The diverse banking landscape in Michigan offers a plethora of options, spanning from local banks to national and online entities.

To pinpoint the optimal bank, we meticulously evaluated vital factors. Assessing the extent of physical branches, product diversity, deposit interest rates, online banking efficiency, and the standard of customer service and support.

Best Michigan Regional Banks

Here are our top picks for regional and community banks in Michigan:

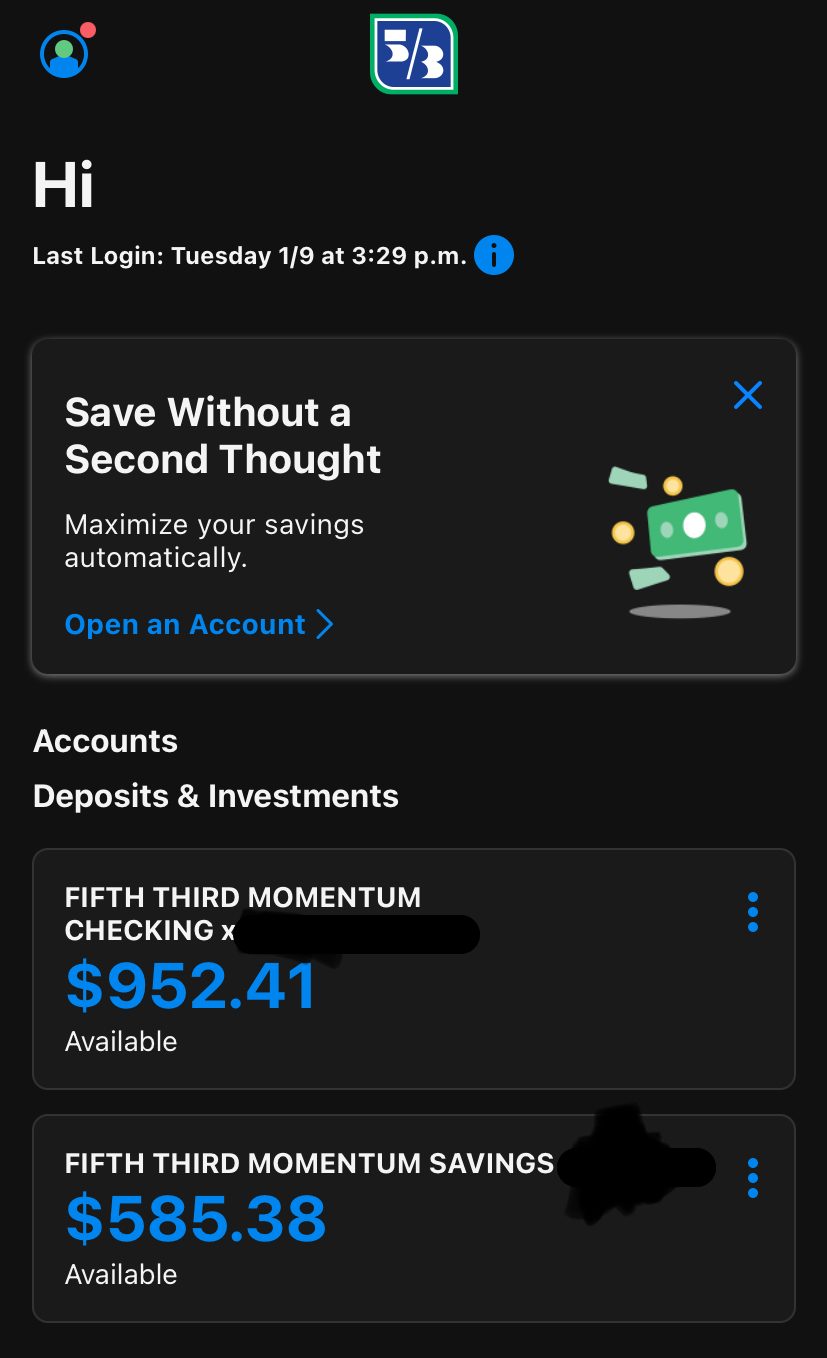

Fifth Third Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Fifth Third Bank maintains a robust presence in 110 cities, boasting nearly 150 branches across the state of Michigan.

