Table Of Content

When Citi Bank Wins?

Both banks have a decent choice of banking products that make it easier to switch from your current bank.

In addition to checking and savings accounts, Citi offers CDs, personal loans, mortgages, IRAs, investment options, wealth management plans and a variety of credit card options.

Citibank can be a better choice than Wells Fargo if:

You want better CD rates

You are not planning on making more than 6 savings withdrawals in a month

You want the best savings rates

You want access to a massive selection of credit card options

When Wells Fargo Bank Wins?

Wells Fargo offers a choice of savings and checking accounts, but there are also mortgages, loans, and investment options including IRAs, 401ks and wealth management products.

Wells Fargo can be a better choice than Citi if:

You’re interested in low deposit mortgages

You need a larger personal loan

You want access to 24/7 customer service.

Citi Bank | Wells Fargo | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

Both accounts have monthly maintenance fees, but while the Wells Fargo fee is slightly more, the waiver criteria is a little more flexible.

However, Citi does offer far better rates on its savings account. You can earn four times the rate of Wells Fargo with no minimum deposit. However, overall – both rates are pretty low compared to national average.

Citi also allows you to earn rewards if you link your Citi checking account with your savings and the auto save function assists you to reach your savings goals.

Both Citi and Wells Fargo have other savings packages if the basic account does not meet your needs.

Citi Bank | Wells Fargo | |

|---|---|---|

APY | 3.70% | 0.26% – 2.51% |

Fees | $4.50/$10 per month

Can be waived if you maintain an average combined monthly balance of $500/$1,500 in your eligible accounts, make one enhanced direct deposit or one qualifying bill payment per statement period

| $5

can be waived by maintaining a $300 minimum daily balance, one qualified automatic transfer, one or more Save as You Go transfers from your Wells Fargo checking account. Primary account owners age 24 or younger are exempt from the fees

|

Minimum Deposit | $0 | $25 |

Checking Needed? | Yes | No |

Main Benefits |

|

|

Checking Account

The Citi and Wells Fargo checking accounts are quite similar. Neither account is interest bearing and both carry a maintenance fee with similar waiver criteria. However, while Citi has no minimum deposit requirements, Wells Fargo requires $25 to open an account.

When it comes to features, the account similarities continue. Both accounts offer access to overdraft services and check writing is included. However, Wells Fargo does allow customers to upgrade or downgrade checking accounts to access the feature set that best suits their needs.

Citi Bank | Wells Fargo | |

|---|---|---|

APY | 0.01% | 0.05% – 0.10% |

Fees | $12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

| $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

|

Minimum Deposit | $0 | $25 |

Main Benefits |

|

|

CDs

This is an area where Citi has a clear edge. While Wells Fargo has a minimum deposit requirement of $2,500, Citi allows you to open an account with any deposit.

Additionally, while Wells Fargo only offers 0.01%- 4.00% depending on your deposit amount, Citi offers a 0.05% – 4.16%. The interest rates are weighted to encourage customers to take on longer terms, if you sign up for a five year CD.

Here as well, both banks offer lower than average rates when it comes to CDs.

Citi Bank | Wells Fargo | |

|---|---|---|

Minimum Deposit | $500 – $2,500 | $2,500 |

APY Range | 0.05% – 4.16% | 0.01%- 4.00% |

Credit Cards

Citi offers a diverse range of credit cards tailored to various needs. Its Citi® Double Cash Card provides 2% cash back on purchases, while the Citi Rewards+® Card rounds up rewards on small purchases.

For travelers, the Citi Premier® Card offers points on travel and dining. Citi also provides co-branded cards with popular brands like Costco.

Many cards feature no annual fees, flexible rewards, and exclusive perks for cardholders.

