Table Of Content

When Marcus Wins?

On the other hand, Marcus is part of the Goldman Sachs group and this is reflected in its products. The bank offers high yield savings products including CDs, and a savings account. You can also access personal loans, home improvement loans and debt consolidation loans.

Where Marcus stands apart is its investment options. You can explore account types and portfolios with numerous IRA options. So, if you want the convenience of having your funds in a high yield savings account or are just getting into investing, Marcus may appeal to you.

Marcus can be a better choice than Synchrony Bank if:

You’re interested in investment products

You may need wealth management

When Synchrony Bank Wins?

Both Marcus and Synchrony are more specialized providers, so neither offers a full variety of banking products. Synchrony has a focus on accounts that help you save.

So, there is a high yield savings account, CDs, and a money market account. You can also access IRAs. However, Synchrony does also have a selection of credit cards.

Synchrony Bank can be a better choice than Marcus Money if:

You need an access to IRA CDs or IRA money market

You want a credit card

Marcus | Synchrony | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

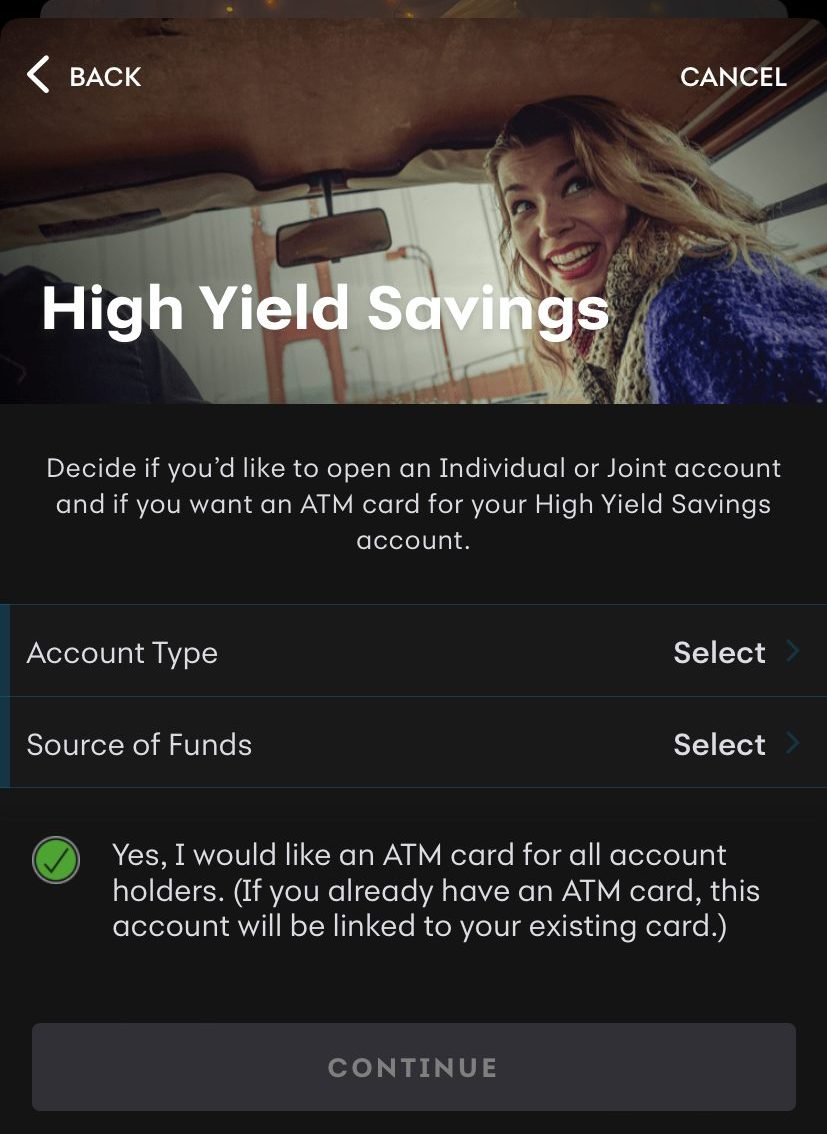

There is not much comparison in this area. Both Marcus and Synchrony offer a high yield savings account. There are minimal account features or perks, but this is an impressive rate that overshadows the typical interest offered with a high street savings account.