The bank provides a comprehensive range of financial products, including diverse checking and savings accounts, loans, credit cards, mortgages, lines of credit, and investment opportunities. One of the bank's notable advantages lies in its offering of low or no monthly fees for checking accounts, coupled with low minimum deposit requirements.

Additionally, customers can benefit from easy access to a wide network of fee-free ATMs. Although customer service representatives may not be available around the clock, they remain reachable even on weekends.

For those prioritizing the highest interest rates on their accounts, it might be prudent to explore other banks, as both money market accounts and savings accounts at Fifth Third Bank offer comparatively lower rates.

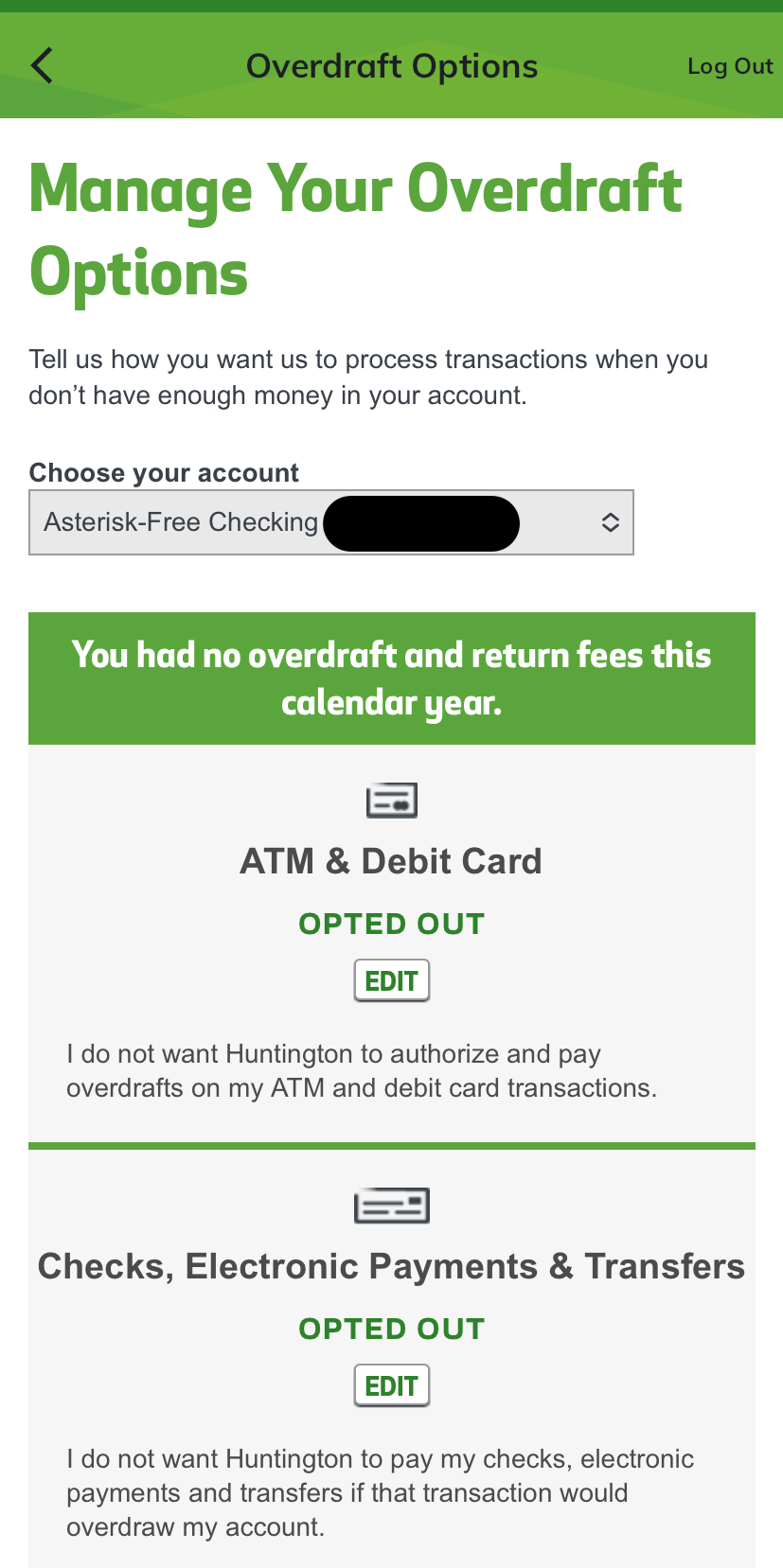

Huntington Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Huntington Bank, a prominent regional financial institution in Michigan, boasts an extensive network of 300 branches spread across 190 cities.

A key advantage it offers is a fee-free basic checking account, empowering customers to manage their finances efficiently. The bank's all-day deposit feature facilitates swift and convenient fund transfers, enhancing customer convenience. Furthermore, the 24-hour grace period on overdrafts proves valuable, granting clients some flexibility when they inadvertently overspend.

Nevertheless, there are noteworthy downsides to consider. Huntington's interest rates on accounts are relatively modest, potentially diminishing the potential earnings on deposited funds.

Moreover, certain interest-bearing checking accounts impose high minimum balance requirements, limiting accessibility for individuals with limited financial resources seeking to avail themselves of these opportunities.

Comerica Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Comerica is a full-service bank providing a wide array of financial solutions, such as deposits, loans, credit options, investments, and insurance products.

Although it primarily operates as a traditional brick-and-mortar bank, certain services may require in-person visits for account openings. In Michigan alone, Comerica boasts an extensive network of over 170 branches spread across 75 cities. The bank has received acclaim for its mobile app, highly praised by both iOS and Android users.

