Table Of Content

If you’re considering a new checking account, you may have considered Citi. Citi has a number of account packages, so here we’ll look at the Citi Access Account vs Citi Regular Banking.

What Is The Citi Access Account?

As the name suggests, the Citi Access account is designed to provide easy access to banking services. With this account you can access the full suite of Citi digital services and products. The account provides digital access at all times and you can enjoy seamless money movement. This allows you to pay bills, deposit checks, transfer money and even settle up expenses with friends via the digital platform.

The main compromise you may need to make compared to other checking account options is that there are no paper checks with Citi Access. You’ll have an ATM or Citi Debit card and access to online bill payment, so Citi has deemed that you should not need paper checks.

Citi Access does have a $10 monthly service fee, but it is possible to have this fee waived if you make a qualifying bill payment, maintain a combined average balance across your linked accounts of $1,500 or more or make one enhanced direct deposit per statement period.

What Is The Citi Regular Banking Account?

Regular Banking is an account for those who like a simple banking service. You can still enjoy seamless money movement and free ATM access within the Citi ATM network. However, there is also unlimited check writing and online bill payment to manage your money.

The Citi Regular Banking account has a $12 monthly service fee, which can be waived in one of several ways including a combined average monthly balance across linked accounts of at least $1,500, one qualifying bill payment or one enhanced direct deposit per statement period.

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

Top Offers From Our Partners

• Receive a cash bonus of $1,500 when you deposit or invest $100,000 – $199,999.99

• Receive a cash bonus of $2,000 when you deposit or invest $200,000 – $299,999.99

• Receive a cash bonus of $2,500 when you deposit or invest $300,000 – 499,999.99

• Receive a cash bonus of $3,500 when you deposit or invest $500,000+

• Earn an extra $500 when you set up recurring monthly Direct Deposits totaling at least $5,000 for 3 months

How Their Checking Acconts Features Compare?