Card | Rewards | Bonus | Annual Fee | Citi® Double Cash Card | 1% – 2%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| N/A

$200 cash back after spending $1,500 on purchases in the first 6 months

| $0 |

|---|---|---|---|---|

Citi Premier® Card | 1X – 10X

10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases

| 75,000 points

75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com

| $95 | |

Citi Simplicity® Card | None | None | $0 | |

Citi® Secured Mastercard® | None | None | $0 | |

| Citi Custom Cash℠ Card | 1-5%

5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

| $200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back)

| $0 |

Wells Fargo offers a diverse selection of credit cards to meet various financial needs:

Card | Rewards | Bonus | Annual Fee | Wells Fargo Active Cash Card

| 2%

2% cash rewards on purchases (unlimited)

| $200

$200 cash rewards bonus when you spend $500 in purchases in the first 3 months

| $0 |

|---|---|---|---|---|

Wells Fargo Autograph Card | 1X – 3X

3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

| 20,000 Points

20,000 bonus points when you spend $1,000 in purchases in the first 3 months | $0 | |

Wells Fargo Reflect Card | N/A | 0% Intro APR: 21 months on purchases and balance transfers | $0 | |

Wells Fargo Bilt Mastercard | 1x – 3x

3X points on dining, 2X points on travel and 1X points on rent payments without the transaction fees and other purchases

| N/A | $0 | |

Wells Fargo Choice Privileges Mastercard | 1x – 5x

5X points on stays at participating Choice Hotels plus on choice privileges point purchases properties, 3X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases | 40,000 points

40,000 bonus points when you spend $1,000 in purchases in the first three months – enough to redeem up to five Rewards nights at select Choice Hotel® properties.

| $0 | |

Wells Fargo Choice Privileges Select Mastercard | 1x – 10x

10X points on stays at participating Choice Hotels® properties plus on Choice Privileges point purchases, 5X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services and 1X points on other purchases | N/A | $95 |

Each card includes benefits like cell phone protection and access to FICO® Credit Scores. Wells Fargo's credit card offerings cater to a range of preferences, from cash back and rewards to balance transfer options.