Nevertheless, customers should be mindful that, akin to other physical banks, Comerica tends to offer lower interest rates on savings and may impose various fees to cover expenses. Although some fees can be waived, charges may be applicable in the long run. While CD accounts cannot currently be opened online, digital alternatives are available for opening savings and checking accounts.

Despite adhering to regular business hours, Comerica goes the extra mile to accommodate customers beyond closing time. They offer a 24/7 interactive voice-response service that caters to different time zones, and during weekdays' office hours, live agents are available to assist customers.

Best Michigan National Banks

We took a close look at many of the major banks in Michigan to see which ones stand out.

First, we checked where their branches are located and how widespread they are across the state. Then, we carefully looked at all the different products and services they offer to see which ones are the best.

Chase Bank

Checking Fees

Checking Promotion

Savings APY

CDs APY

Chase Bank provides a broad range of banking solutions to meet diverse needs, such as checking and savings accounts, credit cards, mortgages, personal and auto loans, investment services, and small business banking. Operating in 100 cities across Michigan with over 160 branches, the bank offers great accessibility.

Key advantages include an extensive branch and ATM network, ensuring easy fund access, and a diverse credit card selection, giving customers numerous options. The Chase Total Checking is one of the most popular checking accounts out there.

However, certain considerations need attention. Some accounts have high monthly fees, demanding careful management. Moreover, their savings account and CD rates might not be as competitive as those from other banks.

Flagstar Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Initially established as a mortgage lender, the bank has successfully expanded into community banking, with a strong synergy between its loan products.

By opening a deposit account and using it for loan payments, customers receive loan rate discounts. Standard checking account features are available, including online and mobile banking, free ATM/debit cards, access to ATMs, and overdraft protection.

