If you live in Washington and need a good bank that fits your requirements, you likely know there are many choices available.

You can pick from smaller local banks, bigger regional banks, large national banks, or even online banks. With so many options, it can be challenging to determine which one is best for you.

Here's a summary of our best Washington banks:

Bank/Institution | Monthly Fees | Our Rating |

|---|---|---|

PNC Bank | $7 – $25 per month

can be waived if you maintain $500+/$2,000/$5,000 direct deposit per month, $500+/$2,000/$5,000 monthly balance in savings or age 62+/$10,000 in all PNC consumer deposit accounts/$25,000 in all PNC consumer deposit accounts/

|

(4.2/5) |

Key Bank | $0 – $25 |

(3.8/5) |

Discover Bank | $0 |

(4.5/5) |

SoFi Bank | $0

|

(4.5/5) |

Chase Bank (Promotion Available) | $0 – $35 |

(4.2/5) |

U.S. Bank | $4.95 – $6.95 |

(3.8/5) |

Bank Of America | $0 – $25 |

(3.8/5) |

Banner Bank | $4 – $12

|

(3.7/5) |

To make things easier, we've done the hard work and picked out the top banks in Washington.

We considered various factors, including the number of branches they have, the range of products they offer, the interest rates on deposits, the quality of their online banking services, and how well they treat their customers.

Best Washington National Banks

We carefully examined several national banks operating in Washington to identify the ones that excel. Here are our picks:

Chase Bank

Checking Fees

Checking Promotion

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

With a widespread presence in 70 cities throughout Washington and a substantial network comprising over 150 branches, the bank prioritizes accessibility for its customers.

Chase Bank offers a comprehensive array of banking solutions to cater to a wide range of needs.

Key strengths of Chase Bank include its extensive branch and ATM network, ensuring convenient access to funds, as well as a diverse selection of credit cards that offer customers multiple choices.

However, it's essential to consider certain factors. Some accounts come with high monthly fees, necessitating prudent management of finances.

Additionally, the interest rates on their savings accounts and CDs might not be as competitive as those offered by other banks.

- Over 4,700 physical branches nationwide

- Access to 15,000+ Chase ATMs

- Highly rated mobile app for account management

- Bill pay, transfers, and mobile check deposit

- Multiple checking account options to choose from

- No ATM fees with Sapphire Checking

- Integrated credit monitoring via Credit Journey

- Digital assistant for quick support and alerts

- Large Nationwide Branch & ATM Network

- User-Friendly and Highly Rated App

- Multiple Checking Accounts for Different Needs

- Built-In Credit Score Monitoring Tool

- Digital Assistant Helps with Daily Tasks

- Monthly Fees on Most Checking Accounts

- Out-of-Network ATM Fees (Except Sapphire)

- High Overdraft Fees for Some Users

- Some Features Only for High-Balance Accounts

- No Free Money Market or Investment Checking

Bank Of America

Checking Fees

Checking Promotion

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

Bank of America provides a wide range of financial services such as checking and savings accounts, credit cards, mortgages, loans, investments, and wealth management.

With over 120 branches throughout Washington, spanning 50 cities, customers can easily access nearby banking facilities.

For added convenience, Bank of America offers both in-person and online banking services. They often have enticing promotions for checking accounts and offer attractive rewards for credit card holders. Additionally, specific CD terms may yield high rates for savers.

However, it's essential to be mindful of certain aspects. The bank charges fees, including overdraft fees, which may not be ideal for those seeking fee-free alternatives.

While their customer service has improved, some individuals may still encounter occasional issues with responsiveness and support.

Moreover, their interest rates on savings accounts and certain loans might not be as competitive as other available options.