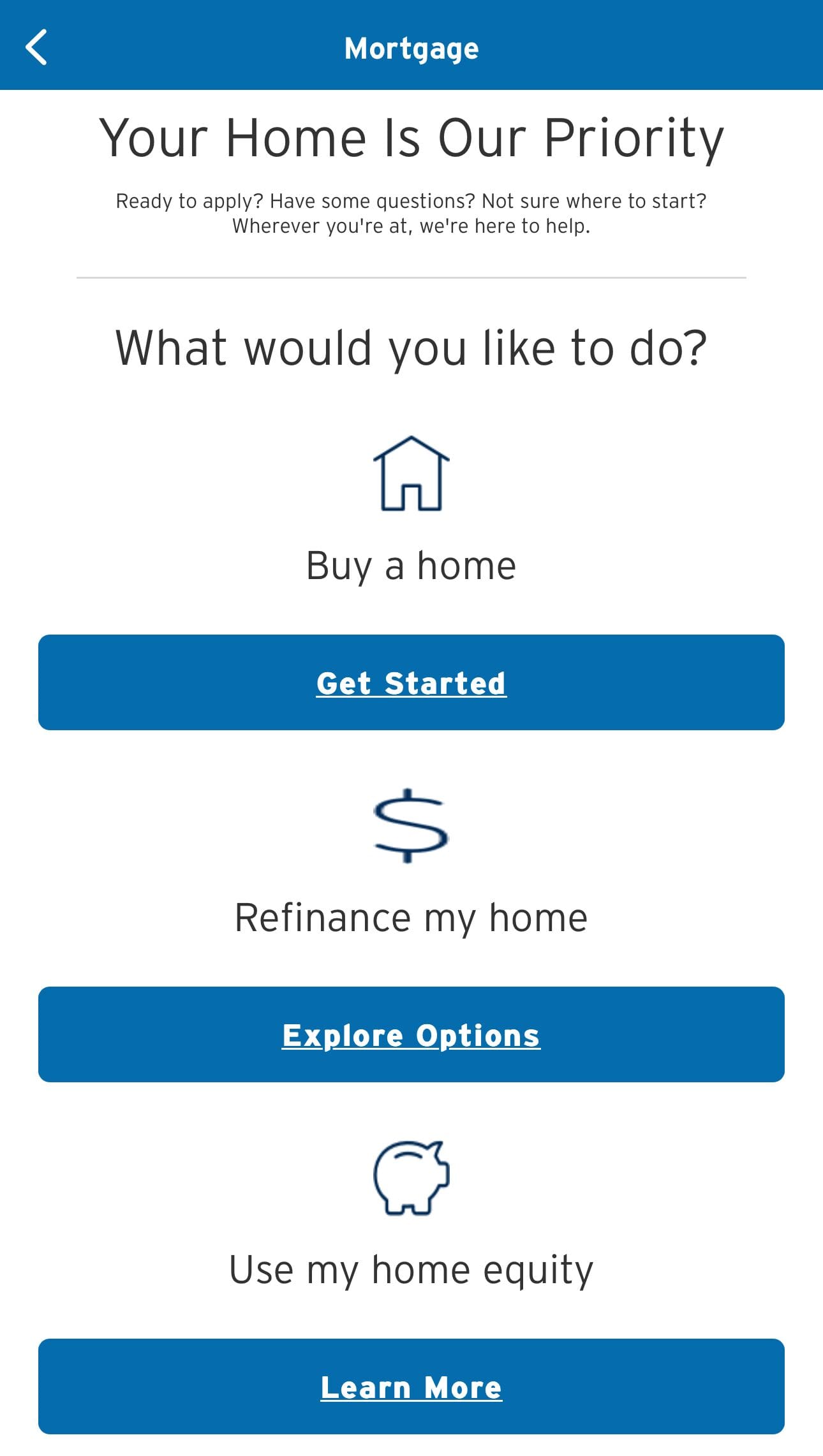

Mortgage

Both banks have a great selection of mortgage products. Citi has home loans for buying, refinancing, or accessing equity. The bank allows prequalification to make it easier when home shopping.

New home loan customers can also qualify for a welcome bonus. You can either access a lower interest rate or receive a $500 credit towards your closing costs.

Wells Fargo also has a choice of mortgages including fixed rate loans, FHA loans, and VA loans. However, a nice feature of Wells Fargo home loans is the potential for only needing a small down payment. Fixed rate loans require a downpayment of 3% or more, while FHA loans need at least 3.5%.

Wells Fargo also offers home equity finance packages that allow you to borrow up to 80% of the property value less any outstanding mortgage, secured loans or liens. These deals are available for up to $500,000.