Also, there is no comparison here as neither bank has a checking account option.

Marcus | Synchrony Bank | |

|---|---|---|

APY | 3.65% | 3.80% |

Fees | $0 | $0 |

Minimum Deposit | $0 | $0 |

Checking Needed? | No | Yes |

Main Benefits |

|

|

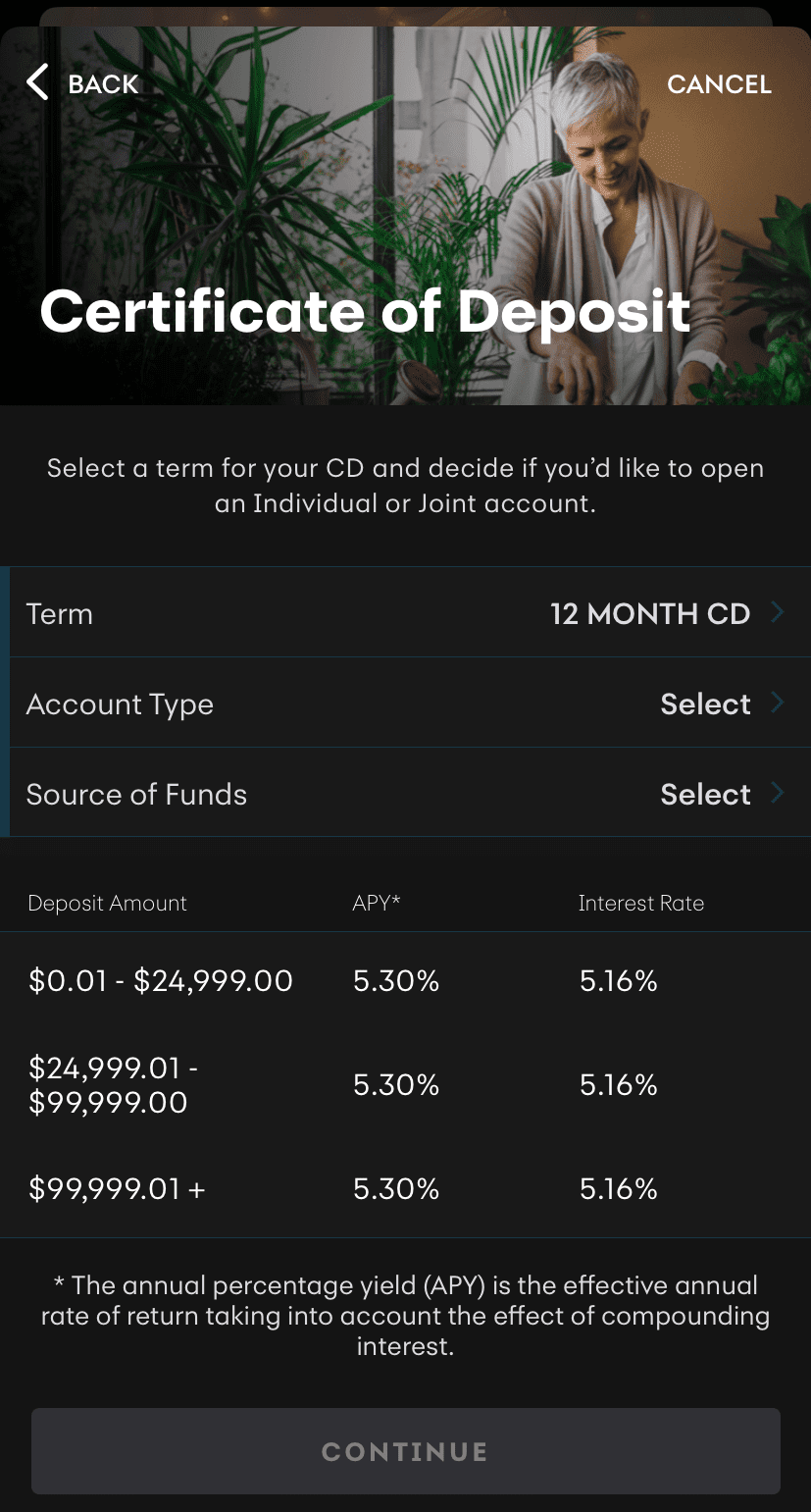

CDs

This is one area where it is possible to make a straight comparison. In this regard, Synchrony certainly has the edge.