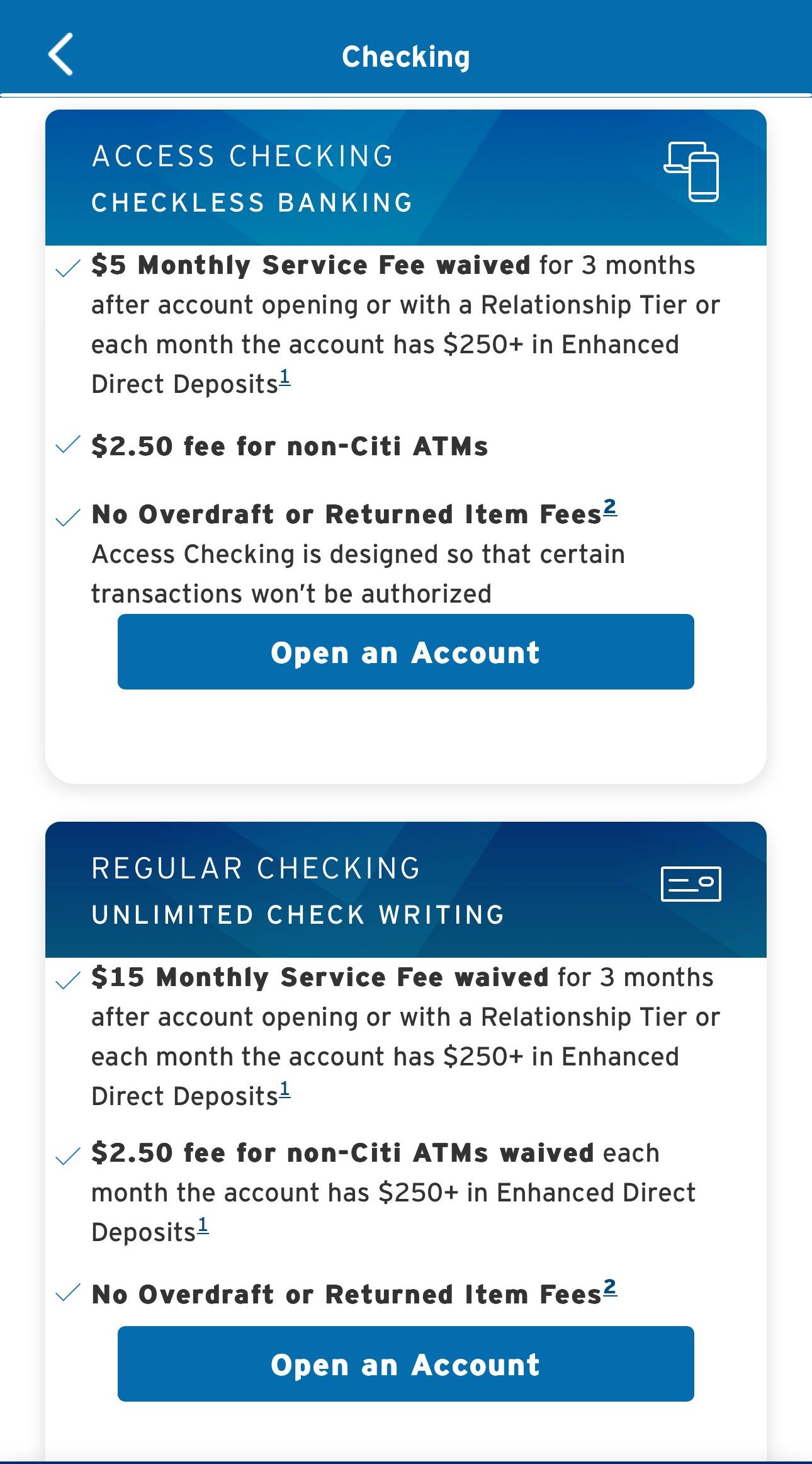

While most features existed on both Citi Access and Citi Regular Banking, there are some differences. Here's a comparison:

Citi Access Account | Citi Regular Account | |

|---|---|---|

Fee | $5 | $15 |

Fee Waiver Criteria | Relationship Tier or $250+ in Enhanced Direct Deposits | Relationship Tier or $250+ in Enhanced Direct Deposits |

Free ATM Access | Yes | Yes |

Check Writing | No | Yes |

Minimum Deposit | $0 | $0 |

Similarities

- Same Waiver Criteria

If you want to avoid paying the monthly service fee, you’ll need to meet at least one of the waiver criteria. These are the same for both accounts.

- Seamless Money Movement

Both accounts offer the Seamless Money Movement feature, which allows you to take control of your finances from the online platform or app.

This makes it easy to perform your day to day banking from the comfort of your own home or on the go.

- Fee Structure

The fees for additional services such as wire transfers and stop payments are the same for both accounts.

- Free ATM Access

Citi has thousands of ATMs within its network, which means that you can make withdrawal without incurring a fee. However, if you use a non network machine, a fee will apply.

Differences

- Check Writing

If you prefer to have check writing capabilities, you will need to opt for the Regular Banking account, as paper checks are not provided with Citi Access.

- Service Fee

While the waiver criteria is the same for both accounts, the specific service fee is different for the Access and Regular accounts. Since the Regular Banking account has a larger feature set, it does have a larger service fee.