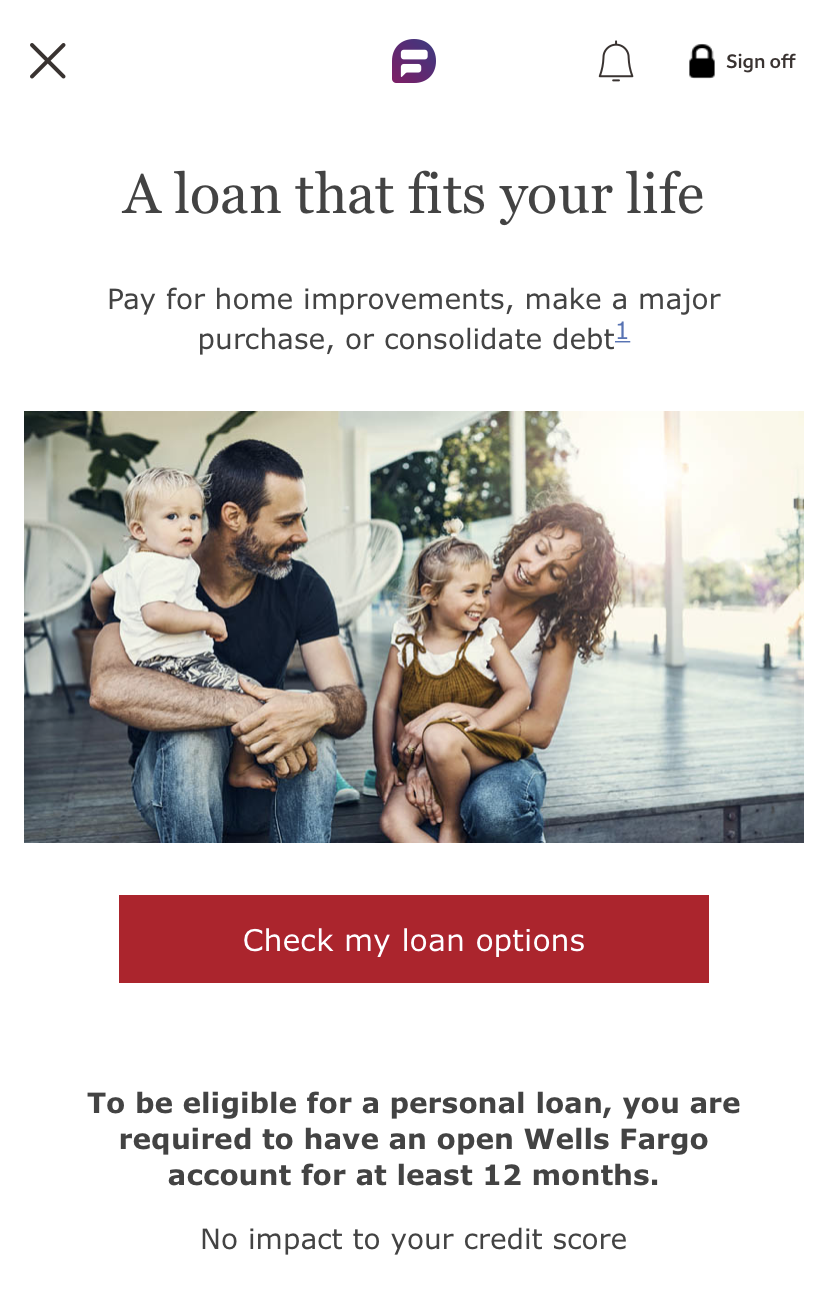

Loans

Citi offers personal loans for up to $30k. You can take your loan with up to a 60 month term. You can qualify for lower rates depending on your credit rating, but all customers can qualify for a rare discount if they sign up for Auto Deduct.

The loan process is straightforward and you can expect a check to be mailed within five business days of receiving approval. Don’t forget to link your eligible Citi checking account and you’ll get Thank You points.

Wells Fargo offers a variety of loan products including student loans, auto loans and personal loans for up to $100k. Personal loans are available with a term of up to 84 months, with no origination fees, closing fees or prepayment penalties. Wells Fargo also offers relationship discounts for qualified customers.

Customer Service

Citi has multiple phone lines that relate to specific banking areas. You can also get stock answers to common queries on the website help page. You can also use the website to direct message the customer support team or use the QR code with your phone to send a message.

Wells Fargo also has a detailed support section on its website, but you can also use the general banking helpline that is open 24/7 to speak to a customer service agent.

Unfortunately, neither bank scores particularly well on consumer review sites. Citi has a poor 1.4/5 rating on Trustpilot, while Wells Fargo scores a modest 2.3 out of 5.

