Table Of Content

CIT bank is a completely digital bank that operates online. They provide various banking and lending services, including CDs . What sets CIT apart from other banks is that they offer a good range of CD options, allowing you to select the one that fits your needs and preferences.

In this guide, we will walk you through the process of opening a CD account with CIT bank. We'll provide you with clear screenshots and explanations to make it easy for you to follow along.

1. Start Your CD Application

Since CIT Bank is an online bank, you won't be able to open a CD account in person at a branch or over the phone. The entire account opening process happens online. If CIT Bank needs any more information from you, they will contact you directly.

To get started, you'll need to go to the CIT Bank website and follow the instructions they provide.

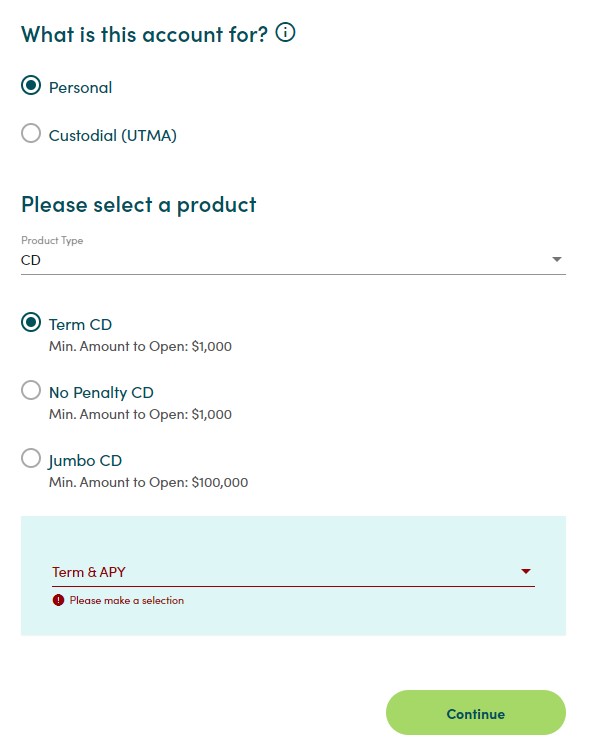

2. Choose CD Product And Term

In this step, you are asked to specify the purpose or type of account you want to open. There are two options available:

Personal Account: This type of account is meant for individuals.

Custodial (UTMA) Account: This account type is designed for minors and is managed by an adult on their behalf.

After selecting the account type, you will move on to choose a specific product from the available options. In this case, you are looking at CD products. The CD options provided by CIT Bank include:

- Term CD: This is a standard CD with a minimum amount required to open of $1,000.

- No Penalty CD: This CD allows you to withdraw funds before the maturity date without incurring penalties. It also requires a minimum opening amount of $1,000.

- Jumbo CD: This CD is designed for larger deposits, with a minimum opening amount of $100,000.

Once you have chosen the product type, you will be prompted to select the desired term or duration of the CD. Each term comes with an associated Annual Percentage Yield (APY) which indicates the interest rate you can expect to earn on the CD. The available terms and their corresponding APYs are listed, ranging from 6 months to 5 years.