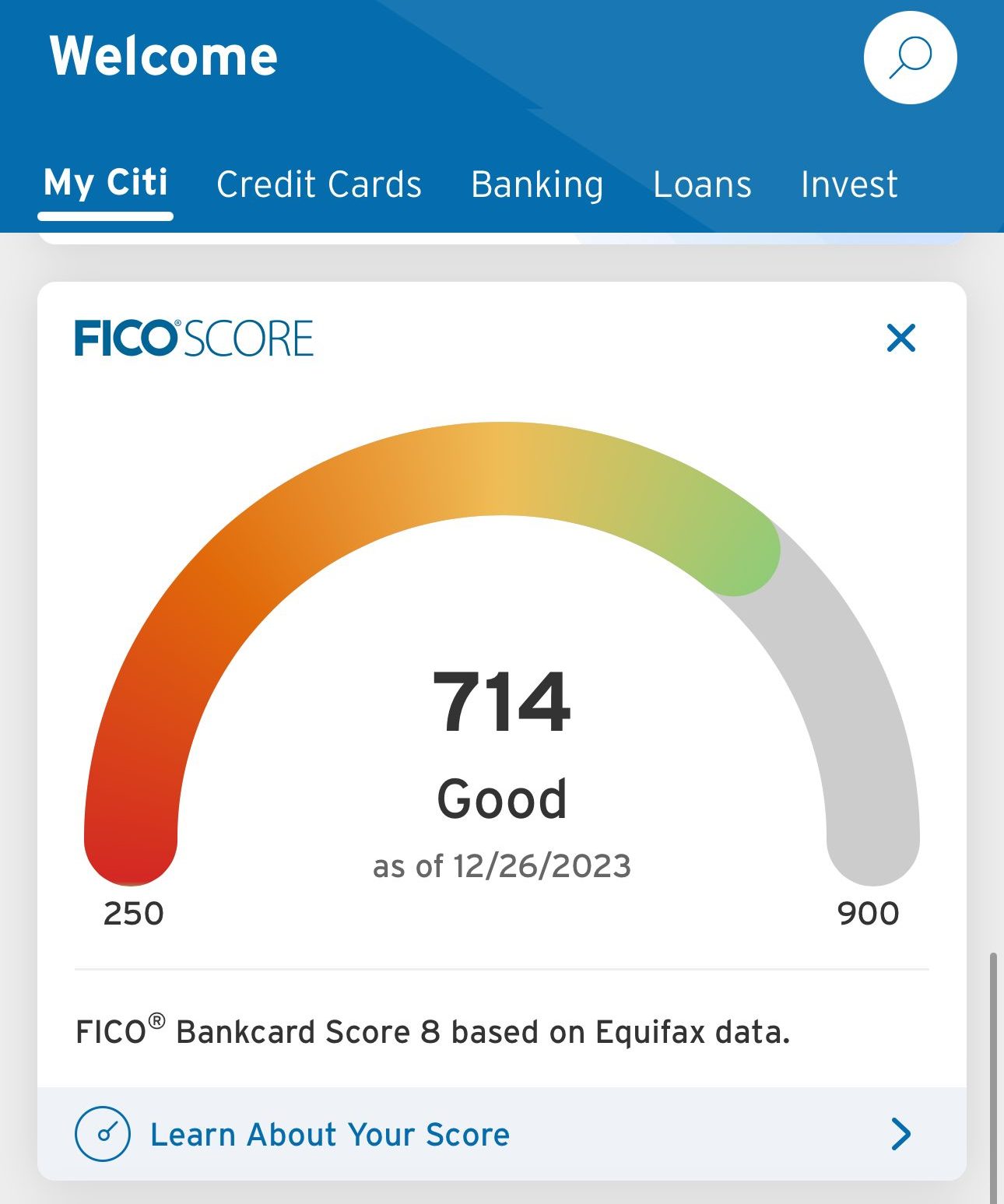

Customers are able to check their FICO score on Citi app:

Which Type of Customer is Best for the Accounts?

The Access account is Citi’s most basic checking account option, so it is a good option for those who want to simplify their banking, while the regular account has more features. To determine which is the better option for you, there is one main question you should ask yourself.

- Do You Need Checks? This is perhaps the most obvious difference between the accounts, so you need to assess whether you actually need paper checks. Both accounts offer bill payment and other methods, but if you’re old school and prefer checks, you’ll be better suited to the Basic Banking account.

However, you also need to consider whether you are comfortable with a $10 or $12 monthly fee. While the waiver criteria is the same for both accounts, you need to think about the months when you cannot waive the fee.

How to Open Citi Access or Citi Regular Banking Account?

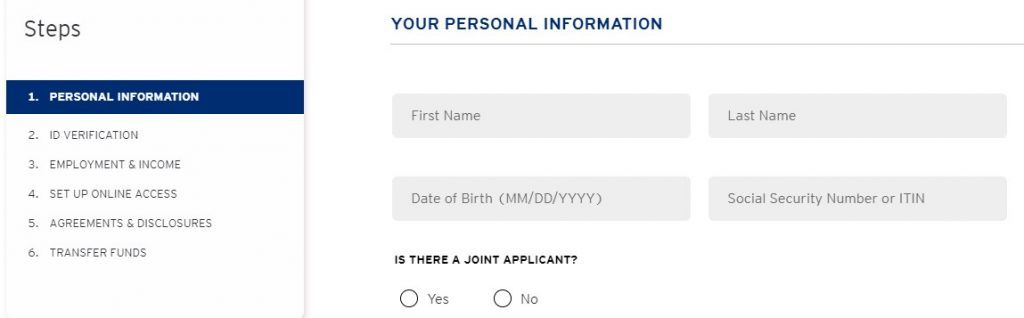

You can pop into your local branch to open either the Access or Regular Banking accounts, but it is also very straightforward to apply online in a few simple steps.