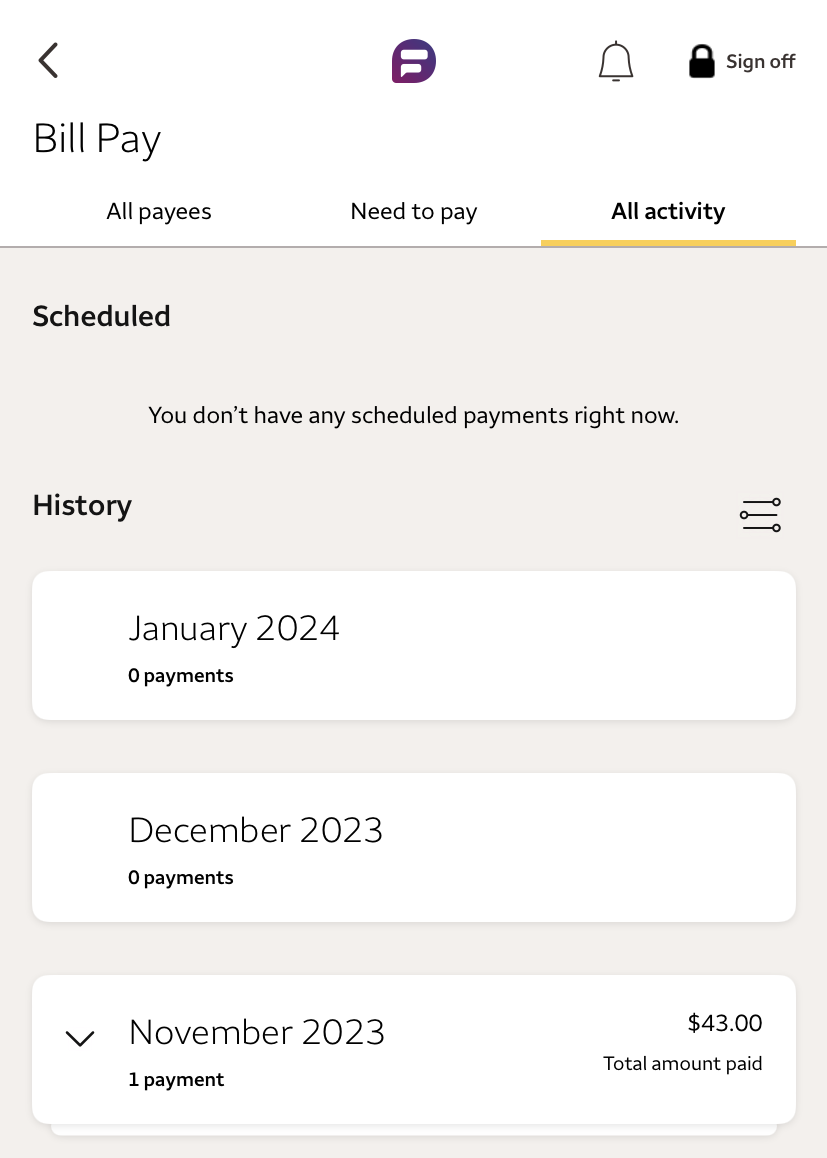

Online/Digital Experience

Both banks offer an app for iOS or Android devices. The Citi mobile app is rated 4.9/5 on Apple and 4.7/5 on Google, while Wells Fargo’s app is rated 4.8/5 on both platforms.

However, if you prefer, the banks also have a decent website. The designs are clean to make a great user experience. Citi’s website is particularly intuitive, making it easy to select and compare credit card options to find which card is best suited to your needs and preferences.

Which Bank is The Winner?

Both Citi and Wells Fargo are reputable institutions, so which bank is better?

While both banks offer similar products, there are some key differences. For example, Wells Fargo may have fewer credit card options, but you can borrow up to $100k on a personal loan, compared to the $30k maximum offered by Citi.

Another stand out is in the CD products, where Citi offers better rates without Wells Fargo’s large minimum deposit.

FAQs

Can I get a bonus promotion with Citi?

Citi offers new customers up to $325] for opening a new personal checking account, as of April 2025. Learn more about the Citi new account bonus promotions.

Can I get a bonus promotion with Wells Fargo?

Yes, Wells Fargo offers bank promotions for new accounts as well as on a variety of credit cards. As of April 2025 , you can get up to $300, based on your minimum deposit.

Can open Citi account if I have bad credit?

If you want to take control of your finances and start working on rebuilding your credit, Citi offers some basic accounts. The Citi Secured Mastercard, on the other hand, is one of the best products for people with bad credit. A security deposit of at least $200 is required, and this refundable deposit will be used to determine your credit limit. Then you can use your card to make regular payments.

Your card activity will be reported to the major credit bureaus to assist you in beginning to rebuild your credit report. The card has no annual fee, and account ownership gives you online access to your FICO score, allowing you to track your progress.

Why are Citi's savings account APY are quite low?

Citi, like many traditional banks, has a branch network that, while convenient for customers, adds to the bank's overhead costs. In contrast to fully online banks, which only require physical buildings for administrative purposes, Citi must pay to staff, operate, and maintain each of its branches.

This is reflected in its interest rates, which are lower when compared to those of a fully online bank. You do, however, have the option of calling your local branch if you require face-to-face assistance with a query.

Is Wells Fargo a good bank for teens?

Wells Fargo is a large bank and it does offer some great options for teen customers, including checking account options and savings plans. There are also some excellent resources to help teenagers to develop their money management skills and learn some financial responsibility.

Since there are also some great college student accounts, it makes it easy to transition to an account with more features as and when you need it.

What does Wells Fargo offer if I have bad credit?

In addition to learning resources to help you to take proactive steps to improve your credit, Wells Fargo has some products that are suitable for those with bad credit. The basic Clear Access checking account has no overdraft fees and can help you to manage your money.