- Multiple Checking Accounts for Different Needs

- Overdraft Protection with Balance Connect®

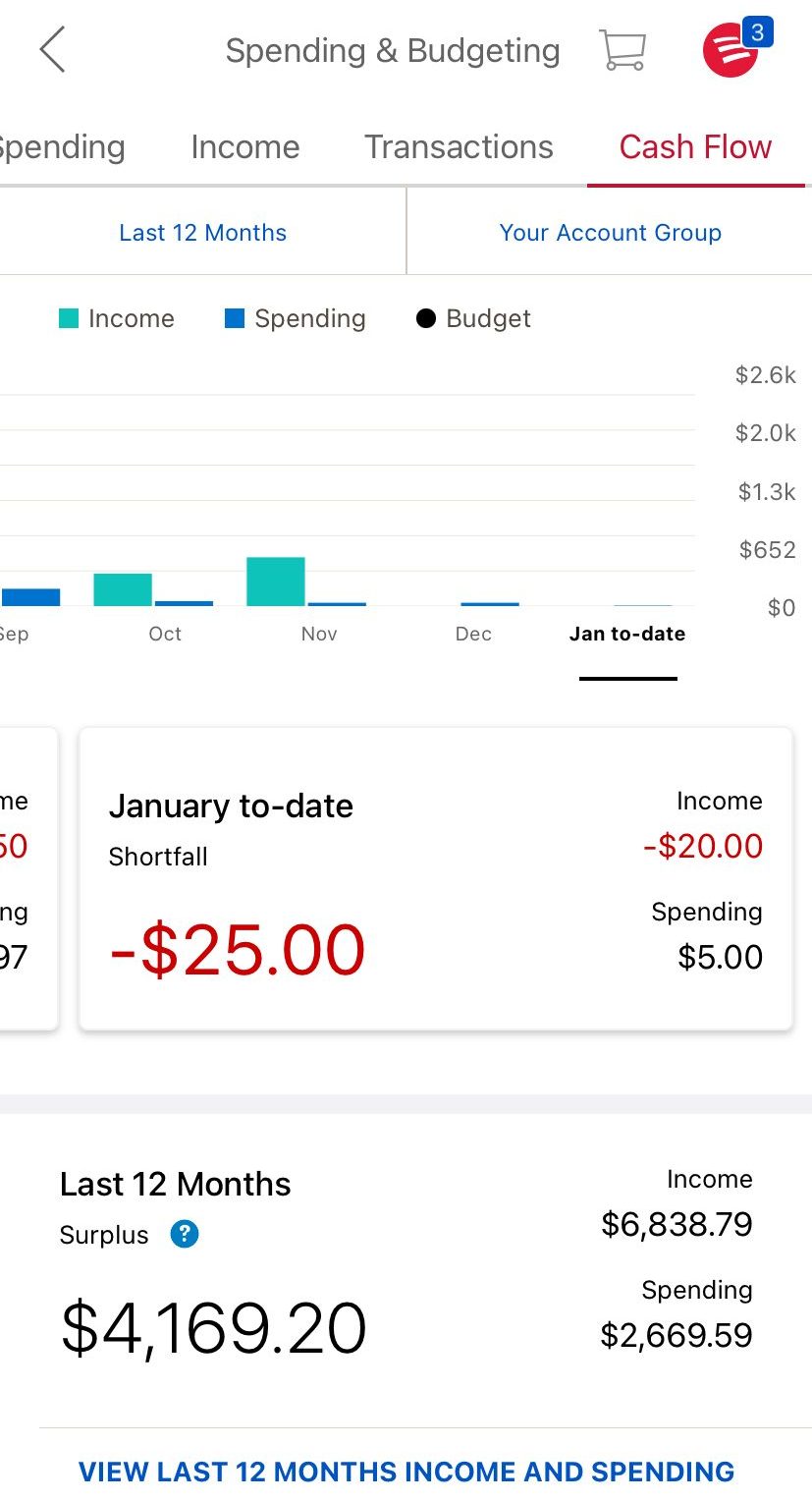

- Mobile App with Budgeting Tools

- Customizable Account Dashboard

- Mobile Check Deposit Available

- Paperless Statement Management

- Wide ATM & Branch Network Nationwide

- Support for Direct Deposit and Bill Pay

- Strong Nationwide Branch Presence

- Robust and User-Friendly Mobile App

- Flexible Overdraft Protection Options

- Comprehensive Suite of Banking Services

- Customizable Alerts and Spending Insights

- Monthly Fees Without Qualifying Activity

- Limited Free Features on Basic Accounts

- Inconsistent Customer Support Experience

- Overdraft Fees Can Still Apply

- No 24/7 Live Support Access

PNC Bank

Fees

Our Rating

Current Promotion

APY Savings

-

Our Verdict

- Features

- Pros & Cons

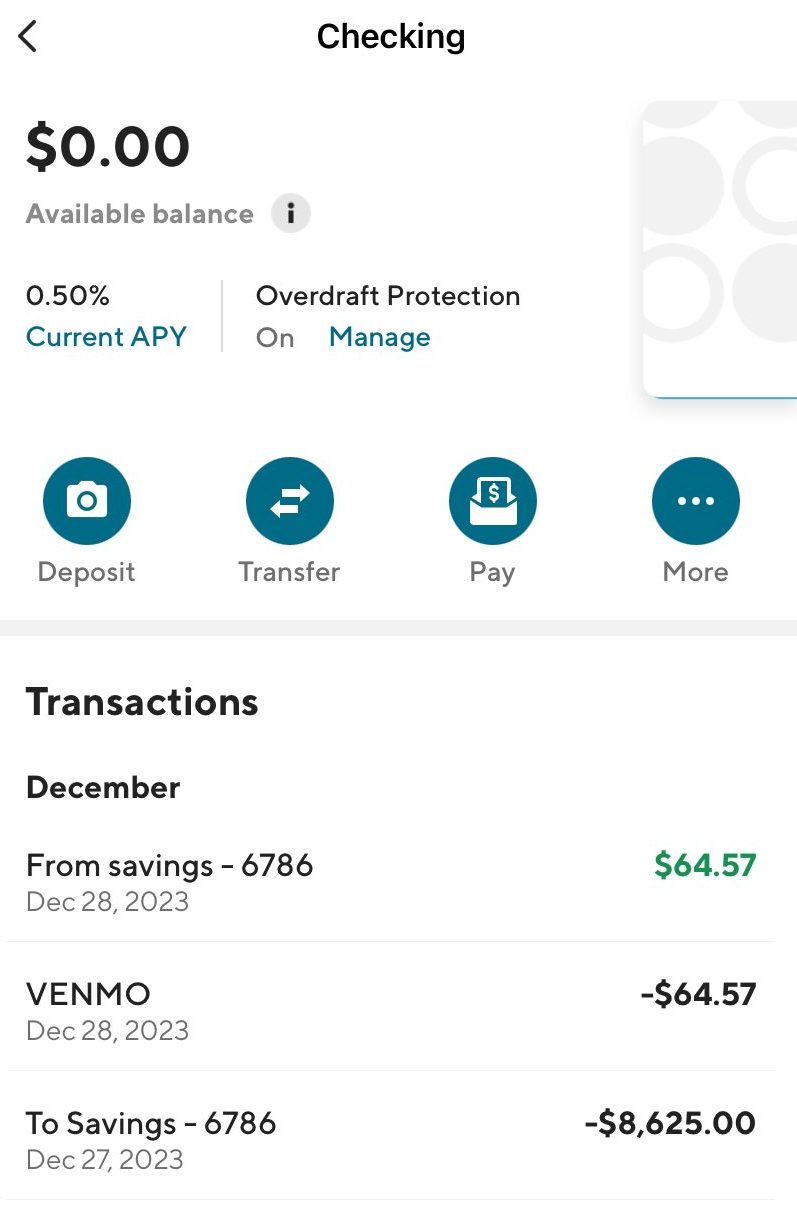

PNC Bank’s Virtual Wallet stands out for Washington residents seeking a modern, all-in-one banking solution.

With its unique three-part structure—Spend, Reserve, and Growth—it’s ideal for managing daily spending, short-term budgeting, and long-term saving in one place.

The intuitive tools like the Money Bar and calendar help avoid overdrafts and track bills effectively. While fees can apply, most are easily waived with direct deposits or minimum balances.

However, the limited local ATM presence in Washington may be a drawback for some. Overall, it’s a solid choice for tech-savvy individuals who prefer a centralized approach to banking.

- Hybrid setup: Spend, Reserve & Growth

- Large ATM network with fee-free access

- Bill pay and check writing tools

- Overdraft protection via Reserve feature

- Debit card with mobile wallet support

- Calendar and Money Bar budgeting tools

- Tiered monthly fees with waiver options

- Welcome bonus up to $400

- All-in-One Financial Management

- Smart Budgeting & Planning Tools

- ATM Fee Reimbursements on Tiers

- Overdraft Buffer with Reserve

- Bonus for New Account Holders

- Monthly Fees Unless Waived

- Requirements for Higher APY

- Out-of-Network ATM Fees

- Numerous Additional Service Charges

- Mixed Customer Service Reputation

U.S. Bank

Checking Fees

Checking Promotion

Earn $250 for $2,000–$4,999.99 in direct deposits.

Earn $350 for $5,000–$7,999.99 in direct deposits.