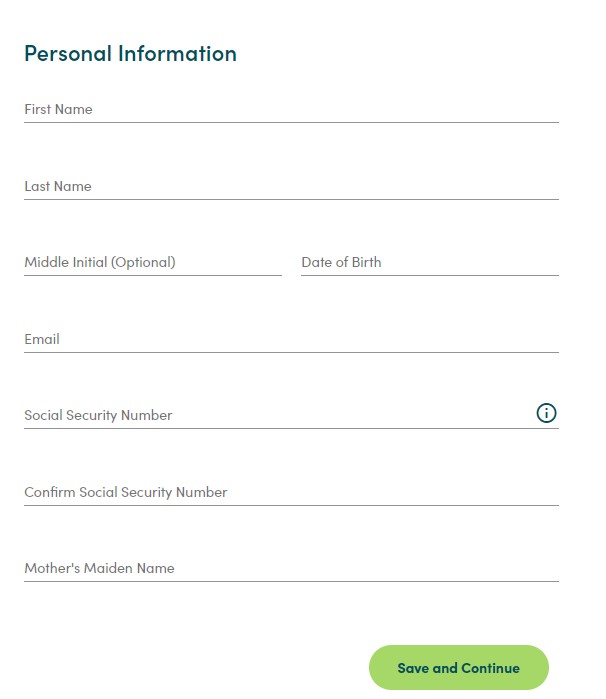

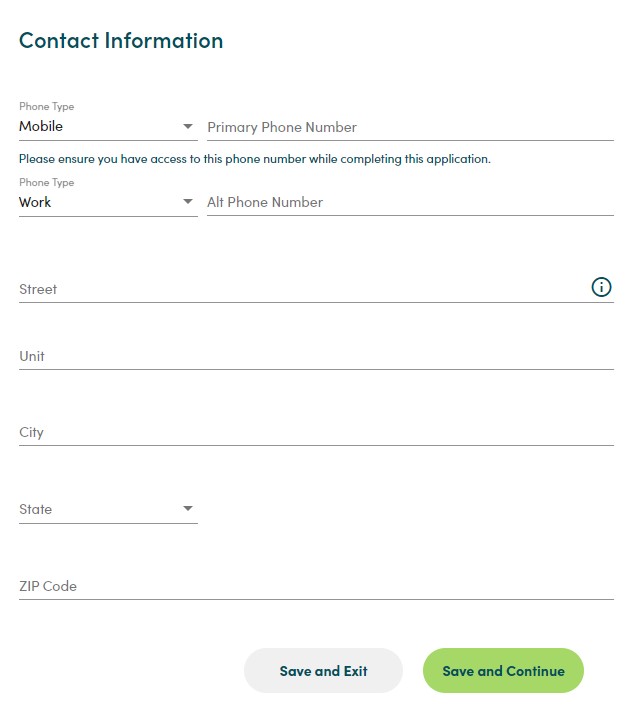

3. Add Personal And Contact Information

In this step, you need to provide personal information to open a bank account. This includes your name, date of birth, email address, social security number, and your mother's maiden name.

You also need to provide your contact information, such as your home address, mobile phone number, and work phone number. Make sure to provide accurate information as it is required for identity verification and communication purposes.

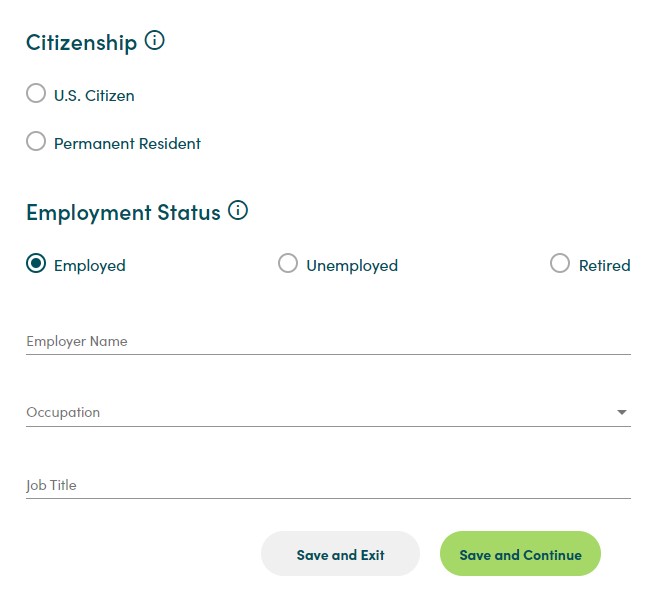

3. Add Employment Status And Job

The next step is to provide information on your employment status and your employer.

- Citizenship: You'll have to specify your citizenship status.

- Employment Status: Indicate your current employment status from the options provided.

- Employer Name: Enter the name of your current employer or the organization you were most recently employed by.

- Occupation: Specify your occupation or profession. For example, you can enter “Software Engineer,” “Teacher,” or “Accountant.”

- Job Title: Provide your job title or the role you held in your previous or current employment. If you are retired, you can mention your previous job title or simply write “Retired” in this field.

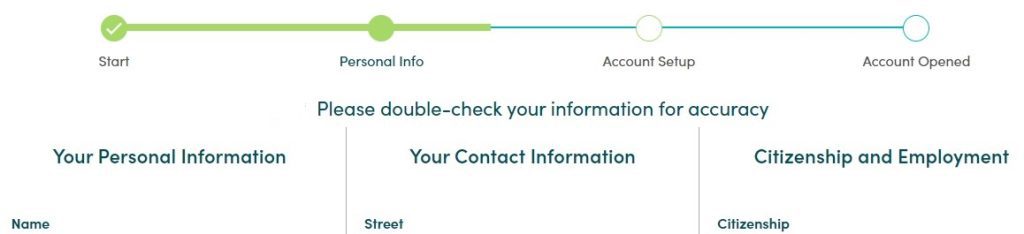

4. Review Info And Add A Joint (If Needed)

In this step, you are asked to review and confirm the accuracy of the information you have provided so far. This includes your personal information (such as your name, date of birth, and social security number), contact information (including your address and phone numbers), as well as details about your citizenship and employment.