You can obtain a debit card with this account, but you cannot write checks. There is a $5 monthly service fee, but it is possible to have this waived if you are under 25.

The Smart Investor Banking Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Citibank Versus Other Banks

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

Capital One began as a credit card company, but it has recently expanded its banking product line. Capital One offers checking and savings accounts, children's accounts, auto finance and refinancing, in addition to an impressive selection of credit cards.

Citi offers a diverse range of banking products, including checking and savings accounts, CDs, credit card options, mortgages, personal loans, wealth management plans, IRAs, and investment options.

Read Full Comparison: Citi vs Capital One: Which Bank is Best For You?

CIT Bank has a banking product line that rivals that of traditional banks. Savings accounts, CDs, an eChecking account, home loans, and mortgages are all available. The main shortfalls in this lineup are the lack of personal loans and a credit card option.

Citibank has a credit card background, but that doesn't mean it has a limited banking product line. Citi offers home loans, personal loans, lines of credit, wealth management options, and investments, as well as everyday and premium banking services.

Read Full Comparison: CIT Bank vs Citi: Which Bank Account Suits You Best?

The Citi checking account is a fairly standard product. The account does have a $12 monthly fee, but it is waived if you make a qualifying deposit or make a qualifying bill payment. Overdraft protection is also available, which automatically transfers funds from your savings account to avoid overdraft fees.

Because the American Express savings account has a high yield, the number of withdrawals or transfers you can make each month is limited to nine. It's also a nice touch that American Express allows you to choose paper statements if you prefer the old-fashioned way.

Read Full Comparison: American Express vs Citi: Where to Save Your Money?

Citi offers an excellent range of banking products that cover the majority of your financial needs.

Personal loans, mortgages, credit cards, investment options, IRAs, and wealth management plans are available in addition to savings and checking accounts. Barclays' product line is more streamlined. This bank offers credit cards, savings accounts, credit cards, and personal loans.

The most obvious product gap is the absence of a checking account. As a result, Barclays becomes more of a supplementary bank rather than your primary day-to-day financial institution.

Read Full Comparison: Citi vs Barclays: Which Bank Account Is Better?

Bank of America is a large banking institution, and its impressive banking product line reflects this. Aside from savings and checking accounts, there are home loans, auto loans, investment options, and a variety of credit cards. Citi also has a diverse product offering. Credit cards, CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and checking and savings accounts are all available.

As a result, if you want to switch from your current bank, either bank is a viable option because you won't have to make any compromises in terms of banking products.

Read Full Comparison: Bank of America vs Citi: Which Bank Suits You Best?

Discover began as a credit card company and has since expanded into banking services. As a result, it stands to reason that Discover would offer a diverse range of credit cards. Discover offers a simpler checking account. There are no account fees or minimum deposits, and you can earn 0.40 percent.

Citi offers home loans, personal loans, lines of credit, wealth management options, and investments, as well as everyday and premium banking services. This exemplifies Citi's viability as a viable alternative to the traditional high-street bank.

Read Full Comparison: Discover vs Citi: Compare Banking Options

While U.S. Bank offers some better conditions when it comes to lending options, Citibank is our winner in this comparison. Here's why.

Citibank is our winner due to its checking account options, various credit cards, and better savings account rates than Truist Bank.

PNC Bank and Citibank are two big players in brick-and-mortar banking. Let's compare them side by side and see which is our winner: PNC Bank vs. Citibank

Citibank leads in credit cards, and TD Bank options for borrowers are broader. But what about the rest? Here's our comparison and winner: Citibank vs. TD Bank

We'll explore Citibank and M&T Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Citibank vs. M&T Bank

Citi is our winner for most consumers, but Ally is also a great option if you are willing to manage your account online. Here's why.

Compare Wells Fargo With Other Banks

Capital One began as a credit card company, but has expanded its line of banking products to rival a traditional bank. Aside from checking and savings accounts, you can also get loan refinancing, auto finance, and children's accounts.

Wells Fargo offers an even broader range of products. There are several checking accounts available, as well as two savings accounts and investment options such as IRAs and 401ks. You can also get loans and mortgages, as well as wealth management services. Wells Fargo is thus a highly comparable alternative to the traditional high street bank.