Earn $450 for $8,000+ in direct deposits. needed. Expired on 12/30/2024

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

Serving the Washington region, U.S. Bank boasts an extensive network of over 120 branches scattered across 80 cities, ensuring easy accessibility for its patrons.

U.S. Bank offers a diverse array of products and services catering to various financial needs. Additionally, the bank's extensive ATM network allows customers to access cash conveniently on the go.

U.S. Bank offers an enticing promotional CD with attractive high-rate options for those looking to grow their savings.

The U.S. Bank Smartly Checking offers a bunch of features for customers, and the bank's mobile app receives high praise from both iPhone and Android users, highlighting its user-friendly and efficient design.

However, there are some drawbacks to consider. Interest rates on savings, CDs, and money market accounts remain relatively low, potentially impacting customers' overall earnings.

Moreover, not all checking accounts come with fee-free ATM withdrawals and overdraft protection, leading to possible additional charges for account holders.

- Multiple checking account types available

- 24/7 customer service via phone and social

- Over 2,900 branches in 25 states

- 4,700+ U.S. Bank ATMs nationwide

- User-friendly online and mobile banking apps

- Zelle integration for person-to-person transfers

- Overdraft protection with linked accounts

- Promotional offers for new accounts

- Diverse Checking Account Options

- Strong Mobile and Online Experience

- Reliable Overdraft Protection Tools

- Frequent Promotions and Bonuses

- Wide Branch and ATM Network

- Limited Branches Outside 25 States

- Most Accounts Charge Monthly Fees

- Waivers Require Direct Deposit or Balance

- Not All Accounts Include ATM Fee Rebates

- Mixed Reviews on Customer Service Issues

Best Washington Online Banks

In our search for online banks in Washington, we focused on comparing their interest rates for savings accounts and CDs.

We were also interested in finding out about the other services they offer, like checking accounts, loans, credit cards, and mortgages.

SoFi Bank

Checking Fees

Checking Promotion

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

In the past, SoFi was mainly known for giving out personal loans and helping people refinance their student and auto loans.

But things changed in early 2022 when it became a chartered bank. After that, it began offering checking and savings accounts, making it one of the top online banks in the nation.

The account has some great benefits. There are no monthly fees, and eligible customers get a strong overdraft coverage program for free.

People with this account can also enjoy a competitive interest rate on their savings and access a large, nationwide network of free ATMs. If you use direct deposit, you might even get paid up to two days earlier than usual.

However, there are a few downsides to keep in mind. SoFi doesn't have physical bank branches, so if you prefer in-person banking, it may not be the best fit.

Depositing cash can be inconvenient too, as it comes with fees. And if you're looking for options like CDs or money market accounts, you won't find them with SoFi.

