Table Of Content

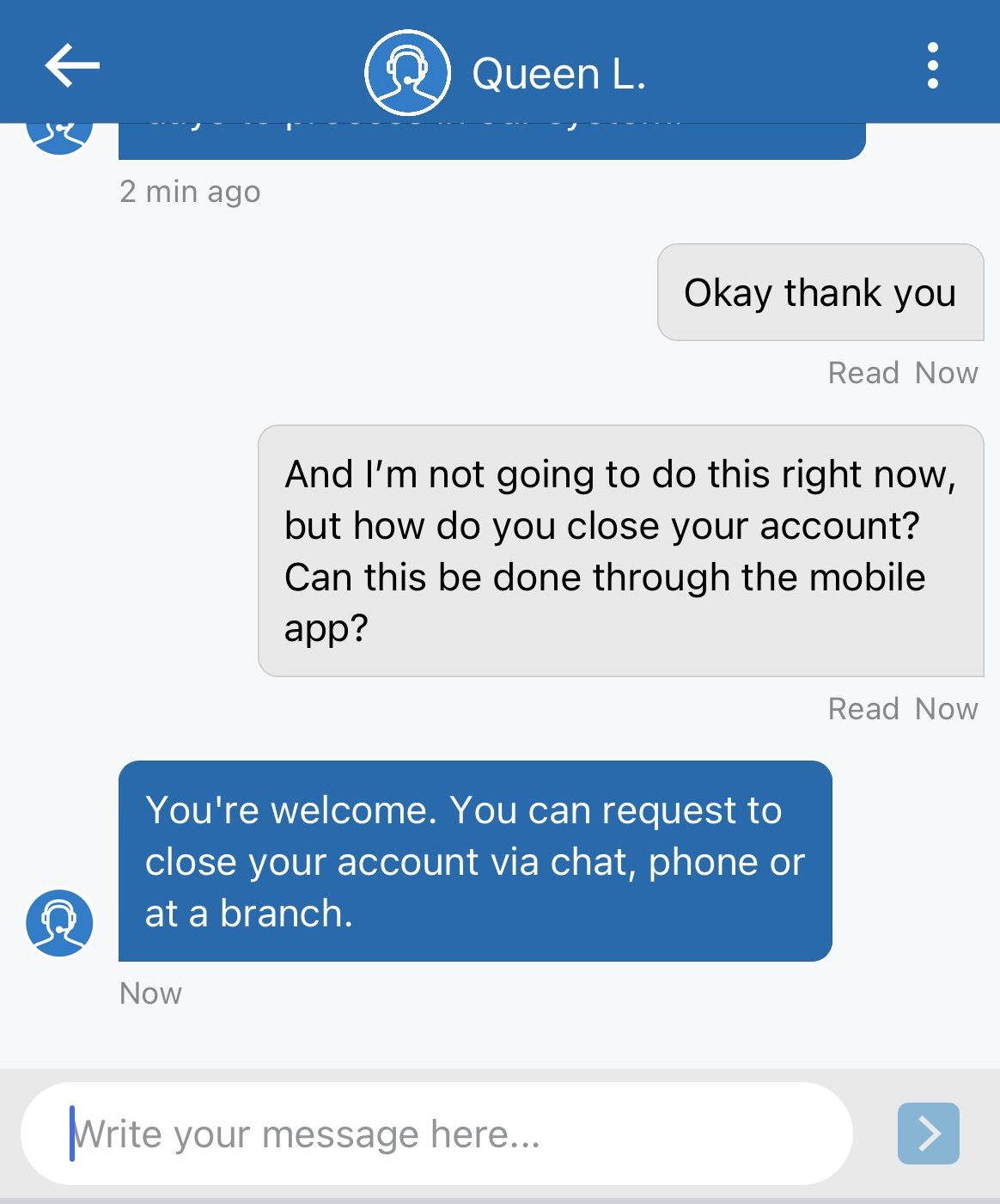

Closing your PNC Bank account is pretty straightforward. You can do it in person by visiting a local branch, calling the customer service team, or submitting an online request through your PNC online banking portal.

To close your account, you will need to provide certain information, including your name, address, social security number, and date of birth. Furthermore, you'll have to pay a $25 account closing fee when closing your PNC bank account. But if you close the account within 180 days of opening it, there won’t be any fee.

Ways to Close Your PNC Bank Checking Account

There are multiple ways for you to close your PNC bank account.

- In Person At Branch: The simplest way is to visit a local branch and request the banker there to help you with the process. You may have different reasons why you want to close your PNC checking account, so make sure to let the rep know so they can assist you in resolving those issues.

- Phone: Alternatively, if it's more convenient, you can call PNC customer service. Customer service reps are usually available 24/7 and will be happy to hear from you and guide you through the process of closing your bank account.

- Semi-Online: Another great option is online banking: simply log into your online banking portal and click the “Close Account” button on your account dashboard. You will just need to provide some information, such as your name and address. Then, you'll need to contact customer support to finalize the closing.

5 Steps To Close Your PNC Bank Checking Account

Closing an account at PNC Bank doesn't have to be difficult if you follow these five steps carefully. Remember to gather all necessary documents beforehand and keep tabs on old and new accounts after submitting your request.

That way, nothing slips through the cracks. Finally, contact customer service for assistance if you have any issues or questions.