In addition to having no minimum deposit, while Marcus requires $500, apart from the one year CD, where the rates are the same, Synchrony’s rates are significantly higher.

Marcus | Synchrony Bank | |

|---|---|---|

Minimum Deposit | $500 | $0 |

APY Range | 3.85% – 4.25%

| Up to 4.15% |

Loan Options

Here, Marcus has the edge. While Synchrony does not offer loans, Marcus has several options. You can access personal loans of up to $40,000 with rates of 6.99% to 19.99% APR. There are no late fees, sign up fees or prepayment fees, but you can enjoy a 0.25% rate discount if you sign up with auto pay.

Additionally, Marcus has a payment holiday scheme. If you make full payments on time every month for a year, you can skip a month with no penalty. Marcus also has debt consolidation and home improvement loans.

Credit Cards

Synchrony currently has some options.

Together with HomeAdvisor, Synchrony clients can get access to Synchrony HOME credit card, that give you the option to pay over time with 6 months special financing on purchases of $299 or more.

In recent years, loans were the only additional product Marcus offered, but the bank has recently launched a selection of credit card options. There are three credit cards currently which offer rewards that you can redeem for eligible GM vehicles.

- GM Rewards: This is a great card if you enjoy GM vehicles and unlimited rewards.

- GM Extended Family: This card allows you to use your employee and supplier discounts.

- GM Business: As the name suggests, this card is open to business users who want to work towards a new GM vehicle.

Customer Service

Marcus has a number of toll free numbers, according to your query area, but none of them are 24/7. Most of the lines are open from 8 am or 9 am to 10 pm ET.

Synchrony does have a 24/7 automated telephone service, but if you want to speak to an agent, the lines are only open 8 am to 10 pm on weekdays and 8 am to 5 pm on the weekend.

However, when you look at the ratings on consumer review platforms, both banks score poorly. While Marcus has a low 2.6 out of 5 rating on Trustpilot, Synchrony has a terrible 1.2 out of 5.

Top Offers From Our Partners

![]()

Online/Digital Experience

Both Marcus and Synchrony have an easy to use website to explore products and access support with various finance topics. This ensures a great user experience, especially if you are unsure what banking services and products are the best options for you.

Both the banks also have highly rated apps. The Marcus app is rated 4.9/5 on the Apple Store and 4 out of 5 on Google. Synchrony’s app is rated 4.8 out of 5 for both Apple and Google.

These apps allow you to not only transfer funds and manage your transactions, but you can access support and manage your card.

Setting up alerts is crucial for staying on top of your financial activities, and Synchrony makes it easy. In the ‘Alerts' section, you can customize notifications for various account activities, such as low balance, large transactions, or withdrawals .

Which Bank is The Winner?

These banks offer different products and services, but does this mean one is a better bank? We’ll need to look a little closer to make that determination.

There is little to separate Marcus and Synchrony in terms of their savings accounts, but Synchrony has the edge in the CD comparison. However, while Synchrony offers a credit card option, Marcus offers personal loans. So, it will really depend on what you are looking for in your new bank.

FAQs

Does Marcus or Synchrony offer a promotion?

Currently, Marcus don't have a promotion for new banking accounts. However, if you choose to use one of Marcus credit cards after opening an account, you'll enjoy a sign up bonus, based on the specific card you selected.

Synchrony bank doesn't offer a welcome bonus or promotion on its savings account.

Can I open an account on Marcus if I have bad credit?

Marcus offers a great savings account for anyone, but if you want a lending product, you may need to work on your credit score. Marcus does not disclose the minimum credit score requirements, but a score of 660 or higher is likely to be required to qualify for a loan.

Is Marcus a lender for car loans?

While it does not provide car loans, the bank does provide personal loans. These are fixed-rate, no-fee loans ranging from 6.99% – 24.99% that can be used for any purpose. With a term of up to six years, the specific rate will be determined by your creditworthiness.