- All-in-One Checking and Spending Account

- No Monthly Maintenance or Overdraft Fees

- Free Visa Debit Card with Allpoint Access

- Unlimited Vaults for Budgeting Goals

- Spending Tracker with SoFi Relay

- Free Paper Checks Available on Request

- FDIC Insurance via Partner Banks

- Mobile App with Bill Pay & Transfers

- No Overdraft or Monthly Fees

- Free Access to 55,000+ ATMs

- Spending Tracker and Budgeting Tools

- Visa Debit Card with Cashback Offers

- Easy Peer-to-Peer Transfers and Bill Pay

- No Physical Branch Locations

- No Cash Deposit Capability

- Third-Party ATM Fees Not Reimbursed

- Limited Daily Withdrawal Amounts

- Only One Checking Account Per User

Discover Bank

Checking Fees

Money Market APY

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

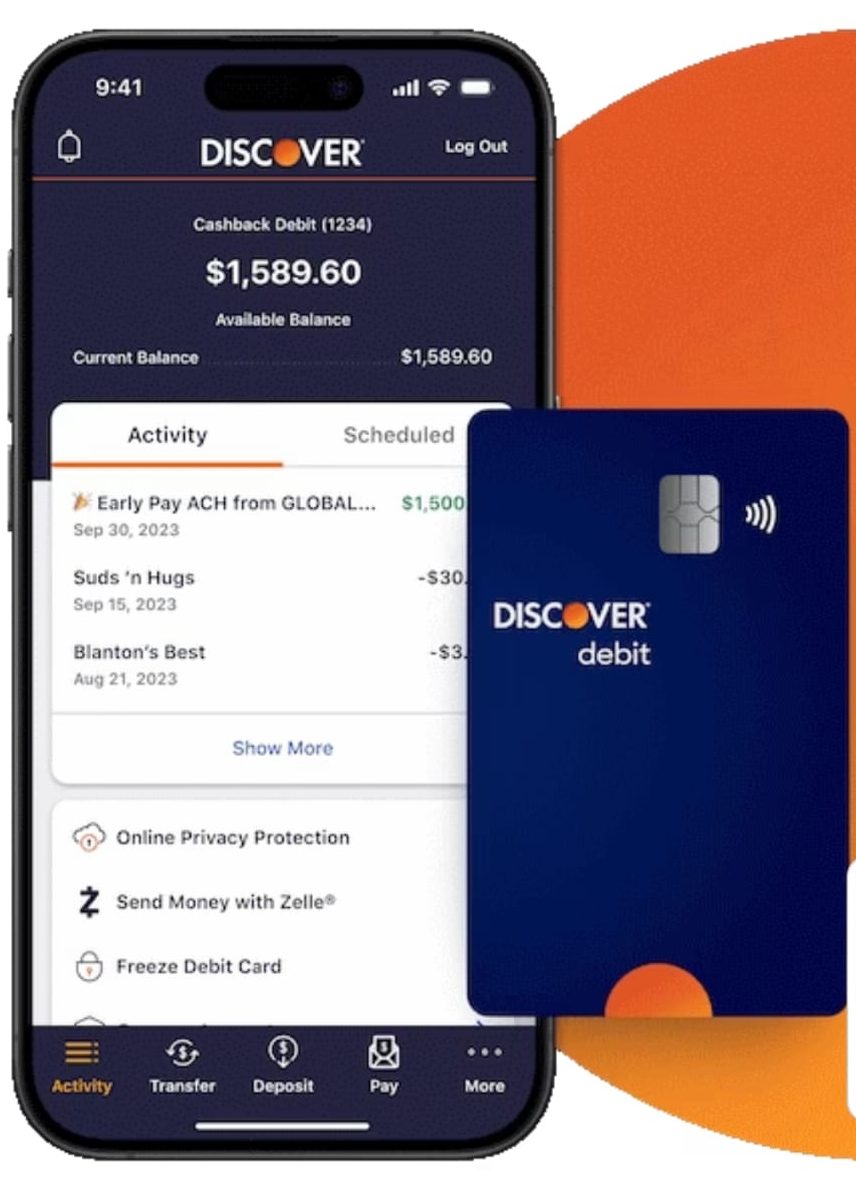

Discover Bank is a popular online bank offering various financial services like savings accounts, credit cards, personal loans, and student loans.

Instead of physical branches, it operates entirely on the internet, providing access to a large network of 415,000 ATMs across the country (with access to over 60,000 surcharge-free ATMs through the Allpoint® or MoneyPass® networks).

Customers enjoy great benefits, such as cashback on debit card purchases, and no monthly maintenance or overdraft fees. Discover CD rates are very competitive, helping you earn more on your money.

The downside is the absence of physical branches for in-person banking. So, if you prefer face-to-face interactions, this might not be the best fit.

Additionally, using ATMs from other banks may come with fees that Discover won't cover, resulting in extra costs for you.

- 1% cash back on debit purchases

- No monthly maintenance or overdraft fees

- Free online bill pay and check ordering

- Easy mobile check deposit

- Access to 50,000+ fee-free ATMs

- Track spending and transfers via app

- 24/7 U.S.-based customer support

- Fully online account opening process

- Cash Back on Debit Card Use

- No Monthly or Overdraft Fees

- Large ATM Network Nationwide

- User-Friendly Mobile Banking App

- Highly Rated Customer Support

- No Physical Branch Access

- No APY on Checking Balances

- Cashback Capped at $3,000 Monthly

- No Business Account Options

- Limited In-Person Services

Best Washington Regional Banks

Here are our top picks for regional and community banks in Washington:

Banner Bank

Checking Fees

Money Market APY

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

Banner Bank is known for its diverse range of banking products, including checking accounts, CDs, money market accounts, IRAs, loans, and investment options.

With over 70 branches in 50 cities across Washington, the bank offers convenience and accessibility to its customers.

Pros of banking with Banner Bank include their wide variety of products, competitive CD and savings rates, interest-bearing checking accounts, and a reputation for providing good customer service.