We’ve created this guide to help make the process as smooth and stress-free as possible. Here are five steps to close your PNC Bank checking account online.

1. Gather Important Documents

Before getting started, you must gather all the necessary documents. This includes the following items:

- Government-issued identification such as a driver's license, passport, or state ID card

- Social Security Number

- A copy of your most recent statement or checkbook register

- Any outstanding checks or deposits that have not yet cleared

- Your mailing address, phone number, and email address

- Your alternative checking account details. If you still don't have an alternative checking account, it's time to choose one and open it before you close your account.

Once you have all these documents in hand, you’re ready to move on to Step 2.

2. Request To Close Your Account Through PNC Portal

Next, log in to your PNC Bank online banking account using your user ID and password. Once logged in, click on the “Accounts” tab and select “Close Accounts & Cards” from the dropdown menu.

From here, select which type of account you want to close (in this case, it would be a checking account).

3. Choose An Option For The Disbursement of Funds

If funds remain in your checking account when you close it, you will need to specify how those funds should be disbursed.

You can choose one of two options: direct deposit or paper check. With direct deposit, the funds will be transferred directly into another eligible account with PNC Bank within 1-3 business days.

With a paper check option, the bank will mail a check to the address listed on your account within 7-10 business days.

4. Verify Details & Submit Request

Finally, review all information provided and make sure everything is accurate before submitting your request. Once submitted, you will receive a confirmation message from the bank about your request.

Depending upon the account type and in-process transaction, it may take several business days for the closure process to be completed. Therefore, allow sufficient time for this step before expecting any changes to take effect on your accounts or cards.

5. Contact PNC Customer Service

After submitting your request for closing an account at PNC Bank online banking portal, you must monitor your old account for any irregularities, such as unauthorized transactions or incorrect balance information.

Next, you must choose how you would like to disburse any remaining funds in the joint account. You can choose between direct deposit or a paper check, which will be mailed to the address listed on your account within 7-10 business days.

When completed, contact PNC customer service to finalize the closing process since you can't complete it all online.

How to Close a PNC Bank Joint Bank Account?

Closing a PNC Bank Joint Account is a slightly different process from closing a regular bank account. In order to close a joint account, you will need to work closely with your co-account holder, as both of your signatures are required for the request to be processed.

Once you have your co-account holder and their consent, you can begin to gather all necessary documents such as government-issued identification, associated social security number, and any outstanding checks or deposits that have not yet cleared.

Once all of these steps are completed, you can submit your request for closing the joint PNC Bank account and monitor both old and new accounts in case any issues arise.

What Happens if PNC Bank Closes Your Account?

If you find yourself in a situation where PNC Bank has closed your account, it is important to understand why this happened and your options for resolving the issue.

In some cases, security or regulatory agencies may have flagged your account due to suspicious activity or other irregularities.

However, there may be other situations that result in account closure, so let’s look at some common scenarios:

- You haven’t used the account for a long time—If you haven’t made any deposits into your PNC Bank savings or checking accounts for some months, then the bank may put it on dormancy. This is often referred to as “dormant status” and is intended to prevent accounts from being used for fraudulent purposes.

- You have a negative balance—If you do not maintain a sufficient balance in your PNC Bank account, then it is likely that you will be unable to access or use the funds. In some cases, this may result in your account being closed altogether. Is that's the case, ensure to pay it to avoid hurting your credit score.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

FAQs

Yes, you can close your PNC Bank account at any time after you have received the promotional bonus. However, make sure to contact the bank before doing so so that they can process your closure request promptly.

There are several ways to close a PNC Bank savings account, such as contacting the bank via phone or in person, requesting it online, and following any steps or documentation requirements they may have.

There are several reasons why PNC Bank may close your account, including not maintaining a sufficient balance or having any suspicious activity on the account.

In some cases, your account may be closed due to inactivity as well. If you have had your account closed unexpectedly, it is important to contact customer support and understand the reason behind this decision.

To close your PNC Bank credit card account, you will need to contact the bank’s customer support team either by phone or in person.

Make sure that you have all relevant information about your current account on hand before initiating this process. You may also need to complete certain documentation requirements and follow any other instructions provided by the bank.

There is no guarantee that a closed PNC bank account will be reopened, though it may be possible to do so under certain circumstances. For example, if your account was closed due to insufficient funds, but you have since taken steps to restore the balance, then your account may be reactivated by the bank.

It is important to contact customer support to learn more about the specific process for reactivating a closed account.

It is possible to reopen a closed PNC Bank account, though this will depend on why your account was originally closed.

For example, if you have had an account closed due to insufficient funds and have taken steps to restore your balance, it may be possible to reactivate your account. However, in other cases, such as suspected fraud or illegal activity, it may not be possible to have your account reopened.

You will most likely be notified if your PNC Bank account is closed. This may come in the form of a letter or email from customer support or by seeing that your account has been removed from online banking.

Sometimes, you may also receive notifications to update your information before your account is closed, such as if it has become dormant due to inactivity.

Yes, PNC Bank may close inactive accounts after a certain period of time, usually a couple of years.

There is no direct way to close your PNC Bank account from the app. However, you can contact customer support via phone or in-person to initiate this process.

Make sure that you have all relevant account information on hand before closing your account so that any required documentation or steps can be completed as quickly as possible.