Pros of the bank include a wide range of banking products, physical branch accessibility, a large ATM network, competitive CD rates, and excellent mortgage options. The bank has a over 100 branches in 80 cities cross Michigan, which is great for customers looking for in person service.

However, there are some drawbacks to consider. The rates offered on savings and money market accounts are lower, and certain fees apply.

Best Michigan Online Banks

During our search for online banks in Michigan, our primary focus revolved around comparing the interest rates they offer for savings accounts and CDs. Additionally, we were keen on exploring the availability of other services such as checking accounts, loans, credit cards, and mortgages.

Capital One Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Capital One is a standout option for consumers looking for competitive rates and a comprehensive, fee-free banking experience. Offering a vast network of no-fee ATMs, customers enjoy easy access to their finances, even without a local branch, thanks to the convenience of online account management from anywhere.

One of Capital One's notable strengths lies in its attractive rates for savings and CD accounts, along with a free checking account that earns interest. The bank's appeal is further heightened by its lack of balance minimums, monthly fees, and overdraft charges. Users particularly appreciate the highly acclaimed mobile app, available for both iPhone and Android users.

While there are some limitations, like the inability to deposit cash at partner ATMs and the absence of money market accounts, these drawbacks are overshadowed by the overall benefits. Capital One continues to be a top choice for those seeking a well-rounded banking experience with favorable rates and flexible financial management.