Read Full Comparison: Capital One vs Wells Fargo: Which Bank Wins?

Wells Fargo offers a diverse range of products, including checking accounts, savings accounts, loans, mortgages, and investments such as 401ks, IRAs, and wealth management options.

US Bank offers an even more impressive range of banking services. Savings and checking account options, investments, personal loans, mortgage products, and wealth management are all available.

Read Full Comparison: Wells Fargo vs US Bank: Which Bank Account Is Better?

Both Ally and Wells Fargo have a fairly impressive banking product lineup that would make switching from a traditional high street bank simple.

Ally offers CDs, auto loans, mortgages, investments, and retirement products in addition to checking and savings. The only glaring omission in the lineup is the absence of a credit card.

Wells Fargo's product lineup is even more impressive. Checking and savings accounts, mortgages, loans, and a variety of investment options such as IRAs, 401ks, and wealth management services are all available.

Read Full Comparison: Ally vs Wells Fargo: Which Bank Account Is Better For You?

The Wells Fargo service is even more extensive. Checking accounts, various savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management solutions are all available.

PNC offers checking and savings accounts, home loans, mortgages, investments, student loan refinancing, and a variety of credit cards.

Read full comparison: Wells Fargo vs PNC: Which Bank Account Wins?

Chase and Wells Fargo appear to offer very similar products at first glance, so we need to dig a little deeper. There is little to distinguish the savings accounts, and both banks provide a variety of checking accounts.

While Chase's account maintenance fee is slightly higher, it does have some more interesting features. Chase also has an advantage in terms of CDs, but Wells Fargo is a better option for loans and mortgages.

Read Full Comparison: Chase vs Wells Fargo: Where to Save Your Money?

Wells Fargo offers a diverse range of banking services. Checking accounts, savings accounts, loans, mortgages, wealth management solutions, and investment options such as 401ks and IRAs are all available. Flagstar also offers a diverse product portfolio that includes a variety of checking and savings accounts, investments, home loans, and loans and investments.

It is important to note, however, that Flagstar does not operate in all states. This bank only operates in Michigan, California, Ohio, Indiana, and Wisconsin, where it has 150 branches. As a result, if you live outside of these areas, you may be unable to use Flagstar's banking services.

Read Full Comparison: Wells Fargo vs Flagstar: Which Bank Is Better For You?

Wells Fargo's product offering is even more extensive. This bank offers checking accounts, a variety of savings accounts, mortgages, loans, and investment options such as IRAs, 401ks, and wealth management services. This makes switching from another bank even easier because you'll have access to all of your favorite banking products.

Bank of America offers a diverse range of banking services. Checking and savings accounts, auto loans, home loans, credit cards, and investment options are all available.

Read Full Comparison: Bank of America vs Wells Fargo: Which Bank Is Better?

There is no clear winner when comparing Wells Fargo and TD bank, but if we have to pick, TD comes out ahead. Here's why.

Wells Fargo offers better savings rates than Truist Bank, more selection for checking accounts and better credit cards. Here's our comparison: Truist Bank vs. Wells Fargo Bank

While Wells Fargo Bank and Citizens Bank offer a range of banking services, Wells Fargo is our winner in this competition. Here's why.

Wells Fargo Bank vs. Citizens Bank : Which Bank Account Is Better?

Fifth Bank may be better than Wells Fargo when it comes to checking accounts, but is it enough? See our complete comparison, and our winner: Wells Fargo Bank vs. Fifth Third Bank

Let's compare savings accounts, checking accounts, CDs, credit cards, and lending products offered by Wells Fargo and M&T Bank.

Wells Fargo Bank vs. M&T Bank: Which Bank Account Is Better?

BMO has great options for checking accounts, and outshines Wells Fargo with higher savings rates. But is it our winner? See our comparison: Wells Fargo vs. BMO Bank

We'll explore Wells Fargo and Regions Bank savings accounts, checking accounts, CDs, credit cards, and lending products. Here's our winner: Wells Fargo vs. Regions Bank

There is no clear winner between SoFi and Wells Fargo as each bank excels in different areas – but Wells Fargo is our winner. Here's why.

Banking Reviews

Aspiration Review

Alliant Credit Union Review