Can you buy gold via Synchrony Bank ?

Synchrony does not have an investment arm that allows its customers to access shares, bonds, and stocks including gold products. So, if you are interested in becoming a Synchrony customer and want to purchase gold stocks, you will need to consider a third party investment platform to make your trades.

Can you invest in Crypto via Synchrony Bank ?

Synchrony has shown no interest in entering the cryptocurrency market, but the bank does have resources and articles to help you understand crypto and whether it would be a good investment strategy for you.

The bank has articles that explore Bitcoin and where you can purchase coins, but these are third party platforms, as there is no direct way to buy crypto through Synchrony.

The Smart Investor Banking Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Synchrony Bank

Both Barclays Bank and Synchrony Bank offer great savings products for their customers, but lack a checking account. Which bank is best?

American Express is our winner with a decent checking account, an impressive savings account, and a great selection of credit cards.

Synchrony Bank vs. American Express Bank: Which Bank Account Is Better?

Capital One is our winner with a full banking package, including a decent checking option, high savings rates, and great credit cards.

Ally Bank is our winner with a complete banking package, including a checking account ( not available with Synchrony) and high savings rates.

Compare Marcus With Other Banks

Marcus, on the other hand, made Goldman Sachs banking more accessible to the general public when it debuted in 2016. Our in-depth Marcus review can help you decide if this online bank is right for you. Goldman Sachs is one of the world's largest investment banks, with offices in every major financial center and a client list that includes other banks as well as the state of New Jersey. With Marcus, however, you could be next on the list.

Axos online bank, which provides checking, savings, CDs, investing, and other services, has a lot to offer. A variety of checking account options allow customers to earn interest or cash back. The APY on Axos Bank's Rewards Checking account isn't the highest among online banks, but it's sufficient to justify opening an account as part of a larger online banking strategy, and there are almost no fees.

Read Full Comparison: Axos vs Marcus: Which Online Bank is Better?

CIT Bank provides a variety of savings account options. If you link your checking account and make qualifying deposits, you can earn a higher rate on the two-tiered Savings Connect. The other savings option is the Savings Builder, which offers 0.399 percent if you keep a balance of $25k or more, or make at least $100 in monthly deposits. There is a six-transaction limit per statement cycle, but there are no account maintenance fees.

Marcus provides an impressive 0.50 percent without the CIT hoops. There is no required minimum deposit or balance. You can also make same-day transfers to and from the account of up to $100,000.

Read Full Comparison: CIT Bank vs Marcus: Compare Banking Options

Marcus' banking product offering is more specialized. Marcus' product line reflects its investment pedigree as part of the Goldman Sachs Group. CDs, high-yield savings, investment options, and a variety of loans are available.

Ally has a banking product line that competes with traditional, high-street banks. A checking account, savings account, CDs, mortgages, auto loans, personal loans, retirement products, and investments are among the numerous products available.

Read Full Comparison: Ally vs Marcus: Which Online Bank Is Better?

Marcus is a subsidiary of Goldman Sachs, which is reflected in its banking products. Marcus provides high-yielding savings and CDs, as well as investment options and a variety of loans. This does not, however, include a checking account.

SoFi's banking products are more akin to those of traditional banks. While there are no checking or savings accounts available, rather a hybrid account, you can access loans, mortgages, and investment products. SoFi also offers insurance. CDs and traditional savings accounts, on the other hand, are not available in the SoFi catalog.

Read Full Comparison: Marcus vs SoFi Money: Which Banking Service Is Better?

Marcus, a Goldman Sachs Bank division, provides online savings accounts, CDs, and personal loans. Marcus has no physical locations, so you can only access your accounts through the Marcus website, mobile app, or phone-based customer service.

In addition to assisting you in avoiding typical bank fees, Chime includes useful new features such as early direct deposits and automatic saving. While Chime does not provide credit cards or loans, its savings options and competitive interest rates make it an excellent choice, especially for younger people.

Both Barclays and Marcus bank offer great savings rates for depositors who are interested in CDs or savings accounts. How they compare? Barclays Bank vs. Marcus