It is important to carefully double-check all the information to ensure its accuracy. Mistakes or inaccuracies could lead to issues with your account or delays in processing your application.

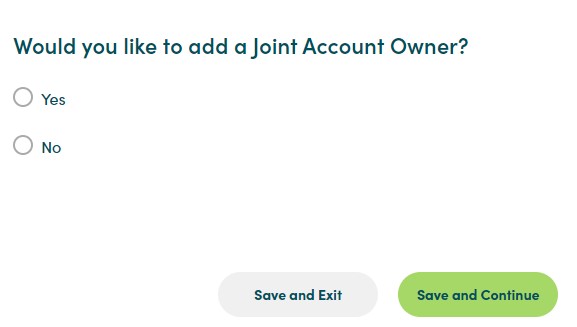

Additionally, you are given the option to add a Joint Account Owner. A Joint Account Owner is someone you want to share the account with, such as a spouse or family member. If you choose to add a Joint Account Owner, you will need to provide their personal information as well.

Sign Up for

Our Newsletter

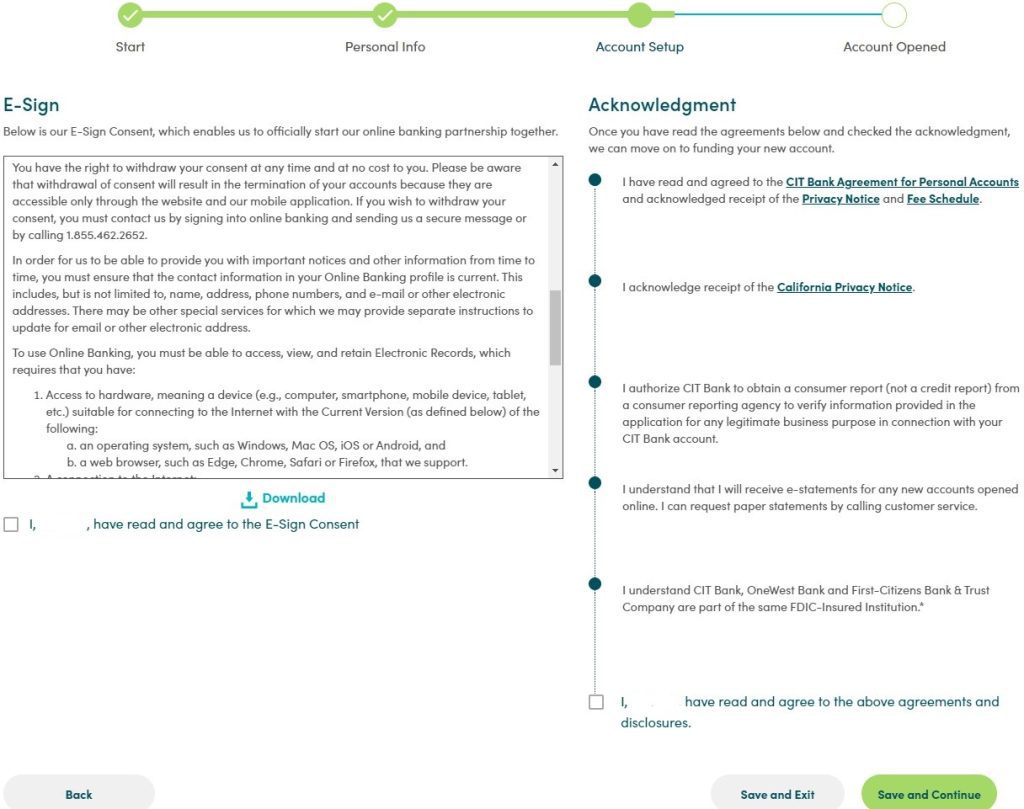

5. Approve CIT Bank CDs Agreement

In this step, you are presented with the E-Sign Consent, which is an agreement that allows you to officially establish an online banking partnership with CIT Bank. Before moving forward, you need to read and acknowledge several agreements and disclosures. Here's a breakdown of the acknowledgments you are asked to make:

CIT Bank Agreement for Personal Accounts: By checking this acknowledgment, you confirm that you have read and agreed to the terms and conditions outlined in the agreement. This agreement governs the terms of your personal account with CIT Bank.

