offers an excellent range of banking products that cover the majority of your financial needs.

Personal loans, mortgages, credit cards, investment options, IRAs, and wealth management plans are available in addition to savings and checking accounts. Barclays' product line is more streamlined. This bank offers credit cards, savings accounts, credit cards, and personal loans.

The most obvious product gap is the absence of a checking account. As a result, Barclays becomes more of a supplementary bank rather than your primary day-to-day financial institution.

Read Full Comparison: Citi vs Barclays: Which Bank Account Is Better?

Barclays and HSBC are non-US banks that offering various banking services to US customers. Let's compare their banking options side by side: Barclays Bank vs. HSBC Bank

Amex comes out on top with a solid checking option (which Barclays doesn't have), an excellent savings account, and great credit cards.

Barclays Bank vs. American Express Bank: Which Bank Account Is Better?

Capital One is our winner for most consumers than Barclays bank. But, there are important things to consider when comparing them: Barclays Bank vs. Capital One

Both Chase and Barclays offer a significant portfolio of banking services for US-based customers, but Chase is our winner. Here's why.

Chase Bank vs. Barclays Bank: Which Bank Account Is Better?

Barclays provides a comprehensive range of services to US customers, while Ally bank is among the best online banks. How do they compare? Barclays Bank vs. Ally Bank

Both Barclays and Marcus bank offer great savings rates for depositors who are interested in CDs or savings accounts. How they compare? Barclays Bank vs. Marcus