However, there are some drawbacks to consider. The rates for money market accounts are lower compared to other options, and customers may need to deposit a substantial amount to benefit from higher savings rates.

Additionally, the bank imposes various fees, which could affect the overall cost of banking with them.

- Wide range of checking account types

- No monthly fees on select accounts

- Reimbursement for non-network ATM fees

- Free debit card with digital wallet support

- Access to 170+ branches across four states

- Mobile app with check deposit & text banking

- Senior discounts and free notary services

- Integrated online banking with bill pay

- Free Checking With No Monthly Fees

- ATM Fee Reimbursements in U.S.

- Mobile App With Remote Deposit

- Strong Branch Network in the West

- Senior Perks and Notary Services

- Limited Online-Only Banking Features

- Basic Mobile App Compared to Competitors

- Geographically Limited Branch Access

- No 24/7 Customer Support

- Debit Card Only Available on Select Accounts

key Bank

Checking Fees

Money Market APY

Savings APY

Our Rating

-

Our Verdict

- Features

- Pros & Cons

KeyBank operates more than 120 branches across 80 cities in Washington. One of its standout features is the absence of monthly fees for their checking accounts.

Additionally, they offer a diverse range of financial products, including credit cards, lines of credit, personal loans, and mortgages.

Notably, KeyBank excels in providing excellent customer service, offering round-the-clock phone assistance, Twitter support, and chat support with extended hours.

Customers with multiple accounts enjoy additional benefits akin to those provided by traditional brick-and-mortar banks.

However, KeyBank's savings account rates are not highly competitive, resulting in lower interest earnings on savings. To benefit from a promotional rate on their money market account, a minimum balance of $25,000 is required.

- Three checking account options

- No-fee account options available

- Free access to 40,000+ ATMs

- In-person banking at 1,000+ branches

- Online and mobile banking tools

- 24/7 live phone support

- Account alerts and budgeting tools

- Debit card and bill pay included

- No-fee checking account options

- Strong branch and ATM presence

- Feature-rich mobile banking app

- Premium benefits for Select Checking

- Helpful 24/7 customer service

- Premium account requires high balance

- Limited perks with basic account

- No interest on standard checking

- Some accounts lack check-writing

- Out-of-network ATM fees may apply

FAQs

What are the biggest banks in Washington?

In 2025, the banking sector in Washington is primarily controlled by Chase Bank, KeyBank, and U.S. Bank, with all three institutions boasting more than 120 branches.

What's Washington's finest bank?

The top bank in Washington varies according to what you want, like if you prefer digital banking, high deposit rates, or no-fee checking accounts. Check out our suggested banks above, each with its unique strengths.

What bank offers the highest CD rates in Washington?

Washington's best CD rates vary depending on the term. One bank might offer the best rates for 3 months, while another bank excels with the best rates for 6 months. Explore our recommended Washington banks for high CD rates and compare them with credit unions.

Which bank offers the highest savings rates in Washington?

Searching for high savings rates can be tricky, but we've narrowed it down for you. Here are some of the best savings rates in Washington for 2025.

How We Picked The Best Bank In Washington: Methodology

The Smart Investor team conducted an extensive review to identify the best banks in Washington. We assessed them based on four main categories, each with specific features:

- Financial Products and Services (40%): We evaluated the range and quality of financial products and services offered by each bank, including checking accounts, savings accounts, CDs, loans, credit cards, and investment options. Banks offering a diverse array of financial products with competitive rates and terms received higher ratings in this category.

- Banking Features and Tools (30%): This category assessed the availability and functionality of banking features and tools, such as transfer options, the ability to set savings goals, account linking capabilities, mobile app usability, check deposit options, and other features important for banks. Banks offering a comprehensive suite of features and user-friendly tools earned higher scores.

- Customer Experience (20%): We closely examined the overall customer experience, including the ease of account opening, communication with customer service representatives, the usability of online banking platforms and mobile apps, and the responsiveness of customer support. Banks with user-friendly interfaces, efficient digital banking tools, and responsive customer service received higher ratings.

- Bank Reputation (10%): Our team analyzed each bank's reputation based on factors such as customer satisfaction ratings, JD Power scores, TrustPilot reviews, and any notable awards or recognitions received. Banks with positive reputations and a history of providing excellent service to customers in Washington received higher ratings.

Within each category, we assigned weights to various features and qualities to ensure a comprehensive evaluation of each bank.