Privacy Notice and Fee Schedule: You acknowledge that you have received the Privacy Notice and Fee Schedule documents. These documents outline how your personal information will be handled and any applicable fees associated with your account.

California Privacy Notice: You acknowledge receipt of the California Privacy Notice, which provides specific information regarding privacy rights for California residents.

Authorization for Consumer Report: By checking this acknowledgment, you authorize CIT Bank to obtain a consumer report (not a credit report) from a consumer reporting agency. This report will be used for legitimate business purposes in connection with your CIT Bank account.

E-Statements: You understand that for any new accounts opened online, you will receive electronic statements (e-statements). If you prefer to receive paper statements, you can request them by contacting customer service.

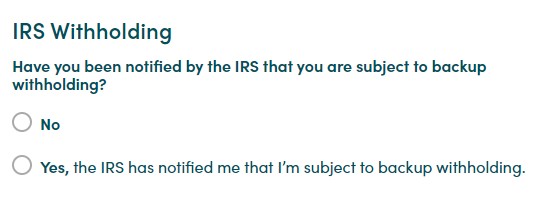

6. IRS Withholding

In this step, you are asked to answer a question regarding IRS withholding. Here are some guidelines to help you determine your response:

If any of the following statements are true, select “NO”:

- You are exempt from backup withholding.

- The IRS has not notified you that you are subject to backup withholding due to failure to report interest or dividends.

- The IRS has informed you that you are no longer subject to backup withholding.

If the IRS has specifically notified you that you are subject to backup withholding, select “YES.”

It's important to note that if you select “YES,” CIT Bank will withhold 24% of all interest paid to your account in compliance with IRS regulations.

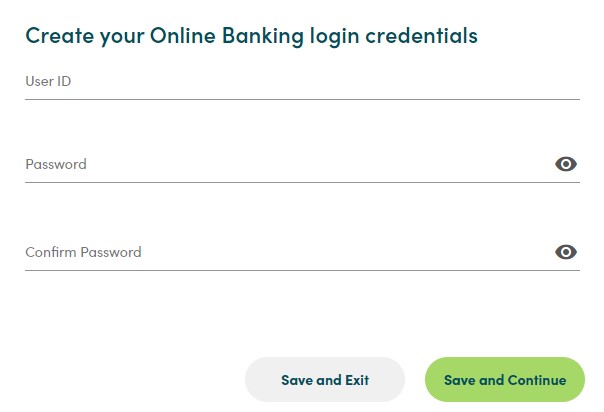

7. Create Your CIT Online Banking Login Credentials

In this step, you will create your login credentials for online banking. You need to choose a User ID, create a password, and confirm the password by re-entering it. The User ID will be used to log in to your account, and the password should be strong and kept confidential.

Should I Open CIT CD Account?

If you want to maximize your interest rates, CIT Bank is a great choice. However, it's important to note that not all terms will have competitive rates. It's recommended to carefully review the different terms offered by CIT Bank and compare them with the same terms offered by other banks.

Here are the rates as of May 2024:

CD Term | APY |

|---|---|

6 Months | 3.00% |

11 Months – No Penalty | 3.50% |

13 Months | 3.50% |

18 Months | 3.00% |

36 Months | 0.40% |

48 Months | 0.50% |

60 Months | 0.50% |

FAQs

What is the grace period?

The grace period is a 10-day period that starts when your CD (certificate of deposit) reaches its maturity date. During this time, you can withdraw your CD without having to pay a penalty for early withdrawal.

If you decide to open a new CD, it can be backdated to the maturity date of the previous CD and earn interest at the current rate, as long as you don't add any extra funds to the deposit.

You can choose to have the new CD issued on the day you contact CIT Bank to redeposit the funds.

When does my 10-calendar-day grace period start?

Your grace period of 10 calendar days begins on the day your CD reaches its maturity date. During these 10 days, you have the option to make changes to your CD or let it automatically renew at the maturity date. If your CD does renew, it will be for the same term as before and at the current interest rate.

How does the CIT Bank early withdrawal penalty work?

The early withdrawal penalty from CIT Bank is based on the original term of your CD. If your CD term is less than one year, the penalty is three months of simple interest. For CD terms between one and three years, the penalty is six months of simple interest. If your CD term is over three years, the penalty is 12 months of simple interest.