- Complete the Application Form: When you visit the Citi website, you will need to find the appropriate product and click the “Apply” button.

- Choose your Preferences: The first stage of the application is to determine your account package. Citi checking and savings accounts are designed to work together, so you can explore the rates, benefits and balance requirements. You should choose the package best suited to your needs.

- Complete the Application: This is fairly standard, but you’ll need to complete all the mandatory fields including your name, address, contact details and Social Security Number.

- Fund Your Account: While there is no minimum balance requirement for either of these accounts, at the end of the application, there is a list of funding options.

- Await the Follow Up Email: After you’ve submitted your application, Citi will process it and send you a follow up email. This may confirm your account is opened or request further details.

FAQs

How do you close a Citi Access Account?

You can request an account closure in your local branch or by calling the customer support helpline.

Do any of them offer a promotion?

There are occasional promotional offers for Citi checking accounts, but you’ll need to check at the time of applying.

Do any of them earn interest on balance?

No neither the Access or Basic bank accounts are interest bearing.

Compare Citi Bank

Citi vs Chase

The Chase and Citi checking accounts both have no minimum deposit and a monthly account maintenance fee of $12. This can also be waived with a balance of $1,500 or more, or with qualifying deposits.

Furthermore, both have a very impressive selection of more than credit card options.

Read Full Comparison: Chase vs Citi: Which Bank Account Wins?

Citi vs Capital One

Capital One began as a credit card company, but it has recently expanded its banking product line. Capital One offers checking and savings accounts, children's accounts, auto finance and refinancing, in addition to an impressive selection of credit cards.

Citi offers a diverse range of banking products, including checking and savings accounts, CDs, credit card options, mortgages, personal loans, wealth management plans, IRAs, and investment options.

Read Full Comparison: Citi vs Capital One: Which Bank is Best For You?

Citi vs American Express

The Citi checking account is a fairly standard product. The account does have a $12 monthly fee, but it is waived if you make a qualifying deposit or make a qualifying bill payment. Overdraft protection is also available, which automatically transfers funds from your savings account to avoid overdraft fees.

Because the American Express savings account has a high yield, the number of withdrawals or transfers you can make each month is limited to nine. It's also a nice touch that American Express allows you to choose paper statements if you prefer the old-fashioned way.

Read Full Comparison: American Express vs Citi: Where to Save Your Money?

Citi vs Bank of America

Bank of America is a large banking institution, and its impressive banking product line reflects this. Aside from savings and checking accounts, there are home loans, auto loans, investment options, and a variety of credit cards. Citi also has a diverse product offering. Credit cards, CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and checking and savings accounts are all available.

As a result, if you want to switch from your current bank, either bank is a viable option because you won't have to make any compromises in terms of banking products.

Read Full Comparison: Bank of America vs Citi: Which Bank Suits You Best?

Citi vs Discover

Discover began as a credit card company and has since expanded into banking services. As a result, it stands to reason that Discover would offer a diverse range of credit cards. Discover offers a simpler checking account. There are no account fees or minimum deposits, and you can earn 0.40 percent.

Citi offers home loans, personal loans, lines of credit, wealth management options, and investments, as well as everyday and premium banking services. This exemplifies Citi's viability as a viable alternative to the traditional high-street bank.

Read Full Comparison: Discover vs Citi: Compare Banking Options

Citi vs CIT Bank

CIT Bank has a banking product line that rivals that of traditional banks. Savings accounts, CDs, an eChecking account, home loans, and mortgages are all available. The main shortfalls in this lineup are the lack of personal loans and a credit card option.

Citibank has a credit card background, but that doesn't mean it has a limited banking product line. Citi offers home loans, personal loans, lines of credit, wealth management options, and investments, as well as everyday and premium banking services.

Read Full Comparison: CIT Bank vs Citi: Which Bank Account Suits You Best?

Citi vs Wells Fargo

Both banks offer a good selection of banking products, making it easier to switch from your current bank.

Citi offers CDs, personal loans, mortgages, IRAs, investment options, wealth management plans, and a variety of credit card options in addition to checking and savings accounts.

Wells Fargo provides savings and checking accounts, but it also provides mortgages, loans, and investment options such as IRAs, 401ks, and wealth management products.

Read Full Comparison: Citi vs Wells Fargo: Which Bank Account Is Better?