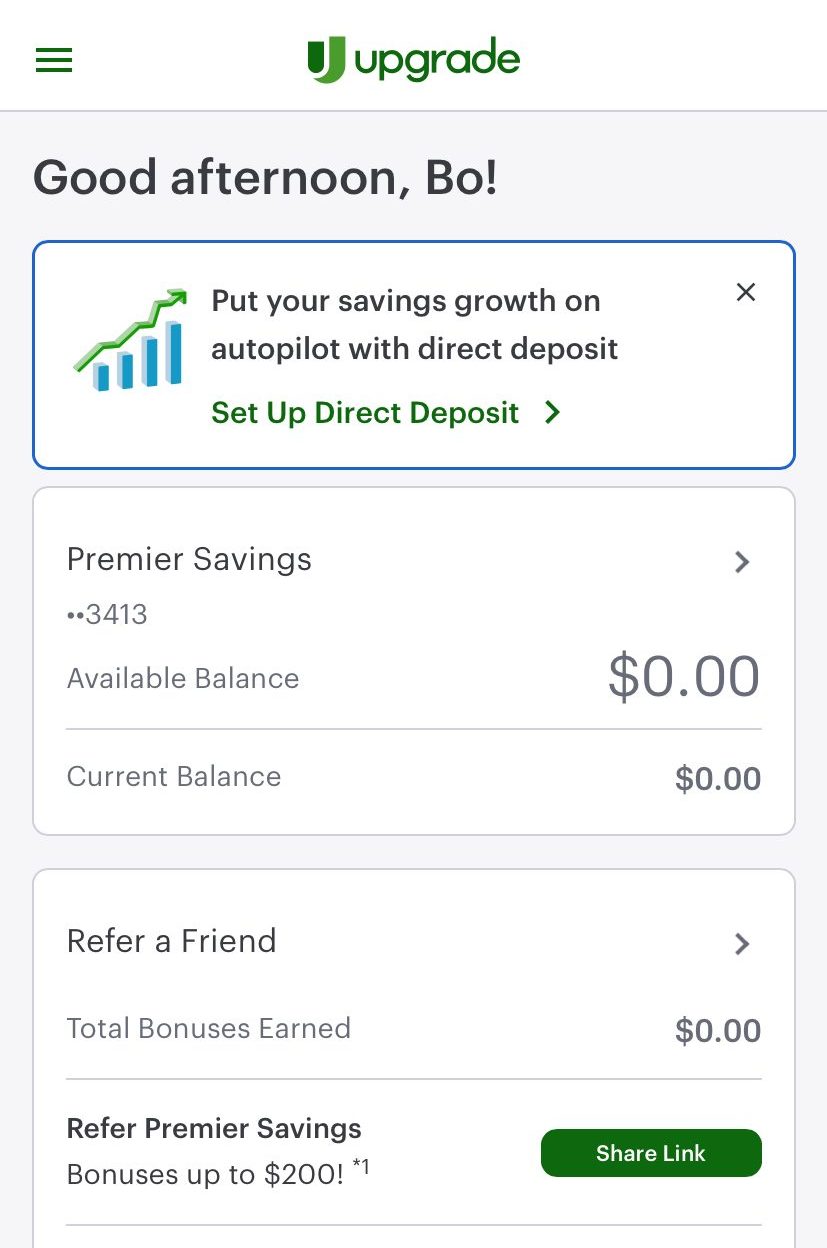

Upgrade

Checking Fees

Checking Promotion

Savings APY

CDs APY

Upgrade is a prominent fintech company, providing a diverse array of financial products like checking, savings, and credit cards. Although not a bank itself, it has a partnership with Cross River Bank to offer accounts and ensure FDIC insurance, safeguarding customers' funds.

For individuals in pursuit of cost-effective checking with cash back on debit card purchases, Upgrade presents an attractive option. Additionally, their high-yield savings accounts offer competitive interest rates, making them one of the top compelling choices for savers. The absence of monthly fees, coupled with ATM fee rebates and extended phone customer service hours, contributes to an improved banking experience for their clients.

Despite these advantages, there are certain limitations to consider. Upgrade does not have an overdraft protection program, and customers may find the lack of cash deposits and branch access inconvenient. However, overall, Upgrade remains an enticing fintech company, catering to diverse financial needs and preferences in the banking industry.

FAQs

What are the largest banks in Michigan?

Chase Bank, Comerica Bank, and Huntington Bank have established their supremacy in Michigan, with each of these banks having a remarkable presence of over 160 branches as of 2025.

What's Michigan's finest bank?

Deciding on the finest bank in Michigan depends on what you're looking for – in-person service, high CD rates, or no-fee checking accounts. Review our recommended banks above, each catering to specific preferences.

What bank offers the highest CD rates in Michigan?

When it comes to CD rates in Michigan, terms matter. The best rates for 5 year may be offered by one bank, while the best rates for 3 months could be at another. Check out our suggested Michigan banks for competitive CD rates and compare them to credit unions.

Where can I find the best savings rates in Michigan?

Finding high savings rates can be challenging, but Michigan has some top-notch options. Discover some of the best saving options in Michigan for 2025.

How We Picked The Best Bank In Michigan: Methodology

The Smart Investor team conducted an extensive review to identify the best banks in Michigan. We assessed them based on four main categories, each with specific features:

- Financial Products and Services (40%): We evaluated the range and quality of financial products and services offered by each bank, including checking accounts, savings accounts, CDs, loans, credit cards, and investment options. Banks offering a diverse array of financial products with competitive rates and terms received higher ratings in this category.

- Banking Features and Tools (30%): This category assessed the availability and functionality of banking features and tools, such as transfer options, the ability to set savings goals, account linking capabilities, mobile app usability, check deposit options, and other features important for banks. Banks offering a comprehensive suite of features and user-friendly tools earned higher scores.

- Customer Experience (20%): We closely examined the overall customer experience, including the ease of account opening, communication with customer service representatives, the usability of online banking platforms and mobile apps, and the responsiveness of customer support. Banks with user-friendly interfaces, efficient digital banking tools, and responsive customer service received higher ratings.

- Bank Reputation (10%): Our team analyzed each bank's reputation based on factors such as customer satisfaction ratings, JD Power scores, TrustPilot reviews, and any notable awards or recognitions received. Banks with positive reputations and a history of providing excellent service to customers in Michigan received higher ratings.

Within each category, we assigned weights to various features and qualities to ensure a comprehensive evaluation of each bank.